Annual Report 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Rules Governing the Share Capital of German Public Companies by Frank Wooldridge

Rules governing the share capital of German public companies by Frank Wooldridge he above rules are somewhat detailed and some - company. However, it contains detailed rules governing times rather complex. A good elementary account the maintenance of capital. Certain of these rules, Tof them by Schneider and Heidenhain is given in including the prohibition imposed on a public company The German Stock Corporation Act ( 2nd ed, pub Kluwer, subscribing for its own shares contained in paragraph 2000) which has been of considerable interest and help to 56 (1) AktG are considered below. The imposition of the author of this article. ancillary obligations upon shareholders is also considered below, where the rules governing the increase and The articles of a public company ( Aktiengesellschaft ) are reduction of capital, which are rather complex, are dealt required to specify the amount of the company’s share with in outline. capital, which has to be denominated in euros. The minimum capital of a public company is at present THE PROVISIONS OF PARAGRAPH 56 AKTG €50,000 (para 7 AktG ). As in the United Kingdom, shares may be issued without a par value ( Stückaktien ) or with one The most important of the abov e provisions would (Nennbetragsaktien ) (para 8(2) AktG ). Par value shares are seem to be those contained in paragraph 56(1) and 562) required to have the value of one euro or a multiple thereof AktG . Paragraph 56(1) AktG provides that a company may (para 8(2) AktG ). The shares in an Aktiengesellschaft are not subscribe for its own shares. Any purported indivisible, as are the rights attaching to each share. -

Annual Report 2010 Facing Markets May Ling Xu (54) Stina Svensson (25) — P

Annual Report 2010 Facing Markets May Ling Xu (54) Stina Svensson (25) — p. 08 — p. 04 Jacob Bennett (33) Matteo Di Lauro (49) — p. 07 — p. 05 Isabel Alisia de Souza (8) Liang Thiangthon (21) — p. 06 — p. 09 2010: Facing Markets The Earth is home to some 6.9 billion people – a the various regions are among the cornerstones of our figure that is constantly growing. No two people are sustainable success. As a growth-oriented com- alike. Everyone is unique, with their own wishes, needs, pany, Beiersdorf mainly focuses on Europe, Asia, and and distinguishing features – including when it comes the Americas and in particular on the growth markets to skin care. Beiersdorf is aware of this and has within these regions. On the following pages, we been responding to these multifacetted requirements will introduce you to some of the people for whom we for more than 125 years with an individual and cons- develop and continuously enhance our innovative skin tantly expanding portfolio of products that are tailored care products. Beiersdorf has updated its Consumer to consumers. This includes globally successful skin Business Strategy so as to be able to delight consumers care brands such as NIVEA, Eucerin, and La Prairie. all over the world with innovative products at fair prices. An extremely high degree of closeness to consumers, This has guided our actions since the beginning of 2010 a global presence, and a focus on market-specific de- under the motto: velopments, and the specific features shown by skin in “Focus on Skin Care. Closer to Markets.” It entails concentrating on skin care and getting even closer to our markets. -

List of Active Bayer Companies with at Least a Share of 50% Last Update: 17.8.2020 Country Company

List of active Bayer companies with at least a share of 50% last update: 17.8.2020 Country Company Algeria Bayer Algerie S.P.A. Argentina Bayer S.A. Argentina Biagro S.A. Argentina Monsanto Argentina SRL Australia Bayer Australia Limited Australia Bayer CropScience Holdings Pty Ltd Australia Bayer CropScience Pty Limited Australia Cotton Growers Services Pty. Limited Australia Imaxeon Pty. Ltd. Australia Monsanto Australia Pty Ltd Bangladesh Bayer CropScience Ltd. Belgium Bayer Agriculture BVBA Belgium Bayer CropScience NV Belgium Bayer NV Bermuda MonSure Limited Bolivia Bayer Boliviana Ltda Bolivia Monsanto Bolivia S.A. Bosnia & Herzeg. Bayer d.o.o. Sarajevo Brazil Alkagro do Brasil Ltda Brazil Bayer S.A. Brazil D&PL Brasil Ltda Brazil Monsanto do Brasil Ltda. Brazil Rede Agro Fidelidade e Intermediacao S.A. Brazil Schering do Brasil Química e Farmacêutica Ltda. Brazil Stoneville Brasil Ltda. Bulgaria Bayer Bulgaria EOOD Burkina Faso Monsanto Burkina Faso SARL Chile Bayer Finance & Portfolio Management S.A. Chile Bayer Finance Ltda. Chile Bayer S.A. Chile Monsanto Chile, S.A. Costa Rica Bayer Business Services Costa Rica, SRL Costa Rica Bayer Medical S.R.L. Costa Rica Bayer S.A. Curacao Pianosa B.V. Germany Adverio Pharma GmbH - 1 - List of active Bayer companies with at least a share of 50% last update: 17.8.2020 Country Company Germany AgrEvo Verwaltungsgesellschaft mbH Germany Alcafleu Management GmbH & Co. KG Germany BGI Deutschland GmbH Germany Bayer 04 Immobilien GmbH Germany Bayer 04 Leverkusen Fußball GmbH Germany Bayer 04 Leverkusen -

User Guide for the Envoy Data Link

User Guide for the Envoy Data Link SLC Doc Number UG-15000 Revision A 12335 134th Court NE Redmond, WA 98052 USA Tel: (425) 285-3000 Fax: (425) 285-4200 Email: [email protected] Preparer: Engineer: Program Manager: Quality Assurance: RESTRICTION ON USE, PUBLICATION, OR DISCLOSURE OF PROPRIETARY INFORMATION This document contains information proprietary to Spectralux Corporation, or to a third party to which Spectralux Corporation may have a legal obligation to protect such information from unauthorized disclosure, use, or duplication. Any disclosure, use, or duplication of this document or of any of the information contained herein for other than the specific purpose for which it was disclosed is expressly prohibited, except as Spectralux Corporation may otherwise agree to in writing. Spectralux™ Avionics Export Notice All information disclosed by Spectralux is to be considered United States (U.S.) origin technical data, and is export controlled. Accordingly, the receiving party is responsible for complying with all U.S. export regulations, including the U.S. Department of State International Traffic in Arms (ITAR), 22 CFR 120-130, and the U.S. Department of Commerce Export Administration Regulations (EAR), 15 CFR 730-774. Violations of these regulations are punishable by fine, imprisonment, or both. User Guide for the Envoy Data Link CHANGE RECORD APPROVAL/ PARAGRAPH DESCRIPTION OF CHANGE DATE REV Jenelle Anderson - All Initial Release July 31, 2019 All Updated with engineering feedback for terminology, implemented feeatured; Jenelle Anderson A deferred features are hidden. See ECO 15403 April 1, 2020 Document Number: UG-15000 Rev. A Page 2 of 173 User Guide for the Envoy Data Link TABLE OF CONTENTS 1 Introduction ........................................................................................................................... -

Fordham Journal of Corporate & Financial

Fordham Journal of Corporate & Financial Law Volume 14 Issue 1 Article 3 2008 Approaching Comparative Company Law David C. Donald Follow this and additional works at: https://ir.lawnet.fordham.edu/jcfl Part of the Banking and Finance Law Commons, and the Business Organizations Law Commons Recommended Citation David C. Donald, Approaching Comparative Company Law , 14 Fordham J. Corp. & Fin. L. 83 (2008). Available at: https://ir.lawnet.fordham.edu/jcfl/vol14/iss1/3 This Article is brought to you for free and open access by FLASH: The Fordham Law Archive of Scholarship and History. It has been accepted for inclusion in Fordham Journal of Corporate & Financial Law by an authorized editor of FLASH: The Fordham Law Archive of Scholarship and History. For more information, please contact [email protected]. APPROACHING COMPARATIVE COMPANY LAW David C. Donald∗ ABSTRACT This Article identifies several common errors that occur in comparative law analyses, offers guidelines to help avoid such errors, and provides a framework for studying the company laws of three major jurisdictions. Part I discusses some of the problems that can arise in comparative law and offers a few points of caution that can be useful for practical, theoretical and legislative comparative law. Part II examines well-known examples of comparative analysis gone astray in order to demonstrate the utility of heeding the outlined points of caution. Part III provides an example of using functional definitions to demarcate the topic “company law,” offering an “effects” test to determine whether a given provision of law should be considered as functionally part of the rules that govern the core characteristics of companies. -

Comparative Company Law

Comparative company law 26th of September 2017 – 3rd of October 2017 Prof. Jochen BAUERREIS Attorney in France and Germany Certified specialist in international and EU law Certified specialist in arbitration law ABCI ALISTER Strasbourg (France) • Kehl (Germany) Plan • General view of comparative company law (A.) • Practical aspects of setting up a subsidiary in France and Germany (B.) © Prof. Jochen BAUERREIS - Avocat & Rechtsanwalt 2 A. General view of comparative company law • Classification of companies (I.) • Setting up a company with share capital (II.) • Management bodies (III.) • Transfer of shares (IV.) • Taxation (V.) • General tendencies in company law (VI.) © Prof. Jochen BAUERREIS - Avocat & Rechtsanwalt 3 I. Classification of companies • General classification – Partnerships • Typically unlimited liability of the partners • Importance of the partners – The companies with share capital • Shares can be traded more or less freely • Typically restriction of the associate’s liability – Hybrid forms © Prof. Jochen BAUERREIS - Avocat & Rechtsanwalt 4 I. Classification of companies • Partnerships – « Civil partnership » • France: Société civile • Netherlands: Maatschap • Germany: Gesellschaft bürgerlichen Rechts • Austria: Gesellschaft nach bürgerlichem Recht (GesnbR) • Italy: Società simplice © Prof. Jochen BAUERREIS - Avocat & Rechtsanwalt 5 I. Classification of companies • Partnerships – « General partnership » • France: Société en nom collectif • UK: General partnership (but without legal personality!) • USA: General partnership -

FTSE Factsheet

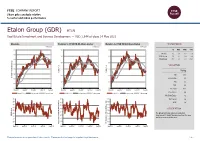

FTSE COMPANY REPORT Share price analysis relative to sector and index performance Etalon Group (GDR) ETLN Real Estate Investment and Services Development — USD 1.644 at close 14 May 2021 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 14-May-2021 14-May-2021 14-May-2021 1.9 150 150 1D WTD MTD YTD Absolute -0.5 -0.5 1.1 -5.0 1.8 140 140 Rel.Sector -1.2 3.1 2.8 -7.6 Rel.Market -1.6 0.9 0.4 -13.0 1.7 130 130 1.6 VALUATION 1.5 120 120 Trailing Relative Price Relative Price Relative 1.4 110 110 PE 45.3 Absolute Price (local currency) (local Price Absolute 1.3 EV/EBITDA 8.5 100 100 PB 0.7 1.2 PCF 3.4 1.1 90 90 Div Yield 10.4 May-2020 Aug-2020 Nov-2020 Feb-2021 May-2021 May-2020 Aug-2020 Nov-2020 Feb-2021 May-2021 May-2020 Aug-2020 Nov-2020 Feb-2021 May-2021 Price/Sales 0.4 Absolute Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Net Debt/Equity 1.0 90 90 90 Div Payout +ve 80 80 80 ROE 1.4 70 70 70 Share Index) Share Share Sector) Share - 60 - 60 60 DESCRIPTION 50 50 50 40 40 The Group's principal activity is residential 40 RSI RSI (Absolute) 30 30 development in Saint-Petersburg metropolitan area and Moscow metropolitan area. -

Siemens Annual Report 2019

Annual Report 2019 siemens.com Table of contents A B C Combined Consolidated Additional Information Management Report Financial Statements A.1 p 2 B.1 p 76 C.1 p 150 Organization of the Siemens Group Consolidated Statements Responsibility Statement and basis of presentation of Income C.2 p 151 A.2 p 3 B.2 p 77 Independent Auditor ʼs Report Financial performance system Consolidated Statements of Comprehensive Income C.3 p 157 A.3 p 5 Report of the Supervisory Board Segment information B.3 p 78 Consolidated Statements C.4 p 162 A.4 p 16 of Financial Position Corporate Governance Results of operations B.4 p 79 C.5 p 174 A.5 p 19 Consolidated Statements Notes and forward- looking Net assets position of Cash Flows statements B.5 p 80 A.6 p 20 Financial position Consolidated Statements of Changes in Equity A.7 p 24 B.6 p 82 Overall assessment of the economic position Notes to Consolidated Financial Statements A.8 p 26 Report on expected developments and associated material opportunities and risks A.9 p 38 Siemens AG A.10 p 40 Compensation Report A.11 p 71 Takeover-relevant information Combined Management Report Pages 1 – 74 A.1 Organization of the Siemens Group and basis of pr esentation Siemens is a technology company that is active in nearly all coun- Non-financial matters of the Group tries of the world, focusing on the areas of automation and digi- and Siemens AG talization in the process and manufacturing industries, intelligent Siemens has policies for environmental, employee and social infrastructure for buildings and distributed energy systems, con- matters, for the respect of human rights, and anti-corruption and ventional and renewable power generation and power distribu- bribery matters, among others. -

Siemens Annual Report 2020

Annual Report 2020 Table of A. contents Combined Management Report A.1 Organization of the Siemens Group and basis of presentation 2 A.2 Financial performance system 3 A.3 Segment information 6 A.4 Results of operations 18 A.5 Net assets position 22 A.6 Financial position 23 A.7 Overall assessment of the economic position 27 A.8 Report on expected developments and as sociated material opportunities and risks 29 A.9 Siemens AG 46 A.10 Compensation Report 50 A.11 Takeover-relevant information 82 B. Consolidated Financial Statements B.1 Consolidated Statements of Income 88 B.2 Consolidated Statements of Comprehensive Income 89 B.3 Consolidated Statements of Financial Position 90 B.4 Consolidated Statements of Cash Flows 92 B.5 Consolidated Statements of Changes in Equity 94 B.6 Notes to Consolidated Financial Statements 96 C. Additional Information C.1 Responsibility Statement 166 C.2 Independent Auditor ʼs Report 167 C.3 Report of the Super visory Board 176 C.4 Corporate Governance 184 C.5 Notes and forward-looking s tatements 199 PAGES 1 – 86 A. Combined Management Report Combined Management Report A.1 Organization of the Siemens Group and basis of presentation A.1 Organization of the Siemens Group and basis of presentation Siemens is a technology company that is active in nearly all Reconciliation to Consolidated Financial Statements is countries of the world, focusing on the areas of automation Siemens Advanta, formerly Siemens IoT Services, a stra- and digitalization in the process and manufacturing indus- tegic advisor and implementation partner in digital trans- tries, intelligent infrastructure for buildings and distributed formation and industrial internet of things (IIoT). -

East Capital Sustainable Investment Report 2018

Sustainable investment report: ESG — a key tool for emerging and frontier market investments Sustainable investment report About East Capital East Capital is an independent asset manager Long-term specialised in emerging and frontier We focus on companies with long-term markets, founded in Sweden in 1997, with growth prospects and position our strategies offices in Dubai, Hong Kong, Luxembourg, to outperform their respective benchmarks Moscow, Oslo, Stockholm and Tallinn. We within three to five years. While we can make manage public equity funds, real estate funds some short-term adjustments, we do so with- and separate accounts, for a broad out sacrificing the overall long-term focus and international client base, including the low core turnover of the portfolios. leading institutions. Our investment strategy is based on in-depth Local company knowledge gained through Meeting frequently with company owners, proprietary fundamental analysis and management teams and policymakers is an frequent company meetings. We care fully integral part of the investment process. Such consider ESG-related risks and opportunities meetings give us in-depth local knowledge in our investment process, and favour that help us make better informed investment companies with long-term, sustainable decisions. growth prospects and responsible owners. Since day one, we have set out to be a long- Research-driven term, active and responsible investor. Over Diligent research is essential for identifying the years, our investment teams have key performance drivers and correctly interacted with thousands of companies, assessing risk. We rely on our own research, management teams, regulators, governments including risk scenarios and a proprietary and other investors. -

No 2157/2001 of 8 October 2001 on the Statute for a European Company (SE)

2001R2157 — EN — 01.07.2013 — 003.001 — 1 This document is meant purely as a documentation tool and the institutions do not assume any liability for its contents ►B COUNCIL REGULATION (EC) No 2157/2001 of 8 October 2001 on the Statute for a European company (SE) (OJ L 294, 10.11.2001, p. 1) Amended by: Official Journal No page date ►M1 Council Regulation (EC) No 885/2004 of 26 April 2004 L 168 1 1.5.2004 ►M2 Council Regulation (EC) No 1791/2006 of 20 November 2006 L 363 1 20.12.2006 ►M3 Council Regulation (EU) No 517/2013 of 13 May 2013 L 158 1 10.6.2013 2001R2157 — EN — 01.07.2013 — 003.001 — 2 ▼B COUNCIL REGULATION (EC) No 2157/2001 of 8 October 2001 on the Statute for a European company (SE) THE COUNCIL OF THE EUROPEAN UNION, Having regard to the Treaty establishing the European Community, and in particular Article 308 thereof, Having regard to the proposal from the Commission (1 ), Having regard to the opinion of the European Parliament (2 ), Having regard to the opinion of the Economic and Social Committee (3 ), Whereas: (1) The completion of the internal market and the improvement it brings about in the economic and social situation throughout the Community mean not only that barriers to trade must be removed, but also that the structures of production must be adapted to the Community dimension. For that purpose it is essential that companies the business of which is not limited to satisfying purely local needs should be able to plan and carry out the reorganisation of their business on a Community scale. -

The German Supervisory Board

The German Supervisory Board: A Practical Introduction for US Public Company Directors The German Supervisory Board: | A Practical Introduction for US Public Company Directors The German Supervisory Board: | A Practical Introduction for US Public Company Directors Contents Foreword Foreword 03 As the world’s economy globalizes, there is often an expectation that business practices will Executive Summary 04 harmonize along with it. This is an expectation The German Supervisory Board: Characteristics and Context 05 that we will see a kind of convergence of corporate The German Supervisory Board in Action: Regular Order, M&A, Crisis 14 governance forms and practices, where boards the world over resemble each other, perhaps Conclusion 15 with a large majority of independent directors, an Endnotes 17 audit committee, a separate chair and CEO, and so on. A lot of this reflects a certain familiarity Claus Buhleier with the Anglo-Saxon board model among Partner, Center for Corporate institutional investors in London and New York. Governance Deloitte Germany [email protected] The reality, however, is quite different. Despite real advances in globalization in other areas, differences in what boards look like and how they work in practice persist across countries. This publication brings to light the differences between the predominant Anglo Saxon, one-tier corporate governance model on the one hand, and the still influential Germanic two-tier-model on the other. The authors, Yvonne Schlaeppi and Michael Marquardt, both experienced corporate directors Kai Bruehl who have served on European company boards, Director, Risk Advisory Deloitte highlight the main characteristics of the German Germany [email protected] supervisory board model and how it demands accountability from its members, despite looking rather different than the combined board model.