3 1 1 1 1 52 2011 Feb Aatsfy

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

APR 2009 Stats Rpts

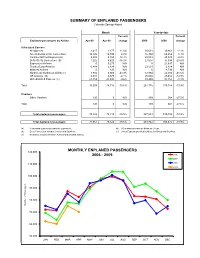

SUMMARY OF ENPLANED PASSENGERS Colorado Springs Airport Month Year-to-date Percent Percent Enplaned passengers by Airline Apr-09 Apr-08 change 2009 2008 change Scheduled Carriers Allegiant Air 2,417 2,177 11.0% 10,631 10,861 -2.1% American/American Connection 14,126 14,749 -4.2% 55,394 60,259 -8.1% Continental/Cont Express (a) 5,808 5,165 12.4% 22,544 23,049 -2.2% Delta /Delta Connection (b) 7,222 8,620 -16.2% 27,007 37,838 -28.6% ExpressJet Airlines 0 5,275 N/A 0 21,647 N/A Frontier/Lynx Aviation 6,888 2,874 N/A 23,531 2,874 N/A Midwest Airlines 0 120 N/A 0 4,793 N/A Northwest/ Northwest Airlink (c) 3,882 6,920 -43.9% 12,864 22,030 -41.6% US Airways (d) 6,301 6,570 -4.1% 25,665 29,462 -12.9% United/United Express (e) 23,359 25,845 -9.6% 89,499 97,355 -8.1% Total 70,003 78,315 -10.6% 267,135 310,168 -13.9% Charters Other Charters 120 0 N/A 409 564 -27.5% Total 120 0 N/A 409 564 -27.5% Total enplaned passengers 70,123 78,315 -10.5% 267,544 310,732 -13.9% Total deplaned passengers 71,061 79,522 -10.6% 263,922 306,475 -13.9% (a) Continental Express provided by ExpressJet. (d) US Airways provided by Mesa Air Group. (b) Delta Connection includes Comair and SkyWest . (e) United Express provided by Mesa Air Group and SkyWest. -

MAR 2009 Stats Rpts

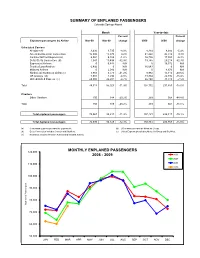

SUMMARY OF ENPLANED PASSENGERS Colorado Springs Airport Month Year-to-date Percent Percent Enplaned passengers by Airline Mar-09 Mar-08 change 2009 2008 change Scheduled Carriers Allegiant Air 3,436 3,735 -8.0% 8,214 8,684 -5.4% American/American Connection 15,900 15,873 0.2% 41,268 45,510 -9.3% Continental/Cont Express (a) 6,084 6,159 -1.2% 16,736 17,884 -6.4% Delta /Delta Connection (b) 7,041 10,498 -32.9% 19,785 29,218 -32.3% ExpressJet Airlines 0 6,444 N/A 0 16,372 N/A Frontier/Lynx Aviation 6,492 0 N/A 16,643 0 N/A Midwest Airlines 0 2,046 N/A 0 4,673 N/A Northwest/ Northwest Airlink (c) 3,983 6,773 -41.2% 8,982 15,110 -40.6% US Airways (d) 7,001 7,294 -4.0% 19,364 22,892 -15.4% United/United Express (e) 24,980 26,201 -4.7% 66,140 71,510 -7.5% Total 74,917 85,023 -11.9% 197,132 231,853 -15.0% Charters Other Charters 150 188 -20.2% 289 564 -48.8% Total 150 188 -20.2% 289 564 -48.8% Total enplaned passengers 75,067 85,211 -11.9% 197,421 232,417 -15.1% Total deplaned passengers 72,030 82,129 -12.3% 192,861 226,953 -15.0% (a) Continental Express provided by ExpressJet. (d) US Airways provided by Mesa Air Group. (b) Delta Connection includes Comair and SkyWest . (e) United Express provided by Mesa Air Group and SkyWest. -

Attachment F – Participants in the Agreement

Revenue Accounting Manual B16 ATTACHMENT F – PARTICIPANTS IN THE AGREEMENT 1. TABULATION OF PARTICIPANTS 0B 475 BLUE AIR AIRLINE MANAGEMENT SOLUTIONS S.R.L. 1A A79 AMADEUS IT GROUP SA 1B A76 SABRE ASIA PACIFIC PTE. LTD. 1G A73 Travelport International Operations Limited 1S A01 SABRE INC. 2D 54 EASTERN AIRLINES, LLC 2I 156 STAR UP S.A. 2I 681 21 AIR LLC 2J 226 AIR BURKINA 2K 547 AEROLINEAS GALAPAGOS S.A. AEROGAL 2T 212 TIMBIS AIR SERVICES 2V 554 AMTRAK 3B 383 Transportes Interilhas de Cabo Verde, Sociedade Unipessoal, SA 3E 122 MULTI-AERO, INC. DBA AIR CHOICE ONE 3J 535 Jubba Airways Limited 3K 375 JETSTAR ASIA AIRWAYS PTE LTD 3L 049 AIR ARABIA ABDU DHABI 3M 449 SILVER AIRWAYS CORP. 3S 875 CAIRE DBA AIR ANTILLES EXPRESS 3U 876 SICHUAN AIRLINES CO. LTD. 3V 756 TNT AIRWAYS S.A. 3X 435 PREMIER TRANS AIRE INC. 4B 184 BOUTIQUE AIR, INC. 4C 035 AEROVIAS DE INTEGRACION REGIONAL 4L 174 LINEAS AEREAS SURAMERICANAS S.A. 4M 469 LAN ARGENTINA S.A. 4N 287 AIR NORTH CHARTER AND TRAINING LTD. 4O 837 ABC AEROLINEAS S.A. DE C.V. 4S 644 SOLAR CARGO, C.A. 4U 051 GERMANWINGS GMBH 4X 805 MERCURY AIR CARGO, INC. 4Z 749 SA AIRLINK 5C 700 C.A.L. CARGO AIRLINES LTD. 5J 203 CEBU PACIFIC AIR 5N 316 JOINT-STOCK COMPANY NORDAVIA - REGIONAL AIRLINES 5O 558 ASL AIRLINES FRANCE 5T 518 CANADIAN NORTH INC. 5U 911 TRANSPORTES AEREOS GUATEMALTECOS S.A. 5X 406 UPS 5Y 369 ATLAS AIR, INC. 50 Standard Agreement For SIS Participation – B16 5Z 225 CEMAIR (PTY) LTD. -

Columbus Regional Airport Authority

COLUMBUS REGIONAL AIRPORT AUTHORITY - PORT COLUMBUS INTERNATIONAL AIRPORT TRAFFIC REPORT June 2014 7/22/2014 Airline Enplaned Passengers Deplaned Passengers Enplaned Air Mail Deplaned Air Mail Enplaned Air Freight Deplaned Air Freight Landings Landed Weight Air Canada Express - Regional 2,377 2,278 - - - - 81 2,745,900 Air Canada Express Totals 2,377 2,278 - - - - 81 2,745,900 AirTran 5,506 4,759 - - - - 59 6,136,000 AirTran Totals 5,506 4,759 - - - - 59 6,136,000 American 21,754 22,200 - - - 306 174 22,210,000 Envoy Air** 22,559 22,530 - - 2 ,027 2 ,873 527 27,043,010 American Totals 44,313 44,730 - - 2,027 3,179 701 49,253,010 Delta 38,216 36,970 29,594 34,196 25,984 36,845 278 38,899,500 Delta Connection - ExpressJet 2,888 2,292 - - - - 55 3,709,300 Delta Connection - Chautauqua 15,614 14,959 - - 640 - 374 15,913,326 Delta Connection - Endeavor 4 ,777 4,943 - - - - 96 5,776,500 Delta Connection - GoJet 874 748 - - 33 - 21 1,407,000 Delta Connection - Shuttle America 6,440 7,877 - - 367 - 143 10,536,277 Delta Connection - SkyWest 198 142 - - - - 4 188,000 Delta Totals 69,007 67,931 29,594 34,196 27,024 36,845 971 76,429,903 Southwest 97,554 96,784 218,777 315,938 830 103,146,000 Southwest Totals 97,554 96,784 - - 218,777 315,938 830 103,146,000 United 3 ,411 3,370 13,718 6 ,423 1 ,294 8 ,738 30 3,990,274 United Express - ExpressJet 13,185 13,319 - - - - 303 13,256,765 United Express - Mesa 27 32 - - - - 1 67,000 United Express - Republic 4,790 5,133 - - - - 88 5,456,000 United Express - Shuttle America 9,825 9,076 - - - - 151 10,919,112 -

Foram Encontrados 367 Parceiros. Verifique Se Está Disponível No Seu Mercado

Foram encontrados 367 parceiros. Verifique se está disponível no seu mercado. Por favor use sempre o Quick Check em www.hahnair.com/quickcheck antes de emitir um bilhete. P4 Air Peace BG Biman Bangladesh Airl… T3 Eastern Airways 7C Jeju Air HR-169 HC Air Senegal NT Binter Canarias MS Egypt Air JQ Jetstar Airways A3 Aegean Airlines JU Air Serbia 0B Blue Air LY EL AL Israel Airlines 3K Jetstar Asia EI Aer Lingus HM Air Seychelles BV Blue Panorama Airlines EK Emirates GK Jetstar Japan AR Aerolineas Argentinas VT Air Tahiti OB Boliviana de Aviación E7 Equaflight BL Jetstar Pacific Airlines VW Aeromar TN Air Tahiti Nui TF Braathens Regional Av… ET Ethiopian Airlines 3J Jubba Airways AM Aeromexico NF Air Vanuatu 1X Branson AirExpress EY Etihad Airways HO Juneyao Airlines AW Africa World Airlines UM Air Zimbabwe SN Brussels Airlines 9F Eurostar RQ Kam Air 8U Afriqiyah Airways SB Aircalin FB Bulgaria Air BR EVA Air KQ Kenya Airways AH Air Algerie TL Airnorth VR Cabo Verde Airlines FN fastjet KE Korean Air 3S Air Antilles AS Alaska Airlines MO Calm Air FJ Fiji Airways KU Kuwait Airways KC Air Astana AZ Alitalia QC Camair-Co AY Finnair B0 La Compagnie UU Air Austral NH All Nippon Airways KR Cambodia Airways FZ flydubai LQ Lanmei Airlines BT Air Baltic Corporation Z8 Amaszonas K6 Cambodia Angkor Air XY flynas QV Lao Airlines KF Air Belgium Z7 Amaszonas Uruguay 9K Cape Air 5F FlyOne LA LATAM Airlines BP Air Botswana IZ Arkia Israel Airlines BW Caribbean Airlines FA FlySafair JJ LATAM Airlines Brasil 2J Air Burkina OZ Asiana Airlines KA Cathay Dragon -

Legislative Fiscal Bureau One East Main, Suite 301 • Madison, WI 53703 • (608) 266-3847 • Fax: (608) 267-6873

Legislative Fiscal Bureau One East Main, Suite 301 • Madison, WI 53703 • (608) 266-3847 • Fax: (608) 267-6873 May 29, 2001 Joint Committee on Finance Paper #899 Tax Exemption for Air Carriers with Hub Terminal Facilities (DOT -- Transportation Finance) [LFB 2001-03 Budget Summary: Page 651, #6 (part)] CURRENT LAW Commercial airlines are exempt from local property taxes and, instead, are taxed under the state’s ad valorem tax authorized by Chapter 76 of the statutes. Proceeds from taxes paid by airlines are deposited in the state’s transportation fund. The property of airlines is valued on a systemwide basis, and a portion of that value is allocated to Wisconsin based on a statutory formula intended to reflect the airline’s activity in the state. The resulting value is taxed at the statewide average tax rate for property subject to local property taxes, net of state tax credits. The formula used to apportion airline values to Wisconsin consists of three, equally weighted factors that include: (a) transport and transport-related revenues; (b) tons of revenue passengers and cargo; and (c) depreciated cost. For each factor, activity in Wisconsin is divided by activity in the system as a whole, and the result is multiplied by one-third. Each company’s allocation percentage equals the sum of the three factors. In 2000, the total Wisconsin valuation of airline property was $431,097,728 and the statewide average property rate was $21.464 per $1,000 of property. The ad valorem tax on airline property generated $9,253,100 in transportation fund revenue in that year. -

3 1 1 1 1 56 2011 Mar Aatsfy

LAMBERT-ST. LOUIS INTERNATIONAL AIRPORT Confidential AIR TRAFFIC ACTIVITY REPORT [email protected] Fiscal2020-01-15 Year 17:11:51 +0000 As of March, 2011 LAMBERT-ST. LOUIS INTERNATIONAL AIRPORT AIR TRAFFIC ACTIVITY REPORT List of Summary Tables and Charts: Summary of Air Traffic Activity Key Air Traffic Activity Relationships Monthly Enplaned Passengers Summary of Enplaned Passengers by Airline Breakdown of Enplaned Passengers by Airline Airline Market Shares Summary of Deplaned Passengers by Airline Originating and Connecting Enplaned Passengers by Airline Originating ConnectingConfidential Enplaned Passengers Originating Enplaned Passengers-Airline Market Shares Connecting Enplaned Passengers-Airline Market Shares Domestic and International Enplaned Passengers by Airline Domestic and [email protected] Enplaned Passengers International Enplaned Passengers-Airline Market Shares Monthly Commercial2020-01-15 Aircraft Departures 17:11:51 +0000 Summary of Aircraft Departures by Airline Monthly Aircraft Operations Breakdown of Aircraft Operations Monthly Aircraft Landed Weight Summary of Aircraft Landed Weight by Airline Monthly Enplaned and Deplaned Cargo Cargo Breakdown between Belly and All-Cargo Carriers Summary of Enplaned and Deplaned Mail by Airline Summary of Enplaned and Deplaned Freight by Airline Mar-11 STL SUMMARY OF AIR TRAFFIC ACTIVITY Lambert-St. Louis International Airport Mar-11 vs Mar-10 and FYTD 11 vs FYTD 10 Page 1 of 2 MonthPercent Year-to-Date Percent Mar-11 Mar-10 Change FY2011 FY2010 Change Enplaned passengers (EP) Domestic Mainline/national *American 95,913 130,210 -26.3% 833,967 1,227,175 -32.0% *Southwest 244,538 204,555 19.5% 2,049,771 1,632,745 25.5% Other 90,187 82,020 10.0% 763,244 608,161 25.5% Subtotal-Mainline/national 430,638 416,785 3.3% 3,646,982 3,468,081 5.2% Regional/commuter *AA Conn/ Am. -

Annual Report 2000

Northwest Northwest Annual Report Airlines Corporation Corporation Annual Report 2000 Northwest Airlines Corporation 5101 Northwest Drive St. Paul, MN 55000-3034 www.nwa.com ©2000 Northwest Airlines Corporation 2000 Northwest Airlines Annual Report 2000 CONDENSED FINANCIAL HIGHLIGHTS Northwest Airlines Corporation Year Ended December 31 Percent (Dollars in millions, except per share data) 2000 1999 Change FINANCIALS Operating Revenues $ 11,415 $ 10,276 11.1 Operating Expenses 10,846 9,562 13.4 Operating Income $ 569 $ 714 Operating Margin 5.0% 6.9% (1.9)pts. Net Income $ 256 $ 300 Our cover depicts the new Detroit terminal, Earnings Per Common Share: due to open in 2001. Basic $ 3.09 $ 3.69 Diluted $ 2.77 $ 3.26 Number of Common Shares Outstanding (millions) 85.1 84.6 NORTHWEST AIRLINES is the world’s fourth largest airline with domestic hubs in OPERATING STATISTICS Detroit, Minneapolis/St. Paul and Memphis, Asian hubs in Tokyo and Osaka, and a Scheduled Service: European hub in Amsterdam. Northwest Airlines and its alliance partners, including Available Seat Miles (ASM) (millions) 103,356 99,446 3.9 Continental Airlines and KLM Royal Dutch Airlines, offer customers a global airline Revenue Passenger Miles (RPM) (millions) 79,128 74,168 6.7 network serving more than 785 cities in 120 countries on six continents. Passenger Load Factor 76.6% 74.6% 2.0 pts. Revenue Passengers (millions) 58.7 56.1 4.6 Table of Contents Revenue Yield Per Passenger Mile 12.04¢ 11.58¢ 4.0 Passenger Revenue Per Scheduled ASM 9.21¢ 8.64¢ 6.6 To Our Shareholders . -

Trans States Holdings Signed Purchase Agreement with Mitsubishi Aircraft for 100 MRJ Aircraft on Dec 27, 2010 TSH President Richard A

MRJ Newsletter Trans States Holdings Signed Purchase Agreement with Mitsubishi Aircraft for 100 MRJ Aircraft on Dec 27, 2010 TSH President Richard A. Leach Attends Reception Ceremony held in Nagoya February 01,2011 Mitsubishi Aircraft Corporation finalized and executed a definitive Purchase Agreement with Trans States Holdings (TSH) for an order of 100 next- generation Mitsubishi Regional Jet (MRJ) aircraft (50 firm, 50 options) on December 27, 2010. TSH President Richard A. Leach visited Japan to attend the reception ceremony held on February 1st 2011 in Nagoya celebrating the definitive Purchase Agreement. Since the announcement of the LOI in October 2009, TSH and Mitsubishi Aircraft have been constantly exchanging views and strengthening the relationship. Both parties are pleased to conclude the definitive Purchase Agreement of the MRJ – the game-changing next- generation regional jet. Mr. Wigmore, CFO of TSH (left); Egawa, President of Mitsubishi Aircraft Corporation (center); Mr. Leach, President of TSH (right) TSH, based in St. Louis, Missouri, is an airline holding company that owns and operates three independent airlines, Trans States Airlines, GoJet Airlines, and Compass Airlines, all of which have significant regional operations in North America. TSH is entrusted with feeder services for United Airlines, Delta Air Lines, and US Airways. TSH President Richard A. Leach said, “We have been very excited about the MRJ program for a long time, and we are extremely pleased to conclude this major order on December 27 last year reaffirming the 100 aircraft commitment we made with our LOI. Since that launch order, we have learned a lot about the quality of the Mitsubishi Aircraft team and the quality of the MRJ aircraft. -

Republic Airways Flight Attendant 2019 Tentative Agreement Review of Compensation and Benefits

Republic Airways Flight Attendant 2019 Tentative Agreement Review of Compensation and Benefits 1 Teamsters Local 135 Airline Division Major Contract Improvements Summary 1. Overall economic improvements 2. Wage rates o Wage scale increases of 5%, 1%, 1%, 2% and 2% in Years 1 through 5 of the agreement (these amounts do not in longevity increases). o Premium pay for credit hours above 87 per month. o Regional comparisons 3. Signing bonus o Total signing bonus of $3.0 million 4. Pay credit guarantee o Minimum daily credit of 3.5 hours 5. Per diem improvements 6. 401(k) employer contribution improvements 7. Guarantee Low Time (GLT) flight attendants employer premium contributions 8. Paid Days Off (PDO) 2 Teamsters Local 135 Airline Division 1. Overall economic improvements • The tentative agreement includes $35.7 million in economic improvements over the five years. o This amounts to an average improvement of $18,100 per flight attendant over five years. o Additionally, the 2019 Tentative Agreement represents $10.2 million in improvements above the rejected 2018 Tentative Agreement. 3 Teamsters Local 135 Airline Division 2. Wage rates YOS Current DOS DOS+1 DOS+2 DOS+3 DOS+4 $18.20 1* $19.70 $19.90 $20.10 $20.50 $20.91 $19.33 Annual Contract Increases: 2 $21.32 $22.39 $22.61 $22.84 $23.29 $23.76 • DOS: 5%* 3 $22.85 $23.99 $24.23 $24.47 $24.96 $25.46 • DOS+1: 1% 4 $24.24 $25.45 $25.71 $25.96 $26.48 $27.01 • DOS+2: 1% 5 $25.66 $26.94 $27.21 $27.48 $28.03 $28.59 • DOS+3: 2% 6 $27.03 $28.38 $28.67 $28.95 $29.53 $30.12 • DOS+4: 2% 7 $28.45 $29.87 -

3 1 1 1 1 120 2017 Apr Aatsfy

AIR TRAFFIC ACTIVITY REPORT By Fiscal Year As of April, 2017 Confidential [email protected] 2020-01-15 17:13:23 +0000 5/24/2017 ST. LOUIS LAMBERT INTERNATIONAL AIRPORT AIR TRAFFIC ACTIVITY REPORT As of April, 2017 Section I - Passenger Data Section Summary of Air Traffic Activity (Enplaned Passengers) 1-1 Summary of Enplaned Passengers By Airline 1-2 Monthly Enplaned Passenger 1-3 Summary of Deplaned Passengers By Airline 1-4 Originating and Connecting Enplaned Passengers by Airline 1-5 Originating Enplaned Passengers Airline Market Shares 1-6 Connecting Enplaned Passengers Airline Market Shares 1-7 Total Enplaned Passengers - Airline Market Shares 1-8 Domestic And International Enplaned Passengers By Airline 1-9 Enplaned Passengers By Concourse 1-10 Enplaned Passengers Per Aircraft Departures 1-11 Section 2 - Aircraft Operations Summary of Aircraft Departures 2-1 Summary Of Aircraft Departures By Airline 2-2 Monthly Commercial Aircraft DeparturesConfidential 2-3 Summary Of Aircraft Arrivals By Airline 2-4 Monthly Aircraft Operations 2-5 Breakdown of Aircraft Operations 2-6 Summary Of Aircraft Operations 2-7 [email protected] Section 3 - Landed Weights 2020-01-15 17:13:23 +0000 Summary Of Aircraft Landed Weight By Airline 3-1 Monthly Aircraft Landed Weight 3-2 Average Weight(lbs) Per Landing 3-3 Section 4 - Cargo Summary Of Enplaned and Deplaned Cargo (LBS) - (Mail and Freight) 4-1 Monthly Enplaned And Deplaned Cargo (LBS) - (Mail and Freight) 4-2 Summary Of Enplaned And Deplaned Freight By Airline 4-3 Summary Of Enplaned And Deplaned Mail By Airline 4-4 ST. -

United Airlines / United Express Reciprocal Jumpseat

Updated July 22, 2020 United Airlines / United Express Reciprocal Jumpseat Frequently Asked Questions What’s changing? Starting June 1, 2020, jumpseat-qualified United (UA) and United Express (UAX) employees in Dispatch, Flight Operations and Inflight Services will be able to electronically self-list for a qualifying jumpseat in employeeRES. UAX carriers include: Air Wisconsin, CommutAir, ExpressJet, GoJet, Mesa Airlines, Republic Airlines, and *SkyWest Airlines (*Flight Operations and Dispatch only). • UA employees will be able self-list for UAX flights within the 50 United States and can continue to self-list for mainline UA flights worldwide. • UAX employees will be able to self-list for UA/UAX flights operating only within the 50 United States. employeeRES will verify jumpseat eligibility and priority during the listing process, which will be reflected in Aero, the system used by customer service representatives (CSRs) at airports, after check in. What’s not changing? UA and UAX employees from Dispatch, Flight Operations and Inflight Services and UA Inflight- qualified management will still be able to list for a jumpseat at the gate with a CSR. Employees with controlled jumpseat privileges, including maintenance groups and select management employees, cannot self-list in employeeRES or with a gate CSR, and must follow established processes to receive authorization for a jumpseat. Why are we making this change? Being able to self-list in employeeRES frees up time for CSRs at gates allowing them more time to complete critical tasks before departure and focus on delivering caring service to our customers. Improved automation in Aero also allows CSRs working the gates to accurately see flight deck and cabin jumpseat availability.