Research Challenge Report Cover Pages

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report

ANNUAL REPORT 2015-16 Forward-looking statement Contents In this Annual Report, we have disclosed forward-looking information to enable investors to 02 comprehend our prospects and take CORPORATE OVERVIEW investment decisions. This report and other statements - written and Corporate Information 01 oral - that we periodically make Corporate Identity 02 contain forward-looking statements Making in India for 20 years 08 that set out anticipated results Chairman’s Message 10 based on the management’s plans Managing Director’s Letter 12 and assumptions. We have tried, Key Performance Indicators 14 wherever possible, to identify such statements by using words such Ten Years Financial Highlights 16 as ‘anticipate’, ‘estimate’, ‘expects’, Community Engagements 28 ‘projects’, ‘intends’, ‘plans’, ‘believes’, Comprehensive and words of similar substance in water solutions connection with any discussion 6 of future performance. We cannot guarantee that these forward-looking 30 statements will be realised, although STATUTORY REPORTS we believe we have been prudent in Board’s Report 30 our assumptions. The achievements Management Discussion of results are subject to risks, and Analysis 60 uncertainties and even inaccurate Report on Corporate assumptions. Should known or Chasing Governance 76 unknown risks or uncertainties Opportunities materialise, or should underlying 18 assumptions prove inaccurate, actual results could vary materially from those anticipated, estimated or projected. Readers should keep this in mind. We undertake no 91 obligation to publicly update any FINANCIAL STATEMENTS forward-looking statement, whether Standalone Financials 92 as a result of new information, future Consolidated Financials 133 Thinking Through events or otherwise. Tomorrow Notice 172 26 The Board Bhagwan Dass Narang Rajiv Mittal Chairman Managing Director and Group CEO Jaithirth Rao Malay Mukherjee Sumit Chandwani Revathi Kasturi S. -

Pgdm (2020-2022)

LIBALoyola Institute of Business Administration (LIBA) A Jesuit Business School PGDM (2020-2022) LOYOLA INSTITUTE OF BUSINESS ADMINISTRATION (LIBA) LOYOLA COLLEGE CAMPUS 1, TANK BUNK ROAD, MAHALINGAPURAM NUNGAMBAKKAM, CHENNAI - 600034 ABOUT LIBA Loyola Institute of Business Administration (LIBA) is a premier B-school, established in 1979 within the premises of Loyola College. It is managed by Jesuits well known for their outstanding contribution to education. LIBA stands for excellence with ethics, the twin hallmarks of Jesuit business education; all its programs and activities embody these two elements. It earnestly strives to inculcate the values of excellence, honesty, justice and service to society in its students. LIBA offers two-year full time PGDM course, (approved by AICTE and recognized by AIU), part-time PGDM (approved by AICTE) and several short-term diploma and certificate programs and many customized management development programs for the industry. THE PROGRAMME LIBA’s prestigious programme in management, leading to the Post-graduate Diploma in Management (PGDM), spans over two years with six terms of approximately three months each. LIBA’s Postgraduate Diploma in Management (PGDM) consists of 126 credits, including the summer project and workshops. The first year of the course presents students with a comprehensive view of the management discipline and a broad perspective of the corporate environment. A sound foundation is laid for advanced learning in the second year. All the core courses offered in the first year are required to be taken. In summer, students are required to spend ten to twelve weeks in an organization working on a project dealing with a significant aspect or problem relating to a functional area. -

PROSPECTUS Dated : January 27, 2006

PROSPECTUS Dated : January 27, 2006 (The Company was incorporated on January 16, 1992 under the Companies Act, 1956. In November 2001, our Registered Office was changed from Jayalakshmi Estates, First Floor No. 8, Haddows Road, Chennai 600 006 to DP: 36, SIDCO Industrial Estate, Thirumazhisai, Chennai-602 107. Telephone: + 91 44 2681 1569, 2681 1570 Fax: + 91 44 2681 1568 Contact Person: Mr. V. Balasubramanian Email: [email protected], Website: www.indo-tech.com Public Issue of 3,945,130 Equity Shares of Rs. 10/- each for cash at a price of Rs. 130/- per Equity Share aggregating to Rs. 512,866,900 (the 'Issue') by Indo Tech Transformers Limited ("Company" or "Issuer") consisting of fresh issue of 2,956,750 equity shares and offer for sale of 397,480 shares of Rs 10/- each by Mr. P. S. Jagdish and 590,900 shares of Rs. 10/- each by Twenty First Century Management Services Limited ("Offerors"). The Fresh Issue and the Offer for Sale are jointly referred to herein as the "Issue". 50,000 Equity Shares will be reserved in the Issue for subscription by eligible employees. The Net Issue to the Public is of 3,895,130 Equity Shares of Rs. 10/- each at a price of Rs. 130 per Equity Share aggregating Rs. 506,366,900 (the "Net Issue"). The Issue would constitute 37.15% of the fully diluted post issue paid up Equity Capital of the Company. The face value of the shares is Rs. 10 and the issue price is 13 times of the face value. -

Bringing Water Back to Life

INDIA AND OVERSEAS OFFICES HEAD OFFICES LIBYA Kolkata INDIA, Chennai VA TECH WABAG - LIBYA VA TECH WABAG LIMITED VA TECH WABAG LIMITED DLF IT Park, Tower 1, 3rd Floor, 8, Major Arterial Road Branch Office Tripoli /Janzour sustainable solutions. for a better life. #11, Murray’s Gate Road, Alwarpet, Chennai 600 018 P.O. Box 91170-Dat Al-Emad Block A, New Town, Kolkata 700 156 Tel: +91 44 4223 23 23, Fax: +91 44 4223 2324 Tripoli /Libya Tel: +91 33 4005 5671 / 5688 / 5689 e-mail: [email protected] Phone: +218 (0) 21 715 8881 Fax: +91 33 4005 5690 AUSTRIA, Vienna Fax: +218 (0) 21 715 8881 Baroda VA TECH WABAG GmbH E-Mail: [email protected] Dresdner Str. 87-91, 1200 Vienna, Austria Internet: www.wabag.com VA TECH WABAG LIMITED Telephone: +43 (1) 25105 -0 Premises No. 401, 4th floor, Rubelite Hub, 32, Ajit NAMIBIA Fax: +43 (1) 25105 -130 Nagar, Co operative Society, Near Urmi Cross Road, WINGOC E-mail: [email protected] Akota, Vadodara-390 020 Gujarat, India Windhoek Goreangab Operating Company (PTY) Ltd. Tel : 91 0265 6544457 EUROPE Matshitshi Street, Goreangab Ext.3 CZECH REPUBLIC Windhoek, Namibia ASIA VA TECH WABAG Brno spol. s r.o. Telephone: +264 (0)61 27 2138 / 27 1742 SINGAPORE Železná 492/16, 619 00 Brno, Czech Republic Fax: +264 (0)61 27 2263 VA TECH WABAG (Singapore) PTE i Telephone:+420 (5) 45 427 - 710 E-mail: [email protected] 55 MARKET STREET #08-01 Bringing water back to life Fax:+420 (5) 45 427 - 736 Website: http://www.wingoc.com.na/ SINGAPORE (048941) (nicht operativ) GERMANY Ujams Wastewater Treatment Company (Pty) Ltd. -

Initiate at Buy, TP INR1,958 and 23% Upside Global Markets Research

VA Tech Wabag VATE.NS VATW IN EQUITY: ENGINEERING & CONSTRUCTION Initiate at Buy, TP INR1,958 and 23% upside Global Markets Research Strong growth prospects in a niche but growing water 27 January 2015 Rating treatment sector Starts at Buy Action: Initiate at Buy and TP of INR1,958, a 23% upside potential Target price Starts at INR 1958 VA Tech Wabag (VATW) is one of India’s largest water treatment companies, with a strong global presence as well. VATW derives its roots from the Austria- Closing price 23 January 2015 INR 1596 based water business of Siemens, which it acquired in 2007. With rising focus of the government and multi-lateral funding agencies on an escalating water Potential upside +22.7% shortage and ~68% of sewage being untreated in India, we think the water treatment sector is poised for secular long-term growth. While constantly- evolving technologies to efficiently capture incremental sources of clean water Anchor themes create an entry barrier in an otherwise fragmented industry, we believe VATW VA Tech Wabag is a niche play brings in strong project management experience, a global client reference list on the emerging water and waste water treatment opportunity, both and technological understanding. Despite the frail financial health of in India as well as in other municipalities (its primary customers, which often delay payments), VATW has emerging markets. With rising maintained a debt-free balance sheet and negligible bad debt. We estimate focus on clean water for drinking 22% revenue CAGR over FY14-17F and ~18% over the next 10 years. We as well as on better effluent initiate at Buy and TP of INR1,958 with 23% upside potential. -

VA TECH WABAG LIMITED Registered Office: 11, Murray’S Gate Road, Alwarpet, Chennai 600 018

VA TECH WABAG LIMITED Registered Office: 11, Murray’s Gate Road, Alwarpet, Chennai 600 018 NOTICE Notice is hereby given that the Eighteenth Annual General 2. Corporate members intending to send their authorised Meeting of the members of VA TECH WABAG LIMITED representatives to attend the Meeting are requested will be held on Thursday, July 25, 2013 at 10.00 a.m. at to send to the Company a certified copy of the Board Rani Seethai Hall, 603, Anna Salai, Chennai 600 006 to Resolution authorising their representative to attend transact the following businesses: and vote on their behalf at the Meeting. Ordinary Business 3. In terms of Article 108 of the Articles of Association of the Company, read with Section 256 of the Companies 1. To consider and adopt the audited Balance Sheet as Act, 1956, Mr. Bhagwan Dass Narang and Mr. Jaithirth at March 31, 2013, the Statement of Profit and Loss Rao, Directors retire by rotation at the ensuing Meeting for the year ended on that date and the reports of the and being eligible, offer themselves for re-appointment. Board of Directors and Auditors thereon. The Board of Directors of the Company commend their 2. To declare a dividend on equity shares. respective re-appointments. 3. To appoint a Director in place of Mr. Bhagwan Dass 4. In respect of the information to be provided under Narang, who retires by rotation, and being eligible, Clause 49(IV)(G) of the Listing Agreement pertaining offers himself for re-appointment. to the Directors being appointed / re-appointed, members are requested to kindly refer the Chapter on 4. -

August - 2011 Issue - 51

Private Circulation only August - 2011 Issue - 51 From the President's Desk In today’s hectic parleys of life, time has become a precious commodity,even the time spent on introspection. There is lot of information pouring in and with such knowledge explosion, we are at cross roads, not able to decide on the correct course of action. What to do on these occasions? Look back and introspect. Introspection is one of the essential aspects, which most people tend to overlook. Looking back gives one the time and space to recollect things, correct the mistakes and also improve. Mr. BANABIHARI PANDA The need for introspection is more significantly felt in the stock markets. There is President & Whole time Director Indbank Merchant Banking Services Ltd constant need to take stock of one’s portfolio and correct the imbalance (if any) to reap the benefits. So, we introspect and look back, but where to look? what to look? Although, there are a host of factors like the balance sheet, profit & loss statement, ratios etc., to look at, the most commendable aspect would be the “Dividend” paid out by the companies. Dividends can be defined as a “payment declared by a company and given to its shareholdersout of company’s current or retained earnings”. As companies make robust gains, they hand out a share of their profits to their shareholders as dividends. India’s growth story is long and strong. Indian companies are making huge in-roads globally and we have listed a few companies who have rewarded their shareholders handsomely over the years in our “Beginners Corner”. -

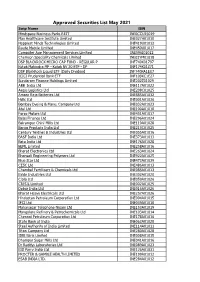

Group1 MAY-2021 APPROVED LIST

Approved Securities List May 2021 Scrip Name ISIN Mindspace Business Parks REIT INE0CCU25019 Max Healthcare Institute Limited INE027H01010 Happiest Minds Technologies Limited INE419U01012 Route Mobile Limited INE450U01017 Computer Age Management Services Limited INE596I01012 Chemcon Speciality Chemicals Limited INE03YM01018 DSP BLACKROCK MICRO CAP FUND - REGULAR P INF740K01797 Kotak Mahindra MF - Kotak NV 20 ETF - DP INF174K01Z71 DSP BlackRock Liquid ETF (Daily Dividend INF740KA1EU7 ICICI Prudential Bank ETF INF109KC1E27 Sundaram Finance Holdings Limited INE202Z01029 ABB India Ltd INE117A01022 Aegis Logistics Ltd INE208C01025 Amara Raja Batteries Ltd INE885A01032 Hdfc Ltd INE001A01036 Bombay Dyeing & Manu. Company Ltd INE032A01023 Atul Ltd INE100A01010 Force Motors Ltd INE451A01017 Bajaj Finance Ltd INE296A01024 Balrampur Chini Mills Ltd INE119A01028 Banco Products India Ltd INE213C01025 Century Textiles & Industries Ltd INE055A01016 BASF India Ltd INE373A01013 Bata India Ltd INE176A01028 BEML Limited INE258A01016 Bharat Electronics Ltd INE263A01024 Bhansali Engineering Polymers Ltd INE922A01025 Blue Star Ltd INE472A01039 CESC Ltd INE486A01013 Chambal Fertilisers & Chemicals Ltd INE085A01013 Exide Industries Ltd INE302A01020 Cipla Ltd INE059A01026 CRISIL Limited INE007A01025 Dabur India Ltd INE016A01026 Bharat Heavy Electricals Ltd INE257A01026 Hindustan Petroleum Corporation Ltd INE094A01015 IFCI Ltd INE039A01010 Mahanagar Telephone Nigam Ltd INE153A01019 Mangalore Refinery & Petrochemicals Ltd INE103A01014 Chennai Petroleum Corporation -

Equity Valuation of VA Tech WABAG

VA Tech Wabag Equity Valuation of VA Tech WABAG Submitted by: DoMS, IIT Madras DoMS, IIT Madras Page 1 VA Tech Wabag Rating Outperform (Target Price Rs 1766) Latest Price (BSE/NSE) Rs. 1591.90/ Rs. 1593.90 52 Week Range (Low/ High) Rs. 480/ Rs. 1748 BSE/ NSE ticker 533269/ WABAG ISIN Code INE956G01038 Face Value of Equity Share Rs. 2 Shares Outstanding 26.5 MN Market Capitalization Rs. 43.48 BN P/E Ratio (TTM) 35.61 Dividend Yield 0.50% Introduction: VA Tech WABAG is one of the leading companies in the world which is present in the water treatment Industry. Its key competency lies in design, completion and operation of drinking and waste water treatment for both industrial and municipal sector. It is a major player in a sector which has not seen much development and proceedings in the country. As a result with the advent of time VA Tech WABAG has established itself as the market leader in water treatment industry in India. India which is the second most populous country in the world is home of more than 1.25 billion people. It is growing at a rate of 1.3% annually and is expected to become the most populous country in the world by overcoming China by 2025. After getting independence in 1947 India has witnessed colossal improvement in its economy and GDP but providing basic requirements to people to sustain life, i.e., clean water still remains a vision that is yet to be realized. Even now many states are suffering from various water quality issues. -

MS-EXCEL II Professional Skills Potential Realization MBTI & FIRO

ACTIVITIES OF THE DEPARTMENT 2019-2020 Freshers day : It was conducted on 25.6.2019. The seniors received the I years with a warm welcome and activities were conducted to build a rapport. SOFT SKILLS CONDUCTED FOR THE YEAR 2019 -2020 Theme Date Name of the Resource Person & Designation Semester I Communication 5.8.19 Mrs.Hilda Interpersonal Skills 6.8.19 Mrs.Priscilla, Ms-Excel -I 7.8.19 Mrs.Vijayalakshmi Personality development 8.8.19 Mr.Solomon Semester II GD & Interview Preparation 24.6.19 Mrs. Hilda Aptitude 27.6.19 Mrs.Yamuna Leadership Development 1.7.19 Mr. Isaac Emotional Intelligence 2.7.19 Mr.Manish Gupta Semester III MS-EXCEL II 09.12.19 Mrs. Vijayalakshmi, Professional Skills 10.12.19 Ms.Nisha Potential Realization 11.12.19 Ms.Hema Ms.Vimla MBTI & FIRO-B Assessments 12.12.19 and discussion Semester IV Campus to Corporate 17.02.2020 Mrs.Priscilla Positive Psychology 18.02.2020 Dr.Balan Rathakrishna Creative Thinking Using 19.02.2020 Mrs.Hilda Thinking Hats , Risk and Crisis Management Conflict Management 20.02.2020 Mr. Solomon ORIENTATION PROGRAMME/ GUEST LECTURES Details of the Resource Details of Theme Person participants Mr.Balaji Ranganathan- Orientation on Human Head HR- TTK Health I Year students Resource . Care participated - 44 Orientation on Mr.Arvind –HR Organisational I Year students Executive - Infosys Development . participated - 44 Mr..John - HR Executive I Year students Learning&Development – Samsung participated- 44 HR Executive, Organisational OD&ExcellenceTeam, I &II Year students Development L&T participated -

Independent Auditor's Certificate on Corporate

Water Annual Report 2016-17 CORPORATE OVERVIEW 01 Corporate Information 06 Global Water Experts 08 Key Performance Indicators 09 Awards 10 Chairman’s Message GLOBAL WATER EXPERTS 06 12 MD’s Message 14 Nurturing Passion 16 Building Customer Relationships 18 Investing in Technological Innovation 20 Creating global synergies 22 Focusing on efficiencies 24 Business Clusters 28 Being Positively Responsible BUSINESS 30 Ten Year Financials CLUSTERS 24 STATUTORY REPORTS 32 Board’s Report 66 Management Discussion and Analysis 84 Report on Corporate Governance 100 Business Responsibility Report FINANCIAL STATEMENTS BEING POSITIVELY RESPONSIBLE 28 112 Standalone Financials 175 Consolidated Financials 251 Notice Forward-looking statement In this Annual Report, we have disclosed forward-looking information to enable investors to comprehend our prospects and take investment decisions. This report and other statements - written and oral - that we periodically make contain forward-looking statements that set out anticipated results based on the management’s plans and assumptions. We have tried, wherever possible, to identify such statements by using words such as ‘anticipate’, ‘estimate’, ‘expects’, ‘projects’, ‘intends’, ‘plans’, ‘believes’, and words of similar substance in connection with any discussion of future performance. We cannot guarantee that these forward-looking statements will be realised, although we believe we have been prudent in our assumptions. The achievements of results are subject to risks, uncertainties and even inaccurate assumptions. Should known or unknown risks or uncertainties materialise, or should underlying assumptions prove inaccurate, actual results could vary materially from those anticipated, estimated or projected. Readers should keep this in mind. We undertake no obligation to publicly update any forward- looking statement, whether as a result of new information, future events or otherwise. -

Learn. Leap. Lead

For further details contact: The Dean (Admissions), SRM University, SRM Nagar, Kattankulathur - 603 203, Kancheepuram Dt., Tamil Nadu, India. Learn. Leap. Lead Ph: +91-44-2745 5715, 2745 3433 Fax: +91-44-2745 3622 Email: [email protected], Web: www.srmuniv.ac.in Contents 03 A universe of fresh possibilities 05 Our vision 05 Our mission 05 From the Chancellor 07 A university is born 09 Four campuses to choose from 11 A world where knowledge is key 13 Learn as students do worldwide 15 A nourishing environment for growth 16 Global linkages and partnerships 17 The world speaks our language 19 Arriving on the job scene 21 To be the center for global research and innovation 22 Foreign faculty on long tenure 23 Faculty Abroad Program 24 International advisory board 26 Corporate advisory board 29 Knowledge has no borders 31 Extending a humanitarian touch 33 Breaking away from the routine 34 Scholarship & bank loan 35 Engineering & Technology 36 Medicine & Health Sciences 37 Science & Humanities 38 Management 39 A simple admission process 40 Administration & contact 41 Getting from where you are to where we are A universe of fresh possibilities Enter a university where new and exciting possiblities appear around every corner. This is education tomorrow, in an environment of academic freedom, where bright minds meet, discover and learn for themselves. Experience SRM University and the world within. The freedom to aspire You will have the freedom to chase your aspirations. Choose from a plethora of courses in every stream imaginable, be it certificate courses, diploma, undergraduate, postgraduate or doctoral programs in engineering, medicine, management or science & humanities.