Tuesday, March 24, 1998

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

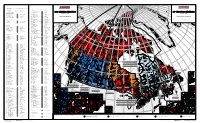

Map of Canada, Official Results of the 38Th General Election – PDF Format

2 5 3 2 a CANDIDATES ELECTED / CANDIDATS ÉLUS Se 6 ln ln A nco co C Li in R L E ELECTORAL DISTRICT PARTY ELECTED CANDIDATE ELECTED de ELECTORAL DISTRICT PARTY ELECTED CANDIDATE ELECTED C er O T S M CIRCONSCRIPTION PARTI ÉLU CANDIDAT ÉLU C I bia C D um CIRCONSCRIPTION PARTI ÉLU CANDIDAT ÉLU É ol C A O N C t C A H Aler 35050 Mississauga South / Mississauga-Sud Paul John Mark Szabo N E !( e A N L T 35051 Mississauga--Streetsville Wajid Khan A S E 38th GENERAL ELECTION R B 38 ÉLECTION GÉNÉRALE C I NEWFOUNDLAND AND LABRADOR 35052 Nepean--Carleton Pierre Poilievre T A I S Q Phillip TERRE-NEUVE-ET-LABRADOR 35053 Newmarket--Aurora Belinda Stronach U H I s In June 28, 2004 E T L 28 juin, 2004 É 35054 Niagara Falls Hon. / L'hon. Rob Nicholson E - 10001 Avalon Hon. / L'hon. R. John Efford B E 35055 Niagara West--Glanbrook Dean Allison A N 10002 Bonavista--Exploits Scott Simms I Z Niagara-Ouest--Glanbrook E I L R N D 10003 Humber--St. Barbe--Baie Verte Hon. / L'hon. Gerry Byrne a 35056 Nickel Belt Raymond Bonin E A n L N 10004 Labrador Lawrence David O'Brien s 35057 Nipissing--Timiskaming Anthony Rota e N E l n e S A o d E 10005 Random--Burin--St. George's Bill Matthews E n u F D P n d ely E n Gre 35058 Northumberland--Quinte West Paul Macklin e t a s L S i U a R h A E XEL e RÉSULTATS OFFICIELS 10006 St. -

Court File No.: CV-18-00605134-00CP ONTARIO

Court File No.: CV-18-00605134-00CP ONTARIO SUPERIOR COURT OF JUSTICE BETWEEN: MICKY GRANGER Plaintiff - and - HER MAJESTY THE QUEEN IN RIGHT OF THE PROVINCE OF ONTARIO Defendant Proceeding under the Class Proceedings Act, 1992 MOTION RECORD OF THE PLAINTIFF (CERTIFICATION) (Returnable November 27 & 28, 2019) VOLUME II of II March 18, 2019 GOLDBLATT PARTNERS LLP 20 Dundas Street West, Suite 1039 Toronto ON M5G 2C2 Jody Brown LS# 58844D Tel: 416-979-4251 / Fax: 416-591-7333 Email: [email protected] Geetha Philipupillai LS# 74741S Tel.: 416-979-4252 / Fax: 416-591-7333 Email: [email protected] Lawyers for the Plaintiff - 2 TO: HER MAJESTY THE QUEEN IN RIGHT - OF THE PROVINCE OF ONTARIO Crown Law Office – Civil Law 720 Bay Street, 8th Floor Toronto, ON, M5G 2K1 Amy Leamen LS#: 49351R Tel: 416.326.4153 / Fax: 416.326.4181 Lawyers for the Defendant TABLE OF CONTENTS TAB DESCRIPTION PG # 1. Notice of Motion (Returnable November 27 and 28, 2019) 1 A. Appendix “A” – List of Common Issues 6 2. Affidavit of Micky Granger (Unsworn) 8 3. Affidavit of Tanya Atherfold-Desilva sworn March 18, 2019 12 A. Exhibit “A”: Office of the Independent Police Review Director – 20 Systemic Review Report dated July 2016 B. Exhibit “B”: Office of the Independent Police Review Director - 126 Executive Summary and Recommendations dated July 2016 C. Exhibit “C”: Office of the Independent Police Review Director – Terms of 142 Reference as of March 2019 D. Exhibit “D”: Affidavit of David D.J. Truax sworn August 30, 2016 146 E. Exhibit “E”: Centre of Forensic Investigators & Submitters Technical 155 Information Sheets effective April 2, 2015 F. -

Wednesday, May 1, 1996

CANADA 2nd SESSION 35th PARLIAMENT VOLUME 135 NUMBER 13 OFFICIAL REPORT (HANSARD) Wednesday, May 1, 1996 THE HONOURABLE GILDAS L. MOLGAT SPEAKER This issue contains the latest listing of Officers of the Senate, the Ministry and Senators. CONTENTS (Daily index of proceedings appears at back of this issue.) Debates: Victoria Building, Room 407, Tel. 996-0397 Published by the Senate Available from Canada Communication Group — Publishing, Public Works and Government Services Canada, Ottawa K1A 0S9, at $1.75 per copy or $158 per year. Also available on the Internet: http://www.parl.gc.ca 257 THE SENATE Wednesday, May 1, 1996 The Senate met at 2:00 p.m., the Speaker in the Chair. Someone once asked what Mr. du Plessis’ favourite day of the year was, and he responded, Boxing Day, because on that day he Prayers. could put his feet up, sit back and reflect on all that has gone on in the past year. Now, Mr. du Plessis, you may put your feet up every day and reflect not only on one year but on 20 remarkable SENATORS’ STATEMENTS years of a distinguished career in the Senate of Canada. We will miss not just your wisdom but your friendship and RAYMOND L. DU PLESSIS, Q.C. your wonderful sense of humour. We wish you well in all your future activities, be they badminton, tennis or dancing. We know TRIBUTES ON RETIREMENT AS LAW CLERK that your family will be delighted as well to be able to claim AND PARLIAMENTARY COUNSEL more of your time, your attention and your very good spirits. -

Wednesday, December 4, 1996

CANADA VOLUME 134 S NUMBER 113 S 2nd SESSION S 35th PARLIAMENT OFFICIAL REPORT (HANSARD) Wednesday, December 4, 1996 Speaker: The Honourable Gilbert Parent CONTENTS (Table of Contents appears at back of this issue.) The House of Commons Debates are also available on the Parliamentary Internet Parlementaire at the following address: http://www.parl.gc.ca 7077 HOUSE OF COMMONS Wednesday, December 4, 1996 The House met at 2 p.m. [Translation] _______________ ANTONIO GREDIAGA KIEFF Mrs. Pierrette Venne (Saint-Hubert, BQ): Mr. Speaker, the Prayers renowned artist Antonio Grediaga Kieff recently very kindly gave the town of Saint-Bruno-de-Montarville one of his sculptures. _______________ This modern work entitled ‘‘Totem ’85 with Spirals and The Speaker: Every so often we have an opportunity to hear Triangles’’ is the first piece of outdoor art to be set up around the some truly magnificent Canadian voices. We are going to add our town. The sculpture, which is bronze and valued at $160,000 on the voices to theirs. I have asked the St. Michael’s Boys Choir to lead international art market, measures 5 metres high and weighs a little us in our national anthem. I know that an hon. member should have over a tonne. led us today, but perhaps next week he will lead us. If the choir is ready, I invite them to lead us in our national anthem. Mr. Kieff’s sculptures may be found in major art collections around the world. Two former American Presidents, Ronald Rea- [Editor’s Note: Whereupon the national anthem was sung.] gan and Jimmy Carter, are proud owners of his works. -

Wednesday, April 24, 1996

CANADA VOLUME 134 S NUMBER 032 S 2nd SESSION S 35th PARLIAMENT OFFICIAL REPORT (HANSARD) Wednesday, April 24, 1996 Speaker: The Honourable Gilbert Parent CONTENTS (Table of Contents appears at back of this issue.) The House of Commons Debates are also available on the Parliamentary Internet Parlementaire at the following address: http://www.parl.gc.ca 1883 HOUSE OF COMMONS Wednesday, April 24, 1996 The House met at 2 p.m. [English] _______________ LIBERAL PARTY OF CANADA Prayers Mr. Ken Epp (Elk Island, Ref.): Mr. Speaker, voters need accurate information to make wise decisions at election time. With _______________ one vote they are asked to choose their member of Parliament, select the government for the term, indirectly choose the Prime The Speaker: As is our practice on Wednesdays, we will now Minister and give their approval to a complete all or nothing list of sing O Canada, which will be led by the hon. member for agenda items. Vancouver East. During an election campaign it is not acceptable to say that the [Editor’s Note: Whereupon members sang the national anthem.] GST will be axed with pledges to resign if it is not, to write in small print that it will be harmonized, but to keep it and hide it once the _____________________________________________ election has been won. It is not acceptable to promise more free votes if all this means is that the status quo of free votes on private members’ bills will be maintained. It is not acceptable to say that STATEMENTS BY MEMBERS MPs will be given more authority to represent their constituents if it means nothing and that MPs will still be whipped into submis- [English] sion by threats and actions of expulsion. -

Hansard 33 1..154

CANADA House of Commons Debates VOLUME 137 Ï NUMBER 108 Ï 1st SESSION Ï 37th PARLIAMENT OFFICIAL REPORT (HANSARD) Friday, November 2, 2001 Speaker: The Honourable Peter Milliken CONTENTS (Table of Contents appears at back of this issue.) All parliamentary publications are available on the ``Parliamentary Internet Parlementaire´´ at the following address: http://www.parl.gc.ca 6871 HOUSE OF COMMONS Friday, November 2, 2001 The House met at 10 a.m. Rights Tribunal and to make consequential amendments to other acts, as reported (with amendments) from the committee. Prayers Hon. Don Boudria (for the Minister of Indian Affairs and Northern Development) moved that the bill, as amended, be concurred in. GOVERNMENT ORDERS (Motion agreed to) The Deputy Speaker: When shall the bill be read the third time? Ï (1000) By leave, now? [English] Some hon. members: Agreed. MISCELLANEOUS STATUTE LAW AMENDMENT ACT, Hon. Don Boudria (for the Minister of Indian Affairs and 2001 Northern Development) moved that the bill be read the third time Hon. Don Boudria (for the Minister of Justice) moved that Bill and passed. C-40, an act to correct certain anomalies, inconsistencies and errors Mr. John Finlay (Parliamentary Secretary to the Minister of and to deal with other matters of a non-controversial and Indian Affairs and Northern Development, Lib.): Mr. Speaker, I uncomplicated nature in the Statutes of Canada and to repeal certain am pleased to speak to the bill at third reading because it is of very provisions that have expired, lapsed, or otherwise ceased to have great importance to the people of Nunavut. -

Wednesday, May 8, 1996

CANADA VOLUME 134 S NUMBER 042 S 2nd SESSION S 35th PARLIAMENT OFFICIAL REPORT (HANSARD) Wednesday, May 8, 1996 Speaker: The Honourable Gilbert Parent CONTENTS (Table of Contents appears at back of this issue.) OFFICIAL REPORT At page 2437 of Hansard Tuesday, May 7, 1996, under the heading ``Report of Auditor General'', the last paragraph should have started with Hon. Jane Stewart (Minister of National Revenue, Lib.): The House of Commons Debates are also available on the Parliamentary Internet Parlementaire at the following address: http://www.parl.gc.ca 2471 HOUSE OF COMMONS Wednesday, May 8, 1996 The House met at 2 p.m. [Translation] _______________ COAST GUARD Prayers Mrs. Christiane Gagnon (Québec, BQ): Mr. Speaker, another _______________ voice has been added to the general vehement objections to the Coast Guard fees the government is preparing to ram through. The Acting Speaker (Mr. Kilger): As is our practice on Wednesdays, we will now sing O Canada, which will be led by the The Quebec urban community, which is directly affected, on hon. member for for Victoria—Haliburton. April 23 unanimously adopted a resolution demanding that the Department of Fisheries and Oceans reverse its decision and carry [Editor’s Note: Whereupon members sang the national anthem.] out an in depth assessment of the economic impact of the various _____________________________________________ options. I am asking the government to halt this direct assault against the STATEMENTS BY MEMBERS Quebec economy. I am asking the government to listen to the taxpayers, the municipal authorities and the economic stakehold- [English] ers. Perhaps an equitable solution can then be found. -

Friday, April 30, 1999

CANADA VOLUME 135 S NUMBER 219 S 1st SESSION S 36th PARLIAMENT OFFICIAL REPORT (HANSARD) Friday, April 30, 1999 Speaker: The Honourable Gilbert Parent CONTENTS (Table of Contents appears at back of this issue.) All parliamentary publications are available on the ``Parliamentary Internet Parlementaire'' at the following address: http://www.parl.gc.ca 14527 HOUSE OF COMMONS Friday, April 30, 1999 The House met at 10 a.m. [Translation] _______________ This year is the fourth anniversary of the Open Skies Agreement and the 25th anniversary of the 1974 Air Transport Preclearance Agreement. Prayers These two agreements have worked hand in glove to transform _______________ air passenger travel between Canada and the United States. [English] In the past, travelling from Canada to the United States was long GOVERNMENT ORDERS and arduous because the airlines were often prevented from providing efficient routings by the outdated air agreement. Because of open skies, some 60 U.S. destinations can now be reached D (1005 ) non-stop from 19 Canadian cities and many more can be reached [English] by convenient connections at U.S. hubs. D (1010 ) PRECLEARANCE ACT Parenthetically, I should point out that in transporter traffic, Hon. David M. Collenette (for the Minister of Foreign since the open skies agreement has come in, Canadian carriers Affairs) moved that Bill S-22, an act authorizing the United States dominate that market. Canadian carriers carry more passengers in to preclear travellers and goods in Canada for entry into the United the transporter market than do U.S. carriers. That is a testament to States for the purposes of customs, immigration, public health, the efficiency of Canada’s various airlines. -

Computational Identification of Ideology In

Computational Identification of Ideology in Text: A Study of Canadian Parliamentary Debates Yaroslav Riabinin Dept. of Computer Science, University of Toronto, Toronto, ON M5S 3G4, Canada February 23, 2009 In this study, we explore the task of classifying members of the 36th Cana- dian Parliament by ideology, which we approximate using party mem- bership. Earlier work has been done on data from the U.S. Congress by applying a popular supervised learning algorithm (Support Vector Ma- chines) to classify Senatorial speech, but the results were mediocre unless certain limiting assumptions were made. We adopt a similar approach and achieve good accuracy — up to 98% — without making the same as- sumptions. Our findings show that it is possible to use a bag-of-words model to distinguish members of opposing ideological classes based on English transcripts of their debates in the Canadian House of Commons. 1 Introduction Internet technology has empowered users to publish their own material on the web, allowing them to make the transition from readers to authors. For example, people are becoming increasingly accustomed to voicing their opinions regarding various prod- ucts and services on websites like Epinions.com and Amazon.com. Moreover, other users appear to be searching for these reviews and incorporating the information they acquire into their decision-making process during a purchase. This indicates that mod- 1 ern consumers are interested in more than just the facts — they want to know how other customers feel about the product, which is something that companies and manu- facturers cannot, or will not, provide on their own. -

October 27,2005 Mayor Anne Marie Decicco City Hall London, Ontario

October 27,2005 Mayor Anne Marie DeCicco City Hall London, Ontario Your worship and Members of Council, A proposed new National Museum Policy and new funding for Canadian museums is moving forward quickly at the federal level: Canada’s museums need your support at the local London level now. The McIntosh Gallery, as well as all the community museums in London, such as those represented in your Landmarks London Committee, will benefit greatly from this new funding of %75M.City support for our grass-roots organizations will be magnified and enhanced as we seek essential funding with greater sustainability, including capital infrastructure. The Canadian Museums Association, of which the McIntosh Gallery is a member, has been lobbying effectively for the new Canadian Museums Policy which Liza Frulla, Minister of Canadian Heritage, will present to cabinet in the coming weeks. We applaud her strong commitment to this initiative and encourage you, our Municipality, to join us as we show her our support. I urge you to write to Finance Minister Ralph Goodale to encourage his support for the new Canadian Museums Policy: Ralph Goodale Minister of Finance L’Esplanade Laurier East Tower, 21st floor 140 O’Connor St. Ottawa ON K1A OG5 Fax: 613 996-9790 Thank you for your consideration. Respectfully submitted, Arlene Kennedy Director McIntosh Gallery P.S. I would greatly appreciate a copy of your correspondence. Thank you. CAMAD IAN MUS E UMS ASS 0 C IAT ION ~ ASSOCIATION DES MUSEES CANADIENS New Museums Funding Moving Forward Rapidly We need your help now -push this over the top! Ottawa, October 26,2005 - New Pettigrew, Lucienne Robillard, Andy Scott, funding for Canadian museums is moving Tony Valeri, Joe Volpe, Prime Minister Paul fotward quickly at the federal level: Martin and many more. -

Tuesday, February 5, 2002

CANADA 1st SESSION • 37th PARLIAMENT • VOLUME 139 • NUMBER 86 OFFICIAL REPORT (HANSARD) Tuesday, February 5, 2002 THE HONOURABLE DAN HAYS SPEAKER This issue contains the latest listing of Senators, Officers of the Senate, the Ministry, and Senators serving on Standing, Special and Joint Committees. CONTENTS (Daily index of proceedings appears at back of this issue.) Debates and Publications: Chambers Building, Room 943, Tel. 996-0193 Published by the Senate Available from Canada Communication Group — Publishing, Public Works and Government Services Canada, Ottawa K1A 0S9, Also available on the Internet: http://www.parl.gc.ca 2182 THE SENATE Tuesday, February 5, 2002 The Senate met at 2:00 p.m., the Speaker in the Chair. Senator Duhamel is well known for his exceptional service to the people of St. Boniface, Winnipeg and Manitoba as a whole. Prayers. In 1994, he was made a chevalier, or knight, of the Ordre de la Pléiade, and in 2000, appointed an officer of the Assemblée parlementaire de la Francophonie, Canadian division. We are NEW SENATOR certain that his senatorial duties will have no effect whatsoever on his devotion to his province. The Hon. the Speaker: Honourable senators, I have the honour to inform the Senate that the Clerk has received a [English] certificate from the Registrar General of Canada showing that the Honourable Ronald J. Duhamel, P.C., has been summoned to the Honourable senators, Senator Duhamel and I have had some Senate. interesting experiences together — I as a critic of education in the province of Manitoba, and he as the deputy minister of that INTRODUCTION same department. -

Executive Backbenchers Or Political Nobodies?

Executive Backbenchers or Political Nobodies? The Role of Parliamentary Secretaries in Canada by David Gamache Hutchison Winner of the Alf Hales Research Award November 1999 Paper written for the Institute On Governance’s 1999 Alf Hales Research award Institute On Governance, 122 Clarence St., Ottawa, Ontario, Canada K1N 5P6 Tel.: 1 613.562.0090 – Fax: 1 613.562.0097 – e-mail: [email protected] – Website: www.iog.ca Ó 1999 All rights reserved Executive Backbenchers or Political Nobodies? The Role of Parliamentary Secretaries in Canada ISBN 1-894443-03-9 Published and distributed by: The Institute On Governance Ottawa, Ontario, Canada Phone: (1-613) 562-0090 Fax: (1-613) 562-0097 Web Site: www.iog.ca Table of Contents ABSTRACT 1 INTRODUCTION 1 HISTORY 3 STATUS 6 SELECTION 7 CAREER PROSPECTS 9 RESPONSIBILITIES 12 JOB SATISFACTION 17 THE FUTURE OF THE POSITION 20 INTERVIEWS 24 NOTES 25 David Gamache Hutchison David Gamache Hutchison served as a Parliamentary Intern in the Canadian House of Commons in the 1998-99 academic year. His previous experience in government included a tour guide position at the Quebec National Assembly and an internship at the Canadian Embassy in Washington, D.C. David is currently completing a Masters degree in political science at the University of Alberta. Alf Hales Research Award The Institute On Governance (IOG) created the Alf Hales Research Award in 1999 to recognise the valuable educational experience that the Parliamentary Internship Programme provides in Canada. The award seeks to promote research excellence and young people’s understanding of governance issues. It is handed out annually to the best Intern essay on a particular aspect of the Parliamentary system.