Ministry of Petroleum and Natural Gas

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Gujarat Refinery Po Jawaharnagar Vadodara

INDIAN OIL CORPORATION LTD. (REFINERIES DIVISION) GUJARAT REFINERY P.O. JAWAHARNAGAR VADODARA - 391 320 VENDOR MEET – MAKE IN INDIA Indian Oil Corporation Ltd., Gujarat Refinery is organizing a Vendor Meet on 21st September 2015 at New Administrative Building Auditorium of Gujarat Refinery, Vadodara with the theme “Make in India”. This program is a part of the roadmap for successful implementation of “Make in India” campaign in Oil and Gas industry with special emphasis on reduction of import content in procurement and also to enhance the participation of domestic vendors for Oil and Gas industry. Interested manufacturers intending to attend the above meet are requested to go through our list of imported items and furnish their credentials in the format given as per Annexure latest by 11.09.2015 by email to [email protected] and [email protected] and be prepared to reach the venue by 9.30 AM. Formal Invitation shall be sent separately to vendors by 15.09.2015. Sr. Materials Manager (I/c) Indian Oil Corporation Ltd. Gujarat Refinery Vadodara List of Items imported (indicative) procured by Gujarat Refinery: 1. Burners & Burner spares (John Zink, Callidus,Hamworthy etc.) 2. Mechanical seals & spares 3. Pumps & Spares (Sundyne, Lawrence, Bornemann,Flowserve,Weir, CPC, Leistritz, Arai etc.) 4. Compressor Spares ( Nuovo Pignone, Simplex Corporation,Plant Maintenance Corporation, Atlas Copco,Kobe Steel,HV Turbo,Compressor products International etc.) 5. Non-metallic valves & valve spares pertaining to the Sour Gas Compressor in Hydrocracker Unit (Compressor Products International) 6. Diaphragm coupling(gear box to compressor) of kobe compressor of LAB unit (Eagle) 7. -

State of Competition in the Indian Petroleum Refining Industry

PUBLIC ENTERPRISES, GOVERNMENT POLICY AND IMPACT ON COMPETITION INDIAN PETROLEUM INDUSTRY Final Report Prepared for the Competition Commission of India January 2009 Indicus Analytics New Delhi Team Members Ashok Desai Laveesh Bhandari Ramrao Mundhe Maj. General Bhupindra Yadav Special Thanks to Experts at the Competition Commission of India Payal Malik i Contents I Introduction............................................................................................................................... 1 II Refinery Technology and Products .......................................................................................... 3 III Global Oil Industry .................................................................................................................... 5 IV Indian Oil Industry .................................................................................................................... 9 V Competition in Exploration ..................................................................................................... 14 VI Competition in user Industries................................................................................................ 18 VII Competition in Refining Industry ............................................................................................ 20 VIII Competition in Gas Industry................................................................................................... 21 IX Conclusion............................................................................................................................. -

Executive Summary

Draft EIA Report Executive Summary 1. Introduction Indian Oil Corporation Limited (IOCL) operates one of its largest oil refineries at Koyali (near Vadodara) in Gujarat, Western India. The refinery was commissioned in the year 1965 with a capacity of 3.0 MMTPA. Over the years, the capacity of the refinery has gradually been increased to 13.7 MMTPA with augmentation of old primary Atmospheric Units (AU-I, AU-II and AU-III) and addition of new primary units viz. Atmospheric Unit-IV in 1978 and AU-V in 1999 as well as augmentation of AU-IV in 2000. Gujarat refinery IOCL owned a land of 434 Acres at survey no 771 to 795 at Dumad with Existing facilities of LPG marketing terminal commissioned during Nov 2002 and IOTL white oil terminal commissioned in the year 2012. LPG marketing Terminal occupies land of approximately 62 Acres in 434 Acres at Dumad Village, Vadodara Savili Road, Dumad. It is about 3 Km from Dumad Approx ~8 Kms away from Gujarat Refinery (GR) of IOCL and situated between Vadodara-Savli Road. The operating processes carried out at the Terminal are receipt of LPG bulk, its storage in 6 mounded storage vessels having max storage capacity of 8300 MT, distribution of bulk LPG by loading Tank trucks and filled LPG cylinder after their filling at carousel machines. The quantity of LPG to be handled in existing facility is 0.50 MMTPA. The existing plant is under operation with GPCB consent obtained vide: AWH 68449, valid up to 18/11/2019 & PESO license obtained vide S/HO/GJ/03/498(S2126), Valid up to 31 March 2019. -

1. REFINERIES in INDIA to Meet the Growing Demand of Petroleum

1. REFINERIES IN INDIA To meet the growing demand of petroleum products, the refining capacity in the country has gradually increased over the years by setting up of new refineries in the country as well as by expanding the refining capacity of the existing refineries. As of April, 2009 there are a total of 20 refineries in the country comprising 17 (seventeen) in the Public Sector and 3 (three) in the Private Sector. The country is not only self sufficient in refining capacity for its domestic consumption but also exports petroleum products substantially. The total refining capacity in the country as on 1.10.2009 stands at 179.956 MMTPA. The company-wise location and capacity of the refineries as on 1.10.2009 is given in Table 1: Table 1 S. No. Name of the company Location of the Refinery Capacity, MMTPA* Indian Oil Corporation Limited (IOC) 1. Guwahati, Assam 1.00 IOC 2. Barauni, Bihar 6.00 IOC 3. Koyali, Vadodara, Gujarat 13.70 IOC 4. Haldia, West Bengal 6.00 IOC Mathura, 5. 8.00 Uttar Pradesh IOC 6. Digboi, Assam 0.65 IOC 7. Panipat, Haryana 12.00 IOC 8. Bongaigaon, Assam 2.35 Hindustan Petroleum Corporation Limited (HPCL) 9. Mumbai, Maharashtra 5.50 HPCL, Visakh Visakhapatnam, Andhra 10. 7.50 Pradesh Bharat Petroleum Corporation Limited (BPCL) 11. Mumbai, Maharashtra 12.00 BPCL, Kochi 12. Kochi, Kerala 9.50 Chennai Petroleum Corporation Limited (CPCL) 13. Manali, Tamil Nadu 9.50 CPCL, Nagapattnam 14. Nagapattnam, Tamil Nadu 1.00 Numaligarh Refinery Ltd.(NRL) 15. Numaligarh, Assam, 3.00 Mangalore Refinery & Petrochemicals Ltd. -

City Disaster Management Plan 2020-21

CITY DISASTER MANAGEMENT PLAN YEAR: 2020-21 MAYOR, VADODARA MESSAGE Vadodara city is one of the fastest growing and developing cities of the nation. The citizens are disciplined, progressive, and hardworking. There are ample of resources in and around the city for human’s social and health well-being. But when disaster struck the daily work of the citizen not only hinders the progress of a city but a state and a nation. Due to climate change and global warming, India is more prone to disasters. Cyclones, heavy rainfall and floods are the ones which affect Vadodara city the most. Among other risks are of earthquake, heat waves and Industrial Chemical Disasters. Every available and possible resource is allocated for the best of disaster management by the Vadodara Municipal Corporation. The more emphasis is given on planning, prepared and training activities of the citizens, as prevention is better than cure! Help from every citizen and organization is expected in terms of disaster management activities. The emergency response teams, fire brigade, police, health department, sanitation department play an important role in fighting any mishap which strikes the city. It is the perseverance of the citizens which leads to the betterment of life in Vadodara city. I am thankful to the creators of this document which will provide clear plan and information for overcoming disasters. Dr. Jigeeshaben J. Sheth Mayor, Vadodara 1 | P a g e CDMP: VADODARA MUNICIPAL COMMISSIONER MESSAGE 2 | P a g e CDMP: VADODARA PREFACE Municipal corporations face a challenge of administrating the rapid urban growth. High rise buildings, densely populated areas, narrow roads, slums, schools, electrical systems, surrounding industrial areas, etc. -

Indian Oil Corporation Limited

INDIAN OIL CORPORATION LIMITED (REFINERIES DIVISION) GUJARAT REFINERY CAPACITY EXPANSION FROM 13.7 TO 18 MMTPA (J-18) PROJECT PRE-QUALIFICATION BOOKLET FOR INVITATION OF PRE-QUALIFICATION BIDS FOR EPCC1 PACKAGE FOR NEW AVU UNIT OF 15 MMTPA NEW ATMOSPHERIC DISTILLATION VACUUM DISTILLATION UNIT SR LPG TREATER UNIT FOR GUJARAT REFINERY CAPACITY EXPANSION FROM 13 7 MMTPA TO 18 MMTPA J-18 PROJECT AT IOCL GUJARAT REFINERY VADODARA GUJARAT, INDIA ON EPCC/LSTK BASIS WITH SINGLE POINT RESPONSIBILITY. (PQ BOOKLET NO: 077154C-000-PQ-701) Prepared and Issued By: TECHNIP INDIA LTD, TECHNIP CENTRE, 19, VELACHERY MAIN ROAD, GUINDY, CHENNAI –600032 IOCL- Gujarat Refinery PROJECT J18 Capacity Expansion Project CLIENT INDIAN OIL CORPORATION LIMITED Project No. Document no. Rev. No. Pre-Qualification Booklet- Page 1 of 65 EPCC-1 077154C001 077154C-000-PQ-701 E TABLE OF CONTENTS S.NO. DESCRIPTION PAGE NO. 1 ABRIDGED VERSION OF INVITATION FOR PRE- 2-3 QUALIFICATION BID 2 INVITATION FOR PRE-QUALIFICATION BID 4-28 3 INSTRUCTIONS FOR PQ BID SUBMISSION 29-49 4 EXHIBITS 50-62 5 CHECK LIST FOR PQ BID SUBMISSION 63-65 This document is developed by TECHNIP India Limited and the information it contains is property of Indian Oil Corporation Ltd. It shall not be used for any purpose other than that for which it is supplied. CONFIDENTIAL – Not to disclose without Authorization IOCL- Gujarat Refinery PROJECT J18 Capacity Expansion Project CLIENT INDIAN OIL CORPORATION LIMITED Project No. Document no. Rev. No. Pre-Qualification Booklet- Page 2 of 65 EPCC-1 077154C001 077154C-000-PQ-701 E CHAPTER – 1 ABRIDGED VERSION OF INVITATION FOR PRE-QUALIFICATION This document is developed by TECHNIP India Limited and the information it contains is property of Indian Oil Corporation Ltd. -

CHAPTER - I Through International Competitive Biddings in a 1

CHAPTER - I through international competitive biddings in a 1. INTRODUCTION deregulated scenario. Appraisal of 35% of the total sedimentary basins is targeted together with 1.1 The Ministry of Petroleum & Natural Gas acquisition of acreages abroad and induction of (MOP&NG) is concerned with exploration & advanced technology. The results of the initiatives production of oil & natural gas (including import taken since 1999 have begun to unfold. of Liquefied Natural Gas), refining, distribution & 1.8 ONGC-Videsh Limited (OVL) a wholly owned marketing, import, export and conservation of subsidiary of ONGC is pursing to acquire petroleum products. The work allocated to the exploration acreage and oil/gas producing Ministry is given in Appendix-I. The names of the properties abroad. OVL has already acquired Public Sector Oil Undertakings and other discovered/producing properties in Vietnam (gas organisations under the ministry are listed in field-45% share), Russia (oil & gas field – 20% Appendix-II. share) and Sudan (oil field-25% share). The 1.2 Shri Ram Naik continued to hold the charge as production from Vietnam and Sudan is around Minister of Petroleum & Natural Gas during the 7.54 Million Metric Standard Cubic meters per financial year 2003-04. Smt. Sumitra Mahajan day (MMSCMD) of gas and 2,50,000 barrels of assumed the charge of Minister of State for oil per day (BOPD) respectively. The first Petroleum & Natural Gas w.e.f 24.05.2003. consignment of crude oil from Sudan project of OVL was received in May, 2003 by MRPL 1.3 Shri B.K. Chaturvedi continued to hold the charge (Mangalore Refinery Petrochemicals Limited) in as Secretary, Ministry of Petroleum & Natural Gas. -

IBEF Presentataion

OIL and GAS For updated information, please visit www.ibef.org November 2017 Table of Content Executive Summary……………….….…….3 Advantage India…………………..….……...4 Market Overview and Trends………..……..6 Porters Five Forces Analysis.….…..……...28 Strategies Adopted……………...……….…30 Growth Drivers……………………..............33 Opportunities…….……….......…………..…40 Success Stories………….......…..…...…....43 Useful Information……….......………….….46 EXECUTIVE SUMMARY . In FY17, India had 234.5 MMTPA of refining capacity, making it the 2nd largest refiner in Asia. By the end of Second largest refiner in 2017, the oil refining capacity of India is expected to rise and reach more than 310 million tonnes. Private Asia companies own about 38.21 per cent of total refining capacity World’s fourth-largest . India’s energy demand is expected to double to 1,516 Mtoe by 2035 from 723.9 Mtoe in 2016. Moreover, the energy consumer country’s share in global primary energy consumption is projected to increase by 2-folds by 2035 Fourth-largest consumer . In 2016-17, India consumed 193.745 MMT of petroleum products. In 2017-18, up to October, the figure stood of oil and petroleum at 115.579 MMT. products . India was 3rd largest consumer of crude oil and petroleum products in the world in 2016. LNG imports into the country accounted for about one-fourth of total gas demand, which is estimated to further increase by two times, over next five years. To meet this rising demand the country plans to increase its LNG import capacity to 50 million tonnes in the coming years. Fourth-largest LNG . India increasingly relies on imported LNG; the country is the fourth largest LNG importer and accounted for importer in 2016 5.68 per cent of global imports. -

2 In-Depth Analysis of Existing Situation

Vadodara Municipal Corporation In-depth analysis of existing situation 2 IN-DEPTH ANALYSIS OF EXISTING SITUATION Vadodara, the third largest city in the state of Gujarat, is one of the focal points of industrial growth in Western India. The city became a metropolis in 1991, along with eleven other major cities across the country, by crossing the one million-population mark. 2.1 DEMOGRAPHIC PROFILE OF VADODARA The city has witnessed high growth (40%) from 1981 to 1991. However, it could not maintain the momentum of growth; the growth rate slowed down to 26% in the last decade, 1991--2001. The population registered in 2001 was 13.06 lakhs as against 10.31 lakhs 1991. The compounded annual growth rate (CAGR) has been steadily declining from 4.64% in 1971-81 to 3.45% in 1981-1991, and further to 2.39 % in 1991-2001. The population in 2005 has been estimated at Table 1. Population of Vadodara around 14.69 lakhs. The population projection Year Population Average annual for 2011 is estimated around 17.54 lakhs and is (lakhs) growth rate (%) based on the hypothesis that the city would 1981 7.34 4.64% grow at a constant rate due to the increasing 1991 10.31 3.45% urbanisation in the state. The trend also shows 2001 13.06 2.39% that the population would increase at a 2005 (Estimated) 14.69 2.99% stabilised average annual growth rate of 2.99% 2011 (Projected) 17.54 2.99% from 2005 to 2011. Source: Census 2001 The population density of the city has increased from 9527 per sq.km in 1991 to 12064 per sq.km in 2001. -

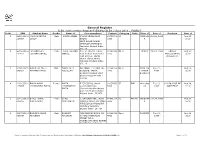

General Register B.Ed

General Register B.Ed. (with Credits)-Regular-FoEduPsy [B.Ed.] CBCS 2016 , FSBED-I Sr.No PRN Student Name Gender Name of Correcpondence Contact Category Caste Place of Date of Previous Date of 1 2014033800 PRAVAL PRATAP Male FRaAtJhVeIrR/ SGIuNaGrHd i a 179/22 YOAGddESreHsWsAR 917N56o7. 43 SC JABMiNrtAhGA Oct B2i9r,t h19 95 College Name AdAmugi s2s7io, n 137357 SINGH NAGAR 1995 R 2019 NEAR GULAB NAGAR JAMNAGAR JAMNAGAR Jamnagar Gujarat India - 361007 2 2019033800 . KYIZOM LATE Female . LATE TSERING h.no 21 Tibetan colony . 91980599 Open Shimla Jan 29, 1992 LOVELY Aug 26, 117471 TSERING DORJEE DORJEE near medical boys hostel 5750 PROFESSIONAL 2019 road Sanjauli shimla UNIVERSITY. shimla shimla Shimla Himachal Pradesh India - 171006 3 2014033800 ABDULLAH PATEL Male DAUD PATEL NATIONAL TELECOM, NR. 91756753 Open PIPALIYA Nov 21, Aug 26, 042906 MAHMAD VAHID ABDULLAH BUSDEPO, VAGRA, 7885 VAGRA 1996 2019 BHARUCH VAGRA Vagra BHARUCH Bharuch Gujarat India - 392140 4 2019033800 BARIA AVANI Female BARIA E-232/33 Rajeshwari 91932853 ST BHIL Ahmedab Feb 13, S D COLLEGE OF Aug 26, 117486 LIMSINGBHAI BARIA LIMSINGBHAI society IOC Road 8998 ad 1997 COMMERCE 2019 BARIA Chandkheda Ahmedabad Ahmedabad Ahmedabad Gujarat India - 382470 5 2011033800 BHALE JINKAL Female BHALE 5, SAI BABA SOC., NEAR 91942754 SC MAHAR VADODAR Jun 09, 1993 Aug 26, 060255 SUDHIRBHAI SUDHIRBHAI VAGHESHWARI, VIP ROAD, 0223 A 2019 KARELIBAUG VADODARA Vadodara Vadodara Gujarat India - 390018 6 2017033800 BHALODI SAVAN Male BHALODI YAMUNAKUNJ BLOCK NO. 91846024 Open DHORAJI Dec 16, -

Gayatrinagar Soc. Bus Stop.Makarpura Road 6:44 AM 2:38 PM 2 Opp

DELHI PUBLIC SCHOOL VADODARA BUS ROUTE FOR 2016-17 Mobile No. : 9016102501 ROUTE NO. 1 Bus Dropping Stop Stop Name Pickup Time No. Time 1 Gayatrinagar Soc. Bus stop.Makarpura Road 6:44 AM 2:38 PM 2 Opp. Voltemp.Makarpura Road 6:46 AM 2:37 PM 3 Makarpura Air Force Station.Makarpura Road 6:51 AM 2:35 PM 4 Opp. Rambaug Society.Makarpura Road 6:53 AM 2:32 PM 5 Ganga Sagar Aptt.Tarsali. 6:58 AM 2:28 PM 6 Moti Nagar No. 2 Tarsali Ring Rd 7:00 AM 2:26 PM 7 Parmeshwar Complex.Tarsali Ring Road. 7:02 AM 2:24 PM 8 Unaddeep Complex.Tarsali Ring Road. 7:03 AM 2:23 PM 9 Anandbaug Society.Tarsali Ring Road. 7:05 AM 2:20 PM 10 D.P.S 7:10 AM 2:15 PM Mobile No. : 9016102502 ROUTE NO. 2 Bus Dropping Stop Stop Name Pickup Time No. Time 1 Shubh Duplex, Opp Novino 6:35 AM 2:43 PM 2 Vidhyakunj Bus stop.Makarpura 6:38 AM 2:40 PM 3 Manglam Soc, Main Gate Opp Novino 6:40 AM 2:38 PM 4 Yogeshwar Sco, main gate Opp Novino 6:41 AM 2:37 PM 5 Ravipark Bus Stand Tarasali Road, 6:43 AM 2:35 PM 6 Mangla green aptt.. 6:46 AM 2:32 PM 7 Desai nagar Tarsali Road 6:51 AM 2:30 PM 8 Tarsali Vegetable market 6:53 AM 2:28 PM 9 Nr Gayatri Faraskhana Opp. Geb Tarsali 6:55 AM 2:25 PM 10 Sai temple, GIDC Road, 7:00 AM 2:20 PM 11 D.P.S 7:10 AM 2:15 PM Mobile No. -

30Th September 2018 1St October 2018

Tentative Technical Program 30th September 2018 September 30th 2018: 14:00 – 17:30 - Delegate Registration September 30th 2018: 19:00 – 21:00 - Conference & Expo Inauguration September 30th 2018: 21:00 - 22:00 - Dinner 1st October 2018 0900 - 1100 Cathodic and Anodic Protection -1 (CAP-1) Hall-A Paper No. Paper CAP11 Cathodic Protection Management of Complex Pipeline Network Keynote Hasan Sabri, Kuwait Oil Company, Kuwait Use of Decouplers with AC Voltage Mitigation CAP12 Jay Warner, Dairyland Electrical Industries, Stoughton, WI USA Unravelling the Impact of Internal pipeline debris deposition on External Cathodic Protection system – CAP13 Investigative approach to IJ failure Rituraj Mishra and Keshav Dewangan, Bharat Petroleum Corporation Ltd (R), Mumbai Above Ground Storage Tank – Case Study of a Linear anode based cathodic protection system design and CAP14 installation aspects on a new construction tank and existing tank Shailesh Javia, MATCOR Inc., USA Limitation of Cathodic Protection & Corrosion of In service Insulated Underground Cross Country line CAP15 Amit Kumar Mishra, Saurabh Vats, Jayaram Bhat M. Mangalore Refinery and Petrochemicals Limited, Mangalore Cathodic Protection System for Buried Plant Piping – Challenges CAP16 Vijay Mittal and Anoop Kumar Singh, GAIL (India) Ltd. Vijaipur, Guna 0900 - 1100 Coatings, Linings and Thermal Insulation - 1 (CLT-1) Hall-B Paper No. Paper CLT11 Superhydrophobic Coatings: A Paradigm Shift in Corrosion Protection Technologies. Keynote Dr. Bimal Prasad Singh, Chief Scientist, CSIR-Institute of Minerals & Materials Technology, Bhubaneswar Water Based Zinc-Silica-Rich Coating (WBZSRC) For Corrosion Protection Of Steel Structures CLT12 Dr. N. R. Bose, CSIR-CGCRI, Kolkata, Soumitra De, Surya Engineering Pvt. Ltd., Kolkata and Siddhartha Roychowdhury, Steel Authority of India Limited, Kolkata Al Coating Instead Of Zn Metallizing On Nuclear Power Plant Components-Advantages CLT13 N.S.