8881 Japan Annual Report April 2013 8881 Japan

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Published on July 21, 2021 1. Changes in Constituents 2

Results of the Periodic Review and Component Stocks of Tokyo Stock Exchange Dividend Focus 100 Index (Effective July 30, 2021) Published on July 21, 2021 1. Changes in Constituents Addition(18) Deletion(18) CodeName Code Name 1414SHO-BOND Holdings Co.,Ltd. 1801 TAISEI CORPORATION 2154BeNext-Yumeshin Group Co. 1802 OBAYASHI CORPORATION 3191JOYFUL HONDA CO.,LTD. 1812 KAJIMA CORPORATION 4452Kao Corporation 2502 Asahi Group Holdings,Ltd. 5401NIPPON STEEL CORPORATION 4004 Showa Denko K.K. 5713Sumitomo Metal Mining Co.,Ltd. 4183 Mitsui Chemicals,Inc. 5802Sumitomo Electric Industries,Ltd. 4204 Sekisui Chemical Co.,Ltd. 5851RYOBI LIMITED 4324 DENTSU GROUP INC. 6028TechnoPro Holdings,Inc. 4768 OTSUKA CORPORATION 6502TOSHIBA CORPORATION 4927 POLA ORBIS HOLDINGS INC. 6503Mitsubishi Electric Corporation 5105 Toyo Tire Corporation 6988NITTO DENKO CORPORATION 5301 TOKAI CARBON CO.,LTD. 7011Mitsubishi Heavy Industries,Ltd. 6269 MODEC,INC. 7202ISUZU MOTORS LIMITED 6448 BROTHER INDUSTRIES,LTD. 7267HONDA MOTOR CO.,LTD. 6501 Hitachi,Ltd. 7956PIGEON CORPORATION 7270 SUBARU CORPORATION 9062NIPPON EXPRESS CO.,LTD. 8015 TOYOTA TSUSHO CORPORATION 9101Nippon Yusen Kabushiki Kaisha 8473 SBI Holdings,Inc. 2.Dividend yield (estimated) 3.50% 3. Constituent Issues (sort by local code) No. local code name 1 1414 SHO-BOND Holdings Co.,Ltd. 2 1605 INPEX CORPORATION 3 1878 DAITO TRUST CONSTRUCTION CO.,LTD. 4 1911 Sumitomo Forestry Co.,Ltd. 5 1925 DAIWA HOUSE INDUSTRY CO.,LTD. 6 1954 Nippon Koei Co.,Ltd. 7 2154 BeNext-Yumeshin Group Co. 8 2503 Kirin Holdings Company,Limited 9 2579 Coca-Cola Bottlers Japan Holdings Inc. 10 2914 JAPAN TOBACCO INC. 11 3003 Hulic Co.,Ltd. 12 3105 Nisshinbo Holdings Inc. 13 3191 JOYFUL HONDA CO.,LTD. -

News Release Nomura Holdings Possible Loss Arising From

News Release Possible Loss Arising from Business Activities Tokyo, March 29, 2021—Nomura Holdings, Inc. today announced that on March 26, 2021, an event occurred that could subject one of its US subsidiaries to a significant loss arising from transactions with a US client. Nomura is currently evaluating the extent of the possible loss and the impact it could have on its consolidated financial results. The estimated amount of the claim against the client is approximately $2 billion based on market prices as of March 26. This estimate is subject to change depending on unwinding of the transactions and fluctuations in market prices. Nomura will continue to take the appropriate steps to address this issue and make a further disclosure once the impact of the potential loss has been determined. As of the end of December 2020, Nomura maintained a consolidated Common Equity Tier 1 ratio of over 17 percent, which is substantially higher than the minimum regulatory requirement. Accordingly, there will be no issues related to the operations or financial soundness of Nomura Holdings or its US subsidiary. ends Nomura Nomura is a global financial services group with an integrated network spanning over 30 countries. By connecting markets East & West, Nomura services the needs of individuals, institutions, corporates and governments through its three business divisions: Retail, Asset Management, and Wholesale (Global Markets and Investment Banking), and Merchant Banking. Founded in 1925, the firm is built on a tradition of disciplined entrepreneurship, serving clients with creative solutions and considered thought leadership. For further information about Nomura, visit www.nomura.com. -

Research Template

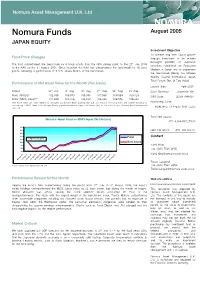

Nomura Asset Management U.K. Ltd Nomura Funds August 2005 JAPAN EQUITY Investment Objective To achieve long term capital growth Fund Price Changes through investment in an actively managed portfolio of Japanese The fund outperformed the benchmark by 6 basis points from the NAV pricing point on the 27th July 2005 securities listed/dealt on Regulated to the NAV on the 31 August 2005. Since inception the fund has outperformed the benchmark by 78 basis Markets in Japan and to outperform points, delivering a performance of 9.12% verses 8.34% of the benchmark. the Benchmark [Being the Morgan Stanley Capital International Japan Total Return (Net of Tax) Index]. Performance of Net Asset Value for the Month (Yen basis) Launch date: April 2005 th rd th th th Period 27 July 3 Aug 10 Aug 17 Aug 24 Aug 31 Aug Base Currency: Japanese Yen Fund (NAVps)* 102,335 103,970 105,080 107,565 109,584 109,123 ISIN Code: LU0217998821 Index (MSCI Japan)** 101,659 102,916 104,224 106,234 108,576 108,340 *Net Asset Value per share (NAVps) is calculated by Nomura Bank (Luxembourg) S.A. according to the prospectus and market standards in Bloomberg Code: Luxembourg. **MSCI Japan is the Morgan Stanley Capital International Japan Total Return (Net of Tax) Index Source: Nomura Asset Management NOMJAEQ LX Equity DES <GO> U.K. Ltd Total Net Assets: Nomura Japan Fund vs MSCI Japan (Net Return) JPY 4,034,857,279.00 110 108 NAV Per Share: JPY 109,123.00 106 104 Fund Contact 102 12-Apr-05, Inception 100 Dt Benchmark 98 Yuhki King 96 +44 (0)20 7521 2635 94 5 5 5 5 [email protected] 5 5 5 5 0 0 0 0 5 5 5 5 5 5 5 -0 -0 -0 -0 - - 05 05 -0 -0 05 0 0 0 05 05 -0 05 05 r r r r y- y- n- n- n n n- l- l-0 l- l- g- g- g- g- p p p ay a a ay u u u u u Ap M M J J J Ju Ju Ju Ju u u ug u u -A -A -A -M -M - - -J -J - - - - - -A -A -A -A -A 0- 1- 8- 1 8 9 6 0 7 7 06 13 2 27 04 1 1 25 0 0 15 22 2 0 13 2 2 03 10 1 24 31 Trevor Langford Source: Nomura Asset Management U.K. -

Nomura Holdings 104Th Fiscal Year First Quarterly Report (PDF)

FORM 6-K U.S. SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Report of Foreign Private Issuer Pursuant to Rule 13a-16 or 15d-16 of the Securities Exchange Act of 1934 Commission File Number: 1-15270 For the month of September 2007. NOMURA HOLDINGS, INC. (Translation of registrant's name into English) 9-1, Nihonbashi 1-chome Chuo-ku, Tokyo 103-8645 Japan (Address of principal executive offices) Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F. Form 20-F X Form 40-F Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934. Yes No X If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- . 1 Information furnished on this form: EXHIBIT Exhibit Number 1. (English Translation) Nomura Holdings 104th Fiscal Year First Quarterly Report 2 SIGNATURES Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. -

Istoxx® Mutb Japan Momentum 300 Index

ISTOXX® MUTB JAPAN MOMENTUM 300 INDEX Components1 Company Supersector Country Weight (%) Z HOLDINGS Technology Japan 0.69 M3 Health Care Japan 0.65 KOEI TECMO HOLDINGS Technology Japan 0.65 MENICON Health Care Japan 0.59 CAPCOM Technology Japan 0.58 FUJITEC Industrial Goods & Services Japan 0.56 Ibiden Co. Ltd. Industrial Goods & Services Japan 0.56 NIPPON PAINT HOLDINGS Chemicals Japan 0.56 RENESAS ELECTRONICS Technology Japan 0.55 JEOL Industrial Goods & Services Japan 0.55 INTERNET INTV.JAPAN Technology Japan 0.53 JSR Corp. Chemicals Japan 0.52 NET ONE SYSTEMS Technology Japan 0.51 Fujitsu Ltd. Technology Japan 0.51 Bank of Kyoto Ltd. Banks Japan 0.51 Hokuhoku Financial Group Inc. Banks Japan 0.51 FUJITSU GENERAL Personal & Household Goods Japan 0.50 Iyo Bank Ltd. Banks Japan 0.50 Kyushu Financial Group Banks Japan 0.50 77 Bank Ltd. Banks Japan 0.49 COCOKARA FINE INC. Retail Japan 0.49 TOSHIBA TEC Industrial Goods & Services Japan 0.48 JCR PHARMACEUTICALS Health Care Japan 0.48 MONOTARO Retail Japan 0.48 COSMOS PHARM. Retail Japan 0.48 Tokyo Electron Ltd. Technology Japan 0.48 Nomura Research Institute Ltd. Technology Japan 0.48 Olympus Corp. Health Care Japan 0.47 SUNDRUG Retail Japan 0.47 Chiba Bank Ltd. Banks Japan 0.47 NEC NETWORKS & SY.INTG. Technology Japan 0.47 Nomura Holdings Inc. Financial Services Japan 0.47 TOKYO OHKA KOGYO Technology Japan 0.47 PENTA-OCEAN CONSTRUCTION Construction & Materials Japan 0.47 FUYO GENERAL LEASE Financial Services Japan 0.46 FUJI Industrial Goods & Services Japan 0.46 Hachijuni Bank Ltd. -

Nomura Holdings, Inc. Consolidated Results of Operations First

Connecting Markets East & West Consolidated Results of Operations First quarter, year ending March 2021 (US GAAP) Nomura Holdings, Inc. July 2020 © Nomura Outline Presentation Financial Supplement Executive summary (p. 2) Consolidated balance sheet (p. 16) Overview of results (p. 3) Value at risk (p. 17) Business segment results (p. 4) Consolidated financial highlights (p. 18) Retail (p. 5-6) Consolidated income (p. 19) Asset Management (p. 7-8) Main revenue items (p. 20) Wholesale (p. 9-11) Consolidated results: Income (loss) before income taxes by segment and region (p. 21) Non-interest expenses (p. 12) Segment “Other” (p. 22) Robust financial position (p. 13) Retail related data (p. 23-26) Funding and liquidity (p. 14) Asset Management related data (p. 27-28) Wholesale related data (p. 29) Number of employees (p. 30) Executive summary Income (loss) before income taxes, net FY2020/21 1Q highlights income (loss)1 Firmwide (billions of yen) 1 2 3 Income before income taxes: Y181.8bn; Net income : Y142.5bn; ROE : 21.0%; EPS : Y45.65 Income (loss) before income taxes – Income before income taxes and net income at second highest level since reporting under US GAAP Net income (loss) 181.8 started in year ended March 2002 138.6 Three segment income before income taxes increased significantly as the market normalized from 128.5 142.5 March downturn and client activity picked up due to portfolio rebalancing, underpinning a record 4 revenue quarter for Wholesale 74.8 69.7 Segment Other booked a gain of Y71.1bn related to -

Outlook for FY21-22 Corporate Earnings

News Release Outlook for FY21-22 corporate earnings Quarterly Update 4 June 2021 For inquiries: Market Strategy Research Dept Equity Research Dept Nomura Securities Co., Ltd. Nomura | JPN Outlook for FY20-21 corporate earnings June 4, 2021 Contents Summary and major assumptions ........................................................ 3 Contributions to recurring profit growth by sector ................................. 5 Revisions to recurring profit estimates (versus old estimates) ............. 7 Revision index for the Russell/Nomura Large Cap Index ..................... 9 Reference Russell/Nomura Large Cap Index: earnings indicators ...................... 10 Recurring profits by sector ................................................................. 12 Percentage change in quarterly sales and profits .............................. 13 Valuation indicators ........................................................................... 14 What are the Russell/Nomura Japan Equity Indexes? ....................... 15 2 Nomura | JPN Outlook for FY20-21 corporate earnings June 4, 2021 Summary and major assumptions Overview of FY20 results At Russell/Nomura Large Cap companies in FY20, sales fell 7.5% y-y, operating profits fell 18.9%, recurring profits rose 4.5%, and net profits rose 16.3% (sales and operating profit figures based on Russell/Nomura Large Cap (ex financials) companies, same hereinafter). Based on the same companies, excluding SoftBank Group [9984], recurring profits fell 10.1% and net profits fell 9.4%. Results were harsh for transportation and other nonmanufacturing sectors in particular during the pandemic, but profits turned around in Q3 on brisk IT-related and stay-at-home consumption and a recovery in demand for goods in H2. If we tally the effect of profitability improvements such as cost reductions in FY20, based on information disclosed by Russell/Nomura Large Cap companies, it boosted FY20 recurring profits by about 11% and ROE by about 0.6ppt (in both cases data for SoftBank Group is excluded). -

Nomura Individual Investor Survey March 2019(PDF 397KB)

News Release Nomura Individual Investor Survey March 2019 14 March 2019 Global Research Division Nomura Securities Co., Ltd. The Nomura Individual Investor Survey is a periodic survey conducted with the aim of better understanding investing activity by individuals and providing information on related trends. Nomura | JPN Nomura Individual Investor Survey December 20, 2018 1. Survey overview (1) Nomura I-View Index up from previous survey at 26.6 The Nomura Individual Investor Market View Index (Nomura I-View Index), based on respondents' three-month outlook for share prices and calculated by subtracting the percentage of responses for "fall" from that for "rise," was 26.6 in March 2019, up 19.0pt versus the previous survey. The Nikkei 225 reference level (4 March 2019 close) was 21,822.04, up 602.54 versus the previous survey (10 December 2018 close of 21,219.50). (2) Stronger investor focus on domestic politics and domestic corporate earnings Respondents were asked to select the factor most likely to affect the stock market over the next three months. The response rate for "domestic politics" rose 3.1ppt versus the previous survey to 7.3%, and the response rate for "domestic corporate earnings" rose 2.3ppt to 6.5%. Meanwhile, the response rate for "international affairs" fell 6.3ppt to 71.1%. (3) Appeal of automobiles sector increases, appeal of consumer goods sector falls On the outlook for sectors over the next three months or so, we calculate a diffusion index (DI) by subtracting the percentage of responses for "unappealing" from that for "appealing." The DI for the automobiles sector increased 5.9pt versus the previous survey to -5.5. -

Nomura Leads First Green Bond Offering in Japanese Manufacturing Industry

News Release Nomura Leads First Green Bond Offering in Japanese Manufacturing Industry Tokyo, September 14, 2018—Nomura Securities Co., Ltd., a wholly owned subsidiary of Nomura Holdings, Inc., today announced that it has priced a three-year Green Bond1 issue valued at 5 billion yen for Hitachi Zosen Corporation. Nomura acted as bookrunner for the offering, which was the first such offering by a Japanese manufacturer. Hitachi Zosen’s core businesses center on the environmental fields of energy and water. Through its energy-from-waste business, and the promotion of renewable energy technologies such as wind energy and biomass power generation, the company aims to contribute to a recycling-oriented society. Hitachi Zosen is a global leader in the energy-from-waste plant business. Energy-from-waste plants allow for the hygienic treatment of waste, and the energy generated during the treatment process is used to provide electric power. The company boasts a track record of 900 plant deliveries mainly in Japan, Asia and Europe. The proceeds from the offering wil l be used as operating expenses, to purchase materials for energy-from-waste plants that offer reduced carbon dioxide emissions. The offering is intended to diversify Hitachi Zosen’s funding sources and help the company implement more environmentally-friendly facilities. To ensure the eligibility and transparency of the green bond offering, and to make the bonds more appealing to investors, Hitachi Zosen has received a second-party opinion from DNV GL Business Assurance Japan, a leading international risk management firm. Hitachi Zosen’s green bonds are eligible for subsidies under the Japanese Ministry of Environment’s “Financial Support Programme for Green Bond Issuance2.” ESG investing has become widespread in recent years. -

Consolidated Results of Operations Third Quarter, Year Ending March 2018

Connecting Markets East & West Consolidated Results of Operations Third quarter, year ending March 2018 (US GAAP) Nomura Holdings, Inc. February 2018 © Nomura Outline Presentation Financial Supplement Executive summary (p. 2) Consolidated balance sheet (p. 16) Overview of results (p. 3) Value at risk (p. 17) Business segment results (p. 4) Consolidated financial highlights (p. 18) Retail (p. 5-6) Consolidated income (p. 19) Asset Management (p. 7-8) Main revenue items (p. 20) Wholesale (p. 9-11) Consolidated results: Income (loss) before income taxes by segment and region (p. 21) Non-interest expenses (p. 12) Segment “Other” (p. 22) Robust financial position (p. 13) Retail related data (p. 23-26) Funding and liquidity (p. 14) Asset Management related data (p. 27-28) Wholesale related data (p. 29) Number of employees (p. 30) Executive summary Income before income taxes and net Highlights income1 Firm-wide (billions of yen) FY2017/18 1Q – 3Q Income before income taxes Income before income taxes: Y281.2bn (+17% YoY); Net income1: Y196.7bn (+10%); ROE 2: 9.3%; Net income 120.8 EPS3: Y55.12 – Retail and Asset Management reported stronger income before income taxes on the back of the stock 95.9 market rally 88.0 81.8 82.3 83.0 – 77.4 Segment Other income before income taxes increased due to disposal of non-core assets and 61.2 70.3 progress of our booking entity strategy 62.8 61.3 56.9 51.9 46.8 FY2017/18 3Q Income before income taxes: Y120.8bn (+45% QoQ); net income1: Y88.0bn (+70%); ROE2: 12.4%; EPS3: Y25.12 – Three segment income before income taxes up QoQ as Retail offset a decline in Wholesale FY2016/17 FY2017/18 – Progress in winding up of EMEA booking entity; Recognized income from FX translation adjustment (approx. -

The Long Run, the Short Run and the In-Between

STRATEGY NOMURA INTERNATIONAL (HK) LIMITED The long run, the short run and the in-between Asia and the rebalancing of the world financial system: inventory restocking, an inflation echo and growth in bi- lateral emerging market trade Sean Darby Tel: +852 2252 2182 email: [email protected] January 2010 Any authors named on this report are strategists unless otherwise indicated. See the important disclosures and analyst certifications on pages 76 to 79. ASIA An unbalanced world Budget deficits C E Cyclical budget Europe o x Asia deficits n Trade p s o + Aging population u r Aging population m t Korea, Taiwan p EM t Under-funding i Baby boomers pension schemes o Vietnam, Indonesia US n and India Impaired banking High saving rate systems Overvalued Unimpaired exchange rates banking system Oil dependent Japan Oil dependent Declining saving Under valuated rate exchange rates © Nomura International (Hong Kong) Limited 2 Source: Nomura International (Hong Kong) Limited – Investment Strategy ASIA Asia: From deflation to inflation Goldilocks Undervalued Steep yield curve Exchange rate Asia Deflation G7 + Low nominal Carry Growth interest rates trade EM Current account Weak US dollar surplus Low bond long term bond yield Source: Nomura International (Hong Kong) limited – Investment Strategy © Nomura International (Hong Kong) Limited 3 ASIA Global liquidity and US interest rates © Nomura International (Hong Kong) Limited 4 ASIA Excess liquidity and US treasury holdings Excess liquidity in Asia Total major foreign holdings of US treasuries % y-o-y, % points Excess liquidity, % points (US$bn) 30 Broad money supply, % y-o-y growth 3500 25 Nominal GDP, % y-o-y growth 20 3000 15 2500 10 2000 5 0 1500 -5 1000 -10 500 -15 China Mal India Thai Sing Twn Phil Kor HK Viet Indo Mar-01 Mar-02 Mar-03 Mar-04 Mar-05 Mar-06 Mar-07 Mar-08 Mar-09 Note: The latest data available are mostly for 2Q09 except: for nominal GDP India and Sep-00 Sep-01 Sep-02 Sep-03 Sep-04 Sep-05 Sep-06 Sep-07 Sep-08 Sep-09 Korea are 1Q09; for broad money supply Indonesia is April-May and Vietnam is 4Q08. -

Research Template

Nomura Asset Management U.K. Ltd Nomura Funds JAPAN EQUITY October 2006 Fund Price Changes The fund underperformed the benchmark by 78 basis points over one month from 29 September to 31 Investment Objective October 2006. Since inception the fund has underperformed the benchmark by 187 basis points, To achieve long term capital growth delivering a performance of 43.22% verses 45.09% for the benchmark. In the year to date the fund has through investment in an actively managed underperformed the benchmark by 70 basis points, delivering a performance of 1.48% versus 2.18% for portfolio of Japanese securities listed/dealt the benchmark. on Regulated Markets in Japan and to outperform the Benchmark [Being the Performance for the Fund since Inception (Yen basis) Morgan Stanley Capital International Japan Total Return (Net of Tax) Index]. 1 month 3 month 6 month 1 Year YTD Since Inception* Launch date: 12 April 2005 29/9- 31/7-31/10 30/4-30/9 31/10- 31/12- 12/4-31/10 Base Currency: Japanese Yen NAVps** % change 0.18 3.52 -5.01 19.92 1.48 43.22 ISIN Code: LU0217998821 Index (MSCI Japan)*** 0.96 3.99 -3.90 19.84 2.18 45.09 Bloomberg Code: Excess Return -0.78 -0.47 -1.12 0.08 -0.70 -1.87 NOMJAEQ LX Equity DES *Inception date: 12th April 2005. **Net Asset Value per share (NAVps) is calculated by Nomura Bank (Luxembourg) S.A. according to the prospectus and market standards in Luxembourg. ***MSCI Japan is the Morgan Stanley Capital International Japan Total Return (Net of Tax) Total Net Assets as at 31 October 06: Index Source: Nomura Asset Management U.K.