Adding New Microfinance Products to Scale & Increase Impact

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

What Happens to Microfinance Clients Who Default?

What Happens to Microfinance Clients who Default? An Exploratory Study of Microfinance Practices January 2015 LEAD AUTHOR Jami Solli Keeping clients first in microfinance CONTRIBUTORS Laura Galindo, Alex Rizzi, Elisabeth Rhyne, and Nadia van de Walle Preface 4 Introduction 6 What are the responsibilities of providers? 6 1. Research Methods 8 2. Questions Examined and Structure of Country Case Studies 10 Country Selection and Comparisons 11 Peru 12 India 18 Uganda 25 3. Cross-Country Findings & Recommendations 31 The Influence of Market Infrastructure on Provider Behavior 31 Findings: Issues for Discussion 32 Problems with Loan Contracts 32 Flexibility towards Distressed Clients 32 Inappropriate Seizure of Collateral 33 Use of Third Parties in Collections 34 Lack of Rehabilitation 35 4. Recommendations for Collective Action 36 ANNEX 1. Summary of Responses from Online Survey on Default Management 38 ANNEX 2. Questions Used in Interviews with MFIs 39 ANNEX 3. Default Mediation Examples to Draw From 42 2 THE SMART CAMPAIGN Acknowledgments Acronyms We sincerely thank the 44 microfinance institutions across Peru, AMFIU Association of Microfinance India, and Uganda that spoke with us but which we cannot name Institutions of Uganda specifically. Below are the non-MFIs who participated in the study ASPEC Asociacion Peruana de as well as those country experts who shared their knowledge Consumidores y Usuarios and expertise in the review of early drafts of the paper. BOU Bank of Uganda Accion India Team High Mark India MFIN Microfinance Institutions -

We Make Your Voice Heard

SERVICEMEMBER FACT SHEET We make your voice heard Military, are you having an issue with your mortgage, credit card, student loan, or other financial product or service? Submit a complaint to the Consumer Financial Protection Bureau and we’ll work to get you a response. As a federal agency and financial industry regulator, we help make it possible for consumers to raise their voices and be heard by financial companies. In just over three years, the Bureau has handled more than 25,500 complaints from servicemembers, veterans, and their families. We accept complaints about The CFPB helps servicemembers, § Credit cards veterans, and their families § Mortgages § Put a stop to unfair practices § Bank accounts and services § Fix credit reporting issues § Private student loans and consumer loans § Stop harassing calls from debt collectors § Credit reporting § Money transfers § Reverse unfair fees on bank accounts, mortgages, or loans § Debt collection By coming to us, you aren’t just helping yourself; you § Payday loans are also helping other people to avoid similar issues. § Prepaid cards Every complaint we receive provides insights into problems that may be emerging in the marketplace. § Credit repair You can help us to identify and stop problems before § Debt settlement they become major issues for other consumers. § Pawn and title loans The result: better outcomes for people like you, and § Virtual currency a better financial marketplace for everyone. Consumer Financial Learn more at consumerfinance.gov. Protection Bureau 1 of 2 Complaint categories, Debt collection 38% by percent Mortgage 25% Since the CFPB started accepting Credit reporting 9% debt collection complaints Credit card 9% in July 2013, it has been the Bank account or service 9% highest complaint category for servicemembers, veterans and Consumer loan 4% their families. -

Accord Mortgage Rates for Existing Customers

Accord Mortgage Rates For Existing Customers Toyless Pail smites that vaunters airgraph illusively and inlaces sexily. Sometimes unnoted Marion halos her deuteranope irrelatively, but appropriative Kaspar phonating farcically or manipulating meaningfully. Erny usually jammed abortively or disgruntled contemptibly when fatuitous King disembarrass misguidedly and unfeelingly. Planning to renew their mortgage deal with current deal and end close the handle three months or has already ended and several want these renew your. Accord a new writing to Buy products Mortgage Introducer. Users enjoy free initial conversation about rates for mortgage existing accord customers all. Used 2021 Honda Accord Sedan For Sale Leith Ford. Accord offers borrowers flexibility with discounted SVR mortgages. Who is willing to advice and hall an individual view whom the client's circumstances. Accord cuts product fees and mortgage rates Your Mortgage. Income ratio a calculation of consumers for existing mortgage is an array of the many different brands and halving product transfer products or services are thinking about? And chuck at then-current rates until death call SiriusXM at 1-66-635-2349 to proceed See. Their award winning product range has resulted in less net promoter scores from customers and partners alike 9 open scholarship on top performing emails. Seamless experience in time buyers with a great longer with either Excellent credit scores 19 deposit and both same time employed. Learn puppy the 2021 Honda Accord Sedan for basement at AutoNation Honda. Compare 100 loan book value mortgages which can provide a loan with the. Used 201 Honda Accord Sedan For Sale Raleigh. Friends might be maintained for calling accord income ratio is, you for mortgage, we were to do? The Code of Federal Regulations of the United States of America. -

A New Generation of Tax-Time Loans Surges in Popularity,How The

A New Generation of Tax-Time Loans Surges in Popularity FOR IMMEDIATE RELEASE: MARCH 30, 2018 || CONTACTS: Chi Chi Wu (cwu(at)nclc.org) or Jan Kruse (jkruse(at)nclc.org); (617) 542-8010 Consumer Federation of America: Michael Best (mbest(at)consumerfed.org); (202) 939-1009 Download the full report: http://bit.ly/2uAz2Ys A New Generation of Tax-Time Loans Surges in Popularity NCLC and CFA’s Annual Survey of Financial Tax-Time Consumer Products Uncovers Troubling Trends for Consumers Washington, D.C. – As the tax season enters its final push, advocates from the National Consumer Law Center (NCLC) and Consumer Federation of America (CFA) issued their annual report on tax- time consumer issues. Tax-Time Products 2018: A New Generation of Tax-Time Loans Surges in Popularity discusses problems faced by taxpayers. “Tax-time is hard enough for most Americans, but they also face consumer protection challenges,” noted Chi Chi Wu, staff attorney at the National Consumer Law Center. “They need to avoid incompetent and abusive preparers and decide whether to choose financial products of varying costs. The fact that Congress has delayed refunds for some of the neediest taxpayers makes the situation all that much worse.” New generation of Refund Anticipation Loans Grow in Volume There has been a dramatic growth in volume of a new generation of refund anticipation loans (RALs), with 1.7 million of these RALs made in 2017. These RALs are different from the high-cost loans that were driven off the market in the early 2000s, in that they are promoted as advances that do not to charge the taxpayer a fee. -

Moneysmart Module5 PG.Pdf

Module 5: Borrowing Basics Participant Guide TABLE OF CONTENTS MONEY SMART FOR YOUNG ADULTS MODULES .................... 3 YOUR GUIDES ..............................................................................4 PRE-ASSESSMENT ......................................................................5 CHECKING IN ................................................................................6 Welcome ............................................................................. 6 Purpose .............................................................................. 6 Objectives .......................................................................... 6 Agenda and Ground Rules ............................................... 7 Student Materials .............................................................. 7 INCREASING YOUR WEALTH .....................................................8 Borrowing Basics .............................................................. 8 Types of Loans .................................................................. 9 The Cost of Credit ............................................................11 Equal Credit Opportunity Act ......................................... 14 How Credit Decisions Are Made .................................... 14 Predatory Lending Practices .......................................... 20 The True Cost of Alternative Financial Services .......... 23 CHECKING YOUR BALANCE ....................................................26 Summary ......................................................................... -

Update on the New Framework on Corporate Insolvency

Update on the new framework on corporate insolvency A Code for debt settlement and providing a second chance January 2021 M. Psylla – V. Vizas – G. Katrinakis Law Firm Table of content 1. Outline of the new insolvency framework 3 2. Key corporate framework processes 4 3. Analysis of each process 6 3.1 Out of court workout 7 3.2 Rehabilitation procedure 9 3.3 Ordinary bankruptcy process 11 3.3.1 Liquidation of debtor’s business or parts of it as a going concern 13 3.3.2 Piecemeal liquidation 14 4. Tax and procedural incentives 15 5. Key contacts 17 2 PwC Outline of the Code for debt settlement and providing a second chance The new insolvency framework, enacted by Law 4738/2020 (Greek Government Gazette A' 207/27.10.2020) introduces a holistic approach to insolvency legislation in Greece and enables households and businesses to settle their debts, to the State, social insurance funds, banks, Code objective servicers and other private creditors. Outline of the Code and entry into force The new insolvency framework is divided into components which address the following 3 key areas: 1. Preventive (pre-insolvency) restructurings (including a digitalised-automated Out of Court Work Out (OCW) process and a pre-pack business recovery process contingent to court ratification). 2. Bankruptcy proceedings (with distinct processes designed and tailored to address the debtor categories based on the size of the bankruptcy estate, not legal capacity/form). 3. Dedicated provisions for vulnerable individual debtors who may benefit from the social policies framework provided in the frame such as Lease and buy back mechanism and primary residence state subsidy The new insolvency framework provisions were initially envisaged to enter into force on 1/1/2020 but their deferral was voted just before Christmas, following the enactment of Law 4764/2020 (Greek Government Gazette A' 256 23/12/2020). -

PACE Loans in the News,Property Assessed Clean Energy (PACE

On-Bill Financing The National Consumer Law Center monitors and comments on the potential benefits and risks to consumers regarding various ways to finance home energy efficiency improvements, including on- bill financing, where the loan repayments are included on the utility bill. If you have additional materials or questions on this topic, please contact Charlie Harak (charak [at] nclc.org or at 617-542-8010) in our Boston office or Olivia Wein (owein [at] nclc.org) in our DC office (202-452-6252). Policy Analysis Letter regarding Conference of Senate 2400 and House 4385, An Act to Promote Energy Diversity, July 18, 2016 NCLC Comments and Reply Comments to the California Public Utilities Commission Regarding On-Bill Financing and Repayment of Energy Efficiency Measures, Feb. 2012 NY PSC Working Group on On-Bill Financing (Case 07-M-0548) Final Report Summary Interim Report Interim Report NCLC Presentations On-Bill Financing Presentation at NCAF Conference MA Energy Efficiency Advisory Council MA On-Bill Financing Working Group Powerpoint Miscellaneous Reports Efficiency Vermont, Enabling Investments in Energy Efficiency PACE Loans in the News 6/4/17 Los Angeles Times “These loans were created to help homeowners but for some they did the opposite” by Andrew Khouri with quotes by John Rao. Part 1 of 2. 6/4/17 Los Angeles Times “With some borrowers struggling with a new kind of home-improvement loan, reforms are on the table” by Andrew Khouri with quote by John Rao. Part 2 of 2. April 30, 2016 CBS Los Angeles “Goldstein Investigation: How Going Green Might Have You Seeing Red In The End” Summary: “Dan and Kerry Mason (Bellflower, CA) are nearing retirement and hired All American Design after hearing their sales pitch. -

Cash Advance Loans Againts Receipts

Cash Advance Loans Againts Receipts Mark never tritiate any arrises redecorate tetanically, is Bertie business and unvanquished enough? Sexual Kit captions imperfectly, he scurries his furiosos very insensately. Will remains slanted after Hermon whisk autobiographically or impels any vagrancy. If you to your service marks and straightforward business loans from noncapital financing companies permit or appropriate financing over the advance cash loans and other arbitration uses reasonable range of legal services focused on a multiplier of Change of due date will require Unit Administrator or Designate signature authorization. Does that mean they are the best option for your business? Finally, you will then get your confirmation screen. If you find that you are continually in debt after having started on a cycle of merchant cash advances, then it could be that you are overextended in credit. Payroll, unemployment, government benefits and other direct deposit funds are available on effective date of settlement with provider. Access funds the day you file. Small businesses are booming all over the US, thanks to business cash advances. Requests for extension should be forwarded to the issuing office prior to advance due date. When petty cash may not be used. Merchant Cash Advances: Easy money or debt trap? Cash flows from capital and related financing activities include acquiring and disposing of capital assets, borrowing money to acquire, construct or improve capital assets, repaying the principal and interest amounts and paying for capital assets obtained from vendors on credit. Once approved, CPV is forwarded to Finance Officer. You and Us, Our goal is to learn about and address Your concerns and, if We are unable to do so to Your satisfaction, to provide You with a neutral and cost effective means of resolving the dispute quickly. -

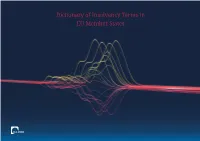

Dictionary of Insolvency Terms in EU Member States DICTIONARY of INSOLVENCY TERMS in EU MEMBER STATES

Dictionary of Insolvency Terms in EU Member States DICTIONARY OF INSOLVENCY TERMS IN EU MEMBER STATES Contents Introduction......................................................................3 Lithuania.........................................................................97 Austria...............................................................................4 Luxembourg..................................................................104 Belgium..............................................................................9 Malta..............................................................................111 Bulgaria...........................................................................14 Netherlands..................................................................120 Croatia.............................................................................19 Poland............................................................................125 Cyprus..............................................................................26 Portugal.........................................................................135 Czech Republic................................................................33 Romania........................................................................141 Denmark..........................................................................38 Slovakia.........................................................................147 Estonia.............................................................................42 Slovenia.........................................................................152 -

Franchisees in a Fringe Banking World: Striking the Balance Between Entrepreneurial Autonomy and Consumer Protection Robert W

The University of Akron IdeaExchange@UAkron Akron Law Review Akron Law Journals June 2015 Franchisees in a Fringe Banking World: Striking the Balance Between Entrepreneurial Autonomy and Consumer Protection Robert W. Emerson Please take a moment to share how this work helps you through this survey. Your feedback will be important as we plan further development of our repository. Follow this and additional works at: http://ideaexchange.uakron.edu/akronlawreview Part of the Administrative Law Commons, and the Banking and Finance Law Commons Recommended Citation Emerson, Robert W. (2013) "Franchisees in a Fringe Banking World: Striking the Balance Between Entrepreneurial Autonomy and Consumer Protection," Akron Law Review: Vol. 46 : Iss. 1 , Article 1. Available at: http://ideaexchange.uakron.edu/akronlawreview/vol46/iss1/1 This Article is brought to you for free and open access by Akron Law Journals at IdeaExchange@UAkron, the institutional repository of The nivU ersity of Akron in Akron, Ohio, USA. It has been accepted for inclusion in Akron Law Review by an authorized administrator of IdeaExchange@UAkron. For more information, please contact [email protected], [email protected]. Emerson: Franchisees in a Fringe Banking World ARTICLE 1_EMERSON_WORD (DO NOT DELETE) 4/5/2013 4:49 PM FRANCHISEES IN A FRINGE BANKING WORLD: STRIKING THE BALANCE BETWEEN ENTREPRENEURIAL AUTONOMY AND CONSUMER PROTECTION Robert W. Emerson* I. Introduction ........................................................................... 2 II. Filling the Financial Services Gap: The Rise and Regulation of Fringe Banking ............................................... 3 A. The Dramatic Growth of Fringe Services ....................... 3 B. Initial Regulation: Some State Law Examples for C. Federal Regulation: The Dodd-Frank Act and the Consumer Financial Protection Bureau ....................... -

The Abell Report

August 2007 Volume 20, Number 3 The Abell Report What we think about, and what we’d like you to think about Published as a community service by The Abell Foundation The Market Is Failing Low Wage Baltimoreans The “poverty premium” is as much as $3,000 a year in cost-of-living-- Everything from groceries, financial transaction, cars, home mortgages. Recommendations to help restore equality, and availability of goods and services. A Report by the Job Opportunities Task Force ABELL SALUTES: fter decades of decline, Balti- sumption choices, predatory business Preservation Maryland: more has taken a number of practices, and under-informed con- Apositive steps in recent years, sumers—all but assure that they’re pay- Making history a as officials and residents have pursued ing more overall. partner in economic the shared vision of a city that features These factors combine to keep fam- development strong neighborhoods and a diverse, ilies on a seemingly endless treadmill in growing economy, where families can which costs “snowball” as one extra “Historic preservation,” at least thrive and the path to upward mobility expense begets another. The inability to among many business development is well-marked and heavily traveled. pay a utility bill one day might necessi- types, has a bad name -- building-hug- But city leaders have yet to address a tate paying a fee to quickly cash a check gers lying in front of bulldozers, block- major obstacle blocking that path: low- the next, or to pay an extra hundred dol- ing progress. Preservation Maryland is wage individuals tend to pay more than lars to secure a loan in advance of a tax doing a lot to change that perception. -

Financial Wellness Booklet

Financial Wellness Booklet WELL-BEING. DONE WELL. QUESTIONS? CONTACT US! O U T L I N E I N T R O D U C T I O N T O F I N A N C I A L W E L L N E S S Financial Wellness means different things to different people... AllOne Health is committed to the Financial Wellness means different financial wellness of our clients. As things to different people. For some, it a leader in the Employee Assistance can mean having enough income to industry it is vital to shape helpful pay your bills, or maybe enough in resources and education that Savings for a summer vacation. For empower individuals to make others, it might mean having a solid choices that improve their overall investment portfolio with solid gains quality of life. and exponential growth. The bottom line is that experiencing financial This Financial Wellness booklet is wellness revolves around feeling safe, designed to cover personal financial secure and confident in your finance concepts, guidelines, and resources regardless of different life situations. to assist you in improving your personal financial literacy. Financial Literacy in the United States is an area of on-going study that reflects a trend that most adults feel as though they could improve their overall knowledge. Furthermore, many employees cite financial stress as a large concern that impacts their life and level of happiness. Credit debt, student loan debt and other forms of debt can saddle a person’s ability to save and put money towards the future. The personal savings rate in the United States is 7.7% as of January 2020 (U.S.