Delhi NCR- Industrial H2 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

List of Education Colleges B.Ed Regular Course

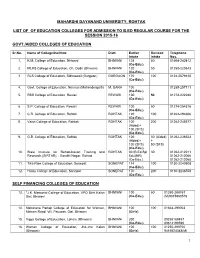

MAHARSHI DAYANAND UNIVERSITY, ROHTAK LIST OF OF EDUCATION COLLEGES FOR ADMISSION TO B.ED REGULAR COURSE FOR THE SESSION 2015-16 GOVT./AIDED COLLEGES OF EDUCATION Sr.No. Name of College/Institute Distt. Earlier Revised Telephone Intake Intake Nos. 1. K.M. College of Education, Bhiwani BHIWANI 128 50 01664-242412 (Co-Edu.) 2. MLRS College of Education, Ch. Dadri (Bhiwani) BHIWANI 120 50 01250-220843 (Co-Edu.) 3. RLS College of Education, Sidhrawali (Gurgaon) GURGAON 170 100 0124-2679128 (Co-Edu.) 4. Govt. College of Education, Narnaul (Mahendergarh) M. GARH 100 01285-257111 (Co-Edu.) 5. RBS College of Education, Rewari REWARI 100 50 01274-222280 (Co-Edu.) 6. S.P. College of Education, Rewari REWARI 100 50 01274-254316 (Co-Edu.) 7. C.R. College of Education, Rohtak ROHTAK 120 100 01262-294606 (Co-Edu.) 8. Vaish College of Education, Rohtak ROHTAK 100 200 01262-248577 (Aided)+ 100 (SFS) (Co-Edu.) 9. G.B. College of Education, Rohtak ROHTAK 100 50 (Aided) 01262-236523 (Aided)+ + 100 (SFS) 50 (SFS) (Co-Edu.) 10. State Institute for Rehabilitation Training and ROHTAK 30 (B.Ed Spl 30 01262-212211 Research,(SIRTAR), , Gandhi Nagar, Rohtak Edu(MR) 01262-212066 (Co-Edu.) 01262-212065 11. Tika Ram College of Education, Sonepat SONEPAT 114 100 0130-2240508 (Co-Edu.) 12. Hindu College of Education, Sonepat SONEPAT 170 200 0130-2246558 (Co-Edu.) SELF FINANCING COLLEGES OF EDUCATION 13. 1*J.K. Memorial College of Education, VPO Birhi Kalan BHIWANI 100 50 01250-288761 4Dist. Bhiwani (Co-Edu.) (M)9315860516 . 14. 1Maharana Partap College of Education for Women, BHIWANI 100 100 01664-290003 5Meham Road, Vill. -

Voter List File 289 1

SUB DIVISION BAR ASSOCIATION, PATAUDI VOTER LIST FOR THE YEAR 2019-20 Serial No. Name Father's/Husband Name Enrolment No. Address Mobile No. Aakash Rajeev P/1497/2018 Vill- Khera Khurampur, Teh. 9728876287 Farrukhnagar, Distt. Gurugram 1 Ajay Kumar Gajraj Singh P/1955/2016 Vill- Rajpura, Teh. Pataudi, Distt. 9416835055 Gurugram 2 Ajay Pal Niwas Kumar P/2404/2014 VPO. Inchhapuri, Teh. Pataudi, 9466233967 Distt. Gurugram 3 Ajay Pal Yadav Dharmpal P/98/2003 VPO.Kharkhari ,Teh. F. Nagar, 9350010008 Distt. Gurugram 4 Ajay Singh Netram P/1446/2011 Vpo. Babra Bakipur, Teh. Farrukh 9911470805 Yadav Nagar, Distt. Gurugram 5 Ajit Singh Bharat Singh P/2482/2011 Vill- Mirzapur Teh. Pataudi Distt. 9313667700 Gurugram 6 Ajit Singh Shripal Singh P/2294/2008 VPO. Jatauli, Teh.Pataudi Distt. 968464022 Chauhan Gurugram 7 Ajit Singh Saini Ram Niwas P/4006/2017 H. No. 185, Ward No. 6, SHiv 9873909779 Colony Haily Mandi, Distt. Gurugram 8 Alok Yadav Kartar Singh P/2023/2009 VPO. Mokalwas, Teh. F. Nagar 9812083747 Distt, Gurugram 9 Aman Yadav Omkar Singh P/3433/2016 New Hazara House, VPO, 9896717276 Jamalpur, Tehsil Farrukh Nagar, Distt. Gurugram. 10 Amarbala S.K. Vats P/1615/2005 Vill- Kosli Teh. Kosli Distt. Rewari 11 Amit Rathi Jagdish P/1000/2011 Village Shekhupur majri Tehsil 9813536946 Farrukhnagar Distt. Gurugram 12 Amit Yadav Subhash Chander P/2071/2014 Vill- Telpuri Teh. Pataudi Distt. 8901366663 Gurugram 13 Anamika Yadav Ashok Kumar Yadav P/788/2015 Vill- Ghoshgarh, PO.Jamalpur, 9671767407 Tehsil Farrukh Nagar, Distt. Gurugram 14 Anand Lala Ram P/2873/2013 VPO. Telpuri Tehsil. -

Village & Townwise Primary Census Abstract, Gurgaon, Part XIII a & B

CENSUS OF INDIA 1981 SBRIES-6 HARYANA DISTRICT CENSUS HANDBOOK- PARTS XIII A & B VILLAGE & TOWN DIRECTORY VILLAGE & TOWNWISE PRIMARY CENSUS ABSTRACT GURGAON DISTRICT o. P. BHARADWAJ OF THE INDIAN ADMTNISTRATIVE SERVICE Director of Census Operations Haryana published by the Government of Haryana 1983 The name GUT9(uJn !"uppo$ed :c be u (:()t1V Upt form oj G1.t1'UgTom is traced to Daronachary«, the teacheT of "the Kuru princes-the Pandavas and }~auTavas. In the motif, Da1fOnIJi.CM1·rya i..s helping the little princes in ge-ttiHg their ball out oj the wif'lZ by c"r-eating a st11.ny oj a1"'7'01.tI$o He was engaged for training the-rn ·i.n archery by theiT grandfather Bhisma when the depicted incident t.oo,.:;· T(i'"(.qled to him CENSUS OF INDIA-1981 A-CENTRAL GOVERNMENT PUBLICATIONS 'fhe publications relating to Haryana bear Series No. 6 and will he published as follows: PartI~A Administration Report-Enumeration (for official use only) Part I-B Administration Report-Tabulation (for official use only) Part II-A General Popul[\tion Tables ') ~ combined Part Il-B primary Censu') Abstract J Part III General Economic Tables . Part IV Social and Cultural Tables / part V Migration Tables Part VI Fertility Tables Part VII Tables on Houses an.d Disabled Population Part ViiI Household Tables Part IX Special Tables on Scheduled Castes part X-A Town Directory Part X-B Survey Reports on selected towns P4rt x-C Survey Reports on selected villages Part XI Ethnographic notes and special studies on Scheduled Castes Part XII Census Atlas B-HARYrANA GOVERNMENT PUBLJCATIONS Parts XIII-A & B . -

UNIVERSITY GRANTS COMMISSION State-Wise List of Private

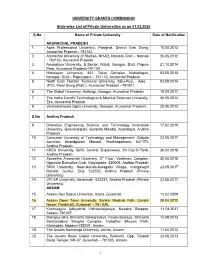

UNIVERSITY GRANTS COMMISSION State-wise List of Private Universities as on 01.02.2020 S.No Name of Private University Date of Notification ARUNACHAL PRADESH 1. Apex Professional University, Pasighat, District East Siang, 10.05.2013 Arunachal Pradesh - 791102. 2. Arunachal University of Studies, NH-52, Namsai, Distt – Namsai 26.05.2012 - 792103, Arunachal Pradesh. 3. Arunodaya University, E-Sector, Nirjuli, Itanagar, Distt. Papum 21.10.2014 Pare, Arunachal Pradesh-791109 4. Himalayan University, 401, Takar Complex, Naharlagun, 03.05.2013 Itanagar, Distt – Papumpare – 791110, Arunachal Pradesh. 5. North East Frontier Technical University, Sibu-Puyi, Aalo 03.09.2014 (PO), West Siang (Distt.), Arunachal Pradesh –791001. 6. The Global University, Hollongi, Itanagar, Arunachal Pradesh. 18.09.2017 7. The Indira Gandhi Technological & Medical Sciences University, 26.05.2012 Ziro, Arunachal Pradesh. 8. Venkateshwara Open University, Itanagar, Arunachal Pradesh. 20.06.2012 S.No Andhra Pradesh 9. Bharatiya Engineering Science and Technology Innovation 17.02.2019 University, Gownivaripalli, Gorantla Mandal, Anantapur, Andhra Pradesh 10. Centurian University of Technology and Management, Gidijala 23.05.2017 Junction, Anandpuram Mandal, Visakhapatnam- 531173, Andhra Pradesh. 11. KREA University, 5655, Central, Expressway, Sri City-517646, 30.04.2018 Andhra Pradesh 12. Saveetha Amaravati University, 3rd Floor, Vaishnavi Complex, 30.04.2018 Opposite Executive Club, Vijayawada- 520008, Andhra Pradesh 13. SRM University, Neerukonda-Kuragallu Village, mangalagiri 23.05.2017 Mandal, Guntur, Dist- 522502, Andhra Pradesh (Private University) 14. VIT-AP University, Amaravati- 522237, Andhra Pradesh (Private 23.05.2017 University) ASSAM 15. Assam Don Bosco University, Azara, Guwahati 12.02.2009 16. Assam Down Town University, Sankar Madhab Path, Gandhi 29.04.2010 Nagar, Panikhaiti, Guwahati – 781 036. -

Consolidated List Private Universities

UNIVERSITY GRANTS COMMISSION State-wise List of Private Universities as on 06.08.2021 S.No Name of Private University Date of Notification ARUNACHAL PRADESH 1. Apex Professional University, Pasighat, District East Siang, 10.05.2013 Arunachal Pradesh - 791102. 2. Arunachal University of Studies, NH-52, Namsai, Distt – Namsai 26.05.2012 - 792103, Arunachal Pradesh. 3. Arunodaya University, E-Sector, Nirjuli, Itanagar, Distt. Papum 21.10.2014 Pare, Arunachal Pradesh-791109 4. Himalayan University, 401, Takar Complex, Naharlagun, 03.05.2013 Itanagar, Distt – Papumpare – 791110, Arunachal Pradesh. 5. North East Frontier Technical University, Sibu-Puyi, Aalo 03.09.2014 (PO), West Siang (Distt.), Arunachal Pradesh –791001. 6. The Global University, Hollongi, Itanagar, Arunachal Pradesh. 18.09.2017 7. The Indira Gandhi Technological & Medical Sciences University, 26.05.2012 Ziro, Arunachal Pradesh. 8. Venkateshwara Open University, Itanagar, Arunachal Pradesh. 20.06.2012 Andhra Pradesh 9. Bharatiya Engineering Science and Technology Innovation 17.02.2019 University, Gownivaripalli, Gorantla Mandal, Anantapur, Andhra Pradesh 10. Centurian University of Technology and Management, Gidijala 23.05.2017 Junction, Anandpuram Mandal, Visakhapatnam- 531173, Andhra Pradesh. 11. KREA University, 5655, Central, Expressway, Sri City-517646, 30.04.2018 Andhra Pradesh 12. Saveetha Amaravati University, 3rd Floor, Vaishnavi Complex, 30.04.2018 Opposite Executive Club, Vijayawada- 520008, Andhra Pradesh 13. SRM University, Neerukonda-Kuragallu Village, mangalagiri 23.05.2017 Mandal, Guntur, Dist- 522502, Andhra Pradesh (Private University) 14. VIT-AP University, Amaravati- 522237, Andhra Pradesh (Private 23.05.2017 University) ASSAM 15. Assam Don Bosco University, Azara, Guwahati 12.02.2009 16. Assam Down Town University, Sankar Madhab Path, Gandhi 29.04.2010 Nagar, Panikhaiti, Guwahati – 781 036. -

International Journal of Research in Informative Science Application & Techniques (IJRISAT) 1 Global Traffic: Discourses

International Journal of Research in Informative ISSN-2581-5814 Science Application & Techniques (IJRISAT) 1 Global Traffic: Discourses and Practices of Trade in English Literature and Culture from 1550 to 1700 (review) DR. ASHOK KUMAR, ASSTT. PROFESSOR, DEPT. OF ENGLISH, G. C. SATNALI DR. SANEH LATA, ENGLISH TEACHER, G. M. S. REWASA MONIKA, RESEARCH SCHOLAR, Singhania University, Pacheri Bari (Raj.) Abstract In the century and a half after 1550, England experienced a variety of economic and cultural changes in the wake of its expanding international trade. This period saw developments as diverse as joint stock companies, advanced map-making techniques, and the creation of maritime insurance to protect investors. But, as this volume makes clear, the changes in the period were more broadly cultural than technological. Building on recent work exploring the place of England within developing systems of global exchange, Global Traffic illuminates the myriad ways that trade became increasingly central not just to the economy but to the changing self-imagination of the English nation. In its varied explorations of travel, exploration, emergent nationalism, imperialism, and incipient colonialism in the early modern period, this collection clarifies the epistemological and discursive shifts through which the abstract world of trade became increasingly central to the wider English culture. In the first section on the new epistemologies of trade, Daniel Vitkus sets the scene by exploring how the overseas maritime trade, underwritten by investors in London, spread over the globe, and how this new global role of the English nation was remained on the London stage. 2 Indian Roads, Traffic Problems and The Common Man Rekha Bai, Rersearch Scholar Singhania University, Pacheri Bari (Raj) SUNITA KUMARI, EXTENSION LECTURER, BAIJNATH COLLEGE, NANGAL CHAUDHARY Abstract India is a country with the second largest road network in the world. -

Comparative Analysis of Quality of Life Among BPL Families in Rural Haryana: a Case Study

International Journal of Research in Economics and Social Sciences (IJRESS) Available online at : http://euroasiapub.org/current.php?title=IJRESS Vol. 6 Issue 7, July 2016, pp. 21~38 ISSN(o): 2249-7382 | Impact Factor: 6.225 , | Thomson Reuters ID: L-5236-2015 Comparative Analysis of Quality of Life among BPL Families in Rural Haryana: A case Study Dr.P.K.Malik* Abstract: Though green revolution and implementation of various integrated rural area development programme are mainly indicating towards rural development & improvement in socio-economic condition of the rural areas. As Integrated Rural Development Programmes generally refers to the process of improving the quality of life(QOL) and the economic well being of people living in rural areas but it is also bitter fact that poverty is growing at a faster pace in rural areas. In India 68.84 percent population (2011 census) belongs to rural areas, which are typically lack basic health and hygienic condition/services. So, the Analysis of the quality of life of rural population specifically socially & economically down trodden section of the society lying Below Poverty Line (BPL) families to understand the pathetic picture of life in rural areas is an utmost need of the hour. Social Problems, disparities, wellbeing and quality of life are the new domains of geographic study in this post modern era. The quality of life studies are also becoming more relevant for inclusive development of society and country. The present study is based on primary survey of 304 BPL households of 4 different villages (Sidhrawali, Rathiwas from Gurgaon District and Garhi Alawalpur and Kapdiwas of Rewari District) of Haryana. -

CHC/PHC/Sub Centers

List of CHC/PHC/ Sub Centers. In District Gurgaon Name of CHC/PHC/Sub- Name of CHC/PHC/Sub-Centers Sr. Sr. Centers General Hospital, Gurgaon 33 SC Nanu Kalan General Hospital, Sec-10, Gurgaon SC Sher Pur (New) 34 Poly Clinic Sec-31 PHC Mandpura (2670010) URCH Centers 35 SC Mand Pura 1 Firoj Gandhi Colony (URCH) 36 SC Nur Garh 2 Laxman Vihar (URCH) (24x7) 37 SC Gudana 3 Rajiv Nagar (URCH) 38 SC Mehchana 4 OM Nagar(URCH) 39 SC Khandewala 5 Mullahera (URCH) 40 SC Mojabad 6 Rajendera Park (URCH) (24x7) 41 SC Khalil Pur 7 Khanda (URCH) 42 SC Jasat 8 Jharsa (URCH) PHC Bhorakalan (2379969) CHC Farrukh Nagar (2375378) 43 SC Bhorakalan PHC Farrukh Nagar 44 SC Dhani Chitersain 1 SC Farrukh Nagar 45 SC Ghosh Garh 2 SC Sultan Pur 46 SC Sidhrawali 3 SC Patli 47 SC Rathi was 4 SC Taj Nagar 48 SC Pathredi 5 SC Majri PHC Kasan (2291570) 6 SC Mushed Pur 49 SC Kasan PHC Gurgaon Village (2309516) 50 SC Manesar 7 SC Gurgaon Village 51 SC Pachgaon 8 SC Karter Puri 52 SC Kufar Pur 9 SC Khandsa 53 SC Ram Pura 10 SC Beghum Pur Khatota 54 SC Shikoh Pur 11 SC Dundaherha PHC Bhangrola (2296268) 12 SC Sirhol 55 SC Bhangrola PHC Wazirabad (2767766) 56 SC Kakrola 13 SC Wazirabad 57 SC Sikenderpur Badha 14 SC Jharsa 58 SC Wazirpur 15 SC Chakker Pur 59 SC Baslambi 16 SC Kanhai 60 SC Babra 17 SC Islam Pur CHC Ghangola 18 SC Baliawas G.H. -

REVISED AGENDA AS the AGENDA NO. 5 IS DELETED (LISTED DUE to TYPOGRAPHICAL ERROR) List of the Projects to Be Taken-Up in the 119Th at 11:30AM Meeting of SEIAA Sr

**REVISED AGENDA AS THE AGENDA NO. 5 IS DELETED (LISTED DUE TO TYPOGRAPHICAL ERROR) List of the projects to be taken-up in the 119th at 11:30AM meeting of SEIAA Sr. No. File No. Name and Address of the Project Proponent Location of the Project 1. SEIAA/HR/19/24 M/s Agrasain Spaces LLP # A-59, Sector 11, Faridabad. EC for Revision & Expansion of Affordable Group EC Housing Project located at Village Mujeri, Sector 70, Faridabad 2. SEIAA/HR/18/ 440 M/s Alesia Buildtech Pvt. Ltd. EC for construction of affordable group housing colony EC at revenue estate Village Riwazpur and Tikawali, SEIAA/HR/19/102 Sector 89, Faridabad, Haryana 3. SEIAA/HR/18/ 422 M/s Puri Construction Pvt. Ltd. EC for construction of Group Housing Colony located EC SEIAA/HR/19/104 in the revenue estate of village Ullawas, Sector-61, District-Gurugram, Haryana 4. SEIAA/HR/19/136 Sh. Bikram Singh S/o S/o Sh. Raghu Nath Singh in EC for Affordable Group Housing Project located in EC collaboration with M/s Nani Resorts and Floriculture the revenue estate of Village Mewka, Sector-92, Pvt. Ltd. Gurugram Manesar Urban Complex, Haryana 5. SEIAA/HR/19/47 M/s Pyramid Infratech Pvt. Ltd. ECfor Proposed Affordable Group Housing Colony EC Sector- 70A, Village-Palra, Gurugram, Haryana. 6. SEIAA/HR/19/156 M/s Pyramid Infratech Pvt. Ltd. EC for Affordable Group Housing Colony Village- EC Nawada, Sector- 86, Gurugram, Haryana. 7. SEIAA/HR/19/53 M/s ELAN LIMITED # 1A 8th Avenue, Bandh Road, EC Proposed Commercial Complex at Village EC Village-Jonpur, New Delhi Badshahpur, Sector- 70, Gurugram, Haryana. -

DBA-VOTING-LIST-2018.Pdf

Sl.No. Name Address Bar Council Bar No. Phone Phone T.U.P. H.No-322/14, Jacubpura, 1 A.L.Sahni P/1007/1983 2 2321473 9313401837 Gurgaon H.No-763-A, Ist Floor, 2 Aakash Aggarwal Block-H, Palam Vihar, P/695/1999 4 9350840785 9910991353 Gurgaon. V.P.O. Dhunela, Post 3 Aakil Ali P/3239/2014 4051 9050300395 9813313823 Office Sohna, Gurgaon H.No-249,Sector-17-A 4 Aarti Bhalla P/2016/2015 4246 9350320004 Gurgaon. H.No-224/7, H.B. 5 Aarti Hans Colony, Sec-7 Ext, P/1398/2011 3061 9910383914 Gurgaon Vill- Udaka, PO-Sohna, 6 Aazad P/3601/2009 2544 9711115701 Distt- Gurgaon Gandhi Nagar Ward No. 7 Abdul Hamid 8 Opp Mewat Model P/778/1994 4054 8860481185 School Tauru. Vill-Rewasan, Teh -Nuh, 8 Abdul Rehman P/95/1998 6 9416256151 9813039030 Distt-Gurgaon PWO Housing Complex, B-2/301, Sector 43, 9 Abha Sinha Sushant Lok-I, Gurgaon P/1800/1999 4751 9871957449 At(P) C-6/6360, Vasant Kunj, New Delhi H.No-645/20, Gali No-6, 10 Abhai singh Yadav P/514/1977 3100 9250171144 Shivji Park, Gurgaon Abhey singh H.No.1434, Sec-15, Part- 0124- 11 P/1132/2001 8 9811198319 Dahima II, Gurgaon. 6568432 Resi-Vill-Dhanwa Pur, Abhey Singh 12 Po-Daulta Bad, Distt- P/857/1995 9 9811934070 Dahiya Gurgaon H.No-209/4, Subhash 13 Abhey Singla P/420/2007 2008 9999499932 9811779952 Nagar, Gur. H.No. 225, sector 15, 14 Abhijeet Gupta P/4107/2016 4757 9654010101 Part-I, Gurgaon. -

Name of S/DIVN. DEF COUNT DHBVN ARGROSS TOP 100

S/Divn & Category Wise TOP 100 Defaulters for the month of NOV-13 under Gurgaon Circle Name of S/DIVN. DEF COUNT DHBVN ARGROSS TOP 100 DEFAULTERS ARGROSS TOP 100 DEFAULTERS ARGROSS IN % AP METER AP UNMETER BULK HT BULK LT DS FISHER GAUSHALA HORTICULTURE HT LT NDS PUBLIC WATER WORKS STREET LIGHT TEMP DS TEMP NDS IDC 18541 120380982.1 74701001.73 62.05 70584.17 0 40922.38 0 13774836.69 0 0 0 19047222.08 15666634.13 24359586.07 0 0 910817.38 830398.83 NEW COLONY 23625 71223443.94 46497948.6 65.28 262202.58 0 5060.22 0 9486878.06 0 0 0 20510785.79 9092552.91 6209838.59 0 0 351112.33 579518.12 KADIPUR 18792 293420719.6 255607070.2 87.11 73510.05 0 138981.53 0 12225013.51 0 0 0 147406743.3 37203614.3 53731157.7 0 0 912684.14 3915365.65 TOTAL Divn 60958 485025145.6 376806020.5 77.69 406296.8 0 184964.13 0 35486728.26 0 0 0 186964751.2 61962801.34 84300582.36 0 0 2174613.85 5325282.6 DLF 15674 126683717.3 94163986.07 74.33 0 0 42378080.48 0 21263272.92 0 0 0 46561.61 734472.66 28040990.55 0 0 221247.63 1479360.22 BADSHAHPUR 7618 139322394.2 59887379.46 42.98 3495572 3255076 0 0 10146110.34 0 0 61642 26356 7962203.05 16976585.07 9051194 1330433 7582208 0 SECTOR-18 MARUTI 22202 164259889.1 115435402.7 70.28 842793.29 0 850374.46 0 9865192.8 0 0 0 53009296.8 14069950.02 35519915.5 0 0 1098921.4 178958.38 SOUTH CITY 25795 146841186.3 98032754.2 66.76 399115.14 0 11149597.31 0 6303419.72 0 0 0 594045.86 1116757.52 76342650.32 0 0 568970.76 1558197.57 TOTAL Divn 71289 577107186.8 367519522.4 63.68 4737480.43 3255076 54378052.25 0 47577995.78 0 0 61642 -

Construction Work of Bye Pass

Construction Work of Bye Pass *276. SH. SATYA PARKASH JRAWTA, M.L.A.: Will the Deputy Chief Minister be pleased to state whether there is any proposal under consideration of the Government to start construction work of Bye Pass of Pataudi; if so, the time by which it is likely to be started? ____________________________________________________ DUSHYANT CHAUTALA, DEPUTY CHIEF MINISTER, HARYANA _________ Yes, Sir. However, no definite time frame for starting construction work can be given since work has not been awarded yet by the NHAI. STARRED ASSEMBLY QUESTION NO. 276 RAISED BY SH. SATYA PARKASH JRAWTA, M.L.A, PATAUDI ASSEMBLY CONSTITUENCY NOTE FOR PAD It is intimated that Gurugram-Pataudi-Rewari road was declared as “in-principle” National Highway by Ministry of Road Transport & Highways (MoRTH) vide letter no. NH-14012/30/2015-P&M dated 08.02.2016 and MoRTH desired to prepare Detailed Project Report (DPR) for this road. Accordingly, Haryana PWD B&R invited tenders for engagement of DPR consultant and on the basis of bid evaluation, tender based estimate was submitted to MoRTH in favor of M/s Xplorer Consultancy Services Pvt. Ltd. MoRTH approved the estimate and accorded administrative approval for preparation of DPR. The consultant submitted alignment report for the Gurugram-Pataudi-Rewari road and the alignment report was submitted to MoRTH for approval. Thereafter, alignment report was also approved by MoRTH. In the meantime, Gurugram-Pataudi-Rewari road was identified as Feeder route under Bharatmala Pariyojna and National Highways Authority of India (NHAI) appointed M/s RITES as consultant for preparation of Detailed Project Report (DPR) of this road.