J-REIT Rating Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Strangers on a Commuter Train

Alisa Freedman Strangers on a Commuter Train Female Students and the Salaryman Who Watched Them in Tayama Katai's Shojo byo In the early twentieth century, there were several transformations in Tokyo urban space and in the lives of its inhabitants. Many of these new social and spatial move ments converged on the train. Throughout the Meiji period (1868-1912)1, a gro wing number of peopte moved to Tokyo from the countryside, and, by the first de cade of the twentieth century, the city population had exploded. However, in the years following ]apan's 1905 military victory over Russia, many families moved from the city to its surrounding countryside, seeking nature and tranquiHity away from the noise and crowds.2 The residents of these suburbs included the salaryman (sarariman), a worker who earned a monthly salary and was a member of the new middle dass which emerged with the financial growth and developing capitalist consumer economy at this time. Perhaps more in image than in reality, the sa laryman, his wife, and at least two children lived alongside upper-class families of high-ranking government officials, whose daughters often attended schoo'l in the center of Tokyo and commuted there by the expanding network of modern mass transportation. From the Meiji 30s, the last decade of the nineteenth century, the number of female students increased, and the image of the schoolgirl dressed in ha kuma, wearing hair ribbons, and traversing Tokyo or its suburbs on bicycle or by train proliferated in popular literature and mass media. 3 The rise of the suburbs, where the salarymen and female students resided, was facilitated by the develop ment of Tokyo's modern mass transportation network, especially the new electric trains, which were cleaner and quieter than steam locomotives. -

Japan's Powder Paradise

tokyo FEBRUARY 2012 weekenderJapan’s premier English language magazine Since 1970 HOKKAIDO JAPAN’S POWDER PARADISE LOVE IS IN THE AIR TWELVE DATE TIPS FOR 2012 VALENTINE’S RESTAURANT GUIDE EDUCATION SPECIAL CAN JAPAN EMBRACE THE 4 F’S? A PIONEERING INTERNATIONAL SCHOOL AGENDA INTERVIEW PLUS! All The Biggest Live Weekender Q&A with WIN Great Prizes with Shows this Month German Ambassador our Readers Survey IN THIS ISSUE: The Latest APAC news from the Asia Daily Wire, People Parties & Places, Hit the Ice in Tokyo and much more... FEBRUARY, 2012 CONTENTS ON PISTE IN HOKKAIDO Weekender heads north to Hokkaido’s winter wonderland. VALENTINE’S DAY PEOPLE, PARTIES, PLACES AGENDA Twelve date ideas for 2012 and Tokyo’s longest running society columnist The best live shows coming up a gorgeous Grand Marnier recipe. hangs out with the Jacksons. in Tokyo this month. 11 Asia Daily Wire 22 Hoshino Resort Tomamu 36 American Apparel A roundup of all the top APAC news of the Exploring one of Hokkaido’s most After a great 2011, the LA based fashion past month. luxurious ski resorts. basics brand is expanding in Japan. 12 German Ambassador Interview 31 Education Special 38 Bill Hersey Q&A with Volker Stanzel, Ambassador of Weekender asks, can Japan embrace the Tokyo’s Longest Running Society Column the Federal Republic of Germany. 4 F’s instead of the 3 R’s? Printed in Weekender For 42 Years! 16 Tokyo Restaurant Guide 32 ISAK 43 Win a Skincare Set Worth ¥30,000 Special guide to Tokyo’s top restaurants An international school with a difference. -

THE WESTIN TOKYO Sakura Map

THE WESTIN TOKYO Sakura Map 1 Meguro River 2 Yoyogi Park Take the JR Yamanote Line from Ebisu Station to Take the JR Yamanote Line from Ebisu Station to Meguro Station (3 minutes). 5 minutes' walk from Harajuku Station (5 minutes). 3 minutes' walk from Meguro Station. Harajuku Station. Along both sides of the river banks spanning Atop the vast lawn, you will find cherry trees 4km, you will find 800 Somei Yoshino cherries in full bloom. This is a popular cherry in bloom. At night, they are illuminated. blossom viewing location. Ueno 4 Yamanote Line Sobu Line Kudanshita Hanzomon Line 7 Shinjyuk3ugyoen 3 Shinjyuku Gyoen National Park 4 Ueno Onshi Park Take the JR Yamanote Line from Ebisu Station to Shinjuku Take the JR Yamanote Line from Ebisu Station to Shinjyuku Station. From Shinjuku Station, board the Tokyo Metro Ueno Station (30 minutes). 2 minutes' walk from the Marunouchi Line and take it to Shinjuku-gyoenmae Station (3 Ueno Park exit of Ueno Station. minutes). 5 minutes' walk from Shinjuku-gyoenmae Station. The main road through the park features Enjoy 1,300 cherry trees of 65 varieties 1,200 cherry trees, making it one of the Marunouchi Line 6 outbloom. foremost destinations in Tokyo. Roppongi 5 Tokyo Midtown Harajyuku Shinanomachi 2 Take the Tokyo Metro Hibiya Line from Ebisu Station to Roppongi Station (6 minutes). 6 minutes' walk from Roppongi Station. 5 When in full bloom, sakura street is turned to sakura tunnel. At night, their illuminated blossoms create a bewitching mood. Hibiya Line 8 6 Meiji Jingu Gaien Ebisu Hamamatsucho Take the JR Yamanote Line from Ebisu Station to Yoyogi Station (8 minutes). -

The JR Pass: 2 Weeks in Japan

Index Introduction to Travel in Japan………………………………… 1 - 7 Day 1 | Sakura Blooms in North Japan…………………….. 8 - 12 Day 2 |Culture in Kyoto…………………………………………… 13 - 18 Day 3 | Shrines and Bamboo Forests……………………….. 19 - 24 Day 4 | The Alpine Route………………………………………… 25 - 29 Day 5 | Takayama Mountain Village……………………….. 30 - 34 Day 6 | Tokyo by Day, Sendai at Night…………………….. 35 - 40 Day 7 | Exploring Osaka………………………………………….. 41 - 44 Day 8 | The 8 Hells of Beppu…………………………………… 45 - 50 Day 9 | Kawachi Fuji Gardens………………………………….. 51 - 53 Day 10 | Tokyo Indulgence………………………………………. 54 - 58 Day 11 | The Ryokan Experience at Mount Fuji……….. 59 - 64 Day 12 | The Fuji Shibazakura Festival……………………… 65 - 70 Day 13 | Harajuku and Shinjuku (Tokyo)…………………… 71 - 75 Day 14 | Sayonara!........................................................ 76 - 78 The Final Bill ……………………………………………………………. 79 1 We Owned the JR Pass: 2 Weeks in Japan May 29, 2015 | By Allan and Fanfan Wilson of Live Less Ordinary Cities can be hard to set apart when rattling past the backs of houses, on dimly lit train lines. Arriving to Tokyo it feels no different, and were it not for the alien neon lettering at junctions, we could have been in any city of the world. “It reminds me of China” Fanfan mutters at a time I was feeling the same. It is at this point where I realize just how little I know about Japan. My first impressions? It’s not as grainy as Akira Kurosawa movies, and nowhere near as animated as Manga or Studio Ghibli productions. This is how I know Japan; through movies and animation, with samurai and smiling eyes. I would soon go on to know and love Japan for many other reasons, expected and unexpected during our 2 week JR pass journeys. -

Unifying Rail Transportation and Disaster Resilience in Tokyo

University of Arkansas, Fayetteville ScholarWorks@UARK Architecture Undergraduate Honors Theses Architecture 5-2020 The Yamanote Loop: Unifying Rail Transportation and Disaster Resilience in Tokyo Mackenzie Wade Follow this and additional works at: https://scholarworks.uark.edu/archuht Part of the Urban, Community and Regional Planning Commons Citation Wade, M. (2020). The Yamanote Loop: Unifying Rail Transportation and Disaster Resilience in Tokyo. Architecture Undergraduate Honors Theses Retrieved from https://scholarworks.uark.edu/archuht/41 This Thesis is brought to you for free and open access by the Architecture at ScholarWorks@UARK. It has been accepted for inclusion in Architecture Undergraduate Honors Theses by an authorized administrator of ScholarWorks@UARK. For more information, please contact [email protected]. The Yamanote Loop: Unifying Rail Transportation and Disaster Resilience in Tokyo by Mackenzie T. Wade A capstone submitted to the University of Arkansas in partial fulfillment of the requirements of the Honors Program of the Department of Architecture in the Fay Jones School of Architecture + Design Department of Architecture Fay Jones School of Architecture + Design University of Arkansas May 2020 Capstone Committee: Dr. Noah Billig, Department of Landscape Architecture Dr. Kim Sexton, Department of Architecture Jim Coffman, Department of Landscape Architecture © 2020 by Mackenzie Wade All rights reserved. ACKNOWLEDGEMENTS I would like to acknowledge my honors committee, Dr. Noah Billig, Dr. Kim Sexton, and Professor Jim Coffman for both their interest and incredible guidance throughout this project. This capstone is dedicated to my family, Grammy, Mom, Dad, Kathy, Alyx, and Sam, for their unwavering love and support, and to my beloved grandfather, who is dearly missed. -

Tokyo Great Garden Spring Campaign

Enlightenment with Asakura style philosophy 7RN\R Former AsakuraAsakura Fumio Garden (Asakura Museum of Sculpture, Taito) 7-18-10 Yanaka, Taito-ku 103-3821-4549 *UHDW National - designated Place of Scenic Beauty "Former Asakura Fumio Garden" Asakura Sculpture Museum is the building that was a studio and residence of Fumio Asakura (1883 ~1964) a leading sculptor of modern Japan. Asakura designed and supervised the building which was completed in 1935. Asakura died in 1964, but the building was opened to the public as a Asakura Sculpture Museum since 1967 by the family of the deceased (transferred to Taito-ku in 1986), in 2001 the building is registered in the tangible cultural heritage of the country. In 2008 the integration of architecture and gardens were admitted for their value and artistic appreciation and *DUGHQ the entire site has been designated as a national scenic spot as "The former gardens of Fumio Asakura". Since 2009 to 2013 was carried out conservation and restoration works on a large scale and appearance could be restored even when Asakura was alive. Admission General 500 yen (300 yen). Elementary, middle and high school students 250 yen (150 yen) *( ) inside is a group rate of more than 20 people *Persons holding the Handicapped person's passbook or a Certificate Issued for Specific Disease Treatment and their caregivers is free Yearly Passport: 1,000 yen (same price for all visitors) 6SULQJ Open 9:30 - 16:30 (Admission until 16:00) Closed Mondays and Thursdays Open on holidays and Closed on the day following a holidays Year-end and New Year holidays *During changing exhibitions, etc. -

Policy of Cultural Affairs in Japan

Policy of Cultural Affairs in Japan Fiscal 2016 Contents I Foundations for Cultural Administration 1 The Organization of the Agency for Cultural Affairs .......................................................................................... 1 2 Fundamental Law for the Promotion of Culture and the Arts and Basic Policy on the Promotion of Culture and the Art ...... 2 3 Council for Cultural Affairs ........................................................................................................................................................ 5 4 Brief Overview of the Budget for the Agency for Cultural Affairs for FY 2016 .......................... 6 5 Commending Artistic and Related Personnel Achievement ...................................................................... 11 6 Cultural Publicity ............................................................................................................................................................................... 12 7 Private-Sector Support for the Arts and Culture .................................................................................................. 13 Policy of Cultural Affairs 8 Cultural Programs for Tokyo 2020 Olympic and Paralympic Games .................................................. 15 9 Efforts for Cultural Programs Taking into Account Changes Surrounding Culture and Arts ... 16 in Japan II Nurturing the Dramatic Arts 1 Effective Support for the Creative Activities of Performing Arts .......................................................... 17 2 -

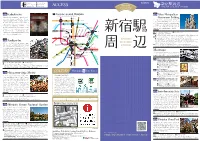

Ka U I Cho O O Etropo Itan Overn Ent Ui Ding J Uniso Ku Ano in a Shrine

2019_shinjuku_eng_f.pdf 1 2020/01/08 16:42 〈English〉 Shinjuku ASS tourist map Stations around Shinuu Kauicho This map is focused around stations in Shinjuku City. oo etropoitan Kabuki-cho was established in 1948 as part of World War II damage reconstruction. The name overnent uiding The Tokyo Metropolitan Government Building was came from a plan to attract a Kabuki theater in designed by the architect Tange Kenzo, and completed the area, although it was not materialized, it in 1991. A panoramic observation deck (entrance free) helped bring a wave of other entertainment on the 45th floor of Main Building No. 1 provides a 202 complexes to Kabuki-cho. Theaters, movie meter high view of Tokyo. The restaurants, cafes, and theaters, restaurants, bars were constructed one employee cafeterias are all available to the public. after the other, and soon Kabuki-cho had become the largest entertainment district in Japan. Safe and enjoyable town planning has been promoted 2-8-1 Shinjuku, Shinjuku-ku 03-5320-7890 and the area attracts many visitors. North Tower: 9:30-23:00 South Tower: 9:30-17:00 (However it is open until 23:00 on days that the North Tower observatory is closed.) North Observatory: The 2nd and 4th Monday of each month South Observatory: The 1st and 3rd Tuesday of each month AROUND When a holiday falls on one of these days, the observatory is opened and the following day is closed. Suehirotei On maintenance days, both observatories are closed. Due to repairs, the number of elevators servicing the SHINJUKU observatories have been reduced. -

Shibuya Disaster Prevention Survival

The probability of the occurrence of a magnitude 7 earthquake in the southern of an earth Kanto area is 70% in the next 30 years and 90% in the next 50 years. In case quake What will happen if a big ear (Source: The Earthquake Research Committee of the Ministry of Education, thquake strikes Shibuya?! Culture, Sports, Science and Technology, “The General view of the national Earthquake Strike earthquake, forecast map,” 2006 revised.) Based on research of all of the buildings in Shibuya City and geological Building collapse Casualties Lifelines Other surveys, Shibuya City has produced a “Regional Risk Map” and a “Map of ・ Protect yourself ・ Prevent fi res and extinguish them im- Shaking Probability” that indicate the risk of building-collapse. You can get the mediately ・ Entire destruction ・ Dead Rate of suffering damages ・ Will have diffi culty maps in the City Offi ce. ・ Cooperate with neighbors to put out fi res and rescue others 2,285 buildings 33 people ・ Electricity 15.0% returning home over 230,000 people Recovery days for lifelines throughout Tokyo: ・ Partial destruction ・ Seriously injured ・ City gas 0% If there is a threat of danger in your house or other place 5,780 buildings 187 people ・ Will need to stay in ★Electricity 6 days where you are, take refuge at a temporary gathering site (public ・ Water supply 31.4% ★City Gas 53 days (No damage is assumed in Shibuya City.) school grounds, parks, etc.) ※1 ・ Injured temporary shelters over ・ Drainage 22.1% 30,000 person ★Water supply 30 days ★Drainage 30 days 1,476 people ★Communications 14 days Survive an Earthquake Disaster! ・ Telephone 8.3% ・ Elevators closed with Tokyo Regional Disaster Prevention Plans, earthquake edition (revised in 2007) ※due to collapse ※1 * In the case of spreading fi res people inside Temporary gathering sites are ※ In Shibuya City ※ 2 determined to be safe. -

Shinjuku Rules of Play

Shinjuku Rules of Play Gary Kacmarcik Version 2 r8 Tokyo is a city of trains and Shinjuku is the busiest In Shinjuku, you manage one of these con- train station in the world. glomerates. You need to build Stores for the Customers to visit while also constructing the rail Unlike most passenger rail systems, Tokyo has lines to get them there. dozens of companies that run competing rail lines rather than having a single entity that manages rail Every turn, new Customers arrive looking to for the entire city. Many of these companies are purchase a specific good. If you have a path to a large conglomerates that own not only the rail, but Store that sells the goods they want, then you also the major Department Stores at the rail might be able to move those new Customers to stations. your Store and work toward acquiring the most diverse collection of Customers. Shinjuku station (in Shinjuku Ward) expands down into Yoyogi station in Shibuya Ward. A direct rail connection exists between these 2 stations that can be used by any player. Only Stores opened in stations with this Sakura icon may be upgraded to a Department Store. Department Store Upgrade Bonus tokens are placed here. The numbers indicate the total number of customers in the Queue (initially: 2). Customer Queue New Customers will arrive on the map from here. Stations are connected by lines showing potential Components future connections. These lines cannot be used until a player uses theE XPAND action to place track Summary on them, turning them into a rail connection. -

Tokyo 2020 TDM -Games Transportation in Metropolitan Activities- Table of Contents

Tokyo 2020 TDM -Games transportation in metropolitan activities- Table of Contents 1. Overview of Tokyo 2020 Games (Traffic Forecast) 1-1) TDM 1-2) 2020 Traffic Restrictions 2. Requested corporate efforts 2-1) Requested Efforts 2-2) Efforts in Summer of 2019 2-3) Verification (References) • Examples (London, G20, etc.) • Traffic Restrictions (G20 and Others, Road Competitions) • Traffic Forecast (Map of Games influence on Transport) • Others 1 1. Overview of Tokyo 2020 Games (Traffic Forecast) 1-2) 2020 Traffic Restrictions (ORN, Personnel Transportation Routes) 2 Examples from Past-Games (London 2012; TDM PR, For General Users) 3 Examples from Past-Games (London 2012; TDM PR For Corporations) 4 Competition schedule and the scale of the games Olympics Paralympics July 24, 2020 (Friday) August 25, 2020 (Tuesday) Period to August 9 (Sunday) to September 6 (Sunday) (17 Days) (13 Days) No. of 33 22 Competitions [Athletes] Approx. 11,000 No. [Athletes] Approx. 4,400 [Spectators] Approx. 7.8 million people [Spectators] Approx. 2.3 million people of [Media Representatives] [Media Representatives] Approx. 9,500 people Visitors Approx. 25,000 people 5 Time Periods That Require Intensive Efforts [2020 Calendar] Olympics: July 24 to August 9 Paralympics: August 25 to September 6 Sun Mon Tue Wed Thu Fri Sat Opening Ceremony Period when there is an Marine Day Sports Day Bicycle (Umi No Hi) annual increase in quantity Competition before Obon. (An annual Bicycle Buddhist event for Triathlon Triathlon Walking Race Triathlon Competition commemorating one's ancestors) Marathon Walking Race Walking Race Closing Ceremony Mountain Day Marathon (Yama No Hi) Period When Traffic Opening Triathlon Measures are Ceremony Particularly Required Triathlon Closing Ceremony Returning equipment including equipment used at games returned to Marathon each country * From 2020, Physical Education Day (Taiiku No Hi) will be changed to Sports Day. -

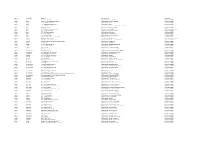

Area Locality Address Description Operator Aichi Aisai 10-1

Area Locality Address Description Operator Aichi Aisai 10-1,Kitaishikicho McDonald's Saya Ustore MobilepointBB Aichi Aisai 2283-60,Syobatachobensaiten McDonald's Syobata PIAGO MobilepointBB Aichi Ama 2-158,Nishiki,Kaniecho McDonald's Kanie MobilepointBB Aichi Ama 26-1,Nagamaki,Oharucho McDonald's Oharu MobilepointBB Aichi Anjo 1-18-2 Mikawaanjocho Tokaido Shinkansen Mikawa-Anjo Station NTT Communications Aichi Anjo 16-5 Fukamachi McDonald's FukamaPIAGO MobilepointBB Aichi Anjo 2-1-6 Mikawaanjohommachi Mikawa Anjo City Hotel NTT Communications Aichi Anjo 3-1-8 Sumiyoshicho McDonald's Anjiyoitoyokado MobilepointBB Aichi Anjo 3-5-22 Sumiyoshicho McDonald's Anjoandei MobilepointBB Aichi Anjo 36-2 Sakuraicho McDonald's Anjosakurai MobilepointBB Aichi Anjo 6-8 Hamatomicho McDonald's Anjokoronaworld MobilepointBB Aichi Anjo Yokoyamachiyohama Tekami62 McDonald's Anjo MobilepointBB Aichi Chiryu 128 Naka Nakamachi Chiryu Saintpia Hotel NTT Communications Aichi Chiryu 18-1,Nagashinochooyama McDonald's Chiryu Gyararie APITA MobilepointBB Aichi Chiryu Kamishigehara Higashi Hatsuchiyo 33-1 McDonald's 155Chiryu MobilepointBB Aichi Chita 1-1 Ichoden McDonald's Higashiura MobilepointBB Aichi Chita 1-1711 Shimizugaoka McDonald's Chitashimizugaoka MobilepointBB Aichi Chita 1-3 Aguiazaekimae McDonald's Agui MobilepointBB Aichi Chita 24-1 Tasaki McDonald's Taketoyo PIAGO MobilepointBB Aichi Chita 67?8,Ogawa,Higashiuracho McDonald's Higashiura JUSCO MobilepointBB Aichi Gamagoori 1-3,Kashimacho McDonald's Gamagoori CAINZ HOME MobilepointBB Aichi Gamagori 1-1,Yuihama,Takenoyacho