Corporate Governance

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Rules Governing the Share Capital of German Public Companies by Frank Wooldridge

Rules governing the share capital of German public companies by Frank Wooldridge he above rules are somewhat detailed and some - company. However, it contains detailed rules governing times rather complex. A good elementary account the maintenance of capital. Certain of these rules, Tof them by Schneider and Heidenhain is given in including the prohibition imposed on a public company The German Stock Corporation Act ( 2nd ed, pub Kluwer, subscribing for its own shares contained in paragraph 2000) which has been of considerable interest and help to 56 (1) AktG are considered below. The imposition of the author of this article. ancillary obligations upon shareholders is also considered below, where the rules governing the increase and The articles of a public company ( Aktiengesellschaft ) are reduction of capital, which are rather complex, are dealt required to specify the amount of the company’s share with in outline. capital, which has to be denominated in euros. The minimum capital of a public company is at present THE PROVISIONS OF PARAGRAPH 56 AKTG €50,000 (para 7 AktG ). As in the United Kingdom, shares may be issued without a par value ( Stückaktien ) or with one The most important of the abov e provisions would (Nennbetragsaktien ) (para 8(2) AktG ). Par value shares are seem to be those contained in paragraph 56(1) and 562) required to have the value of one euro or a multiple thereof AktG . Paragraph 56(1) AktG provides that a company may (para 8(2) AktG ). The shares in an Aktiengesellschaft are not subscribe for its own shares. Any purported indivisible, as are the rights attaching to each share. -

List of Active Bayer Companies with at Least a Share of 50% Last Update: 17.8.2020 Country Company

List of active Bayer companies with at least a share of 50% last update: 17.8.2020 Country Company Algeria Bayer Algerie S.P.A. Argentina Bayer S.A. Argentina Biagro S.A. Argentina Monsanto Argentina SRL Australia Bayer Australia Limited Australia Bayer CropScience Holdings Pty Ltd Australia Bayer CropScience Pty Limited Australia Cotton Growers Services Pty. Limited Australia Imaxeon Pty. Ltd. Australia Monsanto Australia Pty Ltd Bangladesh Bayer CropScience Ltd. Belgium Bayer Agriculture BVBA Belgium Bayer CropScience NV Belgium Bayer NV Bermuda MonSure Limited Bolivia Bayer Boliviana Ltda Bolivia Monsanto Bolivia S.A. Bosnia & Herzeg. Bayer d.o.o. Sarajevo Brazil Alkagro do Brasil Ltda Brazil Bayer S.A. Brazil D&PL Brasil Ltda Brazil Monsanto do Brasil Ltda. Brazil Rede Agro Fidelidade e Intermediacao S.A. Brazil Schering do Brasil Química e Farmacêutica Ltda. Brazil Stoneville Brasil Ltda. Bulgaria Bayer Bulgaria EOOD Burkina Faso Monsanto Burkina Faso SARL Chile Bayer Finance & Portfolio Management S.A. Chile Bayer Finance Ltda. Chile Bayer S.A. Chile Monsanto Chile, S.A. Costa Rica Bayer Business Services Costa Rica, SRL Costa Rica Bayer Medical S.R.L. Costa Rica Bayer S.A. Curacao Pianosa B.V. Germany Adverio Pharma GmbH - 1 - List of active Bayer companies with at least a share of 50% last update: 17.8.2020 Country Company Germany AgrEvo Verwaltungsgesellschaft mbH Germany Alcafleu Management GmbH & Co. KG Germany BGI Deutschland GmbH Germany Bayer 04 Immobilien GmbH Germany Bayer 04 Leverkusen Fußball GmbH Germany Bayer 04 Leverkusen -

Fordham Journal of Corporate & Financial

Fordham Journal of Corporate & Financial Law Volume 14 Issue 1 Article 3 2008 Approaching Comparative Company Law David C. Donald Follow this and additional works at: https://ir.lawnet.fordham.edu/jcfl Part of the Banking and Finance Law Commons, and the Business Organizations Law Commons Recommended Citation David C. Donald, Approaching Comparative Company Law , 14 Fordham J. Corp. & Fin. L. 83 (2008). Available at: https://ir.lawnet.fordham.edu/jcfl/vol14/iss1/3 This Article is brought to you for free and open access by FLASH: The Fordham Law Archive of Scholarship and History. It has been accepted for inclusion in Fordham Journal of Corporate & Financial Law by an authorized editor of FLASH: The Fordham Law Archive of Scholarship and History. For more information, please contact [email protected]. APPROACHING COMPARATIVE COMPANY LAW David C. Donald∗ ABSTRACT This Article identifies several common errors that occur in comparative law analyses, offers guidelines to help avoid such errors, and provides a framework for studying the company laws of three major jurisdictions. Part I discusses some of the problems that can arise in comparative law and offers a few points of caution that can be useful for practical, theoretical and legislative comparative law. Part II examines well-known examples of comparative analysis gone astray in order to demonstrate the utility of heeding the outlined points of caution. Part III provides an example of using functional definitions to demarcate the topic “company law,” offering an “effects” test to determine whether a given provision of law should be considered as functionally part of the rules that govern the core characteristics of companies. -

Comparative Company Law

Comparative company law 26th of September 2017 – 3rd of October 2017 Prof. Jochen BAUERREIS Attorney in France and Germany Certified specialist in international and EU law Certified specialist in arbitration law ABCI ALISTER Strasbourg (France) • Kehl (Germany) Plan • General view of comparative company law (A.) • Practical aspects of setting up a subsidiary in France and Germany (B.) © Prof. Jochen BAUERREIS - Avocat & Rechtsanwalt 2 A. General view of comparative company law • Classification of companies (I.) • Setting up a company with share capital (II.) • Management bodies (III.) • Transfer of shares (IV.) • Taxation (V.) • General tendencies in company law (VI.) © Prof. Jochen BAUERREIS - Avocat & Rechtsanwalt 3 I. Classification of companies • General classification – Partnerships • Typically unlimited liability of the partners • Importance of the partners – The companies with share capital • Shares can be traded more or less freely • Typically restriction of the associate’s liability – Hybrid forms © Prof. Jochen BAUERREIS - Avocat & Rechtsanwalt 4 I. Classification of companies • Partnerships – « Civil partnership » • France: Société civile • Netherlands: Maatschap • Germany: Gesellschaft bürgerlichen Rechts • Austria: Gesellschaft nach bürgerlichem Recht (GesnbR) • Italy: Società simplice © Prof. Jochen BAUERREIS - Avocat & Rechtsanwalt 5 I. Classification of companies • Partnerships – « General partnership » • France: Société en nom collectif • UK: General partnership (but without legal personality!) • USA: General partnership -

Siemens Annual Report 2019

Annual Report 2019 siemens.com Table of contents A B C Combined Consolidated Additional Information Management Report Financial Statements A.1 p 2 B.1 p 76 C.1 p 150 Organization of the Siemens Group Consolidated Statements Responsibility Statement and basis of presentation of Income C.2 p 151 A.2 p 3 B.2 p 77 Independent Auditor ʼs Report Financial performance system Consolidated Statements of Comprehensive Income C.3 p 157 A.3 p 5 Report of the Supervisory Board Segment information B.3 p 78 Consolidated Statements C.4 p 162 A.4 p 16 of Financial Position Corporate Governance Results of operations B.4 p 79 C.5 p 174 A.5 p 19 Consolidated Statements Notes and forward- looking Net assets position of Cash Flows statements B.5 p 80 A.6 p 20 Financial position Consolidated Statements of Changes in Equity A.7 p 24 B.6 p 82 Overall assessment of the economic position Notes to Consolidated Financial Statements A.8 p 26 Report on expected developments and associated material opportunities and risks A.9 p 38 Siemens AG A.10 p 40 Compensation Report A.11 p 71 Takeover-relevant information Combined Management Report Pages 1 – 74 A.1 Organization of the Siemens Group and basis of pr esentation Siemens is a technology company that is active in nearly all coun- Non-financial matters of the Group tries of the world, focusing on the areas of automation and digi- and Siemens AG talization in the process and manufacturing industries, intelligent Siemens has policies for environmental, employee and social infrastructure for buildings and distributed energy systems, con- matters, for the respect of human rights, and anti-corruption and ventional and renewable power generation and power distribu- bribery matters, among others. -

Siemens Annual Report 2020

Annual Report 2020 Table of A. contents Combined Management Report A.1 Organization of the Siemens Group and basis of presentation 2 A.2 Financial performance system 3 A.3 Segment information 6 A.4 Results of operations 18 A.5 Net assets position 22 A.6 Financial position 23 A.7 Overall assessment of the economic position 27 A.8 Report on expected developments and as sociated material opportunities and risks 29 A.9 Siemens AG 46 A.10 Compensation Report 50 A.11 Takeover-relevant information 82 B. Consolidated Financial Statements B.1 Consolidated Statements of Income 88 B.2 Consolidated Statements of Comprehensive Income 89 B.3 Consolidated Statements of Financial Position 90 B.4 Consolidated Statements of Cash Flows 92 B.5 Consolidated Statements of Changes in Equity 94 B.6 Notes to Consolidated Financial Statements 96 C. Additional Information C.1 Responsibility Statement 166 C.2 Independent Auditor ʼs Report 167 C.3 Report of the Super visory Board 176 C.4 Corporate Governance 184 C.5 Notes and forward-looking s tatements 199 PAGES 1 – 86 A. Combined Management Report Combined Management Report A.1 Organization of the Siemens Group and basis of presentation A.1 Organization of the Siemens Group and basis of presentation Siemens is a technology company that is active in nearly all Reconciliation to Consolidated Financial Statements is countries of the world, focusing on the areas of automation Siemens Advanta, formerly Siemens IoT Services, a stra- and digitalization in the process and manufacturing indus- tegic advisor and implementation partner in digital trans- tries, intelligent infrastructure for buildings and distributed formation and industrial internet of things (IIoT). -

No 2157/2001 of 8 October 2001 on the Statute for a European Company (SE)

2001R2157 — EN — 01.07.2013 — 003.001 — 1 This document is meant purely as a documentation tool and the institutions do not assume any liability for its contents ►B COUNCIL REGULATION (EC) No 2157/2001 of 8 October 2001 on the Statute for a European company (SE) (OJ L 294, 10.11.2001, p. 1) Amended by: Official Journal No page date ►M1 Council Regulation (EC) No 885/2004 of 26 April 2004 L 168 1 1.5.2004 ►M2 Council Regulation (EC) No 1791/2006 of 20 November 2006 L 363 1 20.12.2006 ►M3 Council Regulation (EU) No 517/2013 of 13 May 2013 L 158 1 10.6.2013 2001R2157 — EN — 01.07.2013 — 003.001 — 2 ▼B COUNCIL REGULATION (EC) No 2157/2001 of 8 October 2001 on the Statute for a European company (SE) THE COUNCIL OF THE EUROPEAN UNION, Having regard to the Treaty establishing the European Community, and in particular Article 308 thereof, Having regard to the proposal from the Commission (1 ), Having regard to the opinion of the European Parliament (2 ), Having regard to the opinion of the Economic and Social Committee (3 ), Whereas: (1) The completion of the internal market and the improvement it brings about in the economic and social situation throughout the Community mean not only that barriers to trade must be removed, but also that the structures of production must be adapted to the Community dimension. For that purpose it is essential that companies the business of which is not limited to satisfying purely local needs should be able to plan and carry out the reorganisation of their business on a Community scale. -

The German Supervisory Board

The German Supervisory Board: A Practical Introduction for US Public Company Directors The German Supervisory Board: | A Practical Introduction for US Public Company Directors The German Supervisory Board: | A Practical Introduction for US Public Company Directors Contents Foreword Foreword 03 As the world’s economy globalizes, there is often an expectation that business practices will Executive Summary 04 harmonize along with it. This is an expectation The German Supervisory Board: Characteristics and Context 05 that we will see a kind of convergence of corporate The German Supervisory Board in Action: Regular Order, M&A, Crisis 14 governance forms and practices, where boards the world over resemble each other, perhaps Conclusion 15 with a large majority of independent directors, an Endnotes 17 audit committee, a separate chair and CEO, and so on. A lot of this reflects a certain familiarity Claus Buhleier with the Anglo-Saxon board model among Partner, Center for Corporate institutional investors in London and New York. Governance Deloitte Germany [email protected] The reality, however, is quite different. Despite real advances in globalization in other areas, differences in what boards look like and how they work in practice persist across countries. This publication brings to light the differences between the predominant Anglo Saxon, one-tier corporate governance model on the one hand, and the still influential Germanic two-tier-model on the other. The authors, Yvonne Schlaeppi and Michael Marquardt, both experienced corporate directors Kai Bruehl who have served on European company boards, Director, Risk Advisory Deloitte highlight the main characteristics of the German Germany [email protected] supervisory board model and how it demands accountability from its members, despite looking rather different than the combined board model. -

1 Corporate Governance Declaration of Heidelberger Druckmaschinen

Corporate governance declaration of Heidelberger Druckmaschinen Aktiengesellschaft in accordance with Section 289 f and Section 315 d of the German Commercial Code (as of June 2018) Our actions are guided by the principles of transparent corporate management and control (corporate governance). Corporate governance plays an important role at Heidelberger Druckmaschinen Aktiengesellschaft: It is the foundation for the trust of customers, investors, employees and the financial markets in our Company. The following declaration on corporate governance in accordance with Section 289a and Section 315(5) of the German Commercial Code includes the declaration of compliance in accordance with Section 161 of the German Stock Corporation Act, relevant details of corporate governance and the description of the working methods of the Management Board and the Supervisory Board. As Heidelberger Druckmaschinen Aktiengesellschaft is a listed corporation (German Securities Number (WKN) 731400 - ISIN DE0007314007) based in Germany, its corporate governance is determined mainly by the German Stock Corporation Act, the German Codetermination Act, the suggestions and recommendations of the German Corporate Governance Code (most recent version), the Articles of Association of Heidelberger Druckmaschinen Aktiengesellschaft, and the Rules of Procedure for the Supervisory Board and Management Board. The tasks, responsibilities and rules of procedure of the Management Board are set out in detail in the Rules of Procedure, the latest version of which can be found -

Switzerland - AG, SA, LTD

Switzerland - AG, SA, LTD General Type of Company AG/SA/LTD Political Stability Excellent Common or Civil Law Civil Disclosure of Shareholders No Migration of Domicile Permitted Yes Corporate Taxation Favourable Language of Name Latin Alphabet (See below) Corporate Requirements Minimum Number of Shareholders 1 Minimum Number of Directors 1 Corporate Directors Permitted No Company Secretary Required No Usual Authorised Capital CHF 100,000 Minimum Paid Up CHF 100,000 Local Requirements Registered Office/Agent Yes Company Secretary No Local Director (One minimum) Yes Local Meetings Yes Government Register of Directors Yes Government Register of Shareholders No Annual Requirements Annual Return Yes Submit Accounts Yes Audit Requirement Varies Publicly Accessible Accounts Yes Recurring Government Costs Minimum Annual Tax/Licence Fee No Annual Return Filing Fee No [130117] 2 GENERAL INFORMATION Introduction The country is a federal republic and is officially known as the Swiss Confederation. The total area is 41,295 sq km. Switzerland is divided in to 26 Cantons and every Canton and every community has a different taxation system. Population The total estimated population is 7.3 million. Political Structure The two dominant principles of the Swiss Constitution of 1874 are federalism and democracy. The Constitution provides that the Cantons shall exercise all powers of government not delegated to the Federal Government. The three major sectors of the Swiss National government are the Federal Council, the Federal Assembly and the Federal Tribunal. The executive body is the seven-man collegiate Federal Council, which is elected for a four-year term by the national legislature. Infrastructure and Economy Switzerland has a prosperous and stable modern economy with a per capita GDP approximately 10% higher than other Western European countries Language Switzerland is one of the most multilingual countries in Europe. -

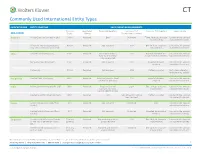

Commonly Used International Entity Types

Commonly Used International Entity Types COUNTRY/REGION ENTITY STRUCTURE BASIC FORMATION REQUIREMENTS Minimum Registered Corporate Secretary Minimum # of Minimum # of Directors Legal Liability ASIA-PACIFIC Capital Address Shareholders/Partners Australia Public Company (Limited or Ltd.) AUD 0 Required One Unlimited Three. At least 2 must be Limited to the amount local residents subscribed for shares Private or Proprietary Company AUD 0 Required Not required 1-50 One. At least 1 must be Limited to the amount (Pty. Ltd. or Proprietary Limited) local resident subscribed for shares China Limited Liability Company CNY 0 Required Not required. But a 1-50 Board of directors or a Limited to the amount local representative single executive director subscribed for shares may be required. Company Limited by Shares CNY 0 Required Not required 2-200 Board of directors Limited to the amount required subscribed for shares Partnership CNY 0 Required Not required 2-50 Partner managed Not a separate legal entity from its parent Hong Kong Limited Private Company HKD 0 Required Required, must be local 1-50 Board of directors Limited to the amount resident or company required subscribed for shares India Private Limited Company (Pvt Ltd) INR 0 Required Required if initial 2-200 Two. At least 1 must be Limited to the amount capital investment local resident subscribed for shares exceeds INR100 million Limited Liability Partnership (LLP) INR 0 Required N/A Two. At least 1 must be Partner managed Limited to the amount local resident subscribed for shares Japan General Corporation (Kabushiki JPY 1 Required Not required Unlimited One Limited to the amount Kaisha) subscribed for shares Limited Liability Company (Godo- JPY 1 Required Not required Unlimited Managed by managing Limited to the amount Kaisha) members subscribed for shares Singapore Private Limited Company (Private $1 in any Required Required and must be 1-50 One. -

Articles of Incorporation Bayerische Motoren Werke Aktiengesellschaft

Bayerische Motoren Werke Aktiengesellschaft Articles of Incorporation as of 29th June 2020 Content First Section: General Provisions 3 Second Section: Capital Stock and Shares 4 Third Section: Constitution and Administration of the Corporation 5 A. The Board of Management 5 B. The Supervisory Board 6 C. The General Meeting of Shareholders 10 Fourth Section: Accounting and Appropriation of the Net Profit 12 2 Non-Binding English Translation: To the extent that a conflict between the English and the German version of these Articles of Incorporation should arise, the German version applies. First Section General Provisions § 1 Name, Registered Office The name of the Corporation is Bayerische Motoren Werke Aktiengesellschaft. The Corporation was established in 1916. The registered office of the Corporation is in Munich/Germany. § 2 Purpose of the Corporation 1. The general purpose of the Corporation is to engage in the production and sale of engines, engine-equipped vehicles, related accessories and products of the machinery and metalworking industry as well as the rendering of services related to the aforementioned items. 2. The Corporation shall be entitled to take all actions and measures, which appear necessary or desirable in order to accomplish the foregoing purposes. In particular, the Corporation shall be entitled to acquire or sell land, set up domestic and foreign branches, establish, acquire and participate in other companies and enter into affiliation and similar agreements. § 3 Announcements, Place of Jurisdiction 1. Announcements by the Corporation shall, where permitted under German law, be published in the electronic version of the Federal Gazette (Bundesanzeiger). 2. By subscribing or acquiring shares or interim certificates of the Corporation the shareholder shall submit to the ordinary place of jurisdiction of the Corporation regarding all disputes between the shareholder and the Corporation or its corporate bodies.