A Microeconomic Analysis of the Full-Size Automobile Market

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

PM147 Anchor 062019 Newsletter

R MORE Availability • MORE Coverage • MORE Experience JUNE, 2019 Anchor Adds MORE More Ford and Lincoln Coverage Anchor Industries, a respected manufacturer in the automotive aftermarket since 1933, continues to lead the market in late model coverage. We remain vigilant in our commitment to be the industry leader for all makes and models, including, domestic, Asian and European applications. This month we focus on 10 new Ford and Lincoln numbers that have been recently added. These numbers fit many of the most popular vehicles on the road today, accounting for over 8,470,050 applications. (based on Polk data) Ford Edge Make sure you’re not missing out on these growing sales opportunities. NEW POPULAR FORD AND LINCOLN APPLICATIONS INCLUDE Anchor No. Make Model Years Location 3294 Ford Mustang - 3.7L 2011-2019 Transmission 3371 Ford Expedition, F150 - 2.7L, 3.5L, 4.6L, 5.0L, 5.4L 2007-2019 Engine Lincoln Navigator - 2.7L, 3.5L, 4.6L, 5.0L, 5.4L Left / Right Ford Explorer 3372 Ford Expedition, F150 - 2.7L, 3.5L, 4.6L, 5.0L, 5.4L 2007-2019 Engine Lincoln Navigator - 2.7L, 3.5L, 4.6L, 5.0L, 5.4L Left / Right 3374 Ford Taurus - 2.0L 2013-2018 Transmission Lincoln MKT - 2.0L 3388 Ford Taurus, PPV, Flex - 3.5L, 3.7L 2013-2019 Front 3390 Ford Taurus - 2.0L 2013-2018 Torque Strut Lincoln MKZ Lincoln MKT - 2.0L 3391 Ford Explorer, Police Interceptor - 3.5L, 3.7L 2016-2018 Torque Strut 3392 Ford Explorer - 2.3L 2011-2019 Front 3407 Ford Edge - 3.5L, 3.7L 2015-2018 Front Lincoln MKZ, Continental - 3.5L, 3.7L 3428 Ford Taurus, Flex - 3.5L 2010-2019 Transmission Lincoln MKS, MKT - 3.5L All application data is available electronically on anchor-online.com, Epicor and WHI Solutions. -

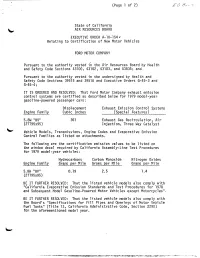

Page 1 Of.Tif

(Page 1 of 2) EO BEST State of California AIR RESOURCES BOARD EXECUTIVE ORDER A-10-154 . Relating to Certification of New Motor Vehicles FORD MOTOR COMPANY Pursuant to the authority vested in the Air Resources Board by Health and Safety Code Sections 43100, 43102, 43103, and 43835; and Pursuant to the authority vested in the undersigned by Health and Safety Code Sections 39515 and 39516 and Executive Orders G-45-3 and G-45-4; IT IS ORDERED AND RESOLVED: That Ford Motor Company exhaust emission control systems are certified as described below for 1979 model-year gasoline-powered passenger cars : Displacement Exhaust Emission Control Systems Engine Family Cubic Inches (Special Features 5. 8W "BV" 351 Exhaust Gas Recirculation, Air (2TT95x95) Injection, Three Way Catalyst Vehicle Models, Transmissions, Engine Codes and Evaporative Emission Control Families as listed on attachments. The following are the certification emission values to be listed on the window decal required by California Assembly-Line Test Procedures for 1979 model-year vehicles : Hydrocarbons Carbon Monoxide Nitrogen Oxides Engine Family Grams per Mile Grams per Mile Grams per Mile 5. 8W "BV" 0. 19 2.5 1.4 (2TT95x95) BE IT FURTHER RESOLVED: That the listed vehicle models also comply with "California Evaporative Emission Standards and Test Procedures for 1978 and Subsequent Model Gasoline-Powered Motor Vehicles except Motorcycles". BE IT FURTHER RESOLVED: That the listed vehicle models also comply with the Board's "Specifications for Fill Pipes and Openings of Motor Vehicle Fuel Tanks" (Title 13, California Administrative Code, Section 2290) for the aforementioned model year. -

Fan Assembly Control Modules

Commercial Vehicles and Services FA70796 FA72133 Fan Assembly Control Modules Top Selling Cooling Fans Assemblies with Modules FA70796 Tech Tip Application: Ford Edge 15-07; Lincoln MKX 15-07 Do not bench test a fan assembly equipped with a control model prior to installation. Fan Assembly control modules require a specific electronic signal and voltage from the ECU. Using a generic 12 volt power source will cause irreversible damage to the FA71750 control module and fan. Application: Infiniti JX35 2013, QX60 19-14; Nissan Pathfinder 19-13 Did you know? Fan Assembly control modules require a specific electronic signal and voltage from the ECU. Using a generic 12 volt power source, such as a battery charger, will cause irreversible damage to the module FA72133 and fan. The first time many technicians Application: Jeep Cherokee 19-14 replace a late model fan assembly they figure it’s a simple electronic component replacement, and unfortunately, many fan assembly modules are ruined because of a lack of knowledge of how modern fan assemblies work. Continental Automotive Systems 800-564-5066 l [email protected] l www.continentalaftermarket.com © 2020 Tech Support: 800-265-1818 l [email protected] Fan Assembly Control Modules Application Coverage Continental Applications Part Number FA70238 Mitsubishi Galant 03-99 FA70240 Chrysler Sebring 05-01; Dodge Stratus 05-01; Mitsubishi Eclipse 05-00 FA70242 Mitsubishi Eclipse 2000, Galant 00-99 FA70267 Lexus RX330 06-04 FA70273 Mazda 6 08-03 FA70309 Mazda 3 09-04 FA70311 Ford -

Na Plant Locations 092110 Lt Veh Only.Qxp

North America car and truck assembly plants – 2010 & beyond AM GENERAL FORD T Mishawaka, Ind. – Ford Transit Connect electric Also see AutoAlliance (gliders, assembly only, production counted in Turkey) UNITED STATES B Chicago – Ford Explorer (new, November), Taurus; Lincoln MKS AUTOALLIANCE T Dearborn, Mich. – Ford F-150, Harley Davidson F-150 C Flat Rock, Mich. – Ford Mustang, Mazda Mazda6 sedan T Detroit Chassis Plant (Detroit) – Ford F-series chassis T Kansas City, Mo.: (One Plant) BMW SUV Plant – Ford Escape, Escape Hybrid; Mercury Mariner, Mariner Hybrid; Mazda Tribute B Spartanburg, S.C.† – BMW X3, X5, X6 Truck Plant – Ford F-150 Super Cab, Super Crew Cab, King Crew Cab T Kentucky Truck (Louisville, Ky.) – F-series Super Duty (F-250 - F-550), CAMI Expedition; Lincoln Navigator T Ingersoll, Ontario, Canada – Chevrolet Equinox, Equinox Sport; T Louisville, Ky. – Ford Escape (4th qtr‘11), Explorer (ends Dec. 16), GMC Terrain Explorer SportTrac (ends Oct. 26); Mercury Mountaineer (ends Sept .28) T Michigan Assembly (Wayne, Mich.) – changeover until Jan. 5, 2011 Ford Focus NOTE Per Renee at CAMI: CAMI became a wholly owned T Ohio Assembly (Avon Lake, Ohio) – E series vans, Transit (2013) subsidiary of GMCL on Dec. 10, 2009. CAMI is, however, still aseparate legal entity and its production numbers should, T Twin Cities (St. Paul, Minn.) – (permanent layoff Dec. 24, 2011) – therefore, be reported separately from GMCL. We do not Ford Ranger, Mazda B series expect the amalgamation of CAMI and GMCL to occur until at least Dec. 31, 2010 (maybe later). Once the amalgamation C Wayne, Mich. – (permanent layoff Nov. -

Ford/Jeep/Lincoln/Mercury 1975-2000 99-5510

Installation instructions for 99-5510 APPLICATIONS See application list inside WIRING & ANTENNA CONNECTIONS (sold separately) Ford/Jeep/Lincoln/Mercury 1975-2000 Wiring Harness: 99-5510 • 70-1002 • 70-1770 KIT FEATURES • 70-1772 • DIN radio provision • 70-1781 Antenna Adapter: • Not required KIT COMPONENTS TOOLS REQUIRED • A) Radio housing • B) Rounded faceplate • C) Cornered faceplate • D) Rear support • E) Bracket set #1 • Phillips screwdriver • Cutting tool • F) Bracket set #2 • G) Spacer set #1 • H) Spacer set #2 • I) (4)) #8 x 1” Phillips screws • 86-5618 Radio removal keys A B C D CAUTION: Metra recommends disconnecting the negative battery terminal before beginning any installation. All accessories, switches, and especially E F G H I air bag indicator lights must be plugged in before reconnecting the battery or cycling the ignition. NOTE: Refer to the instructions included with the REV. 10/9/2014 INST99-5510 REV. aftermarket radio. METRA. The World’s best kits.™ 1-800-221-0932 metraonline.com © COPYRIGHT 2004-2014 METRA ELECTRONICS CORPORATION 99-5510 Applications AMC Ford (continued) Mercury Alliance................................................................. 1983-1987 Taurus .................................................................. 1990-1995 Capri XR2 ............................................................. 1991-1994 Encore .................................................................. 1983-1987 Taurus .................................................................. 1986-1989 Cougar ................................................................. -

2011 Lincoln MKS Brochure

LINCOLN MKS 2011 INSTANT STAR QUALITY. Captivating in every sense, the 2011 Lincoln MKS mixes athletic poise with sweeping lines and uncompromising purity of design. Instantly admired in the full blaze of day, this starship is equally coveted in its mystery by night – as adaptive HID headlamps dazzle in their automated luminosity. Settle inside and bask in the cool glow of signature Lincoln “white” lighting. With a touch of the push-button start, you engage. Silver Diamond Premium Coat Metallic. As awarded by the Insurance Institute for Highway Safety (IIHS). Lincoln MKS earned a 2010 “Top Safety Pick.” LINCOLN MKS 2011 lincoln.com POWER BOOSTER. Backed by 274 hp and 270 lb.-ft. of torque, the standard 355 lively horsepower.2 350 lb.-ft. of torque.2 Power to 3.7L 24-valve Duratec® V6 engine of Lincoln MKS reach for the stars is yours. The available 3.5L EcoBoostTM fuels your ambitions. It also delivers up to 24 mpg V6 twin-turbocharged, direct-injection engine features hwy.1 The standard 6-speed SelectShift AutomaticTM tremendous low-end torque and smooth power on demand. transmission supplies the freedom of a “manual As well as an EPA-estimated 25 mpg hwy.3 It’s V8 power mode” – if you prefer shifting for yourself – with with V6 fuel economy. To harness all that energy, MKS the convenience of an automatic. Steering wheel- with EcoBoost is equipped with intelligent all-wheel mounted paddle shifters feature concise actuation drive (AWD). In varying weather conditions, AWD reacts for exceptional control. To enhance traction, choose instantly, seamlessly distributing torque to the wheel or available intelligent all-wheel drive (AWD). -

SSM 45215 - SYNC/Myford and Mylincoln Touch - Navigation Displays Incorrect - Unable to Locate Vehicle - Built on Or Before 9/30/2014

SSM 45215 - SYNC/MyFord And MyLincoln Touch - Navigation Displays Incorrect - Unable To Locate Vehicle - Built On Or Before 9/30/2014 Some 2013-2015 vehicles equipped with SYNC and/or MyFord Touch, MyLincoln Touchand built on or before 9/30/2014 may exhibit a voice prompt indicating SYNC Services Traffic, Directions or Information (TDI) is unable to locate the vehicle. MyFord Touch equipped vehicles with navigation may also exhibit the vehicle location displayed off road from the current vehicle position, the last known vehicle location being displayed instead of current location, a screen message indicating a Navigation Fault. Reprogram the Global Positioning Satellite Module (GPSM) to the latest calibration using IDS release 96.02 or higher. Use applicable 12651D labor operations from Section 10 of the SLTS manual and use causal part 10E893. APPLICABLE VEHICLES 2015 TRUCK: TH TRANSIT V363 FNA 2014 CAR: HN TRANSIT CONNECT V408N FNA 2015 CAR: HC V408 (EU) 2013 - 2015 CAR: CG C344N HEV 2013 CAR: CH B299 B CAR (NA) 2014 CAR: CT B299 MCA FNA 2015 CAR: CT B299 MCA FNA 2013 - 2015 TRUCK: M2 C520 NA (ESCAPE) 2013 - 2015 TRUCK: UB EXPLORER 2013 - 2015 TRUCK: B7 EXPEDITION (U222) 2013 - 2015 CAR: C7 FUSION 2013 - 2015 CAR: PH TAURUS 2013 - 2014 CAR: ZF MUSTANG (S197) 2015 CAR: ZG MUSTANG (S550) 2013 - 2015 TRUCK: FA P473 SUPER DUTY 2013 - 2014 CAR: DH C346 FOCUS FNA 2013 - 2014 TRUCK: Q1 FORD EDGE/LINCOLN MKX 2013 - 2014 TRUCK: E4 ECONOLINE 2013 - 2014 TRUCK: F6 F150/LINCOLN MARK LT 2013 - 2014 TRUCK: P3 FLEX (FORD C/O UTILITY) 2015 TRUCK: ME -

Featuring the Spectrum of Lincoln Accessories

2020 CUSTOM ISSUE SEVEN LINCOLN ACCESSORIES FEATURING THE SPECTRUM OF LINCOLN ACCESSORIES (INCORPORATES THE 2020 MODEL YEAR) You can build the cost of many Lincoln Accessories into your monthly Tailor payment agreement. your Lincoln But do keep in mind, every qualifying accessory to your must be ordered and purchased at the time your vehicle is bought or leased. Of course, you can Discerning always add Lincoln Accessories any time after acquiring the vehicle. Additionally, you can Taste benefit from warranty coverage offered on all Lincoln Original Accessories and many Lincoln Licensed Accessories. Please turn to page 72 for Not all accessories are additions to specifics. And stop by your Lincoln Dealer for a style alone. Many express your personal comprehensive copy of each limited warranty. preference in comfort and convenience. Luxury Cars Every one of the Lincoln Accessories Lincoln Continental 2 offered within is stylized to harmonize. Lincoln MKS 7 Lincoln MKZ + Hybrid 11 Lincoln Town Car 17 Luxury Utilities Lincoln Aviator 19 Lincoln Corsair 25 Lincoln MKC 30 Lincoln MKT 37 Lincoln MKX 43 Lincoln Nautilus 53 Lincoln Navigator/L 60 Luxury Truck Lincoln Mark LT 70 Of Warranties and More Lincoln Accessories Limited Warranty; 72 Lincoln Automotive Financial Services; Lincoln Protect® Extended Service Plans; Using Different-Sized Wheels or Tires On the cover: 2020 Lincoln Aviator in Blue Diamond Metallic. Above: 2020 Lincoln Aviator in White Platinum Metallic Tri-coat. Tailored with wheel lock kit, hitch-mounted bike rack with ski/snowboard Tailored with dash cam by Thinkware,®1 and hitch-mounted bike rack adapter by THULE,®1 and Lincoln Perimeter Plus Vehicle Security System. -

SSM 46332 - 2008-2017 Various Ford/Lincoln/Mercury Vehicles - Replacing/Upgrading Original Equipment SYNC/Navigation System Components Is Not Supported

SSM 46332 - 2008-2017 Various Ford/Lincoln/Mercury Vehicles - Replacing/Upgrading Original Equipment SYNC/Navigation System Components Is Not Supported Replacing the original equipment SYNC/Navigation system with either an aftermarket SYNC/Navigation kit or modifying original SYNC/Navigation parts to provide additional features is not recommended nor supported on any Ford, Mercury or Lincoln vehicle. Only approved Genuine Ford accessories or originally installed systems are supported and certified to function correctly with other vehicle systems. If you suspect a system has been modified, the following resources can be usedto verify original equipment: Monroney Label (Window Sticker), Professional Technician Society (PTS) OASIS tab – select SYNC or HVBOM. For Genuine Ford accessories use: PTS Workshop Tab – select Dealer Installed Accessory or Accessory Installation. APPLICABLE VEHICLES 2008 - 2009 CAR: AP C1 FORD (C214/C307) EU 2013 - 2017 CAR: CG C344N HEV 2008 - 2011 CAR: B3 C214 EU C-CAR 2010 - 2016 CAR: B7 C344 EU C-CAR 2015 - 2017 CAR: EU C344E MCA EU 2017 CAR: PL D544 LINCOLN CONTINENTAL 2008 - 2012 CAR: FB CROWN VIC 2008 - 2014 TRUCK: Q1 FORD EDGE/LINCOLN MKX 2014 - 2016 CAR: ED CD539(APA)-EDGE 2015 - 2017 CAR: DQ CD539N-EDGE 2008 - 2012 TRUCK: M7 ESCAPE/TRIBUTE/MARINER-LHD 2013 - 2017 TRUCK: M2 C520 NA (ESCAPE) 2008 - 2013 TRUCK: M8 ESCAPE/TRIBUTE (J87) 2008 - 2017 TRUCK: E4 ECONOLINE 2008 - 2017 TRUCK: B7 EXPEDITION (U222) 2008 - 2011 TRUCK: U5 EXPLORER/MOUNTAINEER 2011 - 2017 TRUCK: UB EXPLORER 2013 - 2017 TRUCK: WJ EXPLORER -

2016 Lincoln MKS Brochure

2016 LINCOLN MKS In its most coveted form, beauty extends far beyond the surface. Just as it does in MKS. Precisely crafted with exceptional attention to detail, MKS is designed to transform everyday drives into special experiences. Its strong lines impart confidence while conveying grace from every angle. Its chrome accents gleam in the sunlight. As its beauty flows from within, the 2016 Lincoln MKS establishes a commanding presence and creates its own distinctive style of luxury. 2016 LINCOLN MKS Lincoln.com EXPRESSIVE DESIGN IMAGINE THE JOYFUL EMPOWERMENT OF GOLFING WITH CUSTOM‑FIT CLUBS. IT’S A LOT LIKE THAT. The elegant simplicity of its controls instantly puts you at ease. Seated at the leather-wrapped heated1 steering wheel of your new MKS, you’ll notice paddle shifters discreetly tucked behind it. They give you the power to put the 6-speed SelectShift® automatic transmission through its paces any time you’re in the mood for a more spirited drive. The position of the adjustable1 brake and accelerator pedals, the sideview mirrors, and the front seats can be set using power controls, then saved to memory for your MKS to recall at the touch of a button. Providing personalized comfort for you and your front passenger, dual-zone electronic automatic temperature control lets you each set a different ADAPTIVE HID HEADLAMPS preferred temperature. This feature also works in tandem with the Remote Start System to prepare the vehicle for your arrival. MyKey® lets you To provide more visibility when driving around program a key to establish an earlier low-fuel warning and much more. -

Lincoln and Continental Owners Club -Sponsoring the Western National

Lincoln and Continental Owners Club Sponsoring the Western National Meet New Mexico Region Hosting Albuquerque, New Mexico October 17 - 21, 2018 Theme: “October in the High Desert, Atoms, Balloons and Cars” Schedule of Events Wednesday, October 17, 2018 12 Noon till 6 PM Registration Desk and Hospitality Room open 1 PM Mechanical Judging begins 6 PM till 9 PM Early Bird Welcome Thursday, October 18, 2018 8 AM till 6 PM Registration Desk /Hospitality Room open 8 AM Mechanical Judging 10 AM to 2:30 PM Driving Tour to National Museum of Nuclear Science and History And Lunch at Sandrago’s Gill and Trip on Sandia Park Tramway Transports 3 PM Balance of afternoon for shopping and antiquing, Thursday night on your own Friday, October 19, 2018 8 AM till 6 PM Registration Desk /Hospitality Room open 8 AM Mechanical Judging 9:30 AM till 3:30 PM Driving tour to Anderson, and Abruzzo Albuquerque International Balloon Museum and lunch/ 6 PM till 7 PM Cocktail hour (cash bar) 7 PM till 9:30 PM Mexican Buffet and Lincoln parts and memorabilia auction Saturday, October 20, 2018 7:30 AM Judges Breakfast and Judges Meeting 8 AM till 9:30 AM Final Registration 8 AM to 10 AM Final Mechanical Judging (For those who arrived Friday night or Saturday Morning 8 AM till 10 AM Lincoln Car Show parking adjacent to the hotel 10 AM till 3 PM Lincoln Car Show (Do not leave until cars are released by the Chief Judge) 12 PM to 1 PM Lunch on your own 4 PM LCOC Membership Meeting 6 PM till 7 PM Happy Hour (cash bar) 7 PM till 10 PM Awards Banquet Sunday, October 21, 2018 9 AM Photos of cars by John Walcek 2018 MID AMERICA NATIONAL MEET FREQUENTLY ASKED QUESTIONS Please read carefully Q: Do I have to participate in all activities? A: No, it is okay to pick and choose the activities in which you wish to participate. -

NA Plant Locations 123106.Qxp

North America car and truck assembly plants 2006 AM GENERAL T Twin Cities (St. Paul, Minn.) – (plant on permanent layoff Spring 2008) – Updated 10-30-06 Ford Ranger, Mazda B series T Mishawaka, Ind. – Hummer H2 SUV/SUT C Wayne, Mich. – Ford Focus AUTOALLIANCE C Wixom, Mich. – (plant on permanent layoff May 31, 2007) – C Flat Rock, Mich. – Ford Mustang, Mazda Mazda6 Lincoln Town Car CANADA BMW T Oakville, Ontario – Ford Freestar (until Mar/Apr 07), Edge; Lincoln MKX C Spartanburg, S.C.† – BMW Z4 D platform: Ford Fairlane, Mazda, Volvo D platform trucks(Dec. 2007) T Spartanburg, S.C.† – BMW X5 C St. Thomas, Ontario – Ford Crown Victoria; Mercury Grand Marquis, Lincoln Town Car (Dec. 2007) CAMI MEXICO T Ingersoll, Ontario, Canada – Chevrolet Equinox, Pontiac Torrent, C Cuautitlan – Ford Fiesta Ikon Suzuki XL-7 T Cuautitlan – Ford F-series, F-series Super Duty DAIMLERCHRYSLER C Hermosillo – Ford Fusion; Lincoln MKZ, Mercury Milan UNITED STATES GENERAL MOTORS C Belvidere, Ill. – Dodge Caliber; Jeep Compass and Patriot (Dec. 20) C Conner Avenue (Detroit) – Dodge Viper UNITED STATES T Freightliner Custom Chassis (Gaffney, S.C.)– (plant closed Fall 2006) – T Arlington,Texas – Cadillac Escalade, Esclade ESV, Dodge Sprinter van Escalade hybrid (4th qtr. 2007); Chevrolet Tahoe, T Jefferson Avenue (Detroit) – Jeep Grand Cherokee, Commander Tahoe hybrid (4th qtr. 2007); GMC Yukon, Yukon hybrid (4th qtr. 2007) T Ladson, S.C. – Dodge Sprinter van C Bowling Green, Ky.– Cadillac XLR, Chevrolet Corvette T Newark, Del. – Chrysler Aspen, Dodge Durango C Detroit-Hamtramck, Mich. – Buick Lucerne; Cadillac DTS C Sterling Heights, Mich. – Chrysler Sebring convertible (1st qtr 07), T Doraville, Ga.