A Course Material on ENGINEERING ECONOMICS and FINANCIAL

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Global Marketing Services Henning Schoenenberger 09.2011 Code

Code Description English A Science A11007 Science, general A12000 History of Science B Biomedicine B0000X Biomedicine general B11001 Cancer Research B12008 Human Genetics B12010 Gene Expression B12020 Gene Therapy B12030 Gene Function B12040 Cytogenetics B12050 Microarrays B13004 Human Physiology B14000 Immunology B14010 Antibodies B15007 Laboratory Medicine B16003 Medical Microbiology B16010 Vaccine B16020 Drug Resistance B1700X Molecular Medicine B18006 Neurosciences B18010 Neurochemistry B19002 Parasitology B21007 Pharmacology/Toxicology B21010 Pharmaceutical Sciences/Technology B22003 Virology B23000 Forensic Science C Chemistry C00004 Chemistry/Food Science, general C11006 Analytical Chemistry C11010 Mass Spectrometry C11020 Spectroscopy/Spectrometry C11030 Chromatography C12002 Biotechnology C12010 Applied Microbiology C12029 Biochemical Engineering C12037 Genetic Engineering C12040 Microengineering C12050 Electroporation C13009 Computer Applications in Chemistry C14005 Documentation and Information in Chemistry C15001 Food Science C16008 Inorganic Chemistry C17004 Math. Applications in Chemistry C18000 Nutrition C19007 Organic Chemistry C19010 Bioorganic Chemistry C19020 Organometallic Chemistry C19030 Carbohydrate Chemistry C21001 Physical Chemistry C21010 Electrochemistry C22008 Polymer Sciences C23004 Safety in Chemistry, Dangerous Goods C24000 Textile Engineering C25007 Theoretical and Computational Chemistry C26003 Gmelin C27000 Industrial Chemistry/Chemical Engineering C28000 Medicinal Chemistry C29000 Catalysis C31000 Nuclear -

Advances in Energy Forecasting Models Based on Engineering

20 Sep 2004 14:55 AR AR227-EG29-10.tex AR227-EG29-10.SGM LaTeX2e(2002/01/18) P1: GCE 10.1146/annurev.energy.29.062403.102042 Annu. Rev. Environ. Resour. 2004. 29:345–81 doi: 10.1146/annurev.energy.29.062403.102042 First published online as a Review in Advance on July 30, 2004 ADVANCES IN ENERGY FORECASTING MODELS ∗ BASED ON ENGINEERING ECONOMICS Ernst Worrell,1 Stephan Ramesohl,2 and Gale Boyd3 1Energy Analysis Department, Lawrence Berkeley National Laboratory, Berkeley, California 94720; email: [email protected] 2Energy Division, Wuppertal Institute for Climate, Environment, Energy, 42103 Wuppertal, Germany; email: [email protected] 3Decision and Information Sciences Division, Argonne National Laboratory, Argonne, Illinois 60439; email: [email protected] KeyWords energy modeling, industry, policy, technology ■ Abstract New energy efficiency policies have been introduced around the world. Historically, most energy models were reasonably equipped to assess the impact of classical policies, such as a subsidy or change in taxation. However, these tools are often insufficient to assess the impact of alternative policy instruments. We evalu- ate the so-called engineering economic models used to assess future industrial en- ergy use. Engineering economic models include the level of detail commonly needed to model the new types of policies considered. We explore approaches to improve the realism and policy relevance of engineering economic modeling frameworks. We also explore solutions to strengthen the policy usefulness of engineering eco- nomic analysis that can be built from a framework of multidisciplinary coopera- tion. The review discusses the main modeling approaches currently used and eval- uates the weaknesses in current models. -

Engineering Economy for Economists

AC 2008-2866: ENGINEERING ECONOMY FOR ECONOMISTS Peter Boerger, Engineering Economic Associates, LLC Peter Boerger is an independent consultant specializing in solving problems that incorporate both technological and economic aspects. He has worked and published for over 20 years on the interface between engineering, economics and public policy. His education began with an undergraduate degree in Mechanical Engineering from the University of Wisconsin-Madison, adding a Master of Science degree in a program of Technology and Public Policy from Purdue University and a Ph.D. in Engineering Economics from the School of Industrial Engineering at Purdue University. His firm, Engineering Economic Associates, is located in Indianapolis, IN. Page 13.503.1 Page © American Society for Engineering Education, 2008 Engineering Economy for Economists 1. Abstract The purpose of engineering economics is generally accepted to be helping engineers (and others) to make decisions regarding capital investment decisions. A less recognized but potentially fruitful purpose is to help economists better understand the workings of the economy by providing an engineering (as opposed to econometric) view of the underlying workings of the economy. This paper provides a review of some literature related to this topic and some thoughts on moving forward in this area. 2. Introduction Engineering economy is inherently an interdisciplinary field, sitting, as the name implies, between engineering and some aspect of economics. One has only to look at the range of academic departments represented by contributors to The Engineering Economist to see the many fields with which engineering economy already relates. As with other interdisciplinary fields, engineering economy has the promise of huge advancements and the risk of not having a well-defined “home base”—the risk of losing resources during hard times in competition with other academic departments/specialties within the same department. -

Engineering Economics for Public Water Utilities

Engineering Economics for Public Water Utilities Max Maurer Eawag: Swiss Federal Institute of Aquatic Science and Technology Imprint Author Prof. Dr. Max Maurer, Institute of Environmental Engineering, ETH-Zürich, Switzerland [email protected] Aim This script constitutes part of my lecture ‘Infrastructure Systems in Urban Water Management’ given at ETH Zürich, Switzerland Version 4.7, Jan 2019 License Creative Commons Attribution 4.0 International (https://creativecommons.org/licenses/by/4.0/) Title photo Wastewater Treatment Plant (Mönchaltorf, ZH) Maurer: Engineering Economics Contents 1. Aim of this script ......................................................................................................................... - 5 - Inflation, Interest & Discount Rate ...................................................................................................... - 7 - 2. The strange concept of money .................................................................................................. - 8 - 3. Inflation........................................................................................................................................ - 8 - 4. Interest rates ............................................................................................................................. - 10 - 5. Discount rate ............................................................................................................................. - 10 - 6. Replacement value .................................................................................................................. -

Economics and Engineering” Pedro Garcia Duarte and Yann Giraud

Introduction: From “Economics as Engineering” to “Economics and Engineering” Pedro Garcia Duarte and Yann Giraud The Transformation of Economics into an Engineering Science: From Analogies to Interactions In recent years, economists, who in the past had mostly insisted on their discipline’s strength as a rigorous social science, have turned to its larger role in transforming society. As early as 2002, Alvin Roth, the Stan- ford-educated economist who received the Nobel memorial prize in 2012, has claimed that members of his community should think of themselves as engineers rather than scientists. By this he meant that they should not be interested solely in the making of theoretical models but also in con- fronting these models with the complexities of real-life situations, which is what engineering is allegedly about. He pointed to the rise of the new sub eld of market design, which he had helped develop, as characteristic of an engineer’s stance and provided several examples of engineering practices applied to economics: the design of labor clearinghouses—such as the entry-level labor market for American physicians—and that of the Federal Communications Commission spectrum auctions (Roth 2002). We want to thank the Center for the History of Political Economy and Duke University Press for their support, as well as the many referees who helped us during the editorial process. Yann Giraud wishes to point out that his research has been supported by the project Labex MME-DII (ANR11–LBX-0023–01). Pedro Duarte acknowledges the nancial support of the Institute for Advanced Studies, at the Université de Cergy-Pontoise, for visiting professorships (2016, 2018) that were critical for the shaping of this joint project. -

Engineering Economics and the Law

Session 1339 Engineering Economics and the Law J. Timothy Cromley BANK ONE CORPORATION Abstract Patent and Trade Secret Law is an area of the Law that is very important to engineering and the economy, but it is not among the topics prominently covered (if at all) in a typical course in Engineering Economy (or “Engineering Economics”). To help remedy this apparent deficiency in course coverage, the author presents: a rationale for inclusion of this topic in such a course, an overview of patent and trade secret law, classroom suggestions, and steps for valuing a patent. 1. Why Patent & Trade Secret Law is an Apt Topic for Courses in Engineering Economics It is widely recognized that relationships exist between law and economics . The University of Chicago, for example, has had a Journal of Law and Economics since 1958. 1 The Encyclopedia of Law and Economics , which is published in the Netherlands, has two Nobel Laureates in Economics on its Editorial Board. 2 Because important relationships exist between law and economics , it is appropriate to inquire: What area(s) of the law (if any) are most relevant to a course in engineering economics? Environmental law might be a candidate, as it is relevant to environmental engineers, but it is too specialized to be of general interest in a course on engineering economics. Contract law is a possibility, but its appeal is too broad to properly fit into a focused course like engineering economics. Many other areas of the law are not good fits for similar reasons. Patent law and product liability law are good candidates, but as between these two areas of law, patent law is more highly relevant to both engineering and economics because of its unique links to both technology and monopoly . -

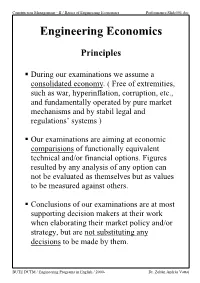

Basics of Engineering Economics Performance:Slide501.Doc Engineering Economics

Construction Management - II / Basics of Engineering Economics Performance:Slide501.doc Engineering Economics Principles § During our examinations we assume a consolidated economy. ( Free of extremities, such as war, hyperinflation, corruption, etc., and fundamentally operated by pure market mechanisms and by stabil legal and regulations’ systems ) § Our examinations are aiming at economic comparisions of functionally equivalent technical and/or financial options. Figures resulted by any analysis of any option can not be evaluated as themselves but as values to be measured against others. § Conclusions of our examinations are at most supporting decision makers at their work when elaborating their market policy and/or strategy, but are not substituting any decisions to be made by them. BUTE DCTM / Engineering Programs in English / 2000- Dr. Zoltán András Vattai Construction Management - II / Basics of Engineering Economics Performance:Slide502.doc Using External Resources Foreign Capital Due to the fact that a typical investment in civil engineering and/or in construction industry moves huge amount of technical and financial resources, it is frequently unavoidable to invoke external („foreign”) resources and/or capital temporarily. Liquidity: Promp available own economic resources. („self-financing capability”) Loan: External economic resource temporarily let for use and to be paid back later increased by some extra fee („foreign capital”, „loan capital”). Interest: „Rent” („price”) of using foreign capital. Its extent is highly defined by the actual „demand versus supply” conditions. BUTE DCTM / Engineering Programs in English / 2000- Dr. Zoltán András Vattai Construction Management - II / Basics of Engineering Economics Performance:Slide503.doc Using External Resources Foreign Capital Term / Pay-Back Period / Lending Period: A time period in which a foreign capital is let for use. -

FE Review Engineering Economics.Pdf

Fundamentals of Engineering Exam Review Engineering Economics Dr. Jerome Lavelle Associate Dean, College of Engineering [email protected]; 919-515-3263; 120 Page Hall Fundamentals of Engineering Exam Review We are grateful to NCEES for granting us permission to copy short sections from the FE Handbook to show students how to use Handbook information in solving problems. This information will normally appear in these videos as white boxes. Fundamentals of Engineering Exam Review Engineering Economy in FE Exams: Chemical Engineering 13. Process Design and Economics (8-12 questions) Civil Engineering 5. Engineering Economics (4-6 questions) Electrical and Computer Engineering 4. Engineering Economics (3-5 questions) Environmental Engineering 4. Engineering Economics (4-6 questions) Industrial and Systems Engineering 4. Engineering Economics (10-12 questions) Mechanical Engineering 5. Engineering Economics (3-5 questions) Other Disciplines 7. Engineering Economics (7-11 questions) Fundamentals of Engineering Exam Review Fundamentals of Engineering Exam Review Time Value of Money = Discounted Cash Flow Analysis Finding the equivalence between quantities of money. These are related by: - timing (when they occur in time) - interest rate (the rate charged or earned) Key Valuables Are: P = Present single sum of money F = Future single sum of money A = Annuity, equivalent cash flow series G = Gradient, increasing/decreasing cash flow series i% = effective interest rate per period n = number of periods, period number Fundamentals of Engineering Exam Review Fundamentals of Engineering Exam Review Cash Flow Diagram: for an investment scenario SINGLE CASH FLOWS Investment scenario F=WITHDRAWAL i = 10% 0 1 2 3 t P= INVESTMENT Fundamentals of Engineering Exam Review 1. -

Fundamentals of Engineering Economics

Fundamentals of Engineering Economics Edited by Kal Renganathan Sharma Included in this preview: • Copyright Page • Table of Contents • Excerpt of Chapter 1 For additional information on adopting this book for your class, please contact us at 800.200.3908 x501 or via e-mail at [email protected] Fundamentals of Engineering Economics By Kal Renganathan Sharma Prairie View A&M University Contents Dedication ix About the Author xi Preface xiii Copyright © 2011 University Readers Inc. All rights reserved. No part of this publication may be reprinted, reproduced, transmitted, or utilized in any form or by any electronic, mechanical, or other means, now known or CHAPTER 1.0 1 hereafter invented, including photocopying, microfilming, and recording, or in any information retrieval system Overview of Engineering Economy without the written permission of University Readers, Inc. 1.1 What is Engineering, What is Economy and 1 What is Engineering Economy ? First published in the United States of America in 2011 by Cognella, a division of University Readers, Inc. Example 1.0 Start of Technocrats of Texas 4 1.2 Seven Principles of Engineering Economy 4 Trademark Notice: Product or corporate names may be trademarks or registered trademarks, and are used only 1.3 Summary 5 for identification and explanation without intent to infringe. 1.4 References 6 1.5 Exercises 6 15 14 13 12 11 1 2 3 4 5 CHAPTER 2.0 9 Printed in the United States of America Fixed and Variable Costs 2.1 One Time and Recurring Costs 9 2.2 Life Cycle of an Enterprise 10 ISBN: 978-1-60927-826-7 2.3 Total Revenue, Total Cost and Profitable Region 11 Example 2.1 Garlic Nibbler Snack Factory 12 2.4 Giffen and Veblen Goods 15 Example 2.2 Japanese Robots 15 Example 2.3 Lawnmovers from China 17 2.5 Dualistic Relations 19 2.6 Summary 23 2.7 References 24 2.8 Exercises 28 Contents Dedication ix About the Author xi Preface xiii Copyright © 2011 University Readers Inc. -

Engineering Economics

Engineering Economics Overview and Application in Process Engineering Industry 10.490 ICE Kangyi MAO 02 OCT 2006 WHAT IS ECONOMICS? “Economics is the study of how people and society choose to employ scarce resources that could have alternative uses in order to produce various commodities and to distribute them for consumption, now or in the future, …” from Paul Samuelson and William Nordhaus, Economics, 12th Ed., McGraw- Hill, New York, 1985. WHAT IS ENGINEERING ECONOMICS? The application of economic principles to engineering problems, for example in comparing the comparative costs of two alternative capital projects or in determining the optimum engineering course from the cost aspect. 1 WHY DO WE NEED TO KNOW ABOUT THIS?! • Optimal cost-effectiveness • Alternative possibilities (Cal Tech Industries!) WHAT DO WE NEED TO KNOW? • Time value of money • Estimation of cash flows • Quantitative measurements of profitability • Systematic comparison of alternatives Time Value of Money The fundamentals underlying all financial activities! 2 TIME VALUE OF MONEY • Why does money have time value? – The owner of the money must defer its use. Thus, the person using the money must pay for deferring the benefits. – An alternative use of the money could have generated other benefits, e.g. interests. • How do we characterize time value? –We use an interest rate, so that the effect of time is proportional to the total amount of money involved and positively related with the length of time. FV PV = (1 + r)n CASH FLOW DIAGRAM • Cash flow diagram is adopted to show the cash flows for a project over time. Cash Flow: $M +7 +7 +15 0 1 2 3 4 TIME:Year -10 -5 A Typical CFD for an engineering project • How to project cash flows? – Cost estimation (the task of engineers!) – Product pricing and sales projection (Mutual efforts of S&M dept., consulting, engineers, and project managers) 3 Quantification of Profitability The central target of most projects! NET PRESENT VALUE (NPV) N −n NPV = ∑Cn (1+ i) n=1 Examines the total value of all cash flows at time 0. -

Engineering Microeconomics Fall 2017 (3 Credits)

Ferraro, 570.334 Syllabus Syllabus Environmental Health and Engineering 570.334 Engineering Microeconomics Fall 2017 (3 credits) Description The Official Boring Description: The course introduces the principles of microeconomics and engineering economics, and applications of those principles to environmental engineering and public policy analysis. The financial and economic implications of engineering designs and control policies are critical to their success. We introduce principles of engineering economics and microeconomics (demand and production theory) and their uses in engineering decision making. The Professor’s Long-winded Description: No matter what line of work you ultimately choose, you will bring no more useful skill to most tasks than an ability to understand the incentives people face and how they are likely to respond to them. A well taught introductory course in microeconomics can teach you more about human behavior in a single term than virtually any other course in the university. Throughout the course, I will try to develop economic intuition by means of examples and applications drawn from everyday experience. My aim is to encourage you to see features of the human-made social and physical landscape as a reflection of an implicit or explicit cost-benefit calculation. Many introductory microeconomics courses (including the one I took as an undergraduate) attempt to present students with far too many concepts in a far too mathematical and mechanical manner. The unfortunate result is that, when the dust settles, most students leave these courses never having fully grasped the essence of economics. For example, the opportunity cost concept, which is central to our understanding of what it means to think like an economist, is just one among hundreds of concepts that go by in a blur. -

ECON 370 – Engineering Economics

STATE UNIVERSITY OF NEW YORK COLLEGE OF TECHNOLOGY CANTON, NEW YORK MASTER SYLLABUS COURSE NUMBER – COURSE NAME ECON 370 – Engineering Economics Created by: Karen Spellacy and Lucas Craig Updated by: School of Business and Liberal Arts Department: Business Semester/Year: FALL 2020 A. TITLE: Engineering Economics B. COURSE NUMBER: ECON 370 C. CREDIT HOURS: 3 credit hour(s) per week for 15 weeks One hour (50 minutes) of lecture per week 3 Two to three hours of lab or clinical per week Two hours of recitation per week 40 hours of internship D. WRITING INTENSIVE COURSE: Yes No E. GER CATEGORY: None: Yes: GER If course satisfies more than one: GER F. SEMESTER(S) OFFERED: Fall Spring Fall & Spring G. COURSE DESCRIPTION: This course will expose students to economic theory through the use of mathematical modeling with a focus on economic decision making for engineers. Microeconomics topics will include supply and demand market analysis, and profitability. Macroeconomics topics will include the aggregate market, economic indicators, fiscal policy and monetary policy. The course will include segments of the engineering economic analysis covered in the Professional Engineering exam such as the application of different economic analysis methods utilized in evaluating the viability of a project and its alternatives, concepts of replacement decisions, capital-budgeting decisions, and project risk and uncertainty. Students will be exposed to specific issues of economic analysis of the private sector versus the public sector. H. PRE-REQUISITES: None