Top 20 Brands and Models.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

MB10597 ©2020 Cummins Filtration Inc

DECEMBER 2020 NEW PRODUCT BULLETIN RELEASED AND AVAILABLE IN AUSTRALIA ON-HIGHWAY Fleetguard Market Description Replaces Applications Related Parts P/N Toyota - 8713906080, 8713907020, 8713952040, 871390D010, 871390D070, 87139YZZ16; Subaru - 72880AJ000, 72880AJ0009P, 72880AL000, SEDNF29100, SEDNF29110; LF3335 (Full Flow Lube Filter) Daihatsu - 871390D010; LCV Cabin Air Filter AF56056 Toyota - Hilux, 4Runner FF5764 (Fuel Filter) Sakura - CA1112; AF26501 (Primary Air Filter) ASAS - HF6098; Great Wall Motors - 8104400CJ08XA; Hengst - E2945LI; Jaguar - T2H8151; Landrover - LR055993; NAPA - 224483 RELEASED GLOBALLY AND AVAILABLE TO ORDER These products are not in Australia’s inventory at this time. Please allow 12 weeks for shipment to Australia. ON-HIGHWAY Fleetguard Market Description Replaces Applications Related Parts P/N LF667 (Full Flow Lube Filter) LF3654 (By-Pass Lube Filter) FS20081 (Fuel/Water Separator), AF26363 (Primary Air Filter) Volvo - 22474709, 23843839, Volvo - VHD, VNL, AD27747 (Air Dryer) Trucks & Nanonet Fuel 23856886; FF42128NN VNR Series; AF56060 (Cabin Air Filter) Buses Filter Mack - 22094967, 23856895, Mack - Anthem, LR Series CV50628 (Crankcase Ventilation) 23920471 HF6162 (Steering Hydraulic Filter) UF106 (Urea Filter) WF2123 (Water Filter without chemical additive) RELEASED GLOBALLY AND AVAILABLE TO ORDER These products are not in Australia’s inventory at this time. Please allow 12 weeks for shipment to Australia. ON-HIGHWAY Fleetguard Market Description Replaces Applications Related Parts P/N Ford - 1812551, 2128722, -

Citroën Berlingo

CITROËN BERLINGO (MF) 1.9 D (MFWJZ) 07.98 - 10.05 51 70 1868 4 CITROËN BERLINGO (MF) 1.9 D 4WD (MFWJZ) 07.98 - 51 69 1868 4 CITROËN BERLINGO karoserie (M_) 1.9 D 70 04.99 - 51 69 1868 4 (MBWJZ, MCWJZ) CITROËN BERLINGO karoserie (M_) 1.9 D 70 4WD 07.98 - 51 69 1868 4 (MBWJZ, MCWJZ) CITROËN BERLINGO karoserie (M_) 2.0 HDI 90 12.99 - 66 90 1997 4 (MBRHY, MCRHY) CITROËN BERLINGO karoserie (M_) 2.0 HDI 90 4WD 11.00 - 66 90 1997 4 (MBRHY, MCRHY) CITROËN C5 I (DC_) 2.0 HDi (DCRHYB) 03.01 - 08.04 66 90 1997 4 CITROËN C5 I (DC_) 2.0 HDi 03.01 - 08.04 79 107 1997 4 CITROËN C5 I (DC_) 2.0 HDi (DCRHZB, DCRHZE) 03.01 - 08.04 80 109 1997 4 CITROËN C5 I (DC_) 2.0 HDi (DCRHZB, DCRHZE) 06.01 - 08.04 80 109 1997 4 CITROËN C5 I (DC_) 2.2 HDi (DC4HXB, DC4HXE) 03.01 - 08.04 98 133 2179 4 CITROËN C5 I Break (DE_) 2.0 HDi (DERHYB) 06.01 - 08.04 66 90 1997 4 CITROËN C5 I Break (DE_) 2.0 HDi (DERHSB, 06.01 - 08.04 79 107 1997 4 DERHSE) CITROËN C5 I Break (DE_) 2.0 HDi 06.01 - 08.04 80 109 1997 4 CITROËN C5 I Break (DE_) 2.2 HDi (DE4HXB, 06.01 - 08.04 98 133 2179 4 DE4HXE) CITROËN C5 II (RC_) 2.2 HDi (RC4HXE) 09.04 - 98 133 2179 4 CITROËN C5 II (RC_) 2.2 HDi (RC4HXE) 02.05 - 98 133 2179 4 CITROËN C5 II Break (RE_) 2.2 HDi (RE4HXE) 09.04 - 98 133 2179 4 CITROËN C5 II Break (RE_) 2.2 HDi (RE4HXE) 02.05 - 98 133 2179 4 CITROËN C8 (EA_, EB_) 2.0 HDi 07.02 - 79 107 1997 4 CITROËN C8 (EA_, EB_) 2.0 HDi 07.02 - 80 109 1997 4 CITROËN C8 (EA_, EB_) 2.2 HDi 07.02 - 94 128 2179 4 CITROËN C8 (EA_, EB_) 2.2 HDi 06.07 - 120 163 2179 4 CITROËN C8 (EA_, EB_) 2.2 HDi 06.06 - 125 -

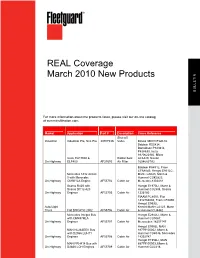

REAL Coverage March 2010 New Products

REAL Coverage March 2010 New Products N BULLETI For more information about the products listed, please visit our on-line catalog at cumminsfiltration.com. Market Application Part # Description Cross Reference Shut-off Industrial Industrial Pro, Sea Pro 3970753S Valve Davco 390010FGD-02 Baldwin RS5434, Donaldson P543614, P828633, Isuzu 8970622940, Micro Isuzu ELF3000 & Radial Seal AC6420, Nissan On-Highway ELF400 AF27693 Air Filter 1654689TA2 Baldwin PA4912, Fram CFA8849, Hengst E931LC, Mercedes 1832 Actros Mahle LAK43, Mann & II with Mercedes Hummel CUK3823, On-Highway OM501LA Engine AF55702 Cabin Air Mercedes 8303418 Scania R420 with Hengst E1970LI, Mann & Scania DC12-420 Hummel CU2304, Scania On-Highway Engines AF55705 Cabin Air 1326180 FIAAM PC8051, Fiat 1312766080, Fram CF8890, Hengst E953LI, Auto/Light Knecht/Mahle LA123, Mann Truck Fiat DUCATO 2002 AF55706 Cabin Air & Hummel CU4442 Mercedes Integro Bus Hengst E2942LI, Mann & with OM457HLA Hummel CU5067, On-Highway Engines AF55707 Cabin Air Merecedes 18357147 Hengst E995LI, MAN MAN NL283EEV Bus 88779100002, Mann & with D2066 LUH11 Hummel CU4036, Mercedes On-Highway Engines AF55708 Cabin Air 18352747 Hengst E1958LI, MAN MAN FRH414 Bus wth 88779100003, Mann & On-Highway D2866 LOH Engines AF55709 Cabin Air Hummel CU2218 Market Application Part # Description Cross Reference FIAAM PC8107, Fram CF9579, Hengst E922LI, Auto/Light Volkswagen Knecht LA65, Mann & Hummel CU1738, Volkswagen Truck Eurovan AF55710 Cabin Air 703819989 Volvo 7450 Bus with D12A- Hengst E2811LI, Mann & Hummel CU4150, -

European Vehicle Market Statistics: Pocketbook 2016/2017

EUROPEAN VEHICLE MARKET STATISTICS Pocketbook 2016/17 European Vehicle Market Statistics 2016/17 Statistics Market Vehicle European International Council on Clean Transportation Europe Neue Promenade 6 10178 Berlin +49 (30) 847129-102 [email protected] www.theicct.org ICCT Table of Contents 1 Introduction 2 2 Number of Vehicles 14 3 Fuel Consumption & CO2 26 4 Technologies 42 5 Key Technical Parameters 52 6 Other Emissions & On-road 68 Annex Remarks on Data Sources 72 List of Figures and Tables 74 References 78 Abbreviations 80 Tables 81 An electronic version of this Pocketbook including more detailed statistical data is available online: http://eupocketbook.theicct.org EUROPEAN VEHICLE MARKET STATISTICS 2016/17 1 INTRODUCTION Market share EU-28 Registrations (million) in 2015 (in %) Fig. 1-1 16 100 Passenger cars: 90 14 Registrations by Others The 2016/17 edition of European Vehicle Market SUV/ 80 vehicle segment Of-Road 12 Statistics ofers a statistical portrait of passenger car, Van Sport 70 light commercial and heavy-duty vehicle fleets in Luxury 10 Upper 60 the European Union (EU) from 2001 to 2015. Medium Medium As in previous editions, the emphasis is on vehicle 8 50 techno logies, fuel consumption, and emissions of Lower 40 greenhouse gases and other air pollutants. 6 Medium The following pages give a concise overview 30 4 of data in subsequent chapters and also summarize 20 Small the latest regulatory developments in the EU. 2 10 More comprehensive tables are included in the annex, Mini 0 0 along with information on sources. 01 10 07 02 03 04 05 06 09 008 2011 2012 2013 2014 2015 20 20 20 20 20 20 20 20 2 20 Number of vehicles Data source: ACEA; data until 2007 is for EU-25 only After declining for several years, new passenger car registrations in the EU increased to about 13.7 million in 2015. -

Fiat Ducato Al-Ko Commercial Vehicle Chassis 13“

FIAT DUCATO AL-KO COMMERCIAL VEHICLE CHASSIS 13“ ESP Standard! AL-KO VEHICLE TECHNOLOGY QUALITY FOR LIFE FROM THE VILLAGE FORGE TO A GLOBAL CORPORATION Our roots were planted in a small village smithy. The fact that a global corporation has emerged from these humble roots is also because we are constantly aware of what our identity represents and what values the company has always embodied: Quality, innovation in product and process as well as reliability and sustainability in our internal and external customer relations. That is the basis of our pursuit for sustainable growth and market leadership in our business divisions. Since 2016 we have made our contribution to the DexKo Group, the world‘s leading manufacturers of axles and chassis components in the lightweight segment. We are proud to continue in successfully shaping this development together with the DexKo and to convey our brand promise of quality, safety and comfort for our products and services to the world. LIFE FOR QUALITY We love quality. We live quality. And we have the right answer for virtually all transport requirements in our sector. AL-KO Vehicle Technology is safety and quality in one: from the product to delivery. We want our customers to be satisfied and successful. Quality for life! www.alko-tech.com 2 I FOR WHEN THE BEST IS EXPECTED Founded in 1931, AL-KO Vehicle Technology is now a global technology company with around 30 sites in Europe, South America, Asia and Australia. Offering high-quality chassis components for trailers, leisure vehicles and light commercial vehicles, AL-KO stands for optimum ergonomics and functionality, highest comfort as well as innovations for greater driving safety. -

Wear Sensors Catalogue 2010/2011

2010/2011 Wear Sensors Catalogue 2010/2011 NUCAP EUROPE, S.A. JOPE EUROPE, S.L. Polígono Arazuri - Orcoyen Polígono Industrial Egués Calle D, Nº 2 Calle Z, Nº 23 31170 Arazuri, Navarra, SPAIN 31486 Egués, Navarra, SPAIN Catalogue T: (+34) 948 281 090 T: (+34) 948 330 615 F: (+34) 948 187 294 F: (+34) 948 361 698 [email protected] [email protected] www.nucap.eu www.jope.es Shims Wear Sensors Catalogue 2010/2011 Wear Sensors Catalogue 2010/2011 © JOPE EUROPE, 2010 Polígono Industrial Egués Calle Z, Nº 23 31486 Egués, Navarra, SPAIN T: (+34) 948 330 615 F: (+34) 948 361 698 [email protected] www.jope.es Diseño: Intro Comunicación, 2010 General Index New reference information 7 Connectors 8 Terminals 11 NEW > OLD references 15 OLD > NEW references 19 Manufacturer Index 23 W1 Wear sensors for passenger cars 33 W2 Clip on wear sensors for passenger cars 79 W3 Clip on wear sensors for industrial vehicles 117 Kits 137 Accesories 141 WVA > JOPE Index 145 Manufacturer > OE > JOPE Index 157 New reference information Wx xx xx xx New reference information Version W1 Wear sensor for passenger cars Lenght, colour, material, etc. W2 Clip on wear sensor for passenger cars W3 Clip on wear sensor for industrial vehicles Connector type Terminal type See page 08 See page 11 Example W2065003 Old 9A004 Clip on wear sensor Version 03 for passenger cars Connector type 06 Terminal type 50 GENERAL CATALOGUE 2010/2011 7 Connectors 00 15 01 02 16 03 5.5 17 04 5.5 18 05 19 06 20 07 21 22 08 09 23 10 24 11 12 25 BLACK 13 26 14 8 JOPE EUROPE WHITE 37 27 BLUE 28 38 VIOLET 29 30 39 -

Ducato Camper 2019 Uk.Pdf

CAMPER DEDICATED ASSISTANCE WEBSITE 00800 3428 1111 www.fiatcamper.com 15 languages - 51 countries Discover the world of exclusive 24 hours a day, 7 days a week FIAT PROFESSIONAL Fiat Professional services everywhere in Europe FOR RECREATIONAL VEHICLES. SERVICE MAXIMUM NETWORK CARE CAMPER 1800 Fiat Camper Assistance Warranty extension* Workshops 6500 Fiat up to 5 years with dedicated Professional Authorised “Fiat Professional Assistance” Workshops throughout Europe included www.fiatcamper.com Only Ducato in all its details is designed from the start to be a motorhome base. It is chosen by the most appreciated European Recreational Vehicles manufacturers and has been giving you the freedom to go wherever you want for more than 35 years. With four Euro 6d-TEMP engines - the 2.3-litre MultiJet2 delivering 140, 160 and 180 HP, available with the fully automatic 9-speed transmission, and the 2.3 litre MultiJet delivering 120 HP with 6-speed manual gearbox - you can choose the 2 DUCATO engine and gearbox that best suits your needs, for even better driving and even more enjoyment. With Ducato and the range of exclusive Fiat Professional services motorhome travellers can stay worry-free. Ducato is the Leader in Freedom. LEADER IN FREEDOM. *two years of contractual warranty + extended warranty for from one to three years at a charge The data contained in this publication is only indicative. This brochure shows model-specific features and contents that can be chosen by motorhome manufacturers. Trim levels and the optional equipment may vary due to specific market or legal requirements. The data contained in this publication is only indicative. -

FIAT DUCATO CITROËN JUMPER PEUGEOT BOXER High Roof

fiamma.com Montageanleitung für die DE Halterungen KIT Installation instructions for EN FIAT DUCATO brackets CITROËN JUMPER FR Instructions de montage pattes Instrucciones de instalacion de los PEUGEOT BOXER ES estribos High Roof IT Istruzioni di montaggio staffe m m 2 7 123 mm Fiamma F65 Fiammastore DE Verpackungsinhalt EN Package contents FR Contenu de l’emballage ES Contenido del embalaje IT Contenuto dell’imballo A X1 B X1 C X1 D X3 E X6 F X3 fiamma.com Montageanleitung für die DE Halterungen KIT Installation instructions for EN G X1 FIAT DUCATO brackets CITROËN JUMPER FR Instructions de montage pattes Instrucciones de instalacion de los PEUGEOT BOXER ES estribos High Roof IT Istruzioni di montaggio staffeX1 m m 2 7 123 mm Fiamma F65 Fiammastore X1 2 Fiammastore DE Gebrauchsanweisungen und Ratschläge EN Maintenance instructions FR Instructions et conseils ES Recomendaciones IT Avvertenze e suggerimenti ACHTUNG: regelmäßig die Befestigung der Halterungen kontrollieren. Achten DE Sie vor allem nach dem ersten Sicherstellen darauf, dass sich die Haltebügel nicht verschoben haben. ATTENTION: periodically check the brackets to make sure it is firmly attached EN (especially after the first miles), make sure the belts are not loose and that holding brackets have not shifted. ATTENTION: contrôler périodiquement l’état de fixation des pattes (surtout après FR les premiers kilomètres), en s’assurant que les supports de fixation n’aient pas bougé. CUIDADO: controlar periodicamente el estado de fijación de los estribos ES (sobretodo después de los primeros Kms), asegurándose que no se desplacen. ATTENZIONE: controllare periodicamente lo stato di fissaggio delle staffe IT (soprattutto dopo i primi chilometri), assicurandosi che le stesse non si siano mosse e che i serraggi siano corretti. -

Engine Alfa Romeo, Fiat, Lancia

Kapitel06.6.fm Seite 333 Freitag, 29. April 2011 11:42 11 Valve Train Engine Alfa Romeo, Fiat, Lancia Locking Tool Set KL-1682-42 K KL-1682-42 K Suitable for Alfa Romeo and Fiat 1.6 Mulitjet; 1.6 16V Multijet; 1.9 JTD 8/16 V und 2.4 JTD 10/20 V Common-Rail diesel engines. 1.6 Multijet - 110 Linea; 199 Grande Punto 1.6 16V Mulitjet - 135 Idea 1.9JTD (8V) - 323.02, 371.01, 182B4.000, 182B9.000, 186A6.000, 188A2.000, 188A7.000188B2.000, 192A1.000, 192A3.000, 937A2.000, 939A1.000; 1.9JTD (16V) - 192A5.000, 192B1.000, 937A5.000, 939A2.000; 2.4JTD (10V) - 325.01, 342.02, 362.02, 185A6.000, 841C.000; 2.4JTD (20V) - 841G.000, 939A3.000) e.g. Alfa Romeo: 145, 146, 147, 156, 159, 166, GT; Fiat: Punto, Grande Punto, Brava/Bravo, Marea/Weekend, Stilo, Doblo/Cargo, Multipla. This tool is used for locking and/or positioning engine shafts such as camshafts and crankshafts while changing a timining belt or during an engine repair. Scope of Delivery: KL-1682-42 K Locking Tool Set Part No. Description Qty. KL-1682-202 Locking tool for crankshaft 1 KL-0482-461 Locking pin for camshaft (2 pieces) 1 KL-1682-131 Locking tool for flywheel 1 KL-1682-4290 Storage case with insert 1 Locking Tool Set for Timing Belt Fiat 1.9 D / TD / JTD, 2.1 TD, 2.4 TD KL-1682-20 KA Suitable for Fiat 1.9 D/TD/JTD; 2.4 TD/JTD and PSA 1.9 D/TD, 2.1 TD diesel KL-1682-20 KA engines (engine code: 160 A7.000, 182 A7.000, 182 A8.000, 182 B4.000, 185 A2.000, 185 A6.000, 188 A2.000 and 188 A3.000) e.g. -

Euro 6D-Temp: No Consequence on Ducato Layout

HALL 16 Product news Fiat Ducato MY2020 BOOTH D42 All change under the skin The new Fiat Ducato MY2020 has been launched. It might seem to look the same as the previous one, but under the body everything has changed – with new engines from 120 to 180 HP and an innovative “9Speed” automatic transmission. Words Antonio Mazzucchelli lmost 40 years after the launch of the first Fiat Ducato in 1981, the Hardware improvements Fiat Professional for Recreation- Aal Vehicles division presented the new Fiat Ducato MY2020 to the media in July. As the best-seller in 12 countries, the leader in the European Professional market for the fifth consecutive year, and first ever developed as a motorhome base vehicle in Europe, the new Ducato has important new features to consolidate its leadership in the motorhome sector. There are no changes to the exterior dimen- sions or body of the new Fiat Ducato for 2020, and it is still built entirely at the Sevel Plant in Val di Sangro, Europe’s largest light commercial vehicle manufacturing facility, and holder of World Class Manufacturing Silver Level. More than 297,000 vehicles rolled out of the Sevel plant in 2018, break- ing its own production record for the fourth year in a row, with a +46% increase over the past six years. The Ducato is produced in over 13,000 variants, including the many 24 B t o B popular bases for outdoor tourism vehicles, cial name of “adBlue”. Compared with the and is sold in more than 80 countries world- previous engines, it would take more than wide. -

Fiat | Chrysler

Release Specifics: Release date………………………..11 June 2018 Diagnostic application version……….04.00.18 Supported vehicles: VEHICLE ACRONYM MY ALFA ROMEO 4C QC 2013, 2018 ALFA ROMEO MITO MT Only 2008 ALFA ROMEO GIULIETTA GU Only 2011 FIAT PUNTO MY 2012 PE Only 2009 FIAT PUNTO EVO FIAT VIAGGIO CM Only 2012 FIAT QUBO FQ Only 2008 FIAT 500L CL Only 2012 FIAT PANDA NP Only 2012 FIAT FREEMONT JF 2011, 2012, 2013, 2014 FIAT PROFESSIONAL FQ Only 2008 FIORINO FIAT OTTIMO OT Only 2014 ABARTH PUNTO MY 2012 PE Only 2009 ABARTH PUNTO EVO LANCIA NUOVA YPSILON NY Only 2011 LANCIA VOYAGER RT 2012, 2013, 2014 LANCIA THEMA LX 2012, 2013, 2014 LANCIA FLAVIA JS 2012, 2013 FIAT PROFESSIONAL DC Only 2014 DUCATO FL 2014 FIAT DOBLO’ DB 2008, 2015 FIAT DOBLO’ FL FIAT 500X FB 2015,2016, 2017,2018 FIAT 500X MCA FD 2019 FIAT 500L ( SASO ) BF 2014, 2015 FIAT CINQUECENTO CC Only 2007 FIAT AEGEA/TIPO PD 2015,2016,2017;2018,2019 ALFA ROMEO GIULIA GA 2015,2016,2017,2018,2019 FIAT SPIDER BA 2017,2018,2019 FIAT FULLBACK MM 2016,2017 FIAT TALENTO RE Only 2016 ALFA ROMEO STELVIO GU 2017,2018,2019 FIAT 500L MCA BG 2018,2019 Updateds: VEHICLE ENGINE SYSTEM FIAT PANDA 0.9 Twin Air ECM – added new iso code for E6D FIAT 500X T.T PAM - update DTC environment ECM - update DTC environment and routine FIAT 500 1.2 8V environment for E6D ECM - update DTC environment and routine FIAT PANDA 1.2 8V environment for E6D FIAT TALENTO 1.6 JTD ECM – “OWE Oil soot rate” data parameter fixed ALFA ROMEO STELVIO T.T AGSM – new iso code ALFA ROMEO GIULIA T.T AGSM – new iso code ALFA ROMEO STELVIO T.T -

F I a T D U C A

DUCATO LUM GB 17-12-2008 9:57 Pagina 1 FIATDUCATO ENGLISH The data contained in this publication is intended merely as a guide. FIAT reserves the right to modify the models and versions described in this booklet at any time for technical and commercial reasons. If you have any further questions please consult your FIAT dealer. Printed in recycled paper without chlorine. OWNER HANDBOOK WHY CHOOSING GENUINE PARTS We really know your vehicle because we invented, designed and built it: we really know every single detail. At Fiat Professional Service authorised workshops you can find technicians directly trained by us, offering quality and professionalism for all service operations. Fiat Professional workshops are always close to you for the regular servicing operations, season checks and practical recommendations by our experts. With Fiat Professional Genuine Parts you keep the reliability, comfort and performance features of your new vehicle unchanged in time: that's why you bought it for. Always ask for Genuine Parts for the components used on our vehicles; we recommend them because they come from our steady commitment in research and development of highly innovative technologies. For all these reasons: rely on Genuine Parts, because they are the only ones designed by Fiat Professional for your vehicle. PERFORMANCE: SAFETY: ENVIRONMENT: PARTICULATE FILTERS, COMFORT: SPARK PLUGS, INJECTORS LINEACCESSORI: BRAKING SYSTEM CLIMATE CONTROL SYSTEM MAINTENANCE SUSPENSION AND WINDSCREEN WIPERS AND BATTERIES ROOF RACK BARS, WHEEL RIMS CHOOSING GENUINE PARTS IS THE MOST NATURAL CHOICE PERFORMANCE COMFORT SAFETY AMBIENT ACCESSORIES VALUES GENUINE PARTS GENUINE PARTS GENUINE PARTS GENUINE PARTS GENUINE PARTS GENUINE PARTS HOW TO RECOGNISE GENUINE PARTS All Genuine Parts undergo strict controls, both during design and manufacturing stages, by specialists using vanguard materials, to test the component reliability.