Docket No. CENT 2003-289-M Petitioner : A.C

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Construction Details and Initial Performance of Two High-Performance Base Sections

Technical Report Documentation Page 1. Report No. 2. Government Accession No. 3. Recipient's Catalog No. FHWA/TX-07/5-4358-01-1 4. Title and Subtitle 5. Report Date CONSTRUCTION DETAILS AND INITIAL PERFORMANCE OF November 2006 TWO HIGH-PERFORMANCE BASE SECTIONS Published: March 2008 6. Performing Organization Code 7. Author(s) 8. Performing Organization Report No. Tom Scullion Report 5-4358-01-1 9. Performing Organization Name and Address 10. Work Unit No. (TRAIS) Texas Transportation Institute The Texas A&M University System 11. Contract or Grant No. College Station, Texas 77843-3135 Project 5-4358-01 12. Sponsoring Agency Name and Address 13. Type of Report and Period Covered Texas Department of Transportation Technical Report: Research and Technology Implementation Office September 2004-August 2005 P. O. Box 5080 14. Sponsoring Agency Code Austin, Texas 78763-5080 15. Supplementary Notes Project performed in cooperation with the Texas Department of Transportation and the Federal Highway Administration. Project Title: Pilot Implementation of High Performance Flexible Base Specifications URL: http://tti.tamu.edu/documents/5-4358-01-1.pdf 16. Abstract Traditional Texas flexible bases specified under Item 247 perform well as long as they are kept dry. However, rapid and sudden failures can occur if water enters these bases. In Project 0-4358 draft specifications (proposed Item 245) were developed for high-performance flexible base materials. These specifications tighten all existing specifications, place an upper limit of 10 percent on the amount of material passing the No. 200 sieve, and introduce new procedures to ensure that the base is not moisture susceptible. -

University of Texas Bulletin Texas Granites

8169-1117-2m University of Texas Bulletin No. 1725: May 1, 1917 Bureau of Economic Geology and Technology J. A. UDDEN, Director Texas Granites BY J. P. NASH Testing Engineer, Bureau of Economic Geology and Technology Published by the University six times a month and entered as second-class matter at the postoffice at AUSTIN, TEXAS The benefits of education and of useful knowledge, generally diffused through a community, are essential to the preservation of a free goverm- ment. Sam Houston, Cultivated mind is the guardian genius of democracy. ... It is the only dictator that freemen acknowl- edge and the only security that free- men desire. Mirabeau*B. Lamar Texas Granites By J. P. Nash. It lias been said that the granite deposits in the central part of Texas contain more varied and serviceable granite than any equal area in the United States. While this is perhaps a debata- ble statement, it is certain that there is a wide range of colors and textures from which it is possible to obtain granite for al- most any purpose for which that stone is now used. This material is found in the central part of the state, principally in Burnet, Llano, and Gillespie counties. The development of the granite quarrying has been rather slow, due to thefact that, for the most part, the material is located at considerable distance from the railroad; and also because of the lack of capital. In the case of the gray granites, the most accessible quarry is 6 miles from the railroad, while others are as much as 12 miles distant. -

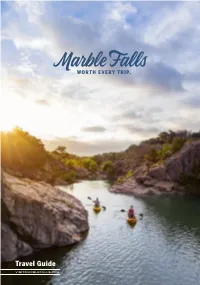

Travel Guide

Travel Guide VISITMARBLEFALLS.ORG Head out to Texas, and stop in the middle. If you follow the Colorado River into the heart of the Texas WATER ACTIVITIES Hill Country, you’ll find yourself in Marble Falls. Founded Table of in 1887, our historic lake town is a welcoming destination Highland Lakes 32-33 for adventures on land and lake alike. Our charming and Contents walkable downtown boasts an inspired and independent Boats 34-35 array of culinary and retail surprises. And Marble Falls’ surroundings are punctuated by state parks, natural Swimming Holes 35 wonders and dozens of local wineries. Fishing 36-37 Check out our trip planning site to discover the region and HILL COUNTRY ACTIVITIES book a place to rest your head. And once you’re here, our Visitor Center is the place for a friendly hello. INTRODUCTION Art Galleries 40-41 Downtown District 4-5 Pack your bags often. Marble Falls is worth every trip. Live Music 41 Festivals & Events 6 -7 Wildflowers 42-43 SHOPPING Golfing 44-45 Home 8 Family-Friendly Activities 46-47 Clothing 9 ABOUT MARBLE FALLS Gifts 9 History of Marble Falls 48 EAT & DRINK Timeline 49 Food 12-13 DIRECTORY OF BUSINESSES Coffee & Sweets 14-15 Shopping 50 Distilleries 16 Food 50-52 Breweries 16-17 Wineries & Breweries 52 Wineries 18-21 Lodging 52-53 LAND ACTIVITIES Water Activities 53 Hiking 24-27 Land Activities 53-54 Off Road & On Road 28-29 Hill Country Activities 54-55 Plan your trip at wortheverytrip.visitmarblefalls.org. A Day in Downtown Marble Falls is brimming with local businesses ready for you to explore. -

The Texas Grenville Orogen, Llano Uplift, Texas

THE TEXAS GRENVILLE OROGEN, LLANO UPLIFT, TEXAS Fieldtrip guide to the Precambrian Geology of the Llano Uplift, central Texas by Sharon Mosher, Mark Helper, and Jamie Levine Department of Geological Sciences, Jackson School of Geosciences, University of Texas at Austin TRIP 405 for THE GEOLOGICAL SOCIETY OF AMERICA ANNUAL MEETING, HOUSTON, TX, FALL 2008 Cosponsored by GSA Structural Geology and Tectonics Division THE TEXAS GRENVILLE OROGEN, LLANO UPLIFT, TEXAS Fieldtrip guide to the Precambrian Geology of the Llano Uplift, central Texas by Sharon Mosher, Mark Helper, and Jamie Levine Department of Geological Sciences, Jackson School of Geosciences, University of Texas at Austin TRIP 405 for THE GEOLOGICAL SOCIETY OF AMERICA ANNUAL MEETING, HOUSTON, TX, FALL 2008 Cosponsored by GSA Structural Geology and Tectonics Division Cover: Robert M. Reed Copyright by Sharon Mosher 2008 GEOLOGY OF THE LLANO UPLIFT by Sharon Mosher INTRODUCTION The Llano Uplift of central Texas consists of multiply deformed, 1.37-1.23 Ga metasedimentary, metavolcanic and metaplutonic rocks intruded by 1.13 to 1.07 Ga, syn- tectonic to post-tectonic granites (Fig. 1) (Mosher, 1998). An early high-pressure eclogite-facies metamorphism is overprinted by dynamothermal, medium-pressure metamorphism at upper amphibolite-facies conditions and a subsequent low-pressure, middle amphibolite-facies metamorphism associated with widespread intrusion of late granites (Carlson et al., 2007). These rocks are exposed in a gentle structural dome exposing ~9000 km2 of Middle Proterozoic crystalline basement in an erosional window through Phanerozoic sedimentary cover (Muehlberger et al., 1967; Flawn and Muehlberger, 1970). Normal and oblique-slip faults related to the Ouachita Orogeny affect Precambrian to Pennsylvanian rocks and juxtapose Paleozoic strata with the Precambrian exposures. -

Collection Agencies License Information As of 11/1/2019

COLLECTION AGENCIES LICENSE INFORMATION AS OF 11/1/2019 This information allows you to verify whether a collection agency is licensed by the State of Colorado. You may also determine whether there is any public record of action involving this office and the agency. The address listed is for the principal place of business. Contact our office for information on other branch office locations. Collection Agency Licenses Collection Agency Licenses are required in most cases to collect debts in default owed to others or that were originally owed to others. Only one license is required regardless of the number of branch offices. Generally, creditors collecting debts they originated or purchased before the debts were in default do not need a license. Licenses expire July 1 of each year and must be renewed at that time. "Status" Category The "Status" category provides the following information: A = license is active C = license has been cancelled D = license was denied E = license has expired due to failure to renew or maintain a surety bond/cash assignment R = license has been revoked "Action" Category In addition to the "Status" column that shows revocations, the "Action" category enables you to determine whether the licensee was subject to legal or administrative action by this office or the licensee entered into a voluntary settlement with this office. If the entry is "yes," the licensee may have been subject to one or more letters of admonition, suspension of the license, a judgment or order against the licensee, or other action, including payments (fines, penalties, consumer refunds, or other monetary payments.) Additionally, "yes" may mean that the licensee's records include a voluntary settlement or stipulation with this office. -

GEOLOGIC QUADRANGLE MAP NO. 48 Geology of the Marble Falls Quadrangle, Burnet and Llano Counties, Texas

r/ r J1'1:i• t:. ;;;;;;;;;;;;;;; ;;;;;;;;;;;;;;; C'I • Q. BUREAU OF ECONOMIC GEOLOGY 0 0 THE UNIVERSITY OF TEXAS AT AUSTIN VI Q. AUSTIN, TEXAS 78712 r:Q ct n.J :IE ..D ..J 0 W. L. F1seER, Director r-"I w r:Q Cl Lt) U"J rn co r-"I a""' n.J Cl . GEOLOGIC QUADRANGLE MAP NO. 48 - .,,.....""' 0 M -0 Cl""' Geology of the Marble Falls Quadrangle, Burnet and Llano Counties, Texas By VIRGILE. 8A.RNBI November 1982 THE UNIVERSITY OF TEXAS AT AUSTIN TO ACCOMPANY MAP-GEOLOGIC BUREAU OF ECONOMIC GEOLOGY QUADRANGLE MAP NO. 48 GEOLOGY OF THE MARBLE FALLS QUADRANGLE, BURNET AND LLANO COUNTIES, TEXAS VIRGIL E. BARNES 1982 CONTENTS General setting . 2 Crack fillings ............... 8 Geologic formations . 2 Houy Formation ............ 8 Precambrian rocks . 2 Ives Breccia Member ........ 8 Igneous rocks . 2 Doublehorn Shale Member .... 8 Town Mountain Granite . 2 Mississippian System .............. 8 Paleozoic rocks . 3 Chappel Limestone ........... 8 Cambrian System . 3 Barnett Formation ........... 8 Moore Hollow Group . 3 Pennsylvanian System ............. 9 Riley Formation . 3 Unnamed phosphorite ......... 9 Hickory Sandstone Member . 3 Marble Falls Limestone ........ 9 Cap Mountain Limestone Member 3 Smithwick Formation ......... 9 Lion Mountain Sandstone Member 3 Mesozoic rocks . 10 Wilberns Formation . 4 Cretaceous System (Lower Cretaceous) . 10 Welge Sandstone Member . 4 Trinity Group . 10 Morgan Creek Limestone Member 4 Shingle Hills Formation . 10 Point Peak Member . 4 Hensen Sand Member . 10 San Saba Member . 4 Post-Smithwick? Mesozoic? diabase ..... 10 Ordovician System (Lower Ordovician) . 5 Cenozoic rocks ...................•. 10 Ellenburger Group . 5 Quaternary deposits .............. 10 Tanyard Formation . 5 Terrace deposits and colluvium . -

Texas Rocks & Fossils 3 4 6 8 9 12

2 11 1 10 TEXAS ROCKS & FOSSILS 3 4 6 8 9 12 13 5 7 17 18 19 21 14 15 16 22 20 31 24 25 26 27 29 32 23 30 28 42 43 33 34 35 36 38 40 41 44 46 37 45 47 48 39 51 53 49 50 56 54 55 57 52 58 64 65 59 60 61 62 63 66 67 80 70 71 73 68 69 74 76 72 77 78 79 75 1. Abundant in many Texas localities, fossil seashells are found in a 14. Cretaceous marine fossils from a cave along the Colorado River 30. A nodule of banded blue agate from near Alpine in West Texas. 43. Llanite is a type of Texas pink granite found nowhere else in the 58. Soapstone, a combination of talc and other minerals, is soft and 72. Specimen of natural pink granite from Burnet County. Also see variety of settings, from blackland prairies to rocky hillsides. Indi- in Travis County. The county is bisected by a major geological Similar specimens are not uncommon throughout much of the world. Llanite’s uniqueness results from crystals of sky-blue easily cut. Fire resistant soapstone lined the inside, or formed the numbers 64, 71 and 73. vidual specimens like these are usually from the Cretaceous pe- feature, the Balcones Escarpment. length of the Rio Grande. Also see numbers 17,18, and 26. quartz mingled with the granite’s rusty-pink feldspar and other mantel of many early Central Texas fireplaces. Blanco County 73. Called graphic granite from the peculiar geometric inclusions that riod of some 100 million years ago. -

Campus Field Trip Guidebook Department of Earth and Atmospheric Sciences University of Houston

Campus Field Trip Guidebook Department of Earth and Atmospheric Sciences University of Houston Art on the UH campus uses rocks! Download the UH ARTour app for Apple and Android Laurentian Pink Granite in sculpture – Benches by Scott Burton at the south entrance of the Gerald D. Hines College of Architecture, sculpted in 1985 Town Mountain Granite in the sculpture – Lotus by Jesus Bautista Moroles in the courtyard of the Graduate School of Social Work, sculpted in 1982 Black Cambrian Granite in the untitled sculpture by Matt Mullican at the plaza of the Science Center Building, sculpted in 1991 1 UH Campus Map showing locations of various stops in your Guide Book Most of the figures and images used in this guide are from GEOL 1330 textbook – Earth by Tarbuck, Lutgens and Tasa, 12th edition, 2017 Figure on the front page is Figure 1.22, see https://goo.gl/dYWRsL 2 STOP 1 Location: first floor lobby S&R 1 (building 550). All three types of rocks are used for various facing stones within the lobby. Sedimentary Rock: travertine wall panels on lobby walls. Description: Travertine is a chemical sedimentary rock formed by precipitation of carbonate minerals often influenced by microbial activity. Travertine is composed of aragonite and calcite, although iron and organic impurities can alter its color to yellow, grey, brown and even red. Travertine deposits are located either in hot or cold springs in karst areas. Water dissolves limestone at depth and become saturated with CO2. The CO2 makes the water acidic. As the groundwater resurfaces, a sudden drop in pressure causes the release of CO2 and crystallization of calcium carbonate. -

Mapping Texas Lands Mapping Texas Lands

046-067TXSE_1_03_p 11/15/02 5:02 PM Page 46 Why It Matters Now The land and climate will help 1 Mapping Texas Lands determine where you choose to live, what jobs will be available, and the quality of your life. TERMS & NAMES OBJECTIVES MAIN IDEA plains, physical geography, 1. Compare places in Texas in terms of Texas is a big place. The land, human geography, settlement, their physical characteristics. weather, and climate vary a great Rio Grande, tributary 2. Compare regions of Texas in terms deal from one part of the state to of their physical characteristics. another. This variation affects where we live and what we do there. During the 1880s some Texans believed that Texas should be surveyed, or explored and mapped. They believed that this survey would help the state’s economic progress. Others would be able to use the survey to help them locate mineral resources and find sources of water for irrigation. Robert T. Hill was a Texan who devoted his life to studying the physical geography and geology of Texas. He believed Robert T. Hill that it was important to survey the state. When the legislature refused to conduct the survey, Hill expressed his disappointment in a newspaper article. Little did I think when, as a Texan, I [worked] . for the purpose of developing [the state’s] resources, . that I was casting pearls before swine. Robert T. Hill, Austin Daily Statesman, March 25, 1887 Two Kinds of Geography plains a wide area of flat or Geography deals with the land and its people. -

The Precambrian of Central Texas Virgil E

Geological Society of America Centennial Field Guide—South-Central Section, 1988 The Precambrian of Central Texas Virgil E. Barnes, Bureau of Economic Geology, University of Texas at Austin, University Station, Box X, Austin, Texas 78713-7508 Figure 1. Map showing the Precambrian rocks of Llano region (Barnes, 1981) and the localities discussed in this chapter. The edge of the Phanerozoic cover is stippled. LOCATION “Precambrian rocks reach the surface in the Llano region of the Geologic Atlas of Texas, scale 1:250,000 (Barnes, 1981). On Central Texas in the highest part of a broad domal arch, the that map ‘(as well as Fig. 1), the Oatman Creek and Sixmile Llano uplift, which appears on a regional geologic map as an Granites (Table 1) are lumped as younger granitic intrusive rocky island of igneous and metamorphic rocks surrounded by Paleo- locally, in the southeast part of the Llano Sheet, the Packsaddle zoic and Cretaceus sedimentary rocks. The widest expanse of Schist is subdivided into four formations (McGehee, 1979). De- Precambrian rocks is about 65 mi ( 105 km), extending westward tailed 7½-minute quadrangle maps include most of the area in from the valley of the Colorado River through a subdued topo- which the Packsaddle Schist has been subdivided (Barnes and graphic basin drained by the Llano River. The broad, gentle basin McGehee, 1976; 1977a, b, c). carved into the Precambrian rocks is bordered by a discontinuous rim of flat-topped limestone hills which are the dissected edge of INTRODUCTION the Edwards Plateau. Within the basin and at its margins are erosional remnants and down-faulted blocks of Paleozoic rocks The first significant study of the Precambrian rocks of the which form prominent hills, locally referred to as mountains.” area was by Walcott ( 1884), who gave the name Llano Group to Clabaugh and McGehee (1972, p. -

Institutions Exempt from the Debit Card Interchange Standards

Institutions Exempt from the Debit Card Interchange Standards Status FRB_ID Legal_Name Short_Name City State TYPE FDIC_ID OCC_ID NCUA_ID Exempt 725291 1199 SEIU FEDERAL CREDIT UNION 1199 SEIU FCU NEW YORK NY Federal Chartered Natural Persons Credit Union 0 0 24670 Exempt 916398 121 FINANCIAL CREDIT UNION 121 FNCL CU JACKSONVILLE FL State Chartered Natural Persons Credit Union 0 0 61605 Exempt 720689 167TH TFR FEDERAL CREDIT UNION 167TH TFR FCU MARTINSBURG WV Federal Chartered Natural Persons Credit Union 0 0 13028 Exempt 3317192 1ST ADVANTAGE BANK 1ST ADVAN BK SAINT PETERS MO State Nonmember Commercial Bank 57899 0 0 Exempt 497383 1ST ADVANTAGE FEDERAL CREDIT UNION 1ST ADVANTAGE FCU YORKTOWN VA Federal Chartered Natural Persons Credit Union 0 0 7448 Exempt 564856 1ST BANK 1ST BK BROADUS MT State Member Commercial Bank 22039 0 0 Exempt 350657 1ST BANK IN HOMINY 1ST BK IN HOMINY HOMINY OK State Member Commercial Bank 4122 0 0 Exempt 148470 1ST BANK OF SEA ISLE CITY 1ST BK OF SEA ISLE CITY SEA ISLE CITY NJ State Nonmember Savings Bank 30367 0 0 Exempt 3048487 1ST BANK YUMA 1ST BK YUMA YUMA AZ State Nonmember Commercial Bank 57298 0 0 Exempt 3945737 1ST BERGEN FEDERAL CREDIT UNION 1ST BERGEN FCU HACKENSACK NJ Federal Chartered Natural Persons Credit Union 0 0 24810 Exempt 941653 1ST CAMERON STATE BANK 1ST CAMERON ST BK CAMERON MO State Nonmember Commercial Bank 32487 0 0 Exempt 3594797 1ST CAPITAL BANK 1ST CAP BK SALINAS CA State Nonmember Commercial Bank 58485 0 0 Exempt 166595 1ST CHOICE CREDIT UNION 1ST CHOICE CU ATLANTA GA State Chartered -

Trans-Pecos Magmatism Part 1

10 Feb 2014 Magmatism in Trans-Pecos Texas, part 1 ! Daniel S. Barker, Department of Geological Sciences, !The Jackson School of Geosciences, The University of Texas at Austin ! ! ! This document has not been peer-reviewed ! ! ! ! ! ! ! ! ! ! To facilitate downloading, this document has been divided into nine parts, each less than !20.6 MB. ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! !1 ! ! ! ! ! Contents Pagination failed repeatedly for some parts, but in this list all items are in their correct order Part 1 Abstract Foreword Data base Precambrian Franklin Mountains Castner Marble Mundy Breccia Thunderbird Series Upper porphyritic granite sill Lower granite sill Red Bluff granite complex “Ferrobasalt” dike Van Horn area Carrizo Mountain group Allamore Formation Tumbledown Formation Pump Station Hills Subsurface Precambrian Cretaceous Maar complex at Pena Mountain East of Pena Mountain Rosillos Ranch Cenozoic Red Hill El Paso area Campus “andesite” Cristo el Rey Coronado Hills (Three Sisters) Thunderbird intrusion Hueco Tanks State Park Cerro Alto Part 2 Finlay Mountains Alamo Creek lavas Hen Egg and Christmas Mountain quadrangles Devil‘s Graveyard lava Hen Egg Mountain North Adobe Mountain Wildhorse Mountain intrusion Lake Ament intrusion Payne’s Waterhole area Luna Vista sill Christmas Mountains Packsaddle Mountain Indian Head Mountain Adobe Walls Mountain Agua Fria Mountain !2 Paisano Peak West Corazones Peak East Corazones Peak Yellow Hill quadrangle Terlingua area California Mountain Willow Mountain Maverick Mountain Whitehouse Mountain