Oberoi Realty Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Nominee List

NOMINEE LIST Best financial reporting (large cap) Cipla Hindalco Industries Hindustan Unilever Infosys Kotak Mahindra Bank Mahindra & Mahindra Piramal Enterprises Tata Steel Vedanta Best financial reporting (small to mid-cap) CEAT Everest Industries Hikal Hindustan Foods IIFL Holdings KEC International Minda Industries Raymond The Phoenix Mills Zensar Technologies Best investor meetings (large cap) Bharti Airtel Hindustan Unilever Infosys Lupin Mahindra & Mahindra Piramal Enterprises Best investor meetings (mid-cap) Balkrishna Industries IIFL Holdings Mindtree RPG Group Sterlite Technologies The Phoenix Mills NOMINEE LIST Best investor meetings (small cap) Amber Enterprises India Equitas Holdings Greenlam Industries Music Broadcast Navin Fluorine International NOCIL Raymond Zensar Technologies Best investor relations officer (large cap) Bharti Airtel Komal Sharan Bharti Airtel Aparna Vyas Garg Bharti Infratel Surabhi Chandna Cipla Naveen Bansal HDFC Conrad D'Souza Hindustan Unilever Suman Hegde Infosys Sandeep Mahindroo Kotak Mahindra Bank Nimesh Kampani Lupin Arvind Bothra Best investor relations officer (small to mid-cap) CEAT Pulkit Bhandari Jindal Steel & Power Nishant Baranwal Motilal Oswal Financial Services Rakesh Shinde PNB Housing Finance Deepika Gupta Padhi Raymond J Mukund RPG Group Pulkit Bhandari Schneider Electric Infrastructure Vineet Jain The Phoenix Mills Varun Parwal NOMINEE LIST Best investor relations team (large cap) Bharti Airtel Cipla Hindustan Unilever Infosys Kotak Mahindra Bank Larsen & Toubro Infotech Power -

Statement of Unclaimed and Unpaid Dividend for the Financial Year 2010-11

OBEROI REALTY LIMITED Statement of unclaimed and unpaid dividend for the Financial Year 2010-11 Proposed Date of transfer to Investor First Investor Middle Investor Last Father/Husband Father/Husband Father/Husband Last DP Id-Client Id-Account Amount Address Country State District Pin Code Investment Type IEPF Name Name Name First Name Middle Name Name Number transferred (DD-MON-YYYY) H NO 13-1/16 VEENAPANI Amount for unclaimed and A V JANARDHAN NA NAGAR MALKAJGIRI INDIA Andhra Pradesh 500047 IN30286310064708 unpaid dividend 100.00 06-Aug-2018 111054 PUSHPA NAGAR CHA BHAG PAVDE V ADI ROAD RAMANAND NGR MAUR Amount for unclaimed and ABHISHEK A NERALKAR NA VIHAR PUS HPA NAGAR INDIA Maharashtra 431602 IN30051319254330 unpaid dividend 10.00 06-Aug-2018 P-47 SHIVALIK NAGAR BHEL Amount for unclaimed and ABHISHEK BAGARIA GOPALBAGARIA HARIDWAR INDIA Uttar Pradesh 249407 IN30177412372217 unpaid dividend 60.00 06-Aug-2018 Amount for unclaimed and ABHITAJ TAYAL NA 122 ANAJ MANDI INDIA Haryana 125050 IN30240410135217 unpaid dividend 200.00 06-Aug-2018 KALLIVAYALIL HOUSE Amount for unclaimed and ABRAHAM JOSEPH NA KALAKETTY P O KOTTAYAM INDIA Kerala 686508 IN30189510002643 unpaid dividend 20.00 06-Aug-2018 183, KUMAR KRUPA NEAR OLD EMPLOYMENT EXCHANGE Amount for unclaimed and ADVI ACHARYA NA VISHVESHWARNAGAR, INDIA Karnataka 580032 IN30112715685676 unpaid dividend 200.00 06-Aug-2018 C/O SUNIL JAIN JAIN Amount for unclaimed and AJIT POKHARANA NA MOHALLA SALEHA SALEHA INDIA Madhya Pradesh 488333 1301930000578237 unpaid dividend 60.00 06-Aug-2018 H NO -

Oberoi Eternia

https://www.propertywala.com/oberoi-eternia-mumbai Oberoi Eternia - Mulund West, Mumbai 3 & 4 BHK apartments available in Oberoi Eternia Oberoi Realty presents Oberoi Eternia with 3 & 4 BHK apartments available in Mulund West, Mumbai Project ID : J811900467 Builder: Oberoi Realty Location: Oberoi Eternia, Mulund West, Mumbai (Maharashtra) Completion Date: Jan, 2016 Status: Started Description Oberoi Eternia is a new launch residential project by Oberoi Realty. It has a thoughtful design and is well equipped with all the modern day amenities as well as basic facilities. The project offers spacious and skillfully designed 3 & 4 BHK apartments. Features Air conditioned RO water system Private terrace/ garden Waste disposal Water storage Security Centrally air conditioned Corner property Oberoi Realty is a well known real estate company. It is a constant quest and an abiding commitment to ensure that the relationship between these spaces and the lives ensconced in or around, feel truly enriched - enhanced by understanding what a discerning lifestyle demands. Mumbai is a place which has ever-evolving and reverberating city, is in a constant quest for spaces that can not only accommodate but also build efficiency for its everyday flight of ambition and purpose-led growth. Features Luxury Features Security Features Power Back-up Centrally Air Conditioned Lifts Security Guards Electronic Security RO System High Speed Internet Wi-Fi Intercom Facility Interior Features Exterior Features Woodwork Modular Kitchen Reserved Parking Visitor Parking -

India Daily, July 09,2018

INDIA DAILY July 9, 2018 India 6-Jul 1-day 1-mo 3-mo Sensex 35,658 0.2 0.6 5.5 Nifty 10,773 0.2 0.0 3.8 Contents Global/Regional indices Dow Jones 24,456 0.4 (3.4) 2.0 Daily Alerts Nasdaq Composite 7,688 1.3 0.6 10.6 Change in Reco FTSE 7,618 0.2 (0.8) 5.9 Oberoi Realty: Beyond FY2018 - time to accelerate Nikkei 22,023 1.1 (3.0) 1.6 Hang Seng 28,818 1.8 (6.9) (4.7) Company alerts KOSPI 2,286 0.6 (6.7) (6.4) Tech Mahindra: AR analysis - acquisitions perform better in FY2018 Value traded – India Cash (NSE+BSE) 310 305 333 Sobha: Strong sales momentum, diversified contribution Derivatives (NSE) 4,566 8,298 4,687 Deri. open interest 3,319 3,701 3,482 Sector alerts Infrastructure: Logistics - steady march ahead for organized players Forex/money market Infrastructure: Logistics: swiftly moving towards integrated offerings Change, basis points 6-Jul 1-day 1-mo 3-mo Rs/US$ 68.9 (6) 195 390 10yr govt bond, % 8.2 - 3 68 Net investment (US$ mn) 5-Jul MTD CYTD FIIs 36 73 (549) MFs 5 116 10,607 Top movers Change, % Best performers 6-Jul 1-day 1-mo 3-mo TCS IN Equity 1,913 1.7 9.5 30.8 KMB IN Equity 1,371 0.5 4.0 22.6 HUVR IN Equity 1,678 (0.6) 5.2 20.6 NEST IN Equity 9,943 (0.1) 0.5 18.6 MM IN Equity 925 1.4 1.5 17.6 Worst performers HDIL IN Equity 20 1.0 (12.3) (52.3) RCOM IN Equity 14 0.4 (14.5) (43.1) UT IN Equity 4 (2.4) (21.2) (38.3) IDBI IN Equity 48 0.3 (22.1) (34.5) SHTF IN Equity 1,112 (3.5) (23.1) (28.7) For Private Circulation Only. -

Global Equity Fund Description Plan 3S DCP & JRA MICROSOFT CORP

Global Equity Fund June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA MICROSOFT CORP 2.5289% 2.5289% APPLE INC 2.4756% 2.4756% AMAZON COM INC 1.9411% 1.9411% FACEBOOK CLASS A INC 0.9048% 0.9048% ALPHABET INC CLASS A 0.7033% 0.7033% ALPHABET INC CLASS C 0.6978% 0.6978% ALIBABA GROUP HOLDING ADR REPRESEN 0.6724% 0.6724% JOHNSON & JOHNSON 0.6151% 0.6151% TENCENT HOLDINGS LTD 0.6124% 0.6124% BERKSHIRE HATHAWAY INC CLASS B 0.5765% 0.5765% NESTLE SA 0.5428% 0.5428% VISA INC CLASS A 0.5408% 0.5408% PROCTER & GAMBLE 0.4838% 0.4838% JPMORGAN CHASE & CO 0.4730% 0.4730% UNITEDHEALTH GROUP INC 0.4619% 0.4619% ISHARES RUSSELL 3000 ETF 0.4525% 0.4525% HOME DEPOT INC 0.4463% 0.4463% TAIWAN SEMICONDUCTOR MANUFACTURING 0.4337% 0.4337% MASTERCARD INC CLASS A 0.4325% 0.4325% INTEL CORPORATION CORP 0.4207% 0.4207% SHORT-TERM INVESTMENT FUND 0.4158% 0.4158% ROCHE HOLDING PAR AG 0.4017% 0.4017% VERIZON COMMUNICATIONS INC 0.3792% 0.3792% NVIDIA CORP 0.3721% 0.3721% AT&T INC 0.3583% 0.3583% SAMSUNG ELECTRONICS LTD 0.3483% 0.3483% ADOBE INC 0.3473% 0.3473% PAYPAL HOLDINGS INC 0.3395% 0.3395% WALT DISNEY 0.3342% 0.3342% CISCO SYSTEMS INC 0.3283% 0.3283% MERCK & CO INC 0.3242% 0.3242% NETFLIX INC 0.3213% 0.3213% EXXON MOBIL CORP 0.3138% 0.3138% NOVARTIS AG 0.3084% 0.3084% BANK OF AMERICA CORP 0.3046% 0.3046% PEPSICO INC 0.3036% 0.3036% PFIZER INC 0.3020% 0.3020% COMCAST CORP CLASS A 0.2929% 0.2929% COCA-COLA 0.2872% 0.2872% ABBVIE INC 0.2870% 0.2870% CHEVRON CORP 0.2767% 0.2767% WALMART INC 0.2767% -

India Daily, September 5, 2011

INDIA DAILY September 5, 2011 India 2-Sep 1-day1-mo 3-mo Sensex 16,821 0.9 (2.8) (8.5) Nifty 5,040 0.8 (3.3) (8.6) Contents Global/Regional indices Daily Alerts Dow Jones 11,240 (2.2) (1.8) (7.5) Nasdaq Composite 2,480 (2.6) (2.1) (9.2) Change in Reco FTSE 5,292 (2.3) 0.9 (9.6) GAIL (India): Upgrade to BUY Nikkie 8,804 (1.6) (5.3) (7.3) Company Hang Seng 19,805 (2.0) (5.4) (13.7) KOSPI 1,816 (2.8) (6.6) (14.1) JSW Steel: Impact on production likely Value traded – India Sector Cash (NSE+BSE) 150 137 134 Property: Sticking with quality Derivatives (NSE) 832 958 726 Strategy Deri. open interest 1,150 1,113 1,183 Strategy: Emerging market ETFs see very large outflows amidst global concerns Forex/money market Change, basis points 2-Sep 1-day 1-mo 3-mo Rs/US$ 45.8 (1) 105 103 10yr govt bond, % 8.4 3 (7) 8 Net investment (US$mn) 30-Aug MTD CYTD FIIs 147 - (93) MFs 58 - (282) Top movers -3mo basis Change, % Best performers 2-Sep 1-day 1-mo 3-mo IDEA IN Equity 100.3 0.3 4.5 42.6 BJAUT IN Equity 1628.1 3.5 16.4 18.3 MM IN Equity 765.1 3.7 17.1 14.5 BPCL IN Equity 682.6 1.2 (2.8) 9.9 NEST IN Equity 4492.2 2.3 6.0 9.7 Worst performers EDSL IN Equity 197.1 (3.5) (34.8) (56.3) IVRC IN Equity 35.8 2.1 (28.7) (48.5) CRG IN Equity 150.3 (0.1) (4.8) (42.4) HDIL IN Equity 105.7 3.5 (14.8) (34.7) ESOIL IN Equity 87.7 (0.8) (13.9) (31.6) For Private Circulation Only. -

Oberoi Realty Limited Since May 2014

Chairman’s Message 02 Prole of our Board of Directors 04 Director’s Report 06 Management Discussion and Analysis 31 Corporate Governance 41 Business Responsibility Report 59 Financial Statements 72 ARCHITECTURAL INNOVATION, SUPERIOR EXECUTION AND FINANCIAL PRUDENCE MAKES 03 OBEROI REALTY ONE OF Decades plus rich experience THE LEADING REAL ESTATE BRANDS IN THE COUNTRY. Understanding emerging trends and evolving consumer behaviour has always been the source of our design philosophy and innovation. We aim to create self-sustaining ecosystem that offer a safe environment and fulfilling lifestyle, 42 thus taking care of the happiness quotient of its Completed projects occupants. At Oberoi Realty, we believe in at strategic locations pursuing excellence through customer centricity across the and perfection in every detail. Mumbai skyline Residential Commercial 45.31 Retail Million sq.ft. area under construction Social Infrastructure as on March 31, 2021 Hospitality At Oberoi Realty, our vision is to build contemporary and sustainable developments that will offer a better quality of life for our customers. 2 Annual Report 2020-21 Dear Shareholders, infrastructure, workspaces, shopping, dining and entertainment destinations. Furthermore, developers with high brand equity, We wish that you are safe, healthy and taking all precautions for financial prudence, proven track record of construction quality your wellbeing. and delivery saw a consolidation of demand in their favour. The FY21 started with the onset of Covid-19 pandemic which by now convergence of these changing consumer preferences, has truly transformed several aspects of our life. The challenging consolidation in the sector and low home loan interest rates situation made everyone more empathetic and sensitive towards ensured a stupendous sales performance in FY21 for the life and the world at large. -

National Stock Exchange of India Limited

NATIONAL STOCK EXCHANGE OF INDIA LIMITED DEPARTMENT : LISTING Download Ref. No.: NSE/CML/34240 Date : February 22, 2017 Circular Ref. No.: 0158/2017 To All Members, Sub: Listing of further issues of 3i Infotech Limited, DCB Bank Limited, ICICI Bank Limited, IDFC Bank Limited, Magma Fincorp Limited, Oberoi Realty Limited, Polaris Consulting & Services Limited and Tech Mahindra Limited In pursuance of Regulation 3.1.1 of the National Stock Exchange (Capital Market) Trading Regulations Part A, it is hereby notified that the list of securities further admitted to dealings on the National Stock Exchange (Capital Market segment) with effect from February 23, 2017 the designated security codes thereof shall be as specified in Annexure. In pursuance of Regulation 2.5.5 of the National Stock Exchange (Capital Market) Trading Regulations Part A, it is hereby notified that the respective lot sizes in respect of securities above shall be as specified in Annexure. For the purpose of trading on the system, the security shall be identified only by its designated codes and trading in such securities shall be in such lot sizes as specified in Annexure. This circular shall be effective from February 23, 2017. For and on behalf of National Stock Exchange of India Limited Divya Poojari Manager Telephone No +91-22-26598235/36, 8346 Regd. Office: Exchange Plaza, Plot No. C/1, G-Block, Bandra-Kurla Complex, Bandra (E), Mumbai 400 051, India CIN: U67120MH1992PLC069769 Tel: +91 22 26598235/36 , 26598346, 26598459 /26598458 Web site: www.nseindia .com Continuation Sheet ANNEXURE 1. 3i Infotech Limited Symbol 3IINFOTECH Name of the Company 3i Infotech Limited Series EQ ISIN* INE748C01020 Face Value (In Rs.) 10 Paid-up Value (In Rs.) 10 Issue Price (In Rs.) 10 Security Description Equity shares of Rs. -

Aegon Life Indepth May 2021.Pdf

MAY 2021 IN-DEPTH INVESTMENT BULLETIN OF AEGON LIFE INSURANCE COMPANY LTD AEGON, toh tension gone. INDEX Description Page No. Enhanced Equity Fund 6 Accelerator Fund 7 Pension Enhanced Equity Fund 8 Pension Index Fund 9 Group Equity Fund 10 Blue Chip Equity Fund 11 Opportunity Fund 12 Debt Fund 14 Pension Debt Fund 15 Secure Fund 16 Pension Secure Fund 17 Conservative Fund 18 Balanced Fund 20 Pension Balanced Fund 22 Stable Fund 24 NAVPF Fund 26 Indepth | May 2021 | 2 Commentary on the Indian Securities Market for April 2021 Nifty (down 0.4%) was largely flat in April post a flattish march. The covid situation has worsened in the month of April in India leading to different levels of lockdowns in various states. The vaccination program for the age group of 18-44 years has been allowed from 1 st May. However, vaccination availability is a concern in the short term and may lead to some delays. The dollar index corrected after three months of up move. It was down 2.09% and closed at 91.28 level. Despite the fall in Dollar index, the rupee was weak and depreciated by 97 paise to close at 74.08 level. Brent Crude gained almost 6% after one month of correction and ended at 67.25 level. Gold was up by 3.6% after three months of correction. Foreign institutional investors (FIIs) investment turned negative after six month of positive inflows. They sold about $1.3 bn worth of equity in April. Domestic institutional investors (DIIs) investment continued to be positive for a second month in a row. -

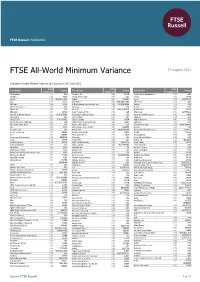

FTSE All-World Minimum Variance

2 FTSE Russell Publications 19 August 2021 FTSE All-World Minimum Variance Indicative Index Weight Data as at Closing on 30 June 2021 Index Index Index Constituent Country Constituent Country Constituent Country weight (%) weight (%) weight (%) 3M Company 0.1 USA Ajinomoto Co 0.05 JAPAN Annaly Capital Management 0.07 USA 3M India 0.02 INDIA Akamai Technologies 0.14 USA Anritsu 0.03 JAPAN a2 Milk 0.03 NEW ZEALAND Akbank 0.01 TURKEY Ansell 0.02 AUSTRALIA A2A 0.01 ITALY Akzo Nobel 0.02 NETHERLANDS ANSYS Inc 0.08 USA ABB India 0.04 INDIA Al Rajhi Banking & Investment Corp 0.04 SAUDI ARABIA Anthem 0.08 USA Abbott Laboratories 0.09 USA Albemarle 0.06 USA Aon plc 0.09 USA AbbVie Inc 0.11 USA Alcon AG 0.02 SWITZERLAND Aozora Bank 0.03 JAPAN ABC-Mart 0.03 JAPAN Aldar Properties PJSC 0.02 UAE APA Group 0.02 AUSTRALIA Abdullah Al Othaim Markets 0.04 SAUDI ARABIA Alexandria Real Estate Equity 0.09 USA Apollo Hospitals Enterprise 0.04 INDIA Abiomed Inc 0.11 USA Alexion Pharm 0.12 USA Apple Inc. 0.09 USA Aboitiz Power 0.02 PHILIPPINES Alfresa Holdings 0.02 JAPAN Applied Materials 0.06 USA Abu Dhabi Commercial Bank 0.02 UAE Alibaba Pictures Group (P Chip) 0.02 CHINA Aptiv PLC 0.04 USA Abu Dhabi Islamic Bank 0.03 UAE Align Technology Inc 0.05 USA Arab National Bank 0.03 SAUDI ARABIA ACC 0.04 INDIA Alimentation Couche-Tard B 0.02 CANADA Aramark 0.04 USA Accenture Cl A 0.09 USA Alinma Bank 0.04 SAUDI ARABIA Arca Continental SAB de CV 0.03 MEXICO Accton Technology 0.03 TAIWAN A-Living Services (H) 0.02 CHINA Arcelik 0.01 TURKEY Acer 0.04 TAIWAN Alkem Laboratories -

Market Insight

Wednesday, May 30th, 2018 MARKET INSIGHT CLOSE PREV CLOSE % CHANGE SUPPORT RESISTANCE 50 DMA 200 DMA NSE 10,614 10,633 0.18 10,664 10,929 10,439 10,317 BANK NIFTY 26,327 26,254 0.28 25,980 26,407 25,014 25,121 SHORT STORY MARKET BREADTH :NEGATIVE TOTAL ADVANCES DECLINES UNCHANGED TRADED “Our favorite holding period is forever” NSE 757 1040 59 1856 MARKET SUMMARY NEW 52 WEEK HIGH NSE LTP 52 WEEK HIGH Markets witnessed a volatile trading session before ending the session on ASTRAL POLY flat a note just by 19 points at 10,614. Initially the index made gap down 1012 1019 opening by 53 points amid concerns about political uncertainty in Italy. M&M 894.50 901 Bank Nifty outperformed today and ended at 26,327 up by 73 points led DMART 1565.50 1571.70 by gains in PSU stocks. NEW 52 WEEK LOW NSE LTP 52 WEEK LOW NIFTY RESISTANCE SUPPORT ABAN 146.30 143.20 O – 10,579 R1 – 10,655.88 S1 – 10,565.63 EVEREADY 250.50 240.10 H – 10,648.50 R2 – 10,697.42 S2 – 10,516.92 GET&D 311 305.60 L – 10558.45 R3 – 10,787.67 S3 – 10,426.67 STOCKS NEAR 52 WEEK HIGH C – 10,614.35 R4 – 10,877.92 S4 – 10,336.42 NSE LTP 52 WEEK HIGH PIDILITE 1187.80 1195.40 BANK NIFTY RESISTANCE SUPPORT HDFC BANK 2048.35 2065 O - 26,039.90 R1 – 26,495.22 S1 -26,070.62 BIOCON 674.90 683 H – 26,405.40 R2 – 26,662.63 S2 – 25,813.43 TATA ELXI 1238.25 1259.90 L – 25,980.85 R3 – 27,087.23 S3 – 25,388.83 DABUR 381.90 389.25 C – 26,327.80 R4 – 27,511.83 S4 – 24,694.23 STOCKS NEAR 52 WEEK LOW NSE LTP 52 WEEK LOW M&M, Bajaj finance, Kotak bank were the major gainers of the day while INGERSOL RSND 554.40 552.05 HPCL, Tata Motors, Hindalco were the major losers of the day. -

Templeton Global Opportunities Trust July 31, 2018

Templeton Global Opportunities Trust July 31, 2018 Templeton Global Opportunities July 31, 2018 Trust Portfolio Holdings The following portfolio data for the Franklin Templeton funds is made available to the public under our Portfolio Holdings Release Policy and is "as of" the date indicated. This portfolio data should not be relied upon as a complete listing of a fund's holdings (or of a fund's top holdings) as information on particular holdings may be withheld if it is in the fund's interest to do so. Additionally, foreign currency forwards are not included in the portfolio data. Instead, the net market value of all currency forward contracts is included in cash and other net assets of the fund. Further, portfolio holdings data of over-the-counter derivative investments such as Credit Default Swaps, Interest Rate Swaps or other Swap contracts list only the name of counterparty to the derivative contract, not the details of the derivative. Complete portfolio data can be found in the semi- and annual financial statements of the fund. Security Security Shares/ Market % of Coupon Maturity Identifier Name Positions Held Value TNA Rate Date 5927375 AEGON NV 567,341 $3,743,816 0.89% N/A N/A G0177J108 ALLERGAN PLC 27,880 $5,132,429 1.22% N/A N/A 02079K305 ALPHABET INC 4,340 $5,326,134 1.27% N/A N/A 031162100 AMGEN INC 41,820 $8,219,721 1.96% N/A N/A 037411105 APACHE CORP 82,680 $3,803,280 0.91% N/A N/A 7088429 AXA SA 143,232 $3,618,521 0.86% N/A N/A 0263494 BAE SYSTEMS PLC 502,879 $4,312,621 1.03% N/A N/A B0FXT17 BAIDU INC 25,580 $6,322,864