Standard Chartered PLC (Holding Co.); Standard Chartered Bank (Lead Bank)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

18 February 2019 Solvency and Diversification in Insurance Remain Key Strengths Despite Change in Structure

FINANCIAL INSTITUTIONS ISSUER IN-DEPTH Lloyds Banking Group plc 18 February 2019 Solvency and diversification in insurance remain key strengths despite change in structure Summary RATINGS In 2018, Lloyds Banking Group plc (LBG) altered its structure to comply with the UK's ring- Lloyds Banking Group plc Baseline Credit a3 fencing legislation, which requires large banks to separate their retail and SME operations, Assessment (BCA) and deposit taking in the European Economic Area (EEA) from their other activities, including Senior unsecured A3 Stable the riskier capital markets and trading business. As part of the change, LBG designated Lloyds Bank plc as the“ring-fenced” entity housing its retail, SME and corporate banking operations. Lloyds Bank plc It also assumed direct ownership of insurer Scottish Widows Limited, previously a subsidiary Baseline Credit A3 Assessment (BCA) of Lloyds Bank. The changes had little impact on the creditworthiness of LBG and Lloyds Adjusted BCA A3 Bank, leading us to affirm the deposit and senior unsecured ratings of both entities. Scottish Deposits Aa3 Stable/Prime-1 Widows' ratings were unaffected. Senior unsecured Aa3 Stable » LBG's reorganisation was less complex than that of most UK peers. The Lloyds Lloyds Bank Corporate Markets plc Banking Group is predominantly focused on retail and corporate banking, and the Baseline Credit baa3 required structural changes were therefore relatively minor. The group created a small Assessment (BCA) separate legal entity, Lloyds Bank Corporate Markets plc (LBCM), to manage its limited Adjusted BCA baa1 Deposits A1 Stable/Prime-1 capital markets and trading operations, and it transferred its offshore subsidiary, Lloyds Issuer rating A1 Stable Bank International Limited (LBIL), to LBCM from Lloyds Bank. -

Using Replicated Ledger to Reduce Swift Costs

WHITE PAPER USING REPLICATED LEDGER TO REDUCE SWIFT COSTS Abstract Nientibus et harum la aliquos que dunt harunte nat qui assimin ctincti nimoloratur? Quis sin enim expello rescitis aliberiosam, sumendu cienimil es ab in pelibus antiunt, eatur sit volorec tetur, occus asi suntiss imporer eperis dolupta que quid quatis mo volorit quas maio. Im acest, eos si beat. Ur? Nonseque reribus. Itatium re, nissi nullupietur audis sit adis con non corrum fugias eosae nones nonsenimus Itate esto moluptatur autatis sinctota dolent labo. Sum autem reriossum eos acerestectur rem que et haribus vel etur Introduction This paper proposes an approach to build a payment product that could be deployed across units of same bank or banks which have correspondent relationships, to reduce SWIFT message costs and to conserve liquidity by reducing need for Settlement and Nostro accounts. The paper proposes an outline of a product that implements a replicated, single wrapper around existing ledgers of such bank units to enable quick, irrevocable, tamper-proof approach to managing electronic payments between correspondent bank units. Existing ledgers of the bank would not be replaced or disturbed. Instead a wrapper application would be deployed that tracks specific entries in the ledger and replicates the changes to all members. This enables each member bank to see the same ledger at the same time and also be guaranteed of its accuracy. For this purpose, it is recommended the product be built using Blockchain for established and proven security. Such a replicated ledger would reduce active, recurring costs of using SWIFT network to pass payment messages. This will also reduce the much larger passive cost of holding funds in a non- remunerative settlement a/c with the correspondent bank. -

OTP Morning Brief

22 JUNE 2021 OTP Morning Brief • Western Europe's stock markets picked up, benefiting from Christine Lagarde's words • The sentiment improved in the USA, despite Fed officials' continued hints at monetary tightening • The EUR/HUF sank near 353 yesterday, when the MNB governor's hawkish article was published. • The MNB is expected to raise interest rates today; its size may determine the HUF's exchange rate. • Most of Asia's indices headed higher today; Brent climbed to USD 75 www.otpresearch.com 1 22 JUNE 2021 Western Europe's stock exchanges shifted into higher gear on Christine Lagarde’s words Western Europe's stock markets started the week with gains: Germany's DAX jumped 1.0%, reversing Friday's fall, the UK's FTSE rose by 0.6%, and the Stoxx600 closed 0.7% higher. It was the words of Christine Lagarde, the ECB's President, that set markets in motion. Speaking at a hearing in the European Parliament, she spoke about maintaining loose monetary conditions and dispelled fears about the spill-over effects of US inflation in Europe. Cyclical sectors have risen; the winners of the day in the Stoxx600 were vehicle manufacturers, chemical, and materials stocks. Retail companies also did well: the UK-based Morrisons food chain skyrocketed 35% after rejecting a GBP 5.5bn takeover bid from Clayton, Dubilier & Rice. Their rivals also jumped: Tesco advanced 1.7%, and Sainbury’s surged 3.8%. The Stoxx600 Health Sector Index stagnated, even though CureVac plummeted more than 10% on suspicion of insider trading; last week, the biopharmaceutical's stock price of fell as clinical trials pointed to low efficacy of its covid vaccine. -

Hsbc to Acquire Lloyds Banking Group Onshore Assets in the Uae

Ab c 29 March 2012 HSBC TO ACQUIRE LLOYDS BANKING GROUP ONSHORE ASSETS IN THE UAE HSBC Bank Middle East Ltd (‘HSBC’), an indirect wholly-owned subsidiary of HSBC Holdings plc, has entered into an agreement to acquire the onshore retail and commercial banking business of Lloyds Banking Group (‘Lloyds’) in the United Arab Emirates (‘UAE’). The value of the gross assets being acquired is US$769m as at 31 December 2011. The transaction, which is subject to regulatory approvals, is expected to complete in 2012. HSBC’s largest operations in the MENA region are based in the UAE where HSBC enjoys a market-leading trade and commercial banking presence, in addition to the largest international retail banking and wealth management business. The business being acquired from Lloyds has approximately 8,800 personal and commercial customers and a loan book of approximately US$573m as at 31 December 2011. Commenting on the acquisition, Simon Cooper, Deputy Chairman and Chief Executive Officer of HSBC in MENA, said: “HSBC is the leading international bank in the UAE and the addition of Lloyds’ strong presence in retail and commercial banking is highly complementary to our business. The acquisition underscores the strategic importance of the UAE, and of the MENA region as a whole, to HSBC.” Media enquiries to: Tim Harrison + 971 4 4235632 [email protected] Brendan McNamara +44 (0) 20 7991 0655 [email protected] ends/more Registered Office and Group Head Office: This news release is issued by 8 Canada Square, London E14 5HQ, United Kingdom Web: www.hsbc.com HSBC Holdings plc Incorporated in England with limited liability. -

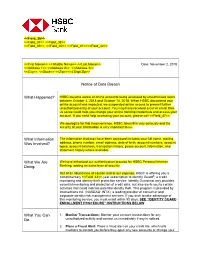

HSBC Became Aware of Online Accounts Being Accessed by Unauthorized Users Between October 4, 2018 and October 14, 2018

<<Field_36>> <<Field_37>> <<Field_38>> <<Field_39>>, <<Field_40>> <<Field_41>><<Field_42>> <<First Name>> << Middle Name>> <<Last Name>> Date: November 2, 2018 <<Address 1>> <<Address 2>> <<Address 3>> <<City>>, <<State>> <<Zip>><<4 Digit Zip>> Notice of Data Breach What Happened? HSBC became aware of online accounts being accessed by unauthorized users between October 4, 2018 and October 14, 2018. When HSBC discovered your online account was impacted, we suspended online access to prevent further unauthorized entry of your account. You may have received a call or email from us so we could help you change your online banking credentials and access your account. If you need help accessing your account, please call <<Field_47>>. We apologize for this inconvenience. HSBC takes this very seriously and the security of your information is very important to us. What Information The information that may have been accessed includes your full name, mailing Was Involved? address, phone number, email address, date of birth, account numbers, account types, account balances, transaction history, payee account information, and statement history where available. What We Are We have enhanced our authentication process for HSBC Personal Internet Doing. Banking, adding an extra layer of security. Out of an abundance of caution and at our expense, HSBC is offering you a complimentary <<Field_43>>-year subscription to Identity Guard®, a credit monitoring and identity theft protection service. Identity Guard not only provides essential monitoring and protection of credit data, but also alerts you to certain activities that could indicate potential identity theft. This program is provided by Intersections Inc. (NASDAQ: INTX), a leading provider of consumer and corporate identity risk management services. -

Standard Chartered Bank, Impacts of E-Banking and the Customer Perception on E-Banking

Strategic Information Management Nowshad M Shawon Abstract Bank is one the most important financial sectors. Internet has made the banking function easier and changed the traditional banking system. The aim of this report is to compare the historical performance of Barclays and Standard chartered bank, impacts of E-banking and the customer perception on E-banking. To make the report uneatable, the author included brief history of the banks. In the first section of the analysis, the author discussed the historical performance of Barclays and Standard chartered through the use of MS-Excel. In the second section, the author discussed the positive and negative impacts of E-banking and finally at the end of this report, the customer perception on E-banking has been discussed through primary data collected by a questionnaire from the customers of Barclays and Standard chartered. NMS Page 1 Table of Contents 1 Introduction .................................................................................................................................... 4 1.1 Background of the Banks ........................................................................................................ 4 1.1.1 Barclays Plc ...................................................................................................................... 4 1.1.2 Standard Chartered Plc ................................................................................................... 5 2 Comparative analysis of Historical performances of Barclays Plc & Standard Chartered Plc -

Unilever Finance Netherlands BV

11 May 2021 Unilever Finance Netherlands B.V. (guaranteed on a joint and several basis by Unilever PLC and Unilever United States, Inc.) and Unilever PLC (guaranteed by Unilever United States, Inc.) U.S.$25,000,000,000 Debt Issuance Programme Application has been made to the Dutch Authority for the Financial Markets (Stichting Autoriteit Financiële Markten or the “AFM”) in its capacity as competent authority under Regulation (EU) 2017/1129 (the “Prospectus Regulation”) to approve this Information Memorandum for the purpose of giving information with regard to the issue of notes by Unilever PLC (“PLC Notes”) and by Unilever Finance Netherlands B.V. (“UFN Notes”, and together with PLC Notes, “Notes”) under the debt issuance programme described herein (the “Programme”) during the period of 12 months after the date hereof. This Information Memorandum is a base prospectus for the purposes of the Prospectus Regulation. This Information Memorandum has been approved by the AFM, as competent authority under the Prospectus Regulation. The AFM only approves this Information Memorandum as meeting the standards of completeness, comprehensibility and consistency imposed by the Prospectus Regulation. Such approval should not be considered as an endorsement of either the Issuers, the Guarantors or the quality of the securities that are the subject of this Information Memorandum. Investors should make their own assessment as to the suitability of investing in the Notes. The requirement to publish a prospectus under the Prospectus Regulation only applies to Notes which are to be admitted to trading on a regulated market as defined in Directive 2014/65/EU (as amended, “MiFID II”) and/or offered to the public in the European Economic Area (the “EEA”) in circumstances where no exemption is available under the Prospectus Regulation. -

Natwest, Lloyds Bank and Barclays Pilot UK's First Business Banking Hubs

NatWest, Lloyds Bank and Barclays pilot UK’s first business banking hubs NatWest, Lloyds Bank and Barclays have announced that they will pilot the UK’s first shared business banking hubs. The first hub will open its door in Perry Barr, Birmingham today. The pilot will also see five other shared hubs open across the UK in the coming weeks The hubs have been specifically designed to enable businesses that manage cash and cheque transactions to pay in large volumes of coins, notes and cheques and complete cash exchange transactions. They will be available on a trial basis to pre-selected business clients in each local area and will offer extended opening times (8am to 8pm) 7 days a week, providing business and corporate customers more flexibility to manage their day-to-day finances. The hubs will be branded Business Banking Hub and they have been designed to enable business customers from Natwest, Lloyds Bank and Barclays to conduct transactions through a shared facility. Commenting on the launch of the pilot, Deputy CEO of NatWest Holdings and CEO of NatWest Commercial and Private Banking Alison Rose said: “We have listened to what our business customers really want from our cash services. It is now more important than ever that we continue to offer innovative services, and we are creating an infrastructure that allows small business owners and entrepreneurs to do what they do best - run their business. I look forward to continued working with fellow banks to ensure the UK's businesses are getting the support they deserve." Commenting on the support this will provide businesses, Paul Gordon, Managing Director of SME and Mid Corporates at Lloyds Bank Commercial Banking said: “SMEs are the lifeblood of the UK economy. -

Banco Santander: Extending Financial Se Vices to Low-Income Communities in B Azil

CASE STUDY Banco Santander: Extending financial se vices to low-income communities in B azil Initi ti e Descriptio In September 2013, Santander Microcrédito joined the Business Call to Action with a commitment to serve 124,799 low-income consumers with microfinance services and to disburse up to US$490 million in microcredit loans by 2015. The goals of Santander Microcrédito are to: • Disburse R$540 million (US$230 million) in microcredit operations by the end of 2014; and R$600 million (US$260 million) in 2015; and • Attain 126,000 active microcredit clients by the end of 2014 and 131,000 additional clients Business Model Santander Microcredit is an example of how Banco in 2015. In Brazil, 52 million people and Santander Brasil contributes to approximately 25 million informal reducing social inequalities in entrepreneurs lack access to the for- the country. When we started mal banking system. Santander Brasil thinking about how to launch Microcredit, a company affiliated with the microcredit programme, we Banco Santander Brasil, was founded decided that it should be a in 2002 to offer microcredit operations model in which all involved to support business entrepreneurs parties could benefit. that could not access formal banking services. To this end, Santander Brasil Microcredit offers loans that con- tribute to employment and income generation for low-income people. Currently, Santander Microcredit The average monthly income in Brazil operates in more than 600 municipali- is US$6801 and 21 percent of the pop- ties (in 10 Brazilian states), and has 25 ulation live below the poverty line2. branch offices. -

Web Updation FAQ's Version 3

FAQ’S for Barclaycard customers 1. Customer: How do I know when my Standard Chartered Bank Credit Card will become active? There is an Instructions letter with your new card that instructs the date on which your new Standard Chartered Bank Credit Card will become active and your Barclaycard will become inactive. A sms will also be sent to you before the activation of your new Standard Chartered Bank Credit Card. 2. Customer: I not received any card from Standard Chartered Bank after I received the Welcome Letter at the end of February 2012? We are dispatching cards in batches. You will receive an SMS from Standard Chartered Bank when your card is dispatched to you. The SMS will contain details of the Airway Bill No. of the courier which you can use to track your card. In case, you do not receive this SMS or your card by the 1st week of June, please write to Customer Care at [email protected] or call Standard Chartered Bank phone banking at the following numbers http://www.standardchartered.co.in/personal/ways-to-bank/en/phone-banking12.html 3. Customer: Do I need to give details about my account again or will it be transferred automatically? You do not need to do anything as all the information that is currently with Barclays bank will be transferred to Standard Chartered Bank in order to have your new card account set up. However if you have set up ECS/SI instructions on your current Barclaycard, then once you have received the new Standard Chartered Bank Credit Card please call the number at the back of your new Standard Chartered Bank Credit Card to provide ECS/SI instructions. -

Inward Remittance — Quick Reference Guide

Inward Remittance — Quick Reference Guide How to instruct a Remitting Bank to remit funds to your account with BOCHK Please instruct the Remitting Bank to send a detailed payment instruction in SWIFT MT103 format to us using the below SWIFT BIC of BOCHK. To designate BOCHK as the Beneficiary’s bank, please provide below details. SWIFT BIC: BKCHHKHHXXX Bank Name: BANK OF CHINA (HONG KONG) LIMITED, HONG KONG Main Address: BANK OF CHINA TOWER, 1 GARDEN ROAD, CENTRAL, HONG KONG Bank Code: 012 (for local bank transfer CHATS / RTGS only) Please provide details of your account for depositing the remittance proceeds. Beneficiary’s Account Number: Please provide the 14-digit account number to deposit the incoming funds. (Please refer to Part 3 for further explanation.) Beneficiary’s Name: Please provide the name of the above account number as in our record. Major Clearing Arrangement and Correspondent Banks of BOCHK CCY SWIFT BIC Name of Bank Details Bank of China (Hong Kong) Ltd - RMB BKCHHKHH838 BOCHK’s CNAPS No.: 9895 8400 1207 Clearing Centre CNY BKCHCNBJXXX Bank of China Head Office, Beijing Direct Participant of CIPS (Payment through CIPS) BKCHCNBJS00 Bank of China, Shanghai Correspondent Bank of BOCHK in the mainland CCY SWIFT BIC Name of Bank CCY SWIFT BIC Name of Bank AUD BKCHAU2SXXX Bank of China, Sydney NOK DNBANOKKXXX DNB Bank ASA, Oslo Bank Islam Brunei Darussalam NZD BND BIBDBNBBXXX ANZBNZ22XXX ANZ National Bank Ltd, Wellington Berhad CAD BKCHCATTXXX Bank of China (Canada), Toronto SEK NDEASESSXXX Nordea Bank AB (Publ), Stockholm CHF UBSWCHZH80A UBS Switzerland AG, Zurich SGD BKCHSGSGXXX Bank of China, Singapore DKK DABADKKKXXX Danske Bank A/S, Copenhagen THB BKKBTHBKXXX Bangkok Bank Public Co Ltd, Bangkok Commerzbank AG, Frankfurt AM COBADEFFXXX CHASUS33XXX JPMorgan Chase Bank NA, New York EUR Main BKCHDEFFXXX Bank of China, Frankfurt USD CITIUS33XXX Citibank New York GBP BKCHGB2LXXX Bank of China, London BOFAUS3NXXX Bank of America, N.A. -

Analisis De La Responsabilidad Social Corporativa Del Sector Bancario

Facultad de Ciencias Económicas y Empresariales ANÁLISIS DE LA RESPONSABILIDAD SOCIAL CORPORATIVA EN EL SECTOR BANCARIO ESPAÑOL Autor: María Sánchez Barbero Director: Laura Gismera Tierno MADRID | Abril 2020 RESUMEN/ABSTRACT Resumen La Responsabilidad Social Corporativa es una práctica en auge desde finales de los años 90 y su función principal es satisfacer a los grupos de interés –stakeholders- de las empresas que la aplican. La RSC busca cumplir con los intereses internos de las compañías y de la sociedad, mejorando así la imagen corporativa de la empresa. El sector bancario español lleva casi 20 años aplicando esta corriente empresarial hasta el punto que, las distintas entidades bancarias que conforman el sector, desarrollan modelos de RSC prácticamente idénticos. Este trabajo tiene como principal objetivo analizar la Responsabilidad Social Corporativa en el sector bancario español. En primer lugar, se expondrá una aproximación al concepto de Responsabilidad Social Corporativa, así como su evolución, las principales teorías sobre la materia y ciertos aspectos diferenciales y normativos con los que se identifica la RSC. Así mismo, se realizará un análisis de la evolución del sector bancario en los últimos años junto con las oportunidades y amenazas a las que se enfrenta el mismo. Finalmente, se analizará el modelo de RSC de cinco de las entidades bancarias más importantes a nivel nacional: Santander, BBVA, CaixaBank, Bankinter y Banco Sabadell. Palabras clave: Responsabilidad Social Corporativa (RSC), economía, entidades bancarias, stakeholders, interés, sostenibilidad, acción social. Abstract Corporate Social Responsibility has been a growing practice since the late 1990s and its main function is to satisfy the stakeholders of the companies that apply it.