Thinking Inside the Box CASE STUDIES FROM

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

ADV Part 2A: Firm Brochure

Firm Brochure Part 2A Natixis Advisors, LLC (“Natixis Advisors”) Natixis Investment Managers Solutions, a division of Natixis Advisors (“Solutions”) Boston Office San Francisco Office 888 Boylston Street 101 Second Street, Suite 1600 Boston, MA 02199 San Francisco, CA 94105 Phone: 617-449-2835 Phone: 617-449-2838 Fax: 617-369-9794 Fax: 617-369-9794 www.im.natixis.com This brochure provides information about the qualifications and business practices of Natixis Advisors. If you have any questions about the contents of this brochure, please contact us at 617-449-2838 or by email at [email protected]. The information in this brochure has not been approved or verified by the United States Securities and Exchange Commission (“SEC”) or by any state securities authority. Additional information about Natixis Advisors is available on the SEC’s website at www.adviserinfo.sec.gov. Registration does not imply that any particular level of skill or training has been met by Natixis Advisors or its personnel. August 4, 2021 1 Important Note about this Brochure This Brochure is not: • an offer or agreement to provide advisory services to any person; • an offer to sell interests (or a solicitation of an offer to purchase interests) in any fund that we advise; or • a complete discussion of the features, risks, or conflicts associated with any advisory service or fund. As required by the Investment Advisers Act of 1940, as amended (the “Advisers Act”), we provide this Brochure to current and prospective clients. We also, in our discretion, will provide this Brochure to current or prospective investors in a fund, together with other relevant offering, governing, or disclosure documents. -

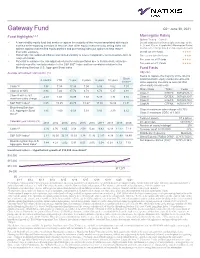

Gateway Fund

Gateway Fund Q2 • June 30, 2021 Fund Highlights1,2,3 Morningstar Rating Options Trading – Class Y • A low-volatility equity fund that seeks to capture the majority of the returns associated with equity Overall rating derived from weighted average of the markets while exposing investors to less risk than other equity investments by selling index call 3-, 5- and 10-year (if applicable) Morningstar Rating options against a diversified equity portfolio and purchasing index put options to help reduce metrics; other ratings based on risk-adjusted returns downside exposure Overall out of 81 funds ★★★★ • Historically has outpaced inflation and limited volatility to a level comparable to intermediate-term to Three years out of 81 funds ★★★ long term bonds Five years out of 57 funds • Potential to enhance the risk-adjusted returns for many portfolios due to its historically attractive ★★★★ risk/return profile, low beta relative to the S&P 500® Index and low correlation relative to the Ten years out of 11 funds ★★★★ Bloomberg Barclays U.S. Aggregate Bond Index Fund Facts Average annualized total returns† (%) Objective Seeks to capture the majority of the returns Since 3 months YTD 1 year 3 years 5 years 10 years associated with equity market investments, 1/1/88** while exposing investors to less risk than Class Y5 3.98 7.34 17.98 7.04 6.98 5.62 7.01 other equity investments Share Class Ticker Cusip Class A at NAV 3.94 7.24 17.72 6.78 6.72 5.37 6.91 Class Y GTEYX 367829-88-4 Class A with 5.75% -2.04 1.08 10.95 4.69 5.47 4.74 6.72 Class A GATEX 367829-20-7 maximum sales charge Class C GTECX 367829-70-2 ® 8 S&P 500 Index 8.55 15.25 40.79 18.67 17.65 14.84 11.31 Class N GTENX 367829-77-7 Bloomberg Barclays U.S. -

Third Supplemental Information Memorandum Dated 23 July 2019

Third Supplemental Information Memorandum dated 23 July 2019 LVMH FINANCE BELGIQUE SA (incorporated as société anonyme / naamloze vennootschap) under the laws of Belgium, with enterprise number 0897.212.188 RPR/RPM (Brussels)) EUR 4,000,000,000 Belgian Multi-currency Short-Term Treasury Notes Programme Irrevocably and unconditionally guaranteed by LVMH Moët Hennessy - Louis Vuitton SE (incorporated as European company under the laws of France, and registered under number 775 670 417 (R.C.S. Paris)) The Programme is rated A-1 by Standard & Poor’s Ratings Services, a division of the McGraw-Hill Companies, Inc. and, Arranger Dealers Banque Fédérative du Crédit Mutuel BNP Paribas BRED Banque Populaire Crédit Agricole Corporate and Investment Bank Crédit Industriel et Commercial BNP Paribas Fortis SA/NV Natixis Société Générale ING Belgium SA/NV ING Bank N.V. Belgian Branch Issuing and Paying Agent BNP Paribas Fortis SA/NV This third supplemental information memorandum is dated 23 July 2019 (the “Third Supplemental Information Memorandum”) and is supplemental to, and shall be read in conjunction with, the information memorandum dated 20 October 2015 as supplemented on 21 April 2016 and on 28 April 2017 (the “Information Memorandum”). Unless otherwise defined herein, terms defined in the Information Memorandum have the same respective meanings when used in this Third Supplemental Information Memorandum. As of the date of this Third Supplemental Information Memorandum: (i) The Issuer herby makes the following additional disclosure: Moody's assigned on 3 July 2019 a first-time A1 long-term issuer rating and Prime-1 (P-1) short-term rating to LVMH Moët Hennessy Louis Vuitton SE.; (ii) The paragraph 1.17 “Rating(s) of the Programme” of the section entitled “1. -

Aqr-Barrons-022916.Pdf

THE DOW JONES BUSINESS AND FINANCIAL WEEKLY www.barrons.com FEBRUARY 29, 2016 % John Liew, Cliff Asness, David Kabiller, and a team of high-powered Ph.Ds have built AQR into a $141 billion investment giant that gets impressive returns in good markets and bad. (over please) THE PUBLISHER’S SALE OF THIS REPRINT DOES Not CONSTITUTE OR IMPLY ANY ENdoRSEMENT OR SpoNSORSHIP OF ANY PRODUct, SERVICE, COMPANY OR ORGANIZATION. Custom Reprints 800.843.0008 www.djreprints.com DO NOT EDIT OR ALTER REPRINT/REPRODUCTIONS NOT PERMITTED 52518 February 29, 2016 BARRON S S5 COVER STORY February 29, 2016 AQR’s academic research has ledBARRON to someS truly alternative funds. S5 COVER STORY MarketAQR’s academic research has Brainiacs led to some truly alternative funds. by Andrew Bary MarketPhotography by Derek Dudek Brainiacs SinceSince U.S. U.S. stocks stocks peakedpeaked inin July,July, few few investmentsshort equity, and have trend-following produced instrong futures returns. funds Globalare in the stocks, black junksince bonds,late July, and in- investmentsby Andrew have produced Bary strong returns. markets. Yet, against this tough backdrop, cluding the industry’s largest fund, the $11 Globalmost commoditiesstocks, junk bonds, have and declined—in most com- manya bunch cases, of academics sharply. are And delivering. many so-called Their billion alternative AQR Managed investments Futures have Strategy failed moditiesPhotography have by declined—in Derek Dudek many cases, firm, AQR Capital Management (AQR (ticker: AQMIX), which is up 7% through sharply.to provide And hoped-formany so-called diversification alternative standsbenefits. for appliedJust look quantitative at the research),big losses mid-February, suffered by against some an notable 11% drop hedge in the Since U.S. -

Hedge Fund Billionaires Attack the Hudson Valley Wall Street Goes All in to Save Tax Breaks for the Wealthy

HEDGE PAPERS No.39 HEDGE FUND BILLIONAIRES ATTACK THE HUDSON VALLEY WALL STREET GOES ALL IN TO SAVE TAX BREAKS FOR THE WEALTHY Hedge funds and billionaire hedge fund managers are destroying our economy, corrupting our government, hurting families and communities and exploding inequality. It’s happening all over America, and increasingly all over the world. And now it’s happening in the Hudson Valley. A tiny group of hedge fund billionaires have targeted the congressional campaign in the 19th House District of New York, spending millions of dollars to support GOP candidate John Faso and attack Democratic candidate Zephyr Teachout. SIX HEDGE FUND BILLIONAIRES HIT THE HUDSON VALLEY WITH $5.5 MILLION IN CAMPAIGN CASH The amount of campaign cash is amazing: we’ve found that six billionaire hedge fund managers from New York City, Connecticut and Long Island have given $5,517,600 to PACs and Super PACs active in the Teachout-Faso campaign in this electoral cycle. These same six men have given $102,768,940 in federal and New York state campaign contributions in the past two decades. They’re not doing it for nothing -- they want something in return. These hedge fund billionaires and their colleagues at hedge funds and private equity firms get billions of dollars in special tax breaks under the “carried interest loophole” – and they want to keep the loophole wide open. Closing the loophole would save the federal government an estimated $18 billion per year, according to an analysis by law professor Victor Fleischer.[1] But huge sums of lobbying and campaign cash directed at Congress – and Congressional candidates – by hedge funds and private equity firms have stymied reform in Washington and fueled continued obstructionism. -

DTC Participant Alphabetical Listing June 2019.Xlsx

DTC PARTICPANT REPORT (Alphabetical Sort ) Month Ending - June 30, 2019 PARTICIPANT ACCOUNT NAME NUMBER ABN AMRO CLEARING CHICAGO LLC 0695 ABN AMRO SECURITIES (USA) LLC 0349 ABN AMRO SECURITIES (USA) LLC/A/C#2 7571 ABN AMRO SECURITIES (USA) LLC/REPO 7590 ABN AMRO SECURITIES (USA) LLC/ABN AMRO BANK NV REPO 7591 ALPINE SECURITIES CORPORATION 8072 AMALGAMATED BANK 2352 AMALGAMATED BANK OF CHICAGO 2567 AMHERST PIERPONT SECURITIES LLC 0413 AMERICAN ENTERPRISE INVESTMENT SERVICES INC. 0756 AMERICAN ENTERPRISE INVESTMENT SERVICES INC./CONDUIT 7260 APEX CLEARING CORPORATION 0158 APEX CLEARING CORPORATION/APEX CLEARING STOCK LOAN 8308 ARCHIPELAGO SECURITIES, L.L.C. 0436 ARCOLA SECURITIES, INC. 0166 ASCENSUS TRUST COMPANY 2563 ASSOCIATED BANK, N.A. 2257 ASSOCIATED BANK, N.A./ASSOCIATED TRUST COMPANY/IPA 1620 B. RILEY FBR, INC 9186 BANCA IMI SECURITIES CORP. 0136 BANK OF AMERICA, NATIONAL ASSOCIATION 2236 BANK OF AMERICA, NA/GWIM TRUST OPERATIONS 0955 BANK OF AMERICA/LASALLE BANK NA/IPA, DTC #1581 1581 BANK OF AMERICA NA/CLIENT ASSETS 2251 BANK OF CHINA, NEW YORK BRANCH 2555 BANK OF CHINA NEW YORK BRANCH/CLIENT CUSTODY 2656 BANK OF MONTREAL, CHICAGO BRANCH 2309 BANKERS' BANK 2557 BARCLAYS BANK PLC NEW YORK BRANCH 7263 BARCLAYS BANK PLC NEW YORK BRANCH/BARCLAYS BANK PLC-LNBR 8455 BARCLAYS CAPITAL INC. 5101 BARCLAYS CAPITAL INC./LE 0229 BB&T SECURITIES, LLC 0702 BBVA SECURITIES INC. 2786 BETHESDA SECURITIES, LLC 8860 # DTCC Confidential (Yellow) DTC PARTICPANT REPORT (Alphabetical Sort ) Month Ending - June 30, 2019 PARTICIPANT ACCOUNT NAME NUMBER BGC FINANCIAL, L.P. 0537 BGC FINANCIAL L.P./BGC BROKERS L.P. 5271 BLOOMBERG TRADEBOOK LLC 7001 BMO CAPITAL MARKETS CORP. -

AQR's Cliff Asness Named the 2019 IAQF/Northfield Financial Engineer of the Year

Contact: Claudia Gray +1 (203) 742-3205 [email protected] AQR’s Cliff Asness Named the 2019 IAQF/Northfield Financial Engineer of the Year GREENWICH, Connecticut, February 28, 2020 – Cliff Asness, Founder, Managing Principal and Chief Investment Officer at AQR Capital Management, was recognized as the 2019 Financial Engineer of the Year (FEOY) by the International Association for Quantitative Finance (IAQF) and Northfield Information Services. He was presented with the honor at the IAQF/Northfield Award Gala Dinner on February 27 by Martin Leibowitz, Managing Director and Vice Chairman of Research at Morgan Stanley. Upon his acceptance of the award, Cliff Asness remarked, “It is a great honor, and quite humbling, to receive this award especially in light of the amazing prior recipients. Thank you to the IAQF for this recognition and for all their work in advancing the field of quantitative finance.” Northfield President Dan diBartolomeo commented, “We are elated to see that a very deserving practitioner has received this year’s award. Cliff Asness has contributed very materially to the asset management industry in terms of the literature, but even more so by the many innovative investment techniques introduced through his firm AQR. His dedication to rigorous thought in many aspects of the investment process is now being appropriately recognized.” The annual IAQF/Northfield FEOY Award, established in 1993, recognizes individual contributions to the advancement of quantitative finance. A nominating committee of approximately 100 people, consisting of all the IAQF governing boards, submits nominations, which are reviewed in a two-step process by a selection committee of 25 members. -

[email protected]

RONEN ISRAEL AQR Capital Management 2 Greenwich Plaza - 3rd Floor Greenwich, CT 06830 Tel: 203 742 3645 Fax: 203 742 3145 Email: [email protected] EXPERIENCE AQR Capital Management Principal 2007- AQR Capital Management Vice President 2004-2007 AQR Capital Management Associate 1999-2004 Quantiative Financial Strategies, Inc. Senior Analyst 1996-1999 PriceWaterhouse Consultant 1995-1996 NYU Leonard N. Stern School of Business Adjunct Professor of Finance 2014- Areas of focus: research and portfolio management of stock selection strategies, hedge fund strategies and alternative risk premia; algorithmic trading and transaction costs analysis EDUCATION Columbia University M.A. Mathematics (mathematical finance) 1999-2000 University of Pennsylvania, Wharton School * B.S. Economics 1991-1995 University of Pennsylvania, School of Engineering * B.A.S. Biomedical Science 1991-1995 * Management and Technology (dual degree) program PUBLISHED PAPERS “The Role of Shorting, Firm Size, and Time on Market Anomalies”, 2013, (with Tobias J. Moskowitz), Journal of Financial Economics, Volume 108, Issue 2, 275–301 (lead paper). “Fact, Fiction and Momentum Investing”, 2014, (with Cliff Asness, Andrea Frazzini, and Tobias J. Moskowitz), Journal of Portfolio Management, 40th Anniversary Issue. “Understanding Style Premia”, 2014, (with Thomas Maloney), Journal of Investing, Winter 2014. “Style Investing: The Long and the Long/Short of It”, 2014, (with Antti Ilmanen and Dan Villalon), IPE (Investment & Pensions Europe) Magazine. “Investing with Style”, 2015, (with Cliff Asness, Antti Ilmanen, and Tobias J. Moskowitz), Journal of Investment Management, Volume 13, No. 1, 27–63. “Fact, Fiction and Value Investing”, 2015, (with Cliff Asness, Andrea Frazzini, and Tobias J. Moskowitz), Journal of Portfolio Management, Fall Issue, Volume 42, Number 1. -

Natixis U.S. Equity Opportunities Fund

Q2 | June 30, 2021 Natixis U.S. Equity Opportunities Fund QUARTERLY PORTFOLIO COMMENTARY Average annualized total returns (%) † as of 6/30/2021 3 months YTD 1 year 3 years 5 years 10 years Class Y 9.14 18.78 47.66 19.79 20.17 16.11 Class A at NAV 9.10 18.60 47.28 19.48 19.87 15.82 Class A with 5.75% maximum sales charge 2.82 11.79 38.81 17.15 18.46 15.13 S&P 500® Index 8.55 15.25 40.79 18.67 17.65 14.84 Russell 1000® Index 8.54 14.95 43.07 19.16 17.99 14.90 Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results. Total return and value will vary, and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit im.natixis.com. Performance for other share classes will be greater or less than shown based on differences in fees and sales charges. †Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. You may not invest directly in an index. Gross expense ratio 1.17% (Class A share) / 0.92% (Class Y share). Net expense ratio 1.17% (Class A share) / 0.92% (Class Y share). As of the most recent prospectus, the investment advisor has contractually agreed to waive fees and/or reimburse expenses (with certain exceptions) once the expense cap of the fund has been exceeded. -

Hedge Funds Vs Traditional Assets

University of Nottingham Hedge Funds & The Alpha Paradigm Ioannis Logothetis Master of Science in Finance & Investment Hedge Funds & The Alpha Paradigm by Ioannis Logothetis September 2012 A Dissertation presented in part consideration for the degree: ‘Master of Science in Finance and Investment’ 1 Abstract Numerous heavily quantitative strategies, macroeconomic and esoteric investment techniques involving currencies, fixed income products, commodities and equities have proven to be very profitable over the last two decades as math whizzes of Wall Street implemented mathematical and quantum physics models to outperform financial markets in search of Alpha. The development of mathematical algorithms, exotic trading techniques, lightening fast computerized machines and platforms and the effective in-depth skilful macroeconomic analysis from numerous hedge fund managers have resulted in trillions of profits or even losses which have in turn affected the global financial system significantly. This thesis will examine the features of the hedge fund industry focusing on the analysis and the background of the ‘Alpha’ paradigm, the various profitable strategies on record, their performance over the years, the recent developments in the field, their influence and their effects on the global economy and the financial system with the infamous events of 2007- 2008 serving as a backdrop. By assessing historically the hedge fund performance it could be demonstrated that hedge funds produce superior risk-adjusted returns over time comparing with traditional assets, and they carried fewer risks when the volatilities are compared. Our findings also support that hedge funds possess the ability create alpha consistently and systematically with limited volatility and by outperforming traditional asset classes, while there is a limited interaction between hedge fund returns and systematic market factors. -

Transition Finance Toolkit

04. TRANSITION FINANCE TOOLKIT 1. April 2021 | BROWN INDUSTRIES: THE TRANSITION TIGHTROPE Tightrope.com C2 - Internal Natixis KEY TAKEAWAYS Chapter 4 Green Finance is now a core component of Climate Action and benefits from a strong impetus and legislative plans from policy-makers. The global Green/Sustainable/Social debt market reached $1.192 trillion threshold as of December 2020. There is increasing investors’ appetite for Brown industries are still largely absent from the Green transition KPI-linked products that could Bond market, which still focuses on green activities and include brown industries players The General Corporate Purpose model tied to a key performance • Investors are relatively less confident in predominantly and/or indicator on which different financial mechanism could be built allows a historically brown companies as they assess company’s profile & more holistic and forward-looking approach of climate finance. strategy in addition to the Use-of-Proceeds. UoP & General Corporate Purpose should not be opposed and can be • There is a lack of standards for activities in "grey areas" (whose complementary. "greenness" depends on observed performances like efficiency gains). The EU Taxonomy tries to address the lack of standards There is a new standard around for activities in grey areas Sustainability-Linked Bonds • Stringent thresholds can be fairly understood from the climate neutrality The ICMA has launched guidelines on the disclosures that should be objective but could lead to a niche of eligible companies or assets. made by issuers when raising funds in debt capital markets (the “Climate • The level of stringency, combined with its binary nature (i.e., without Transition Finance Handbook”). -

26 January 2018 Results of the Mandatory

26 JANUARY 2018 RESULTS OF THE MANDATORY PUBLIC TAKEOVER BID IN CASH AND SQUEEZE-OUT BY Natixis Belgique Investissements SA, a public limited company incorporated under Belgian law (the « Bidder ») ON ALL SHARES AND WARRANTS NOT YET OWNED BY THE BIDDER ISSUED BY Dalenys SA, a public limited company incorporated under Belgian law (the « Target Company »). Results of the bid The initial acceptance period of the mandatory takeover bid launched on 11 December 2017 by the Bidder on 8,620,827 shares representing 45,71% of the share capital and 38,67% of the voting rights of the Target Company and on 5,000 warrants (the “Bid”) ended on 22 January 2018. Following the initial acceptance period, the Bidder and the persons affiliated to him hold 18,401,437 shares and 3,432,944 profit shares representing 97,6 % of the share capital and 97,97 % of the voting rights in the Target Company. Payment of the bid price for the transferred shares will be made on 5 February 2018. Squeeze-out As the Bidder and the persons affiliated to him hold at least 95 % of the shares and securities with voting rights in the Target Company following the initial acceptance period, the Bidder decided to proceed with a squeeze out (in accordance with Article 513 of the Companies Code and Articles 42 and 43 in conjunction with Article 57 of the royal decree of 27 April 2007 on Takeover Bids) (the “Squeeze-out”) in order to acquire the shares and warrants issued by the Target Company not yet acquired by the Bidder, under the same terms and conditions as the Bid.