Managing Hedge Fund Risk

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Bain Capital Distressed and Special Situations 2019 (A), LP

COMMONWEALTH OF PENNSYLVANIA PUBLIC SCHOOL EMPLOYEES’ RETIREMENT SYSTEM Public Investment Memorandum Bain Capital Distressed and Special Situations 2019 (A), L.P. High Yield/Private Credit Commitment James F. Del Gaudio Senior Portfolio Manager April 22, 2019 COMMONWEALTH OF PENNSYLVANIA PUBLIC SCHOOL EMPLOYEES’ RETIREMENT SYSTEM Recommendation: PSERS Investment Professionals, together with Hamilton Lane Advisors, L.L.C. (“Hamilton Lane”), recommend the Board commit up to $200 million to Bain Capital Distressed and Special Situations 2019 (A), L.P. (the “Fund”, or “DSS 19”). Bain Capital Credit, LP (“Bain” or the “Firm”) is seeking to raise their third dedicated distressed and special situations fund, DSS 19, which will focus on global special situations opportunities and distressed securities, targeting $3 billion in commitments. Firm Overview: Bain Capital Credit, LP, an affiliate of Bain Capital, LP, is a leading global credit specialist. The Firm was formed as Sankaty Advisors in 1998 by Jonathan Lavine, Managing Partner and CIO, based on the idea that one could successfully apply the same level of rigorous analysis developed in Bain Capital’s Private Equity business to credit investing. With approximately $39 billion in assets under management as of January 1, 2019, Bain Capital Credit invests across the full spectrum of credit strategies, including leveraged loans, high-yield bonds, distressed debt, direct lending, structured products, non-performing loans (“NPLs”), and equities. Bain Capital Credit currently has 297 employees in -

Preventing Nuclear Catastrophe: Making the Case for Investors and the Private Sector to Work Towards Reducing the Risks of Nuclear Weapons

Preventing Nuclear Catastrophe: Making the Case for Investors and the Private Sector to Work Towards Reducing the Risks of Nuclear Weapons David Epstein, CFA The Cross Capital Initiative | July 2020 Acknowledgements We would like to acknowledge the folks who we interviewed for our ongoing work, along with others who were helpful. (Please note that inclusion of a name should not be taken as an indication that the person has read or endorses the report.) This report was made possible by funding from and in collaboration with N Square. Erika Gregory – Director, N Square Chris Gadomski – Lead Analyst, Nuclear, Morgan Matthews – Deputy Director, N Square Bloomberg New Energy Finance Gretchen Hund – Former Director, PNNL Elizabeth Talerman – CEO, Nucleus Christopher Bidwell – Senior Fellow, Federation Shazeeda Bhola – Strategist/Designer, Nucleus of American Scientists Clare Albers – Nucleus Lauren Borja – Stanton Nuclear Security Franz Busse – Sr. VP of Tech. Systems, Banjo Postdoctoral Fellow, Stanford Tom Freke – Senior Editor, Bloomberg News Michelle Dover – Director of Programs, Elaine Hagan – Assoc. Dean @ UCLA Anderson Ploughshares Fund and Exec. Dir. of Price Center Rob Du Boff, CFA – ESG Analyst, Bloomberg Will Freas – Prog. Coord., Venture Accelerator Intelligence @ UCLA Anderson Nickolas Roth – Senior Fellow & Director, Ben Solomon – Founder/Managing Partner, Stimson Center’s Nuclear Security Program Fedtech Brian Finlay – President/CEO, Stimson Center Jack Fernandes – CEO/Founder, Regenica Unmesh Sheth – Founder, SoPact Biosciences -

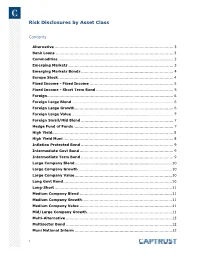

Risk Disclosures by Asset Class

Risk Disclosures by Asset Class Contents Alternative ............................................................................................... 3 Bank Loans .............................................................................................. 3 Commodities ............................................................................................ 3 Emerging Markets .................................................................................... 3 Emerging Markets Bonds .......................................................................... 4 Europe Stock ............................................................................................ 4 Fixed Income - Fixed Income ................................................................... 5 Fixed Income - Short Term Bond .............................................................. 5 Foreign..................................................................................................... 6 Foreign Large Blend ................................................................................. 6 Foreign Large Growth ............................................................................... 6 Foreign Large Value ................................................................................. 7 Foreign Small/Mid Blend .......................................................................... 7 Hedge Fund of Funds ................................................................................ 7 High Yield................................................................................................ -

Investing in Distressed Securities

NEW YORK UNIVERSITY - LEONARD N. STERN SCHOOL OF BUSINESS FINC-GB.3176.31 Topics in Investments: Investing in Distressed Securities Spring 2016 Wednesdays 6:00 – 9:00 pm (February 10 – March 23; no class March 16 (spring break)) KMEC 2-80 (44 West 4th Street) Allan Brown Brad Eric Scheler E-mail: [email protected] Fried, Frank, Harris, Shriver & Jacobson Office hours by appointment Objective: To prepare students to understand, evaluate, and invest in distressed corporate situations and securities. Students will be exposed to the distressed process from a number of different viewpoints (management, trade vendors, senior lenders, subordinated lenders, legal and financial advisors, DIP lenders, bankruptcy courts, vulture investors, distressed debt traders/brokers) to better understand the roles, agendas, and objectives of each of the participants and how they affect investment results. Course Prerequisites Basic accounting and financial statement analysis Basic knowledge of fixed-income and equity securities and related mathematics Basic corporate finance (discount cash flow analysis) Basic common sense Extraordinary enthusiasm and effort Optional textbooks and reference materials Corporate Financial Distress and Bankruptcy, 3rd Edition Edward I. Altman and Edith Hotchkiss (Wiley, 2005) Distress Investing: Principles and Technique Martin J. Whitman and Fernando Diz (Wiley, 2009) Distressed Securities Edward I. Altman (Beard Books, 1999) Distressed Debt Analysis; Strategies for Speculative Investors, Stephen G. Moyer (J. Ross Publishing, 2004) The Vulture Investors (revised edition) Hilary Rosenberg (Wiley, 2000) Bankruptcy Investing – How to Profit from Distressed Companies Ben Branch and Hugh Ray (Beard Books, 2007) Creating Value Through Corporate Restructuring: Case Studies in Bankruptcies, Buyouts, and Breakups Stuart C. -

Hedge Fund Investing in Distressed Securities

Hedge fund investing in distressed securities Capturing the unique value created by corporate and economic turnarounds April 2008 Research, Analysis and Strategy Group • Current stressed/distressed market environment offers ample trading opportunities for hedge funds Thomas Della Casa Mark Rechsteiner • The implicit value of distressed securities is often significantly higher than the prevailing market price Ayako Lehmann • Investing early is better than late The team can be contacted at: [email protected] A member of Man Group Table of contents Executive summary...............................................................................................................3 Growth of the credit market ..................................................................................................4 The credit cycle ....................................................................................................................5 Recent developments (Summer 2007 until March 2008) .......................................................7 Introduction to the credit/distressed universe ........................................................................8 Distressed securities ....................................................................................................................................... 9 Distressed hedge fund investing............................................................................................9 Distressed universe ...................................................................................................................................... -

Quarterly Investment Report Q1 2018

Ah Quarterly Investment Report Q1 2018 Prepared for London Borough of Enfield Pension Fund Prepared by Aon Hewitt Date 21 June 2018 Copyright © 2018 Aon Hewitt Limited. All rights reserved. aon.com Aon Hewitt Limited is authorised and regulated by the Financial Conduct Authority. Registered in England & Wales No. 4396810 Registered office: The Aon Centre | The Leadenhall Building | 122 Leadenhall Street | London | EC3V 4AN This report and any enclosures or attachments are prepared on the understanding that it is solely for the benefit of the addressee(s). Unless we provide express prior written consent no part of this report should be reproduced, distributed or communicated to anyone else and, in providing this report, we do not accept or assume any responsibility for any other purpose or to anyone other than the addressee(s) of this report. Table of Contents Table of Contents 0 Executive Summary – Q1 2018 1 Summary of Key Developments 3 Funding level update 4 Quarterly Investment Outlook Summary 5 Portfolio overview 6 Analysis of Alternatives Portfolio 9 BlackRock – Passive Global Equity 12 Trilogy – Global Unconstrained 13 MFS – Global Unconstrained Equity 14 London CIV – Baillie Gifford Global Alpha Growth Fund 15 Adams Street – Private Equity 16 Lansdowne – Developed Markets Hedge Fund 17 York – Distressed Securities Hedge Fund 18 Davidson Kempner – Event Driven Hedge Fund 19 Gruss – Event Driven Hedge Fund 20 CFM – Stratus Hedge Fund 21 BlackRock – UK Property 22 LGIM – UK Property 23 Brockton – Opportunistic Property 24 International Public Partnership Ltd – Listed PFI 26 Antin – Infrastructure Fund III 27 BlackRock – Passive Index-Linked Gilts 28 Western – Active Investment Grade Credit 29 M&G – Inflation Opportunities 30 Insight – Absolute Return Bond Funds 32 Appendix A – Market Background: Q1 2018 33 Appendix B – Quarterly Investment Outlook 40 Appendix C – Explanation of Manager Ratings 44 Appendix D – Adams Street Ratings Breakdown 46 Disclaimer 47 Executive Summary – Q1 2018 Since Inception p.a. -

The Role of Activist Hedge Funds in Distressed Firms

The Role of Activist Hedge Funds in Distressed Firms Jongha Lim1, 2 Fisher College of Business The Ohio State University This Version: November 19th, 2010 Abstract Frictions to efficient bargaining provide an opportunity for a hedge fund to invest in distressed firms, facilitate reorganizations, and capture some of the rents from doing so. This paper considers a sample of 184 financially distressed firms for the period from 1998 to 2009, and finds that distressed investing has become an important avenue for activism by hedge funds. Distress-focused hedge funds utilize a „fulcrum‟ investment strategy so as to maximize their influence on the reorganization process. Empirical evidence is consistent with the view that hedge funds capture some of the rents they create by reorganizing the distressed firms. First, distress-oriented hedge funds tend to target economically healthy firms in which contracting difficulties are likely to prevent efficient reorganization. Second, hedge funds‟ presence as creditors leads to effective restructuring through both debt-equity swaps and pre-packaged filings. In addition, when hedge funds inject new equity capital into targeted firms, the duration of distress is significantly reduced. Both debt and equity investments by hedge funds are associated with significantly higher probabilities of successful restructuring. Lastly, distress-focused funds in my sample have produced an annual compounded return of 8.6% over the 1998-2009 period, which is economically significant, compared to 3.2% generated by the stock market over the same period. 1 Contacts: Jongha Lim, Doctoral student, Fisher College of Business, The Ohio State University, 2100 Neil Ave, Columbus, Ohio, 43210; E-mail: [email protected]. -

CPZ Prospectus

PROSPECTUS 18,250,000 Shares Calamos Long/Short Equity & Dynamic Income Trust Common Shares of Beneficial Interest $20.00 per Share Investment Objective. Calamos Long/Short Equity & Dynamic Income Trust (the “Fund”) is a newly organized, diversified, closed-end management investment company. The Fund’s investment objective is to seek current income and risk-managed capital appreciation. There can be no assurance that the Fund will achieve its investment objective. Investment Policies. The Fund will invest, under normal circumstances, at least 80% of its managed assets in a globally diversified portfolio comprised of equity securities which are defined to include common stock, preferred stock, convertible securities and exchange-traded funds (“ETFs”) (the “Equity Sleeve”), as well as long and short equity positions managed pursuant to a long/short equity strategy (the “Long/Short Component”). The Long/Short Component will comprise at least 50% of the Fund’s managed assets with a focus on absolute returns in a risk-managed format. The Fund may invest up to 20% of its managed assets opportunistically in globally diversified income-producing securities, including high-yield and investment grade corporate securities, leveraged loans, distressed debt securities, securitized products, U.S. Treasuries and sovereign debt issued by foreign governments (“Fixed Income Sleeve”). Under current market conditions, it is anticipated that the Fund will invest initially 80% of its managed assets in equities, of which 60% will be invested in the Long/Short Component, and 20% of its managed assets in the Fixed Income Sleeve. (continued on following page) Investing in our securities involves certain risks, including the Fund’s anticipated use of leverage. -

Corporate Turn Around Strategies by Financially Distressed Companies Quoted at the Nairobi Securities Exchange

Research Journal of Finance and Accounting www.iiste.org ISSN 2222-1697 (Paper) ISSN 2222-2847 (Online) Vol.5, No.2, 2014 Corporate Turn Around Strategies By Financially Distressed Companies Quoted At The Nairobi Securities Exchange John Mbogo School of Business and Economics, Department of Accounting and Finance Meru University, Kenya. P.O Box 9656-00300 Nairobi Gabriel Waweru School of Business and Economics, Department of Accounting and Finance Meru University, Kenya P.O Box 9656-00300 Nairobi . ABSTRACT Firms that are experiencing financial distress take one action or another in order to turn around their performance. This study sought to find out what turnaround strategies are taken by companies that faced by financial distress. The financially distressed companies generally take actions that are aimed at reducing costs e.g. laying off employees, asset sales and dividend cuts or take actions that are aimed at increasing revenue generation e.g. asset acquisitions in order to improve efficiency. In severe cases of financial distress a company may opt or be forced into liquidation through bankruptcy proceedings. The Kenyan economy under the period of review had mixed results of growing and declining presumably as a result of among others, the global economic crises, the post election violence, loss of investor confidence at the NSE and increased inflation, thus the need to establish the restructuring strategies that the financially distressed companies took in order to turnaround their performance. This study carried out a survey of the companies that were listed for the entire period of the study (2002-2008). Performance of the companies was established by conducting the Z score analysis on each of the companies. -

Distressed Mergers and Acquisitions

Wachtell, Lipton, Rosen & Katz DISTRESSED MERGERS AND ACQUISITIONS 2013 Summary of Contents Introduction ..............................................................................................................1 I. Out-of-Court Workouts of Troubled Companies ...............................................3 A. Initial Responses to Distress ........................................................................4 B. Out-of-Court Transactions ...........................................................................9 II. Prepackaged and Pre-Negotiated Bankruptcy Plans ........................................40 A. Prepackaged Plans .....................................................................................41 B. Pre-Negotiated Plans ..................................................................................46 C. Pre-Negotiated Section 363 Sales ..............................................................48 III. Acquisitions Through Bankruptcy ...................................................................48 A. Acquisitions Through a Section 363 Auction ............................................48 B. Acquisitions Through the Conventional Plan Process .............................101 IV. Acquisition and Trading in Claims of Distressed Companies .......................150 A. What Claims Should an Investor Seeking Control Buy? .........................150 B. What Rights Does the Claim Purchaser Obtain? .....................................154 C. Acquisition of Claims Confers Standing to Be Heard in a Chapter 11 Case -

RISK DISCLOSURE: Bonds and Other Debt Securities a Debt Security Is A

RISK DISCLOSURE: bonds and other debt securities 1. A debt security is a financial instrument that represents a claim against the issuer of the instrument. There are various types of fixed debt instruments depending on the issuer that has issued the instrument, the security provided for the loan by the issuer, the term until the maturity date, and the type of payment of interest. 2. A money‐market instrument is a borrowing of cash for a period, generally no longer than six months, but occasionally up to one year, in which the lender takes a deposit from the money markets in order to lend (or advance) it to the borrower. 3. A bond is a debt security through which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or fixed interest rate. Owners of bonds are debt holders, or creditors, of the issuer. 4. A discount paper is a debt financial instrument that instead of paying interest, is sold at discount. Upon sale, the price of the instrument is calculated by discounting the instrument amount, including calculated interest, to current value. The current value or the price is lower than the amount received upon maturity. Certificates of deposit and treasury bills are examples of discount paper. 5. A state premium bond is another form of fixed‐income financial instrument, in which interest on the bonds is distributed by lottery among the holders of premium bonds. 6. Similar to bonds, a debenture is an agreement between the debenture holder and issuing company, showing the amount owed by the company towards the debenture holders. -

The BOOK of JARGON ® Hedge Funds

The BOOK of JARGON ® Hedge Funds The Latham & Watkins Glossary of Hedge Fund Slang and Terminology First Edition Latham & Watkins operates worldwide as a limited liability partnership organized under the laws of the State of Delaware (USA) with affiliated limited liability partnerships conducting the practice in the United Kingdom, France, Italy and Singapore and as affiliated partnerships conducting the practice in Hong Kong and Japan. Latham & Watkins practices in Saudi Arabia in association with the Law Office of Salman M. Al-Sudairi. In Qatar, Latham & Watkins LLP is licensed by the Qatar Financial Centre Authority. Under New York’s Code of Professional Responsibility, portions of this communication contain attorney advertising. Prior results do not guarantee a similar outcome. Results depend upon a variety of factors unique to each representation. Please direct all inquiries regarding our conduct under New York’s Disciplinary Rules to Latham & Watkins LLP, 885 Third Avenue, New York, NY 10022-4834, Phone: +1.212.906.1200. © Copyright 2013 Latham & Watkins. All Rights Reserved. 2 The purpose of this publication is to assist the newest members of the hedge funds community in learning to talk the talk of hedge funds. It is intended to be a “Berlitz Course” for recent law school and business school graduates seeking initiation into the industry, and a desktop reference for not-so-recent graduates. In this book, you will find the key to the secret verbal handshakes that make up the code of the hedge fund community. The Book of Jargon®: Hedge Funds is one of a series of practice area-specific glossaries published by Latham & Watkins.