Moneyball’ Way Briefs Years of Enrollment

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

National Retailer & Restaurant Expansion Guide Spring 2016

National Retailer & Restaurant Expansion Guide Spring 2016 Retailer Expansion Guide Spring 2016 National Retailer & Restaurant Expansion Guide Spring 2016 >> CLICK BELOW TO JUMP TO SECTION DISCOUNTER/ APPAREL BEAUTY SUPPLIES DOLLAR STORE OFFICE SUPPLIES SPORTING GOODS SUPERMARKET/ ACTIVE BEVERAGES DRUGSTORE PET/FARM GROCERY/ SPORTSWEAR HYPERMARKET CHILDREN’S BOOKS ENTERTAINMENT RESTAURANT BAKERY/BAGELS/ FINANCIAL FAMILY CARDS/GIFTS BREAKFAST/CAFE/ SERVICES DONUTS MEN’S CELLULAR HEALTH/ COFFEE/TEA FITNESS/NUTRITION SHOES CONSIGNMENT/ HOME RELATED FAST FOOD PAWN/THRIFT SPECIALTY CONSUMER FURNITURE/ FOOD/BEVERAGE ELECTRONICS FURNISHINGS SPECIALTY CONVENIENCE STORE/ FAMILY WOMEN’S GAS STATIONS HARDWARE CRAFTS/HOBBIES/ AUTOMOTIVE JEWELRY WITH LIQUOR TOYS BEAUTY SALONS/ DEPARTMENT MISCELLANEOUS SPAS STORE RETAIL 2 Retailer Expansion Guide Spring 2016 APPAREL: ACTIVE SPORTSWEAR 2016 2017 CURRENT PROJECTED PROJECTED MINMUM MAXIMUM RETAILER STORES STORES IN STORES IN SQUARE SQUARE SUMMARY OF EXPANSION 12 MONTHS 12 MONTHS FEET FEET Athleta 46 23 46 4,000 5,000 Nationally Bikini Village 51 2 4 1,400 1,600 Nationally Billabong 29 5 10 2,500 3,500 West Body & beach 10 1 2 1,300 1,800 Nationally Champs Sports 536 1 2 2,500 5,400 Nationally Change of Scandinavia 15 1 2 1,200 1,800 Nationally City Gear 130 15 15 4,000 5,000 Midwest, South D-TOX.com 7 2 4 1,200 1,700 Nationally Empire 8 2 4 8,000 10,000 Nationally Everything But Water 72 2 4 1,000 5,000 Nationally Free People 86 1 2 2,500 3,000 Nationally Fresh Produce Sportswear 37 5 10 2,000 3,000 CA -

NACD Public Company Full Board Members

NACD Public Company Full Board Members: Rank | Company Rank | Company Rank | Company Rank | Company A.O. Smith Corp. Analog Devices Bridge Housing Corporation Clearwire Corp. AAA Club Partners Ansys, Inc. Briggs & Stratton Corp. Cliffs Natural Resources Inc. AARP Foundation Apogee Enterprises, Inc. Brightpoint, Inc. Cloud Peak Energy Inc. Aastrom Biosciences, Inc. Apollo Group, Inc. Bristow Group Inc. CME Group Acadia Realty Trust Applied Industrial Technologies, Broadwind Energy CoBiz, Inc. ACI Worldwide, Inc. Inc. Brookdale Senior Living Inc. Coherent, Inc. Acme Packet, Inc. Approach Resources, Inc. Bryn Mawr Bank Corporation Coinstar, Inc. Active Power, Inc. ArcelorMittal Buckeye Partners L.P. Colgate-Palmolive Co. ADA-ES, Inc. Arch Coal, Inc. Buffalo Wild Wings, Inc. Collective Brands, Inc. Adobe Systems, Inc. Archer Daniels Midland Co. Bunge Limited Commercial Metals Co. Advance Auto Parts ARIAD Pharmaceuticals, Inc. CA Holding Community Health Systems Advanced Energy Industries, Inc. Arkansas Blue Cross Blue Shield CACI International, Inc. Compass Minerals Aerosonic Corp. Arlington Asset Investment Corp. Cal Dive International, Inc. Comverse Technology, Inc. Aetna, Inc. Arthur J. Gallagher & Co. Calamos Asset Management, Inc. Conmed Corp. AFC Enterprises, Inc. Asbury Automobile Cameco Corp. Connecticut Water Service, Inc. AG Mortgage Investment Trust Inc. Aspen Technology, Inc. Cameron ConocoPhillips Agilent Technologies Associated Banc-Corp.5 Campbell Soup Co. CONSOL Energy Inc. Air Methods Corp. Assurant, Inc. Capella Education Co. Consolidated Edison Co. Alacer Gold Corp. Assured Guaranty Ltd. Capital One Financial Corp. Consolidated Graphics, Inc. Alaska Air Group, Inc. ATMI Capstead Mortgage Corp. Consolidated Water Co., Ltd. Alaska Communication Systems Atwood Oceanics, Inc. Cardtronics, Inc. Continental Resources, Inc. Group, Inc. Auxilium Pharmaceuticals Inc. -

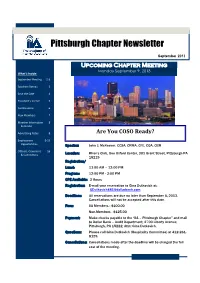

Pittsburgh Chapter Newsletter

x Pittsburgh Chapter Newsletter September 2013 Upcoming Chapter Meeting Monday September 9, 2013 What’s Inside: September Meeting 2-3 Speakers Bureau 3 Save the Date 4 President’s Corner 5 Certifications 6 New Members 7 Member Information 8 Reminder Advertising Rates 8 Are You COSO Ready? Employment 9-15 Opportunities Speaker: John J. McKeever, CCSA, CRMA, CFE, CQA, CBM Officers, Governors 16 & Committees Location: River’s Club, One Oxford Center, 301 Grant Street, Pittsburgh PA 15219 Registration/ Lunch 11:00 AM – 12:00 PM Program: 12:00 PM - 3:00 PM CPE Available: 3 Hours Registration: E-mail your reservation to Gina Dutkovich at: [email protected] Deadlines: All reservations are due no later than September 5, 2013. Cancellations will not be accepted after this date. Fees: IIA Members - $100.00 Non-Members - $125.00 Payment: Make checks payable to the “IIA – Pittsburgh Chapter” and mail to Dollar Bank – Audit Department; 2700 Liberty Avenue; Pittsburgh, PA 15222; Attn: Gina Dutkovich. Questions: Please call Gina Dutkovich (Hospitality Committee) at 412-261- 8129. Cancellations: Cancellations made after the deadline will be charged the full cost of the meeting. Page 2 IIA Pittsburgh Chapter September 2013 Are You COSO Ready? Monday, September 9, 2013 Registration/Lunch: 11:00 AM – 12:00 PM Program: 12:00 PM - 3:00 PM CPE: 3 Hours Location: River’s Club, One Oxford Center 301 Grant Street, Pittsburgh, PA 15219 River’s Club Fees: IIA Members & Students - $100.00, Non-Members - $125.00 UUppccoommiiinnggLLuunncchheeoonnMMeeeettiiinngg NEW! Are You COSO Ready? A presentation of the Updated COSO Framework discusses key changes to the Framework and how they will impact your organization: Why the change is occurring now and what factors influenced the update. -

Palumbo-Donahue School of Business 2019-2020 Graduate Outcomes Employment Information AUGUST 2019, DECEMBER 2019 and MAY 2020 GRADUATES

Innovative Manufacturers Center Palumbo-Donahue 2019-2020 Jared the Galleria of Jewelry School of Business Graduate Outcomes Keener Management Average Annual Income KeyBank Kingsbury Inc. Mean $56,403 KPMG RESPONDENTS NUMBER OF EMPLOYED RESPONDENTS ATTENDING AVERAGE MAJOR TOP EMPLOYERS Median $53,500 Leukemia and Lymphoma Society RESPONDENTS Full-Time, Part-Time, Military, GRADUATE SCHOOL SALARY Mode Luttner Financial Group Service Year Volunteer $55,000 M&T Bank Manzella Manzella Bachelors Degree The average signing bonus Meaden and Moore reported was $4,620. Accounting 48 42% 46% $52,364 BNY Mellon, Cohen & Company, EY LLP, Medici Real Estate PNC Financial Services, PwC, Metal Fortress Radio Swagelok Company Miele Amusements Mount Saint Mary Academy Economics 12 42% 50% BNY Mellon, Continuing Care Actuaries, Paychex Matthews International Internship/Experiential Pittsburgh Int’l Airport Pittsburgh Penguins Entrepreneurship 16 56% 38% Alloy Oxygen Welding and Supply Education Information Pittsburgh Steelers Co., Amos Enterprises, Bobby Rahal PLS Logistics Automotive Group, Vibes by Chico LLC PNC Financial Services PPG Finance 74 78% 12% $53,299 BNY Mellon, Citizen’s Bank, Dick’s 79% of our graduates reported taking at least one internship PricewaterhouseCoopers Sporting Goods, Duquesne University, or career related work experience. The median number of Protiviti McAdam Financial, PNC Financial Prudential Financial Services, PwC internships was two. Reliable Contracting Rivers Casino General Business 4 50% Citizens Bank, Duquesne University A sampling of the most relevant Internship Employers as reported rue21 by graduates: Schneider Downs Information Systems 24 75% 21% $55,750 Amazon, BNY Mellon, Duquesne Light, SEI Investments CO. Management Federated Investors, PNC Financial #1 Cochran Services, PPG, PwC 535 Media Shipley Energy Solenture, LLC Ace Wires Spring & Form Co. -

FALL 2016 CAREER FAIR for Pitt Students and Alumni

FALL 2016 CAREER FAIR For Pitt Students and Alumni WEDNESDAY AND THURSDAY SEPTEMBER 28 AND 29, 2016 Science, Technology, Engineering, CAREER DEVELOPMENT AND PLACEMENT ASSISTANCE and Math majors WEDNESDAY AND THURSDAY OCTOBER 5 AND 6, 2016 Business, Humanities, and Social Sciences majors 11 a.m.–3 p.m. • William Pitt Union to the Fall 2016 Career Fair. • Fall and Spring Career Fairs • Employer Information Sessions • Career Fair Prep Days • Alumni Networking Events • Majors and Minors Expo • On-campus Recruitment and Interviews • Law School Fair • WestPACS Job and Internship Fairs • Summer Job and Internship Fair • Shadow in Your City and Panther Shadow The University of Pittsburgh is an affirmative action, equal opportunity institution. Published in cooperation with the Department of Communications Services. DCS108511-0916 UNIVERSITY OF PITTSBURGH FALL 2016 CAREER FAIR Thank you to our Panther Partners: Diamond Gold Silver Blue In-kind contributions: Department of Auxiliary Services 3 UNIVERSITY OF PITTSBURGH FALL 2016 CAREER FAIR AT A GLANCE Company Booth(s) Days Attending Full-Time Part-Time Internship Accepts Sponsorship of Freshman Seeking OPT/CPT International Friendly? Graduate Level candidates? Students? Candidates? #1 Cochran Automotive A14 Oct. 6 ✔ ✔ ✔ Abercrombie & Fitch LL5 Sept. 28 ✔ ✔ ✔ ABF Freight A3 Oct. 5 ✔ ✔ AECOM B25 Sept. 28 ✔ ✔ ✔ Aerotech B6 Sept. 28, Sept. ✔ ✔ ✔ ✔ ✔ 29 Aerotek B24 Oct. 5 ✔ ✔ ✔ Aetna B30 Sept. 28 ✔ Aflac Pittsburgh Metro Office B23 Oct. 5 ✔ ✔ ✔ Agr International B23 Sept. 29 ✔ ✔ ✔ ✔ Ahold USA B26 Sept. 29 ✔ Alcoa 9/28-B27; Sept. 28, Oct. 5 ✔ ✔ 10/5-A17 ALDI, Inc. TL Oct. 5, Oct. 6 ✔ ✔ ✔ ✔ All Lines/LANtek LL11 Sept. 29 ✔ ✔ ✔ Allegheny County Department of B3 Oct.5, Oct. -

(R&D) Tax Credit

Report toThe the Pennsylvania Pennsylvania Department of General Revenue Assembly Bureau of Research on the Research and Development (R&D) Tax Credit The Pennsylvania Department of Revenue Bureau of Research March 15, 2016 Pennsylvania Research and Development Tax Credit Page 1 of 14 The Pennsylvania R&D Tax Credit Statute On May 7, 1997, Act 7 of 1997 created the Pennsylvania research and development (R&D) tax credit. The R&D tax credit provision became Article XVII-B of the Tax Reform Code of 1971 (TRC). The intent of the R&D tax credit was to encourage taxpayers to increase R&D expenditures within the Commonwealth in order to enhance economic growth. The terms and concepts used in the calculation of the Commonwealth’s R&D tax credit are based on the federal government’s R&D tax credit definitions for qualified research expense.1 For R&D tax credits awarded between December 1997 and December 2003, Act 7 of 1997 authorized the Department of Revenue (Department) to approve up to $15 million in total tax credits per fiscal year. Additionally, $3 million of the $15 million was set aside for “small” businesses, where a “small business” is defined as a “for-profit corporation, limited liability company, partnership or proprietorship with net book value of assets totaling…less than five million dollars ($5,000,000).” Over the years, several changes have been made to the R&D tax credit statute. Table 1 lists all of the acts that have changed the R&D tax credit statute, along with the applicable award years, the overall tax credit cap and the “small” business set aside. -

The Most Compensation

Thanks to new Securities and Exchange Commission regulations, most companies were required to provide previously undisclosed information on executive pay. The additional information gives a more accurate picture of overall compensation, but makes comparisons with prior year’s pay impossible. So information on whether an executive’s pay increased or decreased from the previous year is not included. Total return on stocka The Post-Gazette’s 2009 survey of top executive compensation at regional companies The most What the highest-ranking executives at 49 public companies in the region received in pay during their company’s most recent fiscal year: Change in pension Change in pension Grants of value/Deferred compensation value/deferred stock and Non-stock compensation Total Stocks and Non-equity compensation Other 2009 Percent Executive, company, title Salary Bonus option incentives earnings Other compensation Xxxxxx Executive, company, Title Salary Bonus options incentives earnings Summary total change Paul J. Evanson, Allegheny Energy, chm. pres., CEO $1,121,343 $0 $8,444,786 $1,230,000 $817,184 $360,510 $11,973,823 140.3% Paul J. Evanson, Allegheny Energy, chm., pres., CEO $1,200,000 $0 $8,331,755 $1,918,500 $834,131 $305,345 $12,589,731 8.9 L. Patrick Hassey, Allegheny Technologies, chm., pres. CEO $907,917 $0 $4,377,531 $5,514,208 $367,554 $722,645 $11,889,855 -54.0% L. Patrick Hassey, Allegheny Technologies, chm., pres., CEO $910,000 $0 $5,205,291 $3,481,000 $352,744 $493,070 $10,442,105 -12.4 James V. O'Donnell, American Eagle Outfitters, principal executive officer $1,475,000 $0 $10,228,161 -$299,624 $0 $39,520 $11,443,057 -20.5% James V. -

FACTS™ Trust Impact Assessments Available for the Following Alphabetically Listed Companies

FACTS™ Trust Impact Assessments Available for the Following Alphabetically Listed Companies (Updated October 2010) 1st Source Corporation AECOM Technology Corporation Allergan, Inc. 3M Company Aeropostale, Inc. ALLETE, Inc. 3PAR Inc. AeroVironment, Inc. Alliance Data Systems Corporation 99 Cents Only Stores Aetna Alliant Energy Corporation A. O. Smith Corporation Affiliated Managers Group, Inc. Alliant Techsystems Inc. A. Schulman, Inc. Affymetrix, Inc. Allied Nevada Gold Corp. AAON, Inc. AFLAC Incorporated Allied World Assurance Holdings, Ltd. AAR Corp. Aga Medical Holdings, Inc Allos Therapeutics, Inc. Aaron's, Inc. AGCO Corporation Allscripts Healthcare Solutions Inc Abaxis, Inc. Agilent Technologies Inc. Alnylam Pharmaceuticals, Inc. Abbott Laboratories AGL Resources Inc. Alon USA Energy, Inc. Abercrombie & Fitch Co. Air Methods Corporation Alpha Natural Resources, Inc. ABIOMED, Inc. Air Products & Chemicals, Inc. Alphatec Holdings, Inc. ABM Industries, Inc. Aircastle Limited Altera Corporation AboveNet, Inc. Airgas, Inc. Altria Group, Inc. Abraxis Bioscience, Inc. AirTran Holdings, Inc. AMAG Pharmaceuticals, Inc. Acacia Research Corporation AK Steel Holding Corporation Amazon.com, Inc. Acadia Realty Trust Akamai Technologies, Inc. AMB Property Corporation Accenture Plc Alaska Air Group, Inc. AMCOL International Corporation Accuray Incorporated Alaska Communications Systems Group, Inc Amedisys, Inc. ACI Worldwide Inc Albany International Corp. AMERCO Acme Packet, Inc. Albemarle Corporation Ameren Corporation Acorda Therapeutics Inc. Alberto-Culver Company Activision Blizzard, Inc. American Axle & Manufact. Holdings, Inc. Alcoa Inc. Actuant Corporation Alexander & Baldwin, Inc. American Campus Communities, Inc. Acuity Brands, Inc. Alexander's, Inc. American Capital Agency Corp. Acxiom Corporation American Capital Ltd. ADC Telecommunications Alexandria Real Estate Equities, Inc. American Eagle Outfitters Administaff, Inc. Alexion Pharmaceuticals, Inc. Adobe Systems Incorporated Align Technology, Inc. -

Employer Location Job Title Position Type Posting Date End Date 84 Lumber Eighty Four, Pennsylvania United States Installed Sale

Employer Location Job Title Position Type Posting Date End Date 84 Lumber Eighty Four, Installed Sales Contract Analyst. Full Time Employment 6/27/2019 7/18/2019 Pennsylvania United States 84 Lumber Company Eighty Four, IT Security Administrator. Full Time Employment 6/20/2019 7/11/2019 Pennsylvania United States ABF Freight System, Inc North Lima, Ohio Linehaul Supervisor. Full Time Employment 5/31/2019 6/21/2019 United States Acadia Healthcare Pittsburgh, Counselor Intern. Internship/Externship 6/27/2019 7/18/2019 Pennsylvania United States ACRT, Inc Stow, Ohio Systems Administrator. Full Time Employment 6/7/2019 6/28/2019 United States Acumen Solutions, Inc. Cleveland, Ohio Salesforce Business Analyst. Full Time Employment 6/25/2019 7/16/2019 United States ADP Coraopolis, Inside Sales Account Executive- Health and Full Time Employment 6/14/2019 7/5/2019 Pennsylvania Benefits. United States Advanced Office Systems, Multiple Locations Field Service Technician Full Time Employment 6/19/2019 12/15/2019 Inc. Advantage Technical Pittsburgh, Software Validation Engineer. Full Time Employment 6/26/2019 7/17/2019 Resourcing Pennsylvania United States Aerotech, Inc. Pittsburgh, Purchasing Agent. Full Time Employment 6/26/2019 7/17/2019 Pennsylvania United States Aetna Blue Bell, Sales Compensation Analyst. Full Time Employment 6/28/2019 7/19/2019 Pennsylvania United States Aflac Multiple Locations Part and Full time Intern Admin Assistant Full Time Employment, 3/8/2019 9/4/2019 Internship/Externship AHEDD Sharon, Community Work Incentives Coordinator Full Time Employment 5/2/2019 10/29/2019 Pennsylvania (CWIC) United States AIRES Pittsburgh, Application Support Developer. -

(R&D) Tax Credit

Report toThe the Pennsylvania Pennsylvania Department of General Revenue Assembly Bureau of Research on the Research and Development (R&D) Tax Credit The Pennsylvania Department of Revenue Bureau of Research March 13, 2015 Pennsylvania Research and Development Tax Credit Page 1 of 14 The Pennsylvania R&D Tax Credit Statute On May 7, 1997, Act 7 of 1997 created the Pennsylvania research and development (R&D) tax credit. The R&D tax credit provision became Article XVII-B of the Tax Reform Code of 1971 (TRC). The intent of the R&D tax credit was to encourage taxpayers to increase R&D expenditures within the Commonwealth in order to enhance economic growth. The terms and concepts used in the calculation of the Commonwealth’s R&D tax credit are based on the federal government’s R&D tax credit definitions for qualified research expense.1 For R&D tax credits awarded between December 1997 and December 2003, Act 7 of 1997 authorized the Department of Revenue (Department) to approve up to $15 million in total tax credits per fiscal year. Additionally, $3 million of the $15 million was set aside for “small” businesses, where a “small business” is defined as a “for-profit corporation, limited liability company, partnership or proprietorship with net book value of assets totaling…less than five million dollars ($5,000,000).” Over the years, several changes have been made to the R&D tax credit statute. Table 1 lists all of the acts that have changed the R&D tax credit statute, along with the applicable award years, the overall tax credit cap and the “small” business set aside. -

UNITED STATES SECURITIES and EXCHANGE COMMISSION Washington, D.C

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 13F Form 13F COVER PAGE Report for the Calendar Year or Quarter Ended: March 31, 2011 Check here if Amendment [_]; Amendment Number: ----------- This Amendment (Check only one.): [_] is a restatement. [_] adds new holdings entries. Institutional Investment Manager Filing this Report: Name: The PNC Financial Services Group, Inc. Address: 249 Fifth Avenue Pittsburgh, PA 15222-2707 Form 13F File Number: 28-1235 The institutional investment manager filing this report and the person by whom it is signed hereby represent that the person signing the report is authorized to submit it, that all information contained herein is true, correct and complete, and that it is understood that all required items, statements, schedules, lists, and tables, are considered integral parts of this form. Person Signing the Report on behalf of Reporting Manager: Name: Joseph C. Guyaux Title: President Phone: (412) 762-2569 Signature, Place, and Date of Signing: /s/ Joseph C. Guyaux Pittsburgh, PA May 6, 2011 -------------------- -------------- ---------------- [Signature] [City, State] [Date] Report Type (Check only one.): [X] 13F HOLDINGS REPORT. (Check here if all holdings of this reporting manager are reported in this report.) [_] 13F NOTICE. (Check here if no holdings reported are in this report, and all holdings are reported by other reporting manager(s).) [_] 13F COMBINATION REPORT. (Check here if a portion of the holdings for this reporting manager are reported in this report and -

ANNUAL Report

201 7 ANNUAL RePORT TABLE OF CONTENTS 02 Officers Letter 03 2017 Movement Profile 06 Unique Characteristics of Boys & Girls Clubs 07 2017 Partner Spotlights 15 Annual Campaigns 17 Native Services 19 Military & Outreach Services 21 Alumni & Friends 23 Child & Club Safety 25 Government Relations and Advocacy 26 Advancing Philanthropy 28 Great Futures Campaign Highlights 29 Journey to Great Futures 31 Awards and Honors 32 Income & Expenses 34 Governors & Trustees 43 Individuals 48 Bequests & Heritage Club 49 Corporations 55 Foundations 2017 ANNUAL RePORT 1 BOYS & GIRLS CLUBS OF AMERICA OFFICERS LETTER Your support of Boys & Girls Clubs of America of funding budgeted for 21st Century Community in 2017 propelled us to new heights. We’re Learning Centers to launching a grassroots advocacy now reaching more young people than ever — nearly campaign to increase access to healthy meals and 460,000 kids and teens enter a Boys & Girls Club every snacks for kids through USDA programs, our work in day. Thanks to your generosity, that means 4.3 million the public sector is shining a light on out-of-school-time kids annually are finding what they need at more than programming as a national priority. 4,300 Boys & Girls Clubs across the nation and on U.S. military installations worldwide: safe, inviting spaces We’re also getting in touch with some of our greatest staffed with caring youth development professionals; champions: our alumni. In the past, when you innovative programming in areas that empower young graduated from high school and left your Club behind, people’s creativity and support their success in school; you likely stayed in touch with your Club friends and a and opportunities to grow as leaders and citizens.