Fintech in Canada – British Columbia Edition, 2016

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

In This Issue

Welcome to the January edition of ACT News. This complimentary service is provided by ACT Canada; "building an informed marketplace". Please feel free to forward this to your colleagues. In This Issue 1. Editorial - payment innovation: where is the bar? 2. Desjardins and MasterCard bring new payment options to Canadians 3. Nanopay acquires MintChip from the Royal Canadian Mint 4. Canadian payments market transition: a study by the Canadian Payments Association 5. Suretap and EnStream take big steps forward with Societe de Transport de Montreal in mobile ticketing 6. New credit union association launches in Canada: Canadian Credit Union Association 7. Global study shows increasing security risks to payment data and lack of confidence in securing mobile payment methods 8. Samsung Pay to move online in 2016 9. Elavon delivers Apple Pay for Canadian businesses 10. Beware alleged experts’ scare tactics on mobile payments 11. Ingenico Group accelerates EMV and NFC acceptance in unattended environments with new partner program 12. Paynet delivers a safer payment service with Fraudxpert to its customers 13. VeriFone expands services offering for large retailers in the US and Canada with agreement to acquire AJB Software 14. VISA checkout added to Starbucks, Walmart, Walgreens 15. Gemalto is world's first vendor to receive complete MasterCard approval for cloud based payments 16. ICC Solutions offers a time-saving method and free guide for training staff to process card payments correctly ready for the new year! 17. Walmart adds masterpass as online payment method 18. Equinox and ACCEO partner to deliver integrated retail payment solution 19. UL receives UnionPay qualification for Chinese domestic market 20. -

Australian Private Equity and Venture Capital Association Limited

16 February 2015 Mr Kurt Hockey Manager Financial System Assessment Unit Financial System and Services Division The Treasury Langton Crescent PARKES ACT 2600 Email: [email protected] Dear Mr Hockey, Submission on Crowd-sourced Equity Funding Discussion Paper The Australian Private Equity and Venture Capital Association Limited (AVCAL) welcomes the Government's announcement as part of the Industry Innovation and Competitiveness Agenda (II&CA) about the introduction of reforms to encourage crowd-sourced equity funding (CSEF) in Australia in order to provide startups with improved access to capital. AVCAL is the national association representing the private equity and venture capital industries in Australia. Our members comprise most of the active private equity and venture capital firms in Australia. These firms provide capital for early stage companies, later stage expansion capital, and capital for management buyouts of established companies. At the outset, it worth pointing out that AVCAL is supportive of the Government's plans to introduce a regulatory framework to facilitate the use of CSEF in Australia. The benefit to the broader economy of improving access to finance and capital for small business and startups is well documented. In the context of CSEF, it is apparent that other developed economies have already taken a number of steps to implement policy frameworks which support the use of crowd-sourced equity funding. Because of that, we believe it is vitally important that we remain focussed on positioning Australia to compete for the best entrepreneurial talent both domestically and from offshore. In our view, the implementation of changes to facilitate the use of CSEF should be developed around a set of policy objectives which seek to deliver a simple and cost-efficient framework that successfully aligns the interests of startups and CSEF investors. -

Osservatorio Crowdfunding 1° Report Italiano Sul Crowdinvesting

Osservatorio CrowdFunding 1° Report italiano sul CrowdInvesting Giugno 2016 Indice pagina Introduzione 5 Executive summary 7 1. Il crowdinvesting: definizioni e contesto 9 Definizioni metodologiche 9 Lo sviluppo del crowdfunding e i modelli utilizzati 9 Il crowdfunding in Italia 12 La filiera industriale in Italia 13 Focus sul crowdinvesting 15 L’ equity crowdfunding nel mondo 16 Il lending crowdfunding nel mondo 19 L’ invoice trading nel mondo 22 2. L’equity crowdfunding 25 La normativa di riferimento in Italia 25 I portali autorizzati 26 Le campagne presentate 29 Le imprese protagoniste 35 Gli investitori 41 Le prospettive per il futuro 44 3. Il lending crowdfunding 47 Il quadro di riferimento in Italia 47 I portali attivi 47 I modelli di business 49 I soggetti finanziati 51 I prestatori 56 Le prospettive per il futuro 58 4. L’invoice trading 61 Il quadro normativo di riferimento in Italia 61 I portali operativi in Italia 62 Le imprese finanziate 64 Gli investitori 64 Le prospettive per il futuro 65 La School of Management 67 Il gruppo di lavoro e i sostenitori della ricerca 69 1° REPORT ITALIANO SUL CROWDINVESTING 1 Copyright © Politecnico di Milano – Dipartimento di Ingegneria Gestionale pagina FIGURE Figura 1.1 Numero di piattaforme di crowdfunding attive a livello mondiale a fine 10 2014. Fonte: Massolution Crowdfunding Industry Report 2015 Figura 1.2 Volume di raccolta delle piattaforme di crowdfunding attive a livello 11 mondiale, dal 2013 al 2015. Dati in $ miliardi. Fonte: Massolution Crowdfunding Industry Report 2015 Figura 1.3 Flusso di raccolta delle piattaforme di crowdfunding nelle diverse aree 11 geografiche mondiali, dal 2013 al 2015. -

Broken Confidences Sebastiaan Van Den Berg of Harbourvest Partners Are PE Players Losing Sleep Over Australia’S Super Fund Disclosure Rules? Page 7 Page 19

Asia’s Private Equity News Source avcj.com February 25 2014 Volume 27 Number 07 EDITOR’S VIEWPOINT Bumper PE deal flow in 2013 flatters to deceive Page 3 NEWS Baring Asia, CalPERS, CDH, EQT, Fosun, GGV, Hopu, IDFC, IFC, INCJ, Kendall Court, Morningside, NSSF, Origo, Samena, Temasek Page 4 ANALYSIS Australia’s mid-market GPs wait patiently for a buyout rebound Page 16 INDUSTRY Q&A HESTA’s Andrew Major and QIC’s Marcus Simpson Page 11 Broken confidences Sebastiaan van den Berg of HarbourVest Partners Are PE players losing sleep over Australia’s super fund disclosure rules? Page 7 Page 19 FOCUS FOCUS Diversity in distress The collective spirit GPs adjust to evolving special situations Page 12 Crowdfunding gains traction down under Page 14 PRE-CONFERENCE ISSUE AVCJ PRIVATE EQUITY AND VENTURE CAPITAL FORUM AUSTRALIA 2014 Anything is possible if you work with the right partner Unlocking liquidity for private equity investors www.collercapital.com London, New York, Hong Kong EDITOR’S VIEWPOINT [email protected] Managing Editor Tim Burroughs (852) 3411 4909 Staff Writers Andrew Woodman (852) 3411 4852 Mirzaan Jamwal (852) 3411 4821 That was then, Winnie Liu (852) 3411 4907 Creative Director Dicky Tang Designers Catherine Chau, Edith Leung, Mansfield Hor, Tony Chow Senior Research Manager this is now Helen Lee Research Manager Alfred Lam Research Associates Herbert Yum, Isas Chu, Jason Chong, Kaho Mak Circulation Manager FROM 2006 OR THEREABOUTS, AUSTRALIA pace during the second half of 2013. A total of Sally Yip Circulation Administrator suddenly became the destination in Asia for GPs nine PE-backed offerings raised record proceeds Prudence Lau focused on leveraged buyout deals. -

MOBILE Payments Market Guide 2013

MOBILE PAYMENTS MARKET GUIDE 2013 INSIGHTS IN THE WORLDWIDE MOBILE TRANSACTION SERVICES ECOSYSTEM OVER 350 COMPANIES WORLDWIDE INSIDE Extensive global distribution via worldwide industry events As the mobile payments ecosystem is becoming increasingly more crowded and competitive, the roles of established and new players in the mobile market is shifting, with new opportunities and challenges facing each category of service providers. Efma, the global organization that brings together more than 3,300 retail financial services companies from over 130 countries, welcomes the publication of the Mobile Payments Market Guide 2013 by The Paypers as a valuable source of information and guidance for all actors in the mobile transaction services space. Patrick Desmarès - CEO, Efma MOBILE PAYMENTS MARKET GUIDE 2013 INSIGHTS IN THE WORLDWIDE MOBILE TRANSACTION SERVICES ECOSYSTEM Authors Ionela Barbuta Sabina Dobrean Monica Gaza Mihaela Mihaila Adriana Screpnic RELEASE | VERSION 1.0 | APRIL 2013 | COPYRIGHT © THE Paypers BV | ALL RIGHTS reserved 2 MOBILE PAYMENTS MARKET GUIDE 2013 INTRODUCTION Introduction You are reading the Mobile Payments Market Guide 2013, a state- se and the way commerce is done. From a quick and accessible of-the-art overview of the global mobile transaction services channel for banking on the move to a sophisticated tool for shop- ecosystem and the most complete and up-to-date reference ping, price comparison and buying, the saga of the mobile device source for mobile payments, mobile commerce and mobile is an on-going story that unfolds in leaps and bounds within a banking-related information at global level. This guide is published progressively crowded (and potentially fragmented) ecosystem. -

Girişimciler Için Yeni Nesil Bir Finansman Modeli “Kitle Fonlamasi - Crowdfunding”: Dünya Ve Türkiye Uygulamalari Üzerine Bir Inceleme Ve Model Önerisi

T.C. BAŞKENT ÜNİVERSİTESİ SOSYAL BİLİMLER ENSTİTÜSÜ İŞLETME ANABİLİM DALI İŞLETME DOKTORA PROGRAMI GİRİŞİMCİLER İÇİN YENİ NESİL BİR FİNANSMAN MODELİ “KİTLE FONLAMASI - CROWDFUNDING”: DÜNYA VE TÜRKİYE UYGULAMALARI ÜZERİNE BİR İNCELEME VE MODEL ÖNERİSİ DOKTORA TEZİ HAZIRLAYAN ASLI VURAL TEZ DANIŞMANI DOÇ. DR. DENİZ UMUT DOĞAN ANKARA- 2019 TEŞEKKÜR Beni her konuda daima destekleyen, cesaretlendiren, güçlü olmayı öğreten, mücadeleden, öğrenmekten ve kendimi geliĢtirmekten vazgeçmemeyi ilke edindiren, sevgili babama ve rahmetli anneme, Sevgisini ve desteğini daima hissettiğim değerli eĢime, Tezimin her aĢamasında bana tecrübesi ve bilgi birikimiyle yol gösteren, ilgi ve desteğini esirgemeyen tez danıĢmanım Doç. Dr. Deniz Umut DOĞAN’a, Çok değerli görüĢleri ve yönlendirmeleri için Prof. Dr. Nalan AKDOĞAN’a, ÇalıĢma dönemimde destek ve yardımını benden hiç esirgemeyen Çiğdem GÖKÇE’ye ve sevgili dostlarıma, En içten duygularımla teĢekkür ederim. I ÖZET GiriĢimcilerin en önemli problemi finansal kaynaklara ulaĢmalarında yaĢadıkları zorluklardır. GiriĢimciler finansal sorunlarını çözmek için geleneksel finansman yöntemlerinden ve Risk Sermayesi, GiriĢim Sermayesi, Bireysel Katılım Sermayesi, Mikrofinansman gibi alternatif finansman modellerinden yararlanmaktadır. Günümüzde giriĢimcilerin gereksinim duydukları sermayeye ulaĢmak için kullandıkları yeni finansal yöntemlerden biri Kitle Fonlaması modelidir. ÇalıĢmada giriĢimcilik, giriĢim finansmanı ve Kitle Fonlaması modeli konusunda literatür taraması yapılarak ilgili kavramlara değinilmiĢtir. Dünya’da -

See Important Disclosures and Disclaimers at the End of This Report

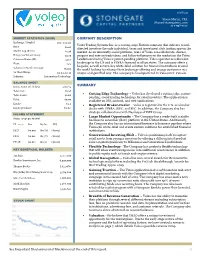

1/28/20 Shane Martin, CFA [email protected] 214-987-4121 MARKET STATISTICS ($CAD) COMPANY DESCRIPTION Exchange / Symbol OTC: VLEOF Voleo Trading Systems Inc. is a cutting-edge Fintech company that delivers to self- Price: $0.05 directed investors the only individual, team and investment club trading app on the Market Cap ($mm): $5.38 market. As an inherently social platform, users of Voleo can collaborate, discuss, Enterprise Value ($mm): $3.76 propose and vote on trade ideas, and follow influencers in the market on the Voleo Common Shares (M): 107.7 Leaderboard using Voleo’s patent-pending platform. Voleo operates as a discount brokerage in the US and is FINRA-licensed in all 50 states. The company offers a Float: 74% bespoke, as well as turn-key white-label solution for financial institutions around Volume (3 Month Average): 76,012 the world looking to enhance their brokerage offering and engage customers in a 52 Week Range: $0.04-$0.30 unique and gamified way. The company is headquartered in Vancouver, Canada. Industry: Information Technology BALANCE SHEET ($mm, except per sh data) 9/30/19 SUMMARY Total Cash: $1.98 • Cutting Edge Technology – Voleo has developed a cutting edge, patent- Total Assets: $2.68 pending, social trading technology for retail investors. The application is Debt: $0.00 available on iOS, android, and web applications. Equity: $2.2 • Registered Broker-Dealer – Voleo is registered in the U.S. as a broker- Equity per share: $0.02 dealer with FINRA, SIPC, and SEC. In addition, the Company also has strategic collaborations with Nasdaq and TMX Group. -

Report on New Payment Solutions

DANISH PAYMENTS COUNCIL REPORT ON NEW PAYMENT SOLUTIONS March 2014 Report on New Payment Solutions Text may be copied from this publication provided that the Danish Payments Council is specifically stated as the source. Changes to or misrepresentation of the contents are not permitted. The Report on New Payment Solutions is available on Danmarks Nationalbank's website: www.nationalbanken.dk under Publications. This publication is based on information available up to November 2013. Inquiries about the Report should be directed to: Danmarks Nationalbank Communications Havnegade 5 DK-1093 Copenhagen K Telephone: +45 33 63 70 00 (direct) or + 45 33 63 63 63 Office hours: Monday-Friday 9.00 a.m.-4.00 p.m. E-mail: [email protected] www.nationalbanken.dk Explanation of symbols: - Magnitude nil 0 Less than one half of unit employed • Category not applicable … Data not available Details may not add because of rounding. Contents PREFACE ..................................................................................................................................... 1 1. INTRODUCTION AND CONCLUSIONS...................................................................................... 3 1.1 Background ........................................................................................................................................ 3 1.2 About the report ................................................................................................................................. 3 1.3 Conclusions ....................................................................................................................................... -

Crossroads 2015

Crossroads 2015 An action plan to develop a vibrant tech startup ecosystem in Australia April 2015 Contents Foreword ................................................................................................................................................. i What is StartupAUS? ............................................................................................................................... 1 Introduction ............................................................................................................................................ 2 State of the Australian startup ecosystem in 2015 ................................................................................. 4 What are “startups”? ............................................................................................................................ 10 Startups are not small businesses ........................................................................................................ 10 Why are startups important? ............................................................................................................... 11 Disrupt or be disrupted ......................................................................................................................... 13 Unicorns matter .................................................................................................................................... 14 Australian startups on a global stage ................................................................................................... -

Breaking Tradition

ANNUAL REPORT 2012 BREAKING TRADITION As our business evolves, so must our brand—to ensure our corporate identity is an authentic expression of our character, offer and value. We renewed our brand to convey the dynamism of the Mint, our commitment to our stakeholders, and the spirit of engagement that drives our interactions with customers. As part of the exercise, we adopted a fresh, modernized logo. This new mark retains the maple leaf as a Canadian icon and coins as a symbol of our core business. It affirms our two core pillars of pride and trust and emphasizes in a new way our third: innovation. 2 | ROYAL CANADIAN MINT ANNUAL REPORT 2012 5 Financial and Operating Highlights 32 Performance Against Objectives 8 At a Glance: Breaking Tradition 34 Management Discussion and Analysis 18 Message from the President and CEO 55 Management Report 19 Message from the Chair 56 Audit Committee Report 20 Corporate Social Responsibility 57 Independent Auditor’s Report 22 Corporate Governance 58 Financial Statements 29 Directors and Officers 62 Notes to the Consolidated Financial Statements 30 Business Lines 100 Statistics HEAD OFFICE AND WINNIPEG PLANT BOUTIQUE LOCATIONS OTTAWA PLANT Royal Canadian Mint Royal Canadian Mint Ottawa Visit our online store 320 Sussex Drive 520 Lagimodière Boulevard 320 Sussex Drive for a full selection of products Ottawa, Ontario Winnipeg, Manitoba Ottawa, Ontario at www.mint.ca Canada K1A 0G8 Canada R2J 3E7 Canada K1A 0G8 613-993-3500 204-983-6400 613-933-8990 Vancouver 752 Granville Street Vancouver, British Columbia -

The Fintech Book Paint a Visual Picture of the Possibilities and Make It Real for Every Reader

Financial Era Advisory Group @finera “Many are familiar with early stage investing. Many are familiar with technology. Many are “FinTech is about all of us – it’s the future intersection of people, technology and money, familiar with disruption and innovation. Yet, few truly understandFinancial how different Era an animal Advisory and it’s happeningGroup now there is an explosion of possibilities on our doorstep. Susanne and is the financial services industry. Such vectors as regulation, compliance, risk, handling The FinTech Book paint a visual picture of the possibilities and make it real for every reader. other people’s money, the psychological behaviours around money and capital ensure A must-read for every disruptor, innovator, creator, banker.” that our financial services industry is full of quirks and complexities. As such The FinTech Derek White, Global Head of Customer Solutions, BBVA Book offers a refreshing take and knowledge expertise, which neophytes as well as experts will be well advised to read.” “FinTech is reshaping the financial experience of millions of people and businesses around Pascal Bouvier, Venture Partner, Santander InnoVentures the world today, and has the potential to dramatically alter our understanding of financial services tomorrow. We’re in the thick of the development of an Internet of Value that will “This first ever crowd-sourced book on the broad FinTech ecosystem is an extremely deliver sweeping, positive change around the world just as the internet itself did a few worthwhile read for anyone trying to understand why and how technology will impact short decades ago. The FinTech Book captures the unique ecosystem that has coalesced most, if not all, of the financial services industry. -

Alberta Securities Commission Page 1 of 2 Reporting Issuer List - Cover Page

Alberta Securities Commission Page 1 of 2 Reporting Issuer List - Cover Page Reporting Issuers Default When a reporting issuer is noted in default, standardized codes (a number and, if applicable a letter, described in the legend below) will be appear in the column 'Nature of Default'. Every effort is made to ensure the accuracy of this list. A reporting issuer that does not appear on this list or that has inappropriately been noted in default should contact the Alberta Securities Commission (ASC) promptly. A reporting issuer’s management or insiders may be subject to a Management Cease Trade Order, but that order will NOT be shown on the list. Legend 1. The reporting issuer has failed to file the following continuous disclosure document prescribed by Alberta securities laws: (a) annual financial statements; (b) an interim financial report; (c) an annual or interim management's discussion and analysis (MD&A) or an annual or interim management report of fund performance (MRFP); (d) an annual information form; (AIF); (e) a certification of annual or interim filings under National Instrument 52-109 Certification of Disclosure in Issuers' Annual and Interim Filings (NI 52-109); (f) proxy materials or a required information circular; (g) an issuer profile supplement on the System for Electronic Disclosure By Insiders (SEDI); (h) a material change report; (i) a written update as required after filing a confidential report of a material change; (j) a business acquisition report; (k) the annual oil and gas disclosure prescribed by National Instrument