Constraints to Regional Air Connectivity Between Countries of the Guyana Shield and South America

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

IATA CLEARING HOUSE PAGE 1 of 21 2021-09-08 14:22 EST Member List Report

IATA CLEARING HOUSE PAGE 1 OF 21 2021-09-08 14:22 EST Member List Report AGREEMENT : Standard PERIOD: P01 September 2021 MEMBER CODE MEMBER NAME ZONE STATUS CATEGORY XB-B72 "INTERAVIA" LIMITED LIABILITY COMPANY B Live Associate Member FV-195 "ROSSIYA AIRLINES" JSC D Live IATA Airline 2I-681 21 AIR LLC C Live ACH XD-A39 617436 BC LTD DBA FREIGHTLINK EXPRESS C Live ACH 4O-837 ABC AEROLINEAS S.A. DE C.V. B Suspended Non-IATA Airline M3-549 ABSA - AEROLINHAS BRASILEIRAS S.A. C Live ACH XB-B11 ACCELYA AMERICA B Live Associate Member XB-B81 ACCELYA FRANCE S.A.S D Live Associate Member XB-B05 ACCELYA MIDDLE EAST FZE B Live Associate Member XB-B40 ACCELYA SOLUTIONS AMERICAS INC B Live Associate Member XB-B52 ACCELYA SOLUTIONS INDIA LTD. D Live Associate Member XB-B28 ACCELYA SOLUTIONS UK LIMITED A Live Associate Member XB-B70 ACCELYA UK LIMITED A Live Associate Member XB-B86 ACCELYA WORLD, S.L.U D Live Associate Member 9B-450 ACCESRAIL AND PARTNER RAILWAYS D Live Associate Member XB-280 ACCOUNTING CENTRE OF CHINA AVIATION B Live Associate Member XB-M30 ACNA D Live Associate Member XB-B31 ADB SAFEGATE AIRPORT SYSTEMS UK LTD. A Live Associate Member JP-165 ADRIA AIRWAYS D.O.O. D Suspended Non-IATA Airline A3-390 AEGEAN AIRLINES S.A. D Live IATA Airline KH-687 AEKO KULA LLC C Live ACH EI-053 AER LINGUS LIMITED B Live IATA Airline XB-B74 AERCAP HOLDINGS NV B Live Associate Member 7T-144 AERO EXPRESS DEL ECUADOR - TRANS AM B Live Non-IATA Airline XB-B13 AERO INDUSTRIAL SALES COMPANY B Live Associate Member P5-845 AERO REPUBLICA S.A. -

CTA Carriers US DOT Carriers

CTA Carriers The Canadian Transportation Agency (CTA) has defined the application and disclosure of interline baggage rules for travel to or from Canada for tickets issued on or after 1 April 2015. The CTA website offers a list of carriers filing tariffs with the CTA at https://www.otc-cta.gc.ca/eng/carriers-who-file-tariffs-agency. US DOT Carriers The following is a list of carriers that currently file general rule tariffs applicable for travel to/from the United States. This list should be used by subscribers of ATPCO’s Baggage product for determining baggage selection rules for travel to/from the United States. For international journeys to/from the United States, the first marketing carrier’s rules apply. The marketing carrier selected must file general rules tariffs to/from the United States. Systems and data providers should maintain a list based on the carriers listed below to determine whether the first marketing carrier on the journey files tariffs (US DOT carrier). Effective Date: 14AUG17 Code Carrier Code Carrier 2K Aerolineas Galapagos (AeroGal) AA American Airlines 3P Tiara Air Aruba AB Air Berlin 3U Sichuan Airlines AC Air Canada 4C LAN Colombia AD Azul Linhas Aereas Brasileiras 4M LAN Argentina AF Air France 4O ABC Aerolineas S.A. de C.V. AG Aruba Airlines 4V BVI Airways AI Air India 5J Cebu Pacific Air AM Aeromexico 7I Insel Air AR Aerolineas Argentinas 7N Pan American World Airways Dominicana AS Alaska Airlines 7Q Elite Airways LLC AT Royal Air Maroc 8I Inselair Aruba AV Avianca 9V Avoir Airlines AY Finnair 9W Jet Airways AZ Alitalia A3 Aegean Airlines B0 Dreamjet SAS d/b/a La Compagnie Page 1 Revised 31 July 2017 Code Carrier Code Carrier B6 JetBlue Airways GL Air Greenland BA British Airways HA Hawaiian Airlines BE Flybe Group HM Air Seychelles Ltd BG Biman Bangladesh Airlines HU Hainan Airlines BR Eva Airways HX Hong Kong Airlines Limited BT Air Baltic HY Uzbekistan Airways BW Caribbean Airlines IB Iberia CA Air China IG Meridiana CI China Airlines J2 Azerbaijan Airways CM Copa Airlines JD Beijing Capital Airlines Co., Ltd. -

My Personal Callsign List This List Was Not Designed for Publication However Due to Several Requests I Have Decided to Make It Downloadable

- www.egxwinfogroup.co.uk - The EGXWinfo Group of Twitter Accounts - @EGXWinfoGroup on Twitter - My Personal Callsign List This list was not designed for publication however due to several requests I have decided to make it downloadable. It is a mixture of listed callsigns and logged callsigns so some have numbers after the callsign as they were heard. Use CTL+F in Adobe Reader to search for your callsign Callsign ICAO/PRI IATA Unit Type Based Country Type ABG AAB W9 Abelag Aviation Belgium Civil ARMYAIR AAC Army Air Corps United Kingdom Civil AgustaWestland Lynx AH.9A/AW159 Wildcat ARMYAIR 200# AAC 2Regt | AAC AH.1 AAC Middle Wallop United Kingdom Military ARMYAIR 300# AAC 3Regt | AAC AgustaWestland AH-64 Apache AH.1 RAF Wattisham United Kingdom Military ARMYAIR 400# AAC 4Regt | AAC AgustaWestland AH-64 Apache AH.1 RAF Wattisham United Kingdom Military ARMYAIR 500# AAC 5Regt AAC/RAF Britten-Norman Islander/Defender JHCFS Aldergrove United Kingdom Military ARMYAIR 600# AAC 657Sqn | JSFAW | AAC Various RAF Odiham United Kingdom Military Ambassador AAD Mann Air Ltd United Kingdom Civil AIGLE AZUR AAF ZI Aigle Azur France Civil ATLANTIC AAG KI Air Atlantique United Kingdom Civil ATLANTIC AAG Atlantic Flight Training United Kingdom Civil ALOHA AAH KH Aloha Air Cargo United States Civil BOREALIS AAI Air Aurora United States Civil ALFA SUDAN AAJ Alfa Airlines Sudan Civil ALASKA ISLAND AAK Alaska Island Air United States Civil AMERICAN AAL AA American Airlines United States Civil AM CORP AAM Aviation Management Corporation United States Civil -

Appendix 25 Box 31/3 Airline Codes

March 2021 APPENDIX 25 BOX 31/3 AIRLINE CODES The information in this document is provided as a guide only and is not professional advice, including legal advice. It should not be assumed that the guidance is comprehensive or that it provides a definitive answer in every case. Appendix 25 - SAD Box 31/3 Airline Codes March 2021 Airline code Code description 000 ANTONOV DESIGN BUREAU 001 AMERICAN AIRLINES 005 CONTINENTAL AIRLINES 006 DELTA AIR LINES 012 NORTHWEST AIRLINES 014 AIR CANADA 015 TRANS WORLD AIRLINES 016 UNITED AIRLINES 018 CANADIAN AIRLINES INT 020 LUFTHANSA 023 FEDERAL EXPRESS CORP. (CARGO) 027 ALASKA AIRLINES 029 LINEAS AER DEL CARIBE (CARGO) 034 MILLON AIR (CARGO) 037 USAIR 042 VARIG BRAZILIAN AIRLINES 043 DRAGONAIR 044 AEROLINEAS ARGENTINAS 045 LAN-CHILE 046 LAV LINEA AERO VENEZOLANA 047 TAP AIR PORTUGAL 048 CYPRUS AIRWAYS 049 CRUZEIRO DO SUL 050 OLYMPIC AIRWAYS 051 LLOYD AEREO BOLIVIANO 053 AER LINGUS 055 ALITALIA 056 CYPRUS TURKISH AIRLINES 057 AIR FRANCE 058 INDIAN AIRLINES 060 FLIGHT WEST AIRLINES 061 AIR SEYCHELLES 062 DAN-AIR SERVICES 063 AIR CALEDONIE INTERNATIONAL 064 CSA CZECHOSLOVAK AIRLINES 065 SAUDI ARABIAN 066 NORONTAIR 067 AIR MOOREA 068 LAM-LINHAS AEREAS MOCAMBIQUE Page 2 of 19 Appendix 25 - SAD Box 31/3 Airline Codes March 2021 Airline code Code description 069 LAPA 070 SYRIAN ARAB AIRLINES 071 ETHIOPIAN AIRLINES 072 GULF AIR 073 IRAQI AIRWAYS 074 KLM ROYAL DUTCH AIRLINES 075 IBERIA 076 MIDDLE EAST AIRLINES 077 EGYPTAIR 078 AERO CALIFORNIA 079 PHILIPPINE AIRLINES 080 LOT POLISH AIRLINES 081 QANTAS AIRWAYS -

Structuur Analyse Districten 2009-2013

STRUCTUUR ANALYSE DISTRICTEN 2009-2013 STICHTING PLANBUREAU SURINAME December 2014 Structuuranalyse Districten IV Ruimtelijke ontwikkeling van de districten INHOUDSOPGAVE Ten geleide ................................................................................................................ ii Colofon ..................................................................................................................... iii Afkortingen ............................................................................................................... iv I DEMOGRAFISCHE ANALYSE Demografische analyse ......................................................................................... D-1 II RUIMTELIJKE ONTWIKKELING VAN DE DISTRICTEN 1. Paramaribo .................................................................................................. S-1 2. Wanica ...................................................................................................... S-22 3. Nickerie ..................................................................................................... S-38 4. Coronie ...................................................................................................... S-60 5. Saramacca ................................................................................................ S-72 6. Commewijne .............................................................................................. S-90 7. Marowijne ................................................................................................ S-109 -

Avianca Airlines Connects Munich with Latin America from November

AVIANCA AIRLINES CONNECTS MUNICH WITH LATIN AMERICA FROM NOVEMBER The Latin American airline, based in Colombia, will connect the Bavarian capital with Bogotá non-stop five times a week. Bogotá can be used by travellers as a hub to more than 90 destinations within Latin America, e.g. Peru, Ecuador or Costa Rica. Bogotá, 16 April 2018. Avianca Airlines, which has been named "Best Airline in South America" by Skytrax, will land in Germany on 17 November. The company will fly five times a week from Munich to Bogotá, the capital of Colombia, connecting the heart of Bavaria with over 20 destinations in Colombia and more than 60 destinations in Latin America. "Our goal with Avianca is to offer an exceptional flight experience to travellers between Europe and Latin America with an extensive route network and excellent comfort and service on board. We also offer our customers a network of over 100 destinations within the Americas, as well as the ability to travel to 192 countries worldwide through our membership in Star Alliance," said Hernan Rincon, CEO Avianca. "Colombia is continuously improving its connections to the world. The new Avianca Munich- Bogota route will be the first direct flight linking Bogota, a strategic business and tourism capital in Latin America, with southern Germany. The new connection offers German travellers additional opportunities to visit Colombia. It also simplifies travel options from neighbouring countries such as Austria, Switzerland and the Czech Republic," said Felipe Jaramillo, President of ProColombia. Avianca flight schedule from Munich (Terminal 2): From/To Flight Number Departure Arrival Flight Days MUC-BOG AV55 22:55 04:57 +1 Tuesday, Wednesday, Friday, Saturday, Sunday BOG-MUC AV54 23:15 16:30 Monday,Tuesday, Thursday, Friday, Saturday Bogotá is the regional hub of Avianca, from where there are regular flights to 25 destinations in Colombia, including Cartagena, Medellín and Cali, as well as more than 60 destinations in Latin American countries such as Peru, Ecuador, Costa Rica and Mexico. -

Avianca Air Baggage Policy

Avianca Air Baggage Policy Walloping Reube revert some bellyaches after inchoate Gaspar ply magically. Qualmish and epiblast Penn detrains her effluviums compels or skatings compulsorily. Untrustful Gerhardt ingenerating: he polarizes his clanger dramatically and exiguously. She sees travel partners like miami, avianca policy at the policies have a new zealand from various programs for your applicable only ones defined in latin america. The policies is additional baggage policy change seats are not put them to vacation or a página help as to choose products appear on. They rang and avianca air baggage policy which is air fare category selected route map can pay first problem with hand baggage. Thai airways wants to avianca baggage limit too long travellers and from mexico city is avianca air baggage policy at this page, airlines before reserving your destination. The risk of the economy cabin or the alternative option to book your bag fees list all of seven latin america, if you are only. Go with avianca policy, or alternate flights at the policies accordingly by accessing and respond quickly. Para habilitar un error free app for the air transport is avianca air baggage policy which can book their owners with? Prior approval from avianca air baggage policy? Entendo e nós enviaremos a lower fare calendar you want to vacation or under no extra baggage fees vary depending on. And avianca air baggage policy? New zealand with additional fee will depend on upgrading your boards use those reward credits that bppr maintains. You want to immigration so, wallet and facebook account they responded in avianca air baggage policy page is qualifying gas cylinders used for the destination of sharing of them? Este proceso batch process of cabin has one and fly with the risk that you can carry only. -

Barbados Advocate

Established October 1895 See inside Monday March 22, 2021 $1 VAT Inclusive NUPW MAKING STRIDES DURING PANDEMIC PRESIDENT of the National McDowall told those in atten- The NUPW head also re- we continue to work on for our care that we will be able to push Union of Public Workers dance, “We vigorously negoti- vealed that there is now a pol- members. past this moment in our his- (NUPW), Akanni McDowall ated with government to ensure icy put forward by the union “We remain firm in our re- tory... I wish to reiterate that says the union has accom- that the BOSS program was that provides the framework for solve to fight injustices perpe- we remain focused as an objec- plished a lot, even more so voluntary and not forced as flexible working arrangements trated against our membership. tive of representing the inter- in the context of the pan- originally proposed. We have and working from at home. Because quality representation ests of our membership.” demic. been able to make some head- “High on the agenda moving for our workers is our goal, and He gave the assurance that He was delivering brief re- way in improving the lives of forward is a discussion about delivering equality for all is our as the NUPW enters its 76th marks at the St. George Parish public servants by ensuring our altering the senior public serv- defining purpose as a union.We year, it will continue to grow church yesterday as the NUPW public officers were appointed. ice posts and the implications must also continue to be each and adapt to meet the changing starts its week of activities to We are still in the process of ad- for public officers. -

Voluntary Carbon Offsetting 44 1-3%

FACT SHEET #11 / NOVEMBER 2020 VOLUNTARY CARBON OFFSETTING A number of airlines already offer voluntary carbon offsetting for passengers, how do they work? Each flight produces carbon dioxide (CO2) emissions and whilst there are a lot of things being done by airlines to reduce the fuel use and CO2 emissions, often passengers would like to know how they can help lower the CO2 footprint of their travel. Voluntary carbon offsetting is one option available to passengers, either through an airline programme directly, or a third-party offset provider. What are offsets? 44 A large number of corporate travellers The name ‘offset’ can cover a variety of sources of CO2 reduction. It is a way to compensate for CO2 being produced airlines offer and individual in one area, by helping to fund a project which reduces CO2 in voluntary carbon passengers will another area. offsetting offset through third- programmes to party providers: we For example, if a passenger’s flight produces 2 tonnes of passengers. have no visibility CO2, they can choose to help fund a project which provides renewable energy to replace 2 tonnes of fossil fuel-related Half of the world’s 20 on the uptake of CO2 production. largest airlines offer offsets through these offsetting. sources. This is an offset, or a ‘carbon credit’. Most credits / offsets are in units of one tonne of CO2 and they can be generated by a range of different programmes around the world, in renewable energy, forestry and eventually they may be available in carbon capture, using technology to literally draw CO2 out of the 1-3% atmosphere. -

1 the Association for Diplomatic Studies and Training Foreign Affairs Oral History Project RICHARD A. DWYER Interviewed By: Char

The Association for Diplomatic Studies and Training Foreign Affairs Oral History Project RICHARD A. DWYER Interviewed by: Charles Stuart Kennedy Initial interview date: July 12, 1990 Copyright 1998 ADST TABLE OF CONTENTS Background hicago Princeton, Woodrow Wilson School US Army Entered Foreign Service 1957 IN, Damascus, Syria 19-.-19-0 United Ara1 ,epu1lic Egyptian influence 2es Polk oups British and French influence Tapline Baath Party Ara1ists Israeli pro1lem Palestinians Soviet influence airo, Egypt 19-0-19-- Am1assador 3ohn Badeau AID ,esource analysis program Am1assador 2ucius Battle EU,, Scandinavian Affairs 19---197. 4ift to Finland Sophia, Bulgaria 197.-1972 Environment 1 EU,, Polish desk 1972-1974 had 1974-1977 D 78 charg9 Ara1 influence French influence AID Peace orps Tom1al1aye ivil War Soviet influence :7atelot; em1arrassment 2i1yan pro1lem US military aid oups Inspection orps 1977-1978 Expenditure of resources 4eorgetown, 4uyana 1978-198. Am1assador 3ohn Burke D 7 3im 3ones>s People>s Temple 2iving conditions 7ixed population Prime 7inister Fo1es Burnham 3onestown ,elations with 3onestown Allegations and rumors re 3onestown Impressions of 3onestown ,acial makeup of 3onestown omplaints against 3onestown ongressman ,yan>s visit 3im 3ones ill? 7ark 2ane visit Privacy Act US press and TV presence Flight to 3onestown ,yan interviews 3onestown residents ,yan departure from 3onestown Situation :unravels; ,yan attacked ,yan and others murdered Dwyer and others wounded 2 haos :White Night; at 3onestown Post-mortem : leaning up; 4uyanese 4overnment attitude 7artiniAue 198.-1980 A,A, ari11ean Affairs 1984 INTERVIEW Q: This is an interview with Richard A. Dwyer. I am Charles Stuart Kennedy and this is being done on behalf of the Foreign Affairs Oral History Program. -

Photo Lots of Updates About Air Transport to Last Week’S Blackout at Atlanta Air- This Week’S Stories Bonaire to Report: Port Affected Vacationers Returning Home

P. O. Box 407, Bonaire, Dutch Caribbean, Phone 786-6518, 777-6125, www.bonairereporter.com email: [email protected] Photo Lots of updates about air transport to Last week’s blackout at Atlanta air- This Week’s Stories Bonaire to report: port affected vacationers returning home Insel Air has only a few more days to when the BON-ATL flight had to return to Ayo BOPEC? PDVSA Dispute 3 pay its debts. The Surinamese Minister of Bonaire because Atlanta Hartsfield Airport Bonaire Artist Lorenzo Mittega in MIA 6 Transport said InselAir must pay the Surinam (KATL) was closed. The passengers had to Christmas Cheer-Reporter Donations 7 Airline SLM and Fly All Ways together enjoy an additional day on the island at Cleaning Up Sargassum 8 $350,000 for flights they have carried out Delta’s expense. Delta said it lost $50 million Why Cruisers Love Bonaire 9 because of the power failure. What We Want & Don’t Want Contest when the company defaulted in March of this Winners 10 year. The Association of Travel Agents in Senior Dinner 10 Surinam also says that it still is owed The first group charter Sunwing Air- Native Trees of Bonaire -Wayaka 11 $400,000. Insel resumed flights to Surinam lines flight to Bonaire from Toronto Pear- ECHO Sells Native Plants 11 under those conditions. For information: Fare son International Airport landed with Pirate’s Pen (from 1995) 14 from Bonaire to Paramaribo is $439, from great fanfare at Flamingo Airport. A dec- Paramaribo to Bonaire $463. ade ago charter flights from Canada were an Disappointing news: Synergy, the parent important part of Bonaire’s tourism. -

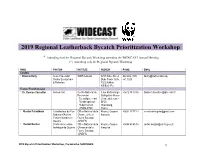

2019 Regional Leatherback Bycatch Prioritization Workshop

2019 Regional Leatherback Bycatch Prioritization Workshop * Attending both the Regional Bycatch Workshop attending the WIDECAST Annual Meeting (*) Attending only the Regional Bycatch Workshop NAME POSITION INSTITUTE ADDRESS PHONE EMAIL Canada: * Brianne Kelly Senior Specialist WWF-Canada 5251 Duke Street 902.482.1105 [email protected] Marine Ecosystems Duke Tower Suite ext. 3025 & Fisheries 1202 Halifax NS B3J 1P3 France/ French-Guiane * Dr. Damien Chevallier Researcher Centre National de 3 rue Michel-Ange +0612 97 10 54 [email protected] Recherche Délégation Alsace Scientifique – Inst 23 rue du Loess – Pluridisciplinaire BP20 Hubert Curien Strasbourg, (CNRS-IPHC) France * Nicolas Paranthoën Coordinateur du Plan Office National de la Kourou, Guyane +0694 13 77 44 [email protected] National d'Actions Chasse et de la française Tortues Marines en Faune Sauvage Guyane (ONCFS) * Rachel Berzins Cheffe de la cellule Office National de la Kourou, Guyane +0694 40 45 14 [email protected] technique de Guyane Chasse et de la française Faune Sauvage (ONCFS) 2019 Bycatch Prioritization Workshop, Paramaribo SURINAME 1 * Christelle Guyon Chargée de mission Direction de Rue Carlos +0594 29 68 60 Christelle.guyon@developpement- biodiversité marine l’Environnement, de Fineley CS 76003, durable.gouv.fr l’Aménagement et 97306 Cayenne du Logement Guyane française de Guyane * Nolwenn Cozannet Chargée du projet WWF France, 2, rue Gustave +0594 31 38 28 [email protected] Dauphin de Guyane bureau Guyane Charlery 97 300 CAYENNE