Delta Galil Industries Ltd. 2018 Periodic Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Public Companies Profiting from Illegal Israeli Settlements on Palestinian Land

Public Companies Profiting from Illegal Israeli Settlements on Palestinian Land Yellow highlighting denotes companies held by the United Methodist General Board of Pension and Health Benefits (GBPHB) as of 12/31/14 I. Public Companies Located in Illegal Settlements ACE AUTO DEPOT LTD. (TLV:ACDP) - owns hardware store in the illegal settlement of Ma'ale Adumim http://www.ace.co.il/default.asp?catid=%7BE79CAE46-40FB-4818-A7BF-FF1C01A96109%7D, http://www.machat.co.il/businesses.php, http://www.nytimes.com/2007/03/14/world/middleeast/14israel.html?_r=3&oref=slogin&oref=slogin&, http://investing.businessweek.com/research/stocks/snapshot/snapshot.asp?ticker=ACDP:IT ALON BLUE SQUARE ISRAEL LTD. (NYSE:BSI) - has facilities in the Barkan and Atarot Industrial Zones and operates supermarkets in many West Bank settlements www.whoprofits.org/company/blue- square-israel, http://www.haaretz.com/business/shefa-shuk-no-more-boycotted-chain-renamed-zol-b-shefa-1.378092, www.bsi.co.il/Common/FilesBinaryWrite.aspx?id=3140 AVGOL INDUSTRIES 1953 LTD. (TLV:AVGL) - has a major manufacturing plant in the Barkan Industrial Zone http://www.unitedmethodistdivestment.com/ReportCorporateResearchTripWestBank2010FinalVersion3.pdf (United Methodist eyewitness report), http://panjiva.com/Avgol-Ltd/1370180, http://www.haaretz.com/print-edition/business/avgol- sees-bright-future-for-nonwoven-textiles-in-china-1.282397 AVIS BUDGET GROUP INC. (NASDAQ:CAR) - leases cars in the illegal settlements of Beitar Illit and Modi’in Illit http://rent.avis.co.il/en/pages/car_rental_israel_stations, http://www.carrentalisrael.com/car-rental- israel.asp?refr= BANK HAPOALIM LTD. (TLV:POLI) - has branches in settlements; provides financing for housing projects in illegal settlements, mortgages for settlers, and financing for the Jerusalem light rail project, which connects illegal settlements with Jerusalem http://www.haaretz.com/print-edition/business/bank-hapoalim-to-lead-financing-for-jerusalem-light-rail-line-1.97706, http://www.whoprofits.org/company/bank-hapoalim BANK LEUMI LE-ISRAEL LTD. -

Company Country

Company Country 1 Teva Pharmaceutical ISR 2 Coca-Cola HBC AG GRC 3 Bank Hapoalim ISR 4 Israel Chemicals ISR 5 Bank Leumi ISR 6 Bezeq ISR 7 Azrieli Group ISR 8 Hellenic Telecommunications Organization S.A. GRC 9 Nice Systems ISR 10 Elbit Systems ISR 11 OPAP GRC 12 Mizrahi Tefahot Bank Ltd. ISR 13 Delek Group ISR 14 Frutarom ISR 15 Osem Investments ISR 16 Israel Discount Bank ISR 17 Israel Corporation ISR 18 Hellenic Petroleum S.A. GRC 19 Gazit Globe (1982) Ltd ISR 20 BANK OF CYPRUS PUBLIC COMPANY LTD CYP 21 Titan Cement Co. S.A. GRC 22 Melisron ISR 23 Alpha Bank S.A. GRC 24 National Bank of Greece S.A. GRC 25 Paz Oil ISR 26 Strauss Group ISR 27 Folli Follie GRC 28 Motor Oil Hellas Corinth Refineries S.A. GRC 29 First Intl Bank of Israel (5) ISR 30 Public Power Corp. S.A. GRC 31 Jumbo S.A. GRC 32 Oil Refineries ISR 33 Alony Hetz Properties & Inv ISR 34 Tower Semiconductor Ltd ISR 35 Migdal Insurance & Financial Holdings Ltd. ISR 36 Grivalia Properties R.E.I.C GRC 37 Harel Investments & Finance ISR 38 Delek Automotive Systems ISR 39 Amot Investments Ltd. ISR 40 Clal Insurance ISR 41 Delta Galil Industries ISR 42 Shikun & Binui Ltd ISR 43 Airport City Ltd ISR 44 Kenon Holdings ISR 45 Athens Water Supply & Sewerage GRC 46 Ezchip Semiconductor ISR 47 Jerusalem Oil Exploration ISR 48 Phoenix Holdings ISR Company Country 49 IDI Insurance Company Ltd ISR 50 Cellcom Israel Ltd. ISR 51 Partner Communications ISR 52 VIOHALCO SA/NV (CB) GRC 53 Mytilineos Holdings S.A. -

Index Announcement

INDEX ANNOUNCEMENT S&P Dow Jones Indices announces changes to the S&P / Harel Sector Indices London, March 25, 2014 – The S&P / Harel Indices are being rebalanced after the close of trading on Monday, March 31st. To follow are the list of indices, their constituents and weights, effective on that date. S&P / Harel Consumer Goods Index Name Weight Osem Investment 15.000% Strauss Group 15.000% Rami Levi Chain Stores Hashikma Marketing Ltd. 15.000% Delek Automotive Systems Ltd 13.123% FOX WIZEL LTD 12.116% Shufersal Ltd. 9.723% Delta-Galil Industries 8.012% Kerur Hldgs 1 3.139% CARASSO MOTORS LTD 2.133% Maabarot Products Ltd. 1.382% Neto ME Holdings Ltd 1.372% Alon Blue Square Israel Ltd 1.000% Gan Shmuel Food Industries 1.000% Dor Alon Energy In Israel (1988) 1.000% Neto Malinda Trading Ltd. 1.000% McGRAW-HILL S&P DOW JONES INDICES INDEX ANNOUNCEMENT S&P / Harel Energy Index Name Weight Isramco Negev 2 LP 15.000% Delek Group Ltd 15.000% Ratio Oil Exploration L.P. 15.000% Avner Oil & Gas Ltd LP 14.776% Paz Oil Company Ltd 11.899% Delek Drilling LP 10.483% Oil Refineries Ltd 5.959% Ormat Industries 4.638% Delek Energy Systems Ltd 1.245% Naphtha Israel Petroleum Corp 1.000% I.N.O.C.-Dead Sea L.P. 1.000% Givot Olam Oil Exploration L.P. 1.000% Alon Natural Gas Exploration Ltd. 1.000% Naphtha Explorations L.P. 1.000% LAPIDOTH-HELETZ LP 1.000% S&P / Harel Health Care Index Name Weight Teva Pharmaceutical Industries 15.000% Perrigo Company plc 15.000% Mazor Robotics Ltd. -

Bluestar Israel Equity Update First Quarter 2014

BlueStar Israel Equity Update First Quarter 2014 Q4 2013 in Review & 2014 Outlook All major global developed market equity benchmarks rose strongly in Q4 2013 despite the announcement of the Federal Reserve’s intentions to reduce the scope of its bond purchase What’s Inside program The BlueStar Israel Global Index rose 10.54% in Q4 2013 on an annualized basis while the TA-100 and MSCI Israel indices were up 7.38% and 6.34%, respectively. The BlueStar 1. Israeli Global benchmark also outperformed the TA-100 and MSCI Israel benchmarks for the full year 2013 by 4 and 15 percentage points, respectively. Equities in Q4 2013 For the second straight quarter the rally in Israeli equities was broad based and in each of the three largest sectors: Information Technology, Financials and Health Care. Additionally a long-awaited recovery in the telecom sector took hold during the quarter. Each of these sectors rose strongly during Q4 2013 indicating strength in the domestic economy and an 2.-6. About the BIGI & acceleration in the growth rates of the economies of Israel’s largest trading partners. BIGTech Indexes, The Israeli government budget deficit continued to shrink bringing on the prospect of lower Rebalance Review, taxes and higher government spending in 2014. The labor force participation rate rose in the and Risk/Return fourth quarter while the unemployment rate remained low. Data The revival in trading volume on the TASE, rise in equity prices in most developed countries, and several relatively large IPOs by Israeli companies during the second half of 2014 resulted in a net addition of 12 companies in the BlueStar Israel Global Index’s December rebalance. -

Delta Galil Industries Ltd. 2020 Periodic Report

Delta Galil Industries Ltd. 2020 Periodic Report March 9th 2021 1 Delta Galil Industries Ltd. 2020 Periodic Report Table of Contents: 1. Chapter A – Description of the Corporation’s Business 2. Chapter B – Board of Directors' Report on the State of Corporate Affairs 3. Chapter C – Financial Statements 4. Chapter D – Additional Information Regarding the Corporation 2 Delta Galil Industries Ltd. Chapter A Description of the Corporation's Business As of December 31 2020 3 TABLE OF CONTENTS Page Chapter A – Description of the General Development of the Corporation’s Business ..................... 7 1. The Corporation’s Activity and Description of the Development of its Business .................... 7 2. The Corporation’s Operating Segment ................................................................................... 11 3. Investments in the Corporation’s Equity and Transactions in its Shares ................................ 12 4. Distribution of Dividends ....................................................................................................... 12 Chapter B – Other Information .......................................................................................................... 13 5. Financial Information Regarding the Corporation’s Operating segments .............................. 13 6. General Environment and Impact of External Factors on the Corporation’s Activity ............ 13 Chapter C – Description of the Corporation's Business by Operating Segment ............................ 14 7. General Information on Operating -

Announcement

ANNOUNCEMENT Review of the FTSE MED Index FTSE Russell has conducted a detailed review of the operation of the FTSE-Med Index for the six-month period from November 2020 to April 2021 in accordance with the Ground Rules of Operation of the Index. Following the relevant assessment by FTSE Russel, the new composition of the Index for the next six months is announced here below in order to inform investors and stakeholders. During the current review of the composition of the Index and in accordance with the Ground Rules, it is noted that the Index includes sixty-four (64) companies from the Tel Aviv Stock Exchange, twenty-one (21) companies from the Athens Stock Exchange and five (5) companies from the Cyprus Stock Exchange (CSE). During the next six months, the Index will comprise the following companies: Company Country 1 Nice Ltd ISR 2 COCA-COLA HBC AG (CR) GRC 3 Teva Pharmaceutical ISR 4 Bank Hapoalim ISR 5 Bank Leumi ISR 6 Azrieli Group ISR 7 ICL Group Ltd ISR 8 HELLENIC TELECOM. ORGANISATION (CR) GRC 9 Mizrahi Tefahot Bank Ltd. ISR 10 Elbit Systems ISR 11 Israel Discount Bank ISR 12 OPAP S.A. (CR) GRC 13 EUROBANK ERGASIAS SERVICES AND HOLDINGS S.A. (CR) GRC 14 Strauss Group ISR 15 PIRAEUS FINANCIAL HOLDINGS S.A. (CR) GRC 16 Tower Semiconductor Ltd ISR 17 First Intl Bank of Israel (5) ISR 18 Bezeq ISR 19 Shikun & Binui Ltd ISR 20 Melisron ISR 21 NATIONAL BANK OF GREECE S.A. (CR) GRC 22 Nova Measuring Instruments Ltd ISR 23 Amot Investments Ltd. -

Old Westbury Funds

SECURITIES AND EXCHANGE COMMISSION FORM N-Q Quarterly schedule of portfolio holdings of registered management investment company filed on Form N-Q Filing Date: 2012-03-27 | Period of Report: 2012-01-31 SEC Accession No. 0000930413-12-001798 (HTML Version on secdatabase.com) FILER OLD WESTBURY FUNDS INC Mailing Address Business Address 760 MOORE ROAD 760 MOORE ROAD CIK:909994| IRS No.: 232874698 | State of Incorp.:MD | Fiscal Year End: 1031 KING OF PRUSSIA PA 19406 KING OF PRUSSIA PA 19406 Type: N-Q | Act: 40 | File No.: 811-07912 | Film No.: 12715936 3027914394 Copyright © 2012 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM N-Q QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS OF REGISTERED MANAGEMENT INVESTMENT COMPANY Investment Company Act file number 811-07912 Old Westbury Funds, Inc. (Exact name of registrant as specified in charter) 760 Moore Rd. King of Prussia, PA 19406 (Address of principal executive offices) (Zip code) Andrew J. McNally BNY Mellon Investment Servicing (US) Inc. 760 Moore Rd. King of Prussia, PA 19406 (Name and address of agent for service) Registrant’s telephone number, including area code: 800-607-2200 Date of fiscal year end: October 31 Date of reporting period: January 31, 2012 Form N-Q is to be used by management investment companies, other than small business investment companies registered on Form N-5 (§§ 239.24 and 274.5 of this chapter), to file reports with the Commission, not later than 60 days after the close of the first and third fiscal quarters, pursuant to rule 30b1-5 under the Investment Company Act of 1940 (17 CFR 270.30b1-5). -

Ticker Name Sector Subgroup Market Cap Price P/E Gryld ESLT ELBIT SYSTEMS LTD Aerospace/Defense Aerospace/Defense-Equip 1872732

Ticker Name Sector Subgroup Market Cap Price P/E GrYld ESLT ELBIT SYSTEMS LTD Aerospace/Defense Aerospace/Defense-Equip 1872732000 43.72 10.16 3.29 TATT TAT TECHNOLOGIES LTD Aerospace/Defense Aerospace/Defense-Equip 44163170 5.01 N/A N/A DELTY DELTA GALIL INDUSTRIES-ADR Apparel Apparel Manufacturers 132338700 5.65 N/A 6.01 CGEN COMPUGEN LTD Biotechnology Medical-Biomedical/Gene 142664900 4.16 N/A N/A PNTR POINTER TELOCATION LTD Commercial Services Commercial Services 19191250 4.01 11.46 N/A LAXAF LAXAI PHARMA LTD Commercial Services Research&Development 570408.8 0.01 N/A N/A BPHX BLUEPHOENIX SOLUTIONS LTD Computers Computer Services 15623440 0.63 N/A N/A JCDA JACADA LTD Computers Computer Services 9037805 2.25 N/A N/A TISA TOP IMAGE SYSTEMS LTD Computers Computers-Integrated Sys 17851280 2.00 18.18 N/A ELTK ELTEK LTD Electronics Circuit Boards 6940612 1.05 N/A N/A ELRNF ELRON ELECTRONIC INDS LTD Electronics Electronic Compo-Misc 122792500 4.14 N/A N/A RADA RADA ELECTRONIC INDS LTD Electronics Electronic Compo-Misc 19954930 2.25 12.50 N/A ORBK ORBOTECH LTD Electronics Electronic Measur Instr 444145500 10.31 7.26 N/A CAMT CAMTEK LTD Electronics Electronic Measur Instr 56486220 1.98 6.83 N/A ITRN ITURAN LOCATION AND CONTROL Electronics Electronic Secur Devices 258956200 12.35 N/A 8.10 MAGS MAGAL SECURITY SYS LTD Electronics Electronic Secur Devices 37967580 2.40 N/A N/A OTIV ON TRACK INNOVATIONS LTD Electronics Identification Sys/Dev 45468330 1.46 N/A N/A BSI ALON HOLDINGS BLUE SQ-ADR Food Food-Retail 342303500 5.19 N/A N/A WILC G. -

Important Notice the Depository Trust Company

Important Notice The Depository Trust Company B #: 0165-12 Date: February 3, 2012 To: All Participants Category: Dividends From: International Services Attention: Operations, Reorg & Dividend Managers, Partners & Cashiers The Bank of New York Mellon – ADRs that the bank, as ADR depositary for these Subject: issues, has determined if they met the criteria for the reduced U.S. tax rate as “qualified dividends” for tax year 2011. Important Legal Information: The Depository Trust Company (“DTC”) does not represent or warrant the accuracy, adequacy, timeliness, completeness or fitness for any particular purpose of the information contained in this communication, which is based in part on information obtained from third parties and not independently verified by DTC and which is provided as is. The information contained in this communication is not intended to be a substitute for obtaining tax advice from an appropriate professional advisor. In providing this communication, DTC shall not be liable for (1) any loss resulting directly or indirectly from mistakes, errors, omissions, interruptions, delays or defects in such communication, unless caused directly by gross negligence or willful misconduct on the part of DTC, and (2) any special, consequential, exemplary, incidental or punitive damages. To ensure compliance with Internal Revenue Service Circular 230, you are hereby notified that: (a) any discussion of federal tax issues contained or referred to herein is not intended or written to be used, and cannot be used, for the purpose of avoiding penalties that may be imposed under the Internal Revenue Code; and (b) as a matter of policy, DTC does not provide tax, legal or accounting advice and accordingly, you should consult your own tax, legal and accounting advisor before engaging in any transaction. -

Holdings As of June 30, 2021

Units Cost Market Value INTERNATIONAL EQUITY FUND-I International Equities 97.27% International Common Stocks AUSTRALIA ABACUS PROPERTY GROUP 4,781 10,939 11,257 ACCENT GROUP LTD 3,078 2,769 6,447 ADBRI LTD 224,863 495,699 588,197 AFTERPAY LTD 18,765 1,319,481 1,662,401 AGL ENERGY LTD 3,897 48,319 23,926 ALTIUM LTD 11,593 214,343 319,469 ALUMINA LTD 10,311 14,655 12,712 AMP LTD 18,515 29,735 15,687 APA GROUP 2,659 20,218 17,735 APPEN LTD 20,175 310,167 206,065 ARENA REIT 2,151 5,757 5,826 ASX LTD 678 39,359 39,565 ATLAS ARTERIA LTD 5,600 25,917 26,787 AURIZON HOLDINGS LTD 10,404 32,263 29,075 AUSNET SERVICES LTD 9,482 10,386 12,433 AUSTRALIA & NEW ZEALAND BANKIN 22,684 405,150 478,341 AVENTUS GROUP 2,360 4,894 5,580 BANK OF QUEENSLAND LTD 2,738 17,825 18,706 BEACH ENERGY LTD 5,466 6,192 5,108 BEGA CHEESE LTD 1,762 6,992 7,791 BENDIGO & ADELAIDE BANK LTD 2,573 19,560 20,211 BHP GROUP LTD 9,407 243,370 341,584 BHP GROUP PLC 75,164 1,584,327 2,212,544 BLUESCOPE STEEL LTD 2,905 24,121 47,797 BORAL LTD 4,848 16,859 26,679 BRAINCHIP HOLDINGS LTD 5,756 2,588 2,112 BRAMBLES LTD 153,566 1,133,082 1,318,725 BRICKWORKS LTD 375 4,689 7,060 BWP TRUST 2,988 8,177 9,530 CARSALES.COM LTD 466 6,896 6,916 CENTURIA INDUSTRIAL REIT 2,943 6,264 8,191 CENTURIA OFFICE REIT 190,589 261,156 334,222 CHALICE MINING LTD 464 3,129 2,586 CHALLENGER LTD 3,038 15,904 12,335 CHARTER HALL LONG WALE REIT 3,600 12,905 12,793 CHARTER HALL RETAIL REIT 148,478 395,662 422,150 CHARTER HALL SOCIAL INFRASTRUC 2,461 5,340 6,404 CIMIC GROUP LTD 409 6,668 6,072 COCHLEAR LTD 2,492 -

S&P Dow Jones Indices Announces Changes to the S&P / Harel Sector

S&P Dow Jones Indices announces changes to the S&P / Harel Sector Indices London, March 23, 2016 – The S&P / Harel Indices are being rebalanced after the close of trading on Thursday, March 31st. Below is the list of indices, their constituents and weights, effective on that date: S&P / Harel Consumer Goods Index Name Weight Osem Investment 15.00% Strauss Group 15.00% Delek Automotive Systems Ltd 15.00% Rami Levi Chain Stores Hashikma Marketing Ltd. 15.00% Delta-Galil Industries 15.00% Shufersal Ltd. 9.56% Neto ME Holdings Ltd 3.61% FOX WIZEL LTD 2.87% Kerur Hldgs 1 2.40% CARASSO MOTORS LTD 1.29% Maabarot Products Ltd. 1.27% Dor Alon Energy In Israel (1988) 1.00% Victory Supermarket Chain Ltd 1.00% Tiv Taam Holdings 1 Ltd. 1.00% Willy Food Investments Ltd. 1.00% S&P / Harel Energy Index Name Weight Isramco Negev 2 LP 15.00% Ormat Technologies 15.00% Paz Oil Company Ltd 15.00% Avner Oil & Gas Ltd LP 15.00% Delek Group Ltd 12.62% Delek Drilling LP 6.18% Oil Refineries Ltd 4.69% Ratio Oil Exploration L.P. 4.45% Jerusalem Oil Exploration 3.32% Delek Energy Systems Ltd 2.58% Energix - Renewable Energies Ltd 1.91% Naphtha Israel Petroleum Corp 1.24% Kenon Holdings Ltd. 1.00% I.N.O.C.-Dead Sea L.P. 1.00% Cohen Development & Industrial Buildings Ltd. 1.00% c S&P DOW JONES INDICES INDEX ANNOUNCEMENT S&P / Harel Health Care Index Name Weight Teva Pharmaceutical Industries 15.00% Perrigo Company plc 15.00% Mylan NV 15.00% Opko Health Inc 15.00% MannKind Corp 5.50% Compugen Ltd. -

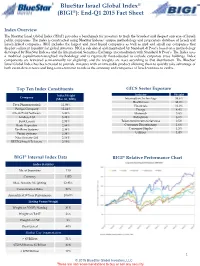

Bluestar Israel Global Index® (BIGI®): End-Q1 2015 Fact Sheet

BlueStar Israel Global Index® (BIGI®): End-Q1 2015 Fact Sheet Index Overview The BlueStar Israel Global Index (’BIGI’) provides a benchmark for investors to track the broadest and deepest universe of Israeli public companies. The index is constructed using BlueStar Indexes’ unique methodology and proprietary database of Israeli and Israeli-linked companies. BIGI includes the largest and most liquid companies as well as mid and small cap companies that display sufficient liquidity for global investors. BIGI is calculated and maintained by Standard & Poor’s based on a methodology developed by BlueStar Indexes and the International Securities Exchange in consultation with Standard & Poor’s. The Index uses a modified capitalization-weighted methodology and is rigorously float-adjusted to exclude corporate cross holdings. Index components are reviewed semi-annually for eligibility, and the weights are reset according to that distribution. The BlueStar Israel Global Index has been created to provide investors with an investable product allowing them to quickly take advantage of both event-driven news and long-term economic trends as the economy and companies of Israel continue to evolve. Top Ten Index Constituents GICS Sector Exposure Index Weight Industry Weight Company (Mar. 31, 2015) Information Technology 33.6% Health Care 32.0% Teva Pharmaceutical 12.93% Financials 16.0% Perrigo Company 12.44% Energy 4.4% Check Point Software 6.42% Materials 3.8% Amdocs Ltd 5.25% Industrials 3.2% Bank Leumi 2.95% Telecommunications Services 2.5% Bank Hapoalim 2.84% Consumer Discretionary 1.6% VeriFone Systems 2.36% Consumer Staples 1.5% Verint Systems 2.34% Utilities 1.4% Nice Systems Ltd 2.16% BEZEQ Israeli Telecom.