Market Comments Single Stock Observations Risk Allocation Style Performance Outlook

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Establishes and Spreads a New Food Culture

The Conversion of the Japanese Cuisine Finalized in the Edo Era to Japanese-style Western and Chinese Cuisine The Acceptance and Modification of Foreign Cuisine Establishes and Spreads a New Food Culture The Opening and Westernization of Japan Zenjiro Watanabe and the Influx of Western Foods Mr. Watanabe was born in Tokyo in 1932 and graduated from Waseda University in 1956. In 1961, he received his Ph.D in commerce from The history of Japanese cuisine is a history full of the the same university and began working at the acceptance and modification of foreign cuisine. Since the rice National Diet Library. Mr. Watanabe worked at the National Diet Library as manager of the culture of the Yayoi Period (200B.C.—250A.D.), Japan has department that researches the law as it applies to agriculture. He then worked as manager of skillfully accepted new food cultures—from Tang-style grand the department that researches foreign affairs, and finally he devoted himself to research at the banquet dishes to the vegetarian dishes of the Kamakura Library. Mr. Watanabe retired in 1991 and is now head of a history laboratory researching Period (1185—1333) to the Portuguese dishes of the Warring various aspects of cities, farms and villages. Mr. Watanabe’s major works include Toshi to States Period (1482—1558)—and adapted them to the Noson no Aida—Toshikinko Nogyo Shiron, 1983, Japanese palate as if they had always been a part of the Ronsosha; Kikigaki •Tokyo no Shokuji, edited 1987, Nobunkyo; Kyodai Toshi Edo ga Washoku Japanese food culture. wo Tsukutta, 1988, Nobunkyo; Nou no Aru Machizukuri, edited 1989, Gakuyoshobo; Tokyo The Edo Era saw the finalization of the Japanese food culture ni Nochi ga Atte Naze Warui, collaboration 1991, Gakuyoshobo; Kindai Nihon Toshikinko into what we today consider Japanese cuisine. -

Notice of Convocation of the 97Th Annual General Meeting of Shareholders

[Translation]: This represents an excerpted translation, for reference and convenience only, of the original notice issued in Japanese. In the event of any discrepancies between the Japanese and English versions, the former shall prevail. (Securities Code: 4118) June 3, 2021 Notice of Convocation of the 97th Annual General Meeting of Shareholders Dear Shareholders: Notice is hereby given that the 97th Annual General Meeting of Shareholders of the Company will be held as set forth below. In order to avoid the risk of COVID-19 infection at the Annual General Meeting of Shareholders, it is strongly recommended that shareholders refrain from attending the meeting in person. You may exercise your voting rights either via return mail or via the Internet.1 Please review the accompanying "Reference Document Concerning the General Meeting of Shareholders" and cast your votes so as to reach the Company prior to 6:00 p.m. (JST) on June 24, 2021 (Thursday). Yours very truly, Minoru Tanaka President and Representative Director KANEKA CORPORATION 3-18, Nakanoshima 2-chome, Kita-ku, Osaka, Japan 1 (Note): Please note that shareholders outside Japan shall not use these voting procedures via return mail or the internet. Institutional investors should refer to the attached document entitled “Information about Exercise of Voting Rights” described on page 3. [Translation] - 1 - Particulars 1. Date and time of the meeting: Friday, June 25, 2021, at 10:00 a.m. (JST) Reception will start at 9:00 a.m. (JST) 2. Place of the meeting: Osaka Headquarters of the Company, Nakanoshima Festival Tower (36th floor), 3-18, Nakanoshima 2-chome, Kita-ku, Osaka, Japan 3. -

FAST RETAILING CO., LTD. Takeda Pharmaceutical Co., Ltd. Nisshin

ANNUAL REPORT OF PROXY VOTING RECORD REPORTING PERIOD: JULY 1, 2018 – JUNE 30, 2019 WisdomTree Japan Equity Index ETF (JAPN/JAPN.B) _________________________________________________________________________________________________________ FAST RETAILING CO., LTD. Meeting Date: 11/29/2018 Country: Japan Primary Security ID: J1346E100 Record Date: 08/31/2018 Meeting Type: Annual Ticker: 9983 Shares Voted: 50 Vote Proposal Text Proponent Mgmt Rec Instruction Elect Director Yanai, Tadashi Mgmt For For Elect Director Hambayashi, Toru Mgmt For For Elect Director Hattori, Nobumichi Mgmt For For Elect Director Shintaku, Masaaki Mgmt For For Elect Director Nawa, Takashi Mgmt For For Elect Director Ono, Naotake Mgmt For For Elect Director Okazaki, Takeshi Mgmt For For Elect Director Yanai, Kazumi Mgmt For For Elect Director Yanai, Koji Mgmt For For Appoint Statutory Auditor Tanaka, Akira Mgmt For For Appoint Statutory Auditor Kashitani, Takao Mgmt For For Takeda Pharmaceutical Co., Ltd. Meeting Date: 12/05/2018 Country: Japan Primary Security ID: J8129E108 Record Date: 10/19/2018 Meeting Type: Special Ticker: 4502 Shares Voted: 4,500 Vote Proposal Text Proponent Mgmt Rec Instruction Approve Issuance of Common Shares in Mgmt For For Preparation for Acquisition of Shire Plc Elect Director Ian Clark Mgmt For For Elect Director Olivier Bohuon Mgmt For For Elect Director Steven Gillis Mgmt For For Nisshin Steel Co., Ltd. Meeting Date: 12/10/2018 Country: Japan Primary Security ID: J57828105 Record Date: 09/30/2018 Meeting Type: Special Ticker: 5413 ANNUAL REPORT OF PROXY VOTING RECORD REPORTING PERIOD: JULY 1, 2018 – JUNE 30, 2019 WisdomTree Japan Equity Index ETF (JAPN/JAPN.B) _________________________________________________________________________________________________________ Nisshin Steel Co., Ltd. -

Basic Strategy for Food & Beverage Services

Tokyo 2020 Basic Strategy for Food & Beverage Services 2018.03 17FNB0219000 Table of Contents 1 Aims of the Food & Beverage Service Strategy 1 1.1 What Tokyo 2020 aims to achieve through its food & beverage services 1.2 Philosophy guiding preparations for the food & beverage strategy 1.3 Operation of food and beverage services to realise the Games Vision 2 Scale of the Games 5 2.1 Period of the Games 2.2 Games Venues 2.3 Stakeholders 3 Food & Beverage Services 9 3.1 Scope of responsibility 3.1.1 Areas where food & beverages are provided under the responsibility of Tokyo 2020 3.1.2 Areas that are not under the responsibility of Tokyo 2020 but are subject to the requirements of the food & beverage strategy 3.2 Matters requiring special consideration 3.2.1 Food safety management 3.2.2 Countermeasures against natural disasters 3.2.3 Nutrition management (including labelling) 3.2.4 Consideration for diversity 3.2.5 Heat countermeasures 3.3 Details of food & beverage services 3.3.1 Basic Direction 3.3.2 Athletes and NOCs/NPC officials 3.3.3 International Federations (IFs) 3.3.4 Olympic and Paralympic Families, etc. 3.3.5 Broadcasting Services and Press 3.3.6 Marketing Partners 3.3.7 Spectators 3.3.8 Staff members 3.4 Special consideration for Paralympians 4 Consideration for Sustainability 21 4.1 Basic principles 4.2 Approach to ensure sustainability in operations Table of Contents 5 Approach for the Future 23 5.1 Introduction and transfer of Japanese food culture 5.2 Usage of domestic agricultural products (e.g. -

Whither the Keiretsu, Japan's Business Networks? How Were They Structured? What Did They Do? Why Are They Gone?

UC Berkeley Working Paper Series Title Whither the Keiretsu, Japan's Business Networks? How Were They Structured? What Did They Do? Why Are They Gone? Permalink https://escholarship.org/uc/item/00m7d34g Authors Lincoln, James R. Shimotani, Masahiro Publication Date 2009-09-24 eScholarship.org Powered by the California Digital Library University of California WHITHER THE KEIRETSU, JAPAN’S BUSINESS NETWORKS? How were they structured? What did they do? Why are they gone? James R. Lincoln Walter A. Haas School of Business University of California, Berkeley Berkeley, CA 94720 USA ([email protected]) Masahiro Shimotani Faculty of Economics Fukui Prefectural University Fukui City, Japan ([email protected]) 1 INTRODUCTION The title of this volume and the papers that fill it concern business “groups,” a term suggesting an identifiable collection of actors (here, firms) within a clear-cut boundary. The Japanese keiretsu have been described in similar terms, yet compared to business groups in other countries the postwar keiretsu warrant the “group” label least. The prewar progenitor of the keiretsu, the zaibatsu, however, could fairly be described as groups, and, in their relatively sharp boundaries, hierarchical structure, family control, and close ties to the state were structurally similar to business groups elsewhere in the world. With the break-up by the U. S. Occupation of the largest member firms, the purging of their executives, and the outlawing of the holding company structure that held them together, the zaibatsu were transformed into quite different business entities, what we and other literature call “network forms” of organization (Podolny and Page, 1998; Miyajima, 1994). -

Nori Tofu Kikkoman Spam Musubi Pocky Dashi Manju Sushi Ramen

Nori Tofu Kikkoman Spam Musubi Pocky Dashi Manju Sushi Ramen Tempura Yakitori Musubi Takoyaki Taiyaki Umeboshi Sashimi Ochazuke Yakisoba Donburi Chirashi Unagi Uni Mochi Tsukemono Anpan Sapporo Ichiban Sake Mikan Bento Gohan Sekihan Dango Miso Teriyaki Kokuho Rose Katsu Curry Ramune Green Tea Kaki / Persimmon Cherry Blossom / Ume / Plum Ozoni Sakura Benihana Daiso Nijiya Marukai Kinokuniya Uniqlo Zojirushi Toyota Nissan Seiko Butsudan Incense / Senko Kodomo no Hi Matsuri Kimono Children's Day Hinamatsuri Koinobori Festival Mochitsuki Oshogatsu Obon Sumo Karaoke Odori Ikebana Taiko Bonsai Mikoshi Shamisen Chanoyu Kenjinkai Fujinkai Ohaka Mairi Executive Order Japan Pearl Harbor 9066 February 19, 1942 December 7, 1941 Assembly Center Day of Topaz Tanforan Remembrance Military Intelligence Manzanar Tule Lake Service (MIS) Civil Liberties Act Dorthea Lange Concentration Camp 442nd Regimental Go For Broke No-No Boy Combat Team Shib Sibs Jake Shimabukuro Purple Heart (Alex & Maia Shibutani) Yuri Kochiyama Eric Shinseki Pat Morita Sessue Hayakawa Ellison Onizuka George Takei Isamu Noguchi Yoko Ono Nikkei Wat(aru) Misaka Norm Mineta Daniel Inouye Tommy Kono Kristi Yamaguchi Apolo Ohno Wally Yonamine Ruth Asawa Fred Korematsu Issei Nisei Sansei Yonsei Hapa Nihonjin Obaachan Ojiichan Sensei (Baachan) (Jiichan) Blanket Boy Angel Island Immigration Gentlemen's Picture Brides Immigration Act Agreement (1965 - abolish national quota) Kodomo no Gambatte Gaman Tame ni Itadakimasu Mottainai Konnichiwa Arigatou Oishii (O)hashi Daruma Tsuru (Crane) Kokeshi Manga Anime Nintendo Playstation Kendama Jan Ken Po Japantown Community Nihonmachi Emperor Empress Samurai Yukata Momotaro Kabuto Geta Tabi Obi. -

Respondents(Eng)

JCGR JCGIndex Survey 2008 List of 252 responding firms Mining (1) House Foods Corporation (03)(05)(06) INPEX Corporation (07) (07) Nichirei Corporation (02)(03)(04)(05)(06) Construction (13) (07) Taisei Corporation (05)(06)(07) Fujicco Co., Ltd. ((07) OBAYASHI CORPORATION (04)(05)(06) (07) Textiles & Apparel (6) HASEKO Corporation Gunze Limited (02)(03)(04)(05)(06)(07) KAJIMA Corporation Japan Wool Textile Co., Ltd. (04)(05) Maeda Corporation (02)(03)(04)(05)(06) (06)(07) (07) Teijin Limited (03)(04)(05)(06)(07) Totetsu Kogyo Co., Ltd. (04)(05)(06)(07) Toray Industries, Inc. (03)(05)(06) TOA CORPORATION Japan Vilene Company, Ltd. (05)(07) Daiwa House Industry Co., Ltd. (05)(06) Wacoal Holdings Corp. (02)(04)(05)(06) (07) (07) Sekisui House, Ltd. (05)(06)(07) Nippon Densetsu Kogyo Co., Ltd. (04) Pulp and Paper (2) (05)(07) Rengo Co., Ltd. (02)(04)(05)(06)(07) Takasago Thermal Engineering Co., Ltd. The Pack Corporation (06) DAI-DAN Co., Ltd. (04)(05)(06) Chemicals (20) Toyo Engineering Corporation Asahi Kasei Corporation (05)(06)(07) Showa Denko K.K (04)(05)(06)(07) Foods (10) Nippon Soda Co., Ltd. (03)(04)(05)(06) Morozoff Limited (07) (07) NH Foods Ltd. (04)(05)(06)(07) Tokuyama Corpo (02)(04)(05)(06)(07) Asahi Breweries, Ltd. (02)(03)(04)(05) Kanto Denka Kogyo Co., Ltd. (04)(05)(06) (06)(07) (07) The Nisshin OilliO Group, Ltd. (05)(06) Shin-Etsu Chemical Co., Ltd. (05)(06) (07) Mitsubishi Chemical Holdings Fuji Oil Co., Ltd. (03)(04) Corporation (04)(05)(06) Kikkoman Corporation (07) JSR Corporation (04)(05)(06)(07) Ajinomoto Co., Inc. -

Food Industry Research Analysts INITIATION

30 August 2016 Asia Pacific/Japan Equity Research Food Products (Personal Products (Japan)) / MARKET WEIGHT Food Industry Research Analysts INITIATION Masashi Mori 81 3 4550 9695 [email protected] Recommend Morinaga Milk Industry and Morinaga & Co. ■ Initiating coverage: We rate three companies OUTPERFORM: Morinaga Milk Industry (2264), Morinaga & Co. (2201), and Meiji Holdings (2269). We have NEUTRAL ratings on four companies: Kikkoman (2801), Ajinomoto (2802), Toyo Suisan (2875), and Nissin Foods Holdings (2897). We rate one firm UNDERPERFORM: Yakult (2267). We are already covering Calbee (2229) with a NEUTRAL rating. We believe the foods sector remains under selling pressure due to relatively high valuations. However, we are fundamentally bullish on companies that have strong medium-term earnings growth profiles and are not currently overvalued. ■ Five key points: Our basic evaluation standards are: (1) companies positioned in the few growth categories in the Japanese foods market: yogurt and chocolate due to rising health consciousness; fruit granola and other cereal due to changing breakfast habits; and cheese, coffee and alcoholic beverages due to changes in food culture; (2) companies set to benefit from shifts in consumption behavior in Japan: those strong in B-to-B distribution, those able to meet growing demand for ready-made meals, those able to respond to growth in the convenience store channel; (3) companies having a strong presence in emerging markets with attractive future demographics; (4) companies positioned to ride the Japanese food boom and other tailwinds and which are positioned for sales growth in developed nations outside of Japan; and (5) companies capable of making internal shifts, including restructuring and management mindset. -

Published on 7 October 2015 1. Constituents Change the Result Of

The result of periodic review and component stocks of TOPIX Composite 1500(effective 30 October 2015) Published on 7 October 2015 1. Constituents Change Addition( 80 ) Deletion( 72 ) Code Issue Code Issue 1712 Daiseki Eco.Solution Co.,Ltd. 1972 SANKO METAL INDUSTRIAL CO.,LTD. 1930 HOKURIKU ELECTRICAL CONSTRUCTION CO.,LTD. 2410 CAREER DESIGN CENTER CO.,LTD. 2183 Linical Co.,Ltd. 2692 ITOCHU-SHOKUHIN Co.,Ltd. 2198 IKK Inc. 2733 ARATA CORPORATION 2266 ROKKO BUTTER CO.,LTD. 2735 WATTS CO.,LTD. 2372 I'rom Group Co.,Ltd. 3004 SHINYEI KAISHA 2428 WELLNET CORPORATION 3159 Maruzen CHI Holdings Co.,Ltd. 2445 SRG TAKAMIYA CO.,LTD. 3204 Toabo Corporation 2475 WDB HOLDINGS CO.,LTD. 3361 Toell Co.,Ltd. 2729 JALUX Inc. 3371 SOFTCREATE HOLDINGS CORP. 2767 FIELDS CORPORATION 3396 FELISSIMO CORPORATION 2931 euglena Co.,Ltd. 3580 KOMATSU SEIREN CO.,LTD. 3079 DVx Inc. 3636 Mitsubishi Research Institute,Inc. 3093 Treasure Factory Co.,LTD. 3639 Voltage Incorporation 3194 KIRINDO HOLDINGS CO.,LTD. 3669 Mobile Create Co.,Ltd. 3197 SKYLARK CO.,LTD 3770 ZAPPALLAS,INC. 3232 Mie Kotsu Group Holdings,Inc. 4007 Nippon Kasei Chemical Company Limited 3252 Nippon Commercial Development Co.,Ltd. 4097 KOATSU GAS KOGYO CO.,LTD. 3276 Japan Property Management Center Co.,Ltd. 4098 Titan Kogyo Kabushiki Kaisha 3385 YAKUODO.Co.,Ltd. 4275 Carlit Holdings Co.,Ltd. 3553 KYOWA LEATHER CLOTH CO.,LTD. 4295 Faith, Inc. 3649 FINDEX Inc. 4326 INTAGE HOLDINGS Inc. 3660 istyle Inc. 4344 SOURCENEXT CORPORATION 3681 V-cube,Inc. 4671 FALCO HOLDINGS Co.,Ltd. 3751 Japan Asia Group Limited 4779 SOFTBRAIN Co.,Ltd. 3844 COMTURE CORPORATION 4801 CENTRAL SPORTS Co.,LTD. -

Japan Market Outlook- 07 July 2021

Market Outlook- 07 July 2021 Despite concerns about COVID-19 variants and Fed On Tuesday's currency market, the US dollar is trading in moves, Japanese stocks rose slightly. The Nikkei 225 the higher 110 yen range. Index rose 45.02 points, or 0.2 percent, to 28,643.21, while the Topix gained 0.3 percent to 1,954.50. According to a government report, the average household spending in Japan increased 11.6 percent year on year in SoftBank Group, a tech-startup investor, rose 1%, while May. This exceeded expectations for a 10.9 percent Daikin Industries, a maker of air conditioners, rose 2.6 increase following a 13.0 percent increase in April. percent. Household spending was down 2.1 percent on a monthly Air transport gained the most on the Topix, gaining 2.8 basis, but that was better than the 3.7 percent drop percent. Following that, oil and coal producers rose 1.8 expected. percent, followed by miners, who rose 1.6 percent. The average monthly income per household was 489,019 Shippers fell the most, down 1%, followed by securities yen, a 2.6 percent decrease year on year. firms, which fell 0.7 percent, and pharmaceutical companies, which fell 0.6 percent. The Japanese government is expected to decide on Thursday whether to extend a state of quasi-emergency The major exporters are mixed, with Sony up more than in Tokyo and three nearby prefectures beyond the original 1% and Canon up 0.5 percent, while Panasonic is down July 11 deadline. -

Calvert VP EAFE International Index Portfolio 1St Quarter Holdings

Calvert VP EAFE International Index Portfolio March 31, 2020 Schedule of Investments (Unaudited) Common Stocks — 98.5% Security Shares Value Australia (continued) Security Shares Value Australia — 5.8% Ramsay Health Care, Ltd. 1,442 $ 50,704 REA Group, Ltd. 537 25,155 AGL Energy, Ltd. 6,090 $ 63,734 Rio Tinto, Ltd. 3,172 163,420 Alumina, Ltd.(1) 14,501 12,996 Santos Ltd., 13,517 27,761 AMP,Ltd.(1)(2) 22,416 18,306 Scentre Group 45,895 43,959 APA Group(1) 11,361 72,094 Seek, Ltd.(1) 3,323 30,366 Aristocrat Leisure, Ltd. 4,773 61,847 Sonic Healthcare, Ltd. 4,020 60,420 ASX, Ltd. 1,623 76,185 South32, Ltd. 48,353 53,377 Aurizon Holdings, Ltd. 16,477 42,701 Stockland 19,317 29,704 AusNet Services(1) 27,031 28,383 Suncorp Group, Ltd.(1) 11,330 62,918 Australia & New Zealand Banking Group, Ltd. 24,210 253,900 Sydney Airport 8,748 30,225 Bendigo & Adelaide Bank, Ltd. 4,706 18,080 Tabcorp Holdings, Ltd.(1) 15,814 24,474 BGP Holdings PLC(2)(3) 77,172 — Telstra Corp., Ltd. 37,215 69,858 BHP Group, Ltd. 26,250 476,209 TPG Telecom, Ltd.(1) 3,460 14,735 BlueScope Steel, Ltd. 4,388 22,973 Transurban Group(1) 24,274 180,808 Boral, Ltd. 10,917 13,712 Treasury Wine Estates, Ltd. 6,449 40,039 Brambles, Ltd. 14,024 90,648 Vicinity Centres 25,959 16,238 Caltex Australia, Ltd. 1,867 25,210 Washington H. -

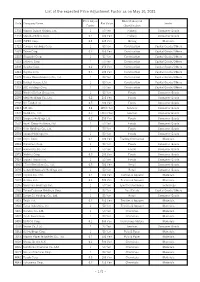

List of the Expected Price Adjustment Factor As on May 10, 2021

List of the expected Price Adjustment Factor as on May 10, 2021 Price Adjust Nikkei Industrial Code Company Name Par Value Sector Factor Classification 1332 Nippon Suisan Kaisha, Ltd. 1 50 Yen Fishery Consumer Goods 1333 Maruha Nichiro Corp. 0.1 500 Yen Fishery Consumer Goods 1605 INPEX Corp. 0.4 125 Yen Mining Materials 1721 Comsys Holdings Corp. 1 50 Yen Construction Capital Goods/Others 1801 Taisei Corp. 0.2 250 Yen Construction Capital Goods/Others 1802 Obayashi Corp. 1 50 Yen Construction Capital Goods/Others 1803 Shimizu Corp. 1 50 Yen Construction Capital Goods/Others 1808 Haseko Corp. 0.2 250 Yen Construction Capital Goods/Others 1812 Kajima Corp. 0.5 100 Yen Construction Capital Goods/Others 1925 Daiwa House Industry Co., Ltd. 1 50 Yen Construction Capital Goods/Others 1928 Sekisui House, Ltd. 1 50 Yen Construction Capital Goods/Others 1963 JGC Holdings Corp. 1 50 Yen Construction Capital Goods/Others 2002 Nisshin Seifun Group Inc. 1 50 Yen Foods Consumer Goods 2269 Meiji Holdings Co., Ltd. 0.2 250 Yen Foods Consumer Goods 2282 NH Foods Ltd. 0.5 100 Yen Foods Consumer Goods 2413 M3, Inc. 2.4 125/6 Yen Services Consumer Goods 2432 DeNA Co., Ltd. 0.3 500/3 Yen Services Consumer Goods 2501 Sapporo Holdings Ltd. 0.2 250 Yen Foods Consumer Goods 2502 Asahi Group Holdings, Ltd. 1 50 Yen Foods Consumer Goods 2503 Kirin Holdings Co., Ltd. 1 50 Yen Foods Consumer Goods 2531 Takara Holdings Inc. 1 50 Yen Foods Consumer Goods 2768 Sojitz Corp. 0.1 500 Yen Trading Companies Materials 2801 Kikkoman Corp.