Washington Prime Group Inc. Third Quarter 2020 Earnings Presentation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Store # Phone Number Store Shopping Center/Mall Address City ST Zip District Number 318 (907) 522-1254 Gamestop Dimond Center 80

Store # Phone Number Store Shopping Center/Mall Address City ST Zip District Number 318 (907) 522-1254 GameStop Dimond Center 800 East Dimond Boulevard #3-118 Anchorage AK 99515 665 1703 (907) 272-7341 GameStop Anchorage 5th Ave. Mall 320 W. 5th Ave, Suite 172 Anchorage AK 99501 665 6139 (907) 332-0000 GameStop Tikahtnu Commons 11118 N. Muldoon Rd. ste. 165 Anchorage AK 99504 665 6803 (907) 868-1688 GameStop Elmendorf AFB 5800 Westover Dr. Elmendorf AK 99506 75 1833 (907) 474-4550 GameStop Bentley Mall 32 College Rd. Fairbanks AK 99701 665 3219 (907) 456-5700 GameStop & Movies, Too Fairbanks Center 419 Merhar Avenue Suite A Fairbanks AK 99701 665 6140 (907) 357-5775 GameStop Cottonwood Creek Place 1867 E. George Parks Hwy Wasilla AK 99654 665 5601 (205) 621-3131 GameStop Colonial Promenade Alabaster 300 Colonial Prom Pkwy, #3100 Alabaster AL 35007 701 3915 (256) 233-3167 GameStop French Farm Pavillions 229 French Farm Blvd. Unit M Athens AL 35611 705 2989 (256) 538-2397 GameStop Attalia Plaza 977 Gilbert Ferry Rd. SE Attalla AL 35954 705 4115 (334) 887-0333 GameStop Colonial University Village 1627-28a Opelika Rd Auburn AL 36830 707 3917 (205) 425-4985 GameStop Colonial Promenade Tannehill 4933 Promenade Parkway, Suite 147 Bessemer AL 35022 701 1595 (205) 661-6010 GameStop Trussville S/C 5964 Chalkville Mountain Rd Birmingham AL 35235 700 3431 (205) 836-4717 GameStop Roebuck Center 9256 Parkway East, Suite C Birmingham AL 35206 700 3534 (205) 788-4035 GameStop & Movies, Too Five Pointes West S/C 2239 Bessemer Rd., Suite 14 Birmingham AL 35208 700 3693 (205) 957-2600 GameStop The Shops at Eastwood 1632 Montclair Blvd. -

Presentation Includes Forward Looking Statements

Citi Global Property CEO Conference 1 March 2020 Safe Harbor Some of the information contained in this presentation includes forward looking statements. Such statements are subject to a number of risks and uncertainties which could cause actual results in the future to differ materially and adversely from those described in the forward looking statements. Investors should consult the Company’s filings with the Securities and Exchange Commission (SEC) for a description of the various risks and uncertainties which could cause such a difference before deciding whether to invest. This presentation also contains non GAAP financial measures and comparable net operating income (NOI). Reconciliation of this non GAAP financial measure to the most directly comparable GAAP measure can be found within the Company’s quarterly supplemental information package and in filings made with the SEC, which are available on the investor relations section of its website at www.washingtonprime.com. 2 Washington Prime Group: National Footprint with Local Flavor National Footprint with Local Flavor Satisfying Shoppers across Demographic Continuums With 104 town centers throughout the US, we are as American as apple pie. Catering from the aspirant to the affluent and Middle America to metropolis, As a matter of fact, we are also as American as deep dish pizza in Chicago, WPG assets capture the socioeconomic continuum via one of the nation’s Hawaiian poke salad, vegan spring rolls in Malibu, El Paso Tex-Mex, Maryland largest retail portfolios. crab cakes, kimchi in Orange County, Memphis barbeque and a Kansas City porterhouse. In fact, the demographic constituency of WPG is a representative microcosm of the American consumer. -

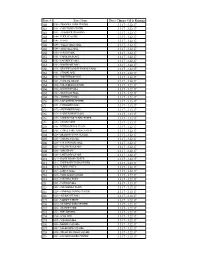

List of Creditors

Yatsen Group of Companies Inc. and Other Applicants Identified in the Initial Order (collectively, “YGC”) List of Creditors Please note the following: 1. This list of creditors has been prepared from information contained in the books and records of YGC. All balances are as at December 31, 2020. 2. The amounts included in this list of creditors do not take into consideration any un-invoiced amounts, nor have the amounts been adjusted for any amounts that may also be receivable from creditors. 3. This list of creditors has been prepared without admission as to the liability for, or quantum of, any of the amounts shown. 4. To date, a claims procedure has not been approved by the Court, and creditors are NOT required to file a statement of account or proof of claim at this point in time. If, at a later date, a claims procedure is approved by the Court, all known creditors will be notified and claim forms will be posted to the Monitor's website. It is through such a claims procedure that creditor claims will be reviewed and determined. Page 1 of 5 Yatsen Group of Companies Inc., et. al. (collectively, "YGC") List of Creditors Please note the following: 1. This list of creditors has been prepared from information contained in the books and records of YGC. All balances are as at December 31, 2020. 2. The amounts included in this list of creditors do not take into consideration any un-invoiced amounts, nor have the amounts been adjusted for any amounts that may also be receivable from creditors. -

Morgan Stanley Capital I Trust 2019-MEAD

Presale: Morgan Stanley Capital I Trust 2019-MEAD November 13, 2019 PRIMARY CREDIT ANALYST Preliminary Ratings Sahil Kundra Centennial LTV ratio Market value Debt yield + 1 (303) 721 4203 Class Preliminary rating(i) Preliminary amount ($) (%)(ii) decline (%)(iii) (%)(iv) sahil.kundra A AAA (sf) 297,065,000 42.49 73.94 15.30 @spglobal.com X-A(v) AAA (sf) 297,065,000 (vi) N/A N/A N/A SECONDARY CONTACT B AA- (sf) 69,920,000 52.49 67.81 12.38 Dennis Q Sim New York C A- (sf) 52,440,000 59.99 63.21 10.83 (1) 212-438-3574 D BBB- (sf) 64,315,000 69.19 57.57 9.39 dennis.sim @spglobal.com E NR 100,510,000 83.57 48.75 7.78 RR interest(vii) NR 30,750,000 N/A N/A N/A This presale report is based on information as of Nov. 13, 2019. The ratings shown are preliminary. Subsequent information may result in the assignment of final ratings that differ from the preliminary ratings. Accordingly, the preliminary ratings should not be construed as evidence of final ratings. This report does not constitute a recommendation to buy, hold, or sell securities. (i)The rating on each class of securities is preliminary and subject to change at any time. The issuer will issue the certificates to qualified institutional buyers in line with Rule 144A of the Securities Act of 1933. (ii)Based on S&P Global Ratings' value. (iii)Reflects the decline in the $735.9 million as-is appraised value that would be necessary to experience a principal loss at the given rating level. -

Store # Store Name Dates Clinique Gift Is Running 140 3.3.17

Store # Store Name Dates Clinique Gift Is Running 140 0140 - TRIANGLE TOWN CENTER 3.3.17 - 3.22.17 141 0141 - CARY TOWN CENTER 3.3.17 - 3.22.17 143 0143 - ALAMANCE CROSSING 3.3.17 - 3.22.17 144 0144 - FOUR SEASONS 3.3.17 - 3.22.17 145 0145 - HANES 3.3.17 - 3.22.17 146 0146 - VALLEY HILLS MALL 3.3.17 - 3.22.17 148 0148 - ASHEVILLE MALL 3.3.17 - 3.22.17 150 0150 - SOUTH PARK 3.3.17 - 3.22.17 151 0151 - CAROLINA PLACE 3.3.17 - 3.22.17 152 0152 - EASTRIDGE MALL 3.3.17 - 3.22.17 153 0153 - NORTHLAKE MALL 3.3.17 - 3.22.17 156 0156 - WESTFIELD INDEPENDENCE MALL 3.3.17 - 3.22.17 161 0161 - CITADEL MALL 3.3.17 - 3.22.17 162 0162 - NORTHWOOD MALL 3.3.17 - 3.22.17 163 0163 - COASTAL GRAND 3.3.17 - 3.22.17 164 0164 - COLUMBIANA CENTRE 3.3.17 - 3.22.17 166 0166 - HAYWOOD MALL 3.3.17 - 3.22.17 167 0167 - WESTGATE MALL 3.3.17 - 3.22.17 168 0168 - ANDERSON MALL 3.3.17 - 3.22.17 170 0170 - MACARTHUR CENTER 3.3.17 - 3.13.17 171 0171 - LYNNHAVEN MALL 3.3.17 - 3.13.17 172 0172 - GREENBRIER MALL 3.3.17 - 3.13.17 174 0174 - PATRICK HENRY MALL 3.3.17 - 3.13.17 176 0176 - SHORT PUMP TOWN CENTER 3.3.17 - 3.13.17 179 0179 - STONY POINT 3.3.17 - 3.13.17 201 0201 - INTERNATIONAL PLAZA 3.3.17 - 3.22.17 203 0203 - CITRUS PARK TOWN CENTER 3.3.17 - 3.22.17 204 0204 - BRANDON TOWN CENTER 3.3.17 - 3.22.17 205 0205 - TYRONE SQUARE 3.3.17 - 3.22.17 206 0206 - COUNTRYSIDE MALL 3.3.17 - 3.22.17 207 0207 - GULFVIEW SQUARE 3.3.17 - 3.22.17 208 0208 - WIREGRASS 3.3.17 - 3.22.17 209 0209 - LAKELAND SQUARE 3.3.17 - 3.22.17 210 0210 - EAGLE RIDGE CENTER 3.3.17 - 3.22.17 213 0213 -

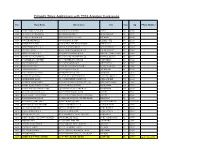

DILLARDS | Annalee Store List

Dillard's Store Addresses with 2018 Annalee Exclusives Store Store Name Address Line 2 City State Zip Phone Number 0141 CARY TOWNE CENTER 1105 WALNUT STREET CARY NC 27511 0143 ALAMANCE CROSSING 1003 BOSTON DRIVE BURLINGTON NC 27215 0146 VALLEY HILLS MALL 1930 US HIGHWAY 70 SE HICKORY NC 28602 0150 SOUTHPARK MALL 4400 SHARON ROAD CHARLOTTE NC 28211 0151 CAROLINA PLACE 11041 CAROLINA PLACE PKWY PINEVILLE NC 28134 0156 INDEPENDENCE MALL 3500 OLEANDER DRIVE WILMINGTON NC 28403 0161 CITADEL MALL 2066 SAM RITTENBERG BLVD. CHARLESTON SC 29407 0162 NORTHWOOD MALL 2150 NORTHWOODS BLVD NORTH CHARLESTON SC 29406 0163 COASTAL GRAND MALL 100 COASTAL GRAND CIRCLE MYRTLE BEACH SC 29577 0164 COLUMBIANA CENTRE 100 COLUMBIANA CIRCLE COLUMBIA SC 29212 0166 HAYWOOD MALL 700 HAYWOOD ROAD GREENVILLE SC 29607 0167 WESTGATE MALL 205 W. BLACKSTOCK ROAD SPARTANBURG SC 29301 0168 ANDERSON MALL 3101 N.MAIN SUITE D ANDERSON SC 29621 0170 MACARTHUR CENTER 200 MONTICELLO AVE NORFOLK VA 23510 0171 LYNNHAVEN MALL 701 LYNNHAVEN PARKWAY VIRGINIA BEACH VA 23452 0172 GREENBRIER MALL 1401 GREENBRIER PARKWAY CHESAPEAKE VA 23320 0174 PATRICK HENRY MALL 12300 JEFFERSON AVENUE STE 300 NEWPORT NEWS VA 23602 0176 SHORT PUMP TOWN CENTER 11824 W BROAD STREET RICHMOND VA 23233 0179 STONY POINT FASHION PARK 9208 STONY POINT PARKWAY RICHMOND VA 23235 0201 INTERNATIONAL PLAZA 2223 N WESTSHORE BLVD TAMPA FL 33607 0203 WESTFIELD CITRUS PARK 8161 CITRUS PARK TOWN CTR MALL TAMPA FL 33625 0204 WESTFIELD BRANDON 303 BRANDON TOWN CENTER MALL BRANDON FL 33511 0205 TYRONE SQUARE MALL 6990 TYRONE SQUARE ST. PETERSBURG FL 337103936 0206 WESTFIELD COUNTRYSIDE 27001 US HIGHWAY 19 N CLEARWATER FL 33761 0207 GULFVIEW SQUARE 9409 U.S. -

Dillard's Store Name: Wacoal Fi(Gh)T for the Cure ™

Wacoal Fi(gh)t for the Cure ™ Help Knockout Breast Cancer at a Fit for the Cure ® Event. Event Dillard's Store Name: City: State: Event Date: Hours: Parkway Place Huntsville AL 10/11/12 10-8 Eastern Shore Center Spanish Fort AL 10/5/12 10-8 Bel Air Mall Mobile AL 10/6/12 10-8 Wiregrass Commons Dothan AL 10/5/12 10-8 Quintard Mall Oxford AL 10/2/12 10-8 Village Mall Auburn AL 10/5/12 10-8 The Shoppes at Eastchase Montgomery AL 10/4/12 10-8 Regency Square Mall Florence AL 10/5/12 10-8 Park Plaza Little Rock AR 10/5/12 10-8 Hot Springs Mall Hot Springs AR 10/5/12 10-8 Northwest Arkansas Fayetteville AR 9/20/12 10-8 Pines Mall Pine Bluff AR 10/5/12 10-8 The Mall @ Turtle Creek Jonesboro AR 10/5/12 10-8 McCain Mall N. Little Rock AR 10/5/12 10-8 Pinnacle Hills Promenade Rogers AR 9/19/12 10-8 Central Mall Ft. Smith AR 9/21/12 10-8 Scottsdale Scottsdale AZ 10/26/12 10-8 Paradise Valley Phoenix AZ 10/25/12 10-8 Park Place Tucson AZ 10/18/12 10-8 Westridge/Desert Sky Mall Phoenix AZ 10/5/12 10-8 Arrowhead Towne Center Glendale AZ 10/19/12 10-8 Chandler Fashion Mall Chandler AZ 10/20/12 10-8 Superstition Mall Mesa AZ 10/5/12 10-8 San Tan Village Gilbert AZ 10/5/12 10-8 Prescott Gateway Prescott AZ 10/5/12 10-8 The Shops at Lake Havas Lake Havasu AZ 10/5/12 10-8 Tucson Mall Tucson AZ 10/17/12 10-8 Flagstaff Flagstaff AZ 10/5/12 10-8 Promenade At Casa Grande Casa Grande AZ 10/5/12 10-8 Yuma Palms Yuma AZ 10/4/12 10-8 Sierra Vista Towne Ctr. -

Thornton, Colorado

THORNTON, COLORADO PROPERTY OVERVIEW DENVER PREMIUM OUTLETS® THORNTON, CO MAJOR METROPOLITAN AREAS TOURISM / TRAFFIC Denver: 15 miles Located in Thornton, Colorado in the northern part of the Denver metro DENVER Boulder: 15 miles PREMIUM OUTLETS Loveland/Ft. Collins: 27 miles area, Denver Premium Outlets is scheduled to open in 2017 and will THORNTON, CO Greeley: 30 miles serve the metropolitan Denver market. Positioned along I-25, the north-south interstate running between Denver 36 RETAIL and Ft. Collins, the center will be located at the intersection of I-25 and 76 470 Baseline Road, which carries 112,000 cars daily. The center has excellent GLA (sq. ft.) 320,000; 80 stores visibility along I-25. LAKEWOOD 270 58 70 OPENING DATES 40 DENVER Denver, Colorado is a market of 2.8 million people and is the 21st 6 225 largest metro area in the United States. This center will be the only 70 Opening October 2017 25 outlet center serving the north side of Denver. The Denver market also receives 12.7 million overnight visitors per year generating $3 billion in 470 N RADIUS POPULATION total spending. 15 miles: 1,101,265 Positioned north of Denver, east of the Boulder market with 313,000 30 miles: 2,915,582 people just 15 miles away, southwest of the Greeley market with 45 miles: 3,619,189 267,000 people 30 miles away, and south of the Loveland/Ft. Collins market with 316,000 people 27 miles away, Denver Premium Outlets AVERAGE HH INCOME will benefit from these populous areas as well. -

Thornton, Colorado

THORNTON, COLORADO PROPERTY OVERVIEW DENVER PREMIUM OUTLETS® THORNTON, CO MAJOR METROPOLITAN AREAS SELECT TENANTS Denver: 15 miles American Eagle Outfitters, Armani Exchange, Cole Haan Outlet, DENVER Boulder: 15 miles Columbia Factory Store, Gap Outlet, kate spade new york, Polo Ralph PREMIUM OUTLETS Loveland/Ft. Collins: 27 miles Lauren Factory Store, Tumi, Under Armour THORNTON, CO Greeley: 30 miles TOURISM / TRAFFIC RETAIL Located in Thornton, Colorado in the northern part of the Denver metro GLA (sq. ft.) 328,000; 80 stores area, Denver Premium Outlets will be opening in September of 2018 and will serve the metropolitan Denver market. OPENING DATE Positioned along I-25, the north-south interstate running between Denver and Ft. Collins, the center will be located at the intersection of I-25 and Opened September 2018 Baseline Road, which carries 112,000 cars daily. The center has excellent visibility along I-25. RADIUS POPULATION Denver, Colorado is a market of 2.8 million people and is the 21st largest 15 miles: 1,249,917 metro area in the United States. This center will be the only outlet center 30 miles: 3,069,527 serving the north side of Denver. The Denver market also receives 12.7 45 miles: 3,776,518 million overnight visitors per year generating $3 billion in total spending. Positioned north of Denver, east of the Boulder market with 313,000 AVERAGE HH INCOME people just 15 miles away, southwest of the Greeley market with 267,000 people 30 miles away, and south of the Loveland/Ft. Collins market with 30 miles: $92,805 316,000 people 27 miles away, Denver Premium Outlets will benefit from these populous areas as well. -

THE CHAMBER Aurora Bennett Centennial Stapleton Denver JULY/AUG 2019 NEWSLETTER

Serving the east-metro area including: THE CHAMBER Aurora Bennett Centennial Stapleton Denver JULY/AUG 2019 NEWSLETTER ‘Cowboy up’ and kick up some trail dust at South Metro Chamber Team Wins LA Golf Tournament Chamber Business After Hours July 25, 2019 In a sweep, the South Metro Chamber of Commerce Team won the 21st Annual Leadership Aurora Golf Tournament – with a score 20 below par. Left to right are South Metro Chamber President Robert Golden, Jack Parsons, Steve Morgan, and Terry Walsh. Aurora Chamber President Kevin Hougen and Golden made a bet about the tournament, which Hougen lost. However, Golden generously donated the $100 ‘prize’ back to the Leadership Aurora Scholarship fund. Arapahoe County Fair Chamber helping Chamber. Kick-off Dinner! Get ready for a boot stompin’ 2019 Annual Armed Forces Recognition Luncheon night of networking, food, The 43rd AFRL took place on May 10th at the the Guard and Reserve, and our commonwealth and drinks. Doubletree Hotel Denver. More than 500 people partners from Canada and Australia. This year’s Grab your ropes and reign in attended this year’s luncheon, as the Aurora keynote speaker was Chief Master Sergeant new business contacts! Chamber’s Defense Council honored the men and Patrick McMahon, senior enlisted leader, United women who serve in the Eastern Metro Area. States Strategic Command, Offutt Air Force Base, Special recognition was given to junior enlisted Nebraska. n Arapahoe County members from all branches of service to include Fairgrounds Events Center 25690 E. Quincy Ave. Aurora, -

Education, Commerce and Industry – Aurora, Colorado (Updated June 2019)

Education, Commerce and Industry – Aurora, Colorado (Updated June 2019) Aurora’s economy is thriving, partly because the city continues to lure some of the top businesses in the nation in such industries as aerospace and defense, bioscience and health care, transportation and logistics, and renewable energy. Aurora’s business friendly, customer service-driven attitude is the heart of the Aurora Advantage 4 Business. Educational opportunities abound in Aurora, providing an ample training ground for the city’s future workforce. Education Higher Education • University of Colorado Anschutz Medical Campus o University of Colorado Hospital ranked No. 1 hospital in Colorado, and nationally ranked in 11 specialties and high performing in one adult specialty and six procedures/conditions in 2018-19 by U.S. News & World Report o University of Colorado Anschutz Medical Campus ranked No. 12 for primary care and No. 30 for research in 2018-19 by U.S. News & World Report o Children’s Hospital Colorado ranked nationally in 10 pediatric specialties in 2018-19 by U.S. News & World Report • Community College of Aurora, including the nationally recognize Colorado Film School • Pickens Technical College • Colorado Technical University – Aurora Campus • American Sentinel University • Anthem College • Concorde Career College • Everest College • Pima Medical Institute • Platt College School Districts • Cherry Creek Schools (one of the top performing districts in Colorado) • Aurora Public Schools (one of the state’s most diverse districts with children from more than 90 nations) • Bennett Public Schools (undeveloped land in Aurora that extends east of Monaghan Road, north of County Line Road and south of 72nd Avenue falls within this district.) • Brighton Public Schools (serving Aurora residents who live in the new Highpoint at DIA neighborhood) • Douglas County School District (serving residents of Aurora’s Inspiration neighborhood along Gartrell Road, just north of Inspiration Road) Workforce: 190,859 people working in Aurora • Percent Working in.. -

Thornton, Colorado

THORNTON, COLORADO PROPERTY OVERVIEW DENVER PREMIUM OUTLETS® THORNTON, CO MAJOR METROPOLITAN AREAS TOURISM / TRAFFIC Denver: 15 miles Located in Thornton, Colorado in the northern part of the Denver metro DENVER Boulder: 15 miles area, Denver Premium Outlets will be opening in September of 2018 and PREMIUM OUTLETS Loveland/Ft. Collins: 27 miles will serve the metropolitan Denver market. THORNTON, CO Greeley: 30 miles Positioned along I-25, the north-south interstate running between Denver and Ft. Collins, the center will be located at the intersection of I-25 and RETAIL Baseline Road, which carries 112,000 cars daily. The center has excellent visibility along I-25. GLA (sq. ft.) 328,000; 80 stores Denver, Colorado is a market of 2.8 million people and is the 21st largest metro area in the United States. This center will be the only outlet center OPENING DATES serving the north side of Denver. The Denver market also receives 12.7 million overnight visitors per year generating $3 billion in total spending. Opening September 2018 Positioned north of Denver, east of the Boulder market with 313,000 people just 15 miles away, southwest of the Greeley market with 267,000 RADIUS POPULATION people 30 miles away, and south of the Loveland/Ft. Collins market with 316,000 people 27 miles away, Denver Premium Outlets will benet from 15 miles: 1,250,993 these populous areas as well. 30 miles: 3,045,204 45 miles: 3,736,139 AVERAGE HH INCOME LOCATION / DIRECTIONS 30 miles: $93,118 Northeast quadrant o I-25 and 136th Avenue in Thornton, CO Information as of 5/1/18.