Euro Crash Risk

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Press Release Changes to the List of Euro Foreign Exchange Reference

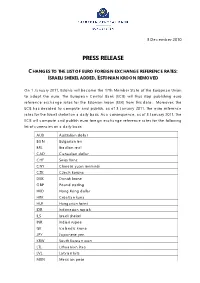

3 December 2010 PRESS RELEASE CHANGES TO THE LIST OF EURO FOREIGN EXCHANGE REFERENCE RATES: ISRAELI SHEKEL ADDED, ESTONIAN KROON REMOVED On 1 January 2011, Estonia will become the 17th Member State of the European Union to adopt the euro. The European Central Bank (ECB) will thus stop publishing euro reference exchange rates for the Estonian kroon (EEK) from this date. Moreover, the ECB has decided to compute and publish, as of 3 January 2011, the euro reference rates for the Israeli shekel on a daily basis. As a consequence, as of 3 January 2011, the ECB will compute and publish euro foreign exchange reference rates for the following list of currencies on a daily basis: AUD Australian dollar BGN Bulgarian lev BRL Brazilian real CAD Canadian dollar CHF Swiss franc CNY Chinese yuan renminbi CZK Czech koruna DKK Danish krone GBP Pound sterling HKD Hong Kong dollar HRK Croatian kuna HUF Hungarian forint IDR Indonesian rupiah ILS Israeli shekel INR Indian rupee ISK Icelandic krona JPY Japanese yen KRW South Korean won LTL Lithuanian litas LVL Latvian lats MXN Mexican peso 2 MYR Malaysian ringgit NOK Norwegian krone NZD New Zealand dollar PHP Philippine peso PLN Polish zloty RON New Romanian leu RUB Russian rouble SEK Swedish krona SGD Singapore dollar THB Thai baht TRY New Turkish lira USD US dollar ZAR South African rand The current procedure for the computation and publication of the foreign exchange reference rates will also apply to the currency that is to be added to the list: The reference rates are based on the daily concertation procedure between central banks within and outside the European System of Central Banks, which normally takes place at 2.15 p.m. -

Regional and Global Financial Safety Nets: the Recent European Experience and Its Implications for Regional Cooperation in Asia

ADBI Working Paper Series REGIONAL AND GLOBAL FINANCIAL SAFETY NETS: THE RECENT EUROPEAN EXPERIENCE AND ITS IMPLICATIONS FOR REGIONAL COOPERATION IN ASIA Zsolt Darvas No. 712 April 2017 Asian Development Bank Institute Zsolt Darvas is senior fellow at Bruegel and senior research Fellow at the Corvinus University of Budapest. The views expressed in this paper are the views of the author and do not necessarily reflect the views or policies of ADBI, ADB, its Board of Directors, or the governments they represent. ADBI does not guarantee the accuracy of the data included in this paper and accepts no responsibility for any consequences of their use. Terminology used may not necessarily be consistent with ADB official terms. Working papers are subject to formal revision and correction before they are finalized and considered published. The Working Paper series is a continuation of the formerly named Discussion Paper series; the numbering of the papers continued without interruption or change. ADBI’s working papers reflect initial ideas on a topic and are posted online for discussion. ADBI encourages readers to post their comments on the main page for each working paper (given in the citation below). Some working papers may develop into other forms of publication. Suggested citation: Darvas, Z. 2017. Regional and Global Financial Safety Nets: The Recent European Experience and Its Implications for Regional Cooperation in Asia. ADBI Working Paper 712. Tokyo: Asian Development Bank Institute. Available: https://www.adb.org/publications/regional-and-global-financial-safety-nets Please contact the authors for information about this paper. Email: [email protected] Paper prepared for the Conference on Global Shocks and the New Global/Regional Financial Architecture, organized by the Asian Development Bank Institute and S. -

Baltic Monetary Regimes in the Xxist Century

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Viksnins, George J. Article — Digitized Version Baltic monetary regimes in the XXIst century Intereconomics Suggested Citation: Viksnins, George J. (2000) : Baltic monetary regimes in the XXIst century, Intereconomics, ISSN 0020-5346, Springer, Heidelberg, Vol. 35, Iss. 5, pp. 213-218 This Version is available at: http://hdl.handle.net/10419/40777 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available under an Open gelten abweichend von diesen Nutzungsbedingungen die in der dort Content Licence (especially Creative Commons Licences), you genannten Lizenz gewährten Nutzungsrechte. may exercise further usage rights as specified in the indicated licence. www.econstor.eu EU ENLARGEMENT member states, the candidates should expect the dangers of inaction are even greater because the enlargement to be in a state of fluidity. existing member states may use their veto on • Second, the fact that uncertainty cannot be accession of new members to protect their broader interests. -

Relevant Market/ Region Commercial Transaction Rates

Last Updated: 31, May 2021 You can find details about changes to our rates and fees and when they will apply on our Policy Updates Page. You can also view these changes by clicking ‘Legal’ at the bottom of any web-page and then selecting ‘Policy Updates’. Domestic: A transaction occurring when both the sender and receiver are registered with or identified by PayPal as residents of the same market. International: A transaction occurring when the sender and receiver are registered with or identified by PayPal as residents of different markets. Certain markets are grouped together when calculating international transaction rates. For a listing of our groupings, please access our Market/Region Grouping Table. Market Code Table: We may refer to two-letter market codes throughout our fee pages. For a complete listing of PayPal market codes, please access our Market Code Table. Relevant Market/ Region Rates published below apply to PayPal accounts of residents of the following market/region: Market/Region list Taiwan (TW) Commercial Transaction Rates When you buy or sell goods or services, make any other commercial type of transaction, send or receive a charity donation or receive a payment when you “request money” using PayPal, we call that a “commercial transaction”. Receiving international transactions Where sender’s market/region is Rate Outside of Taiwan (TW) Commercial Transactions 4.40% + fixed fee Fixed fee for commercial transactions (based on currency received) Currency Fee Australian dollar 0.30 AUD Brazilian real 0.60 BRL Canadian -

The Quest for Monetary Integration – the Hungarian Experience

Munich Personal RePEc Archive The quest for monetary integration – the Hungarian experience Zoican, Marius Andrei University of Reading, Henley Business School 5 April 2009 Online at https://mpra.ub.uni-muenchen.de/17286/ MPRA Paper No. 17286, posted 14 Sep 2009 23:56 UTC The Quest for Monetary Integration – the Hungarian Experience Working paper Marius Andrei Zoican visiting student, University of Reading Abstract From 1990 onwards, Eastern European countries have had as a primary economic goal the convergence with the traditionally capitalist states in Western Europe. The usage of various exchange rate regimes to accomplish the convergence of inflation and interest rates, in order to create a fully functional macroeconomic environment has been one of the fundamental characteristics of states in Eastern Europe for the past 20 years. Among these countries, Hungary stands out as having tried a number of exchange rate regimes – from the adjustable peg in 1994‐1995 to free float since 2008. In the first part, this paper analyses the macroeconomic performance of Hungary during the past 15 years as a function of the exchange rate regime used. I also compare this performance, where applicable, with two similar countries which have used the most extreme form of exchange rate regime: Estonia (with a currency board) and Romania, who never officialy pegged its currency and used a managed float even since 1992. The second part of this paper analyzes the overall Hungarian performance from the perspective of the Optimal Currency Area theory, therefore trying to establish if, after 20 years of capitalism, and a large variety of monetary policies, Hungary is indeed prepared to join the European Monetary Union. -

EUROPEAN COMMISSION Brussels, 23.7.2013 COM(2013)

EUROPEAN COMMISSION Brussels, 23.7.2013 COM(2013) 540 final REPORT FROM THE COMMISSION Twelfth Report on the practical preparations for the future enlargement of the euro area EN EN REPORT FROM THE COMMISSION TO THE EUROPEAN PARLIAMENT, THE COUNCIL, THE EUROPEAN CENTRAL BANK, THE EUROPEAN ECONOMIC AND SOCIAL COMMITTEE AND THE COMMITTEE OF THE REGIONS Twelfth Report on the practical preparations for the future enlargement of the euro area 1. INTRODUCTION Since the adoption of the euro by Estonia on 1 January 2011, the euro area consists of seventeen EU Member States. Among the remaining eleven Member States, nine Member States are expected to adopt the euro once the necessary conditions are fulfilled. Denmark and the United Kingdom have a special "opt-out"-status and are not committed to adopt the euro. This report assesses the state of play of the practical preparations for introducing the euro in Latvia and evaluates the progress made in preparing the changeover related communication campaign. Following the Council decision from 9 July 2013 concluding that the necessary conditions for euro adoption are fulfilled, Latvia will adopt the euro on 1 January 2014 ("€- day"). The conversion rate between the Latvian lats and the euro has been irrevocably fixed at 0.702804 Latvian lats to one euro. 2. STATE OF PLAY OF THE PREPARATIONS FOR THE CHANGEOVER IN LATVIA Latvia will be the sixth of the group of Member States which joined the EU in 2004 to adopt the euro. Latvia's original target date of 1 January 2008 foreseen in the Action Plan for Implementation of the Single European Currency of 1 November 2005 was subsequently reconsidered. -

The History of the Romanian Monetary System in a European Context

Mugur Isărescu: The history of the Romanian monetary system in a European context Opening speech by Mr Mugur Isărescu, Governor of the National Bank of Romania, on the occasion of the inauguration of the Euro Exhibition at Banca Naţională a României, Bucharest, 10 March 2011. * * * Dear Mr González-Páramo, Your Excellencies, Distinguished guests, It is an honour for us and we are glad to welcome you today, at the opening of an exhibition not only educational and attractive, but also relevant considering Romania’s euro adoption. We do hope the Euro Exhibition that the National Bank of Romania is hosting, on behalf of Romania, will prove successful all the more so as our country is destination No. 10 of the European Central Bank’s travelling exhibition. Let me thank Mr. José Manuel González-Páramo for accepting to jointly launch the Euro Exhibition today in Bucharest where it will be open for about three months, here, in the old financial centre of Bucharest where the Romanian leu was born. The leu-euro relation is thus acquiring a symbolical dimension with a certain meaning in the current European context. The reference to the European context is neither conventional nor formal. It reveals that the Romanian leu is one of the strong historical bonds that put our country on the European map. Its roots in the olden leeuwendaalder or the Dutch lion-thaler show not only its descent from the former Dutch coin (and therefore its being related to the US dollar), but also its European dimension as ever since its birth, shortly after the creation of the modern Romanian state, our leu currency was French. -

Relevant Market/ Region Commercial Transaction Rates

Last Updated: 31, May 2021 You can find details about changes to our rates and fees and when they will apply on our Policy Updates Page. You can also view these changes by clicking ‘Legal’ at the bottom of any web-page and then selecting ‘Policy Updates’. Domestic: A transaction occurring when both the sender and receiver are registered with or identified by PayPal as residents of the same market. International: A transaction occurring when the sender and receiver are registered with or identified by PayPal as residents of different markets. Certain markets are grouped together when calculating international transaction rates. For a listing of our groupings, please access our Market/Region Grouping Table. Market Code Table: We may refer to two-letter market codes throughout our fee pages. For a complete listing of PayPal market codes, please access our Market Code Table. Relevant Market/ Region Rates published below apply to PayPal accounts of residents of the following market/region: Market/Region list Vietnam (VN) Commercial Transaction Rates When you buy or sell goods or services, make any other commercial type of transaction, send or receive a charity donation or receive a payment when you “request money” using PayPal, we call that a “commercial transaction”. Receiving international transactions Where sender’s market/region is Rate Outside of Vietnam (VN) Commercial Transactions 4.40% + fixed fee Fixed fee for commercial transactions (based on currency received) Currency Fee Australian dollar 0.30 AUD Brazilian real 0.60 BRL Canadian dollar -

Convergence Report 2013 on Latvia

ISSN 1725-3217 Convergence Report 2013 on Latvia EUROPEAN ECONOMY 3|2013 Economic and Financial Affairs The European Economy series contains important reports and communications from the Commission to the Council and the Parliament on the economic situation and developments, such as the European economic forecasts and the Public finances in EMU report. Unless otherwise indicated the texts are published under the responsibility of the Directorate-General for Economic and Financial Affairs of the European Commission to which enquiries should be addressed. Legal notice Neither the European Commission nor any person acting on its behalf may be held responsible for the use which may be made of the information contained in this publication, or for any errors which, despite careful preparation and checking, may appear. More information on the European Union is available on the Internet (http://europa.eu). ISBN 978-92-79-28535-6 doi: 10.2765/40058 © European Union, 2013 Reproduction is authorised provided the source is acknowledged. European Commission Directorate-General for Economic and Financial Affairs Convergence Report 2013 on Latvia EUROPEAN ECONOMY European Economy N° 3/2013 ABBREVIATIONS LV Latvia EA Euro area EU-27 European Union, 27 Member States EU-25 European Union, 25 Member States before 2007 (i.e. EU-27 excl. BG and RO) EU-15 European Union, 15 Member States before 2004 EUR Euro ECU European currency unit LVL Latvian lats USD US dollar SDR Special Drawing Rights AMR Alert Mechanism Report BoL Bank of Latvia BoP Balance of Payments -

ESSA-Sport National Report – Denmark 1

ESSA-Sport National Report – Denmark 1 TABLE OF CONTENTS TABLE OF CONTENTS ................................................................................................................................ 2 1. THE ESSA-SPORT PROJECT AND BACKGROUND TO THE NATIONAL REPORT ............................................ 4 2. NATIONAL KEY FACTS AND OVERALL DATA ON THE LABOUR MARKET ................................................... 8 3. THE NATIONAL SPORT AND PHYSICAL ACTIVITY SECTOR ...................................................................... 15 4. SPORT LABOUR MARKET STATISTICS ................................................................................................... 28 5. NATIONAL EDUCATION AND TRAINING SYSTEM .................................................................................. 36 6. NATIONAL SPORT EDUCATION AND TRAINING SYSTEM ....................................................................... 42 7. FINDINGS FROM THE EMPLOYER SURVEY............................................................................................ 52 8. REPORT ON NATIONAL CONSULTATIONS ............................................................................................ 90 9. NATIONAL CONCLUSIONS ................................................................................................................... 93 10. NATIONAL ACTION PLAN AND RECOMMENDATIONS ......................................................................... 95 BIBLIOGRAPHY ...................................................................................................................................... -

Short-Run Determinants of the USD/PLN Exchange Rate and Policy Implications

Theoretical and Applied Economics FFet al Volume XXII (2015), No. 2(603), Summer, pp. 247-254 Short-run determinants of the USD/PLN exchange rate and policy implications Yu HSING Southeastern Louisiana University, Hammond, USA [email protected] Abstract. This paper examines short-run determinants of the U.S. dollar/Polish zloty (USD/PLN) exchange rate based on a simultaneous-equation model of demand and supply. Using a reduced form equation and the EGARCH model, the paper finds that the USD/PLN exchange rate is positively associated with the real reference rate in Poland, real GDP in the U.S., the real stock index in Poland and the expected exchange rate and is negatively influenced by the U.S. real federal funds rate, real GDP in Poland, and the real stock index in the U.S. Hence, monetary policy is effective in influencing the USD/PLN exchange rate. Keywords: exchange rates, interest rates, real GDP, stock indexes, EGARCH. JEL Classification: F31, F41. 248 Yu Hsing 1. Introduction The Polish zloty/U.S. dollar exchange rate has experienced fluctuations like most other currencies in transition economies. During its early transformation from a socialist to a market economy, the zloty had declined significantly against the U.S. dollar from 0.0506 in 1989.M1 to 4.6369 in 2000.M10. The adoption of a managed floating exchange rate regime in April 2000, the joining of the EU in May 2004, relative political stability, improvements in international trade, and economic growth had made the zloty stronger as evidenced by the change in the exchange rate against the U.S. -

Coping with the International Financial Crisis at the National Level in a European Context

European Commission Directorate-General for Financial Stability, Financial Services and Capital Markets Union Coping with the international financial crisis at the national level in a European context Impact and financial sector policy responses in 2008 – 2015 This document has been prepared by the Directorate-General for Financial Stability, Financial Services and Capital Markets Union (DG FISMA). This document is a European Commission staff working document for information purposes. It does not represent an official position of the Commission on this issue, nor does it anticipate such a position. Neither the European Commission nor any person acting on its behalf may be held responsible for the use which may be made of the information contained in this publication, or for any errors which, despite careful preparation and checking, may appear. ABBREVIATIONS Countries and regions EU: European Union EA: Euro area CEE: Central and Eastern Europe MS: Member State BE: Belgium BG: Bulgaria CZ: Czech Republic DK: Denmark DE: Germany EE: Estonia IE: Ireland EL: Greece ES: Spain FR: France HR: Croatia IT: Italy CY: Cyprus LV: Latvia LT: Lithuania LU: Luxembourg HU: Hungary MT: Malta NL: The Netherlands AT: Austria PL: Poland PT: Portugal RO: Romania SI: Slovenia SK: Slovakia FI: Finland SE Sweden UK: United Kingdom JP: Japan US: United States of America Institutions EBA: European Banking Authority EBRD: European Bank for Reconstruction and Development EC: European Commission ECB: European Central Bank Fed: Federal Reserve, US IMF: International Monetary Fund OECD: Organisation for Economic Cooperation and Development v Graphs/Tables/Units bn: Billion bp. /bps: Basis point / points lhs: Left hand scale mn: Million pp.