Printmgr File

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Urgent Action

UA: 190/17 Index: ASA 17/6887/2017 China Date: 7 August 2017 URGENT ACTION SIX ACTIVISTS DETAINED FOR LIU XIAOBO MEMORIAL Wei Xiaobing, He Lin, Liu Guangxiao, Li Shujia, Wang Meiju and Qin Mingxin have been criminally detained on suspicion of “assembling a crowd to disturb social order” after they held a seaside memorial for deceased Nobel Peace Prize laureate Liu Xiaobo in Jiangmen, Guangdong province. Guangdong activists Wei Xiaobing (aka “1.3 billion citizens”), He Lin, Liu Guangxiao, Li Shujia, Wang Meiju and Qin Mingxin have been taken away by police and had their homes raided several days after they conducted a seaside memorial for Liu Xiaobo on 19 July 2017 to mark the seventh day after the Nobel Peace Prize’s death. Broadcasted live by Hong Kong Cable TV, the activists brought a chair, some flowers and chanted slogans, including “Liu Xiaobo, Rest in Peace” and “Free Liu Xia”, to pay tribute to Liu Xiaobo and support his wife Liu Xia during the memorial. They later uploaded the video and photos of the action on social media. All six activists are being criminally detained at the Xinhui District Detention Centre in Jiangmen city, Guangdong province on suspicion of “assembling a crowd to disturb social order”. According to Wei Xiaobing’s lawyer, who met with him on 26 July 2017, he was taken away from his home in Jieshi Town, Lufeng city, Guangdong province, at around 1am on 22 July. Later that same morning, at around 4am, He Lin, Liu Guangxiao and Li Shujia were also taken away from their homes by police from Xinhui District, Jiangmen city. -

Vertical Metal F'ile Cabinets

Barcode:3827074-03 C-570-111 INV - Investigation - CHINESE EXPORTERS AND PRODUCERS OF VERTICAL METAL F'ILE CABINETS Best Beaufy Furniture Co., Ltd. Feel Life Co., Ltd. Lianping Industry Zone, Dalingshan Town Room 202, Deweisen Building Dongguan, Guangdon g, 523809 Nanshan District, Shenzhen Tel: +86 769-85623639 1sf ¡ +86 7 55-66867080-8096 Fax: +86 769-85628609 Fax: +86 755-86146992 Email: N/A Email : [email protected] Website: Website : www. feellife. com www. d gbestbeauty. company. weiku. com/ Fujian lvyer Industrial Co., Ltd. Chung \ilah Steel Furniture Factory Co., Yangxia Village, Guhuai Town Lrd. Changle, Fujian, 350207 Block A,7lF Chinaweal Centre Tel: +86 59128881270 414-424 Jaffe Road, Wanchai Fax: +86 59128881315 Hong Kong Email : nancy @flivyer. com Tel: +85 228930378 Website : www. ivyer.net. cnl Fax: +85 228387626 Email: N/A Fuzhou Nu Deco Crafts Co., Ltd. Website : http ://chungwah. com.hk/ 1306 Xinxing Building No. 41, Bayiqi Mid. Road Concept Furniture (Anhui) Co.' Ltd. Fuzhou, Fujian, 350000 Guangde Economic and Technical Tel: +86 591-87814422 Developm ent Zone, Guangde County P¿¡; +86 591-87814424 Anhui, Xuancheng, 242200 Email: [email protected] Tel: 865-636-0131 Website : http :/inu-deco.cnl Fax: 865-636-9882 Email: N/A Fuzhou Yibang Furniture Co., Ltd. Website: N/A No. 85-86 Building Changle Airport Industrial Zone Dong Guan Shing Fai X'urniture Hunan Town, Changle 2nd Industrial Area Fujian, Fuzhou, 350212 Shang Dong Administrative Dist. fsf; +86 591-28637056 Qishi, Dongguan, Guangdong, 523000 Fax: +86 591-22816378 Tel: +86 867592751816 Email: N/A Fax: N/A V/ebsite : htþs ://fi yb. -

SCHOLAR EDUCATION GROUP 思 考 樂 教 育 集 團 (Incorporated in the Cayman Islands with Limited Liability) (Stock Code: 1769)

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. SCHOLAR EDUCATION GROUP 思 考 樂 教 育 集 團 (Incorporated in the Cayman Islands with limited liability) (Stock Code: 1769) CONNECTED TRANSACTIONS TENANCY AGREEMENTS THE NOVEMBER 2020 CRV AGREEMENTS The Group is continuously identifying suitable premises for its business expansion. The Board is pleased to announce that, further to the December 2019 CRV Agreements, the April 2020 CRV Agreement and the May 2020 CRV Agreement, the Group has again cooperated with CR Vanguard (a state-owned enterprise with nearly 220,000 employees, and a leading retailer and operator of commercial properties with a mature, extensive business network of over 3,100 retail stores under its ownership in more than 240 cities across the PRC), and entered into the November 2020 CRV Agreements for the rental of four premises in (i) Huadu District, Guangzhou, (ii) Xiangzhou District, Zhuhai, (iii) Torch Hi-Tech Industrial Development Zone, Zhongshan and (iv) Shunde District, Foshan, respectively, with a view to developing and operating new learning centres. The Board considers that such premises would be conducive to the Group in strengthening its market leading presence in Guangdong-Hong Kong-Macau Greater Bay Area, and the entering into of the November 2020 CRV Agreements signify the development of the Group’s strategic cooperation with CREG (a substantial shareholder of the Company) and CR Vanguard. -

Surface Deformation Evolution in the Pearl River Delta Between 2006 and 2011 Derived from the ALOS1/PALSAR Images

Surface Deformation Evolution in the Pearl River Delta between 2006 and 2011 derived from the ALOS1/PALSAR images Genger Li Guangdong Institute of Surveying and Mapping of Geology Guangcai Feng ( [email protected] ) Central South University Zhiqiang Xiong Central South University Qi Liu Central South University Rongan Xie Guangdong Institute of Surveying and Mapping of Geology Xiaoling Zhu Guangdong Institute of Surveying and Mapping of Geology Shuran Luo Central South University Yanan Du Guangzhou University Full paper Keywords: Pearl River Delta, natural evolution, surface subsidence, SBAS-InSAR Posted Date: October 30th, 2020 DOI: https://doi.org/10.21203/rs.3.rs-32256/v2 License: This work is licensed under a Creative Commons Attribution 4.0 International License. Read Full License Version of Record: A version of this preprint was published on November 26th, 2020. See the published version at https://doi.org/10.1186/s40623-020-01310-2. Page 1/22 Abstract This study monitors the land subsidence of the whole Pearl River Delta (PRD) (area: ~40,000 km2) in China using the ALOS1/PALSAR data (2006-2011) through the SBAS-InSAR method. We also analyze the relationship between the subsidence and the coastline change, river distribution, geological structure as well as the local terrain. The results show that (1) the land subsidence with the average velocity of 50 mm/year occurred in the low elevation area in the front part of the delta and the coastal area, and the area of the regions subsiding fast than 30 mm/year between 2006 and 2011 is larger than 122 km2; (2) the subsidence order and area estimated in this study are both much larger than that measured in previous studies; (3) the areas along rivers suffered from surface subsidence, due to the thick soft soil layer and frequent human interference; (4) the geological evolution is the intrinsic factor of the surface subsidence in the PRD, but human interference (reclamation, ground water extraction and urban construction) extends the subsiding area and increases the subsiding rate. -

Surface Deformation Evolution in the Pearl

Li et al. Earth, Planets and Space (2020) 72:179 https://doi.org/10.1186/s40623-020-01310-2 FULL PAPER Open Access Surface deformation evolution in the Pearl River Delta between 2006 and 2011 derived from the ALOS1/PALSAR images Genger Li1, Guangcai Feng2*, Zhiqiang Xiong2, Qi Liu2, Rongan Xie1, Xiaoling Zhu1, Shuran Luo2 and Yanan Du3 Abstract This study monitors the land subsidence of the whole Pearl River Delta (PRD) (area: ~ 40,000 km2) in China using the ALOS1/PALSAR data (2006–2011) through the SBAS-InSAR method. We also analyze the relationship between the sub- sidence and the coastline change, river distribution, geological structure as well as the local terrain. The results show that (1) the land subsidence with the average velocity of 50 mm/year occurred in the low elevation area in the front part of the delta and the coastal area, and the area of the regions subsiding faster than 30 mm/year between 2006 and 2011 is larger than 122 km2; (2) the subsidence order and area estimated in this study are both much larger than that measured in previous studies; (3) the areas along rivers sufered from surface subsidence, due to the thick soft soil layer and frequent human interference; (4) the geological evolution is the intrinsic factor of the surface subsidence in the PRD, but human interference (reclamation, ground water extraction and urban construction) extends the subsid- ing area and increases the subsiding rate. Keywords: Pearl river delta, Natural evolution, Surface subsidence, SBAS-InSAR Introduction sufered many surface deformation disasters, including Deltas have abundant natural resources, superior natural land subsidence, landslides and collapses (Syvitski et al. -

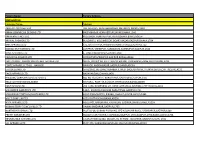

Factory Name

Factory Name Factory Address BANGLADESH Company Name Address AKH ECO APPARELS LTD 495, BALITHA, SHAH BELISHWER, DHAMRAI, DHAKA-1800 AMAN GRAPHICS & DESIGNS LTD NAZIMNAGAR HEMAYETPUR,SAVAR,DHAKA,1340 AMAN KNITTINGS LTD KULASHUR, HEMAYETPUR,SAVAR,DHAKA,BANGLADESH ARRIVAL FASHION LTD BUILDING 1, KOLOMESSOR, BOARD BAZAR,GAZIPUR,DHAKA,1704 BHIS APPARELS LTD 671, DATTA PARA, HOSSAIN MARKET,TONGI,GAZIPUR,1712 BONIAN KNIT FASHION LTD LATIFPUR, SHREEPUR, SARDAGONI,KASHIMPUR,GAZIPUR,1346 BOVS APPARELS LTD BORKAN,1, JAMUR MONIPURMUCHIPARA,DHAKA,1340 HOTAPARA, MIRZAPUR UNION, PS : CASSIOPEA FASHION LTD JOYDEVPUR,MIRZAPUR,GAZIPUR,BANGLADESH CHITTAGONG FASHION SPECIALISED TEXTILES LTD NO 26, ROAD # 04, CHITTAGONG EXPORT PROCESSING ZONE,CHITTAGONG,4223 CORTZ APPARELS LTD (1) - NAWJOR NAWJOR, KADDA BAZAR,GAZIPUR,BANGLADESH ETTADE JEANS LTD A-127-131,135-138,142-145,B-501-503,1670/2091, BUILDING NUMBER 3, WEST BSCIC SHOLASHAHAR, HOSIERY IND. ATURAR ESTATE, DEPOT,CHITTAGONG,4211 SHASAN,FATULLAH, FAKIR APPARELS LTD NARAYANGANJ,DHAKA,1400 HAESONG CORPORATION LTD. UNIT-2 NO, NO HIZAL HATI, BAROI PARA, KALIAKOIR,GAZIPUR,1705 HELA CLOTHING BANGLADESH SECTOR:1, PLOT: 53,54,66,67,CHITTAGONG,BANGLADESH KDS FASHION LTD 253 / 254, NASIRABAD I/A, AMIN JUTE MILLS, BAYEZID, CHITTAGONG,4211 MAJUMDER GARMENTS LTD. 113/1, MUDAFA PASCHIM PARA,TONGI,GAZIPUR,1711 MILLENNIUM TEXTILES (SOUTHERN) LTD PLOTBARA #RANGAMATIA, 29-32, SECTOR ZIRABO, # 3, EXPORT ASHULIA,SAVAR,DHAKA,1341 PROCESSING ZONE, CHITTAGONG- MULTI SHAF LIMITED 4223,CHITTAGONG,BANGLADESH NAFA APPARELS LTD HIJOLHATI, -

Factory Name Address City Zip Code Province Country # of Workers Category Jiangsu Asset Underwear Co., Ltd

Factory name Address City Zip code Province Country # of workers Category Jiangsu Asset Underwear Co., Ltd. No. 6, Wang One Road, Economic Development Zone, Lianshui County Huaian 223001 Jiangsu China <1000 apparel Shen Zhen BP Co., Ltd. 1-5 Floor, B12, Hengfeng Industrial Zone, Hezhou, Xixiang Bao'an Area Shenzhen 518100 Guangdong China <1000 apparel Zhong Shan Kin Tak Garment Factory Ltd. Wan An Industrial District, Ji Dong 1, Xiaolan Town Zhongshan 528400 Guangdong China <1000 apparel Zhongshan Vigor Garment Co., Ltd. Chang Ling Lu, Lan Bian Village, NanLangZhen Zhongshan 528400 Guangdong China <1000 apparel Intimate Fashion Co., Ltd. 140 Moo.5, Phutthamonthon 5 Road, Omnoi Kratumban 74130 Samut Sakhon Thailand <1000 apparel Elite Fame Garment Factory Shang Nan, Yuanzhou Town, Bolou Huizhou City Huizhou City 528400 Guangdong China <1000 apparel DongGuan XuYang Textile Co.,Ltd NO.127,yongmao road ,renzhou village,santian town Dongguan 523999 Guangdong China <1000 fabric Maoming City Jinquan Rubber & Plastics Products Co.,Ltd No.57 Qiongsha Road,ShaYuan Town Dianbai District, Maoming 525028 Guangdong China <1000 elastic Hongda High-Tech Holding Co., Ltd No. 118 Jian She Road Xucun Town Haining 311409 Zhejiang China <1000 fabric Fuzhou Meijiahua Knitting & Textile Co., Ltd Room 1416, Building 16th, Haixibaiyue Town 2nd 18 Duyuan Road Fuzhou 350019 Fujian China <1000 fabric Deqing Taihe Industries Co., Ltd Gantang High & New Technology Development Zone Decheng Town Deqing 526600 Guangdong China <1000 fabric Dongguan City Humen Town Xinghui -

Exhibitors for the 2019 International Home + Housewares Show

Exhibitors for the 2019 International Home + Housewares Show Company Name Address Category Phone, Booth # 2652 E 45th St PH 323-588-3026 26 California Bazar Wholesale Vernon, CA 90058 clean + contain Booth N6240 United States 29783 Spruce Rd PH 847-477-9093 6 Ideas, Inc. Evergreen, CO 80439 clean + contain Booth N6004 United States 14832 Arrow Hwy. PH 626-962-2990 Above All Co. Forearm Forklift Inc. Baldwin Park, CA 91706 clean + contain Booth N6061 United States 1 Mira Street, Sosnovy Bor, Leningrad Region, Russia, 188540 PH +78136973000 Abrasive Technologies, LLC clean + contain Sosnovy Bor, Leningrad Region, 188540 Booth N6565 Russian Federation Zone 3, Waterton Point Brocastle Avenue PH 44-0-1656-66 Addis Housewares, Ltd. Bridgend, CF31 3US clean + contain Booth N7143 United Kingdom 1821 N Highway CC PO Box 2310 PH 417-725-2691 Aire-Master of America, Inc. Nixa, MO 65714 clean + contain Booth N6918 United States ISTOC 9 ADA NO 1 BAGCILAR PH 90-212-659-4 AKYUZ PLASTIK A. S. ISTANBUL, 34217 clean + contain Booth N6844 Turkey Partida La Marjal, N 61 PH 34-965567319 Alberto Forte Composite, S.L. Banyeres De Mariola, Alicante, 03450 clean + contain Booth N6938 Spain PO Box 4695 PH 480-361-1573 Alliance Consumer Products SCOTTSDALE, AZ 85261 clean + contain Booth N6003 United States 210 Carpenter Dam Rd PH 501-262-2700 Alliance Rubber Company Hot Springs, AR 71903-0950 clean + contain Booth N8159 United States 3241 Winpark Dr PH 763-545-0700 AMC Sales Inc. Minneapolis, MN 55427-2023 clean + contain Booth N6859 United States PO Box 611 PH 248-669-2100 Armaly Brands Walled Lake, MI 48390-0611 clean + contain Booth N6508 United States 141 W 36th St Ste 901 PH 212-631-0300 Azzure Home NEW YORK, NY 10018 clean + contain Booth N6530 United States 8 Bellows Falls Rd PO Box 710 PH 802-387-5509 Basketville Putney, VT 05346-0710 clean + contain Booth N6106 United States 1250 E Sanborn Street PH 507-454-4664 Behrens Manufacturing Winona, MN 55987 clean + contain Booth N6453 United States No. -

C190521039002a Cpc证书

CHILDREN'S PRODUCT CERTIFICATE (CPC) C190521039002A The submitted sample(s) (mentioned as below) has (have) been tested by CPST according to the standard(s) / specification(s) cited as below as requested by applicant and found the compliance(s) with the related requirements stated therein. 1. Identification of the product covered by this certificate: Sample Name: Inflatable water play mat Sample Description: TOYS Model: HX2019PM02, HX2019PM03, HX2019PM04, HX2019PM05,HX2019PM01 Batch No.: 2019-03-01 2. Citation to each CPSC product safety regulation to which this product is being certified: 1.ASTM F963-17 Standard Consumer Safety Specification for Toy Safety: 1)Physical & Mechanical Tests 2)4.2 Flammability 3)4.3.5 Heavy Elements 2.Lead in Nonmetal Children’s Products(CPSC-CH-E1002-08.3:2012) - USA Consumer Product Safety Improvement Act (H.R.4040) Sec.101.(a) 3.Determination of Phthalates (CPSC-CH-C1001:09.4) - USA Consumer Product Safety Improvement Act (H.R.4040) Sec.108 4.Tracking labels for children’s products— USA Consumer Product Safety Improvement Act (H.R.4040) Sec.103 5.16 CFR 1500.50 Test methods for simulating use and abuse of toys and other articles intended for use by children. 3. Identification of the U.S. importer or domestic manufacturer certifying compliance of the product: Importer: JIANGMEN XINHUI HENGXIN SPORT PRODUCTS CO., LTD. Address: NO. 1-120, QIAO XING BEI ROAD, HUICHENG TOWN, XINHUI DISTRICT, JIANGMEN CITY, GUANGDONG PROVINCE, CHINA. 4. Contact information for the individual maintaining records of test results: Contact: Vannessa Address: NO. 1-120, QIAO XING BEI ROAD, HUICHENG TOWN, XINHUI DISTRICT, JIANGMEN CITY, GUANGDONG PROVINCE, CHINA. -

Produzent Adresse Land

Produzent Adresse Land Durable Plastic Ltd. Mulgaon, Kaligonj, Gazipur, Dhaka Bangladesh Lhotse (BD) Ltd. Plot No. 60&61, Sector -3, Karnaphuli Export Processing Zone, North Potenga, Chittagong Bangladesh Bengal Plastics Ltd. Yearpur, Zirabo Bazar, Savar, Dhaka Bangladesh ASF Sporting Goods Co., Ltd. Km 38.5, National Road No. 3, Thlork Village, Chonrok Commune, Korng Pisey District, Konrrg Pisey, Kampong Speu Cambodia Ningbo Zhongyuan Alljoy Fishing Tackle Co., Ltd. No. 416 Binhai Road, Hangzhou Bay New Zone, Ningbo, Zhejiang China Ningbo Energy Power Tools Co., Ltd. No. 50 Dongbei Road, Dongqiao Industrial Zone, Haishu District, Ningbo, Zhejiang China Junhe Pumps Holding Co., Ltd. Wanzhong Villiage, Jishigang Town, Haishu District, Ningbo, Zhejiang China Skybest Electric Appliance (Suzhou) Co., Ltd. No. 18 Hua Hong Street, Suzhou Industrial Park, Suzhou, Jiangsu China Zhejiang Safun Industrial Co., Ltd. No. 7 Mingyuannan Road, Economic Development Zone, Yongkang, Zhejiang China Zhejiang Dingxin Arts&Crafts Co., Ltd. No. 21 Linxian Road, Baishuiyang Town, Linhai, Zhejiang China Zhejiang Natural Outdoor Goods Inc. Xiacao Village, Pingqiao Town, Tiantai County, Taizhou, Zhejiang China Guangdong Xinbao Electrical Appliances Holdings Co., Ltd. South Zhenghe Road, Leliu Town, Shunde District, Foshan, Guangdong China Yangzhou Juli Sports Articles Co., Ltd. Fudong Village, Xiaoji Town, Jiangdu District, Yangzhou, Jiangsu China Eyarn Lighting Ltd. Yaying Gang, Shixi Village, Shishan Town, Nanhai District, Foshan, Guangdong China Lipan Gift & Lighting Co., Ltd. No. 2 Guliao Road 3, Science Industrial Zone, Tangxia Town, Dongguan, Guangdong China Zhan Jiang Kang Nian Rubber Product Co., Ltd. No. 85 Middle Shen Chuan Road, Zhanjiang, Guangdong China Ansen Electronics Co. Ning Tau Administrative District, Qiao Tau Zhen, Dongguan, Guangdong China Changshu Tongrun Auto Accessory Co., Ltd. -

Vertical Facility List

Facility List The Walt Disney Company is committed to fostering safe, inclusive and respectful workplaces wherever Disney-branded products are manufactured. Numerous measures in support of this commitment are in place, including increased transparency. To that end, we have published this list of the roughly 7,600 facilities in over 70 countries that manufacture Disney-branded products sold, distributed or used in our own retail businesses such as The Disney Stores and Theme Parks, as well as those used in our internal operations. Our goal in releasing this information is to foster collaboration with industry peers, governments, non- governmental organizations and others interested in improving working conditions. Under our International Labor Standards (ILS) Program, facilities that manufacture products or components incorporating Disney intellectual properties must be declared to Disney and receive prior authorization to manufacture. The list below includes the names and addresses of facilities disclosed to us by vendors under the requirements of Disney’s ILS Program for our vertical business, which includes our own retail businesses and internal operations. The list does not include the facilities used only by licensees of The Walt Disney Company or its affiliates that source, manufacture and sell consumer products by and through independent entities. Disney’s vertical business comprises a wide range of product categories including apparel, toys, electronics, food, home goods, personal care, books and others. As a result, the number of facilities involved in the production of Disney-branded products may be larger than for companies that operate in only one or a limited number of product categories. In addition, because we require vendors to disclose any facility where Disney intellectual property is present as part of the manufacturing process, the list includes facilities that may extend beyond finished goods manufacturers or final assembly locations. -

Produzent Adresse Land Allplast Bangladesh Ltd

Zeitraum - Produzenten mit einem Liefertermin zwischen 01.01.2020 und 31.12.2020 Produzent Adresse Land Allplast Bangladesh Ltd. Mulgaon, Kaliganj, Gazipur, Rfl Industrial Park Rip, Mulgaon, Sandanpara, Kaligonj, Gazipur, Dhaka Bangladesh Bengal Plastics Ltd. (Unit - 3) Yearpur, Zirabo Bazar, Savar, Dhaka Bangladesh Durable Plastic Ltd. Mulgaon, Kaligonj, Gazipur, Dhaka Bangladesh HKD International (Cepz) Ltd. Plot # 49-52, Sector # 8, Cepz, Chittagong Bangladesh Lhotse (Bd) Ltd. Plot No. 60 & 61, Sector -3, Karnaphuli Export Processing Zone, North Potenga, Chittagong Bangladesh Plastoflex Doo Branilaca Grada Bb, Gračanica, Federacija Bosne I H Bosnia-Herz. ASF Sporting Goods Co., Ltd. Km 38.5, National Road No. 3, Thlork Village, Chonrok Commune, Konrrg Pisey, Kampong Spueu Cambodia Powerjet Home Product (Cambodia) Co., Ltd. Manhattan (Svay Rieng) Special Economic Zone, National Road 1, Sangkat Bavet, Krong Bavet, Svaay Rieng Cambodia AJS Electronics Ltd. 1st Floor, No. 3 Road 4, Dawei, Xinqiao, Xinqiao Community, Xinqiao Street, Baoan District, Shenzhen, Guangdong China AP Group (China) Co., Ltd. Ap Industry Garden, Quetang East District, Jinjiang, Fujian China Ability Technology (Dong Guan) Co., Ltd. Songbai Road East, Huanan Industrial Area, Liaobu Town, Donggguan, Guangdong China Anhui Goldmen Industry & Trading Co., Ltd. A-14, Zongyang Industrial Park, Tongling, Anhui China Aold Electronic Ltd. Near The Dahou Viaduct, Tianxin Industrial District, Dahou Village, Xiegang Town, Dongguan, Guangdong China Aurolite Electrical (Panyu Guangzhou) Ltd. Jinsheng Road No. 1, Jinhu Industrial Zone, Hualong, Panyu District, Guangzhou, Guangdong China Avita (Wujiang) Co., Ltd. No. 858, Jiaotong Road, Wujiang Economic Development Zone, Suzhou, Jiangsu China Bada Mechanical & Electrical Co., Ltd. No. 8 Yumeng Road, Ruian Economic Development Zone, Ruian, Zhejiang China Betec Group Ltd.