BPCE/Natixis 2018 US Resolution Plan Public Section

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

ADV Part 2A: Firm Brochure

Firm Brochure Part 2A Natixis Advisors, LLC (“Natixis Advisors”) Natixis Investment Managers Solutions, a division of Natixis Advisors (“Solutions”) Boston Office San Francisco Office 888 Boylston Street 101 Second Street, Suite 1600 Boston, MA 02199 San Francisco, CA 94105 Phone: 617-449-2835 Phone: 617-449-2838 Fax: 617-369-9794 Fax: 617-369-9794 www.im.natixis.com This brochure provides information about the qualifications and business practices of Natixis Advisors. If you have any questions about the contents of this brochure, please contact us at 617-449-2838 or by email at [email protected]. The information in this brochure has not been approved or verified by the United States Securities and Exchange Commission (“SEC”) or by any state securities authority. Additional information about Natixis Advisors is available on the SEC’s website at www.adviserinfo.sec.gov. Registration does not imply that any particular level of skill or training has been met by Natixis Advisors or its personnel. August 4, 2021 1 Important Note about this Brochure This Brochure is not: • an offer or agreement to provide advisory services to any person; • an offer to sell interests (or a solicitation of an offer to purchase interests) in any fund that we advise; or • a complete discussion of the features, risks, or conflicts associated with any advisory service or fund. As required by the Investment Advisers Act of 1940, as amended (the “Advisers Act”), we provide this Brochure to current and prospective clients. We also, in our discretion, will provide this Brochure to current or prospective investors in a fund, together with other relevant offering, governing, or disclosure documents. -

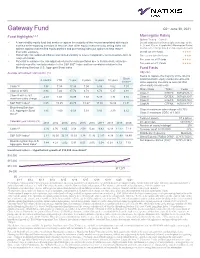

Gateway Fund

Gateway Fund Q2 • June 30, 2021 Fund Highlights1,2,3 Morningstar Rating Options Trading – Class Y • A low-volatility equity fund that seeks to capture the majority of the returns associated with equity Overall rating derived from weighted average of the markets while exposing investors to less risk than other equity investments by selling index call 3-, 5- and 10-year (if applicable) Morningstar Rating options against a diversified equity portfolio and purchasing index put options to help reduce metrics; other ratings based on risk-adjusted returns downside exposure Overall out of 81 funds ★★★★ • Historically has outpaced inflation and limited volatility to a level comparable to intermediate-term to Three years out of 81 funds ★★★ long term bonds Five years out of 57 funds • Potential to enhance the risk-adjusted returns for many portfolios due to its historically attractive ★★★★ risk/return profile, low beta relative to the S&P 500® Index and low correlation relative to the Ten years out of 11 funds ★★★★ Bloomberg Barclays U.S. Aggregate Bond Index Fund Facts Average annualized total returns† (%) Objective Seeks to capture the majority of the returns Since 3 months YTD 1 year 3 years 5 years 10 years associated with equity market investments, 1/1/88** while exposing investors to less risk than Class Y5 3.98 7.34 17.98 7.04 6.98 5.62 7.01 other equity investments Share Class Ticker Cusip Class A at NAV 3.94 7.24 17.72 6.78 6.72 5.37 6.91 Class Y GTEYX 367829-88-4 Class A with 5.75% -2.04 1.08 10.95 4.69 5.47 4.74 6.72 Class A GATEX 367829-20-7 maximum sales charge Class C GTECX 367829-70-2 ® 8 S&P 500 Index 8.55 15.25 40.79 18.67 17.65 14.84 11.31 Class N GTENX 367829-77-7 Bloomberg Barclays U.S. -

Műhelytanulmányok 112

Centre for Economic and Regional Studies of the Hungarian Academy of Sciences – Institute of World Economics MTA Közgazdaság- és Regionális Tudományi Kutatóközpont Világgazdasági Intézet Műhelytanulmányok 112. 2016. május Somai Miklós AZ ÁLLAM SZEREPE A FRANCIA GAZDASÁGBAN Magyar Tudományos Akadémia Közgazdaság- és Regionális Tudományi Kutatóközpont Világgazdasági Intézet Műhelytanulmányok 112. (2016) 1–63. 2016. május Az állam szerepe a francia gazdaságban szerző: Somai Miklós tudományos főmunkatárs Magyar Tudományos Akadémia Közgazdaság- és Regionális Tudományi Kutatóközpont Világgazdasági Intézet email: [email protected] Minden itt kifejtett vélemény és következtetés a szerző sajátja, amely nem minden esetben tükrözi a Világgazdasági Intézet, illetve a Közgazdaság- és Regionális Tudományi Kutatóközpont kutatóinak véleményét, vagy a Magyar Tudományos Akadémia álláspontját ISBN 978-963-301-631-2 ISSN 1417-2720 MTA Közgazdaság- és Regionális Tudományi Kutatóközpont Világgazdasági Intézet Műhelytanulmányok 112. (2016) 1–63. 2016. május Az állam szerepe a francia gazdaságban Somai Miklós1 Összefoglaló Jelen tanulmány az államnak elsősorban a teljesen vagy részben állami tulajdonú vállalatokon – valamint az ezekhez kapcsolódó intézményrendszeren – keresztül megvalósuló gazdasági szerepvállalására koncentrál. Először röviden áttekinti az állami szerepvállalás franciaországi hagyományait, illetve azt, hogy ez a funkció hogyan illeszkedik az általános gazdaságpolitikai eszközrendszerbe. A következő fejezetben bemutatja a XX. század nagy államosítási hullámait és a vállalatok kimentésének 1970- es/1980-as évekbeli technikáját. A következő nagy téma a neoliberális fordulat jegyében beköszöntő (re)privatizációs kurzus, amikor több olyan cég is magánkézbe került, amit még a második világháború végén/után államosítottak. Végül a tanulmány a válság és a válság körüli évek gazdaságpolitikáját (pl. bankmentést) próbálja meg érthetőbbé tenni, illetve az állam modernkori gazdasági szerepvállalását, a vagyonkezelési funkciót szemléltetni. -

Third Supplemental Information Memorandum Dated 23 July 2019

Third Supplemental Information Memorandum dated 23 July 2019 LVMH FINANCE BELGIQUE SA (incorporated as société anonyme / naamloze vennootschap) under the laws of Belgium, with enterprise number 0897.212.188 RPR/RPM (Brussels)) EUR 4,000,000,000 Belgian Multi-currency Short-Term Treasury Notes Programme Irrevocably and unconditionally guaranteed by LVMH Moët Hennessy - Louis Vuitton SE (incorporated as European company under the laws of France, and registered under number 775 670 417 (R.C.S. Paris)) The Programme is rated A-1 by Standard & Poor’s Ratings Services, a division of the McGraw-Hill Companies, Inc. and, Arranger Dealers Banque Fédérative du Crédit Mutuel BNP Paribas BRED Banque Populaire Crédit Agricole Corporate and Investment Bank Crédit Industriel et Commercial BNP Paribas Fortis SA/NV Natixis Société Générale ING Belgium SA/NV ING Bank N.V. Belgian Branch Issuing and Paying Agent BNP Paribas Fortis SA/NV This third supplemental information memorandum is dated 23 July 2019 (the “Third Supplemental Information Memorandum”) and is supplemental to, and shall be read in conjunction with, the information memorandum dated 20 October 2015 as supplemented on 21 April 2016 and on 28 April 2017 (the “Information Memorandum”). Unless otherwise defined herein, terms defined in the Information Memorandum have the same respective meanings when used in this Third Supplemental Information Memorandum. As of the date of this Third Supplemental Information Memorandum: (i) The Issuer herby makes the following additional disclosure: Moody's assigned on 3 July 2019 a first-time A1 long-term issuer rating and Prime-1 (P-1) short-term rating to LVMH Moët Hennessy Louis Vuitton SE.; (ii) The paragraph 1.17 “Rating(s) of the Programme” of the section entitled “1. -

Florida Prime Holdings Report Data As of March 18, 2021

Florida Prime Holdings Report Data as of March 18, 2021 Current Security Name Security Classification Cpn Maturity Rate Reset Par Amort Cost (2) Mkt Value (1) Yield ABN Amro Bank NV, Amsterdam TD TIME DEPOSIT 0.09 3/22/2021 530,000,000 0.09 $530,000,000 $530,000,000 ABN Amro Bank NV, Amsterdam TD TIME DEPOSIT 0.09 3/23/2021 50,000,000 0.09 $50,000,000 $50,000,000 ABN Amro Bank NV, Amsterdam TD TIME DEPOSIT 0.09 3/25/2021 250,000,000 0.09 $250,000,000 $250,000,000 ABN Amro Bank NV, Amsterdam TD TIME DEPOSIT 0.10 3/19/2021 98,000,000 0.10 $98,000,000 $98,000,000 ANZ National (Int'l) Ltd. CP4-2 COMMERCIAL PAPER - 4-2 5/18/2021 100,000,000 0.15 $99,974,583 $99,981,192 Albion Capital LLC CPABS4-2 COMMERCIAL PAPER - ABS- 4(2) 3/22/2021 48,000,000 0.12 $47,999,360 $47,999,483 Albion Capital LLC CPABS4-2 COMMERCIAL PAPER - ABS- 4(2) 3/22/2021 22,668,000 0.16 $22,667,597 $22,667,756 Albion Capital LLC CPABS4-2 COMMERCIAL PAPER - ABS- 4(2) 4/9/2021 18,763,000 0.22 $18,760,477 $18,761,521 Albion Capital LLC CPABS4-2 COMMERCIAL PAPER - ABS- 4(2) 4/20/2021 50,000,000 0.18 $49,991,750 $49,993,492 Albion Capital LLC CPABS4-2 COMMERCIAL PAPER - ABS- 4(2) 4/26/2021 54,369,000 0.18 $54,358,398 $54,360,400 Anglesea Funding LLC, Aug 04, 2021 COMMERCIAL PAPER ASSET BACKED CALLABLE 0.20 8/4/2021 4/5/2021 100,000,000 0.21 $100,000,000 $100,000,000 Anglesea Funding LLC, Aug 17, 2021 COMMERCIAL PAPER ASSET BACKED CALLABLE 0.21 8/17/2021 4/19/2021 90,000,000 0.21 $90,000,000 $90,000,000 Anglesea Funding LLC, Jul 30, 2021 COMMERCIAL PAPER ASSET BACKED CALLABLE 0.22 7/30/2021 4/1/2021 22,000,000 0.22 $22,000,000 $22,000,000 Antalis S.A. -

DTC Participant Alphabetical Listing June 2019.Xlsx

DTC PARTICPANT REPORT (Alphabetical Sort ) Month Ending - June 30, 2019 PARTICIPANT ACCOUNT NAME NUMBER ABN AMRO CLEARING CHICAGO LLC 0695 ABN AMRO SECURITIES (USA) LLC 0349 ABN AMRO SECURITIES (USA) LLC/A/C#2 7571 ABN AMRO SECURITIES (USA) LLC/REPO 7590 ABN AMRO SECURITIES (USA) LLC/ABN AMRO BANK NV REPO 7591 ALPINE SECURITIES CORPORATION 8072 AMALGAMATED BANK 2352 AMALGAMATED BANK OF CHICAGO 2567 AMHERST PIERPONT SECURITIES LLC 0413 AMERICAN ENTERPRISE INVESTMENT SERVICES INC. 0756 AMERICAN ENTERPRISE INVESTMENT SERVICES INC./CONDUIT 7260 APEX CLEARING CORPORATION 0158 APEX CLEARING CORPORATION/APEX CLEARING STOCK LOAN 8308 ARCHIPELAGO SECURITIES, L.L.C. 0436 ARCOLA SECURITIES, INC. 0166 ASCENSUS TRUST COMPANY 2563 ASSOCIATED BANK, N.A. 2257 ASSOCIATED BANK, N.A./ASSOCIATED TRUST COMPANY/IPA 1620 B. RILEY FBR, INC 9186 BANCA IMI SECURITIES CORP. 0136 BANK OF AMERICA, NATIONAL ASSOCIATION 2236 BANK OF AMERICA, NA/GWIM TRUST OPERATIONS 0955 BANK OF AMERICA/LASALLE BANK NA/IPA, DTC #1581 1581 BANK OF AMERICA NA/CLIENT ASSETS 2251 BANK OF CHINA, NEW YORK BRANCH 2555 BANK OF CHINA NEW YORK BRANCH/CLIENT CUSTODY 2656 BANK OF MONTREAL, CHICAGO BRANCH 2309 BANKERS' BANK 2557 BARCLAYS BANK PLC NEW YORK BRANCH 7263 BARCLAYS BANK PLC NEW YORK BRANCH/BARCLAYS BANK PLC-LNBR 8455 BARCLAYS CAPITAL INC. 5101 BARCLAYS CAPITAL INC./LE 0229 BB&T SECURITIES, LLC 0702 BBVA SECURITIES INC. 2786 BETHESDA SECURITIES, LLC 8860 # DTCC Confidential (Yellow) DTC PARTICPANT REPORT (Alphabetical Sort ) Month Ending - June 30, 2019 PARTICIPANT ACCOUNT NAME NUMBER BGC FINANCIAL, L.P. 0537 BGC FINANCIAL L.P./BGC BROKERS L.P. 5271 BLOOMBERG TRADEBOOK LLC 7001 BMO CAPITAL MARKETS CORP. -

IDENTITY May 2019 a Universal Cooperative Banking Model

IDENTITY May 2019 A universal cooperative banking model In our capacity as the 2nd largest banking group in France, we play a key role in the projects pursued by our 30 million customers, to whom we offer our support every day thanks to the expertise and know-how of our 105,000 employees. Strong, respected brands Groupe BPCE nd largest banking million million cooperative Financing 2 group in France 30 customers 9 shareholders more than 2 A universal cooperative banking model Diverse range of business activities in France and abroad Retail banking, Asset & Wealth Insurance Management Banking and financial Asset management, services, Insurance, Wealth management Specialized financing Natixis Investment Managers, Banque Populaire, Natixis Wealth Management Caisse d’Epargne, Banque Palatine, Natixis Assurances Corporate & Payments Investment Banking Capital Markets, Financing, Management of domestic, Trade & Treasury Solutions European and international payment instruments Natixis Natixis Payments Financing % of the French Present in different more than 20 economy more than 40 countries 3 RETAIL BANKING, INSURANCE Financing the economy at a local and regional level aving for retirement, buying your first apartment, starting a new business and financing your company’s growth, Smanaging your everyday banking opera- €564bn tions in a few clicks, obtaining advice on This is the total of our loan outstandings how to develop your business activities in (as at December 31, 2018) France or abroad... • As many expectations as customers Our banks provide our customers – a clien- tele of private individuals, professionals, associations, companies, and local author- €705bn ities – with personalized solutions tailored This is the total of our customers’ to their various needs and projects, ranging savings deposits from the most mundane to the most highly (as at December 31, 2018) complex… • Banque Populaire banks, Caisses d’Epargne, Banque Palatine, Crédit Coopératif, CASDEN.. -

Natixis U.S. Equity Opportunities Fund

Q2 | June 30, 2021 Natixis U.S. Equity Opportunities Fund QUARTERLY PORTFOLIO COMMENTARY Average annualized total returns (%) † as of 6/30/2021 3 months YTD 1 year 3 years 5 years 10 years Class Y 9.14 18.78 47.66 19.79 20.17 16.11 Class A at NAV 9.10 18.60 47.28 19.48 19.87 15.82 Class A with 5.75% maximum sales charge 2.82 11.79 38.81 17.15 18.46 15.13 S&P 500® Index 8.55 15.25 40.79 18.67 17.65 14.84 Russell 1000® Index 8.54 14.95 43.07 19.16 17.99 14.90 Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results. Total return and value will vary, and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit im.natixis.com. Performance for other share classes will be greater or less than shown based on differences in fees and sales charges. †Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. You may not invest directly in an index. Gross expense ratio 1.17% (Class A share) / 0.92% (Class Y share). Net expense ratio 1.17% (Class A share) / 0.92% (Class Y share). As of the most recent prospectus, the investment advisor has contractually agreed to waive fees and/or reimburse expenses (with certain exceptions) once the expense cap of the fund has been exceeded. -

INSIDE the GLOBAL BANK SECTOR Kanganews’S First Annual Guide to Global Financial Institutions, with a Focus on the Australian Dollar Funding Market

FINANCIAL INSTITUTION YEARBOOK DEC 18/JAN 19 SUPPLEMENT_VOL 13 ISSUE 110 www.kanganews.com AUSTRALASIAN FIXED INCOME: GLOBAL REACH, LOCAL EXPERTISE INSIDE THE GLOBAL BANK SECTOR KangaNews’s first annual guide to global financial institutions, with a focus on the Australian dollar funding market SPONSORED BY SUBSCRIBE TODAY current issue + supplement KangaNews is a one-stop information source on the AUD and NZD bond markets. Each issue provides all the information market participants need to keep up to date with the deals and trends making headlines in the markets; in-depth issuer and investor insights; deal and league tables; and statistics. Subscribers also have access to email updates on breaking deals and news from the KangaNewsAlert service, as well as all the data on www.kanganews.com To subscribe or request a free trial please contact Jeremy Masters t. +61 2 8256 5577 e. [email protected] KangaNews SUPPLEMENT TO DEC 18/JAN 19 EDITION VOLUME 13 ISSUE 110 www.kanganews.com Head of content and editor Contents LAURENCE DAVISON [email protected] ROUNDTABLE Senior content manager and deputy editor GLOBAL PERSPECTIVES HELEN CRAIG [email protected] ON BANK FUNDING Staff writer MATT ZAUNMAYR 12The international bank debt-issuance market is constantly [email protected] evolving. KangaNews speaks to funding executives from Editorial research assistant Asia, Australia, Europe, Japan and North America to get LUKE SWISS the latest on market conditions and outlook. Head of commercial JEREMY MASTERS 24_ [email protected] BNP Paribas 2 25_ Sales support officer MARKET NEWS YAZZY MCGUID Trends in the Australian financial Canadian Imperial Bank of Commerce [email protected] 26_ institution funding and capital space Commonwealth Bank of Australia including issuance timing patterns, an Chief executive 28_ Australian take on TLAC global-bank SAMANTHA SWISS , Commerzbank [email protected] TLAC issuance, Canadian bank supply 29_ and sustainability themed bank bonds. -

Transition Finance Toolkit

04. TRANSITION FINANCE TOOLKIT 1. April 2021 | BROWN INDUSTRIES: THE TRANSITION TIGHTROPE Tightrope.com C2 - Internal Natixis KEY TAKEAWAYS Chapter 4 Green Finance is now a core component of Climate Action and benefits from a strong impetus and legislative plans from policy-makers. The global Green/Sustainable/Social debt market reached $1.192 trillion threshold as of December 2020. There is increasing investors’ appetite for Brown industries are still largely absent from the Green transition KPI-linked products that could Bond market, which still focuses on green activities and include brown industries players The General Corporate Purpose model tied to a key performance • Investors are relatively less confident in predominantly and/or indicator on which different financial mechanism could be built allows a historically brown companies as they assess company’s profile & more holistic and forward-looking approach of climate finance. strategy in addition to the Use-of-Proceeds. UoP & General Corporate Purpose should not be opposed and can be • There is a lack of standards for activities in "grey areas" (whose complementary. "greenness" depends on observed performances like efficiency gains). The EU Taxonomy tries to address the lack of standards There is a new standard around for activities in grey areas Sustainability-Linked Bonds • Stringent thresholds can be fairly understood from the climate neutrality The ICMA has launched guidelines on the disclosures that should be objective but could lead to a niche of eligible companies or assets. made by issuers when raising funds in debt capital markets (the “Climate • The level of stringency, combined with its binary nature (i.e., without Transition Finance Handbook”). -

26 January 2018 Results of the Mandatory

26 JANUARY 2018 RESULTS OF THE MANDATORY PUBLIC TAKEOVER BID IN CASH AND SQUEEZE-OUT BY Natixis Belgique Investissements SA, a public limited company incorporated under Belgian law (the « Bidder ») ON ALL SHARES AND WARRANTS NOT YET OWNED BY THE BIDDER ISSUED BY Dalenys SA, a public limited company incorporated under Belgian law (the « Target Company »). Results of the bid The initial acceptance period of the mandatory takeover bid launched on 11 December 2017 by the Bidder on 8,620,827 shares representing 45,71% of the share capital and 38,67% of the voting rights of the Target Company and on 5,000 warrants (the “Bid”) ended on 22 January 2018. Following the initial acceptance period, the Bidder and the persons affiliated to him hold 18,401,437 shares and 3,432,944 profit shares representing 97,6 % of the share capital and 97,97 % of the voting rights in the Target Company. Payment of the bid price for the transferred shares will be made on 5 February 2018. Squeeze-out As the Bidder and the persons affiliated to him hold at least 95 % of the shares and securities with voting rights in the Target Company following the initial acceptance period, the Bidder decided to proceed with a squeeze out (in accordance with Article 513 of the Companies Code and Articles 42 and 43 in conjunction with Article 57 of the royal decree of 27 April 2007 on Takeover Bids) (the “Squeeze-out”) in order to acquire the shares and warrants issued by the Target Company not yet acquired by the Bidder, under the same terms and conditions as the Bid. -

REGISTRATION DOCUMENT and FULL-YEAR FINANCIAL REPORT Contents

2014 REGISTRATION DOCUMENT AND FULL-YEAR FINANCIAL REPORT Contents FINANCIAL REPORT 213 5 5.1 IFRS Consolidated Financial Statements of Groupe BPCE as at December 31, 2014 214 PRESENTATION OF GROUPE BPCE 3 5.2 Statutory Auditors’ report on the consolidated fi nancial statements 318 1 1.1 Presentation of Groupe BPCE 4 5.3 IFRS Consolidated Financial Statements 1.2 History of the Group 5 of BPCE SA group as at December 31, 2014 320 1.3 Organization of Groupe BPCE 6 5.4 Statutory Auditors’ report on the consolidated 1.4 Key fi gures 2014 9 fi nancial statements 400 1.5 Contacts 11 5.5 BPCE parent company fi nancial statements 402 1.6 Calendar 11 5.6 Statutory Auditors’ report on the fi nancial statements 447 1.7 2014-2017 strategic plan: “Growing Differently” 12 1.8 Groupe BPCE’s Businesses 15 SOCIAL, ENVIRONMENTAL 6 AND SOCIETAL INFORMATION 449 CORPORATE GOVERNANCE 29 6.1 Sustainable development strategy and cooperative identity 450 2 2.1 Introduction 30 6.2 Response to economic challenges 456 2.2 Management and Supervisory Bodies 32 6.3 Human resources information 463 2.3 Role and operating rules of governing bodies 65 6.4 Response to environmental challenges 474 2.4 Rules and principles governing the determination of pay and benefi ts 72 6.5 Response to societal challenges 482 2.5 Potential confl icts of interest 84 6.6 CSR reporting methodology 491 2.6 Chairman’s report on internal control and risk 6.7 Report by one of the Statutory Auditors, management procedures for the year ended a designated independent third-party body, on the December