Mary-Poppins.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Saving Mr. Banks

LAMORINDA WEEKLY | Saving Mr. Banks Published December 18th, 2013 Saving Mr. Banks By Derek Zemrak I went into the press screening of "Saving Mr. Banks" thinking I was going to see a "feel good" Disney holiday movie. But in reality, I got more than a "spoonful of sugar." I saw a solid film with a superior script and superb acting based on the true story about P. L. Travers, the author of "Mary Poppins." The film stars two-time Oscar winner Emma Thompson ("Sense and Sensibility," "Howards End") as the bitter Travers and two-time Oscar winner and Bay Area native Tom Hanks ("Forrest Gump," "Philadelphia") as Walt Disney. Disney's daughters loved the book, "Mary Poppins," and he promised them that one day he would make a "Mary Poppins" movie. Well, sometimes things are not that easy, even if you are Walt Disney. Travers was very protective of the creation of her characters in "Mary Poppins" and she had no desire to have them come to life on the big screen. After 20 years chasing his promise to his daughters, Disney continued to pursue the rights from Travers. When the royalties were drying up, Travers finally agreed under Walt Disney Studios Motion Pictures one condition: that she maintain total control of production. As Disney says, "A promise is a promise," and for his daughters he agreed to the terms. Disney did not have any idea what was in store for him and the production crew as they began making "Mary Poppins." Travers was not happy about anything from the script, the music, the animation, to the casting of Dick Van Dyke. -

Mary Poppins Jr. Full Synopsis from Mtishows.Com

Mary Poppins Jr. Full Synopsis From mtishows.com Bert, a man of many trades, introduces the audience to the unhappy Banks family: father George, mother Winifred, and children Jane and Michael (Prologue). The family; the housekeeper, Mrs. Brill; and the houseboy, Robertson Ay, are shocked when Katie Nanna quits and storms out in frustration. George muses about what he expects from the household - the nanny, in particular ("Cherry Tree Lane - Part 1"). Though Jane and Michael insist upon their own requirements for their caregiver ("The Perfect Nanny"), George dismisses their requests ("Cherry Tree Lane - Part 2"). As if summoned, Mary Poppins appears, offering her services as a nanny. She fits the children's requirements exactly ("Practically Perfect / Practically Perfect - Playoff" ). She then takes the children to the park, where they meet Bert, who describes how wonderful everyday life can be when spending time with Mary ("Jolly Holiday"). At first, the children are not convinced, but when Mary Poppins brings to life a park statue named Neleus, Jane and Michael are in awe of her. The children return home and gush to their father about the nanny, but George is preoccupied ("Winds Do Change"). A few weeks later, the household is preparing for Winifred's party, and Jane and Michael make a mess of the house. Despite Mary's magic ("A Spoonful of Sugar"), the party is ruined when no one attends ("Spoonful - Playoff"). Later, Mary takes the children on a visit to George's workplace, the bank ("Precision and Order - Part 1"). While Clerks are bustling about and clients are trying to convince George to grant them loans, the children burst into the bank ("Precision and Order - Part 2"). -

Mary Poppins JR Character Descriptions.P

Disney and Cameron Mackintosh’s Mary Poppins JR CHARACTER BREAKDOWN MALES Bert, the narrator of the story, is a good friend to Mary Poppins. An everyman, Bert is a chimney sweep and a sidewalk artist, among many other occupations. With a twinkle in his eye and skip in his step, Bert watches over the children and the goings-on around Cherry Tree Lane. He is a song-and-dance man with oodles of charm who is wise beyond his years. We are looking for a very strong singer, dancer and actor for this role. Songs: Prologue Practically Perfect (Playoff) Jolly Holiday Winds Do Change Supercalifragilisticexpialidocious Twists and Turns Playing the Game/Chim Chim Cher-ee Let’s Go Fly a Kite Step in Time Step in Time (Playoff) A Spoonful of Sugar (Reprise) George Banks, husband to Winifred and father to Jane and Michael, is a banker to the very fiber of his being. Demanding “precision and order” in his household, he is a pipe-and-slippers man who doesn’t have much to do with his children, and believes that Miss Andrew, his cruel, strict, childhood nanny, gave him the perfect upbringing. George’s emotional armor, however off-putting, conceals a sensitive soul. A baritone (lower singer), George may also speak-sing and should be a very strong actor. Songs: Cherry Tree Lane (Part 1) Cherry Tree Lane (Part 2) Precision and Order (speaking) A Man Has Dreams Cherry Tree Lane (Reprise) Give Us the Word Anything Can Happen (Part 2) Anything Can Happen (Finale) Michael Banks is the cheeky son of Mr. -

Sacramento Theatre Company Mary Poppins

Sacramento Theatre Company Study Guide The Mary Poppins Jr. By Richard M. Sherman, Robert B. Sherman, and Julian Fellowes Based on the novel by P.L. Travers and the Walt Disney Motion Picture Study Guide Materials Compiled by Anna Miles 1 Sacramento Theatre Company Mission Statement The Sacramento Theatre Company (STC) strives to be the leader in integrating professional theatre with theatre arts education. STC produces engaging professional theatre, provides exceptional theatre training, and uses theatre as a tool for educational engagement. Our History The theatre was originally formed as the Sacramento Civic Repertory Theatre in 1942, an ad hoc troupe formed to entertain locally-stationed troops during World War II. On October 18, 1949, the Sacramento Civic Repertory Theatre acquired a space of its own with the opening of the Eaglet Theatre, named in honor of the Eagle, a Gold Rush-era theatre built largely of canvas that had stood on the city’s riverfront in the 1850s. The Eaglet Theatre eventually became the Main Stage of the not-for-profit Sacramento Theatre Company, which evolved from a community theatre to professional theatre company in the 1980s. Now producing shows in three performance spaces, it is the oldest theatre company in Sacramento. After five decades of use, the Main Stage was renovated as part of the H Street Theatre Complex Project. Features now include an expanded and modernized lobby and a Cabaret Stage for special performances. The facility also added expanded dressing rooms, laundry capabilities, and other equipment allowing the transformation of these performance spaces, used nine months of the year by STC, into backstage and administration places for three months each summer to be used by California Musical Theatre for Music Circus. -

A Spoonful of Sugar Natali Bode Augustana College - Rock Island

Augustana College Augustana Digital Commons Tredway Library Prize for First-Year Research Prizewinners 5-16-2012 A Spoonful of Sugar Natali Bode Augustana College - Rock Island Follow this and additional works at: http://digitalcommons.augustana.edu/libraryprize Part of the Other Nutrition Commons, and the Other Public Health Commons Recommended Citation Bode, Natali, "A Spoonful of Sugar" (2012). Tredway Library Prize for First-Year Research. Paper 1. http://digitalcommons.augustana.edu/libraryprize/1 This Student Paper is brought to you for free and open access by the Prizewinners at Augustana Digital Commons. It has been accepted for inclusion in Tredway Library Prize for First-Year Research by an authorized administrator of Augustana Digital Commons. For more information, please contact [email protected]. Bode 1 Natali Bode Dr. Popple LSFY 103 16 May 2012 A Spoonful of Sugar A popular song in the musical Mary Poppins states that “a spoonful of sugar helps the medicine go down” (Sherman). Examining the United States’ sugar consumption, one might venture to state that Miss Poppins was correct in her statement, but for an entirely different reason than originally intended. Miss Poppins really should have said that “a spoonful of sugar helps increase the amount of medicine one takes”; however, it was probably not catchy enough to place it into the song. It is known that the more sugar a person consumes, the more likely he or she is susceptible to different diseases, which leads to additional medicine consumption—or more medicine to “go down”. Today, it is common knowledge that the United States is currently facing an obesity epidemic, which is also associated with many other diseases such as cardiovascular diseases and diabetes. -

Margaux Deverin

Premier Sponsors KIDDSTUFF Series Sponsors A Musical based on the stories of P.L. Travers Production of and the Walt Disney film Original Music and Lyrics by Richard M. Sherman and Robert B. Sherman Book by Julian Fellowes New Songs and Additoinal Music and Lyrics by George Stiles and Anthony Drewe Co-Created by Cameron Mackintosh Adapted by iTheatrics under the supervision of Timothy Allen McDonald AUGUST 1−3 Scenic Design Costume Design Lighting Design Sound Design Jack Golden Anna Jekel William M. Brown Kristin Hamby Music Director Choreographer Stage Manager Production Manager Oliver Scott Priscilla Hummel Kylee Risdon Hannah Schneider Director Original London and Broadway Production Credits: Margaux Deverin Produced by Cameron Mackintosh and Thomas Schumacher The videotaping or other video or audio recording of this Scenic and Costume Design production is strictly prohibited. Bob Crowly Co-Direction and Choreography Matthew Bourne MARY POPPINS JR Directed by is presented through special arrangement with Music Theatre International (MTI). All Richard Eyre authorized performance materials are also supplied by MTI. www.MTIShows.com CAST Bert ................................................................................................................................................................................... SIRUS DESNOES George Banks .......................................................................................................................................................... THOMAS HAMRICK Winifred Banks ...........................................................................................................................................................................LILY -

The Pierce Players

P i e r c e P l a y e r s presents Pierce Middle School June 6, 7 & 8, 2019 Original Music & Lyrics by Richard M. Sherman Book & Robert B. Sherman by Julian Fellowes Co-created Additional Music & Lyrics by by Cameron Mackintosh George Stiles & Anthony Drew A musical based on the stories of P.L. Travers and the Disney film The Pierce Players would like to express profound thanks to the PARENTS who contributed to this production by gathering costume pieces, taking photographs, creating the lobby display, providing items for concessions, etc. Your contributions were many, generous, and greatly appreciated. We could not do this without you. Special Thanks: Karen Spaulding Randy Elkinson Julia Hanna Nick Fitzgerald Jim McKay Joe Dolan Kyle Alves Jim DeMaggio Stephanie Sherman Susan Higgins Colleen Queally Gretchen Duffy Sandy Wyse Brendan Bonn The Pierce Faculty Mike Buzzell Lisa Deschenes Kristin Hallisey The Custodial Staff Guillermo Ortiz Michelle Cardoza M, W, & G—hoping our kite-flying days aren’t over yet… Produced by special arrangement with: Music Theatre International 423 West 55th Street New York, New York 10019 ACT I PROLOGUE: London, 1910 SCENE 1: 17 Cherry Tree Lane, parlor “Cherry Tree Lane”............The Banks Family, Mrs. Brill & Robertson Ay “The Perfect Nanny”………………….………………………………..Jane & Michael SCENE 2: 17 Cherry Tree Lane, nursery “Practically Perfect”……………….…………….Mary Poppins, Jane & Michael SCENE 3: A Park “Chim Chim Cher-ee”…………………………………………………………..………Bert “Jolly Holiday”………Bert, Mary, Jane, Michael, Neleus, & Park Strollers SCENE 4: 17 Cherry Tree Lane, parlor “Winds Do Change”……………………………………………………………..….……Bert “A Spoonful of Sugar”……….…Mary, Jane, Michael, Mrs. -

Mary Poppins the Articles in This Study Guide Are Not Meant to Mirror Or Interpret Any Productions at the Utah Shakespeare Festival

Insights A Study Guide to the Utah Shakespeare Festival Mary Poppins The articles in this study guide are not meant to mirror or interpret any productions at the Utah Shakespeare Festival. They are meant, instead, to be an educational jumping-off point to understanding and enjoying the plays (in any production at any theatre) a bit more thoroughly. Therefore the stories of the plays and the inter- pretative articles (and even characters, at times) may differ dramatically from what is ultimately produced on the Festival’s stages. The Study Guide is published by the Utah Shakespeare Festival, 351 West Center Street; Cedar City, UT 84720. Bruce C. Lee, publication manager and editor; Phil Hermansen, art director. Copyright © 2016, Utah Shakespeare Festival. Please feel free to download and print The Study Guide, as long as you do not remove any identifying mark of the Utah Shakespeare Festival. For more information about Festival education programs: Utah Shakespeare Festival 351 West Center Street Cedar City, Utah 84720 435-586-7880 www.bard.org. Cover photo: Elizabeth Broadhurst as Mary Poppins in Mary Poppins, 2016. Mary Poppins Contents Information on the Play About the Playwright 4 Characters 6 Synopsis 7 Scholarly Articles on the Play The Magic Visitor 8 Utah Shakespeare Festival 3 351 West Center Street • Cedar City, Utah 84720 • 435-586-7880 About the Playwrights: Mary Poppins By Don Leavitt Like Mary Poppins’s iconic, magical carpet bag—seemingly bottomless and containing all manner of fantastic items—the list of writers and composers credited with bringing the stage production of Mary Poppins to life is a varied one that, at casual glance, appears end- less. -

Tso Double Basses Play Showtunes

TSO DOUBLE BASSES PLAY SHOWTUNES Saturday 5 June, 2pm and 4.30pm Design Tasmania, Launceston Stuart Thomson double bass Aurora Henrich double bass PRECIS Matt McGrath double bass James Menzies double bass BERNSTEIN (arr. Frampton) West Side Basses (12’) ARLEN (arr. Frampton) Dorothy’s Basses from The Wizard of Oz (9’) VERDI (arr. Frampton) La traviata’s Basses (7’) SHERMAN (arr. Frampton) Mary Poppins Basses (11’) The four arrangements heard in this concert are by Ashley Frampton, assistant double bass in the Royal Liverpool Philharmonic Orchestra. Ashley got into the double bass arranging business following a request from the University of Liverpool for an ensemble piece, which resulted in Mary Poppins Basses, the final work in today’s program. Since then, he has produced nearly two dozen arrangements for double bass quartet. Although formed in 2016, the TSO Double Bass Quartet redoubled efforts to rehearse and perform during the Covid crisis of 2020. The group gained wide exposure (world-wide, in fact) through its popular video performances on TSO Daily Dose, starting with Basses of the Caribbean. Three further clips on TSO Daily Dose followed. Leonard Bernstein’s West Side Story opened on Broadway in September 1957 and ran until June 1959, before returning for another successful season the following year. With lyrics by Bernstein and Stephen Sondheim, and choreography by Jerome Robbins, it updated Shakespeare’s Romeo and Juliet, relocating it to the upper west side of Manhattan in the late 1950s. Sparring teenage gangs – one Puerto Rican, the other ‘American’ – replaced Shakespeare’s feuding families. An acclaimed film followed in 1961 (it took out the Best Picture Oscar the following year) with yet another film adaptation, directed by Stephen Spielberg, due for imminent release. -

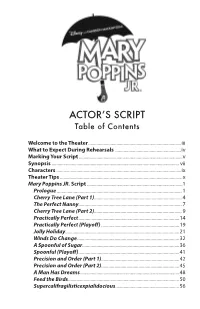

Actor's Script

ACTOR’S SCRIPT Table of Contents Welcome to the Theater ...............................................................................iii What to Expect During Rehearsals ........................................................iv Marking Your Script ........................................................................................v Synopsis ............................................................................................................ vii Characters ..........................................................................................................ix Theater Tips ........................................................................................................x Mary Poppins JR. Script .................................................................................1 Prologue ........................................................................................................1 Cherry Tree Lane (Part 1) .........................................................................4 The Perfect Nanny ......................................................................................7 Cherry Tree Lane (Part 2) .........................................................................9 Practically Perfect ....................................................................................14 Practically Perfect (Playoff) .................................................................19 Jolly Holiday ...............................................................................................21 Winds Do Change -

Study Guide ORIGINAL MUSIC and LYRICS by RICHARD M

©Disney/CML A MUSICAL BASED ON THE STORIES OF P.L. TRAVERS AND THE WALT DISNEY FILM study guide ORIGINAL MUSIC AND LYRICS BY RICHARD M. SHERMAN AND ROBERT B. SHERMAN Prepared by Disney Theatrical group Education Department BOOK BY JULIAN FELLOWES NEW SONGS AND ADDITIONAL MUSIC AND LYRICS BY GEORGE STILES AND ANTHONY DREWE CO-CREATED BY CAMERON MACKINTOSH intro - welcome Anything can happen if we recognize In Mary Poppins, the factory owner John Northbrook tells Michael that money has a worth (for example, one dollar or, in London, one the magic of everyday life. Author P.L. Travers pound) but it also has a value (or what the money can do to help understood this special kind of magic when she published her first others). Mary Poppins teaches the Banks family (and the audience!) book, Mary Poppins, in 1934. The tale of the mysterious nanny who to value the important things in life: family, friendship and teaches a troubled family to appreciate the important things in life imagination. In Mary Poppins, Mary sings, Anything can happen if went on to become one of the most recognized and beloved stories you let it. Mary Poppins is about discovering the extraordinary world of all time. Thirty years later, Walt Disney released the film based around us, even when things look bleak. This guide is designed to on Travers' stories: a unique mixture of animation and live action help you explore the extraordinary world of Mary Poppins. that has become a classic. Now Mary Poppins flies over audiences and lands on a Disney BROADEN YOUR HORIZON Broadway stage, complete with new songs and breathtaking theatrical magic. -

Mary Poppins Characters and Synopsis.Pdf

Original Music and Lyrics by Richard M. Sherman and Robert B. Sherman Book by Julian Fellowes New Songs and Additional Music and Lyrics by George Stiles and Anthony Drewe Co-Created by Cameron Mackintosh A Musical based on the stories of P.L. Travers and the Walt Disney Film Character List CHARACTERS: DESCRIPTIONS: (ages listed are suggested character age, not actor age) ENSEMBLE MARY POPPINS features a large ensemble of singers and dancers in a variety of supporting roles. MARY POPPINS includes a number of dance styles, including tap, ballet, jazz and other genres. Ensemble roles may not be needed at call-backs. ENSEMBLE ROLES INCLUDE: ANNIE, FANNIE, VALENTINE, TEDDY BEAR, MR. PUNCH, DOLL, TOYS, CHIMNEY SWEEPS, PARKGOERS, MISS SMYTHE, VON HUBBLER, NORTHBROOK, POLICEMAN, BANK EMPLOYEES BERT Bert is a Chimney Sweep and Jack-of-all-Trades. Charming and charismatic. Must move well. Late 20s to mid 30s. Baritone to G. Callback Music: Let’s Go Fly a Kite, Chim-Chiminey & Jolly Holiday MARY POPPINS Jane and Michael’s Nanny, Mary Poppins is a dazzling personality and a force to be reckoned with. Mid 20s. Mezzo Soprano with a strong top. Callback Music: Practically Perfect & Jolly Holiday MR. GEORGE BANKS A bank manager, Mr. Banks is father to Jane and Michael. He tries to be a good provider, but often forgets how to be a good father. Late 30s to Early 40s, Baritone. Callback Music: Precision and Order & Good for Nothing MRS. WINIFRED BANKS A former actress, Mrs. Banks is very busy trying to live up to her husband’s expectations.