Notice of Convocation of the Extraordinary General Meeting of Shareholders

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Defendants and Auto Parts List

Defendants and Parts List PARTS DEFENDANTS 1. Wire Harness American Furukawa, Inc. Asti Corporation Chiyoda Manufacturing Corporation Chiyoda USA Corporation Denso Corporation Denso International America Inc. Fujikura America, Inc. Fujikura Automotive America, LLC Fujikura Ltd. Furukawa Electric Co., Ltd. G.S. Electech, Inc. G.S. Wiring Systems Inc. G.S.W. Manufacturing Inc. K&S Wiring Systems, Inc. Kyungshin-Lear Sales And Engineering LLC Lear Corp. Leoni Wiring Systems, Inc. Leonische Holding, Inc. Mitsubishi Electric Automotive America, Inc. Mitsubishi Electric Corporation Mitsubishi Electric Us Holdings, Inc. Sumitomo Electric Industries, Ltd. Sumitomo Electric Wintec America, Inc. Sumitomo Electric Wiring Systems, Inc. Sumitomo Wiring Systems (U.S.A.) Inc. Sumitomo Wiring Systems, Ltd. S-Y Systems Technologies Europe GmbH Tokai Rika Co., Ltd. Tram, Inc. D/B/A Tokai Rika U.S.A. Inc. Yazaki Corp. Yazaki North America Inc. 2. Instrument Panel Clusters Continental Automotive Electronics LLC Continental Automotive Korea Ltd. Continental Automotive Systems, Inc. Denso Corp. Denso International America, Inc. New Sabina Industries, Inc. Nippon Seiki Co., Ltd. Ns International, Ltd. Yazaki Corporation Yazaki North America, Inc. Defendants and Parts List 3. Fuel Senders Denso Corporation Denso International America, Inc. Yazaki Corporation Yazaki North America, Inc. 4. Heater Control Panels Alps Automotive Inc. Alps Electric (North America), Inc. Alps Electric Co., Ltd Denso Corporation Denso International America, Inc. K&S Wiring Systems, Inc. Sumitomo Electric Industries, Ltd. Sumitomo Electric Wintec America, Inc. Sumitomo Electric Wiring Systems, Inc. Sumitomo Wiring Systems (U.S.A.) Inc. Sumitomo Wiring Systems, Ltd. Tokai Rika Co., Ltd. Tram, Inc. 5. Bearings Ab SKF JTEKT Corporation Koyo Corporation Of U.S.A. -

Minebea Co., Ltd. ANNUAL REPORT 2006 Year Ended March 31, 2006 for Minebea, Competitiveness

Minebea Co., Ltd. ANNUAL REPORT 2006 Year Ended March 31, 2006 For Minebea, competitiveness Minebea Co., Ltd., was established in 1951 as Japan’s first specialized manufacturer means ensuring both ultraprecision of miniature ball bearings. Today, the Company is the world’s leading comprehensive manufacturer of miniature ball bearings and high-precision components, supplying customers worldwide in the information and telecommunications equipment, aerospace, automotive and household electrical appliance industries. machining and mass As of March 31, 2006, the Minebea Group encompassed 44 subsidiaries and affiliates in 13 countries. The Group maintains 28 plants and 43 sales offices and employs a total of 47,526 people. production technologies. Contents 2 At a Glance 3 Consolidated Financial Highlights 4 A Message to Our Shareholders 7 Special Feature: Capitalizing on Core Technologies to Develop Diverse New Businesses 17 Protecting the Environment 17 Contributing to Society 18 Corporate Governance 20 A History of Achievements Disclaimer Regarding Future Projections In this annual report, all statements that are not historical facts are future projections made based on certain assumptions and our 22 Directors, Auditors and Executive Officers management’s judgement drawn from currently available information. Accordingly, when evaluating our performance or value as a 23 Organization going concern, these projections should not be relied on entirely. Please note that actual performance may vary significantly from any particular projection, owing to various factors, including: (i) changes in economic indicators surrounding us, or in demand trends; 24 Contact Information (ii) fluctuation of foreign exchange rates or interest rates; and (iii) our ability to continue R&D, manufacturing and marketing in a timely manner in the electronics business sector, where technological innovations are rapid and new products are launched 25 Financial Section continuously. -

Electronics System Coordinator

Electronics System Coordinator RYOSAN CO., LTD. CORPORATE PROFILE 2020 Since its founding, Ryosan has conducted corporate activities based on the strong conviction that “a corporation is a public institution.” This phrase means that corporations are founded in order to benefit society in both the present and the future. Corporations are allowed to exist only if they are needed by society. In other words, corporations lose their meaning when they are no longer needed by society. Ryosan will continue its corporate activities with this strong conviction and firm resolution. “A corporation is a public institution.” Ryosan keeps this phrase firmly in its heart as the Company moves forward into the future. Ryosan History ~1960 1970 1980 1990 2000 2010~ 1953 1974 1981 1996 2000 2012 Ryosan Denki Co., Ltd. is established Hong Kong Ryosan Limited is The company name is changed to Ryosan Technologies USA Inc. The head office is moved to the current Ryosan Europe GmbH is established. in Kanda-Suehirocho, Chiyoda-ku, established. Ryosan Co., Ltd. is established. Head Office Building. Tokyo. Consolidated net sales exceed 300 2014 1976 1982 1997 billion yen. Ryosan India Pvt. Ltd. is established. 1957 Singapore Ryosan Private Limited Consolidated net sales exceed Zhong Ling International Trading The Company is reorganized as is established. 100 billion yen. (Shanghai) Co.,Ltd. is established. 2001 2016 a stock company as Korea Ryosan Corporation and Ryosan Engineering Headquarters obtain Ryosan Denki Co., Ltd. 1979 1983 1999 (Thailand) Co.,Ltd. are established. ISO9001 certification. Ryotai Corporation is established. Stock is listed on the Second Section Kawasaki Comprehensive Business 1963 of the Tokyo Stock Exchange. -

Integrated Report (Year Ended March 2019)

Introduction/ Chapter I Chapter II Chapter III Chapter IV President’s message Value Creation Story of MinebeaMitsumi Financial Strategy and Capital Policy Initiatives for Value Creation Initiatives to Support Value Creation 1986 2010 Hamamatsu Plant is established Suzhou Plant is established to expand Development in the electronic devices production of LED backlights Chapter I Value Creation Story of MinebeaMitsumi and components area is expanded History of MinebeaMitsumi Backlights Suzhou Plant (China) FDDs and MODs 2018 Global development ahead of other Hamamatsu Plant (Japan) Kosice Plant in Slovakia commences 2010 1988 production Our plant is established in Cambodia, and Lop Buri Plant is established in Thailand Supply to Europe market is commences production the next year Production in expanded companies For risk diversification, expansion of the electronic production and reduction of costs devices and components Cambodia Plant Speedy diversification through M&As area is expanded 1980 1963 Lop Buri Plant (Thailand) Ayutthaya Plant is AGA (Active Grill Plant is relocated from Kawaguchi, Saitama, and operations 1994 established 1984 Kosice Plant (Slovakia) Shutter) Actuators begin at the Karuizawa Plant, to become the mother The Company Bang Pa-in Plant is Minebea Electronics & plant of all the MinebeaMitsumi Group’s plants advances for the first established as the second Hi-Tech Components , in Miyota-machi, Nagano worldwide time into Thailand, the (Shanghai) Ltd. (our facility in Thailand Resonant devices Group’s largest first plant -

INVESTORS GUIDE 2019 Osaka Office to Our Shareholders and Investors Fukuoka Sales Office Shinjuku Office Shinjuku Support Center Tachikawa Sales Office

TOKYO ELECTRON DEVICE LIMITED Securities code: 2760 Business Locations (As of July 1, 2019) Business Location Domestic Subsidiary Omiya Sales Office Matsumoto Sales Office Sendai Sales Office Tsukuba Sales Office Iwaki Sales Office Nagoya Sales Office Mito Sales Office Kyoto Sales Office INVESTORS GUIDE 2019 Osaka Office To Our Shareholders and Investors Fukuoka Sales Office Shinjuku Office Shinjuku Support Center Tachikawa Sales Office Engineering Center Headquarters (Yokohama) FAST CORPORATION (Yamato-city, Kanagawa prefecture) TOKYO ELECTRON DEVICE Mishima Sales Office NAGASAKI LTD. Hamamatsu Sales Office (Isahaya-city, Nagasaki prefecture) Business/Marketing location Overseas Design and development location Dalian Yokohama Ottawa Seoul Silicon Valley Shanghai Taipei Shenzhen Bangkok Wuxi Hong Kong Singapore Philippines Note on forward-looking statements This Investors Guide was prepared on July 1, 2019. Forward looking statements, including business strategies and business forecasts, were made by the Company’s management, based on information available at that time, and may be revised due to changes in the business environment. Therefore, please be advised that the Company cannot guarantee the accuracy or the reliability of the statements. For the latest information, please refer to our information releases or our website. Note also that product and service names remain the trademarks of their respective owners. Corporate Communications Dept. https://www.teldevice.co.jp World Headquarters Yokohama East Square, 1-4 Kinko-cho, Kanagawa-ku,Yokohama -

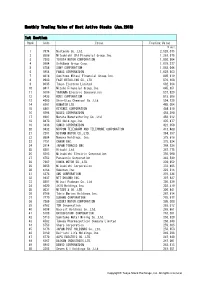

Monthly Trading Value of Most Active Stocks (Jan.2018) 1St Section

Monthly Trading Value of Most Active Stocks (Jan.2018) 1st Section Rank Code Issue Trading Value \ mil. 1 7974 Nintendo Co.,Ltd. 2,526,075 2 8306 Mitsubishi UFJ Financial Group,Inc. 1,261,575 3 7203 TOYOTA MOTOR CORPORATION 1,086,604 4 9984 SoftBank Group Corp. 1,079,377 5 6758 SONY CORPORATION 1,068,044 6 6954 FANUC CORPORATION 1,028,863 7 8316 Sumitomo Mitsui Financial Group,Inc. 895,619 8 9983 FAST RETAILING CO.,LTD. 870,168 9 8035 Tokyo Electron Limited 682,994 10 8411 Mizuho Financial Group,Inc. 645,951 11 6506 YASKAWA Electric Corporation 537,829 12 9433 KDDI CORPORATION 513,306 13 4063 Shin-Etsu Chemical Co.,Ltd. 504,120 14 6301 KOMATSU LTD. 485,054 15 6861 KEYENCE CORPORATION 484,810 16 6594 NIDEC CORPORATION 458,398 17 6981 Murata Manufacturing Co.,Ltd. 458,012 18 8473 SBI Holdings,Inc. 435,477 19 3436 SUMCO CORPORATION 423,058 20 9432 NIPPON TELEGRAPH AND TELEPHONE CORPORATION 413,468 21 7201 NISSAN MOTOR CO.,LTD. 394,197 22 8604 Nomura Holdings, Inc. 379,616 23 7751 CANON INC. 375,624 24 2914 JAPAN TOBACCO INC. 368,526 25 6501 Hitachi,Ltd. 367,775 26 6503 Mitsubishi Electric Corporation 350,098 27 6752 Panasonic Corporation 342,549 28 7267 HONDA MOTOR CO.,LTD. 339,952 29 8058 Mitsubishi Corporation 333,495 30 4755 Rakuten,Inc. 329,315 31 6273 SMC CORPORATION 315,134 32 9437 NTT DOCOMO,INC. 307,827 33 8801 Mitsui Fudosan Co.,Ltd. 305,639 34 5020 JXTG Holdings,Inc. -

News Release

NEWS RELEASE Jun 11, 2020 R&I View: Electronic Components Companies Struggle with Automotive Businesses Eyes on investments in advanced fields Demand for automotive electronic components has plunged in the wake of the novel coronavirus outbreak. In the January-March 2020 period, TDK Corp. (Sec. Code: 6762, Issuer Rating: A+) and Taiyo Yuden Co., Ltd. (Sec. Code: 6976, Issuer Rating: A) posted net losses due primarily to impairment losses on assets associated with automotive businesses, combined with a seasonal decline in smartphone-related demand. Alps Alpine Co., Ltd. (Sec. Code: 6770, Issuer Rating: A-), which derives around 70% of consolidated sales from automotive products and components, including car navigation systems, fell into an operating loss. As growth in unit sales of smartphones and other digital devices became difficult to envisage, many electronic components companies have been actively investing in expanding automotive businesses as the core of their growth strategies. If automobile production and sales continue to be stagnant for a protracted period of time due, for example, to the slow containment of the coronavirus or the emergence of a serious second wave, the earnings impact will be amplified. Should development plans for next-generation vehicles be disturbed, the risk of impairment of related facilities and goodwill will also warrant attention. R&I will keep an eye on the earnings of Nidec Corp. (Sec. Code: 6594, Issuer Rating: AA-) and MinebeaMitsumi Inc. (Sec. Code: 6479, Issuer Rating: A), which have made aggressive investments in the growth of their automotive businesses in recent years. Demand is rising for products such as notebook and tablet computers and game consoles, reflecting changes in the way people live, as exemplified by the wider adoption of teleworking and consumption at home driven by restrictions on going out. -

Platinum Japan Fund

THE PLATINUM TRUST QUARTERLY REPORT 30 JUNE 2021 1 Platinum Japan Fund The Fund (C Class) returned 0.8% over the quarter and 18.3% over the year.1 The Japanese equity market was broadly flat for the quarter in Australian dollar (AUD) terms, as the cyclical rally in the stocks of beneficiaries of stronger global growth and higher interest rates took a time-out, with the current elevated levels of consumer price inflation increasingly being viewed as transitory by market participants (please see our Macro Overview). Given the Fund’s exposure to growth cyclicals and deep value plays, it was pleasing that the Fund delivered a James Halse similar return to the broader market. Portfolio Manager# From a Japan-specific standpoint, generally upbeat first- quarter earnings reports were offset by a reticence amongst company managements to raise profit forecasts due to the Performance uncertainty generated by the pandemic. However, despite recurrent waves of infections and concomitant restrictions on (compound p.a.+, to 30 June 2021) movement, the latest Tankan business sentiment survey SINCE QUARTER 1YR 3YRS 5YRS improved to the best level since mid-2018 for the country’s INCEPTION large manufacturers.2 Platinum Japan Fund* 1% 18% 5% 10% 14% MSCI Japan Index^ 1% 14% 7% 10% 3% Toyota Motor (+13%) was the largest contributor to Fund performance during the quarter due to our large position size. + Excludes quarterly performance. * C Class – standard fee option. Inception date: 30 June 1998. Digital media company CyberAgent (+20%) continued its After fees and costs, before tax, and assuming reinvestment of distributions. -

Alma Eikoh Japan Large Cap Equity Fund a Sub-Fund of Alma Capital Investment Funds SICAV

FOR PROFESSIONAL INVESTORS ONLY Alma Eikoh Japan Large Cap Equity Fund A sub-fund of Alma Capital Investment Funds SICAV As of 31 May 2021 Eikoh Fund description • Investment objective: seek long-term capital growth by investing generally in Japanese large cap stocks (with market capitalisation in excess of US$ 1bn) • Investment process: analyse long term company fundamentals through extensive in-house bottom up research with a strong risk management ethos • Portfolio of around 30 companies which are well managed, profitable and with good prospects. Portfolio managers believe that Cash Flow Return on Investment and value creation are key Investment manager: ACIM (Alma Capital Investment Management) • Alma Capital Investment Management is a Luxembourg based asset management company and holds a branch office in London • ACIM manages assets of $4bn and is regulated by the Luxembourg regulator the CSSF • The portfolio managers, led by James Pulsford, worked together at Eikoh Research Investment Management managing the portfolio before joining ACIM in January 2020 • Naohiko Saida based in Tokyo at Milestone Asset Management provides a dedicated research service to the team at ACIM, Naohiko and James have worked together for the last twenty years Cumulative performance (%) 1 M 3 M 6 M YTD 1Y 3Y ITD ITD (annualized) I GBP Hedged C shares 2.81 9.51 21.63 15.06 49.05 46.77 152.42 14.20 I GBP C shares 0.31 4.48 9.45 4.30 27.48 36.66 - - I EUR Hedged C shares 2.77 9.47 21.58 15.14 48.54 42.72 - - I JPY C shares 3.03 9.87 22.53 15.91 50.20 47.62 - - I EUR C shares 1.48 5.93 14.41 9.75 33.73 - - - I EUR D shares -0.67 3.66 11.95 7.37 30.79 - - - I USD Hedged C shares 2.89 9.57 22.14 15.51 49.89 53.06 163.50 14.91 Topix (TR) 1.38 4.12 10.81 7.62 25.61 18.17 80.92 8.88 Fund launched on 12 June 2014 (I USD Hedged C and I GBP Hedged C shares) Portfolio characteristics Performance (Indexed - Base 100) Main indicators Fund Index Alma Eikoh Japan Large Cap Equity Fund Topix TR No. -

Minebeamitsumi, Iwasaki Electric Began an Iot Street Lighting Joint Demonstration Experiment in Suginami Ward - LED Streetlights with Unique Wireless Connectivity

To whom it may concern February 18, 2020 MINEBEA MITSUMI Inc. IWASAKI ELECTRIC CO., LTD. MinebeaMitsumi, Iwasaki Electric Began an IoT Street Lighting Joint Demonstration Experiment in Suginami Ward - LED Streetlights with Unique Wireless Connectivity - MINEBEA MITSUMI Inc. (MinebeaMitsumi) and IWASAKI ELECTRIC CO., LTD. (Iwasaki Electric) recently were provided the Suginami Ward demonstration field, and launched the “IoT Streetlight Demonstration Experiment”, which pioneered the smart city project. The test site will be equipped with 11 smart streetlights and one environmental sensor near the north exit of Nishi-Ogikubo Station. A unique feature of this set up is that the streetlights equipped with our own wireless connectivity form a network so streetlights and sensors can be centrally managed. The smart LED road/streetlights jointly being developed by MinebeaMitsumi and Iwasaki Electric can freely control the amount of light via wireless communication, enabling monitoring of lighting status and power consumption, while streamlining operation management and reducing power costs at the same time. Furthermore, combining environmental sensors makes it possible to acquire various data, such as temperature, humidity, atmospheric pressure, wind speed, etc., and provide information services to residents. Through this project, we will contribute to energy and labor saving in Suginami Ward management, improvement of convenience for residents, and realization of safe and secure town development. [Installation Site] [Streetlight Information Monitoring Screen] Smart Streetlight Installation situation Environmental Sensor 1 [MinebeaMitsumi Smart City Solution] MinebeaMitsumi has developed a high efficiency LED streetlight with wireless functionality together with Iwasaki Electric with whom we have a business alliance, and been promoting the “Smart City” project since 2015. -

TAIYO YUDEN Lithium Ion Capacitors: an Effective EDLC Replacement

Whitepaper TAIYO YUDEN Lithium Ion Capacitors: An Effective EDLC Replacement Lithium Ion Capacitors overcome the pitfalls of EDLCs, providing superior self-discharge characteristics, high-energy density, reliability, longevity and safety. Atsuya Sato Field Application Engineering Supervisor TAIYO YUDEN TAIYO YUDEN Lithium Ion Capacitors: The Ultimate EDLC Replacement Background An accepted energy solution, conventional Electrical Double Layer Capacitors (EDLC) have many notable drawbacks relating to self-discharge characteristics, energy density, reliability, longevity and thermal design. TAIYO YUDEN Lithium Ion Capacitors overcome these issues and are an effective replacement for EDLCs. Lithium Ion Capacitors are hybrid capacitors, featuring the best characteristics of both EDLC and Lithium Ion Secondary Batteries (LIB). EDLCs were first created in Japan in the 1970s and began appearing in various home appliances in the 1990s. Since the 2000s, they have been used in mobile phones and digital cameras. EDLCs are typically used to protect against sudden momentary drops or sudden interruptions in power. They can instantaneously output large amounts of power, while a battery cannot. They are frequently used as backup power sources in servers and storage devices for integrated circuits, processors, memory and more. While EDLCs are intended to be backup power sources, conventional EDLCs suffer from a phenomenon known as self-discharge, where the capacitor will gradually lose its charge over time. Self-discharge can occur more rapidly during exposure to high temperature environments. The extremely low self-discharge of an Lithium Ion Capacitor, even in high heat environments, ensures a long-lasting charge. Furthermore, Lithium Ion Capacitors have no risk of thermal runaway. No additional thermal design considerations, space or components are necessary when designing with an Lithium Ion Capacitor. -

![[IFRS] (Consolidated) (Year Ended March 31, 2021)](https://docslib.b-cdn.net/cover/2000/ifrs-consolidated-year-ended-march-31-2021-842000.webp)

[IFRS] (Consolidated) (Year Ended March 31, 2021)

BRIEF REPORT OF FINANCIAL RESULTS〔IFRS〕(Consolidated) (Year ended March 31, 2021) May 7, 2021 Registered Company Name: MINEBEA MITSUMI Inc. Common Stock Listings: Tokyo and Nagoya Code No: 6479 URL https://www.minebeamitsumi.com/ Representative: Yoshihisa Kainuma Representative Director, CEO & COO Contact: Mitsunobu Yamamoto General Manager of Accounting Department Date planned to hold ordinary general meeting of shareholders: June 29, 2021 Expected date of payment for dividends: June 30, 2021 Date planned to file report of securities: June 29, 2021 Phone: (03) 6758-6711 Preparation of supplementary explanation material for financial results : Yes Holding of presentation meeting for financial results : Yes(For Analyst) (Amounts less than one million yen have been rounded.) 1. Business Performance (April 1, 2020 through March 31, 2021) (1) Consolidated Results of Operations (%: Changes from previous fiscal year) Profit before Net sales % Operating income % % income taxes (millions of yen) Change (millions of yen) Change Change (millions of yen) Year ended March 31, 2021 988,424 1.0 51,166 (12.8) 49,527 (14.7) Year ended March 31, 2020 978,445 10.6 58,647 (18.6) 58,089 (18.6) Profit for the year Comprehensive Profit for % attributable to % income % the year Change owners of the parent Change for the year Change (millions of yen) (millions of yen) (millions of yen) Year ended March 31, 2021 38,787 (17.3) 38,759 (15.7) 68,308 177.8 Year ended March 31, 2020 46,923 (22.7) 45,975 (23.6) 24,593 (60.8) Profit to equity Profit before Earnings