Luxury Daily Is Published Each Business Day

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

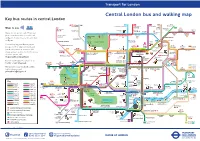

Key Bus Routes in Central London

Route 8 Route 9 Key bus routes in central London 24 88 390 43 to Stoke Newington Route 11 to Hampstead Heath to Parliament to to 73 Route 14 Hill Fields Archway Friern Camden Lock 38 Route 15 139 to Golders Green ZSL Market Barnet London Zoo Route 23 23 to Clapton Westbourne Park Abbey Road Camden York Way Caledonian Pond Route 24 ZSL Camden Town Agar Grove Lord’s Cricket London Road Road & Route 25 Ground Zoo Barnsbury Essex Road Route 38 Ladbroke Grove Lisson Grove Albany Street Sainsbury’s for ZSL London Zoo Islington Angel Route 43 Sherlock Mornington London Crescent Route 59 Holmes Regent’s Park Canal to Bow 8 Museum Museum 274 Route 73 Ladbroke Grove Madame Tussauds Route 74 King’s St. John Old Street Street Telecom Euston Cross Sadler’s Wells Route 88 205 Marylebone Tower Theatre Route 139 Charles Dickens Paddington Shoreditch Route 148 Great Warren Street St. Pancras Museum High Street 453 74 Baker Regent’s Portland and Euston Square 59 International Barbican Route 159 Street Park Centre Liverpool St Street (390 only) Route 188 Moorgate Appold Street Edgware Road 11 Route 205 Pollock’s 14 188 Theobald’s Toy Museum Russell Road Route 274 Square British Museum Route 390 Goodge Street of London 159 Museum Liverpool St Route 453 Marble Lancaster Arch Bloomsbury Way Bank Notting Hill 25 Gate Gate Bond Oxford Holborn Chancery 25 to Ilford Queensway Tottenham 8 148 274 Street Circus Court Road/ Lane Holborn St. 205 to Bow 73 Viaduct Paul’s to Shepherd’s Marble Cambridge Hyde Arch for City Bush/ Park Circus Thameslink White City Kensington Regent Street Aldgate (night Park Lane Eros journeys Gardens Covent Garden Market 15 only) Albert Shaftesbury to Blackwall Memorial Avenue Kingsway to Royal Tower Hammersmith Academy Nelson’s Leicester Cannon Hill 9 Royal Column Piccadilly Circus Square Street Monument 23 Albert Hall Knightsbridge London St. -

Central London Bus and Walking Map Key Bus Routes in Central London

General A3 Leaflet v2 23/07/2015 10:49 Page 1 Transport for London Central London bus and walking map Key bus routes in central London Stoke West 139 24 C2 390 43 Hampstead to Hampstead Heath to Parliament to Archway to Newington Ways to pay 23 Hill Fields Friern 73 Westbourne Barnet Newington Kentish Green Dalston Clapton Park Abbey Road Camden Lock Pond Market Town York Way Junction The Zoo Agar Grove Caledonian Buses do not accept cash. Please use Road Mildmay Hackney 38 Camden Park Central your contactless debit or credit card Ladbroke Grove ZSL Camden Town Road SainsburyÕs LordÕs Cricket London Ground Zoo Essex Road or Oyster. Contactless is the same fare Lisson Grove Albany Street for The Zoo Mornington 274 Islington Angel as Oyster. Ladbroke Grove Sherlock London Holmes RegentÕs Park Crescent Canal Museum Museum You can top up your Oyster pay as Westbourne Grove Madame St John KingÕs TussaudÕs Street Bethnal 8 to Bow you go credit or buy Travelcards and Euston Cross SadlerÕs Wells Old Street Church 205 Telecom Theatre Green bus & tram passes at around 4,000 Marylebone Tower 14 Charles Dickens Old Ford Paddington Museum shops across London. For the locations Great Warren Street 10 Barbican Shoreditch 453 74 Baker Street and and Euston Square St Pancras Portland International 59 Centre High Street of these, please visit Gloucester Place Street Edgware Road Moorgate 11 PollockÕs 188 TheobaldÕs 23 tfl.gov.uk/ticketstopfinder Toy Museum 159 Russell Road Marble Museum Goodge Street Square For live travel updates, follow us on Arch British -

1 Draft Paper Elisabete Mendes Silva Polytechnic Institute of Bragança

Draft paper Elisabete Mendes Silva Polytechnic Institute of Bragança-Portugal University of Lisbon Centre for English Studies, Faculty of Arts and Humanities, Portugal [email protected] Power, cosmopolitanism and socio-spatial division in the commercial arena in Victorian and Edwardian London The developments of the English Revolution and of the British Empire expedited commerce and transformed the social and cultural status quo of Britain and the world. More specifically in London, the metropolis of the country, in the eighteenth century, there was already a sheer number of retail shops that would set forth an urban world of commerce and consumerism. Magnificent and wide-ranging shops served householders with commodities that mesmerized consumers, giving way to new traditions within the commercial and social fabric of London. Therefore, going shopping during the Victorian Age became mandatory in the middle and upper classes‟ social agendas. Harrods Department store opens in 1864, adding new elements to retailing by providing a sole space with a myriad of different commodities. In 1909, Gordon Selfridge opens Selfridges, transforming the concept of urban commerce by imposing a more cosmopolitan outlook in the commercial arena. Within this context, I intend to focus primarily on two of the largest department stores, Harrods and Selfridges, drawing attention to the way these two spaces were perceived when they first opened to the public and the effect they had in the city of London and in its people. I shall discuss how these department stores rendered space for social inclusion and exclusion, gender and race under the spell of the Victorian ethos, national conservatism and imperialism. -

Coronavirus: U.S

Coronavirus: U.S. department stores could be in their 'last stages' https://www.cnbc.com/2020/09/01/coronavirus-us-department-stores-cou... Lauren Thomas A Nordstrom store in Irvine, California. Scott Mlyn | CNBC The coronavirus pandemic is shining a light on U.S. department stores’ dependence on selling fashion and their delay in adapting to today’s retail environment. Not only are a number filing for bankruptcy, but some, including the oldest in the nation, are liquidating entirely. One by one, the categories that have defined department stores for decades have been seized by other types of retailers. Big-box chains Walmart and Target have acquired the value shopper. Best Buy and Amazon reign in electronics. The likes of Home Goods and Wayfair have become top-of-mind destinations for home furnishings. And Williams-Sonoma has sealed a place for itself in kitchens, for its high-end appliances and cutlery. Fashion seemed to be the one stronghold department stores had left. For a while, that was enough. But not anymore. Apparel sales are in a free fall, dropping roughly 20% year over year in July, after suffering a 25% decline in June, according to the latest data from the Commerce Department. Clothing has been one of the hardest-hit categories in retail during the pandemic, with fewer people concerned about refreshing their wardrobes when they hardly ever venture to public places. And some simply aren’t able to spend on a new outfit like they used to, as millions of Americans are unemployed due to the crisis. “Too many U.S. -

NEW YORK, 650 5TH AVE @ 52ND ST BOSTON, COPLEY PLACE Fashion

NEW YORK, 650 5TH AVE @ 52ND ST BOSTON, COPLEY PLACE Fashion. Beauty. Business. DEC 2015 No. 2 FOLLOW US FOLLOW SHOP AT LANDSEND.COM AT SHOP ’Tis the Season! The fashion insider’s holiday gift guide, wish lists, books, retailer picks and party style. (And the time Salvador Dalí threw a mink- lined bathtub through Bonwit’s window.) WE BELIEVE IN YOU Edward Nardoza EDITOR IN CHIEF Pete Born EXECUTIVE EDITOR, BEAUTY Bridget Foley EXECUTIVE EDITOR James Fallon EDITOR Robb Rice GROUP DESIGN DIRECTOR ’Tis the Season! 46 To shine brightest in the evening, dress up with the John B. Fairchild most festive of accoutrements. 1927 — 2015 MANAGING EDITOR Peter Sadera MANAGING EDITOR, Dianne M. Pogoda Billy Reid’s bow tie, FASHION/SPECIAL REPORTS $125, billyreid.com EXECUTIVE EDITOR, EUROPE Miles Socha DEPUTY MANAGING EDITOR Evan Clark Ben Sherman’s leather NEWS DIRECTOR Lisa Lockwood hip flask gift set, $20, DEPUTY EDITOR, DATA AND ANALYSIS Arthur Zaczkiewicz Ben Sherman New SITTINGS DIRECTOR Alex Badia H SENIOR EDITOR, RETAIL David Moin York SENIOR EDITOR, SPECIAL PROJECTS, Arthur Friedman TEXTILES & TRADE Cartier’s Rotonde de SENIOR EDITOR, FINANCIAL Vicki M. Young Cartier Chronograph BUREAU CHIEF, LONDON Samantha Conti watch, $9,050, Cartier BUREAU CHIEF, MILAN Luisa Zargani BUREAU CHIEF, LOS ANGELES Marcy Medina stores ASIAN EDITOR Amanda Kaiser BUREAU CHIEF, WASHINGTON Kristi Ellis Brooks Brothers knot ASSOCIATE EDITOR Jenny B. Fine stud set, $325, Brooks SENIOR EDITOR, SPECIALTY RETAIL Sharon Edelson Brothers stores and E SENIOR PRESTIGE MARKET Julie Naughton BEAUTY EDITOR brooksbrothers.com. SENIOR FASHION FEATURES EDITOR Jessica Iredale ACCESSORIES MARKET DIRECTOR Roxanne Robinson FASHION MARKET DIRECTOR Mayte Allende EYE EDITOR Taylor Harris MEN’S SENIOR EDITOR Jean E. -

Written Statement of the 2005 UDP (Pdf, 2577KB)

IMPORTANT NOTE: The Unitary Development Plan (UDP) is gradually being replaced by the Local Development Framework. Check the planning policy pages on the Council’s website (http://www.richmond.gov.uk/planning_guidance_and_policies.htm) for details of when policies and proposal sites have been superseded. This copy of the original UDP First Review 2005 replicates the text of the written statement for information (issued February 2012). Images and maps are not included. If you have any questions or comments, please contact Planning Policy and Design: 2nd Floor Civic Centre, York Street, Twickenham, TW1 3BZ Telephone: 020 8891 7117 Email: [email protected] LONDON BOROUGH OF RICHMOND UPON THAMES UNITARY DEVELOPMENT PLAN: FIRST REVIEW Adopted 1 March 2005 WRITTEN STATEMENT Prepared in accordance with section 13 of the Town & Country Planning Act 1990 as amended by Section 27 of the Planning and Compensation Act 1991 FOREWORD The Unitary Development Plan First Review is the land use plan for the Borough, and seeks, through its policies and proposals, to guide development, as well as to protect and enhance the Borough’s special environment, for present and future generations. The Plan is set in the context of national and regional planning guidance, but the policies are tailored for this Borough’s unique environment, characterised by its well- loved Royal Parks large open spaces, many historic buildings and conservation areas, attractive town centres and residential areas and extensive River Thames frontage. New developments must recognise and enhance this special character. A key initiative of the Council is its Civic Pride programme, which is intended to make Richmond upon Thames the safest, cleanest and greenest Borough in London. -

LONDON Cushman & Wakefield Global Cities Retail Guide

LONDON Cushman & Wakefield Global Cities Retail Guide Cushman & Wakefield | London | 2019 0 For decades London has led the way in terms of innovation, fashion and retail trends. It is the focal location for new retailers seeking representation in the United Kingdom. London plays a key role on the regional, national and international stage. It is a top target destination for international retailers, and has attracted a greater number of international brands than any other city globally. Demand among international retailers remains strong with high profile deals by the likes of Microsoft, Samsung, Peloton, Gentle Monster and Free People. For those adopting a flagship store only strategy, London gives access to the UK market and is also seen as the springboard for store expansion to the rest of Europe. One of the trends to have emerged is the number of retailers upsizing flagship stores in London; these have included Adidas, Asics, Alexander McQueen, Hermès and Next. Another developing trend is the growing number of food markets. Openings planned include Eataly in City of London, Kerb in Seven Dials and Market Halls on Oxford Street. London is the home to 8.85 million people and hosting over 26 million visitors annually, contributing more than £11.2 billion to the local economy. In central London there is limited retail supply LONDON and retailers are showing strong trading performances. OVERVIEW Cushman & Wakefield | London | 2019 1 LONDON KEY RETAIL STREETS & AREAS CENTRAL LONDON MAYFAIR Central London is undoubtedly one of the forefront Mount Street is located in Mayfair about a ten minute walk destinations for international brands, particularly those from Bond Street, and has become a luxury destination for with larger format store requirements. -

2019 Property Portfolio Simon Malls®

The Shops at Clearfork Denver Premium Outlets® The Colonnade Outlets at Sawgrass Mills® 2019 PROPERTY PORTFOLIO SIMON MALLS® LOCATION GLA IN SQ. FT. MAJOR RETAILERS CONTACTS PROPERTY NAME 2 THE SIMON EXPERIENCE WHERE BRANDS & COMMUNITIES COME TOGETHER SIMON MALLS® LOCATION GLA IN SQ. FT. MAJOR RETAILERS CONTACTS PROPERTY NAME 2 ABOUT SIMON Simon® is a global leader in retail real estate ownership, management, and development and an S&P 100 company (Simon Property Group, NYSE:SPG). Our industry-leading retail properties and investments across North America, Europe, and Asia provide shopping experiences for millions of consumers every day and generate billions in annual sales. For more information, visit simon.com. · Information as of 12/16/2019 3 SIMON MALLS® LOCATION GLA IN SQ. FT. MAJOR RETAILERS CONTACTS PROPERTY NAME More than real estate, we are a company of experiences. For our guests, we provide distinctive shopping, dining, and entertainment. For our retailers, we offer the unique opportunity to thrive in the best retail real estate in the best markets. From new projects and redevelopments to acquisitions and mergers, we are continuously evaluating our portfolio to enhance the Simon experience—places where people choose to shop and retailers want to be. 4 LOCATION GLA IN SQ. FT. MAJOR RETAILERS CONTACTS PROPERTY NAME WE DELIVER: SCALE A global leader in the ownership of premier shopping, dining, entertainment, and mixed-use destinations, including Simon Malls®, Simon Premium Outlets®, and The Mills® QUALITY Iconic, irreplaceable properties in great locations INVESTMENT Active portfolio management increases productivity and returns GROWTH Core business and strategic acquisitions drive performance EXPERIENCE Decades of expertise in development, ownership, and management That’s the advantage of leasing with Simon. -

London 252 High Holborn

rosewood london 252 high holborn. london. wc1v 7en. united kingdom t +44 2o7 781 8888 rosewoodhotels.com/london london map concierge tips sir john soane’s museum 13 Lincoln's Inn Fields WC2A 3BP Walk: 4min One of London’s most historic museums, featuring a quirky range of antiques and works of art, all collected by the renowned architect Sir John Soane. the old curiosity shop 13-14 Portsmouth Street WC2A 2ES Walk: 2min London’s oldest shop, built in the sixteenth century, inspired Charles Dickens’ novel The Old Curiosity Shop. lamb’s conduit street WC1N 3NG Walk: 7min Avoid the crowds and head out to Lamb’s Conduit Street - a quaint thoroughfare that's fast becoming renowned for its array of eclectic boutiques. hatton garden EC1N Walk: 9min London’s most famous quarter for jewellery and the diamond trade since Medieval times - nearly 300 of the businesses in Hatton Garden are in the jewellery industry and over 55 shops represent the largest cluster of jewellery retailers in the UK. dairy art centre 7a Wakefield Street WC1N 1PG Walk: 12min A private initiative founded by art collectors Frank Cohen and Nicolai Frahm, the centre’s focus is drawing together exhibitions based on the collections of the founders as well as inviting guest curators to create unique pop-up shows. Redhill St 1 Brick Lane 16 National Gallery Augustus St Goswell Rd Walk: 45min Drive: 11min Tube: 20min Walk: 20min Drive: 6min Tube: 11min Harringtonn St New N Rd Pentonville Rd Wharf Rd Crondall St Provost St Cre Murray Grove mer St Stanhope St Amwell St 2 Buckingham -

Holt Renfrew's 175Th Birthday

NEWSLETTER The Town of York Historical Society ____________________________________________________________________________________________________________ September 2012 Vol. XXVIII No. 3 This year Canadians celebrate a number of CANADIAN RETAILER anniversaries. 50 years ago medicare was introduced CELEBRATES 175 YEARS in Saskatchewan; 100 years ago the Grey Cup and the Calgary Stampede were inaugurated; 200 years ago the Americans declared war on Britain and invaded her territories in Upper and Lower Canada. At the time, many “Canadians” and First Nations joined in their defence. 25 years later, rebellions took place in both Canadas against the same British rule that had been fought for previously. Also in 1837, a new monarch ascended to the throne – the young Victoria – who would rule Britannia and Canada for more than 60 years. In the year of our current Queen’s Diamond Jubilee, we recognize the 175th anniversary of a Canadian retailer who, during Queen Victoria’s reign, became furrier to generations of British royalty. In 1947, Holt Renfrew & Co. was chosen by the Canadian government to design a wedding present for Princess Elizabeth. It was a coat of wild Labrador mink. Many North American women owned furs at the time, but the harsh realities of post-war Britain are evident in the photograph at left in which one man, fists clenched, has not doffed his hat. Princess Elizabeth in her Holt’s mink, a wedding gift from Canada, 1947 Continued on page 2 _______________________________________________________________________________________________________________________________________ James Scott Howard’s Family Bible Finds Its Way Home On a hot day last August a young couple delivered a very special gift to Toronto’s First Post Office: a bible they had bought at an estate sale. -

A Flip Attitude NEW YORK — Turn It Over

BARNEYS NEW YORK PLOTS MORE FLAGSHIPS/14-15 WWDWomen’s Wear Daily • The Retailers’TUESDAY Daily Newspaper • May 10, 2005• $2.00 Ready-to-Wear/Textiles A Flip Attitude NEW YORK — Turn it over. That’s the advice from a variety of designers who are exploring the reverse sides of fabrics for fresh, unexpected looks. Here, a Tuleh coat for fall, which Bryan Bradley designed using the alternative side of a Luigi Verga fabric. “The front was just too applied,” says Bradley. “The back is more unified.” For more on this and other textile trends, see pages 6 and 7. Saks Inc. Takes Action: Retailer Fires Executives Following Internal Probe By David Moin NEW YORK — Saks Inc. is cleaning house, IELA GILBERT but its problems aren’t going away. The retailer said late Monday afternoon that its internal investigation into alleged improper collections of about $20 million in vendor markdown allowances, as well as related accounting and disclosure issues, is over and several senior executives are either being fired or asked to resign. Saks also disclosed that it received an inquiry from the U.S. Attorney for the Southern District of New York, raising speculation that broader and more See Saks, Page8 PHOTO BY JOHN AQUINO; MODEL: GRATIA/SVM; HAIR AND MAKEUP BY JILLIAN CHAITIN; FASHION ASSISTANT: STEPHANIE BAGLEY; STYLED BY DAN STYLED BY STEPHANIE BAGLEY; ASSISTANT: JILLIAN CHAITIN; FASHION HAIR AND MAKEUP BY JOHN AQUINO; MODEL: GRATIA/SVM; PHOTO BY 14 WWD, TUESDAY, MAY 10, 2005 Barneys Turns It Up: F By David Moin Renderings of the Boston flagship. -

354 PORTAGE AVENUE – CARLTON BUILDING (HOLT RENFREW BUILDING) John D

354 PORTAGE AVENUE – CARLTON BUILDING (HOLT RENFREW BUILDING) John D. Atchison, 1912 Winnipeg’s development boom of 1881-82 brought about the quick rise and demise of many real estate agents. But it also provided a base upon which others, such as British immigrant John Henry Oldfield, were able to establish long-standing careers. Oldfield (1857-1924) began working as a local realtor in 1881. He subsequently (1899) formed a partnership with William Hicks Gardner (1873-1951), another British transplant. Insurance agent Walter T. Kirby (1858-c.1950) joined the firm in 1906. Oldfield, Kirby and Gardner Ltd. went on to function for many decades across the Canadian Northwest as a real estate broker, property manager, insurance agent, mortgage lender, and investment dealer. Among its local activities, the company helped shape Portage Avenue as a major commercial district in the early 1900s. It built its own head office at 234 Portage in 1909, followed by a mixed-use revenue property, the Carlton Building at the southeast corner of Portage and Carlton Street, in 1912. City of Winnipeg 2002 Both were designed by architect John D. Atchison (1870-1959), an Illinois native who trained and worked in Chicago before opening his Winnipeg office. From 1905 until he moved to California in 1923, Atchison produced an extensive portfolio of commercial, residential and institutional structures. Among his surviving projects are the Hample, Kennedy, Boyd and Curry buildings on Portage Avenue, and the Canada Permanent, Maltese Cross, Great-West Life, Cadomin, Union Tower and Bank of Hamilton buildings elsewhere in the downtown. The three-storey Carlton Building is a low-profile version of the Chicago Style of architecture, with detailing that reflects an Italianate influence.