Camels Rating System for Banking Industry in Pakistan

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

12. BANKING 12.1 Scheduled Banks Operating in Pakistan Pakistani Banks

12. BANKING 12.1 Scheduled Banks Operating in Pakistan Pakistani Banks Public Sector Banks Nationalized Banks 1. First Women Bank Limited 2. National Bank of Pakistan Specialized Banks 1. Industrial Development Bank of Pakistan (IDBP) 2. Punjab Provincial Co-operative Bank Limited (PPCB) 3. Zarai Traqiati Bank Limited 4. SME Bank Ltd. Provincial Banks 1. The Bank of Khyber 2. The Bank of Punjab Private Domestic Banks Privatized Bank 1. Allied Bank of Pakistan Limited 2. Muslim Commercial Bank Limited 3. United Bank Limited 4. Habib Bank Ltd. Private Banks 1. Askari Commercial Bank Limited 2. Bank Al-Falah Ltd. 3. Bank Al-Habib Ltd. 4. Bolan Bank Ltd. 5. Faysal Bank Ltd. 6. KASB Bank Limited 7. Meezan Bank Ltd. 8. Metropolitan Bank Ltd 9. Prime Commercial Bank Ltd. 10. PICIC Commercial Bank Ltd. 11. Saudi-Pak Commercial Bank Limited 12. Soneri Bank Ltd. 13. Union Bank Ltd. Contd. 139 12.1 Scheduled Banks Operating in Pakistan Private Banks 14. Crescent Commercial Bank Ltd. 15. Dawood bank Ltd. 16. NDLC - IFIC Bank Ltd. Foreign Banks 1. ABN AMRO Bank NV 2. Al-Baraka Islamic Bank BSC 3. American Express Bank Ltd. 4. Citi Bank NA 5. Deutsche Bank AE 6. Habib Bank AG Zurich 7. Oman International Bank SAOG 8. Rupali Bank Ltd 9. Standard Chartered Bank Ltd. 10. The Bank of Tokyo-Mitsubishi Ltd. 11. The Hong Kong & Shanghai Banking Corporation Ltd. Source: SBP Note: Banks operating as on 30th June, 2004 140 12.2 State Bank of Pakistan - Assets of the Issue Department (Million Rupees) Last Day of June Particulars 2003 2004 2005 Total Assets 522,891.0 611,903.7 705,865.7 1. -

Jelena Mcwilliams-FDIC

www-scannedretina.com Jelena McWilliams-FDIC Jelena McWilliams-FDIC Voice of the American Sovereign (VOAS) The lawless Municipal Government operated by the "US CONGRESS" Washington, D.C., The smoking gun; do you get it? John Murtha – Impostor committed Treason – Time to sue his estate… Trust through Transparency - Jelena McWilliams - FDIC Chair Theft through Deception - Arnie Rosner - American sovereign, a Californian — and not a US Citizen via the fraudulent 14th Amendment. Sovereignty! TRUMP – THE AMERICAN SOVEREIGNS RULE AMERICA! All rights reserved - Without recourse - 1 of 120 - [email protected] - 714-964-4056 www-scannedretina.com Jelena McWilliams-FDIC 1.1. The FDIC responds - the bank you referenced is under the direct supervision of the Consumer Financial Protection Bureau. From: FDIC NoReply <[email protected]> Subject: FDIC Reply - 01003075 Date: April 29, 2019 at 6:36:46 AM PDT To: "[email protected]" <[email protected]> Reply-To: [email protected] April 29, 2019 Ref. No.: 01003075 Re: MUFG Union Bank, National Association, San Francisco, CA Dear Arnold Beryl Rosner: Thank you for your correspondence, which was received by the Federal Deposit Insurance Corporation (FDIC). The FDIC's mission is to ensure the stability of and public confidence in the nation's financial system. To achieve this goal, the FDIC has insured deposits and promoted safe and sound banking practices since 1933. We are responsible for supervising state- chartered, FDIC-insured institutions that are not members of the Federal Reserve System. Based on our review of your correspondence, the bank you referenced is under the direct supervision of the Consumer Financial Protection Bureau. -

Annual Report 2013 Contents

ANNUAL REPORT 2013 CONTENTS VISION & MISSION STATEMENT 02 VALUES 03 SERVICES 04 THE GROUP 05 MILESTONES 2013 06 CORPORATE INFORMATION 12 MANAGEMENT COMMITTEES 13 DIRECTORS' REPORT TO THE SHAREHOLDERS 14 KEY FINANCIAL DATA 18 HORIZONTAL ANALYSIS 19 STATEMENT OF VALUE ADDITION 20 NOTICE OF NINETEENTH ANNUAL GENERAL MEETING 21 STATEMENT OF COMPLIANCE WITH THE CODE OF CORPORATE GOVERNANCE 22 REVIEW REPORT TO THE MEMBERS ON STATEMENT OF CODE OF CORPORATE GOVERNANCE 23 STATEMENT OF INTERNAL CONTROLS 25 STANDALONE FINANCIAL STATEMENTS AUDITORS' REPORT TO THE MEMBERS 28 STATEMENT OF FINANCIAL POSITION 30 PROFIT AND LOSS ACCOUNT 31 STATEMENT OF COMPREHENSIVE INCOME 32 CASH FLOW STATEMENT 33 STATEMENT OF CHANGES IN EQUITY 34 NOTES TO THE FINANCIAL STATEMENTS 35 STATEMENT OF WRITTEN-OFF LOANS 90 CONSOLIDATED FINANCIAL STATEMENTS DIRECTORS' REPORT ON CONSOLIDATED FINANCIAL STATEMENTS 92 AUDITORS' REPORT TO THE MEMBERS 94 CONSOLIDATED STATEMENT OF FINANCIAL POSITION 95 CONSOLIDATED PROFIT AND LOSS ACCOUNT 96 CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME 97 CONSOLIDATED CASH FLOW STATEMENT 98 CONSOLIDATED STATEMENT OF CHANGES IN EQUITY 99 NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS 100 STATEMENT OF WRITTEN-OFF LOANS 159 PATTERN OF SHAREHOLDING 160 BRANCH NETWORK 163 FORM OF PROXY VISION Partnering Success MISSION STATEMENT Excellence in customer service and innovation for sustained profitable growth through prudent business practices VALUES Vision - Customer Focus and Innovation Attitude - Passion and Quest that Drives Us Leadership - Sense of Integrity, -

Bank Regulation 101

BANK REGULATION 101 PART 1: THE BASICS – HOW ARE BANKS STRUCTURED AND HOW DO AGENCIES PROVIDE OVERSIGHT? Feb. 17, 2021 11:00 a.m. – 12:15 p.m. EST Bank Regulation 101 PART 1: THE BASICS – HOW ARE BANKS STRUCTURED AND HOW DO AGENCIES PROVIDE OVERSIGHT? Feb. 17, 2021 | 11:00 a.m. – 12:15 p.m. EST Discussion Items 11:00 AM - Core Concept #1: What’s a Bank?........................................................................1 - Core Concept #2: The Structure of Bank Regulation ...........................................4 - Core Concept #3: Bank Holding Company (“BHC”) Powers & Activities .............7 - Core Concept #4: Prudential Regulation ...........................................................13 - Core Concept #5: Types of Banks & their Charters ...........................................20 - Core Concept #6: The U.S. Bank Regulators .....................................................29 - Core Concept #7: Examinations ........................................................................40 - Core Concept #8: Enforcement Actions ............................................................53 12:00 AM – 12:15 AM - Q&A Portion Core Concept #1: What is a Bank? What’s a “Bank”? • Although many definitions are possible, U.S. law and regulation generally view a “bank” as an entity that: • Takes deposits; • Makes loans; and • Pays CheCks and transaCts payments. • The U.S. bank regulatory framework takes as its primary point of foCus the first of these funCtions – deposit taking. • Generally, an entity must be Chartered and liCensed as -

Prospectus, Especially the Risk Factors Given at Para 4.11 of This Prospectus Before Making Any Investment Decision

ADVICE FOR INVESTORS INVESTORS ARE STRONGLY ADVISED IN THEIR OWN INTEREST TO CAREFULLY READ THE CONTENTS OF THIS PROSPECTUS, ESPECIALLY THE RISK FACTORS GIVEN AT PARA 4.11 OF THIS PROSPECTUS BEFORE MAKING ANY INVESTMENT DECISION. SUBMISSION OF FALSE AND FICTITIOUS APPLICATIONS ARE PROHIBITED AND SUCH APPLICATIONS’ MONEY MAY BE FORFEITED UNDER SECTION 87(8) OF THE SECURITIES ACT, 2015. SONERI BANK LIMITED PROSPECTUS THE ISSUE SIZE OF FULLY PAID UP, RATED, LISTED, PERPETUAL, UNSECURED, SUBORDINATED, NON-CUMULATIVE AND CONTINGENT CONVERTIBLE DEBT INSTRUMENTS IN THE NATURE OF TERM FINANCE CERTIFICATES (“TFCS”) IS PKR 4,000 MILLION, OUT OF WHICH TFCS OF PKR 3,600 MILLION (90% OF ISSUE SIZE) ARE ISSUED TO THE PRE-IPO INVESTORS AND PKR 400 MILLION (10% OF ISSUE SIZE) ARE BEING OFFERED TO THE GENERAL PUBLIC BY WAY OF INITIAL PUBLIC OFFER THROUGH THIS PROSPECTUS RATE OF RETURN: PERPETUAL INSTRUMENT @ 6 MONTH KIBOR* (ASK SIDE) PLUS 2.00% P.A INSTRUMENT RATING: A (SINGLE A) BY THE PAKISTAN CREDIT RATING COMPANY LIMITED LONG TERM ENTITY RATING: “AA-” (DOUBLE A MINUS) SHORT TERM ENTITY RATING: “A1+” (A ONE PLUS) BY THE PAKISTAN CREDIT RATING AGENCY LIMITED AS PER PSX’S LISTING OF COMPANIES AND SECURITIES REGULATIONS, THE DRAFT PROSPECTUS WAS PLACED ON PSX’S WEBSITE, FOR SEEKING PUBLIC COMMENTS, FOR SEVEN (7) WORKING DAYS STARTING FROM OCTOBER 18, 2018 TO OCTOBER 26, 2018. NO COMMENTS HAVE BEEN RECEIVED ON THE DRAFT PROSPECTUS. DATE OF PUBLIC SUBSCRIPTION: FROM DECEMBER 5, 2018 TO DECEMBER 6, 2018 (FROM: 9:00 AM TO 5:00 PM) (BOTH DAYS INCLUSIVE) CONSULTANT TO THE ISSUE BANKERS TO THE ISSUE (RETAIL PORTION) Allied Bank Limited Askari Bank Limited Bank Alfalah Limited** Bank Al Habib Limited Faysal Bank Limited Habib Metropolitan Bank Limited JS Bank Limited MCB Bank Limited Silk Bank Limited Soneri Bank Limited United Bank Limited** **In order to facilitate investors, United Bank Limited (“UBL”) and Bank Alfalah Limited (“BAFL”) are providing the facility of electronic submission of application (e‐IPO) to their account holders. -

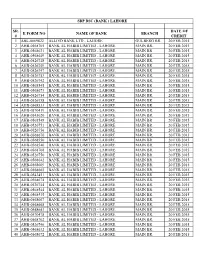

Sr. # E Form No Name of Bank Branch Date of Credit 1 Abl-0069822 Allied Bank

SBP BSC (BANK ) LAHORE SR. DATE OF E FORM NO NAME OF BANK BRANCH # CREDIT 1 ABL-0069822 ALLIED BANK LTD - LAHORE GULBERG BR. 20 FEB 2015 2 AHB-0568705 BANK AL HABIB LIMITED - LAHORE MAIN BR. 20 FEB 2015 3 AHB-0568631 BANK AL HABIB LIMITED - LAHORE MAIN BR. 20 FEB 2015 4 AHB-0568649 BANK AL HABIB LIMITED - LAHORE MAIN BR. 20 FEB 2015 5 AHB-0526748 BANK AL HABIB LIMITED - LAHORE MAIN BR. 20 FEB 2015 6 AHB-0526749 BANK AL HABIB LIMITED - LAHORE MAIN BR. 20 FEB 2015 7 AHB-0526747 BANK AL HABIB LIMITED - LAHORE MAIN BR. 20 FEB 2015 8 AHB-0526753 BANK AL HABIB LIMITED - LAHORE MAIN BR. 20 FEB 2015 9 AHB-0526742 BANK AL HABIB LIMITED - LAHORE MAIN BR. 20 FEB 2015 10 AHB-0568545 BANK AL HABIB LIMITED - LAHORE MAIN BR. 20 FEB 2015 11 AHB-0568673 BANK AL HABIB LIMITED - LAHORE MAIN BR. 20 FEB 2015 12 AHB-0526754 BANK AL HABIB LIMITED - LAHORE MAIN BR. 20 FEB 2015 13 AHB-0526758 BANK AL HABIB LIMITED - LAHORE MAIN BR. 20 FEB 2015 14 AHB-0568533 BANK AL HABIB LIMITED - LAHORE MAIN BR. 20 FEB 2015 15 AHB-0570419 BANK AL HABIB LIMITED - LAHORE MAIN BR. 20 FEB 2015 16 AHB-0543020 BANK AL HABIB LIMITED - LAHORE MAIN BR. 20 FEB 2015 17 AHB-0568548 BANK AL HABIB LIMITED - LAHORE MAIN BR. 20 FEB 2015 18 AHB-0526751 BANK AL HABIB LIMITED - LAHORE MAIN BR. 20 FEB 2015 19 AHB-0526756 BANK AL HABIB LIMITED - LAHORE MAIN BR. 20 FEB 2015 20 AHB-0568670 BANK AL HABIB LIMITED - LAHORE MAIN BR. -

WHY SILK? 111-007-455 2009 Inspiration for the Name Silkbank Comes from the Silk Route - a Trade Corridor Connecting Asia to Europe and the Rest of the World

Silkbank Building ANNUAL I.I. Chundrigar Road, Karachi REPORT www.silkbank.com.pk WHY SILK? 111-007-455 2009 Inspiration for the name Silkbank comes from the Silk Route - a trade corridor connecting Asia to Europe and the rest of the world. Silk, known for its distinctive properties and characteristics, symbolizes Silkbank’s brand beliefs. Premium & Upscale Silk is known for class and premium quality. Silkbank is positioned as an upscale bank providing its customers with premium banking experience. Talent & Innovation Silk embodies talent and timeless innovation. Silkbank promises its customers innovative products delivered through talented staff. Strong & Reliable Silk is amongst the strongest fibres known to mankind. Silkbank derives its strength from its strong international institutional sponsors giving it credibility and reliability. Dependable Silk through the times has held its value. Silkbank driven by a team of professionals provides an optimal experience that you can depend on. Contents Vision & Mission 02 Chairman's Message 03 Silkbank Products President & CEO's Message 05 Senior Management Committee 07 Assets Corporate Information 11 Directors’ Report 15 Statement of Compliance with the Code of Liabilities Corporate Governance 23 Statement of Internal Control 25 Notice of AGM 29 Review Report to the Members on Statement of Compliance with the Best Practices of Code of Corporate Governance 30 Independent Auditors’ Report 33 Balance Sheet 37 Profit and Loss Account 38 Statement of Comprehensive Income 39 Cash Flow Statement -

Snapshot of Results of Banks in Pakistan Snapshot of Results of Banks in Pakistan Six Months Period Ended 30 June 2016

KPMG Taseer Hadi & Co. Chartered Accountants Snapshot of results of Banks in Pakistan Snapshot of results of banks in Pakistan Six months period ended 30 June 2016 This snapshot has been prepared by KPMG Taseer Hadi & Co. and summarizes the performance of selected banks in Pakistan for the 6 months period ended 30 June 2016. The information contained in this snapshot has been obtained from the published consolidated financial statements of the banks and where consolidated financial statements were not available, standalone financials have been used. Reference should be made to the published financial statements of the banks to enhance the understanding of ratios and analysis of performance of a particular bank. We have tried to provide relevant financial analysis of the banks which we thought would be useful for benchmarking and comparison. However, we welcome any comments, which would facilitate in improving the contents of this document. The comments may be sent on [email protected] Dated: 23 September 2016 Karachi © 2016 KPMG Taseer Hadi & Co., a Partnership firm registered in Pakistan and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 2 Document Classification: KPMG Public HBL NBP UBL MCB ABL BAF 2016 2015 2016 2015 2016 2015 2016 2015 2016 2015 2016 2015 Ranking By total assets 1 1 2 2 3 3 4 4 5 5 6 6 By net assets 1 1 2 2 3 3 4 4 5 5 7 7 By profit before tax 1 1 4 4 2 3 3 2 5 5 7 8 Profit before tax * 28,298 -

The Road to Inclusion 2015 FINCA ANNUAL REPORT the FINCA Journey: Founder’S Letter

The Road to Inclusion 2015 FINCA ANNUAL REPORT The FINCA Journey: Founder’s Letter From its birth, FINCA’s purpose has The very scope and rapidity of FINCA’s growth, and that been inclusion: to serve the world’s most of the global microfinance movement, is testimony to how large was the exclusion that existed around the disadvantaged citizens. world, particularly with regard to women’s access to credit. Today, millions of mothers and fathers in the When FINCA launched its first “Village Banks” in the developing world have not one but several microfinance 1980s, our purpose was to assist illiterate, unemployed, providers who will give a small loan of working capital— and poverty-stricken families—especially mothers— often accessed by cellphone within a matter of minutes. with $50 loans to create businesses capable of generating $2–$3 of extra income per day. This result, Inclusion of women, and rapid access to working we trusted, would be just enough to improve their capital (or savings), is just the start of another process children’s nutrition, keep them in school and still set of inclusion. A growing business enables a FINCA aside a few cents per day in savings. borrower to improve her family’s nutrition and health, to keep her children in school, to buy a solar-powered This was a revolutionary proposition at the time. lamp and to simply hope and plan for the future. A child Throughout the underdeveloped world, 80% of citizens, who stays in school long enough to become numerate women in particular, were excluded from access to and literate will be able to earn a wage five times greater credit from the commercial banking system. -

Global Financial Crisis of 2007: Analysis of Origin & Assessment Of

Global financial crisis of 2007 : analysis of origin & assessment of contagion to emerging economies : lessons & challenges for financial regulation Shazia Ghani To cite this version: Shazia Ghani. Global financial crisis of 2007 : analysis of origin & assessment of contagion to emerging economies : lessons & challenges for financial regulation. Economics and Finance. Université de Grenoble, 2013. English. NNT : 2013GRENE011. tel-00987627 HAL Id: tel-00987627 https://tel.archives-ouvertes.fr/tel-00987627 Submitted on 6 May 2014 HAL is a multi-disciplinary open access L’archive ouverte pluridisciplinaire HAL, est archive for the deposit and dissemination of sci- destinée au dépôt et à la diffusion de documents entific research documents, whether they are pub- scientifiques de niveau recherche, publiés ou non, lished or not. The documents may come from émanant des établissements d’enseignement et de teaching and research institutions in France or recherche français ou étrangers, des laboratoires abroad, or from public or private research centers. publics ou privés. 1 La crise financière de 2007 Analyse des origines et impacts macroéconomiques sur les économies émergentes. Quels sont les leçons et les défis de régulation financière ? Global Financial Crisis of 2007 Analysis of Origin & Assessment of Contagion to Emerging Economies Lessons & Challenges for Financial Regulation Présentée par Shazia GHANI Thèse dirigée par Faruk ÜLGEN 2 ACKNOWLEDGEMENTS It is a pleasure to thank the many people who made this thesis possible. I am profoundly indebted to my supervisor Mr ULGEN Faruk for his sound advice, his great patience, and hour‘s long attentiveness over the last three and half years for being a model of excellence in my research area. -

GAO-15-365 Accessible Version, Bank Regulation: Lessons Learned

United States Government Accountability Office Report to Congressional Addressees June 2015 BANK REGULATION Lessons Learned and a Framework for Monitoring Emerging Risks and Regulatory Response Accessible Version GAO-15-365 June 2015 BANK REGULATION Lessons Learned and a Framework for Monitoring Emerging Risks and Regulatory Response Highlights of GAO-15-365, a report to congressional addressees Why GAO Did This Study What GAO Found Weakness in federal oversight was one Past banking-related crises highlight a number of regulatory lessons learned. of many factors that contributed to the These include the importance of size of federal losses and the number of bank failures in banking-related · Early and forceful action. GAO’s past work on failed banks found that crises over the past 35 years— regulators frequently identified weak management practices that involved the including the 1980s thrift and banks in higher-risk activities early on in each crisis, before banks began commercial bank crises and the 2007– experiencing declines in capital. However, regulators were not always 2009 financial crisis. Resolving the effective in directing bank management to address underlying problems failures of banks and thrifts due to before bank capital began to decline and it was often too late to avoid failure. these crises resulted in estimated For example, examiners did not always press bank management to address costs to federal bank and thrift problems promptly or issue timely enforcement actions. insurance funds over $165 billion, as well as other federal government costs, · Forward-looking assessments of risk. The crises revealed limitations in such as taxpayer-funded assistance key supervisory tools for monitoring and addressing emerging risks. -

The Regulation of Private Money

NBER WORKING PAPER SERIES THE REGULATION OF PRIVATE MONEY Gary B. Gorton Working Paper 25891 http://www.nber.org/papers/w25891 NATIONAL BUREAU OF ECONOMIC RESEARCH 1050 Massachusetts Avenue Cambridge, MA 02138 May 2019 Thanks to Bob DeYoung for comments and suggestions. Forthcoming in Journal of Money, Credit and Banking. The views expressed herein are those of the author and do not necessarily reflect the views of the National Bureau of Economic Research. NBER working papers are circulated for discussion and comment purposes. They have not been peer-reviewed or been subject to the review by the NBER Board of Directors that accompanies official NBER publications. © 2019 by Gary B. Gorton. All rights reserved. Short sections of text, not to exceed two paragraphs, may be quoted without explicit permission provided that full credit, including © notice, is given to the source. The Regulation of Private Money Gary B. Gorton NBER Working Paper No. 25891 May 2019 JEL No. G2,G21 ABSTRACT Financial crises are bank runs. At root the problem is short-term debt (private money), which while an essential feature of market economies, is inherently vulnerable to runs in all its forms (not just demand deposits). Bank regulation aims at preventing bank runs. History shows two approaches to bank regulation: the use of high quality collateral to back banks’ short-term debt and government insurance for the short-term debt. Also, explicit or implicit limitations on entry into banking can create charter value (an intangible asset) that is lost if the bank fails. This can create an incentive for the bank to abide by the regulations and not take too much risk.