June 2008 Presentation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Entertainment & Syndication Fitch Group Hearst Health Hearst Television Magazines Newspapers Ventures Real Estate & O

hearst properties WPBF-TV, West Palm Beach, FL SPAIN Friendswood Journal (TX) WYFF-TV, Greenville/Spartanburg, SC Hardin County News (TX) entertainment Hearst España, S.L. KOCO-TV, Oklahoma City, OK Herald Review (MI) & syndication WVTM-TV, Birmingham, AL Humble Observer (TX) WGAL-TV, Lancaster/Harrisburg, PA SWITZERLAND Jasper Newsboy (TX) CABLE TELEVISION NETWORKS & SERVICES KOAT-TV, Albuquerque, NM Hearst Digital SA Kingwood Observer (TX) WXII-TV, Greensboro/High Point/ La Voz de Houston (TX) A+E Networks Winston-Salem, NC TAIWAN Lake Houston Observer (TX) (including A&E, HISTORY, Lifetime, LMN WCWG-TV, Greensboro/High Point/ Local First (NY) & FYI—50% owned by Hearst) Winston-Salem, NC Hearst Magazines Taiwan Local Values (NY) Canal Cosmopolitan Iberia, S.L. WLKY-TV, Louisville, KY Magnolia Potpourri (TX) Cosmopolitan Television WDSU-TV, New Orleans, LA UNITED KINGDOM Memorial Examiner (TX) Canada Company KCCI-TV, Des Moines, IA Handbag.com Limited Milford-Orange Bulletin (CT) (46% owned by Hearst) KETV, Omaha, NE Muleshoe Journal (TX) ESPN, Inc. Hearst UK Limited WMTW-TV, Portland/Auburn, ME The National Magazine Company Limited New Canaan Advertiser (CT) (20% owned by Hearst) WPXT-TV, Portland/Auburn, ME New Canaan News (CT) VICE Media WJCL-TV, Savannah, GA News Advocate (TX) HEARST MAGAZINES UK (A+E Networks is a 17.8% investor in VICE) WAPT-TV, Jackson, MS Northeast Herald (TX) VICELAND WPTZ-TV, Burlington, VT/Plattsburgh, NY Best Pasadena Citizen (TX) (A+E Networks is a 50.1% investor in VICELAND) WNNE-TV, Burlington, VT/Plattsburgh, -

Consultation Publique Échéance Canal+

TRAVAUX CSA DU Consultation publique préalable au lancement d’un appel aux candidatures métropolitain sur la télévision numérique terrestre Consultation publique sur le fondement de l’article 31 de la loi du 30 septembre 1986 modifiée relative à la liberté de communication Juin 2019 © Conseil supérieur de l’audiovisuel Consultation publique préalable au lancement d’un appel aux candidatures métropolitain sur la télévision numérique terrestre Sommaire Présentation ....................................................... 1 Modalités de participation à la consultation publique .............. 1 Introduction ....................................................... 2 I. Le marché de la TNT payante ................................. 4 A) L’évolution de l’offre télévisuelle de la TNT payante 4 B) Le positionnement des chaînes de la TNT payante et la situation du service Canal+ 5 • Cinq chaînes aux formats variés ....................................................................................... 5 • La situation du service Canal+ ......................................................................................... 6 C) L’économie de la TNT payante 9 II. Le marché de la TNT gratuite ............................... 11 A) L’offre de programmes présents sur la TNT gratuite 11 • Évolution de l’offre de la TNT gratuite .............................................................................11 • La programmation des chaînes de la TNT nationale gratuite .............................................12 • La généralisation progressive de la haute -

Fetishism and the Culture of the Automobile

FETISHISM AND THE CULTURE OF THE AUTOMOBILE James Duncan Mackintosh B.A.(hons.), Simon Fraser University, 1985 THESIS SUBMITTED IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE DEGREE OF MASTER OF ARTS in the Department of Communication Q~amesMackintosh 1990 SIMON FRASER UNIVERSITY August 1990 All rights reserved. This work may not be reproduced in whole or in part, by photocopy or other means, without permission of the author. APPROVAL NAME : James Duncan Mackintosh DEGREE : Master of Arts (Communication) TITLE OF THESIS: Fetishism and the Culture of the Automobile EXAMINING COMMITTEE: Chairman : Dr. William D. Richards, Jr. \ -1 Dr. Martih Labbu Associate Professor Senior Supervisor Dr. Alison C.M. Beale Assistant Professor \I I Dr. - Jerry Zqlove, Associate Professor, Department of ~n~lish, External Examiner DATE APPROVED : 20 August 1990 PARTIAL COPYRIGHT LICENCE I hereby grant to Simon Fraser University the right to lend my thesis or dissertation (the title of which is shown below) to users of the Simon Fraser University Library, and to make partial or single copies only for such users or in response to a request from the library of any other university, or other educational institution, on its own behalf or for one of its users. I further agree that permission for multiple copying of this thesis for scholarly purposes may be granted by me or the Dean of Graduate Studies. It is understood that copying or publication of this thesis for financial gain shall not be allowed without my written permission. Title of Thesis/Dissertation: Fetishism and the Culture of the Automobile. Author : -re James Duncan Mackintosh name 20 August 1990 date ABSTRACT This thesis explores the notion of fetishism as an appropriate instrument of cultural criticism to investigate the rites and rituals surrounding the automobile. -

Road & Track Magazine Records

http://oac.cdlib.org/findaid/ark:/13030/c8j38wwz No online items Guide to the Road & Track Magazine Records M1919 David Krah, Beaudry Allen, Kendra Tsai, Gurudarshan Khalsa Department of Special Collections and University Archives 2015 ; revised 2017 Green Library 557 Escondido Mall Stanford 94305-6064 [email protected] URL: http://library.stanford.edu/spc Guide to the Road & Track M1919 1 Magazine Records M1919 Language of Material: English Contributing Institution: Department of Special Collections and University Archives Title: Road & Track Magazine records creator: Road & Track magazine Identifier/Call Number: M1919 Physical Description: 485 Linear Feet(1162 containers) Date (inclusive): circa 1920-2012 Language of Material: The materials are primarily in English with small amounts of material in German, French and Italian and other languages. Special Collections and University Archives materials are stored offsite and must be paged 36 hours in advance. Abstract: The records of Road & Track magazine consist primarily of subject files, arranged by make and model of vehicle, as well as material on performance and comparison testing and racing. Conditions Governing Use While Special Collections is the owner of the physical and digital items, permission to examine collection materials is not an authorization to publish. These materials are made available for use in research, teaching, and private study. Any transmission or reproduction beyond that allowed by fair use requires permission from the owners of rights, heir(s) or assigns. Preferred Citation [identification of item], Road & Track Magazine records (M1919). Dept. of Special Collections and University Archives, Stanford University Libraries, Stanford, Calif. Conditions Governing Access Open for research. Note that material must be requested at least 36 hours in advance of intended use. -

16 Other Languages

Publication Publisher Publication Magazine Publisher Genre Country Country Language Baba & Kleuter Media 24 Ltd omen's LifestySouth Africa South Africa af Brei Idees Media 24 Ltd Home South Africa South Africa Afrikaans Dekor Idees Media 24 Ltd Home South Africa South Africa Afrikaans Die GROOT 4x4 Gids Media 24 Ltd Automotive South Africa South Africa Afrikaans Die Tuinier Tydskrif Lonehill Trading (PTY) LTD Home South Africa South Africa Afrikaans Finweek - Afrikaans Media 24 Ltd News South Africa South Africa Afrikaans Handwerk Idees Media 24 Ltd Home South Africa South Africa Afrikaans Huisgenoot Media 24 Ltd EntertainmentSouth Africa South Africa Afrikaans Huisgenoot 100 Media 24 Ltd EntertainmentSouth Africa South Africa Afrikaans Huisgenoot Bak Media 24 Ltd Home South Africa South Africa Afrikaans Huisgenoot Beskuit en Muffins Media 24 Ltd Home South Africa South Africa Afrikaans Huisgenoot Beste Braai Media 24 Ltd Home South Africa South Africa Afrikaans Huisgenoot Beste Resepte Media 24 Ltd Home South Africa South Africa Afrikaans Huisgenoot Beste Resepte – 100 Jaar se gunstelinMedia 24 Ltd EntertainmentSouth Africa South Africa Afrikaans Huisgenoot Beste Resepte Poedings Media 24 Ltd Women South Africa South Africa Afrikaans Huisgenoot Blokraai Media 24 Ltd EntertainmentSouth Africa South Africa Afrikaans Huisgenoot Diabete Media 24 Ltd Home South Africa South Africa Afrikaans Huisgenoot Die Onvertelde Stories Media 24 Ltd EntertainmentSouth Africa South Africa Afrikaans Huisgenoot Dinosaurusse Media 24 Ltd Science & TechSouth -

Milestones 2008 Milestones

009 2 / Milestones 2008 Milestones Milestones 2008 / 2009 www.lagardere.com Document prepared by the Corporate Communications Department This document is printed on paper from environmentally certified sustainably PEFC/10-31-1222 managed forests. (PEFC/10-31-1222) Grasset 817_MIL09_covHD_c03_T2_UK.indd 2 15/06/09 11:06 à écout res er liv s e 859_MIL09_corpo_T2.indd 1 d 15/06/09 12:03 P r o fi l e Lagardère, a world-class pure-play media group led by Arnaud Lagardère, operates in more than 40 countries and is structured according to four distinct, complementary business lines: • Lagardère Publishing, its book-publishing business segment. • Lagardère Active, which specializes in magazine publishing, audiovisual (radio, television, audiovisual production) and digital activities, and advertising sales. • Lagardère Services, its travel retail and press-distribution business segment. • Lagardère Sports, which specializes in the sports economy and sporting rights. Lagardère holds a 7.5% stake in EADS, over which it exercises joint control. 2 Milestones 2008 / 2009 859_MIL09_corpo_T2.indd 2 15/06/09 12:03 Grasset Pr o fi l e 3 859_MIL09_corpo_T2.indd 3 15/06/09 12:04 GOVERNANCE Arnaud Lagardère editorial I am convinced that we must continually cultivate and strengthen our company fundamentals, which are both straightforward and sound. By giving concrete expression to our strategic perspective as a pure-play media company focusing on content creation, we have achieved unquestioned legitimacy and are now striving for leadership at global level. With the diversifi cation of our activities, both geographically and by business line, we have assembled a well-balanced portfolio of complementary assets. -

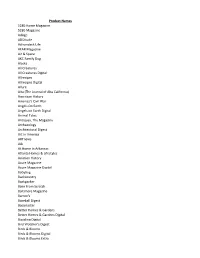

Product Names 5280 Home Magazine 5280 Magazine Adage Additude

Product Names 5280 Home Magazine 5280 Magazine AdAge ADDitude Adirondack Life AFAR Magazine Air & Space AKC Family Dog Alaska All Creatures All Creatures Digital Allrecipes Allrecipes Digital Allure Alta (The Journal of Alta California) American History America's Civil War Angels On Earth Angels on Earth Digital Animal Tales Antiques, The Magazine Archaeology Architectural Digest Art In America ARTnews Ask At Home In Arkansas Atlanta Homes & Lifestyles Aviation History Azure Magazine Azure Magazine Digital Babybug Backcountry Backpacker Bake From Scratch Baltimore Magazine Barron's Baseball Digest Bassmaster Better Homes & Gardens Better Homes & Gardens Digital Bicycling Digital Bird Watcher's Digest Birds & Blooms Birds & Blooms Digital Birds & Blooms Extra Blue Ridge Country Blue Ridge Motorcycling Magazine Boating Boating Digital Bon Appetit Boston Magazine Bowhunter Bowhunting Boys' Life Bridal Guide Buddhadharma Buffalo Spree BYOU Digital Car and Driver Car and Driver Digital Catster Magazine Charisma Chicago Magazine Chickadee Chirp Christian Retailing Christianity Today Civil War Monitor Civil War Times Classic Motorsports Clean Eating Clean Eating Digital Cleveland Magazine Click Magazine for Kids Cobblestone Colorado Homes & Lifestyles Consumer Reports Consumer Reports On Health Cook's Country Cook's Illustrated Coral Magazine Cosmopolitan Cosmopolitan Digital Cottage Journal, The Country Country Digital Country Extra Country Living Country Living Digital Country Sampler Country Woman Country Woman Digital Cowboys & Indians Creative -

STEVEN R. SWARTZ President & Chief Executive Officer, Hearst

STEVEN R. SWARTZ President & Chief Executive Officer, Hearst Steven R. Swartz became president and chief executive officer of Hearst, one of the nation’s largest diversified media, information and services companies, on June 1, 2013, having worked for the company for more than 20 years and served as its chief operating officer since 2011. Hearst’s major interests include ownership in cable television networks such as A&E, HISTORY, Lifetime and ESPN; global financial services leader Fitch Group; Hearst Health, a group of medical information and services businesses; transportation assets including CAMP Systems International, a major provider of software-as-a-service solutions for managing maintenance of jets and helicopters; 33 television stations such as WCVB-TV in Boston, Massachusetts, and KCRA-TV in Sacramento, California, which reach a combined 19 percent of U.S. viewers; newspapers such as the Houston Chronicle, San Francisco Chronicle and Albany Times Union, more than 300 magazines around the world including Cosmopolitan, ELLE, Men’s Health and Car and Driver; digital services businesses such as iCrossing and KUBRA; and investments in emerging digital entertainment companies such as Complex Networks. Swartz, 59, is a member of the Hearst board of directors, a trustee of the Hearst Family Trust and a director of the Hearst Foundations. He was president of Hearst Newspapers from 2009 to 2011 and executive vice president from 2001 to 2008. From 1995 to 2000, Swartz was president and chief executive of SmartMoney, a magazine venture launched by Hearst and The Wall Street Journal in 1991 with Swartz as founding editor. Under his leadership, SmartMoney magazine won two National Magazine Awards and was Advertising Age’s Magazine of the Year. -

Sons of Anarchy Offre Parrainage 2010

Associez-vous à TF6, Télévision Nouvelle Génération SONS OF ANARCHY OFFRE PARRAINAGE 2010 DECEMBRE 2009 SONS OF ANARCHY « Sons of anarchy » est un gang de motards dirigé DISPOSITIF ANNONCEUR d’une main de fer par Clay Morrow, pour qui . 30 BA avec billboard 6 '‘ pour la 1ère semaine, l’illégalité est un business avec lequel on ne rigole puis 10 BA/semaine avec billboard 6’’ pas … Jax, son beau-fils, devra un jour prendre la . 1 billboard 6'' en pré-générique du 1er épisode relève mais pour cela, il devra d’abord devenir un . 1 billboard 6’’ en pré-générique du 2ème épisode homme et gommer ses faiblesses. Sa mère, . 1 billboard 6'' en post-générique 2ème épisode véritable dure à cuire, est là pour faire en sorte que soit 132 PRESENCES sur la période cela arrive le plus possible. Série américaine avec Katey Sagal, Charlie Hunnam, Ron Forfait par partenaire sur 7 semaines* : Perlman … 10 000 € Net H.T OFFRE OUVERTE A DEUX PARTENAIRES Hors budget de production sur TF6 PROGRAMMATION A partir du 18 janvier 2010, pendant 7 semaines : Tous les lundis vers 23h, 2 épisodes par soirée Rediffusions : le samedi en 2ème PS Les horaires et la programmation sont donnés à titre indicatif et sont susceptibles d’être modifiés par la chaîne. * Toutes conditions commerciales déduite, cumul inclus, hors frais techniques sur TF6 Cette offre est soumise aux CGV 2010, consultables sur le site www.tf1pub.fr Contact commercial : 01 41 41 11 57 2 SONS OF ANARCHY : une série qui fait parler d’elle Bientôt sur TF6 ! 3 ANNEXE TF6 Télévision nouvelle génération INITIALISATION -

Reference Document Including the Annual Financial Report

REFERENCE DOCUMENT INCLUDING THE ANNUAL FINANCIAL REPORT 2012 PROFILE LAGARDÈRE, A WORLD-CLASS PURE-PLAY MEDIA GROUP LED BY ARNAUD LAGARDÈRE, OPERATES IN AROUND 30 COUNTRIES AND IS STRUCTURED AROUND FOUR DISTINCT, COMPLEMENTARY DIVISIONS: • Lagardère Publishing: Book and e-Publishing; • Lagardère Active: Press, Audiovisual (Radio, Television, Audiovisual Production), Digital and Advertising Sales Brokerage; • Lagardère Services: Travel Retail and Distribution; • Lagardère Unlimited: Sport Industry and Entertainment. EXE LOGO L'Identité / Le Logo Les cotes indiquées sont données à titre indicatif et devront être vérifiées par les entrepreneurs. Ceux-ci devront soumettre leurs dessins Echelle: d’éxécution pour approbation avant réalisation. L’étude technique des travaux concernant les éléments porteurs concourant la stabilité ou la solidité du bâtiment et tous autres éléments qui leur sont intégrés ou forment corps avec eux, devra être vérifié par un bureau d’étude qualifié. Agence d'architecture intérieure LAGARDERE - Concept C5 - O’CLOCK Optimisation Les entrepreneurs devront s’engager à executer les travaux selon les règles de l’art et dans le respect des règlementations en vigueur. Ce 15, rue Colbert 78000 Versailles Date : 13 01 2010 dessin est la propriété de : VERSIONS - 15, rue Colbert - 78000 Versailles. Ne peut être reproduit sans autorisation. tél : 01 30 97 03 03 fax : 01 30 97 03 00 e.mail : [email protected] PANTONE 382C PANTONE PANTONE 382C PANTONE Informer, Rassurer, Partager PROCESS BLACK C PROCESS BLACK C Les cotes indiquées sont données à titre indicatif et devront être vérifiées par les entrepreneurs. Ceux-ci devront soumettre leurs dessins d’éxécution pour approbation avant réalisation. L’étude technique des travaux concernant les éléments porteurs concourant la stabilité ou la Echelle: Agence d'architecture intérieure solidité du bâtiment et tous autres éléments qui leur sont intégrés ou forment corps avec eux, devra être vérifié par un bureau d’étude qualifié. -

United Kingdom Distribution Points

United Kingdom Distribution to national, regional and trade media, including national and regional newspapers, radio and television stations, through proprietary and news agency network of The Press Association (PA). In addition, the circuit features the following complimentary added-value services: . Posting to online services and portals with a complimentary ReleaseWatch report. Coverage on PR Newswire for Journalists, PR Newswire's media-only website and custom push email service reaching over 100,000 registered journalists from 140 countries and in 17 different languages. Distribution of listed company news to financial professionals around the world via Thomson Reuters, Bloomberg and proprietary networks. Releases are translated and distributed in English via PA. 3,298 Points Country Media Point Media Type United Adones Blogger Kingdom United Airlines Angel Blogger Kingdom United Alien Prequel News Blog Blogger Kingdom United Beauty & Fashion World Blogger Kingdom United BellaBacchante Blogger Kingdom United Blog Me Beautiful Blogger Kingdom United BrandFixion Blogger Kingdom United Car Design News Blogger Kingdom United Corp Websites Blogger Kingdom United Create MILK Blogger Kingdom United Diamond Lounge Blogger Kingdom United Drink Brands.com Blogger Kingdom United English News Blogger Kingdom United ExchangeWire.com Blogger Kingdom United Finacial Times Blogger Kingdom United gabrielleteare.com/blog Blogger Kingdom United girlsngadgets.com Blogger Kingdom United Gizable Blogger Kingdom United http://clashcityrocker.blogg.no Blogger -

Oddo Media Forum

ODDO May 16th, 2008 MEDIA FORUM 1. M6 Group’s activities First quarter 2008 2 An enlarged population with multichannel access Population equipped with multichannel access accounts for 44% in 2007 and jumps to 73% in 2008 Q1 < 10 channels Free multichannel: DTT Free multichannel: DSL Multichannel with subscription (cable, satellite…) 100% 90% 18% 21,5% 23% 24% 26% 28% 28% 28% 29% 29% 29% 29% 80% 1% 70% 5% 4% 12% 12% 16% 18% 18,5% 60% 50% 32% 40% 82% 79% 77% 76% 74% 72% 67% 44% 30% 46% 56% 46,5% 20% 27% 10% 11% 7% 6% 0% 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 M6 estimates 3 Source: Médiamétrie and M6 estimates M6 Group’s presence in the fragmented environment TF1 27,2% (-3.2 pts) France 2 17,6% (-0.6 pt) Historical France 3 13,4% (-0.9 pt) channels 76.9% M6 11,0% (-1.3 pt) Arte -F5 4,1% (-0.3 pt) Canal + 3,6% (-0.3 pt) TMC 2,0% (+1.0 pt) W9 1,7% (+0.8 pt) Gulli 1,4% (+0.7 pt) NT1 1,1% (+0.6 pt) NRJ 12 1,0% (+0.7 pt) Other TV France 4 0,8% (+0.5 pt) channels 23.1% Direct 8 0,5% (+0.3 pt) Virgin 17 0,5% (=) I Télé 0,3% (=) BFM TV 0,3% (+0.1 pt) OtherAutres TV chanelschaînes excl.hors DTTTNT 13,5% (+1.9 pt) 4 Source : Médiamétrie - national audience share individuals 4 y.o. and over Source: Médiamétrie In access prime time, M6 outperforms TF1 on housewives <50 Season 2006-2007 Sept.