Greater Boston

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Songs by Title Karaoke Night with the Patman

Songs By Title Karaoke Night with the Patman Title Versions Title Versions 10 Years 3 Libras Wasteland SC Perfect Circle SI 10,000 Maniacs 3 Of Hearts Because The Night SC Love Is Enough SC Candy Everybody Wants DK 30 Seconds To Mars More Than This SC Kill SC These Are The Days SC 311 Trouble Me SC All Mixed Up SC 100 Proof Aged In Soul Don't Tread On Me SC Somebody's Been Sleeping SC Down SC 10CC Love Song SC I'm Not In Love DK You Wouldn't Believe SC Things We Do For Love SC 38 Special 112 Back Where You Belong SI Come See Me SC Caught Up In You SC Dance With Me SC Hold On Loosely AH It's Over Now SC If I'd Been The One SC Only You SC Rockin' Onto The Night SC Peaches And Cream SC Second Chance SC U Already Know SC Teacher, Teacher SC 12 Gauge Wild Eyed Southern Boys SC Dunkie Butt SC 3LW 1910 Fruitgum Co. No More (Baby I'm A Do Right) SC 1, 2, 3 Redlight SC 3T Simon Says DK Anything SC 1975 Tease Me SC The Sound SI 4 Non Blondes 2 Live Crew What's Up DK Doo Wah Diddy SC 4 P.M. Me So Horny SC Lay Down Your Love SC We Want Some Pussy SC Sukiyaki DK 2 Pac 4 Runner California Love (Original Version) SC Ripples SC Changes SC That Was Him SC Thugz Mansion SC 42nd Street 20 Fingers 42nd Street Song SC Short Dick Man SC We're In The Money SC 3 Doors Down 5 Seconds Of Summer Away From The Sun SC Amnesia SI Be Like That SC She Looks So Perfect SI Behind Those Eyes SC 5 Stairsteps Duck & Run SC Ooh Child SC Here By Me CB 50 Cent Here Without You CB Disco Inferno SC Kryptonite SC If I Can't SC Let Me Go SC In Da Club HT Live For Today SC P.I.M.P. -

Stepstone Atlantic Fund, L.P

StepStone Atlantic Fund, L.P. Private Equity and Infrastructure Quarterly Monitoring Report For the period ending December 31, 2020 Report Prepared For: Important Information This document is meant only to provide a broad overview for discussion purposes. All information provided here is subject to change. This document is for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation for any security, or as an offer to provide advisory or other services by StepStone Group LP, StepStone Group Real Assets LP, StepStone Group Real Estate LP, StepStone Conversus LLC, Swiss Capital Alternative Investments AG and StepStone Group Europe Alternative Investments Limited or their subsidiaries or affiliates (collectively, “StepStone”) in any jurisdiction in which such offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. The information contained in this document should not be construed as financial or investment advice on any subject matter. StepStone expressly disclaims all liability in respect to actions taken based on any or all of the information in this document. This document is confidential and solely for the use of StepStone and the existing and potential clients of StepStone to whom it has been delivered, where permitted. By accepting delivery of this presentation, each recipient undertakes not to reproduce or distribute this presentation in whole or in part, nor to disclose any of its contents (except to its professional advisors), without the prior written consent of StepStone. While some information used in the presentation has been obtained from various published and unpublished sources considered to be reliable, StepStone does not guarantee its accuracy or completeness and accepts no liability for any direct or consequential losses arising from its use. -

1988 Cheap Trick Ricky Skaggs Roy Clark Highwat 101

1988 CHEAP TRICK RICKY SKAGGS ROY CLARK HIGHWAT 101/SWEETHEARTS OF THE RODEO DEL SHANNON MISS VALLEY FAIR CONTEST 1989 NITTY GRITTY DIRT BAND TANYA TUCKER 38 SPECIAL STATLERS THREE DOG NIGHT MISS VALLEY FAIR CONTEST 1990 SAWYER BROWN CLINT BLACK THE BELLAMY BROTHERS THE OAKRIDGE BOYS BELINDA CARLISLE OLIE ANDERSON THRILL SHOW 1991 KENTUCKY HEAD HUNTERS WINGER RESTLESS HEART/BAILLEE & BOYS TRAVIS TRITT THE STATLERS TRACTOR PULL 1992 KATHY MATTEA REO SPEEDWAGON VINCE GILL CHARLIE DANIELS BROOKS & DUNN/MARTY BROWN TRACTOR PULL 1993 PAM TILLIS/CHRIS LEDOUX SAWYER BROWN BILLY DEAN BROOKS & DUNN JOHN ANDERSON RESTLESS HEART 1994 MARK CHESTNUTT OAKRIDGE BOYS PATTY LOVELESS CONFEDERATE RAILROAD CHARLIE DANIELS 1995 JOE DIFFEE RICK TREVINO COLLIN RAY SUZY BOGGUSS KANSAN/RARE EARTH TIM MCGRAW 1996 PAM TILLIS TRISHA YEARWOOD SAMMY KERSHAW SAWYER BROWN LITTLE TEXAS ROY CLARK 1997 ALABAMA ALABAMA BRYAN WHITE MARK CHESTNUTT BLACKHAWK TOBY KEITH 1998 CLAY WALKER LYNYRD SKYNYRD CLINT BLACK DIAMOND RIO MICHAEL PETERSON & THE KINLEYS LEE ANN WOMACK 1999 JOHN MICHAEL MONTGOMERY MARTINA MCBRIDE DEF LEPPARD AARON TIPPIN RICKY VAN SHELTON GLEN CAMPBELL 2000 TRACY LAWRENCE SAWYER BROWN NEAL MCCOY STYX MONTGOMERY GENTRY GEORGE JONES 2001 RANDY TRAVIS LONESTAR CLAY WALKER KANSAS PHIL VASSAR CHARLIE DANIELS 2002 ROCKIN ROADHOUSE TOUR-JOE DIFFEE, TRACY LAWRENCE, MARK CHESTNUTT TRICK PONY KENNY CHESNEY POISON ALABAMA CHELY WRIGHT 2003 SAWYER BROWN NEAL MCCOY TRAVIS TRITT SURVIVOR/STARSHIP MARTINA MCBRIDE RONNIE MILSAP 2004 DIERKS BENTLEY GATLIN BROTHERS BROOKS AND -

Venture Capital and the Finance of Innovation, Second Edition

This page intentionally left blank VENTURE CAPITAL & THE FINANCE OF INNOVATION This page intentionally left blank VENTURE CAPITAL & THE FINANCE OF INNOVATION SECOND EDITION ANDREW METRICK Yale School of Management AYAKO YASUDA Graduate School of Management, UC Davis John Wiley & Sons, Inc. EDITOR Lacey Vitetta PROJECT EDITOR Jennifer Manias SENIOR EDITORIAL ASSISTANT Emily McGee MARKETING MANAGER Diane Mars DESIGNER RDC Publishing Group Sdn Bhd PRODUCTION MANAGER Janis Soo SENIOR PRODUCTION EDITOR Joyce Poh This book was set in Times Roman by MPS Limited and printed and bound by Courier Westford. The cover was printed by Courier Westford. This book is printed on acid free paper. Copyright 2011, 2007 John Wiley & Sons, Inc. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning or otherwise, except as permitted under Sections 107 or 108 of the 1976 United States Copyright Act, without either the prior written permission of the Publisher, or authorization through payment of the appropriate per-copy fee to the Copyright Clearance Center, Inc. 222 Rosewood Drive, Danvers, MA 01923, website www.copyright.com. Requests to the Publisher for permission should be addressed to the Permissions Department, John Wiley & Sons, Inc., 111 River Street, Hoboken, NJ 07030-5774, (201)748-6011, fax (201)748-6008, website http://www.wiley.com/go/permissions. Evaluation copies are provided to qualified academics and professionals for review purposes only, for use in their courses during the next academic year. These copies are licensed and may not be sold or transferred to a third party. -

Preqin and Nevca Update: New England Venture Capital in 2017

PREQIN AND NEVCA UPDATE: NEW ENGLAND VENTURE CAPITAL IN 2017 In association with PREQIN AND NEVCA UPDATE: NEW ENGLAND VENTURE CAPITAL IN 2017 FOREWORD ith this report, the New England Venture Capital Association (NEVCA) is thrilled to welcome Preqin as our 2018 Data Partner. While WNEVCA quarterly reports have traditionally examined general regional activity with an eye toward portfolio-related data, Preqin’s depth of information and expertise in both the fund performance and LP space enables a new approach. This report, and subsequent 2018 quarterly publications, will feature a tighter focus on fund performance, investor activity and fundraising, with sector-specific breakouts and highlights. The return of NEVCA quarterly reports is a component of a larger organizational initiative to bring awareness to the scale and success of the regional venture capital industry, while also providing meaningful insight for those within the ecosystem. Some initial takeaways from the data: ■ New England skews Seed, with 31% of funds closed in the past decade raising under $100mn. ■ New England fundraises above weight class, accounting for nearly a quarter of national venture capital commitments since 2007. ■ And appetite is growing, with a record 70 firms currently fundraising (in stark contrast to the 10-year average of 40). ■ Continuing trend: cash invested on the rise as deal counts fall. While each of the above bullets is expounded upon in the following report, there is a wealth of data yet to be leveraged. As you read further, consider areas to expand: What additional data would be useful? Is anything extraneous? What components should be further developed? Your feedback is welcome! Sincerely, Jody Rose President, New England Venture Capital Association PREQIN’S VENTURE CAPITAL DATA AND INTELLIGENCE Preqin tracks all aspects of the venture capital industry, with comprehensive data on institutional investors, fundraising, fund managers, fund terms and conditions, fund performance, deals and exits, service providers and more. -

1 JAMES OTTO Just Got Started Lovin' You 2 TRACE

TOP100 OF 2008 1 JAMES OTTO Just Got Started Lovin' You (Warner Bros.) 51 GEORGE STRAIT How 'Bout Them Cowgirls (MCA) 2 TRACE ADKINS You're Gonna Miss This (Capitol) 52 BROOKS & DUNN God Must Be Busy (Arista) 3 RODNEY ATKINS Cleaning This Gun (Come...) (Curb) 53 BUCKY COVINGTON It's Good To Be Us (Lyric Street) 4 CHRIS CAGLE What Kinda Gone (Capitol) 54 CLAY WALKER Fall (Curb) 5 GEORGE STRAIT I Saw God Today (MCA) 55 HEIDI NEWFIELD Johnny And June (Curb) 6 ALAN JACKSON Small Town Southern Man (Arista) 56 JOSH TURNER f/ T . Y E A R W O O D Another Try (MCA) 7 BRAD PAISLEY Letter To Me (Arista) 57 JASON MICHAEL CARROLL Livin' Our Love Song (Arista) 8 BLAKE SHELTON Home (Warner Bros.) 58 CARRIE UNDERWOOD So Small (19/Arista) 9 BRAD PAISLEY I'm Still A Guy (Arista) 59 CHUCK WICKS All I Ever Wanted (RCA) 10 PHIL VASSAR Love Is A Beautiful Thing (Universal South) 60 GARTH BROOKS More Than A Memory (Pearl/Big Machine) 11 GARY ALLAN Watching Airplanes (MCA) 61 TIM MCGRAW Let It Go (Curb) 12 TAYLOR SWIFT Our Song (Big Machine) 62 BUCKY COVINGTON I'll Walk (Lyric Street) 13 LADY ANTEBELLUM Love Don't Live Here (Capitol) 63 CRAIG MORGAN Love Remembers (BNA) 14 KEITH ANDERSON I Still Miss You (Columbia) 64 JAKE OWEN Something About A Woman (RCA) 15 KENNY CHESNEY Don't Blink (BNA) 65 GARY ALLAN Learning How To Bend (MCA) 16 CARRIE UNDERWOOD All-American Girl (19/Arista) 66 JEWEL Stronger Woman (Valory) 17 ALAN JACKSON Good Time (Arista) 67 ZAC BROWN BAND Chicken Fried (Atlantic/Home Grown/BPP) 18 MONTGOMERY GENTRY Back When I Knew It All (Columbia) 68 JAMEY JOHNSON In Color (Mercury) 19 RASCAL FLATTS Winner At A Losing Game (Lyric Street) 69 MONTGOMERY GENTRY Roll With Me (Columbia) 20 JIMMY WAYNE Do You Believe Me Now (Valory) 70 TOBY KEITH Get My Drink On (Show Dog) 21 DARIUS RUCKER Don't Think I Don't Think.. -

112 It's Over Now 112 Only You 311 All Mixed up 311 Down

112 It's Over Now 112 Only You 311 All Mixed Up 311 Down 702 Where My Girls At 911 How Do You Want Me To Love You 911 Little Bit More, A 911 More Than A Woman 911 Party People (Friday Night) 911 Private Number 10,000 Maniacs More Than This 10,000 Maniacs These Are The Days 10CC Donna 10CC Dreadlock Holiday 10CC I'm Mandy 10CC I'm Not In Love 10CC Rubber Bullets 10CC Things We Do For Love, The 10CC Wall Street Shuffle 112 & Ludacris Hot & Wet 1910 Fruitgum Co. Simon Says 2 Evisa Oh La La La 2 Pac California Love 2 Pac Thugz Mansion 2 Unlimited No Limits 20 Fingers Short Dick Man 21st Century Girls 21st Century Girls 3 Doors Down Duck & Run 3 Doors Down Here Without You 3 Doors Down Its not my time 3 Doors Down Kryptonite 3 Doors Down Loser 3 Doors Down Road I'm On, The 3 Doors Down When I'm Gone 38 Special If I'd Been The One 38 Special Second Chance 3LW I Do (Wanna Get Close To You) 3LW No More 3LW No More (Baby I'm A Do Right) 3LW Playas Gon' Play 3rd Strike Redemption 3SL Take It Easy 3T Anything 3T Tease Me 3T & Michael Jackson Why 4 Non Blondes What's Up 5 Stairsteps Ooh Child 50 Cent Disco Inferno 50 Cent If I Can't 50 Cent In Da Club 50 Cent In Da Club 50 Cent P.I.M.P. (Radio Version) 50 Cent Wanksta 50 Cent & Eminem Patiently Waiting 50 Cent & Nate Dogg 21 Questions 5th Dimension Aquarius_Let the sunshine inB 5th Dimension One less Bell to answer 5th Dimension Stoned Soul Picnic 5th Dimension Up Up & Away 5th Dimension Wedding Blue Bells 5th Dimension, The Last Night I Didn't Get To Sleep At All 69 Boys Tootsie Roll 8 Stops 7 Question -

Songs by Artist

Songs by Artist Title Title (Hed) Planet Earth 2 Live Crew Bartender We Want Some Pussy Blackout 2 Pistols Other Side She Got It +44 You Know Me When Your Heart Stops Beating 20 Fingers 10 Years Short Dick Man Beautiful 21 Demands Through The Iris Give Me A Minute Wasteland 3 Doors Down 10,000 Maniacs Away From The Sun Because The Night Be Like That Candy Everybody Wants Behind Those Eyes More Than This Better Life, The These Are The Days Citizen Soldier Trouble Me Duck & Run 100 Proof Aged In Soul Every Time You Go Somebody's Been Sleeping Here By Me 10CC Here Without You I'm Not In Love It's Not My Time Things We Do For Love, The Kryptonite 112 Landing In London Come See Me Let Me Be Myself Cupid Let Me Go Dance With Me Live For Today Hot & Wet Loser It's Over Now Road I'm On, The Na Na Na So I Need You Peaches & Cream Train Right Here For You When I'm Gone U Already Know When You're Young 12 Gauge 3 Of Hearts Dunkie Butt Arizona Rain 12 Stones Love Is Enough Far Away 30 Seconds To Mars Way I Fell, The Closer To The Edge We Are One Kill, The 1910 Fruitgum Co. Kings And Queens 1, 2, 3 Red Light This Is War Simon Says Up In The Air (Explicit) 2 Chainz Yesterday Birthday Song (Explicit) 311 I'm Different (Explicit) All Mixed Up Spend It Amber 2 Live Crew Beyond The Grey Sky Doo Wah Diddy Creatures (For A While) Me So Horny Don't Tread On Me Song List Generator® Printed 5/12/2021 Page 1 of 334 Licensed to Chris Avis Songs by Artist Title Title 311 4Him First Straw Sacred Hideaway Hey You Where There Is Faith I'll Be Here Awhile Who You Are Love Song 5 Stairsteps, The You Wouldn't Believe O-O-H Child 38 Special 50 Cent Back Where You Belong 21 Questions Caught Up In You Baby By Me Hold On Loosely Best Friend If I'd Been The One Candy Shop Rockin' Into The Night Disco Inferno Second Chance Hustler's Ambition Teacher, Teacher If I Can't Wild-Eyed Southern Boys In Da Club 3LW Just A Lil' Bit I Do (Wanna Get Close To You) Outlaw No More (Baby I'ma Do Right) Outta Control Playas Gon' Play Outta Control (Remix Version) 3OH!3 P.I.M.P. -

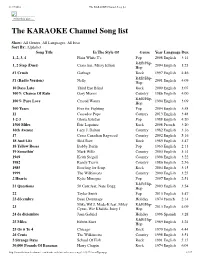

The KARAOKE Channel Song List

11/17/2016 The KARAOKE Channel Song list Print this List ... The KARAOKE Channel Song list Show: All Genres, All Languages, All Eras Sort By: Alphabet Song Title In The Style Of Genre Year Language Dur. 1, 2, 3, 4 Plain White T's Pop 2008 English 3:14 R&B/Hip- 1, 2 Step (Duet) Ciara feat. Missy Elliott 2004 English 3:23 Hop #1 Crush Garbage Rock 1997 English 4:46 R&B/Hip- #1 (Radio Version) Nelly 2001 English 4:09 Hop 10 Days Late Third Eye Blind Rock 2000 English 3:07 100% Chance Of Rain Gary Morris Country 1986 English 4:00 R&B/Hip- 100% Pure Love Crystal Waters 1994 English 3:09 Hop 100 Years Five for Fighting Pop 2004 English 3:58 11 Cassadee Pope Country 2013 English 3:48 1-2-3 Gloria Estefan Pop 1988 English 4:20 1500 Miles Éric Lapointe Rock 2008 French 3:20 16th Avenue Lacy J. Dalton Country 1982 English 3:16 17 Cross Canadian Ragweed Country 2002 English 5:16 18 And Life Skid Row Rock 1989 English 3:47 18 Yellow Roses Bobby Darin Pop 1963 English 2:13 19 Somethin' Mark Wills Country 2003 English 3:14 1969 Keith Stegall Country 1996 English 3:22 1982 Randy Travis Country 1986 English 2:56 1985 Bowling for Soup Rock 2004 English 3:15 1999 The Wilkinsons Country 2000 English 3:25 2 Hearts Kylie Minogue Pop 2007 English 2:51 R&B/Hip- 21 Questions 50 Cent feat. Nate Dogg 2003 English 3:54 Hop 22 Taylor Swift Pop 2013 English 3:47 23 décembre Beau Dommage Holiday 1974 French 2:14 Mike WiLL Made-It feat. -

Final Rule: Exemptions for Advisers to Venture Capital Funds

SECURITIES AND EXCHANGE COMMISSION 17 CFR Part 275 Release No. IA-3222; File No. S7-37-10 RIN 3235-AK81 Exemptions for Advisers to Venture Capital Funds, Private Fund Advisers With Less Than $150 Million in Assets Under Management, and Foreign Private Advisers AGENCY: Securities and Exchange Commission. ACTION: Final rule. SUMMARY: The Securities and Exchange Commission (the ―Commission‖) is adopting rules to implement new exemptions from the registration requirements of the Investment Advisers Act of 1940 for advisers to certain privately offered investment funds; these exemptions were enacted as part of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the ―Dodd- Frank Act‖). As required by Title IV of the Dodd-Frank Act – the Private Fund Investment Advisers Registration Act of 2010 – the new rules define ―venture capital fund‖ and provide an exemption from registration for advisers with less than $150 million in private fund assets under management in the United States. The new rules also clarify the meaning of certain terms included in a new exemption from registration for ―foreign private advisers.‖ DATES: Effective Date: July 21, 2011. FOR FURTHER INFORMATION CONTACT: Brian McLaughlin Johnson, Tram N. Nguyen or David A. Vaughan, at (202) 551-6787 or <[email protected]>, Division of Investment Management, U.S. Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-8549. SUPPLEMENTARY INFORMATION: The Commission is adopting rules 203(l)-1, 203(m)-1 and 202(a)(30)-1 (17 CFR 275.203(l)-1, 275.203(m)-1 and 275.202(a)(30)-1) under the - 2 - Investment Advisers Act of 1940 (15 U.S.C. -

Christmas O Christmas Tree Christmas O Come All Ye Faithful

Christmas O Christmas Tree Christmas O come All Ye Faithful Christmas O Come O Come Emmanuel Celine Dion O Holy Night Christmas O Holy Night Tevin Campbell O Holy Night Christmas O Little Town of Bethlehem Christmas O Tannenbaum Shakira Objection Beatles Ob-La-Di, Ob-La-Da Animotion Obsession Frankie J. & Baby Bash Obsession (No Es Amor) [Karaoke] Christina Obvious Yellowcard Ocean Avenue Billie Eilish Ocean Eyes Billie Eilish Ocean Eyes George Strait Ocean Front Property Bobbie Gentry Ode To Billy Joe Adam Sandler Ode To My Car Cranberries Ode To My Family Alabama Of Course I'm Alright Michael Jackson Off The Wall Lana Del Rey Off To The Races Dave Matthews Oh Buddy Holly Oh Boy Neil Sedaka Oh Carol Shaggy Oh Carolina Beatles Oh Darling Madonna Oh Father Paul Young Oh Girl Sister Act Oh Happy Day Larry Gatlin Oh Holy Night Vanessa Williams Oh How The Years Go By Ulf Lundell oh la la Don Gibson Oh Lonesome Me Brad Paisley & Carrie Underwood Oh Love (Duet) Diamond Rio Oh Me Oh My Sweet Baby Stampeders Oh My Lady Roy Orbison Oh Pretty Woman Ready For the world Oh Sheila Steve Perry Oh Sherrie Childrens Oh Susanna Blessed Union of Souls Oh Virginia Frankie Valli Oh What A Night (December '63) Big Tymers & Gotti & Boo & Tateeze Oh Yeah! [Karaoke] Wiseguys Ohh la la Linda Ronstadt Ohhh Baby Baby Crosby Stills Nash and Young Ohio Merle Haggard Okie From Muskogee Billy Gilman Oklahoma [Karaoke] Reba McEntire and Vince gill Oklahoma Swing Eagles Ol 55 Randy Travis Old 8X10 Brad Paisley Old Alabama Kenny Chesney Old Blue Chair Jim Reeves Old Christmas Card Nickelback Old Enough Three Dog Night Old Fashioned Love Song Alabama Old Flame Dolly Parton Old Flames Can't Hold A Candle To You Mark Chesnutt Old Flames Have New Names Phil Stacey Old Glory Eric Clapton Old Love Childrens Old MacDonald Hootie and the Blowfish Old Man & Me Bob Seger Old Time Rock & Roll Tanya Tucker Old Weakness George Micheal Older Cherie Older Than My Years Trisha Yearwood On A Bus To St. -

Oct. 8, at 10 A.M

Dorchester Reporter “The News and Values Around the Neighborhood” Volume 37 Issue 41 Thursday, October 8, 2020 50¢ One last Mass, then St. Matthew Church is shuttered after 97 years of services BY BILL FORRY The combined parish will now gather exclusively at EDITOR the St. Angela church building on Blue Hill Avenue in St. Matthew Church has closed its doors, appar- Mattapan Square for liturgies, funerals, marriages, ently forever. The building on Stanton Street in and other services. Dorchester, which has been a worship space for Fr. Paul Soper, a priest who runs the Archdiocese Catholics since 1923, held its final Mass last Sunday, of Boston’s pastoral planning office, said that a group according to the Archdiocese of Boston. of parishioners along with their pastor, Rev. Garcia The move comes three months after St. Matthew Breneville, made the decision recently. It went into and St. Angela parishes— both with predominantly effect on Oct. 1, he said. Haitian congregations in recent years— merged to “The decision to move to a single church was made form a single new entity, Our Lady of Carmel parish. (Continued on page 15) Covid ‘uptick’ ongoing concern in Boston, says Walsh; Dot areas noted BY KATIE TROJANO during a Oct. 2 press availabil- REPORTER STAFF ity outside of City Hall. During a week in which Walsh had a crisp reaction the nation absorbed the news to the outbreak of the corona- that the president and the virus at the White House: “If first lady had tested positive he can get it with all of the for Covid-19, Mayor Walsh protections around him, it just warned that Bostonians must shows that no one is safe and continue to be vigilant about anyone can get it.” viral spread, noting that here Boston officials have been has been “an uptick in the closely monitoring the city’s city over the last few weeks,” positive rate and trends, the with two Dorchester zip codes mayor said.