Rock Island County Farm Guidelines

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Sample Costs for Beef Cattle, Cow-Calf Production

UNIVERSITY OF CALIFORNIA AGRICULTURE AND NATURAL RESOURCES COOPERATIVE EXTENSION AGRICULTURAL ISSUES CENTER UC DAVIS DEPARTMENT OF AGRICULTURAL AND RESOURCE ECONOMICS SAMPLE COSTS FOR BEEF CATTLE COW – CALF PRODUCTION 300 Head NORTHERN SACRAMENTO VALLEY 2017 Larry C. Forero UC Cooperative Extension Farm Advisor, Shasta County. Roger Ingram UC Cooperative Extension Farm Advisor, Placer and Nevada Counties. Glenn A. Nader UC Cooperative Extension Farm Advisor, Sutter/Yuba/Butte Counties. Donald Stewart Staff Research Associate, UC Agricultural Issues Center and Department of Agricultural and Resource Economics, UC Davis Daniel A. Sumner Director, UC Agricultural Issues Center, Costs and Returns Program, Professor, Department of Agricultural and Resource Economics, UC Davis Beef Cattle Cow-Calf Operation Costs & Returns Study Sacramento Valley-2017 UCCE, UC-AIC, UCDAVIS-ARE 1 UC AGRICULTURE AND NATURAL RESOURCES COOPERATIVE EXTENSION AGRICULTURAL ISSUES CENTER UC DAVIS DEPARTMENT OF AGRICULTURAL AND RESOURCE ECONOMICS SAMPLE COSTS FOR BEEF CATTLE COW-CALF PRODUCTION 300 Head Northern Sacramento Valley – 2017 STUDY CONTENTS INTRODUCTION 2 ASSUMPTIONS 3 Production Operations 3 Table A. Operations Calendar 4 Revenue 5 Table B. Monthly Cattle Inventory 6 Cash Overhead 6 Non-Cash Overhead 7 REFERENCES 9 Table 1. COSTS AND RETURNS FOR BEEF COW-CALF PRODUCTION 10 Table 2. MONTHLY COSTS FOR BEEF COW-CALF PRODUCTION 11 Table 3. RANGING ANALYSIS FOR BEEF COW-CALF PRODUCTION 12 Table 4. EQUIPMENT, INVESTMENT AND BUSINESS OVERHEAD 13 INTRODUCTION The cattle industry in California has undergone dramatic changes in the last few decades. Ranchers have experienced increasing costs of production with a lack of corresponding increase in revenue. Issues such as international competition, and opportunities, new regulatory requirements, changing feed costs, changing consumer demand, economies of scale, and competing land uses all affect the economics of ranching. -

Permaculture Design Plan Alderleaf Farm

PERMACULTURE DESIGN PLAN FOR ALDERLEAF FARM Alderleaf Farm 18715 299th Ave SE Monroe, WA 98272 Prepared by: Alderleaf Wilderness College www.WildernessCollege.com 360-793-8709 [email protected] January 19, 2011 TABLE OF CONTENTS INTRODUCTION 1 What is Permaculture? 1 Vision for Alderleaf Farm 1 Site Description 2 History of the Alderleaf Property 3 Natural Features 4 SITE ELEMENTS: (Current Features, Future Plans, & Care) 5 Zone 0 5 Residences 5 Barn 6 Indoor Classroom & Office 6 Zone 1 7 Central Gardens & Chickens 7 Plaza Area 7 Greenhouses 8 Courtyard 8 Zone 2 9 Food Forest 9 Pasture 9 Rabbitry 10 Root Cellar 10 Zone 3 11 Farm Pond 11 Meadow & Native Food Forest 12 Small Amphibian Pond 13 Parking Area & Hedgerow 13 Well house 14 Zone 4 14 Forest Pond 14 Trail System & Tenting Sites 15 Outdoor Classroom 16 Flint-knapping Area 16 Zone 5 16 Primitive Camp 16 McCoy Creek 17 IMPLEMENTATION 17 CONCLUSION 18 RESOURCES 18 APPENDICES 19 List of Sensitive Natural Resources at Alderleaf 19 Invasive Species at Alderleaf 19 Master List of Species Found at Alderleaf 20 Maps 24 Frequently Asked Questions and Property Rules 26 Forest Stewardship Plan 29 Potential Future Micro-Businesses / Cottage Industries 29 Blank Pages for Input and Ideas 29 Introduction The permaculture plan for Alderleaf Farm is a guiding document that describes the vision of sustainability at Alderleaf. It describes the history, current features, future plans, care, implementation, and other key information that helps us understand and work together towards this vision of sustainable living. The plan provides clarity about each of the site elements, how they fit together, and what future plans exist. -

Guide to Raising Dairy Sheep

A3896-01 N G A N I M S I A L A I S R — Guide to raising N F O dairy sheep I O T C C Yves Berger, Claire Mikolayunas, and David Thomas U S D U O N P R O hile the United States has a long Before beginning a dairy sheep enterprise, history of producing sheep for producers should review the following Wmeat and wool, the dairy sheep fact sheet, designed to answer many of industry is relatively new to this country. the questions they will have, to determine In Wisconsin, dairy sheep flocks weren’t if raising dairy sheep is an appropriate Livestock team introduced until the late 1980s. This enterprise for their personal and farm industry remains a small but growing goals. segment of overall domestic sheep For more information contact: production: by 2009, the number of farms in North America reached 150, Dairy sheep breeds Claire Mikolayunas Just as there are cattle breeds that have with the majority located in Wisconsin, Dairy Sheep Initiative been selected for high milk production, the northeastern U.S., and southeastern Dairy Business Innovation Center there are sheep breeds tailored to Canada. Madison, WI commercial milk production: 608-332-2889 Consumers are showing a growing interest n East Friesian (Germany) [email protected] in sheep’s milk cheese. In 2007, the U.S. n Lacaune (France) David L. Thomas imported over 73 million pounds of sheep Professor of Animal Sciences milk cheese, such as Roquefort (France), n Sarda (Italy) Manchego (Spain), and Pecorino Romano University of Wisconsin-Madison n Chios (Greece) Madison, Wisconsin (Italy), which is almost twice the 37 million n British Milksheep (U.K.) 608-263-4306 pounds that was imported in 1985. -

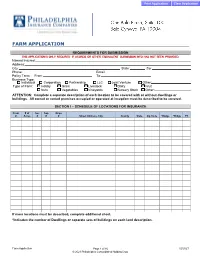

Farm Application

FARM APPLICATION REQUIREMENTS FOR SUBMISSION THIS APPLICATION IS ONLY REQUIRED IF ACORDS OR OTHER EQUIVALENT SUBMISSION INFO HAS NOT BEEN PROVIDED. Named Insured: Address: City: State: Zip: Phone: Email: Policy Term: From: To: Business Type: Individual Corporation Partnership LLC Joint Venture Other: Type of Farm: Hobby Grain Livestock Dairy Fruit Nuts Vegetables Vineyards Nursery Stock Other: ATTENTION: Complete a separate description of each location to be covered with or without dwellings or buildings. All owned or rented premises occupied or operated at inception must be described to be covered. SECTION I – SCHEDULE OF LOCATIONS FOR INSURANCE Prem # of Sec Twp Rnge # Acres # # # Street Address, City County State Zip Code *Dwlgs *Bldgs PC If more locations must be described, complete additional sheet. *Indicates the number of Dwellings or separate sets of buildings on each land description. Farm Application Page 1 of 16 02/2021 © 2021 Philadelphia Consolidated Holding Corp. SECTION II – ADDITIONAL INTEREST 1. Please check as applicable: Mortgagee Loss Payee Contract Holder Additional Insured Lessor of Leased Equipment 2. Name: Loan Number: 3. Address: City: State: Zip: 4. Applies to: 5. Please check as applicable: Mortgagee Loss Payee Contract Holder Additional Insured Lessor of Leased Equipment 6. Name: Loan Number: 7. Address: City: State: Zip: 8. Applies to: If additional lienholders needed, attach separate sheet. SECTION III – FARM LIABILITY COVERAGES LIMITS OF LIABILITY H. Bodily Injury & Property Damage $ I. Personal & Advertising Injury $ Basic Farm Liability Blanketed Acres Yes No Total Number of Acres Additional dwellings on insured farm location.owned by named insured or spouse Additional dwellings off insured farm location, owned by named insured or spouse and rented to others, but at least partly owner-occupied Additional dwellings off insured farm location, owned by named insured or spouse and rented to others with no part owner-occupied Additional dwellings on or off insured location, owned by a resident member of named insured’s household J. -

Quantity of Livestock for Farm Deferral

Quantity of Livestock for Farm Deferral Factors Include: How many animals do you need to qualify for farm deferral? ▪ Soil Quality ▪ Use of Irrigation There is no simple answer to this question. Whether ▪ Time of Year you are trying to qualify for the farm deferral program ▪ Topography and Slope or simply remain in compliance, there are many ▪ Type and Size of Livestock underlying factors. ▪ Wooded Vs. Open Each property is unique in how many animals per acre it can support. The following general guidelines have been developed. This is a suggested number of animals, because it varies on weight, size, breed and sex of animal. Approximate Requirements for Adult Animals on Dry Pasture: This is a rough estimate of how many pounds per acre. Horses (Excluding personal/pleasure) 1 head per 2 acres Typically, 100-800 Cattle – 1 to 2 head per 2 acres pounds minimum on Llamas – 1 to 2 head per acre dry and 500-1000 on irrigated pasture. Sheep – 2 to 4 head per acre Goats – 3 to 5 head per acre Range Chickens – 100-300 per acre size Important to Remember: The portion of the property in farm deferral must be used fully and exclusively for a compliant farming practice with the primary intent of making a profit. It must contain quality forage and be free of invasive weeds and brush. The forage must be grazed by sufficient number of livestock to keep it eaten down during the growing season. If pasture has adequate livestock but is full of blackberry briars, noxious weeds like scotch broom and tansy ragwort, or is full of debris like scrap metal, it will NOT qualify for farm use. -

Strengthening Farm-Agribusiness Linkages in Africa Iii

$*6) 2FFDVLRQDO 3DSHU 6WUHQJWKHQLQJ IDUPDJULEXVLQHVV OLQNDJHVLQ$IULFD 6XPPDU\UHVXOWVRIILYH FRXQWU\VWXGLHVLQ*KDQD 1LJHULD.HQ\D8JDQGDDQG 6RXWK$IULFD $*6) 2FFDVLRQDO 3DSHU 6WUHQJWKHQLQJ IDUPDJULEXVLQHVV OLQNDJHVLQ$IULFD 6XPPDU\UHVXOWVRIILYH FRXQWU\VWXGLHVLQ*KDQD 1LJHULD.HQ\D8JDQGDDQG 6RXWK$IULFD E\ $QJHOD'DQQVRQ$FFUD*KDQD &KXPD(]HGLQPD,EDGDQ1LJHULD 7RP5HXEHQ:DPEXD1MXUX.HQ\D %HUQDUG%DVKDVKD0DNHUHUH8QLYHUVLW\8JDQGD -RKDQQ.LUVWHQDQG.XUW6DWRULXV3UHWRULD6RXWK$IULFD (GLWHGE\$OH[DQGUD5RWWJHU $JULFXOWXUDO0DQDJHPHQW0DUNHWLQJDQG)LQDQFH6HUYLFH $*6) $JULFXOWXUDO6XSSRUW6\VWHPV'LYLVLRQ )22'$1'$*5,&8/785(25*$1,=$7,212)7+(81,7('1$7,216 5RPH 5IFEFTJHOBUJPOTFNQMPZFEBOEUIFQSFTFOUBUJPOPGNBUFSJBM JOUIJTJOGPSNBUJPOQSPEVDUEPOPUJNQMZUIFFYQSFTTJPOPGBOZ PQJOJPOXIBUTPFWFSPOUIFQBSUPGUIF'PPEBOE"HSJDVMUVSF 0SHBOJ[BUJPO PG UIF 6OJUFE /BUJPOT DPODFSOJOH UIF MFHBM PS EFWFMPQNFOUTUBUVTPGBOZDPVOUSZ UFSSJUPSZ DJUZPSBSFBPSPG JUTBVUIPSJUJFT PSDPODFSOJOHUIFEFMJNJUBUJPOPGJUTGSPOUJFSTPS CPVOEBSJFT "MM SJHIUT SFTFSWFE 3FQSPEVDUJPO BOE EJTTFNJOBUJPO PG NBUFSJBM JO UIJT JOGPSNBUJPOQSPEVDUGPSFEVDBUJPOBMPSPUIFSOPODPNNFSDJBMQVSQPTFTBSF BVUIPSJ[FEXJUIPVUBOZQSJPSXSJUUFOQFSNJTTJPOGSPNUIFDPQZSJHIUIPMEFST QSPWJEFEUIFTPVSDFJTGVMMZBDLOPXMFEHFE3FQSPEVDUJPOPGNBUFSJBMJOUIJT JOGPSNBUJPOQSPEVDUGPSSFTBMFPSPUIFSDPNNFSDJBMQVSQPTFTJTQSPIJCJUFE XJUIPVUXSJUUFOQFSNJTTJPOPGUIFDPQZSJHIUIPMEFST"QQMJDBUJPOTGPSTVDI QFSNJTTJPOTIPVMECFBEESFTTFEUPUIF$IJFG 1VCMJTIJOH.BOBHFNFOU4FSWJDF *OGPSNBUJPO%JWJTJPO '"0 7JBMFEFMMF5FSNFEJ$BSBDBMMB 3PNF *UBMZ PSCZFNBJMUPDPQZSJHIU!GBPPSH ª'"0 Strengthening farm-agribusiness -

Moving Toward Sustainable Farming Practices Agriculture and Natural Resources Fact Sheet #533

http://www.metrokc.gov/wsu-ce 919 SW Grady Way, Suite 120 Renton, WA 98055-2980 (206) 205-3100, 711(TTY) Moving toward Sustainable Farming Practices Agriculture and Natural Resources Fact Sheet #533 Many compelling factors are prompting farmers to use more sustainable practices (see side bar for definition of terms). The high cost of energy, low profit margins of conven- tional methods, increasing environmental awareness of consumers, growers, and regulators, and stronger markets for alternatively grown products are just a few. Implementing sustainable farming practices is not always Stage II. easy and comes with some inherent risks. Lower yields and Substitute with alternative inputs and farming practices. reduced profits are not uncommon during the first year or Once you are using inputs efficiently, you can begin to two of the transition period. Nonetheless, with some replace resource-intensive and environmentally damaging careful planning and understanding of the process, adopt- inputs and practices with environmentally sound alterna- ing sustainable farming practices can meet with success. tives. Examples of such alternatives includes organic and biological pest control, composting, and biological control Principles of Sustainable Practices of weeds. A few guiding principles can go a long way toward increasing the ecological and economic sustainability of a farm. Some of these to keep in mind are: Organic versus Sustainable Recycling materials on the farm; The term organic is officially defined by the Using renewable sources of energy; National Organic Standards Board. Reducing off-farm inputs including synthetic chemicals; Using naturally occurring materials; Organic agriculture is an ecological produc- Managing instead of controlling pests and weeds; tion management system that promotes and Reestablishing natural biological relationships with the enhances biodiversity, biological cycles and farm setting; soil biological activity. -

Suters Glen Permaculture Farm Picture Tour of a Homestead with Edible Gardens and Natural Lawn Care Solutions

Suters Glen Permaculture Farm Picture tour of a homestead with edible gardens and natural lawn care solutions By: Cory Suter Permaculture Farmer, Co-chair of Urban Ag Work Group for Fairfax Food Council (Hobby gardeners: Hala Elbarmil & Allison Suter assist with weeding, and some planting) Suters Glen Permaculture Farm 5.34 acre homestead just off Popes Head Rd near 123 in Fairfax, VA 22030 Orchard in partial bloom March 17, 2020 Lambs: Monty & Clover born March 30, 2020 The magic of any place is best experienced over multiple seasons using all five senses The taste of just picked produce is so good, kids like to eat fruits and vegetables from our garden We hope this tour will be a feast for your eyes and imagination for what is possible This picture was taken Spring 2016, a year after we bought Suters Glen Picture of annual garden taken four years later, April 6, 2020 at sunset View of half of rear pasture taken from top of roof November 2016 Entrance to Suters Glen March 2018 Following driveway past guest cottage April 2020 Remodeled 1925 Farmhouse that was on a 100+ acre plot for most of its’ life Unless otherwise labeled, all pictures in this slideshow are from different perspectives of the 5.34 acre remaining lot we bought. Rear of home as seen from wildflower meadow with bachelor’s buttons and blackberries in bloom Cory found his philosophy of gardening in the permaculture literature that calls us to mimic natural systems so that we can produce more with less work. Since we bought Suters Glen in 2015, we have never tilled this garden, and as far as we know, zero chemicals have been used in this garden for at least 24 years. -

Factory Farming: Assessing Investment Risks

FACTORY FARMING: ASSESSING INVESTMENT RISKS 2016 report Find out more, or join us, at: fairr.org Follow us: @FAIRRinitiative FACTORY FARMING: KILLER STATS INVESTORS CAN’T IGNORE DOWN INVESTORS IN 52.3 reason for rapid user of MCDONALDS AND KFC O O antibiotics HIT BY US$10.8BN LOSS 27.6 N 1 spread of bird (H5N2) N 1 OF MARKET CAP IN 2014 DUE TO FOOD 11.4 and swine (H1N1) flu in the US SAFETY SCANDAL AT A CHINESE SUPPLIER 7.9 industry losses due to US bird of all antibiotics in the US now used UP 88.2 [FarmEcon] [CDC] $3.3bn flu outbreak in 2015 80% in animal factory farms ALTERNATIVE FOOD TECH COMPANY 65.3 HAMPTON CREEK SET TO BE FASTEST GROWING 59.9 FOOD COMPANY IN HISTORY, BENEFITING 12.7 FROM IMPACT OF 2015 85% US BIRD FLU CRISIS 66.2 of all soya DOWN 39.4 globally is used ANIMAL WELFARE in animal feeds, SCANDAL LEADS TO 57.1 a major cause of LARGEST MEAT RECALL deforestation [WWF] IN US HISTORY, 28.4 of global GHG AND BANKRUPTCY emissions, more FOR MEAT-PACKER 75.5 14% consumer HALLMARK/WESTLAND than the transport O IN 2012 24.9 N 1 of water in sector* [FAO] drought-stricken DOWN 11.4 INVESTORS IN TYSON [Pacific Institute] FOODS EXPOSED AFTER 7.9 * from livestock sector as a whole, with factory California COMPANY REVEALS farming as key component ENVIRONMENTAL 88.2 VIOLATIONS. rise in 'heat stress' days set to hit cattle and rising hit on profits of California POSSIBLE $500M OF 59.9 [UC Davis] 21% industry due to warming climate $250m dairies due to drought in 2015 REGULAR GOVERNMENT CONTRACTS AT RISK 12.7 fairr.org fairr.org | 1 KEY FINDINGS FOREWORD AND IMPLICATIONS FOR INVESTORS Animal factory farming is exposed to at least 28 environmental, social This report explores the industrialisation of the world’s meat and fish production, a relatively recent Increasingly, major investors and governance (ESG) issues that could significantly damage financial trend, and assesses the potential risks that a range are paying attention to value over the short or long-term. -

Care of Farm Animals 2021 Gaamps

Generally Accepted Agricultural and Management Practices for the Care of Farm Animals January 2021 Michigan Commission of Agriculture & Rural Development PO BOX 30017 Lansing, MI 48909 In the event of an agricultural pollution emergency such as a chemical/fertilizer spill, manure lagoon breach, etc., the Michigan Department of Agriculture and Rural Development and/or the Michigan Department of Environment, Great Lakes, and Energy (EGLE) should be contacted at the following emergency telephone numbers: Michigan Department of Agriculture and Rural Development: 800-405-0101 Michigan Department of Environment, Great Lakes, and Energy’s Pollution Emergency Alerting System (PEAS): 800-292-4706 If there is not an emergency, but you have questions on the Michigan Right to Farm Act or items concerning a farm operation, please contact the: Michigan Department of Agriculture and Rural Development Right to Farm Program P.O. Box 30017 Lansing, Michigan 48909 517-284-5619 517-335-3329 FAX 877-632-1783 Table of Contents PREFACE ____________________________________________________________________ iii OVERVIEW __________________________________________________________________ 1 BEEF CATTLE AND BISON _______________________________________________________ 3 DAIRY _____________________________________________________________________ 10 VEAL ______________________________________________________________________ 18 SWINE _____________________________________________________________________ 24 EQUINE ____________________________________________________________________ -

Agricultural Revolution'

3 European farmers and the British 'agricultural revolution' James Simpson Indebted in great part to Arthur Young, the traditional view of European agriculture over the long eighteenth century sees rapid technological and institutional changes taking place in England, but stagnation on the con tinent. Both these views have been challenged over the past decade or two. Today the concept of an 'agricultural revolution' in England is rejected by some historians, and others have questioned the contribution to pro ductivity growth of the well-known technical and institutional changes that took place. Likewise most French historians now reject the idea of a 'societe immobile' and argue that if change was slow, there were usually good economic reasons to continue using traditional farming systems and technology. Despite this change of emphasis, even the most revisionist historians have not challenged the idea that a significant productivity gap existed between Britain and other leading European economies in 1815.1 This paper tries to suggest a few reasons why this gap existed. The first section examines briefly the recent literature on long-run agrarian change in several European countries. I argue that incentives for investment in British agriculture were considerably more favourable than in most other countries in the period 1650 and 1750. The rest of the paper considers a number of areas where British agriculture developed along different lines to that of two major European economies, namely France and Spain. Section 2 looks at livestock specialisation, section 3 at the opportunities for labour-intensive farming during this period of population growth, and section 4 the restrictions to changes in land use because of the nature of property ownership. -

Sustainable Agriculture

Sustainable Agriculture by Paul F. O'Connell, Deputy Administrator, Cooperative State Research Service, USDA, Wasliington, DC In the United States, as in other many positive aspects of today's industrialized countries, farming agriculture. practices are being reexamined. The unforeseen costs of con- Consumers of food and fiber, ventional agriculture include not many farmers, and various envi- only these environmental issues, ronmentalists are expressing con- but also the economic risks and cerns about how modern losses experienced by a great agriculture is being practiced. many farmers during the early Agriculture should welcome 1980's, when foreign demand for this increased interest. Modern U.S. farm products stagnated and agriculture has done a tremen- land values plunged. A few years dous job of providing high-quality ago, "sustainability" was seen as and reasonably priced food for consumers. All you have to do is visit any supermarket to realize the tremendous variety of prod- ucts available. One of the first things Eastern Europeans look for when they visit the West is the broad selection of food supplies available. But changes can be made to re- spond to health and safety issues, such as persistent soil erosion and a loss of natural soil productivity; contamination of ground water by agricultural chemicals; pesticide residues in food; growing resis- tance to pesticides by insects and other pests; loss of genetic diver- Neil Eash and Aaron Steinwand, ARS research sity; depletion of irrigation water associates, examine a soil core sample. Samples will be analyzed to see tiow nitrates and other supplies; aggravated salinity; and nutrients are distributed, and to locate carbon the loss of fish and wildlife habi- accumulations from decaying organic matter.