Managing a Growing Family Business: a Case of Tracom Stock Brokers Pvt

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Fmcg & Large Cap – Fund Analysis for Long Term

Industry Internship and Report on “FMCG & LARGE CAP – FUND ANALYSIS FOR LONG TERM BENEFITS” BY Sumant Kumar 1NZ16MBA64 Submitted to DEPARTMENT OF MANAGEMENT STUDIES NEW HORIZON COLLEGE OF ENGINEERING, OUTER RING ROAD, MARATHALLI, BANGALORE In partial fulfillment of the requirements for the award of the degree of MASTER OF BUSINESS ADMINISTRATION Under the guidance of INTERNAL GUIDE EXTERNAL GUIDE Niviya Feston Nandakishore Appanaboyina Sr. Asst. Professor Dir. -Operations & Talent Acquisition 2016-2018 CERTIFICATE This is to certify that Sumant Kumar bearing USN 1NZ16MBA64, is a bonfide student of Master of Business Administration course of the Institute Batch 2016-2018, autonomous program, affiliated to Visvesvaraya Technological University, Belgaum. Internship report on “FMCG & LARGE CAP – FUND ANALYSIS FOR LONG TERM BENIFITS” is prepared by him under the guidance of Niviya Feston (Sr. Asst. Professor), in partial fulfillment of requirements for the award of the degree of Master of Business Administration of Visvesvaraya Technological University, Belgaum Karnataka. Signature of Internal Guide Signature of HOD Signature of Principal DECLARATION I, Sumant Kumar, hereby declare that the Internship report entitled “FMCG & LARGE CAP – FUND ANALYSIS FOR LONG TERM BENIFITS” with reference to “Dvija Digital Pvt. Ltd., Whitefield” prepared by me under the guidance of Niviya Feston (Sr. Asst. Professor), faculty of M.B.A Department, New Horizon College of Engineering and external assistance by Dr. Nandakishore Appanaboyina (Director-Operations and Talent Acquisition), Dvija Digital Pvt. Ltd. I also declare that this Internship work is towards the partial fulfillment of the university regulations for the award of the degree of Master of Business Administration by Visvesvaraya Technological University, Belgaum. -

MARKET LENS 13363 Intraday Pic HDFC Resistance 13869 Intraday Pick POWERGRID 14103 Intraday Pick SBIN

Institutional Equity Research NIFTY 13635 IN FOCUS February 01, 2021 Support 13499 Stock in Focus GSPL MARKET LENS 13363 Intraday Pic HDFC Resistance 13869 Intraday Pick POWERGRID 14103 Intraday Pick SBIN EQUITY INDICES Indices Absolute Change Percentage Change Domestic Last Trade Change 1-D 1-Mth YTD BSE Sensex 46,285.8 (588.6) -1.3% -3.3% -3.1% CNX Nifty 13,634.6 (182.9) -1.3% -2.7% -2.5% S&P CNX 500 11,302.4 (140.2) -1.2% -2.4% -1.9% SENSEX 50 14,287.7 (194.3) -1.4% -2.4% -2.4% International Last Trade Change 1-D 1-Mth YTD DJIA 29,982.6 (620.7) -2.1% -2.0% -2.0% NASDAQ 13,070.7 (266.5) -2.0% 1.4% 1.4% NIKKEI 27,885.3 221.9 0.8% 1.6% 1.6% HANGSENG 28,457.9 174.1 0.6% 4.5% 4.5% MSCI Emerging Mkts 1,329.6 (21.0) -1.6% 3.0% 3.0% ADRs / GDRs Last Trade Change 1-D 1-Mth YTD Dr. Reddy’s Lab (ADR) 61.3 (4.8) -7.2% -14.0% -14.0% STOCK IN FOCUS Tata Motors (ADR) 17.8 (0.8) -4.0% 41.3% 41.3% f Gujarat State Petronet’s (GUJS) total gas transmission volume is Infosys (ADR) 16.9 (0.8) -4.3% -0.4% -0.4% ICICI Bank (ADR) 15.1 0.2 1.1% 1.6% 1.6% expected to rise by 14% YoY and 6% QoQ to ~43mmscmd in 3QFY21. -

Indian Exchanges

Equity Research INDIA November 4, 2020 BSE Sensex: 40261 Indian exchanges ICICI Securities Limited is the author and Monthly tracker – Derivatives hit new highs while cash and distributor of this report commodity moderates MCX (HOLD) In Oct’20, cash volumes continued momentum for NSE (ADTV grew 39% YoY), while BSE saw moderation. Cash volumes have cooled from the record highs for both the 2,000 exchanges (NSE and BSE cash ADTV for the month of Aug / Sept / Oct’20 was Rs610 / 1,750 556 / 523bn and Rs44 / 32 / 28bn respectively). NSE derivatives ADTV grew robust 1,500 79% YoY and has been inching higher. (Aug /Sep / Oct’20 ADTV was Rs19 / 22 / 26bn). 1,250 MCX commodity ADTV (ex-crude) was up 70% YoY. Overall, MCX ADTV was up 13% (Rs) 1,000 YoY in Oct’20 but has been declining on MoM basis (Aug /Sep / Oct’20 ADTV was 750 Rs409 /316 / 305bn). Crude futures witnessed a MoM increase of 7%. Currency 500 derivatives ADTV rose 17% YoY in Oct’20 (NSE: +46% YoY and BSE: -26% YoY). Equity cash: Trend remains strong for NSE while BSE saw moderation. Oct-18 Oct-19 Apr-20 Oct-20 Nov-17 May-18 May-19 In Oct’20, NSE’s ADTV (average daily turnover value) came in at Rs523bn, up 39% YoY, clocking tenth consecutive month of healthy growth. Number of trades grew 23% YoY in Oct’20. BSE’s Oct’20 cash ADTV was Rs27.5bn, down 2.7% YoY. BSE’s exclusive segment came in at Rs586mn, up 73% YoY. -

PARALYZED ECONOMY? Restructure Your Investments Amid Gloomy Economy with Reduced Interest Rates

Outlook Money - Conclave pg 54 Interview: Prashant Kumar, Yes Bank pg 44 APRIL 2020, ` 50 OUTLOOKMONEY.COM C VID-19 PARALYZED ECONOMY? Restructure your investments amid gloomy economy with reduced interest rates 8 904150 800027 0 4 Contents April 2020 ■ Volume 19 ■ issue 4 pg 10 pg 10 pgpg 54 43 Cultivating OutlookOLM Conclave Money ConclaveReports and insights from the third Stalwartsedition of share the Outlook insights Moneyon India’s valour goalConclave to achieve a $5-trillion economy Investors can look out for stock Pick a definite recovery point 36 Management34 stock strategies Pick of Jubilant in the market scenario, FoodWorksHighlighting and the Crompton management Greaves strategies of considering India’s already ConsumerJUBL and ElectricalsCGCE slow economic growth 4038 Morningstar Morningstar InIn focus: focus: HDFC HDFC short short term term debt, debt, HDFC HDFC smallsmall cap cap fund fund and and Axis Axis long long term term equity equity Gold Markets 4658 Yes Yes Bank Bank c irisisnterview Real EstateInsuracne AT1Unfair bonds treatment write-off meted leaves out investors to the AT1 in a Mutual FundsCommodities shock,bondholders exposes in gaps the inresolution our rating scheme system 5266 My My Plan Plan COVID-19: DedicatedHow dedicated SIPs can SIPs help can bring bring financial financial Volatile Markets disciplinediscipline in in your your life lives Investors need to diversify and 6 Talk Back Regulars : 6 Talk Back restructure portfolios to stay invested Regulars : and sail through these choppy waters AjayColumnsAjayColumns Bagga, Bagga, SS Naren,Naren, :: Farzana Farzana SuriSuri CoverCover Design: Vinay VINAY D DOMINICOMinic HeadHead Office Office AB-10, AB-10, S.J. -

Sebi Registered Depository Participants of Cdsl As on 31-12-2016

SEBI REGISTERED DEPOSITORY PARTICIPANTS OF CDSL AS ON 31-12-2016 NAME OF THE DP REGN. NO. ADD1 ADD2 ADD3 CITY STATE PIN CODE TELEPHONE1 TELEPHONE2 FAX EMAIL 101 B, DLF 1 4A SECURITIES LIMITED IN-DP-CDSL-685-2013 JASOLA VIHAR NEW DELHI UP 110025 011-49002201 011-49002202 [email protected] TOWER A THANE ROAD NO. 16V, (91- IIIFL HOUSE, SUN INDUSTRIAL 2 5PAISA CAPITAL LIMITED IN-DP-192-2016 PLOT NO.B-23, THANE 400064 92)39294000/41035 (91-92)25806654 [email protected] INFOTECH PARK, AREA, WAGHLE MIDC, 000 ESTATE, 3 A C AGARWAL SHARE BROKERS PVT. LTD. IN-DP-186-2016 406, 4TH FLOOR, PAYAL COMPLEX, SAYAJIGUNJ, BARODA GUJARAT 390005 0265-2361672 0265-2362786 [email protected] ITTS HOUSE, 2ND 33, SHREE 4 A.C.CHOKSI SHARE BROKERS PRIVATE LIMITED IN-DP-104-2015 KALAGHODA MUMBAI 400 023 61595100 61595199 [email protected] FLOOR, SAIBABA MARG, 4TH FLOOR FREE 43, FREE PRESS 215, NARIMAN 5 A.K. STOCKMART PVT. LTD. IN-DP-CDSL-458-2008 PRESS JOURNAL MUMBAI 400021 022-67546500 9967003611 022-67544666 [email protected] HOUSE POINT MARG SHREYAS NEAR GORAI GORAI LINK 6 A.S. STOCK BROKING & MANAGEMENT PVT. LTD. IN-DP-CDSL-338-2006 BUNGLOW BRIDGE BUS ROAD, BORIVALI MUMBAI MAHARASHTRA 400092 022-28676040 022-28676041/42 022-28676044 [email protected] NO.70/74 STOP, (W), FORTUNE 8-2- MONARCH ROAD 7 AASMAA SECURITIES PRIVATE LIMITED IN-DP-45-2015 293/82/A/707/708/7 HYDERABAD 33 04060120045 [email protected] NO. 211, JUBILEE 09, SHOP NO. -

S.No. Broker Code Broker Name Contact Person Phone No. Mobile

Broker S.no. Broker Name Contact Person Phone No. Mobile No. Add 1 Add 2 Add 3 Pin Email Code [email protected]; RUCHIKA RAINA SINGH, 9899636606, 25, C BLOCK [email protected]; 011-45675504, 1 001 SPA CAPITAL ADVISORS LTD. VARUN KAUSHIK, 9873486360, COMMUNITY JANAK PURI NEW DELHI 110058 [email protected]; 45675588,45675528 SANJAY JAIN 9910234032 CENTRE [email protected]; [email protected]; HARISH 9999114500, SABHARWAL 5TH 97, NEHRU [email protected];aparnarazdan@ba 2 002 BAJAJ CAPITAL LTD. HARISH SABHARWAL 011-41693000 NEW DELHI 110019 9811121101 FLOOR, BAJAJ PLACE jajcapital.com HOUSE [email protected]; [email protected]; J. M. FINANCIAL SERVICES PRADYUMNA 022-30877349, PALM COURT, 4TH LINK ROAD [email protected]; 3 003 MUMBAI 400064 PVT LTD SATPATHY 30877000, 67617000 FLOOR, M WING MALAD WEST [email protected]; [email protected]; [email protected] 105-108, CONNAUGHT [email protected]; 011-61127438, 040- 9989836349, 19, BARAKHAMBA 4 004 KARVY STOCK BROKING LTD. B V R NAIDU ARUNACHAL PLACE, NEW 110001 [email protected]; [email protected]; 44677536 9177401508 ROAD BUILDING DELHI [email protected] R. R. FINANCIAL RAJEEV SAXENA, S K 47 M M ROAD, RANI [email protected]; [email protected]; 5 005 011-23636362-63 9717553830 JHANDEWALAN NEW DELHI 110055 CONSULTANTS LTD. SINGH JHANSI MARG [email protected] [email protected]; HSBC SECURITIES AND 52/60 M. G. ROAD [email protected]; 6 006 SHWETANK DEV 022-40854280 9811374741 MUMBAI 400001 CAPITAL MARKETS (I) P LTD FORT [email protected]; [email protected] MR. -

New Projects Surge in Decemberqtr

THURSDAY, 2 JANUARY 2020 16 pages in 1 section www.business-standard.com MUMBAI (CITY) ~9.00 VOLUME XXIV NUMBER 100 THE MARKETS ON WEDNESDAY Chg# Sensex 41,306.0 52.3 Nifty 12,182.5 14.0 STRATEGY P15 BACK PAGE P16 Nifty futures* 12,243.8 61.3 Dollar ~71.2 ~71.4** Euro ~79.9 ~80.1** CONSUMER BEHAVIOUR CHANDRAYAAN-3 NEXT YEAR, Brent crude ($/bbl)## 66.3## 66.4** Gold (10 gm)### ~38,962.0 ~121.0 IN THE 2020s 4 CHOSEN FOR GAGANYAAN *(Jan.) Premium on Nifty Spot; **Previous close; # Over previous close; ## At 9 pm IST; ### Market rate exclusive of VAT; Source: IBJA PUBLISHED SIMULTANEOUSLY FROM AHMEDABAD, BENGALURU, BHUBANESWAR, CHANDIGARH, CHENNAI, HYDERABAD, KOCHI, KOLKATA, LUCKNOW, MUMBAI (ALSO PRINTED IN BHOPAL), NEW DELHI AND PUNE CABLE TV TO COST GST collection I-T vets foreign LESS AS TRAI AMENDS New projects surge contribution TARIFF STRUCTURE crosses ~1 trn, The Telecom Regulatory Authority of sought by India has released amendments to the New Tariff Order, in which it has directed in December qtr but misses target Tata trust cable operators to provide 200 channels for ~153. The regulator has also set DILASHA SETH SHRIMI CHOUDHARY January 15 as the deadline for 37% y-o-y increase despite a fall in capacity utilisation New Delhi, 1 January New Delhi, 1 January broadcasters to announce their new MOP-UP pricing structure. At present, direct-to- SACHIN P MAMPATTA & AMRITHA PILLAY Goods and services tax (GST) The income-tax (I-T) department is exam- home or cable TV operators provide only Mumbai, 1 January collection crossed the ~1 tril- TREND ining the foreign contributions sought by 100 channels for a network capacity fee lion mark for the second Figures in ~cr the Navajbai Ratan Tata Trust (NRTT) as a of ~153 (~130 excluding taxes). -

Sr No Liquidity Enhancers Registered with BSE Ltd. Market Makers / General Market Participants 3 ASIT C.MEHTA INVESTMENT INTERRMEDIATES LTD

Name of the Members registered with BSE as Liquidity Enhancers as on February, 2016 Sr No Liquidity Enhancers Registered with BSE Ltd. Market Makers / General Market Participants 3 ASIT C.MEHTA INVESTMENT INTERRMEDIATES LTD. MM 6 DIMENSIONAL SECURITIES PVT.LTD. GMP 15 ACK CAPITAL MANAGEMENT PVT.LTD. GMP 18 ASHOK CHANDRAKANT SAMANI GMP 32 ANVIL SHARE & STOCK BROKING PVT.LTD. GMP 42 BCB BROKERAGE PVT.LTD. GMP 44 B.D.SHAH SECURITIES LTD. GMP 59 C.R.KOTHARI & SONS SHARES & STOCK BROKERS PVT.LTD. GMP 62 B.R.JALAN SECURITIES PVT.LTD. MM 66 HSBC Securities & Capital Mkt. Pvt. Ltd. GMP 74 BP EQUITIES PVT.LTD. GMP 84 IDBI CAPITAL MARKETS SERVICES LTD. GMP 89 JOINDRE CAPITAL SERVICES LTD. GMP 103 ICICI SECURITIES LTD. GMP 106 WELLWORTH SHARE & STOCK BROKING LTD. GMP 111 NAVKAR SHARES GMP 117 KMS Stock Broking Co. Private Limed GMP 119 ANTIQUE STOCK BROKING LTD. GMP 120 KEYNOTE CAPITAL GMP 121 EDELWEISS SECURITIES LTD. MM 122 MEHTA EQUITIES PVT. LTD. GMP 126 MAGNUM EQUITY BROKING LTD GMP 130 DSP MERRILL LYNCH LTD. GMP 132 Axis Equities Pvt. Ltd GMP 138 IKAB SECURITIES & INVESTMENT LTD. GMP 139 BALAJI EQUITIES LTD. GMP 144 GANDHI SECURITIES & INVESTMENT PVT LTD GMP 148 DILIP. C.BAGRI GMP 156 ACUMEN CAPITAL MARKET INDIA LTD. GMP 160 PRAGYA SECURITIES PVT.LTD. GMP 162 DALAL & BROACHA STOCK BROKING PVT.LTD. GMP 172 ABHIPRA CAPITAL LTD. GMP 173 DOLAT CAPITAL MARKET PVT.LTD. GMP 176 FORTUNE EQUITY BROKERS (INDIA) LTD. GMP 178 CNB FINWIZ PRIVATE LIMITED MM 179 INDIA INFOLINE LTD. GMP 182 SYSTEMATIX SHARES & STOCKS INDIA LTD. -

Reliance Securities Limited Annual Report 2018- 2019

Reliance Securities Limited Annual Report 2018- 2019 I I I REUANCE SECURITIES LIMITED FINANC-JAL STATEMENT AS A1"MARCH 31, 2019 Palhak I-l.1). Associates Chaiion;:d ACCOLinlJ3nts INDEPENDENT AUDITORS' REPORT TO THE MEMBERS Of RELIANCE SECURITIES UM ITEO Opinion We have audited the J(companyu,g Ind AS finanC1a1 staterrie-nts of Reliance Securities limited("tM Compan'(''),which comp;iS<! the 8..ila~ce, Sheet 11s jjt March 31. 2019, the Stateme1ll of Profit and loss finclvding Othe, Comp,ehensive Income), the Statemer'll of C,Hh Flows and the StiHt:'fl'le/'ll of changes in EquilV for the year then ended, and a summarvof ~ignific.:1nt accounting policies and other expfanatorv 10formation(he1einait-er refe"ed I() as "the Ind AS financial st;)teroents"I In o~r opm1on a:nd to the best o{ our informc1tion ,;1nd acc0tding to the explanatiOM given to vs, the aforcss\id Ind AS fu1anc1al <;t,i'ltem-ents giye the informaoon ,e-qvi1ed by the Companie, Act, 2-013("the Act'") in the 111c1Mer s-o teqt,tired and give a true and fair view 11, collformily with the Indian Actot•l'lt•ng Standards pre-icribed unde1· sect/011 13) of the Act read with th~ Compt1n1es !Indian Accounting, Standards) Rules, 20lS. as amended, ('"Ind AS"I and other accounting p;inciples gene~ally accepted in lndl;,,, of the sr<,m~ of affairs of the Company ,>S ;tt March 31, 2019; and its profit ~nd tot;al Comprehensive Income, Change in E:qu1tv and its cash Rows for the ye;,r ended on tha, date Basis tor opinion we COlldvcred our audrl of the Ind AS f?n.i,~cial st,llements in accordance with tht St.l1)ct;vds on Auditing specifi ed under Section 143(10l of the ;.'\ti, Our respot1sibilities under t,1ose St.incfords 3re fur1her dcs<ribe(I i1) lhe Auditor's Respon.sibilities for t-hc Au(lit or the Ind AS Financial StatenicntS se«i<111 of our r£>port. -

MARKET LENS 13736 Intraday Pic GODREJCP Resistance 14161 Intraday Pick SBILIFE 14354 Intraday Pick TCS

Institutional Equity Research NIFTY 13968 IN FOCUS January 28, 2021 Support 13852 Stock in Focus TECHM MARKET LENS 13736 Intraday Pic GODREJCP Resistance 14161 Intraday Pick SBILIFE 14354 Intraday Pick TCS EQUITY INDICES Indices Absolute Change Percentage Change Domestic Last Trade Change 1-D 1-Mth YTD BSE Sensex 47,409.9 (937.7) -2.0% 0.1% -0.7% CNX Nifty 13,967.5 (271.4) -1.9% 0.7% -0.1% S&P CNX 500 11,546.4 (197.4) -1.7% 1.0% 0.2% SENSEX 50 14,636.5 (276.0) -1.9% 0.8% 0.0% International Last Trade Change 1-D 1-Mth YTD DJIA 30,303.2 (633.9) -2.1% -0.3% -1.0% NASDAQ 13,270.6 (355.5) -2.7% 2.9% 3.0% NIKKEI 28,275.9 (359.3) -1.3% 5.3% 3.0% HANGSENG 28,914.9 (382.7) -1.3% 9.9% 6.2% MSCI Emerging Mkts 1,371.4 (17.3) -1.3% 9.5% 6.2% ADRs / GDRs Last Trade Change 1-D 1-Mth YTD Dr. Reddy’s Lab (ADR) 65.8 (2.8) -4.1% -6.6% -7.8% STOCK IN FOCUS Tata Motors (ADR) 17.8 (0.6) -3.4% 51.0% 41.4% f TechM works with the top US and European telecom operators and Infosys (ADR) 17.5 (0.4) -2.1% 5.2% 3.1% is the key service provider of world’s first softwarized and cloud- ICICI Bank (ADR) 14.3 (0.5) -3.7% 2.4% -3.6% based network built by Rakuten in Japan. -

List of Dps Providing Easiest Facility Dp Id Dp Name 10100 Stock Holding Corporation of India Ltd

LIST OF DPS PROVIDING EASIEST FACILITY DP ID DP NAME 10100 STOCK HOLDING CORPORATION OF INDIA LTD. (RETAIL) 10200 KHAMBATTA SECURITIES LIMITED 10400 BCB BROKERAGE PRIVATE LIMITED 10600 ANAND RATHI SHARE AND STOCK BROKERS LIMITED 10700 KRCHOKSEY SHARES AND SECURITIES PVT LTD 10800 GANDHI SECURITIES AND INVESTMENT PVT LTD 10900 MOTILAL OSWAL FINANCIAL SERVICES LIMITED 11100 VIJAN SHARE & SECURITIES PRIVATE LIMITED 11300 PRABHUDAS LILLADHER PVT LTD 11700 DALAL & BROACHA STOCK BROKING PVT. LTD 11800 WALLFORT FINANCIAL SERVICES LIMITED 12000 SVV SHARES & STOCK BROKERS PVT. LTD. 12200 CENTRUM BROKING LIMITED 12400 HDFC BANK LIMITED 12500 CHURIWALA SECURITIES PRIVATE LIMITED 12600 GEPL CAPITAL PRIVATE LIMITED 12900 R N PATWA SHARE & STOCK BROKERS (P) LTD 13100 STANDARD CHARTERED BANK 13200 ASIT C. MEHTA INVESTMENT INTERRMEDIATES LIMITED 13500 CIL SECURITIES LIMITED 13700 MEHTA EQUITIES LIMITED 13800 BANK OF MAHARASHTRA 14000 ASIAN MARKETS SECURITIES PRIVATE LIMITED 14100 ALANKIT ASSIGNMENTS LIMITED 14300 ICICI BANK LIMITED 14400 KARVY STOCK BROKING LIMITED 15200 ACML CAPITAL MARKETS LIMITED 15600 CITIBANK N.A. 15800 STANDARD CHARTERED BANK 16000 STEWART & MACKERTICH WEALTH MANAGEMENT LIMITED 16400 MANSUKH STOCK BROKERS LIMITED 16700 VSE STOCK SERVICES LIMITED 16900 J G SHAH FINANCIAL CONSULTANTS PRIVATE LIMITED 17000 INDIRA SECURITIES PRIVATE LIMITED 17500 KANTILAL CHHAGANLAL SECURITIES PRIVATE LIMITED 17600 ICICI BANK LIMITED -JAIPUR MAIN BRANCH 17700 HEM SECURITIES LIMITED 17800 EAST INDIA SECURITIES LIMITED 18000 SKSE SECURITIES LIMITED 18600 -

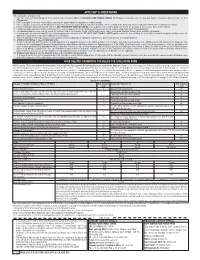

Applicant's Undertaking

APPLICANT’S UNDERTAKING I/We hereby agree and confirm that: 1. I/We have read, understood and agreed to the contents and terms and conditions of RELIANCE HOME FINANCE LIMITED, Shelf Prospectus dated December 15, 2016 and Tranche I Prospectus dated December 15, 2016 (“Prospectus”). 2. I/We hereby apply for allotment of the NCDs to me/us and the amount payable on application is remitted herewith. 3. I/We hereby agree to accept the NCDs applied for or such lesser number as may be allotted to me/us in accordance with the contents of the Prospectus subject to applicable statutory and/or regulatory requirements. 4. I/We irrevocably give my/our authority and consent to IDBI TRUSTEESHIP SERVICES LIMITED to act as my/our trustees and for doing such acts as are necessary to carry out their duties in such capacity. 5. I am/We are Indian National(s) resident in India and I am/ we are not applying for the said NCDs as nominee(s) of any person resident outside India and/or Foreign National(s). 6. The application made by me/us does not exceed the investment limit on the maximum number of NCDs which may be held by me/us under applicable statutory and/or regulatory requirements. 7. In making my/our investment decision I/We have relied on my/our own examination of the RELIANCE HOME FINANCE LIMITED and the terms of the issue, including the merits and risks involved and my/our decision to make this application is solely based on disclosures contained in the Prospectus.