Nintendo: Annual Report 2014

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Princess Peach Bowser Luigi

English Answers for the lesson on Wednesday, 15 July 2020 2 Profiles (answers) You are not expected to identify every example! Nouns Verbs Adjectives Adverbs Princess Peach Princess Peach has long, blonde hair and blue eyes. She is tall and usually wears a pink evening gown with frilly trimmings. Her hair is sometimes pulled back into a high ponytail. Peach is mostly kind and does not show an aggressive nature, even when she is fearlessly fighting or confronting her enemies. Although often kidnapped by huge Bowser, Peach is always happy to have Bowser on the team when a bigger evil threatens the Mushroom Kingdom. She puts previous disagreements aside. Bowser Bowser is the King of the Koopas. Koopas are active turtles that live in the Mushroom Kingdom. Bowser has a large, spiked turtle shell, horns, razor-sharp fangs, clawed fingers and toes, and bright red hair. He is hugely strong and regularly breathes fire. Bowser can also jump high. He often kidnaps Princess Peach to lure poor Mario into a trap. Bowser occasionally works with Mario and Luigi to defeat a greater evil. Then they work together. Luigi Luigi is taller than his older brother, Mario, and is usually dressed in a green shirt with dark blue overalls. Luigi is an Italian plumber, just like his brother. He always seems nervous and timid but is good-natured. He is calmer than his famous brother. If there is conflict, Luigi will smile and walk away. It is often thought that Luigi may secretly love Princess Daisy. . -

Nintendo Repair Request

Nintendo Australia Pty Limited ABN 43 060 566 083 NINTENDO REPAIR REQUEST Contact Information / Return Address Please fill in your details below using block letters. FULL NAME: PHONE: ADDRESS: MOBILE: SUBURB: STATE: POST CODE: FAULT DESCRIPTION: SENT ITEMS: PRODUCT (e.g. Wii, 3DS, etc): COLOUR: IS PROOF OF PURCHASE ATTACHED? YES / NO AGE OF PRODUCT: SERIAL NUMBER: STYLUS: CONTROLLER: AV CABLE: ACCESSORIES: (Please only send those accessories that require/relate to the repair) A/C ADAPTOR: SENSOR BAR: Wii REMOTE: Wii NUNCHUCK: OTHER: SOFTWARE TITLES: (Please only send those accessories that require/relate to the repair) TOTAL ITEMS SENT: Please refer to Service Conditions on following page. AUSTRALIA WIDE CONSUMER SUPPORT: (03) 9730 9822 804 Stud Road Scoresby Victoria 3179 Australia PO Box 804 Ferntree Gully Victoria 3156 Australia Administration +61 3 9730 9900 Facsimile +61 3 9730 9922 www.nintendo.com.au Nintendo Australia Pty Limited ABN 43 060 566 083 Service Conditions WARRANTY: IF THE PRODUCT IS COVERED UNDER WARRANTY, THERE WILL BE NO CHARGE FOR PARTS AND LABOUR. THE NINTENDO WARRANTY COVERS ALL MANUFACTURING FAULTS/DEFECTS. PLEASE REFER TO THE WARRANTY INFORMATION ON www.nintendo.com.au FOR FULL WARRANTY DETAILS. APPRAISAL CHARGE: AFTER THE PRODUCT UNDERGOES A FULL DIAGNOSTIC TEST, AND A SPECIFIED FAULT CANNOT BE DIAGNOSED, AN APPRAISAL CHARGE MAY APPLY. $50.00 FOR Wii U AND Wii U GAMEPAD $35.00 FOR Wii, 3DS AND 3DS XL HARDWARE $30 FOR DSi XL HARDWARE $25 FOR ALL OTHER HARDWARE $20 FOR Wii AND Wii U SOFTWARE AND ASSESSORIES $15 FOR ALL OTHER SOFTWARE AND ASSESSORIES NON-WARRANTY: SHOULD THE WARRANTY NOT APPLY DUE TO MISUSE, ABUSE, ACCIDENT OR WEAR AND TEAR, OR IF THE WARRANTY HAS LAPSED, A CHARGE WILL APPLY TO COVER PARTS, LABOUR AND ADMINISTRATION COSTS. -

First, Download the Software. Lade Zuerst Die Software Herunter

[0321-EUR-L2] First, download the software. Lade zuerst die Software herunter. • Commencez par télécharger le logiciel. • Download eerst de software. • Primero debes descargar el programa. • Em primeiro lugar, descarrega a aplicação. Come prima cosa, scarica il software. Once the download is finished, start the software! • Sobald der Download abgeschlossen ist, starte die Software! Lorsque le téléchargement est terminé, démarrez le logiciel ! • Start de software op zodra het downloaden klaar is! • En cuanto la descarga haya finalizado, ¡abre el programa! • Assim que o download estiver concluído, inicia a aplicação! • Al termine del download, avvia il software! Start Nintendo eShop. On the “Search” screen, search for “MKLIVE”. Download Mario Kart Live: Home Circuit™. Rufe den Nintendo eShop auf. • Accédez au Nintendo eShop. • Ga naar Gib auf dem „Suchen“-Bildschirm „MKLIVE“ ein. • Sur l’écran de recherche, Lade Mario Kart Live: Home Circuit herunter. • Téléchargez le logiciel de Nintendo eShop. • Abre Nintendo eShop. • Acede à Nintendo eShop. saisissez « MKLIVE ». • Kies ZOEKEN en zoek op "MKLIVE". • Elige “Buscar” « Mario Kart Live: Home Circuit ». • Download Mario Kart Live: Home Circuit. Avvia il Nintendo eShop. y luego escribe “MKLIVE”. • No ecrã de pesquisa, procura por “MKLIVE”. Descarga Mario Kart Live: Home Circuit. • Descarrega Mario Kart Live: Nello schermo di ricerca, inserisci “MKLIVE”. Home Circuit. • Scarica Mario Kart Live: Home Circuit. Read the Health and Safety Information on this sheet before playing. • Lies die Gesundheits- und Sicher- Free space required: 1.1 GB or more. Please make sure that you have enough free space in the system memory or on a microSD card. Additional storage may be needed for installation or software updates. -

Nintendo Co., Ltd

Nintendo Co., Ltd. Financial Results Briefing for the Nine-Month Period Ended December 2013 (Briefing Date: 1/30/2014) Supplementary Information [Note] Forecasts announced by Nintendo Co., Ltd. herein are prepared based on management's assumptions with information available at this time and therefore involve known and unknown risks and uncertainties. Please note such risks and uncertainties may cause the actual results to be materially different from the forecasts (earnings forecast, dividend forecast and other forecasts). Nintendo Co., Ltd. Consolidated Statements of Income Transition million yen FY3/2010 FY3/2011 FY3/2012 FY3/2013 FY3/2014 Apr.-Dec.'09 Apr.-Dec.'10 Apr.-Dec.'11 Apr.-Dec.'12 Apr.-Dec.'13 Net sales 1,182,177 807,990 556,166 543,033 499,120 Cost of sales 715,575 487,575 425,064 415,781 349,825 Gross profit 466,602 320,415 131,101 127,251 149,294 (Gross profit ratio) (39.5%) (39.7%) (23.6%) (23.4%) (29.9%) Selling, general and administrative expenses 169,945 161,619 147,509 133,108 150,873 Operating income 296,656 158,795 -16,408 -5,857 -1,578 (Operating income ratio) (25.1%) (19.7%) (-3.0%) (-1.1%) (-0.3%) Non-operating income 19,918 7,327 7,369 29,602 57,570 (of which foreign exchange gains) (9,996) ( - ) ( - ) (22,225) (48,122) Non-operating expenses 2,064 85,635 56,988 989 425 (of which foreign exchange losses) ( - ) (84,403) (53,725) ( - ) ( - ) Ordinary income 314,511 80,488 -66,027 22,756 55,566 (Ordinary income ratio) (26.6%) (10.0%) (-11.9%) (4.2%) (11.1%) Extraordinary income 4,310 115 49 - 1,422 Extraordinary loss 2,284 33 72 402 53 Income before income taxes and minority interests 316,537 80,569 -66,051 22,354 56,936 Income taxes 124,063 31,019 -17,674 7,743 46,743 Income before minority interests - 49,550 -48,376 14,610 10,192 Minority interests in income -127 -7 -25 64 -3 Net income 192,601 49,557 -48,351 14,545 10,195 (Net income ratio) (16.3%) (6.1%) (-8.7%) (2.7%) (2.0%) - 1 - Nintendo Co., Ltd. -

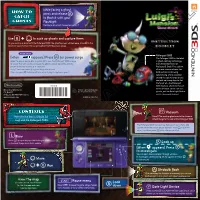

How to Catch Ghosts Controls

While facing a ghost, HOW TO press and release CATCH to flash it with your GHOSTS Flashlight. Flashing a ghost will momentarily stun it. Use to suck up ghosts and capture them. As you suck up a ghost with the Poltergust 5000, the ghost’s power will decrease. Move in the INSTRUCTION direction opposite from the escaping ghost to fill the power gauge. BOOKLET POWER GAUGE Poltergust 5000 (When appears) Press for power surge The Poltergust 5000 is the latest When the power gauge fills up, press to give the Poltergust 5000 a surge in ghost-catching technology of power that will quickly decrease the ghost’s power. When the ghost’s from the brilliant mind of power is reduced to zero, it is captured. Professor E. Gadd. This custom, • Luigi™ can lose hearts if a ghost drags him around. all-in-one vacuum cleaner has • You can press to dodge attacks while trying to capture a ghost. both suction and blowing functionality, and is powerful enough to capture large ghosts and pick up heavy objects. But that’s not all—the Poltergust 79102A 5000 features attachments such as the Strobulb, which can stun Nintendo of America Inc. Product recycling information: P.O. Box 957 visit recycle.nintendo.com ghosts, and the Dark-Light Device, Redmond, WA 98073-0957 U.S.A. which can reveal illusions! www.nintendo.com PRINTED IN USA CONTROLS Vacuum Here are the basic controls for Press to suck up ghosts and other items or Luigi and the Poltergust 5000. attach things to the end of the Poltergust 5000. -

Super Smash Bros. Melee) X25 - Battlefield Ver

BATTLEFIELD X04 - Battlefield T02 - Menu (Super Smash Bros. Melee) X25 - Battlefield Ver. 2 W21 - Battlefield (Melee) W23 - Multi-Man Melee 1 (Melee) FINAL DESTINATION X05 - Final Destination T01 - Credits (Super Smash Bros.) T03 - Multi Man Melee 2 (Melee) W25 - Final Destination (Melee) W31 - Giga Bowser (Melee) DELFINO'S SECRET A13 - Delfino's Secret A07 - Title / Ending (Super Mario World) A08 - Main Theme (New Super Mario Bros.) A14 - Ricco Harbor A15 - Main Theme (Super Mario 64) Luigi's Mansion A09 - Luigi's Mansion Theme A06 - Castle / Boss Fortress (Super Mario World / SMB3) A05 - Airship Theme (Super Mario Bros. 3) Q10 - Tetris: Type A Q11 - Tetris: Type B Metal Cavern 1-1 A01 - Metal Mario (Super Smash Bros.) A16 - Ground Theme 2 (Super Mario Bros.) A10 - Metal Cavern by MG3 1-2 A02 - Underground Theme (Super Mario Bros.) A03 - Underwater Theme (Super Mario Bros.) A04 - Underground Theme (Super Mario Land) Bowser's Castle A20 - Bowser's Castle Ver. M A21 - Luigi Circuit A22 - Waluigi Pinball A23 - Rainbow Road R05 - Mario Tennis/Mario Golf R14 - Excite Truck Q09 - Title (3D Hot Rally) RUMBLE FALLS B01 - Jungle Level Ver.2 B08 - Jungle Level B05 - King K. Rool / Ship Deck 2 B06 - Bramble Blast B07 - Battle for Storm Hill B10 - DK Jungle 1 Theme (Barrel Blast) B02 - The Map Page / Bonus Level Hyrule Castle (N64) C02 - Main Theme (The Legend of Zelda) C09 - Ocarina of Time Medley C01 - Title (The Legend of Zelda) C04 - The Dark World C05 - Hidden Mountain & Forest C08 - Hyrule Field Theme C17 - Main Theme (Twilight Princess) C18 - Hyrule Castle (Super Smash Bros.) C19 - Midna's Lament PIRATE SHIP C15 - Dragon Roost Island C16 - The Great Sea C07 - Tal Tal Heights C10 - Song of Storms C13 - Gerudo Valley C11 - Molgera Battle C12 - Village of the Blue Maiden C14 - Termina Field NORFAIR D01 - Main Theme (Metroid) D03 - Ending (Metroid) D02 - Norfair D05 - Theme of Samus Aran, Space Warrior R12 - Battle Scene / Final Boss (Golden Sun) R07 - Marionation Gear FRIGATE ORPHEON D04 - Vs. -

Best Wishes to All of Dewey's Fifth Graders!

tiger times The Voice of Dewey Elementary School • Evanston, IL • Spring 2020 Best Wishes to all of Dewey’s Fifth Graders! Guess Who!? Who are these 5th Grade Tiger Times Contributors? Answers at the bottom of this page! A B C D E F G H I J K L M N O P Q R Tiger Times is published by the Third, Fourth and Fifth grade students at Dewey Elementary School in Evanston, IL. Tiger Times is funded by participation fees and the Reading and Writing Partnership of the Dewey PTA. Emily Rauh Emily R. / Levine Ryan Q. Judah Timms Timms Judah P. / Schlack Nathan O. / Wright Jonah N. / Edwards Charlie M. / Zhu Albert L. / Green Gregory K. / Simpson Tommy J. / Duarte Chaya I. / Solar Phinny H. Murillo Chiara G. / Johnson Talula F. / Mitchell Brendan E. / Levine Jojo D. / Colledge Max C. / Hunt Henry B. / Coates Eve A. KEY: ANSWER KEY: ANSWER In the News Our World............................................page 2 Creative Corner ..................................page 8 Sports .................................................page 4 Fun Pages ...........................................page 9 Science & Technology .........................page 6 our world Dewey’s first black history month celebration was held in February. Our former principal, Dr. Khelgatti joined our current Principal, Ms. Sokolowski, our students and other artists in poetry slams, drumming, dancing and enjoying delicious soul food. Spring 2020 • page 2 our world Why Potatoes are the Most Awesome Thing on the Planet By Sadie Skeaff So you know what the most awesome thing on the planet is, right????? Good, so you know that it is a potato. And I will tell you why the most awesome thing in the world is a potato, and you will listen. -

Mario Kart 8 Nintendo Promotion Promotional Terms and Conditions. 1. Information on How to Enter and Prizes Form Part of These C

Mario Kart 8 Nintendo promotion Promotional Terms and Conditions. 1. Information on How to Enter and prizes form part of these Conditions of Entry. 2. The promotional period begins on the 24th April 2017 and ends on the Sunday 7th May at 11.59pm AEDST. 3. Eligible entrants must Like Bluemouth Interactive’s Facebook Community Page and the Press-Start Australia’s Facebook Community Page during the promotional period + enter the codeword “Switch” on the wall or comments section - for the entry to be considered valid, 4. Employees of Bluemouth Interactive, Press-Start Australia’s, Nintendo Australia and associated companies and their immediate families and any agencies associated with this promotion are excluded from entry. 5. The promotion is valid for residents of Australia and New Zealand only. 6. The random draw will take place on or around at 10.00am on the Tuesday 9th May, 2017 at Southern Cross Austereo, 257 Clarendon St, South Melbourne, VIC. Prize winners name will be published on the Press-Start Australia page by 10th May, 2017. 7. The first randomly-drawn, eligible entry will receive: § 1 x Nintendo Switch Console– valued at AUD$479 § 1 x Zelda: Breath of the Wild Game – valued at $89.95 § 1 x Mario Kart 8 Deluxe game – valued on $79.95 § 1 Mario Kart 8 case (licensed) by RDS $29.95 § 1 x Mario Kart 8 game guide (licensed) by Prima $29.95 § 1 x JoyCon Charging Station (licensed) by Power A $59.95 § 1 x LucidSound LS20 headset $149.95 Total prize pool : $918.70 8. -

Operations Manual

NINTENDO CLASSIC MINI WARNING – ELECTRICAL SAFETY T his seal is your assurance that Nintendo has reviewed this To avoid risk of overheating, fire, explosion, electric shock, injury, deformation and/or malfunction: product and that it has met our standards for excellence in • Do not use the console during a lightning storm. workmanship, reliability and entertainment value. Always look • Do not disassemble, make alterations to, or try to repair the console. for this seal when buying games and accessories to ensure • Do not step on, forcefully bend or pull on the cables of the console. When unplugging the console from the power supply, turn off the console first and complete compatibility with your Nintendo Product. pull on the plug rather than the cable. • Do not allow liquids or foreign substances to enter the console. In the event liquid (e.g. water, juice, oil or pet urine) or foreign substances enter the con- sole, immediately stop using it, turn the power off, disconnect the console from the power supply and contact Nintendo Customer Service for advice on how to proceed. • Only use an AC adapter that is compatible with this console, such as the separately sold Nintendo USB AC adapter (CLV-003(AUS)) or another USB-compatible 5V/1A (5W) output AC adapter. Please make sure to use an AC adapter that has been approved for use in your country, and read its instruction manual to en- Thank you for selecting the Nintendo Classic Mini: Nintendo Entertainment System™ console. sure that it is able to supply power to this console. • When connecting the USB cable to the console or to a power supply, make sure the connector on the USB cable is orientated correctly and then insert it Nintendo may change product specifications and update the manual from time to time. -

CSR Report 2013

CSR Report 2013 We def ine CSR as “Putting Smiles on the Faces of Everyone Nintendo Touches.” This CSR report is a digest version of the activities Nintendo has been working on to achieve our CSR goal. Please refer to the Nintendo Co., Ltd. website for more detailed information about our CSR activities. We welcome your opinions and comments about the CSR Report 2013 on our website. Digest Version (this report) C S R R e p o r t 2 0 13 Detailed Version (website) http://www.nintendo.co.jp/csr/en/ Nintendo Overview Reporting Scope The scope of this report covers the activities and data of the Company Name Nintendo Group (Nintendo Co., Ltd. and its main consolidated Nintendo Co., Ltd. subsidiaries). Any information not within this scope is explicitly Location identif ied as such. For the purposes of this report, the term “Nintendo” refers to the entire Nintendo Group. Nintendo Co., Ltd. is 11-1 Hokotate-cho, Kamitoba, Minami-ku, Kyoto, Japan referred to by its complete name. Founded September 1889 Reporting Period This report mainly covers activities in f iscal year 2012 (from April Incorporated 2012 through March 2013), in addition to some recent activities and November 1947 some activities prior to f iscal year 2012. Capital 10,065,400,000 yen Publication Date Publication date of English report: July 2013 Net Sales (consolidated) (The next English report will be published in July 2014) 635,422,000,000 yen (f iscal year ended March 2013) Number of Consolidated Employees 5,080 employees (as of the end of March 2013) Business Description Manufacture and sale of home leisure equipment CSR Repor t 2013 President’s Message Expanding Smile Network Over Generations, Genders and Geographic Locations People of all ages, speaking dif ferent languages and representing various cultures, are learning to understand each other through the enjoyment of Nintendo products. -

Using Trade Dress to Protect the Look and Feel of Video Games

THE JOHN MARSHALL REVIEW OF INTELLECTUAL PROPERTY LAW TRYING ON TRADE DRESS: USING TRADE DRESS TO PROTECT THE LOOK AND FEEL OF VIDEO GAMES BENJAMIN C.R. LOCKYER ABSTRACT With the creation of video games for smart phones, video games are some of the most accessible forms of entertainment on the market. What was once only an attraction inside the designated location of arcade halls, is now within the grip of nearly every smart phone user. With new game apps for smart phones going viral on a regular basis, the video game industry has become one of the most profitable in the entertainment realm. However, the industry's overall success has also led to increased competition amongst game developers. As a result, competing developers create near exact copies of highly successful video games called clones. By copying non-copyrightable elements, clone developers can create confusingly similar video games. This comment examines the creation of clone video games and how their developers avoid copyright infringement by exploiting scènes à faire and the merger doctrine. The exploitation of copyright law for video game developers could be combated by trademark law. By using the Lanham Act's protection for trade dress, non-copyrightable elements that identify popular games may be protected. By seeking trade dress protection against clones, game developers can sustain the value of their investment in gaming apps, while also minimizing the issue of consumer confusion. Copyright © 2017 The John Marshall Law School Cite as Benjamin C.R. Lockyer, Trying on Trade Dress: Using Trade Dress to Protect the Look and Feel of Video Games, 17 J. -

Live Round Set 1 Answer Sheet Team ID

Live Round Set 1 Answer Sheet Team ID: 1. 2. 3. Live Round Set 2 Answer Sheet Team ID: 4. 5. 6. Live Round Set 3 Answer Sheet Team ID: 7. 8. 9. Live Round Set 4 Answer Sheet Team ID: 10. 11. 12. Live Round Set 5 Answer Sheet Team ID: 13. 14. 15. Live Round Set 6 Answer Sheet Team ID: 16. 17. 18. Live Round Set 7 Answer Sheet Team ID: 19. 20. 21. Live Round Set 8 Answer Sheet Team ID: 22. 23. 24. 1 1. Mario (without his hat) is 4 feet tall. Mario's hat is 8 the height of Mario (without his hat). If Mario consumes a mushroom, which makes both him and his hat double in height, what is his final height (with his hat), in feet? 2. Princess Peach is trapped in a castle with brick walls. The walls are 360 bricks high, and Princess Peach can climb over the wall in 2 hours. Assuming she climbs at a constant rate, how many bricks can Princess Peach climb in 30 minutes? 3. Luigi joins Mario on his journey to save Peach. Luigi is scared and runs at 3 meters per second, while Mario runs at 5 meters per second. Luigi and Mario begin running in the same direction at the same time from the same place. How far is Mario away from Luigi after 6 seconds? 1 1. Mario (without his hat) is 4 feet tall. Mario's hat is 8 the height of Mario (without his hat). If Mario consumes a mushroom, which makes both him and his hat double in height, what is his final height (with his hat), in feet? 2.