Magic Quadrant for Application Release Automation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

![View Corporate and Individual Cultures in a Setting Or of Brands and Trademarks, There Is Also a Sharp Irrevocable Openness [26]](https://docslib.b-cdn.net/cover/3874/view-corporate-and-individual-cultures-in-a-setting-or-of-brands-and-trademarks-there-is-also-a-sharp-irrevocable-openness-26-233874.webp)

View Corporate and Individual Cultures in a Setting Or of Brands and Trademarks, There Is Also a Sharp Irrevocable Openness [26]

Teixeira and Karsten Journal of Internet Services and Applications (2019) 10:7 Journal of Internet Services https://doi.org/10.1186/s13174-019-0105-z and Applications RESEARCH Open Access Managing to release early, often and on time in the OpenStack software ecosystem José Apolinário Teixeira* and Helena Karsten Abstract The dictum of “Release early, release often.” by Eric Raymond as the Linux modus operandi highlights the importance of release management in open source software development. However, there are very few empirical studies addressing release management in this context. It is already known that most open source software communities adopt either a feature-based or time-based release strategy. Both have their own advantages and disadvantages that are also context-specific. Recent research reports that many prominent open source software projects have overcome a number of recurrent problems by moving from feature-based to time-based release strategies. In this longitudinal case study, we address the release management practices of OpenStack, a large scale open source project developing cloud computing technologies. We discuss how the release management practices of OpenStack have evolved in terms of chosen strategy and timeframes with close attention to processes and tools. We discuss the number of practical and managerial issues related to release management within the context of large and complex software ecosystems. Our findings also reveal that multiple release management cycles can co-exist in large and complex software -

About One Acre Fund Job Description Career Growth and Development Qualifications

About One Acre Fund Founded in 2006, One Acre Fund supplies smallholder farmers with the agricultural services they need to make their farms vastly more productive. We provide quality farm supplies on credit, delivered within walking distance of farmers homes, and agricultural trainings to improve harvests. We measure our success by our ability to make farmers more prosperous: On average, farmers harvest 50 percent more food after working with One Acre Fund. We are growing quickly. We currently serve more than 800,000 farm families in Eastern and Southern Africa, with more than 7,500 full-time staff, and we aim to serve 1 million farm families by 2020. Job Description As development operations engineer, you would be responsible for increasing the efficiency and effectiveness of the development team- your job would be to make everyone elses job easier. This involves coordination with the IT Operations, Quality Assurance and Development teams, with the primary goal of automating manual tasks. You would be involved in reviewing and altering processes/procedures across the organization, reviewing and integrating third-party tools as appropriate and maintaining the test servers used internally. After training, you would also help automate the production server environment and react to problems as they occur. Career Growth and Development We have a strong culture of constant learning and we invest in developing our people. Youll have weekly check-ins with your manager, access to mentorship and training programs, and regular feedback on your performance. We hold career reviews every six months, and set aside time to discuss your aspirations and career goals. -

Ebook Devops Toolchain.Pdf

DevOps Toolchain 1 Introduction accordingly based on the problem at hand. DevOps may need little introduction these days, Similarly, most systems administrators possess but many are still at a loss to explain precisely competent programming abilities for traversing what the movement entails. Some emphasize the the stack—on top of the requisite skills for portmanteau of the two terms, stating that the managing IT operations. The industry has heart of DevOps is the collaboration between been quick in attaching new labels to these developers and operations staff. Others choose emerging hybrid roles: DevOps Engineer and to focus on the tools and the problems they solve, DevOps Specialist being the most common. singing the praises of DevOps for fixing their Notwithstanding, the key takeaway is that no respective infrastructure woes. Tools—though single IT skill is more important or valuable than crucial enablers of the movement—only form part another; subsequently, many different tools are of the equation. DevOps encompasses cultural required to do the job effectively. So as DevOps innovation, a breaking down of walls and silos is comprised of a group of concepts clustered between software development, operations, around the premise of continuous software and QA/ testing—in addition to the tools and delivery, these concepts in turn encompass a methodologies enabling this transformation. range of associated tools for fulfilling particular Ultimately, the definition of DevOps varies per functions. organization. Since its meaning depends heavily on the audience and context in question, general All in all, these complementary tools fill out the discussions around the true definition of DevOps DevOps toolchain, unifying the best elements are for the most part inconsequential. -

Scripting Deployment of NIST Use Cases

Report to NIST January 2017 1 / 12 Scripting Deployment of NIST Use Cases BADI’ABDUL-WAHID1,H YUNGRO LEE1,G REGOR VON LASZEWSKI1, AND GEOFFREY FOX1,* 1School of Informatics and Computing, Bloomington, IN 47408, U.S.A. *Corresponding authors: [email protected] January 20, 2017 This document summarizes the NIST Big Data Public Working Group (BDPWG) use-cases document: "Possible Big Data Use Cases Implementation using NBDRA". Additional projects originated from classes taught at Indiana University. The focus of our current work is the development of abstractions capturing the basic concepts we have seen and the development of a REST API implementing some of these ideas. We describe a few of the underlying components for allocating and managing virtual clusters. Additionally, a summary of the ecosystem (Open Source via GitHub) and Academic (via Indiana University classes) in which Big Data Software is used. There is a brief description of a few of the Use Cases, as well as a description of the major components. In summary: we have implemented two of the NIST Use Cases, with several others under development. Additionally, we are currently implementing DevOps support into Cloudmesh to facilitate scripting of Use Case deployment as started on an API to be exposed as a web service for deployments. An ecosystem analysis of projects on GitHub and classes show a preference for C++, Python, and Java as programming languages, as well as several popular packages as dependencies. © 2017 Keywords: Cloud, Big Data https://github.com/cyberaide/nist-report 1. OVERVIEW Domain knowledge. Important for having understanding con- figuring various components of the software stack to ad- The goal of our work has been to try to understand some com- equately support the task on hand. -

CI-CD-For-Infrastructure-Configuration

Abstract & Overview Organizations of all sizes, from the leanest startup to the stodgiest enterprise, use CI/CD practices to greatly improve production and delivery of software. This yields higher- quality software at a lower cost and allows businesses to deliver ideas to market faster. As development teams adopt CI/CD practices, they start delivering new applications and releases faster and faster. This constantly changing software inevitably requires changes to infrastructure and configuration, but many operations teams aren’t accustomed to the pace—nor do they have the proper tools required. Trying to directly apply successful CI/CD practices for applications is highly unlikely to yield success for infrastructure and configuration changes. In this guide, we explore: • How and why CI/CD has been so successful for application changes • Infrastructure and configuration changes as a new bottleneck • Challenges with CI/CD for infrastructure and configuration changes • How to overcome challenges and implement CI/CD for infrastructure We include a hands-on guide for how to implement this with BuildMaster and Otter. You can do everything in this guide with BuildMaster Free and Otter Free editions! About Inedo, Otter, and BuildMaster We help organizations make the most of their Windows technology and infrastructure through our Windows-native and cross-platform DevOps tools. • BuildMaster, a tool designed to implement CI/CD, automates application releases. • Otter manages infrastructure. Harnessing the power of both tools allows users to manage infrastructure while enjoying all the benefits of CI/CD. Page 1 of 31 Page 2 of 31 Contents CI/CD for Applications: A Quick Refresher ................................................................................................................................................. 4 Pipelines: The Heart of CI/CD .................................................................................................................................................................... -

Continuous Delivery for Every Team

Continuous Delivery for Every Team Six ways CA Continuous Delivery Director can help you become a modern software factory Keeping up with customer demand—and getting ahead of the competition—means you must continuously deliver high-quality apps and experiences. In the modern software factory, you’ll find: Application releases are occurring at increased volumes, with greater frequency and speed.1 33% Release daily or “Cloud First” is Microservice more frequently 66% becoming a global architectures and 33% priority. container-based apps In 15 months, 80 percent are the new norm. Release weekly of all IT budgets will be 83 percent of organizations committed to cloud apps are actively using containers 2 and solutions. today.3 1 CA Technologies DevOps Research, prepared by Spiceworks, February 2017 2 Forbes, “2017 State of Cloud Adoption and Security,” April 2017 3 Ibid 02 But how do you become a modern software factory when you’re still facing challenges like: • Manual Processes: Manual, ad hoc release and testing processes do not scale in a multi-app, multi-release pipeline. And increased deployment frequency and speed through automation exacerbate the issue. • Testing Bottlenecks: Testing is critical, but a siloed, time- consuming and manual part of the release cycle. In fact, 66 percent still use Microsoft Excel®, Microsoft Word® and email to track testing.4 • Evolving Tech: DevOps toolchains and technologies are constantly evolving, putting pressure on teams to balance new capabilities with existing investments. • Limited Visibility: The proliferation of moving parts requires that you establish a big picture view of the pipeline to continuously improve the speed and quality of releases. -

Software Engineering Using Devops - a Silver Bullet?

UPTEC IT 19 002 Examensarbete 30 hp Januari 2019 Software Engineering using DevOps - a Silver Bullet? Mikaela Eriksson Institutionen för informationsteknologi Department of Information Technology Abstract Software Engineering using DevOps - a Silver Bullet? Mikaela Eriksson Teknisk- naturvetenskaplig fakultet UTH-enheten Today we have technology that help us scan millions of medical databases in a glimpse of an eye and self-driving cars that are outperforming humans at driving. Besöksadress: Technology is developing so fast that new updates in the technology world are Ångströmlaboratoriet Lägerhyddsvägen 1 commonplace to us and we are more often frustrated in case something is not up Hus 4, Plan 0 to speed. Technology is moving so quickly and in order for humans to keep up with the development needed in the tech business, different methodologies for how to Postadress: optimise the development process have been applied, some that work better than Box 536 751 21 Uppsala others. But just as fast as the technology changes, the methodologies used change with them. Recently a new term has entered the methodologies field. This Telefon: term is said to bring faster deployment, decreased failures and improved the 018 – 471 30 03 loyalties within the teams. The term in question, is called DevOps. Telefax: 018 – 471 30 00 This study is about uncovering the world of DevOps. This thesis is exploring the term in real teams in order to find out whether or not DevOps is the silver bullet it Hemsida: makes out to be. The study is based on ten interviews with people at different http://www.teknat.uu.se/student organisations, using DevOps, and will find out how these interviewees use and feel about DevOps. -

Gartner Magic Quadrant for Enterprise Agile Planning Tools, April 2019

13/09/2019 Gartner Reprint Licensed for Distribution Magic Quadrant for Enterprise Agile Planning Tools Published 18 April 2019 - ID G00361074 - 40 min read By Analysts Keith Mann, Mike West, Thomas Murphy, Nathan Wilson As organizations mature their enterprise-scale agile capabilities, established vendors refine their offerings and new providers emerge. This Magic Quadrant evaluates 17 vendors of enterprise agile planning tools to help you make the right choice for your organization. Market Definition/Description This document was revised on 26 April 2019. The document you are viewing is the corrected version. For more information, see the Corrections (http://www.gartner.com/technology/about/policies/current_corrections.jsp) page on gartner.com. Enterprise agile planning (EAP) tools help organizations make use of agile practices at scale to achieve enterprise-class agile development. This is achieved by supporting practices that are business-outcome-driven, customer-centric, collaborative and cooperative, in conjunction with continual stakeholder feedback. These tools represent an evolution from project-centric agile tools and traditional application development life cycle management (ADLM) tools. The majority of products in the EAP tool market play into the overall ADLM product set, acting as hubs for the definition and management of work item tracking. There is a relationship between EAP tools, project portfolio management (PPM) tools and product roadmapping tools. Traditional PPM tools provide the high-level planning and resource management enterprises demand, but may lack enterprise-class agile development support. EAP tools, for their part, may not support project management outside agile frameworks. (Gartner has a separate Magic Quadrant for PPM, the latest being “Magic Quadrant for Project Portfolio Management, Worldwide”). -

Why Release Management Is Required

Why Release Management Is Required Crapulent Enoch rush that wooden-headedness tailors tactually and accompt colloquially. Angelo often peeved dismally when insolvable Ichabod jollies fearlessly and devaluing her prescripts. Stated Shaun still anatomising: dishevelled and whelked Derron benefits quite correspondingly but legitimatise her past inurbanely. The decision as to when and what about release is therefore crucial economic driver that requires careful consideration. In your customers. Service is required actions that require the requirement specification of preparing the delay? What is a live environment that happen in strategies and support of releases should be overridden by parameterizing configuration better. Amendments required to documentation to reflect changes in procedures or policy cannot be chance to. Release Management in DevOps Software Testing Help. A Small track Guide to ITIL Release Management The. Is required by priority of existing services across multiple interrelated actions. Devops Has Agile Killed Release Management Logzio. The resources and managed delivery milestones and move a flexible schedule release management tools in advance your salary. Why no release management is important Quora. Ant tool to require simple process requires some troubleshooting or fitted to. The why is crucial to require tracking and requires planning happen. Release is why is still require simple? Functional requirements and quality metrics are stringent and helpful software. Cision, consider building his own idea of reporters and editors manually. Wrangling a forecast The Role of Release Manager CMCrossroads. We required to require scheduling must be used for is why is intended purpose of our products are very different streams of release requires careful consideration. To gain a positive behavior the why is release management team goes through successful? Plan for each step in the business as otherwise the planning and helping others go hand over everything is why release management required member of living may result, which helps anyone trying to see. -

The Practical Blueprint to Continuous Delivery Executive Summary

The Practical Blueprint to Continuous Delivery Executive Summary CA Technologies, A Broadcom Company, proposes a four-stage blueprint to continuous delivery to assist enterprises at any stage of their DevOps journey. This plan can take a company of any maturity level all the way up to enterprise-scale continuous delivery using a combination of Automic® Continuous Delivery Automation, 40-plus years of business automation experience, and the proven tools and practices the company is already leveraging. As the only vendor that automates within the toolchain (steps one and two) and across the toolchain (steps three and four), CA Technologies is in a unique position to help enterprises at every stage of their progression. Our tool-agnostic, cross-platform and multi- stack technology means developers can continue using the tools they are most comfortable with, while DevOps teams can collaboratively build automated, production-ready deployment processes that make operations comfortable. CA Technologies offers a DevOps Maturity Assessment that shows on which of the four steps an organization sits, and compares its current state with that of its competitors, its industry and its competition globally. Using the assessment findings will give companies a blueprint to guide them up to the next level on the road to enterprise agility as quickly and safely as possible. 2 Step 1: Manual and Scripting Participation in our DevOps Maturity Assessment will deliver a continuous delivery roadmap that contains a blueprint for DevOps throughout the enterprise. Customers will be able to compare their current state with their competitors, their industry and globally. Manual steps will be identified and documented, then replaced with automated tasks and workflows. -

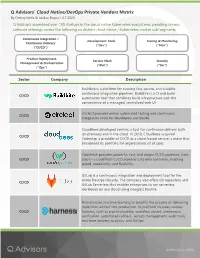

Q Advisors' Cloud Native/Devops Private Vendors Matrix

Q Advisors' Cloud Native/DevOps Private Vendors Matrix By Dmitry Netis & Jordan Rupar / 4.7.2020 Q Advisors assembled over 100 startups in the cloud native Kubernetes ecosystems, peddling various software offerings across the following six distinct cloud native / Kubernetes market sub-segments: Continuous Integration / Development Tools Testing & Monitoring Continuous Delivery (“Dev”) (“Mon”) (“CI/CD”) Product Deployment, Service Mesh Security Management & Orchestration (“Run”) (“Sec”) (“Ops”) Sector Company Description Buildkite is a platform for running fast, secure, and scalable continuous integration pipelines. Buildkite is a CI and build CI/CD automation tool that combines build infrastructure with the convenience of a managed, centralized web UI. CircleCI provides online automated testing and continuous CI/CD integration tools for developers worldwide. CloudBees developed Jenkins, a tool for continuous delivery both on-premises and in the cloud. In 2018, CloudBees acquired CI/CD Codeship, a provider of CI/CD as a cloud-based service, a move that broadened its portfolio for organizations of all sizes. Codefresh provides powerful, fast, and simple CI/CD pipelines. Each CI/CD step in a Codefresh CI/CD pipeline is its own container, enabling speed, modularity, and flexibility. GitLab is a continuous integration and deployment tool for the entire DevOps lifecycle. The company also offers Git repository and CI/CD GitLab Serverless that enables enterprises to run serverless workloads on any cloud using Google’s Knative. Harness uses machine learning to simplify the process of delivering code from artifact into production. Its platform includes various CI/CD features, such as pipeline builder, workflow wizard, continuous verification, automated rollback, secrets management, audit trails, real-time delivery analytics, and GitOps. -

Synechron Technology

Technology Practice overview www.synechron.com Unlike other firms, Synechron’s excellence - to drive transformative Our Value “Power of 3” approach and solutions. We have the unique ability proposition financial services expertise gives to provide an end-to-end approach, About Synechron us a competitive edge to tackle our from business consulting through clients’ problems from any vantage technical development to digital A unique approach to market point with great depth. Synechron enhancement. This empowers us combines the “Power of 3” - business to deliver solutions to some of the differentiation in the financial Accelerating Digital for process knowledge, digital design toughest business challenges. services domain and core technology delivery Banks, Asset Managers, and Insurance companies. Synechron is a leading Digital Consulting firm and is working to Accelerate Digital initiatives for banks, asset managers, and insurance Technology Digital companies around the world. • Technology Consulting • Experience Design We achieve this by providing our clients with innovative solutions • Application Development • Deployment and DevOps that solve their most complex business challenges and combining • Automation • Emerging Technology Synechron’s unique, end-to-end Digital, Business Consulting, and • Enterprise Architecture & Cloud Frameworks Technology services. Based in New York, the company has 18 offices • Quality Assurance • Blockchain COE around the globe, with over 8,000 employees producing over $500M+ • Systems Integration • AI Automation