Book Review the New Frugality

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Sexual Politics of Meat by Carol J. Adams

THE SEXUAL POLITICS OF MEAT A FEMINISTVEGETARIAN CRITICAL THEORY Praise for The Sexual Politics of Meat and Carol J. Adams “A clearheaded scholar joins the ideas of two movements—vegetari- anism and feminism—and turns them into a single coherent and moral theory. Her argument is rational and persuasive. New ground—whole acres of it—is broken by Adams.” —Colman McCarthy, Washington Post Book World “Th e Sexual Politics of Meat examines the historical, gender, race, and class implications of meat culture, and makes the links between the prac tice of butchering/eating animals and the maintenance of male domi nance. Read this powerful new book and you may well become a vegetarian.” —Ms. “Adams’s work will almost surely become a ‘bible’ for feminist and pro gressive animal rights activists. Depiction of animal exploita- tion as one manifestation of a brutal patriarchal culture has been explored in two [of her] books, Th e Sexual Politics of Meat and Neither Man nor Beast: Feminism and the Defense of Animals. Adams argues that factory farming is part of a whole culture of oppression and insti- tutionalized violence. Th e treatment of animals as objects is parallel to and associated with patriarchal society’s objectifi cation of women, blacks, and other minorities in order to routinely exploit them. Adams excels in constructing unexpected juxtapositions by using the language of one kind of relationship to illuminate another. Employing poetic rather than rhetorical techniques, Adams makes powerful connec- tions that encourage readers to draw their own conclusions.” —Choice “A dynamic contribution toward creating a feminist/animal rights theory.” —Animals’ Agenda “A cohesive, passionate case linking meat-eating to the oppression of animals and women . -

Opportunities of Frugality in the Post-Corona Era

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Herstatt, Cornelius; Tiwari, Rajnish Working Paper Opportunities of frugality in the post-Corona era Working Paper, No. 110 Provided in Cooperation with: Hamburg University of Technology (TUHH), Institute for Technology and Innovation Management Suggested Citation: Herstatt, Cornelius; Tiwari, Rajnish (2020) : Opportunities of frugality in the post-Corona era, Working Paper, No. 110, Hamburg University of Technology (TUHH), Institute for Technology and Innovation Management (TIM), Hamburg This Version is available at: http://hdl.handle.net/10419/220088 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available under an Open gelten abweichend von diesen Nutzungsbedingungen -

Institutional Entrepreneurship and Permaculture: a Practice Theory Perspective

Institutional entrepreneurship and permaculture: a practice theory perspective Article (Accepted Version) Genus, Audley, Iskandarova, Marfuga and Brown, Chris Warburton (2021) Institutional entrepreneurship and permaculture: a practice theory perspective. Business Strategy and the Environment. pp. 1-14. ISSN 0964-4733 This version is available from Sussex Research Online: http://sro.sussex.ac.uk/id/eprint/95322/ This document is made available in accordance with publisher policies and may differ from the published version or from the version of record. If you wish to cite this item you are advised to consult the publisher’s version. Please see the URL above for details on accessing the published version. Copyright and reuse: Sussex Research Online is a digital repository of the research output of the University. Copyright and all moral rights to the version of the paper presented here belong to the individual author(s) and/or other copyright owners. To the extent reasonable and practicable, the material made available in SRO has been checked for eligibility before being made available. Copies of full text items generally can be reproduced, displayed or performed and given to third parties in any format or medium for personal research or study, educational, or not-for-profit purposes without prior permission or charge, provided that the authors, title and full bibliographic details are credited, a hyperlink and/or URL is given for the original metadata page and the content is not changed in any way. http://sro.sussex.ac.uk Institutional -

Oythe of Cheap

LIVING FULLY • Spirit the Mariellen Ward oydiscovers that living of simply doesn’t just make good financial cheap sense. It’s a joyous way to be. Illustration: Kagan McLeod My friend Shelly Rowen and I were stretched out on the grass on our blue yoga mats. The summer sun was beating down on the unadorned and unshaded backyard of my rented flat. We were talking about the economy and our shrinking incomes when she said, “I’m using up all of my old lipsticks, the ones that are just nubs. And I’m using up all of my bottles of hand cream and moisturizer too, before I buy more.” “I’m watching for specials at the grocery store,” I said. “And I choose local items, such as apples, rather than fancy imported items, such as Japanese pears.” And then I noticed something: Shelly was smiling. And so was I. This was the moment when I was surprised to discover that I was actually enjoying frugality. I didn’t feel down about it, and neither did Shelly. In fact, we both felt good about our fiscally and environmentally responsible ways. I realized that we had both embraced the idea that living simply can be deeply satisfying. You can be frugal and joyful. And that’s what’s different about the new frugality. In the past, thrift always felt thin-lipped and dour to me. My parents lived through the Great Depression, which, at least in books and movies about those days, seems like it was hard and grim. But a paradigm shift is underway that includes a new awareness of the impact human behaviour is having on the environment and a growing realization that all of the stuff we surround ourselves with does not make us any happier. -

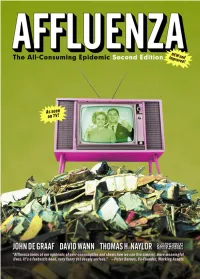

Affluenza: the All-Consuming Epidemic Second Edition

An Excerpt From Affluenza: The All-Consuming Epidemic Second Edition by John de Graaf, David Wann, & Thomas H. Naylor Published by Berrett-Koehler Publishers contents Foreword to the First Edition ix part two: causes 125 Foreword to the Second Edition xi 15. Original Sin 127 Preface xv 16. An Ounce of Prevention 133 Acknowledgments xxi 17. The Road Not Taken 139 18. An Emerging Epidemic 146 Introduction 1 19. The Age of Affluenza 153 20. Is There a (Real) Doctor in the House? 160 part one: symptoms 9 1. Shopping Fever 11 part three: treatment 2. A Rash of Bankruptcies 18 171 21. The Road to Recovery 173 3. Swollen Expectations 23 22. Bed Rest 177 4. Chronic Congestion 31 23. Aspirin and Chicken Soup 182 5. The Stress Of Excess 38 24. Fresh Air 188 6. Family Convulsions 47 25. The Right Medicine 197 7. Dilated Pupils 54 26. Back to Work 206 8. Community Chills 63 27. Vaccinations and Vitamins 214 9. An Ache for Meaning 72 28. Political Prescriptions 221 10. Social Scars 81 29. Annual Check-Ups 234 11. Resource Exhaustion 89 30. Healthy Again 242 12. Industrial Diarrhea 100 13. The Addictive Virus 109 Notes 248 14. Dissatisfaction Guaranteed 114 Bibliography and Sources 263 Index 276 About the Contributors 284 About Redefining Progress 286 vii preface As I write these words, a news story sits on my desk. It’s about a Czech supermodel named Petra Nemcova, who once graced the cover of Sports Illustrated’s swimsuit issue. Not long ago, she lived the high life that beauty bought her—jet-setting everywhere, wearing the finest clothes. -

Teacher's Guide

A 56 minute video In 2 parts for classrooms- 29/27 minutes Produced by John de Graaf and Vivia Boe A co-production of KCTS Seattle & Oregon Public Broadcasting Teacher’s Guide by Francine Strickwerda and Ti Locke AFFLUENZA will expose students to the problem of overconsumption and its effects on the society and the environment. The one-hour program takes a hard, sometimes humorous look at the American passion for shopping, and how it leads to debt and stress for families, communities, the nation and the world. It also explores the strategies used by marketers to sell products to young people. The program is appropriate for students grade 6-12, and in universities, and will be a useful resource for teachers of communications, economics, mathemat- ics, social studies, environmental studies and the arts. Each activity in this guide references a clip from the video, and discussion questions, which can be used before and after viewing the clip. Counters differ on VHS machines, so the starting and ending points for clips are approximate. Many activities also have background information and reproducible worksheets. CONTENTS Language Arts / Social Studies 3What is Affluenza? 5Worksheet- Family Interview Communications / Business / Economics 6 Activity #1 What are Advertisers really selling? 8 Activity #2 Who are advertisers selling to? 9 Activity #3 Advertising inSchools 10 Activity #4 Be an Adbuster Mathematics / Economics / Life Skills 12 #1 Credit Quandaries 15 Worksheet- Credit Cards: The Fine Print Social Studies / Environmental Studies 16 Activity #1 Popcorn Party 18 Activity #2 A Small World 20 Activity #3 A History of Wanting More 21 Worksheet - The Impact of Stuff Language Arts / Art 22 The Good Life References 23 Books 27 Organizations 31 Internet Quiz 32 What is Affluenza? 36 Do you have it? Bullfrog Films PO Box 149, Oley PA 19547 Phone: (610) 779-8226 or (800) 543-3764 Fax: (610) 370-1978 Email: [email protected] Website: www.bullfrogfilms.com © Copyright 1997. -

A Brief History of Frugality Discourses in the United States Terrence H

GCMC_A_479219.fm Page 235 Friday, July 16, 2010 8:41 PM Consumption Markets & Culture Vol. 13, No. 3, September 2010, 235–258 A brief history of frugality discourses in the United States Terrence H. Witkowski* 5 Department of Marketing, California State University, Long Beach, California, USA TaylorGCMC_A_479219.sgm10.1080/10253861003786975Consumption,1025-3866Original2010Taylor133000000SeptemberTerrenceWitkowskiwitko@csulb.edu and& Article Francis (print)/1477-223XFrancis Markets 2010 and Culture (online) Public discourses advocating frugal consumption have had a long history in the United States. This study provides a brief account of six different periods of such anti-consumerist thought and rhetoric: colonial, antebellum, Gilded Age, early 10 twentieth century, World War II, and late twentieth century. The final section uses history to better understand the religious, political, and societal tensions that have characterized American frugality discourses. Keywords: anti-consumption; frugality; thrift; US history 15 In the Fall of 2002, a small group of concerned Christians calling itself “The Evangel- ical Environmental Network” launched a media campaign built around the headline “What Would Jesus Drive?” An advertisement published on their website and in Christianity Today juxtaposed an image of Jesus at prayer with a photo of freeway 20 congestion (Figure 1). The copy attacked car pollution for the illness and death it causes – the elderly, poor, sick, and young being the most afflicted – and for its contribution to global warming. The appeal concluded as follows: Transportation is now a moral choice and an issue for Christian reflection. It’s about more than engineering – it’s about ethics. About obedience. About loving our neighbor. 25 So what would Jesus drive? We call upon America’s automobile industry to manufacture more fuel-efficient vehicles. -

The Wisdom of Frugality

© Copyright, Princeton University Press. No part of this book may be distributed, posted, or reproduced in any form by digital or mechanical means without prior written permission of the publisher. Introduction For well over two thousand years frugality and simple liv- ing have been recommended and praised by people with a reputation for wisdom. Philosophers, prophets, saints, poets, culture critics, and just about anyone else with a claim to the title of “sage” seem generally to agree about this. Frugality and simplicity are praiseworthy; extrava- gance and luxury are suspect. This view is still widely promoted today. Each year new books appear urging us to live more economically, advising us how to spend less and save more, critiquing consumerism, or extolling the pleasures and benefits of the simple life.1 Websites and blogs devoted to frugality, simple living, downsizing, downshifting, or living slow are legion.2 The magazine Simple Living can be found at thou- sands of supermarket checkout counters. All these books, magazines, e- zines, websites, and blogs are full of good ideas and sound precepts. Some mainly offer advice regarding personal finance along with ingenious and useful money- saving tips. (The advice is usually excellent; the tips vary in value. I learned from For general queries, contact [email protected] 260966ZZI_WISDOM_CS6_PC.indd 1 30/06/2016 08:57:42 © Copyright, Princeton University Press. No part of this book may be distributed, posted, or reproduced in any form by digital or mechanical means without -

Journal of Personality and Social Psychology the Malleable Morality

Journal of Personality and Social Psychology The Malleable Morality of Conspicuous Consumption Shreyans Goenka and Manoj Thomas Online First Publication, February 14, 2019. http://dx.doi.org/10.1037/pspp0000237 CITATION Goenka, S., & Thomas, M. (2019, February 14). The Malleable Morality of Conspicuous Consumption. Journal of Personality and Social Psychology. Advance online publication. http://dx.doi.org/10.1037/pspp0000237 Journal of Personality and Social Psychology: Personality Processes and Individual Differences © 2019 American Psychological Association 2019, Vol. 1, No. 999, 000 0022-3514/19/$12.00 http://dx.doi.org/10.1037/pspp0000237 The Malleable Morality of Conspicuous Consumption Shreyans Goenka and Manoj Thomas Cornell University Conspicuous consumption has often been decried as immoral by many philosophers and scholars, yet it is ubiquitous and widely embraced. This research sheds light on the apparent paradox by proposing that the perceived morality of conspicuous consumption is malleable, contingent upon how different moral lenses highlight the different characteristics embedded in the behavior. Utilizing the Moral Foundations Theory, we demonstrate that the individualizing values (i.e., equality and welfare) make people focus on the self-enhancing characteristics of conspicuous consumption, making it seem morally objectionable. However, the binding values (i.e., deference to authority, in-group loyalty, and purity) make people focus on the social identity signaling characteristic of conspicuous consumption, making it seem morally permissible. First, an archival dataset shows that the prevalence of the different moral values predicts per-capita spending on luxury goods across different countries. Then, 6 studies (N ϭ 2903) show that the trait endorsement and the momentary salience of the different moral foundations can influence the moral judgment of conspicuous consumption as well as the propensity to engage in conspicuous consumption. -

Proquest Dissertations

"A REVOLUTION WE CREATE DAILY": FREEGAN ALTERNATIVES TO CAPITALIST CONSUMPTION IN NEW YORK CITY BY Kelly Ernst Submitted to the Faculty of the College of Arts and Sciences of American University in Partial Fulfillment of the Requirements for the Degree of Doctorate of Philosophy In Anthropology Chair: Dr. David Vine Dean of the College of Arts and Sciences ~ ~ ?J-, [\)\~ Date 2010 American University Washington, D.C. 20016 AMERICAN UNIVERSITY UBAARV q :5 f; b UMI Number: 3406836 All rights reserved INFORMATION TO ALL USERS The quality of this reproduction is dependent upon the quality of the copy submitted. In the unlikely event that the author did not send a complete manuscript and there are missing pages, these will be noted. Also, if material had to be removed, a note will indicate the deletion. UMI 3406836 Copyright 201 O by ProQuest LLC. All rights reserved. This edition of the work is protected against unauthorized copying under Title 17, United States Code. Pro uesr --- --- ProQuest LLC 789 East Eisenhower Parkway P.O. Box 1346 Ann Arbor, Ml 48106-1346 ©COPYRIGHT by Kelly Ernst 2010 ALL RIGHTS RESERVED To Mom and Dad. You have sacrificed for me, celebrated with me, maybe not always agreed with me, but you have always, always supported me. "A REVOLUTION WE CREATE DAILY": FREEGAN ALTERNATIVES TO CAPIT AUST CONSUMPTION IN NEW YORK CITY BY Kelly Ernst ABSTRACT New York City freegans are a group of critical consumption activists dedicated to limiting their impact on the environment, consumption of resources, and participation in what they argue is an exploitive capitalist economy. -

The 12 Permaculture Design Principles Compiled by Jason Gerhardt 1

The 12 Permaculture Design Principles Compiled by Jason Gerhardt 1. Observe and Interact. Good design depends on a free and harmonious relationship between nature and people, in which careful observation and thoughtful interaction provide the design inspiration, repertoire and patterns. It is not something that is generated in isolation, but through continuous and reciprocal interaction with the subject. 2. Catch and Store Energy. Some of the (appropriate) sources of energy include: Sun, wind, and runoff water flows, wasted resources from agricultural, industrial and commercial activities The most important storages of future value include: Fertile soil with high humus content, perennial vegetation systems, especially trees, water bodies, passive solar buildings. 3. Obtain a Yield. This principle reminds us that we should design any system to provide for self-reliance at all levels (including ourselves), by using captured and stored energy effectively to maintain the system and capture more energy. More broadly, flexibility and creativity in finding new ways to obtain a yield will be critical in the transition from energy growth to descent. 4. Apply Self-Regulation and Accept Feedback. This principle deals with self-regulatory aspects of Permaculture design that limit or discourage inappropriate growth or behavior. With better understanding of how positive and negative feedbacks work in nature, we can design systems that are more self- regulating, thus reducing the work involved in repeated and harsh corrective management. 5. Use and Value Renewable Resources and Services. Renewable resources are those that are renewed and replaced by natural processes over reasonable periods, without the need for major non-renewable inputs. -

Spiritual Vegetarianism

Spiritual vegetarianism: Identity in everyday life of Thai non-traditional religious cult members Boonyalakha Makboon A thesis submitted to Auckland University of Technology in fulfilment of the requirements for the degree of Doctor of Philosophy (PhD) 2015 School of Communications ii Table of Contents Attestation of Authorship ……………………………………………………………………………….….. ix List of Figures ……………………………………………………………………………………………….…… x List of Interview Examples ……………………..…………………………………………………………. xv Acknowledgements .…………………………………………………………………………………………… xvi Ethics Approval ….………………………………………………………………………………………………. xvii Abstract .……………………………………………………………………………………………………………..xviii 1. Introduction: Vegetarianism, identity, and religious belief ……………………………. 1 1.1The reasons I studied vegetarians in Thailand………………………………………... 1 1.2 The reasons I wanted to study vegetarians’ identity production ………….. holistically …………………………………………………………………………………………….. 3 1.3 The reason that religion is important in my study.……………………………….… 4 1.4 The reason I conducted a video-ethnography.…………………………………….…. 5 1.5 The reason I used multimodal (inter)action analysis as my theoretical/…. methodological framework …………………………………………………………………… 6 1.6 The reason I conducted sociolinguistics interviews ……………………………… 6 1.7 Why mediated discourse theory was relevant for my study ………………… 7 1.8 Structure of the thesis ………………………………………………………………………….. 8 1.9 Conclusion ……………………………………………………………………………………………. 16 iii 2. Research design: A video ethnography, multimodal transcription, and ………. introduction