Nomura Individual Investor Survey June 2019(PDF 376KB)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Published on July 21, 2021 1. Changes in Constituents 2

Results of the Periodic Review and Component Stocks of Tokyo Stock Exchange Dividend Focus 100 Index (Effective July 30, 2021) Published on July 21, 2021 1. Changes in Constituents Addition(18) Deletion(18) CodeName Code Name 1414SHO-BOND Holdings Co.,Ltd. 1801 TAISEI CORPORATION 2154BeNext-Yumeshin Group Co. 1802 OBAYASHI CORPORATION 3191JOYFUL HONDA CO.,LTD. 1812 KAJIMA CORPORATION 4452Kao Corporation 2502 Asahi Group Holdings,Ltd. 5401NIPPON STEEL CORPORATION 4004 Showa Denko K.K. 5713Sumitomo Metal Mining Co.,Ltd. 4183 Mitsui Chemicals,Inc. 5802Sumitomo Electric Industries,Ltd. 4204 Sekisui Chemical Co.,Ltd. 5851RYOBI LIMITED 4324 DENTSU GROUP INC. 6028TechnoPro Holdings,Inc. 4768 OTSUKA CORPORATION 6502TOSHIBA CORPORATION 4927 POLA ORBIS HOLDINGS INC. 6503Mitsubishi Electric Corporation 5105 Toyo Tire Corporation 6988NITTO DENKO CORPORATION 5301 TOKAI CARBON CO.,LTD. 7011Mitsubishi Heavy Industries,Ltd. 6269 MODEC,INC. 7202ISUZU MOTORS LIMITED 6448 BROTHER INDUSTRIES,LTD. 7267HONDA MOTOR CO.,LTD. 6501 Hitachi,Ltd. 7956PIGEON CORPORATION 7270 SUBARU CORPORATION 9062NIPPON EXPRESS CO.,LTD. 8015 TOYOTA TSUSHO CORPORATION 9101Nippon Yusen Kabushiki Kaisha 8473 SBI Holdings,Inc. 2.Dividend yield (estimated) 3.50% 3. Constituent Issues (sort by local code) No. local code name 1 1414 SHO-BOND Holdings Co.,Ltd. 2 1605 INPEX CORPORATION 3 1878 DAITO TRUST CONSTRUCTION CO.,LTD. 4 1911 Sumitomo Forestry Co.,Ltd. 5 1925 DAIWA HOUSE INDUSTRY CO.,LTD. 6 1954 Nippon Koei Co.,Ltd. 7 2154 BeNext-Yumeshin Group Co. 8 2503 Kirin Holdings Company,Limited 9 2579 Coca-Cola Bottlers Japan Holdings Inc. 10 2914 JAPAN TOBACCO INC. 11 3003 Hulic Co.,Ltd. 12 3105 Nisshinbo Holdings Inc. 13 3191 JOYFUL HONDA CO.,LTD. -

News Release Nomura Holdings Possible Loss Arising From

News Release Possible Loss Arising from Business Activities Tokyo, March 29, 2021—Nomura Holdings, Inc. today announced that on March 26, 2021, an event occurred that could subject one of its US subsidiaries to a significant loss arising from transactions with a US client. Nomura is currently evaluating the extent of the possible loss and the impact it could have on its consolidated financial results. The estimated amount of the claim against the client is approximately $2 billion based on market prices as of March 26. This estimate is subject to change depending on unwinding of the transactions and fluctuations in market prices. Nomura will continue to take the appropriate steps to address this issue and make a further disclosure once the impact of the potential loss has been determined. As of the end of December 2020, Nomura maintained a consolidated Common Equity Tier 1 ratio of over 17 percent, which is substantially higher than the minimum regulatory requirement. Accordingly, there will be no issues related to the operations or financial soundness of Nomura Holdings or its US subsidiary. ends Nomura Nomura is a global financial services group with an integrated network spanning over 30 countries. By connecting markets East & West, Nomura services the needs of individuals, institutions, corporates and governments through its three business divisions: Retail, Asset Management, and Wholesale (Global Markets and Investment Banking), and Merchant Banking. Founded in 1925, the firm is built on a tradition of disciplined entrepreneurship, serving clients with creative solutions and considered thought leadership. For further information about Nomura, visit www.nomura.com. -

210419 Testimony of Tareq Amin FINAL

Testimony of Tareq Amin Representative Director, Executive Vice President and CTO of Rakuten Mobile Hearing on “Leading the Wireless Future: Securing American Network Technology” U.S. House of Representatives Committee on Energy and Commerce, Subcommittee on Communications and Technology April 21, 2021 Good morning, Chairmen Pallone and Doyle, Ranking Members McMorris Rodgers and Latta, and Members of the Subcommittee. Thank you for the opportunity to testify today on this important topic. I am Tareq Amin, Representative Director, Executive Vice President and CTO of Rakuten Mobile. To start, let me say Rakuten doesn’t think of itself as a mobile operator. We are a technology company, with both Japanese and American DNA, committed to bringing the best of what the technology sector offers to advance the agility, security, and affordability of the wireless networks and services. In fact, Rakuten Mobile is its own first customer. Running on our open cloud-based Rakuten Communications Platform (or RCP), our mobile network in Japan proves that cloud-based wireless networks are no longer a vision that merits discussion. They are not just a proof of concept, they are a reality. We are driving a more diverse supply chain, with continuing innovation across multiple technologies, and providing significant consumer benefit. And, the majority of our network components come from U.S. suppliers. In today’s testimony I want to help you see through my eyes and those of our employees, executives, and customers how we decided to revolutionize mobile and wireless networks and the advantages of such an architecture for American networks. Almost seven years ago, I had an opportunity to visit the data centers of one of America’s top Internet platforms and I was shocked to see how they engineered, how they built, and how they architected their systems. -

Factset-Top Ten-0521.Xlsm

Pax International Sustainable Economy Fund USD 7/31/2021 Port. Ending Market Value Portfolio Weight ASML Holding NV 34,391,879.94 4.3 Roche Holding Ltd 28,162,840.25 3.5 Novo Nordisk A/S Class B 17,719,993.74 2.2 SAP SE 17,154,858.23 2.1 AstraZeneca PLC 15,759,939.73 2.0 Unilever PLC 13,234,315.16 1.7 Commonwealth Bank of Australia 13,046,820.57 1.6 L'Oreal SA 10,415,009.32 1.3 Schneider Electric SE 10,269,506.68 1.3 GlaxoSmithKline plc 9,942,271.59 1.2 Allianz SE 9,890,811.85 1.2 Hong Kong Exchanges & Clearing Ltd. 9,477,680.83 1.2 Lonza Group AG 9,369,993.95 1.2 RELX PLC 9,269,729.12 1.2 BNP Paribas SA Class A 8,824,299.39 1.1 Takeda Pharmaceutical Co. Ltd. 8,557,780.88 1.1 Air Liquide SA 8,445,618.28 1.1 KDDI Corporation 7,560,223.63 0.9 Recruit Holdings Co., Ltd. 7,424,282.72 0.9 HOYA CORPORATION 7,295,471.27 0.9 ABB Ltd. 7,293,350.84 0.9 BASF SE 7,257,816.71 0.9 Tokyo Electron Ltd. 7,049,583.59 0.9 Munich Reinsurance Company 7,019,776.96 0.9 ASSA ABLOY AB Class B 6,982,707.69 0.9 Vestas Wind Systems A/S 6,965,518.08 0.9 Merck KGaA 6,868,081.50 0.9 Iberdrola SA 6,581,084.07 0.8 Compagnie Generale des Etablissements Michelin SCA 6,555,056.14 0.8 Straumann Holding AG 6,480,282.66 0.8 Atlas Copco AB Class B 6,194,910.19 0.8 Deutsche Boerse AG 6,186,305.10 0.8 UPM-Kymmene Oyj 5,956,283.07 0.7 Deutsche Post AG 5,851,177.11 0.7 Enel SpA 5,808,234.13 0.7 AXA SA 5,790,969.55 0.7 Nintendo Co., Ltd. -

Japanese E-Commerce Contract Software & Comp Services

Boku New contract Japanese e-commerce contract Software & Comp Services 26 September 2018 Boku has widened its reach in the domestic Japanese market through a new agreement to provide direct carrier billing (DCB) services to a Rakuten Price 172.0p e-commerce business. The contract is significant in that it demonstrates Market cap £369m Boku’s ability to support physical as well as digital goods, as well as for its potential to be expanded to support additional Rakuten services. Net cash ($m) at end H118 28.4 Shares in issue 214.2m Revenue EBITDA* EPS* DPS P/E EV/EBITDA Year end ($m) ($m) ($) ($) (x) (x) Free float 45.4% 12/17 24.4 (2.3) (0.03) 0.0 N/A N/A Code BOKU 12/18e 34.8 5.4 0.01 0.0 207.4 85.4 12/19e 42.0 11.6 0.03 0.0 68.9 39.8 Primary exchange AIM 12/20e 49.9 19.1 0.06 0.0 37.4 24.2 Secondary exchange N/A Note: *EBITDA and EPS (diluted) are normalised, excluding amortisation of acquired intangibles, exceptional items and share-based payments. Share price performance Boku has signed an initial deal to provide direct carrier billing for Rakuten Collection, an e-commerce site focused on limited edition, collectibles trading in Japan, and a division of Rakuten Group (Tokyo listed, market cap ¥1.2tn/£8.3bn). This represents Boku’s first major agreement for physical e-commerce in Japan. We note that the Rakuten Group operates more than 70 services, including an e- commerce shopping mall (Rakuten Ichiba), streaming video (Rakuten TV) and e- books (Rakuten Kobo). -

Impact of COVID-19 on Consumer Behaviour

Impact of COVID-19 on Consumer Behaviour April 2020 Our Proprietary Panels Japan (JP) China (CN) South Korea (KR) 2,200,000 3,204,500 640,000 Taiwan (TW) Hong Kong (HK) Singapore (SG) 120,000 52,000 80,000 Thailand (TH) Malaysia (MY) Indonesia (ID) 550,000 196,000 550,000 India (IN) Vietnam (VN) Philippines (PH) 650,000 300,000 315,000 • Markets: China, Hong Kong, India, Indonesia, Japan, South Korea, Malaysia, Philippines, Singapore, Taiwan, Survey Thailand, United States, Vietnam Methodology & Sample size: 1,000 respondents per market, 13,000 in total Notes • • Profile of respondents: 20+ y.o. respondents from Rakuten Insight proprietary panels, with good distribution on age, gender, region & occupation • Survey timing April 2020 Sources of information News on traditional forms of media, TV, radio Marked contrast between Japan & China when it comes to continues to be a highly trusted source of trusting experts & influencers on social media with trust information even in the digital age much higher in China & lower in Japan Korea relatively low trust in many sources of While people spend more time watching TV news or information with the most highly trusted reading news websites, the time spent on following source being TV news (71%) influencers or celebrities on social media is less than usual Consumers from around the world rely on These times of uncertainty & gravity appear to have led to information from TV news & government consumers to spend their time on more serious & reliable websites. A slight decrease can be observed in sources of information trusting the information on social media How much do you trust the following sources of information? International consumers rely on information from Government websites and TV news. -

Research Template

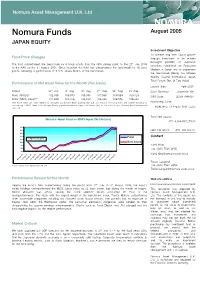

Nomura Asset Management U.K. Ltd Nomura Funds August 2005 JAPAN EQUITY Investment Objective To achieve long term capital growth Fund Price Changes through investment in an actively managed portfolio of Japanese The fund outperformed the benchmark by 6 basis points from the NAV pricing point on the 27th July 2005 securities listed/dealt on Regulated to the NAV on the 31 August 2005. Since inception the fund has outperformed the benchmark by 78 basis Markets in Japan and to outperform points, delivering a performance of 9.12% verses 8.34% of the benchmark. the Benchmark [Being the Morgan Stanley Capital International Japan Total Return (Net of Tax) Index]. Performance of Net Asset Value for the Month (Yen basis) Launch date: April 2005 th rd th th th Period 27 July 3 Aug 10 Aug 17 Aug 24 Aug 31 Aug Base Currency: Japanese Yen Fund (NAVps)* 102,335 103,970 105,080 107,565 109,584 109,123 ISIN Code: LU0217998821 Index (MSCI Japan)** 101,659 102,916 104,224 106,234 108,576 108,340 *Net Asset Value per share (NAVps) is calculated by Nomura Bank (Luxembourg) S.A. according to the prospectus and market standards in Bloomberg Code: Luxembourg. **MSCI Japan is the Morgan Stanley Capital International Japan Total Return (Net of Tax) Index Source: Nomura Asset Management NOMJAEQ LX Equity DES <GO> U.K. Ltd Total Net Assets: Nomura Japan Fund vs MSCI Japan (Net Return) JPY 4,034,857,279.00 110 108 NAV Per Share: JPY 109,123.00 106 104 Fund Contact 102 12-Apr-05, Inception 100 Dt Benchmark 98 Yuhki King 96 +44 (0)20 7521 2635 94 5 5 5 5 [email protected] 5 5 5 5 0 0 0 0 5 5 5 5 5 5 5 -0 -0 -0 -0 - - 05 05 -0 -0 05 0 0 0 05 05 -0 05 05 r r r r y- y- n- n- n n n- l- l-0 l- l- g- g- g- g- p p p ay a a ay u u u u u Ap M M J J J Ju Ju Ju Ju u u ug u u -A -A -A -M -M - - -J -J - - - - - -A -A -A -A -A 0- 1- 8- 1 8 9 6 0 7 7 06 13 2 27 04 1 1 25 0 0 15 22 2 0 13 2 2 03 10 1 24 31 Trevor Langford Source: Nomura Asset Management U.K. -

Japan Corporate Credit Spotlight

Makiko Yoshimura Japan Corporate Director Corporate Ratings Credit Spotlight Katsuyuki Nakai Director October 22, 2020 Corporate Ratings Hiroki Shibata Senior Director Corporate Ratings Advertising; Electronics; IT Services; E-Commerce; Telecom And Investment Holding Companies This report does not constitute a rating action. Japan Corporate Credit Spotlight Sector Comments Pages 3 - 13 Advertising Electronics Appendix IT Services Pages 14 - 16 E-Commerce Telecom And Investment Holding Companies All graphics show data for companies studied. Sector Comments Pages 3 - 13 Advertising Outlook: Negative Gradual Recovery After Temporary COVID-19 Hit Trend And Changes – Advertising revenue, which is vulnerable to economic downturns, will contract more sharply than Japan's GDP during the COVID-19 pandemic. – Digital media will likely lead a recovery thanks to cost advantages and demand for marketing data. – Companies in this study are among domestic leaders in digital advertising and media. – Competitive differences among Japan-based and overseas advertisers will not change significantly as all face similar conditions. – Future creditworthiness of the companies studied largely hinges on their financial standings. Key Assumptions – Total advertising revenue in Japan in fiscal 2021 will not recover to fiscal 2019 levels, despite the contribution from internet advertising. – Profitability of the companies studied will not recover to pre-COVID-19 levels in the coming one to two years despite cost reductions. – COVID-19's degree of impact on the companies studied will differ according to their financial health before the crisis. 4 Advertising Risks And Key Credit Drivers: – A resurgence of COVID-19 further souring advertising clients' appetites. – Priorities for use of cash flow, such as growth investments and shareholder returns, under difficult conditions. -

Nomura Holdings 104Th Fiscal Year First Quarterly Report (PDF)

FORM 6-K U.S. SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Report of Foreign Private Issuer Pursuant to Rule 13a-16 or 15d-16 of the Securities Exchange Act of 1934 Commission File Number: 1-15270 For the month of September 2007. NOMURA HOLDINGS, INC. (Translation of registrant's name into English) 9-1, Nihonbashi 1-chome Chuo-ku, Tokyo 103-8645 Japan (Address of principal executive offices) Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F. Form 20-F X Form 40-F Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934. Yes No X If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- . 1 Information furnished on this form: EXHIBIT Exhibit Number 1. (English Translation) Nomura Holdings 104th Fiscal Year First Quarterly Report 2 SIGNATURES Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. -

Strong in the New Normal 2.0

Strong in the New Normal 2.0 CORPORATE REPORT 2020 MISSION Contribute to society by creating value through innovation and entrepreneurship Our Philosophy Empowering people to realize their hopes and dreams. Embracing new thinking. The Rakuten Group’s mission is to contribute Rakuten changes the world through innovation. to society by creating value through innova- tion and entrepreneurship. By providing high-quality services that help our users and partners grow, we aim to VISION advance and enrich society. To fulfill our role as a Global Innovation Global Innovation Company Company, we are committed to maximizing both corporate and shareholder value. At Rakuten, we drive disruptive innovation, engaging knowledge, creativity and passion from around the world to achieve ambitious goals, and help build communities in which people can pursue their dreams and live in happiness. VALUES AND PRINCIPLES Rakuten Shugi (Rakuten Basic Principles) The core values of the Rakuten Group, along with the values and principles understood and practiced by Rakuten employees, embody Rakuten Shugi. The two components it consists of are the Brand Concepts and Five Principles for Success. With Rakuten Shugi as a common foundation, we place high value on the entrepreneurial spirit that drives us to get things done. By working with local communities and nurturing a robust corporate culture enabling each member of our diverse team to perform at their best, the Rakuten Group is committed to boosting corporate value and contributing to progress in society. 2 Rakuten Group, Inc. Corporate Report 2020 Contents Introduction 2 Business Strategies for Further Growth 24 Rakuten’s Governance 47 A Massive Expansion of Rakuten Ecosystem Amidst a Core Businesses 1 Conversation Once-in-a-century Digital Transformation of Society 2 E-commerce services show strong growth alongside Sarah J. -

Cebit2017 Japan Pavilion List of Exhibitors As of 25Th Jan 2017 JETRO Trade Fair Department

CeBIT2017 Japan Pavilion List of exhibitors as of 25th Jan 2017 JETRO Trade Fair Department *alphabetical order by zone Zone Name of Exhibitors URL 1 Life/Office/Society ABEJA, Inc. http://www.abeja.asia/ 2 Life/Office/Society Afro Co., Ltd. https://www.afro.co.jp 3 Life/Office/Society AISIN SEIKI Co., Ltd. http://www.aisin.com 4 Life/Office/Society Asahi Kasei Corp. http://www.asahi-kasei.co.jp/asahi/en/ 5 Life/Office/Society Asterisk, Inc. https://asreader.com/ 6 Life/Office/Society Broadband Tower, Inc. http://www.bbtower.co.jp/en/corporate/ 7 Life/Office/Society Canon Inc. http://global.canon/en/ 8 Life/Office/Society CEATEC JAPAN http://www.ceatec.com/ 9 Life/Office/Society CENOTE Inc. http://cenote.tech 10 Life/Office/Society Cerevo Inc. http://cerevo.com 11 Life/Office/Society Classmethod https://classmethod.jp/company/english/ 12 Life/Office/Society Craftar Inc. http://www.craftar.co.jp/ 13 Life/Office/Society CS-COMMUNICATION Co.,Ltd. http://www.cs-com.co.jp/ 14 Life/Office/Society Dai Nippon Printing Co., Ltd. http://www.dnp.co.jp/eng 15 Life/Office/Society Data Stadium Inc. https://www.datastadium.co.jp/en/index 16 Life/Office/Society DENSO CORPORATION https://www.denso.com/global/en/ 17 Life/Office/Society Design M Plus, Inc. http://www.design-mplus.com/en 18 Life/Office/Society Dynamic Map Planning Co., Ltd http://dynamic-maps.co.jp 19 Life/Office/Society Epson Europe B.V. http://global.epson.com/ 20 Life/Office/Society Falcon Denshi K.K. http://www.falcon-denshi.co.jp/en/index.shtml 21 Life/Office/Society Forum8 Co., Ltd. -

Announcement of Issuance of New Shares and Disposal of Treasury Stock Through Third-Party Allotment

March 12, 2021 Company name Rakuten, Inc. Representative Hiroshi Mikitani Chairman and CEO (Stock Code: 4755 Tokyo Stock Exchange First Section) Announcement of Issuance of New Shares and Disposal of Treasury Stock through Third-Party Allotment At a Board of Directors meeting held today, Rakuten, Inc., (hereinafter “the Company”), resolved to issue new shares and dispose of treasury stock through third-party allotment (hereinafter the “Third-Party Allotment”), as described below. 1. Details of Offering (1) Payment date From March 29, 2021 to April 30, 2021 (2) Number of new shares to be issued and Total number of common shares as below (1+2): 211,656,500 shares Number of treasury 1. Number of newly issued common shares: 139,737,600 shares stock to be disposed 2. Number of disposed treasury stocks: 71,918,900 shares of (Number of shares offered) (3) Issue price and JPY 1,145 per share Disposal price (4) Amount of proceeds JPY 242,346,692,500 to be raised (5) By the Third-Party Allotment, the Company will allot 131,004,000 Offering and disposal shares to Japan Post Holdings Co., Ltd., 57,382,900 shares to Image method Frame Investment (HK) Limited, 14,536,000 shares to Walmart Inc., (expected allotment) 4,366,800 shares to Mikitani Kosan, Inc. and 4,366,800 shares to Spirit Inc. (6) Each of the above items is subject to the notified entries in force, Others based on the Financial Instruments and Exchange Act. * Note: Payment of the Third-Party Allotment is expected to be on March 29, 2021.