THE OPEL-COMEBACK Strategy Update

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

OPEL ADAM PRICES and OPTIONS 2017.5 Models

OPEL ADAM PRICES AND OPTIONS 2017.5 models. Prices effective 6.2.17 ADAM RANGE HIGHLIGHTS ADAM ADAM ROCKS ADAM S Highlights: Highlights: Highlights: • Opel OnStar • Opel OnStar • Opel OnStar • Electronic climate control • Power folding canvas roof • 1.4i Turbo (150PS) engine • Cruise control • Protective body styling • Sports body styling • City mode steering assistance • Electronic climate control • 18-inch diamond cut alloy wheels • Speed-sensitive power-assisted steering • Cruise control • Uprated brakes and sports suspension • Multi-function trip computer • City mode steering • Electronic climate control • Electrically operated front windows • Multi-function trip computer • Cruise control • Electrically operated front windows • Multi-function trip computer Infotainment: • Electrically operated front windows • Radio CD 3.0 BT Infotainment: • CD and FM/AM Radio As ADAM. Infotainment: ® • Bluetooth phone and music streaming Opel OnStar personal assistant: As ADAM, plus: • USB and Aux-in connection for As ADAM. • Two additional speakers smartphone/MP3 music connectivity Opel OnStar personal assistant: Interior/styling features: • Steering wheel controls for phone, music As ADAM. and cruise control As ADAM, plus: • Four speakers • Ocio Black Cloth/Morrocana seats Interior/styling features: As ADAM, plus: Opel OnStar personal assistant: Exterior/styling features: • Red your Engine Black Cloth/Morrocana • Emergency and crash response As ADAM, plus: seats • Wi-Fi hotspot • LED daytime running lights/LED tail lights • Silver ADAM S facia and -

Registration Document

20 REGISTRATION DOCUMENT Including the annual financial report 17 GROUPE PSA - 2017 REGISTRATION DOCUMENT -1 ANALYSIS OF THE BUSINESS AND GROUP OPERATING RESULTS IN 2017 AND OUTLOOK Capital Expenditure in Research & Development 4.4.2. Banque PSA Finance, signature of a framework agreement with the BNP Paribas Group to form a car financing Partnership for Opel Vauxhall vehicles On 6 March 2017, when the Master Agreement was concluded with BNP Paribas Personal Finance, will from an accounting point of view General Motors, the Company simultaneously signed a Framework retain the current European platform and staff of GM Financial. The Agreement with BNP Paribas and BNP Paribas Personal Finance, to Opel Vauxhall finance companies will distribute financial and organise the joint purchase of Opel Vauxhall’s finance companies insurance products over a territory initially including the following and the setting up of a car financing partnership for Opel Vauxhall countries: Germany, United Kingdom, France, Italy, Sweden, Austria, vehicles. Ireland, Netherlands, Belgium, Greece and Switzerland. The The acquisition of Opel Vauxhall’s finance companies will be cooperation may potentially be extended thereafter to other completed through a holding company. This joint venture, owned in countries where Opel Vauxhall has a presence. equal shares and on the same terms by Banque PSA Finance and 4.5. CAPITAL EXPENDITURE IN RESEARCH & DEVELOPMENT Automotive Expertise to deliver useful technologies Innovation, research and development are powerful levers for Every year, Groupe PSA invests in research and development to developing competitive advantages by addressing the major stay ahead, technologically, of environmental and market changes. challenges faced in the automotive industry (environmental, safety, emerging mobility and networking needs, etc.). -

The European Markets and Strategies to Watch for Maximum Opportunity

THE EUROPEAN MARKETS AND STRATEGIES TO WATCH FOR MAXIMUM OPPORTUNITY BRIAN MADSEN ONLINE AUCTIONS IT SOLUTIONS SMART DATA 1 THE SPEED OF CHANGE IS FASTER THAN EVER 2 THE NEW NORMAL 3 CHANGE OF INCREASE IN INCREASES YOUNG DEMAND AND SUPPLY OWMERSHIP PRIVATE LEASINGCHALLENGESUSED CAR INVENTORY 4 WE FIGHT WITH CHANGES AND AGAINST OTHER NEEDS 5 PRODUCT MIX ONLINE OEM SALES NEW PLAYERS 6 CHANGE OF INCREASE IN INCREASES YOUNG DEMAND AND SUPPLY OWMERSHIPHOW TO CREATEPRIVATE OPPORTUNITIES LEASING USED CAROUT INVENTORY OF CHALLENGES 7 USED CAR USE DIGITAL SOLUTIONS TO MOBILE ADAPT COMMUNICATION LEASING MATCH CARS WITH BUYERS SOLUTIONS TO CUSTOMER NEEDS 8 WE ALL NEED TO BE BETTER ONLINE 9 216 MILLION 16 MILLION 45 MILLION 6 MILLION PASSENGERS CARS NEW CARS SOLD USED CARS SOLD CARS FOR SALE ON THE ROAD PER YEAR PER YEAR ONLINE EVERY DAY 10 43% 47% 33% 4% PUBLISHED ONLINE WITHOUT PRICE CHANGE 2 MIO CARS ARE WITHOUT PHOTO FOR MORE FOR MORE MISSING INFORMATION FOR MORE THAN 90 DAYS THAN 30 DAYS THAN 30 DAYS 11 TIME IS IMPORTANT FOR THE RETAIL SELLER 12 TIME STARTS BEFORE AND IS PART OF REMARKETING 13 PRIVATE LEASE INVENTORY TCO MONTHLY COST DEMAND UC PRICE RV SALES USED CARS 14 REMARKETING WORKFLOW MANAGEMENT 15 38 % 6 % 49 % 24% FOUND A BUYER HIGHER PRICES PAID BY USED CARS SOLD BY NON CARS OFFERED OUTSIDE THE COUNTRY NON FRANCHISE DEALERS FRANCHISE DEALERS AND SOLD UPSTREAM AUTOROLA CASE STUDY 16 RETAIL DRIVEN REMARKETING 17 HOW DO WE FIND THE RIGHT BUYER FOR EACH VEHICLE ? 18 GEO PRICING VALUE REMARKETING CHALLENGES RV TCO MORE CHAIN DATA SALES SMART -

Year in Review 2015 Facts & Figures Opel Mokka X

YEAR IN REVIEW 2015 FACTS & FIGURES OPEL MOKKA X More information about Opel: Weitere Informationen über Opel: opel.com opel.de For media: Für Journalisten: media.opel.com media.opel.de Social Media: https://www.facebook.com/Opel https://www.youtube.com/opel http://twitter.com/opel http://instagram.com/opelofficial https://plus.google.com/+Opel https://www.facebook.com/OpelDE https://www.youtube.com/opelde http://twitter.com/opelDE http://twitter.com/KT_Neumann/@ KT_Neumann http://www.opel-blog.com/ If you have any questions, please contact: Bei Fragen wenden Sie sich bitte an: Nico Schmidt +49 61 42 77 83 25 [email protected] Alexander Bazio +49 61 42 77 29 14 [email protected] Rainer Rohrbach +49 61 42 77 28 22 [email protected] This document was produced by Opel Corporate Communications, February 2016 Dieses Dokument wurde produziert von Opel Corporate Communications, Februar 2016 Layout | Gestaltung: www.designkultur-wiesbaden.de INDEX INHALT AT A GLANCE – 2015 5 ÜBERBLICK – 2015 5 CHAPTER I: COMPANY KAPITEL I: DAS UNTERNEHMEN Management Board 7 Geschäftsführung 7 Heritage 8 Geschichte 10 Innovations 12 Innovationen 15 Awards 17 Auszeichnungen 18 Opel Locations in Europe 20 Opel-Standorte in Europa 20 CHAPTER II: VEHICLES & TECHNOLOGIES KAPITEL II: FAHRZEUGE & TECHNOLOGIEN Vehicles 23 Fahrzeuge 23 Technologies 34 Technologien 34 CHAPTER III: PRODUCTION KAPITEL III: PRODUKTION Production by Country and Plant 36 Produktion nach Ländern und Werken 36 Vehicle Production by Model 37 Fahrzeugproduktion nach Modellen -

Product 810721

30 March, 2014, www.brodit.com, © 2014 Brodit AB Product 810721 810721 Headrest mount Headrest mount for Vesa, fits 75x75mm. Fits headrests with the following measurements between the bars: Min. inner size 123 mm, Max. outer size 183 mm. Headrest mount The headrest mount is to be placed onto the front seat's headrest. You can install it yourself in a couple of minutes, installation instructions are included. Is your car missing? This headrest mount fits a number of vehicles, some of them are listed below. Are you missing a model? Measure the headrest in your vehicle, if it matches the measurements below this product will fit in your car. Minimum inner size between headrest bars: 95 mm. Maximum outer size between headrest bars: 155 mm. EAN: 7320288107219 Item no 810721 fits: Acura MDX 07-14 (For USA) Acura RDX 13-14 (For USA) Acura RL 05-13 (For USA) Acura RLX 13-14 (For USA) Acura TL 04-12 (For USA) Acura TSX 04-12 (For USA) Acura ZDX 10-12 (For USA) Alfa Romeo 147 01-11 (For all countries) Alfa Romeo 147 01-11 (For Europe) Alfa Romeo 156 02-06 (For Europe) Alfa Romeo 156 02-06 (For all countries) Alfa Romeo 159 06-13 (For all countries) Alfa Romeo 159 06-13 (England) Alfa Romeo Brera 06-11 (For all countries) Alfa Romeo Brera 06-11 (For all countries) Alfa Romeo Spider/GTV 06-11 (For Europe) Alfa Romeo Spider/GTV 06-11 (Australia) Audi A1 11-14 (For all countries) Audi A1 11-14 (For all countries) Audi A2 01-05 (For Europe) 1(15) Audi A2 01-05 (For all countries) Audi A3 01-14 (For all countries) Audi A3 01-14 (For Europe) Audi A4 Avant -

Power Transmission Group Automotive Aftermarket Contents Introduction

WORK BOOK Power Transmission Group Automotive Aftermarket Contents Introduction Page High mechanical output on demand, completely independent of wind or water power – the spread of the steam engine un- Introduction 3 leashed the industrial revolution in the factories. The individual production machines were driven via steel shafts mounted on Timing belts 4 the ceiling of the building, pulleys and flat drive belts made of Function 5 leather. Design/materials 6 Profiles/handling 9 The first cars and motorcycles also used this power transmis- Maintenance and replacement 10 sion principle. However, the flat belts in this application were Changing the timing belt 12 soon replaced by something better: the V-belt with its trapezoi- Timing chains 13 dal cross-section transmitted the necessary forces with a signifi- Tools 14 cantly lower pretension and became the accepted standard for ancillary component drives. Timing belt drive components 18 Idlers and guide pulleys 19 The multi V-belt, a further development of the V-belt, has been Tensioners 20 taking over automotive applications since the early 1990s. Its Water pumps 22 long ribs enable it to transmit even greater loads. Its flat design allows multiple units to be incorporated and driven at the same V-belts and multi V-belts 26 time. This gives new impetus to the ever more compact design Function, handling 27 of engines. Timing belts have been used for synchronous pow- Design, materials, profiles 28 er transmission to drive the camshaft in automotive engines – V-belts since the 1960s. – multi V-belts – Elastic multi V-belts The next generations of the old transmission belts are now Maintenance and replacement 34 high-tech products. -

BELWAG Summer Sale OPEL Vom 17

BELWAG Summer Sale OPEL vom 17. August bis 31. August 2020 Modell Türen G Farbe Nr. Listenpreis Nettopreis Rabatt CHF % Opel Ampera-e Electric/204 Excellence* 5 m-a quantumgrau 19387 52'700.00 39'900.00 12'800.00 24% Opel Ampera-e Electric/204 Excellence* 5 m-a mineralschwarz 19384 52'700.00 39'900.00 12'800.00 24% Opel Ampera-e Electric/204 Excellence* 5 m-a mineralschwarz 19385 52'700.00 39'900.00 12'800.00 24% Opel Ampera-e Electric/204 Excellence* 5 m-a quantumgrau 19386 52'700.00 39'900.00 12'800.00 24% Opel Astra 1.4T/145 Ultimate S/S 5 s cosmicggrey 19474 43'800.00 37'400.00 6'400.00 15% Opel Astra 1.5D/122 GS Line S/S 5 a schneeweiss 19406 39'610.00 33'700.00 5'910.00 15% Opel Astra 1.5D/122 GS Line S/S 5 a mineralschwarz 19405 42'720.00 36'700.00 6'020.00 14% Opel Astra ST 1.2T/130 Edition S/S 5 m Nauticblau 19425 30'150.00 25'500.00 4'650.00 15% Opel Astra ST 1.5D/122 GS Line S/S 5 a mineralschwarz 19404 43'520.00 38'200.00 5'320.00 12% Opel Astra ST 1.5D/122 Ultimate S/S 5 a diamantblau 19476 44'250.00 38'900.00 5'350.00 12% Opel Astra ST 1.6D/136 Enjoy* 5 a argonsilber 19086 35'430.00 23'700.00 11'730.00 33% Opel Astra ST 1.6D/136 Enjoy* 5 a argonsilber 19047 35'820.00 23'700.00 12'120.00 34% Opel Astra ST 1.6D/136 Enjoy* 5 a quarzgrau 19050 35'970.00 23'700.00 12'270.00 34% Opel Astra ST 1.6D/136 Excellence* 5 a quarzgrau 19089 37'660.00 25'700.00 11'960.00 32% Opel Astra ST 1.6D/136 Excellence* 5 a mineralschwarz 19232 38'380.00 25'700.00 12'680.00 33% Opel Combo Cargo 1.5D/102 L2/H1 Enjoy S/S4 m jadeweiss 19354 32'213.10 -

Opel Adam 13

OPEL ADAM 13- OP04088BA C. Certified Parts *. ADD Products C * ITEM NO. DESCRIPTION YEAR PART NO PARTS LINK MEASURE * OP04088BA FRT BUMPER PRIMED-GRAY 13- 1400991 1pc / 6.78 CNO 212 - 1 OPEL ASTRA 91-97 OP04005BAGZ OP04005BAHZ OP04005BAZ OP04006BAGZ OP04008BA OP07006GAZ OP07006GMZ C. Certified Parts *. ADD Products C * ITEM NO. DESCRIPTION YEAR PART NO PARTS LINK MEASURE OP04005BAZ FRT BUMPER MAT-CLR W/O F.L.HOLE BLACK 92-97 1400119 1pc / 5.00 COP04005BAGZ FRT BUMPER PRIMED W/F.L.HOLE BLACK 92-97 1pc / 5.00 OP04005BAHZ FRT BUMPER W/O F.L.H. GRAIN-PNTED BLK 92-97 1pc / 5.00 OP04005BASZ FRT BUMPER PRIMED W/F.L.HOLE BLACK 92-97 1pc / 5.00 COP04006BAGZ RR BUMPER MAT-COLOR W/O MLDG HOLES BLACK 92-97 1pc / 5.50 OP04006BAL6Z RR BUMPER MAT-COLOR BLACK 92-97 90519180 1pc / 17.10 OP04008BA RR BUMPER MAT-COLOR BLACK 92-97 1404444 1pc / 4.50 OP07005GLZ GRILLE MAT-CLR W/O R.SHIELD BLACK 92-95 5pc / 2.80 OP07006GAZ GRILLE MAT-COLOR BLACK 95-97 TAC453 5pc / 3.10 OP07006GHZ GRILLE MAT-CLR W/R.SHIELD BLACK 95-97 5pc / 3.10 OP07006GMZ GRILLE MAT-CLR W/O R.SHIELD BLACK 95-97 5pc / 3.10 COP20004B HOOD . 92-97 1160220 1pc / 4.00 OP20004C HOOD . 92-97 1160220 1pc / 4.00 CNO 213 - 1 OPEL ASTRA 98-03 OP07011GA OP07012GA C. Certified Parts *. ADD Products C * ITEM NO. DESCRIPTION YEAR PART NO PARTS LINK MEASURE COP07011GA GRILLE MAT-CLR W/CHRM MLDG BLACK 98-04 6320065 5pc / 0.85 COP07012GA GRILLE MAT-COLOR BLACK 98-04 6320066 5pc / 0.85 CNO 214 - 1 OPEL ASTRA 04-09 OP04032BA OP04039MAL OP04042BA OP04049BA OP07020GA OP07021GA OP07021MA OP07030GA OP10026AL OP20018A OP99012CAL OP99013CAL C. -

Opel Gliwice

LKA.410.013.03.2017 P/17/016 WYSTĄPIENIE POKONTROLNE I. Dane identyfikacyjne kontroli Numer i tytuł kontroli P/17/016 – Wykorzystanie przez przedsiębiorców środków publicznych na innowacje i prace badawczo-rozwojowe Jednostka Najwyższa Izba Kontroli przeprowadzająca Delegatura w Katowicach kontrolę Kontroler Mariusz Krynke , główny specjalista kontroli pańs twowej , upoważnienie do kontroli nr LKA/178/2017 z dnia 19 czerwca 2017 r. [Dowód: akta kontroli str. 1-2] Jednostka Opel Manufacturing Poland Sp. z o.o. w Gliwicach 1, kontrolowana ul. Adama Opla 1, 44-121 Gliwice 2 Kierownik jednostki Zarząd OMP w składzie: Andrzej Korpak, Jacek Żarnowiecki, Stefan Moisa kontrolowanej i Michał Jankowiak 3 [Dowód: akta kontroli str. 9] II. Ocena kontrolowanej działalności 4 Ocena ogólna Najwyższa Izba Kontroli ocenia pozytywnie działalność kontrolowanej jednostki w zbadanym zakresie. OMP prawidłowo wywiązywała się z zapisów umowy nr POIG.04.05.01-00-004/10- 00 z 1 lutego 2011 r. zawartej z Ministrem Gospodarki, realizując projekt „Uruchomienie produkcji samochodów Astra IV generacji w wersji trzy- i czterodrzwiowej” 5 w ramach poddziałania 4.5.1 Wsparcie inwestycji w sektorze produkcyjnym, działania 4.5 Wsparcie inwestycji o dużym znaczeniu dla gospodarki, osi priorytetowej 4 Inwestycje w innowacyjne przedsięwzięcia, Programu Operacyjnego „Innowacyjna Gospodarka 2007-2013” . Projekt zakończono w terminie realizując cele zakładane we wniosku o dofinansowanie oraz osiągając zakładane wskaźniki produktu i rezultatu w przyjętych wielkościach. Zakres rzeczowy Projektu obejmujący 54 kategorie wydatków nie zmienił się w trakcie jego realizacji, a wszelkie korekty i przesunięcia pomiędzy tymi kategoriami oraz zmiany umowy o dofinansowanie, m.in. w zakresie kwot nakładów, dokonywane były po uzgodnieniach między stronami w drodze aneksowania i nie miały wpływu na realizację celów Projektu. -

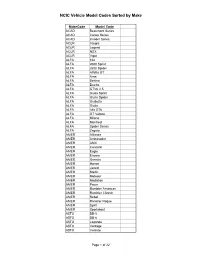

NCIC Vehicle Model Codes Sorted by Make

NCIC Vehicle Model Codes Sorted by Make MakeCode Model Code ACAD Beaumont Series ACAD Canso Series ACAD Invader Series ACUR Integra ACUR Legend ACUR NSX ACUR Vigor ALFA 164 ALFA 2600 Sprint ALFA 2600 Spider ALFA Alfetta GT ALFA Arna ALFA Berlina ALFA Duetto ALFA GTV6 2.5 ALFA Giulia Sprint ALFA Giulia Spider ALFA Giulietta ALFA Giulia ALFA Alfa GT6 ALFA GT Veloce ALFA Milano ALFA Montreal ALFA Spider Series ALFA Zagato AMER Alliance AMER Ambasador AMER AMX AMER Concord AMER Eagle AMER Encore AMER Gremlin AMER Hornet AMER Javelin AMER Marlin AMER Matador AMER Medallion AMER Pacer AMER Rambler American AMER Rambler Classic AMER Rebel AMER Rambler Rogue AMER Spirit AMER Sportabout ASTO DB-5 ASTO DB-6 ASTO Lagonda ASTO Vantage ASTO Volante Page 1 of 22 NCIC Vehicle Model Codes Sorted by Make MakeCode Model Code ASUN GT ASUN SE ASUN Sunfire ASUN Sunrunner AUDI 100 AUDI 100GL AUDI 100LS AUDI 200LS AUDI 4000 AUDI 5000 AUDI 850 AUDI 80 AUDI 90 AUDI S4 AUDI Avant AUDI Cabriolet AUDI 80 LS AUDI Quattro AUDI Super 90 AUDI V-8 AUHE 100 Series AUHE 3000 Series AUHE Sprite AUST 1100 AUST 1800 AUST 850 AUST A99 & 110 AUST A40 AUST A55 AUST Cambridge AUST Cooper "S" AUST Marina AUST Mini Cooper AUST Mini AUST Westminster AVTI Series A AVTI Series B BENT Brooklands BENT Continental Convertible BENT Corniche BENT Eight BENT Mulsanne BENT Turbo R BERO Cabrio BERO Palinuro BERO X19 BMC Princess BMW 2002 Series BMW 1600 Page 2 of 22 NCIC Vehicle Model Codes Sorted by Make MakeCode Model Code BMW 1800 BMW 200 BMW 2000 Series BMW 2500 Series BMW 2.8 BMW 2800 -

2017-03-06-PSA-OPEL.Pdf

PSA & Opel / Vauxhall Alliance: Driving Towards A Better Future A Game-Changing Alliance for PSA & Opel / Vauxhall • Leading European OEM: #1 / #2 Positions Across Key Markets • Complementary Brands • Drive Efficiency on a Higher Scale • Stronger Homebase to Address International Growth Opportunities • Step-Change in Innovation Capability 4.3 MM €55 Bn €4.8 Bn +50% Vehicles Auto Revenue(1) Auto EBITDA(2) R&D Spend Notes 1. 2016A metrics 2. 2016E metrics. Defined as recurring operating income + D&A, assuming 40% of Opel / Vauxhall Auto R&D capitalized 2 Opel / Vauxhall Teams to Drive Turnaround with Full PSA Support 3 Alliance Will Enhance Push-to-Pass and Raise Opel / Vauxhall to Industry Benchmark Current Perimeter Growth(1) by 2018 vs 2015 Group Revenue 10% Additional 15%(1) by 2021E Automotive Average (4) (4) Recurring Operating >4.5% over >6% by 2021E(3) 2% by 2020E 6% by 2026E Margin 2016A-18E Operational Free Positive by 2020E Cash Flow(2) Notes 1. At constant (2015) exchange rate 2. Defined as ROI + D&A – restructuring – capex – Capitalized R&D – Change in NWC 3. vs. initial guidance of 6% by 2021 4 4. Subject to full review of IFRS – US GAAP differences Existing PSA – Opel / Vauxhall OEM Partnership Already Delivering Significant Results Proven Cooperation Model Impact of 3 Joint Vehicle Programs from c.€1.1 Bn Savings Already Based on Three Key Pillars 2017E Onwards Generated With Add. €0.3 Bn p.a. Joint Purchasing Organization Crossland X C3 Aircross PSA Share - In € Bn 220k units (2018E)(1) – Alignment of pricing to benchmark on joint procurement BVH1 platform R&D/ Capex, Joint +0.3 p.a. -

Takata Airbag Recall Initiation Schedule

Consumer Goods (Motor Vehicles With Affected Takata Airbag Inflators and Specified Spare Parts) Recall Notice 2018 - GM Holden Ltd - Initiation Schedule. RECALL INITIATION DATE MAKE/ MODEL MODEL YEAR LOCATION INITIAL REPAIR PRA No. LETTER - START DATE DATE Holden PJ Astra 2014-2017 All States ACTIVE 2018/16957 2009 NT, QLD, WA ACTIVE 2019/17364 NSW, ACT, VIC, SA, 2009 ACTIVE 2019/17363 TAS Holden AH Astra* 3-Door Hatch 2005 - 2008 NT, QLD ACTIVE 2019/17363 5-Door Hatch 2005 - 2008 WA ACTIVE 2019/17363 Wagon 2005 - 2008 NSW, ACT ACTIVE 2019/17363 2005 - 2008 VIC, SA, TAS ACTIVE 2019/17363 2005 - 2009 NT, QLD ACTIVE 2019/17363 Holden AH Astra* 2005 - 2009 WA ACTIVE 2019/17363 Convertible 2005 - 2009 NSW, ACT ACTIVE 2019/17363 2005 - 2009 VIC, SA, TAS ACTIVE 2019/17363 2009 NT, QLD, WA ACTIVE 2019/17364 NSW, ACT, VIC, SA, 2009 ACTIVE 2019/17363 TAS 2006 - 2008 NT, QLD ACTIVE 2019/17363 HSV Astra VXR 2006 - 2008 WA ACTIVE 2019/17363 2006 - 2008 NSW, ACT ACTIVE 2019/17363 2006 - 2008 VIC, SA, TAS ACTIVE 2019/17363 2012-2013 NT, QLD ACTIVE 2018/16856 2012-2013 WA ACTIVE 2018/16856 2012-2013 NSW, ACT ACTIVE 2018/16856 2012-2013 VIC, SA & TAS ACTIVE 2018/16856 2014-2018 NT, QLD, WA ACTIVE 2018/16856 Holden Barina^ 2014 NSW ACTIVE 2018/16856 2014 ACT ACTIVE 2018/16856 2015 - 2018 NSW, ACT ACTIVE 2018/16856 2014 VIC, SA, TAS ACTIVE 2018/16856 2015-2018 VIC, SA, TAS ACTIVE 2018/16856 Holden Cascada 2015-2017 All States ACTIVE 2018/16957 2010-2013 NT, QLD ACTIVE 2018/16856 2010-2013 WA ACTIVE 2018/16856 Holden Cruze^ 2010-2013 NSW, ACT ACTIVE 2018/16856 2010-2013 VIC, SA & TAS ACTIVE 2018/16856 2014-2016 NT, QLD, WA ACTIVE 2018/16856 RECALL INITIATION DATE MAKE/ MODEL MODEL YEAR LOCATION INITIAL REPAIR PRA No.