Retail Market Summary for 2014

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Why the Battle for IKEA's New Atlantic Canada Store Was Over Before It

BUSINESS ATTRACTION The Big Deal Why the battle for IKEA’s new Atlantic Canada store was over before it started By Stephen Kimber atlanticbusinessmagazine.com | Atlantic Business Magazine 119 Date:16-04-20 Page: 119.p1.pdf consumers in the Halifax area, but it’s also in the crosshairs of a web of major highways that lead to and from every populated nook and cranny in Nova Scotia, not to forget New Brunswick and Prince Edward Island, making it a potential shopping destination for close to two million Maritimers. No wonder its 500-acre site already boasts 1.3 million square feet of shopaholic heaven with over 100 retailers and services, including five of those anchor-type destinations: Walmart, Home Depot, Costco, Canadian Tire and Cineplex Cinemas. Glenn Munro was apologetic. I’d been All it needed was an IKEA. calling and emailing him to follow up on January’s announcement that IKEA — the iconic Swedish furniture retailer with 370 stores and $46.6 billion in sales worldwide y now, the IKEA creation last year — would build a gigantic (for us story has morphed into myth: Bin 1947, Ingvar Kamprad, at least) $100-million, 328,000-square- an eccentric, dyslexic 17-year-old foot retail store in Dartmouth Crossing. He Swedish farm boy, launched a mail-order company called IKEA. hadn’t responded. He’d invented the name using his initials and his home district. Soon after, he also invented the “flat I wanted to know how and why pack” to more efficiently package IKEA had settled on Halifax and and ship his modernist build-it- not, say, Moncton as the site for 328,000 yourself furniture. -

The Halifax Region Tourism Opening

The Halifax Region Tourism Opening 2020 Plan Prepared for Discover Halifax Halifax Regional Municipality Prepared by FINAL REPORT June 11, 2020 Prepared for Discover Halifax Halifax Regional Municipality Prepared by Fathom Studio 1 Starr Lane Dartmouth, NS 902 461 2525 fathomstudio.ca Release R1—11 June 2020 Contents 01 Protecting People; Our Two Imperatives ......................................... 1 1.1 The Tourism Imperative & Objectives of this Plan ..................................................2 02 Introduction ......................................... 5 2.1 A Pre-Covid Snapshot of Tourism in NS ...................................................................5 2.2 The Provincial Reopening Strategy .7 2.3 A Proposal for the Easing of Tourism Restrictions ...............................................8 03 Strategy for keeping our Destination Safe ......................................................13 3.1 Travel Between Safe Markets .........14 3.2 Safe Spaces ...........................................22 3.3 Communication to promote safe travel & public health goals ..............32 3.4 Responsive Design to Adapt to Changing Epidemiology......................36 04 Site Specific Actions .......................39 4.1 Halifax & Lunenburg Waterfronts .43 4.2 Citadel Hill National Historic Site ...51 4.3 Nova Scotia Provincial Parks ...........55 4.4 Halifax Regional Municipality Parks, Trails, & Gardens ....................................57 4.5 Downtown Halifax / Dartmouth ......61 4.6 Halifax Shopping Centre ....................64 -

Deals & Discounts

DEALS & DISCOUNTS FOR NSTU MEMBERS INCLUDING RTO MEMBERS!! Subject to change without notice. Updated November 16, 2012. KELTIC LODGE RESORT & SPA 1-800-565-0444 or www. ACCOMMODATIONS kelticlodge.ca. Open mid May to mid October. $115/night plus tax, based on double occupancy, subject to availability. Please request NSTU Contract Hotel the NSTU member rate at time of booking and provide your NSTU TheDELTA HALIFAX and DELTA BARRINGTON are the card upon check in. Rate is based on leisure travel only and is not NSTU’s contract hotels and offers members on NSTU business applicable to group business. a rate of $86 July 1, 2011 to June 30, 2013. For leisure travel, $96 LISCOMBE LODGE RESORT & CONFERENCE July 1, 2012 to June 30, 2013 plus a special parking rate of $9.95 CENTRE Call 1-800-665-6343 or visit www.liscombelodge. per day (self parking). NSTU membership identification is ca. Open mid May to mid October. $99/night plus tax, based on required and the NSTU rate is for one room booking per NSTU double occupancy, subject to availability. Please request the NSTU membership card. The Delta Halifax can be reached at 902-425- member rate at time of booking and provide your NSTU card upon 6700/1-888-423-3582. The Delta Barrington can be reached at check-in. Rate is based on leisure travel only and is not applicable 902-429-7410. For more info, check the Delta Halifax website to group business. at www.deltahotels.com/corporate/cor/nstu.html. The Delta properties are now both smoke-free. -

Cinema Locations

CINEMA LOCATIONS SHOW-TIME PRE-SHOW BACKLITS TIMEPLAY DIGITAL SIGNAGE 4X6 CINEMA LOBBY TIMED DVD LOOPED TOTAL DIGital 3D LOC SCREENS LOC SCREENS LOC BACKLITS LOC SCREENS LOC CIR ID# LOCATION MARKET LOC SCREENS SCREENS SCREENS AVAIL. NewfouNdLANd ET 26 Empire Studio 12 St. John’s 1 12 12 5 1 12 1 4 1 ET 22 Empire Cinemas Mt. Pearl Shop. Centre Mount Pearl 1 6 1 1 1 ET 24 Millbrook Cinemas Corner Brook 1 2 1 1 Total NEWFOuNdLANd 3 20 12 5 1 12 0 0 3 6 0 0 2 NOvA Scotia Halifax ET 30 Empire 17 Cinemas Bayers Lake Halifax 1 17 16 4 1 17 1 4 1 ET 43 Parklane 8 Cinemas Halifax 1 8 8 3 1 8 1 4 1 ET 18 Oxford Halifax 1 1 1 1 1 ET 45 Empire 12 Dartmouth Crossing Dartmouth 1 12 12 6 1 12 1 3 1 ET 19 Empire Studio 7 Lower Sackville 1 7 7 3 1 7 1 2 1 TOTAL HALIFAX 5 45 44 16 5 45 0 0 4 13 0 0 4 NOvA SCOTIA BALANCE ET 14 Empire Studio 7 New Glasgow 1 7 7 3 1 7 1 1 1 ET 34 Empire Studio 5 Yarmouth 1 5 5 2 1 5 1 2 1 ET 32 Empire 7 Cinemas New Minas 1 7 7 3 1 7 1 1 1 ET 33 Empire Capitol Theatre Antigonish 1 1 ET 40 Empire Studio 7 Truro 1 7 7 3 1 7 1 1 1 ET 4 Empire Studio 7 Bridgewater 1 7 7 3 1 7 1 1 1 ET 16 Empire Drive-In Westville 1 1 ET 41 Paramount Cinemas Amherst 1 3 ET 3 Empire Studio 10 Sydney 1 10 10 4 1 10 1 2 1 TOTAL NOvA SCOTIA BALANCE 9 48 43 18 6 43 0 0 6 8 0 0 6 Total NOvA Scotia 14 93 87 34 11 88 0 0 10 21 0 0 10 PEI Charlottetown ET 61 Empire Studio 8 Charlottetown 1 8 8 3 1 8 1 2 1 ET 60 Empire Studio 5 Summerside 1 5 5 2 1 5 1 1 1 Total PEI 2 13 13 5 2 13 0 0 2 3 0 0 2 NEW BRunswick Saint John / Moncton ET 10 Crystal Palace Cinemas Dieppe (Moncton) 1 8 8 4 1 8 1 2 1 ET 9 Empire 8 Trinity Drive Moncton 1 8 8 4 1 8 1 4 AF 601 Vogue Sackville (Moncton) 1 1 1 ET 7 Empire Studio 10 Saint John 1 10 10 4 1 10 1 1 1 ET 6 Empire 4 Cinemas Rothesay (St. -

Best Shopping Centers/Malls in Halifax"

"Best Shopping Centers/Malls in Halifax" Erstellt von : Cityseeker 5 Vorgemerkte Orte Park Lane "Shop Till You Drop!" Enjoy shopping sprees, downtown vibes and entertainment at Park Lane, the anchor of Atlantic Canada’s premiere shopping district. Park Lane is ideally situated at the foot of the Halifax Citadel, just a block away from the famous Victorian Public Gardens, and within a few blocks of universities, colleges, hospitals, and the downtown business core. Park by Park Lane Lane offers a unique shopping experience, with a superb fashion mix and a Cineplex Cinemas entertainment complex with eight screens and stadium seating, amid marble, glass, fountains, and skylights. +1 902 420 0660 www.shopparklane.ca Elizabeth.Engram@crombie 5657 Spring Garden Road, .ca Halifax NS Halifax Shopping Centre "Assorted Stores and Services" Minutes from downtown Halifax and easily accessible by bus, Halifax Shopping Centre has all the departmental stores, clothing shops (including the largest Gap in the Maritimes), electronics, games and hobbies, books, and food services you want. Having opened in 1962, this shopping center has become a favorite among the locals. There is plenty by Public Domain of parking, some just for expectant moms and those with young children. +1 902 454 8666 www.halifaxshoppingcent hfxcustomerservice@20vic. 7001 Mumford Road, Tower re.com/ com 1, Suite 202, Halifax NS Mic Mac Mall "Everything Under One Roof" Known as "The Most Mall," Mic Mac Mall houses over 160 outlets for food, clothing, music, electronics, books, toys, sports equipment, banking, dry cleaning and anything else your heart may desire. One of the largest malls in the city, this place is a shopper's paradise. -

Nova Scotia CRIME STOPPERS

1-800-222-TIPS NovA ScotiA - cApe BretoN Crime StopperS ! 13th Annual Awa renes s Guide www.crimestoppers.ns.ca www.capebretoncrimestoppers.ca TOGETHER WE CAN ERASE CRIME TUNED IN TO OUR COMMUNITY EastLink TV is very proud to support Nova Scotia CRIME STOPPERS. Because it’s our home too. 1-800-222-8477 (TIPS) www. crimestoppers .ns.ca www. capebretoncrimestoppers .ca 13th Annual Awareness Guide 1 Table of Contents 13 th Annual Awareness Guide Congratulatory Messages The Honourable Darrell Dexter . .1 The Honourable Ross Landry . .3 NS Crime Stoppers President - John O’Reilly . .5 Crime Stoppers International President – Michael Gordon-Gibson . .7 Canadian Crime Stoppers Chair – Ralph Page . .7 Mayor of Halifax – Peter Kelly . .9 RCMP Assistant Commissioner – Alphonse MacNeil . .11 Halifax Regional Police Chief – Frank A. Beazley . .13 NS Crime Stoppers Police Coordinator – Gary Frail . .17 Nova Scotia Crime Stoppers Civilian Coordinator – Ron Cheverie . .18 Publisher’s Page – Mark Fenety . .19 Celebrating Articles / Stories of Interest 25 The Story of Crime Stoppers . .21 Crime Stoppers – Nova Scotia . .23 Crime of the Week Stories . .61 Bullying . .85 ears in Nova Scotia Human Trafficking – It’s Happening Here . .89 Contraband Cigarettes . .93 Statistics on Crime Stoppers Photo Album Provincial Board . .27 page 25 Annapolis Valley . .29 Antigonish . .31 Colchester and Area . .35 Cumberland County . .39 East Hants . .41 Halifax . .43 Lunenburg County . .47 Pictou County . .53 ...see page 57 Queens County . .55 West Hants . .57 Advertisers’ Index . .96 2 13th Annual Awareness Guide www. crimestoppers .ns.ca www. capebretoncrimestoppers .ca Honourable Ross Landry On behalf of the province of Nova Scotia, I would like to extend a sincere thanks to everyone involved in Crime Stoppers for your part in making Nova Scotia a better and safer place to live. -

ICSC Atlantic Provinces

ICSC Atlantic Provinces Halifax Marriott Harbourfront Halifax, NS August 10 – 12, 2016 New Location ! Program ICSC Atlantic Provinces WEDNESDAY, AUGUST 10 Welcome Remarks and Golf Tournament Introduction to the Program 8:45 – 9:00 am (Optional Event) 8:30 am – 4:30 pm Rebecca Logan ICSC 2016 Atlantic Provinces Idea Exchange Brunello Golf Course Committee Co-Chair 120 Brunello Blvd Marketing Director, Mic Mac Mall Timberlea, NS Ivanhoé Cambridge Bus will leave the Marriott Harbourfront Hotel at Dartmouth, NS 7:30 am. To register, visit www.icsc.org/2016AP Kendra Wren to get a copy of the Sports Event Form. ICSC 2016 Atlantic Provinces Idea Exchange Committee Co-Chair Wine and Beer Tour with Assistant Marketing Director, Mic Mac Mall Ivanhoé Cambridge Grape Escapes Dartmouth, NS (Optional Event) 10:00 am – 5:00 pm Industry Update / To register, visit www.icsc.org/2016AP to get ICSC Designations a copy of the Optional Event Form. 9:00 – 9:20 am Donald Burton Registration ICSC Provincial Director 5:00 – 8:00 pm Vice President, Property Management Strathallen Property Management, Inc. Next Generation Halifax, NS Networking Event 5:30 – 6:30 pm General Session 9:20 – 10:00 am Marriott Harbourfront Halifax The State of the Halifax Economy and Meet some of the industry experts while enjoying Plans for Future Growth local refreshments. Halifax has experienced strong economic growth • Marketing: Rebecca Logan in recent years, but this momentum will need to • Brokerage: Peter MacKenzie be maintained to deal with looming demographic • Construction: Doug Doucet change. This presentation draws on the Halifax • Finance: Richard Tower Index and the city's new Growth Plan to describe • Landlord: Donald Burton recent economic developments and plans for a prosperous future. -

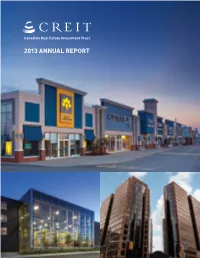

2013 Annual Report CREIT Property Portfolio (As at December 31, 2013) CREIT and Number of CREIT Share Co-Owner Total Properties (000S Sq

Canadian Real Estate Investment Trust 2013 ANNUAL REPOrt CREIT PROPERTY PORTFOLIO (as at December 31, 2013) CREIT and Number of CREIT Share Co-owner Total Properties (000s sq. ft.) (000s sq. ft.) Retail 74 9,000 12,600 Industrial 93 9,000 9,400 Office 17 3,000 4,500 Sub-total 184 21,000 26,500 Under development 1 14 3,100 5,700 Total 198 24,100 32,200 1 Includes properties being developed or redeveloped which are not yet income- producing, and properties held for future development. Dartmouth Crossing Shopping Centre, Dartmouth, Nova Scotia TARGET PRODUct MIX % Retail 50 % Office 25 % Industrial 25 1185 West Georgia Street, Vancouver, British Columbia ANNUALIZED RETURNS TO UNITHOLDERS (compound annual total return, including reinvested distributions) 1 1 Year 5 Years 10 Years 20 Years 4.0% 19.3% 16.5% 15.6% 1 CREIT was first listed on the Toronto Stock Exchange in September 1993; the 20-year period reflects the full calendar years from January 1, 1994 to December 31, 2013. Eastlake Industrial Park, Calgary, Alberta 1 CREITis a publicly traded real estate investment trust (REIT) listed on the Toronto Stock Exchange (TSX) under the symbol REF.UN. Our primary business objective is to carefully accumulate and aggressively manage a portfolio of high-quality real 20 estate assets and to deliver the benefits of years real estate ownership to our investors. CREIT was the first publicly listed Since being listed on the TSX in September real estate investment trust in Canada. We were listed on the of 1993, CREIT has consistently delivered Toronto Stock Exchange on September 13, 1993. -

Design Review Committee April 11, 2013 TO

Design Review Committee April 11, 2013 TO: Chair and Members of Design Review Committee Original Signed SUBMITTED BY: _________________________________________________ Brad Anguish, Director, Community and Recreation Services DATE: March 12, 2013 SUBJECT: Case 18404: Substantive Site Plan Approval – Addition to Scotia Square, Barrington Street, Halifax ORIGIN Application by Crombie Developments Limited LEGISLATIVE AUTHORITY Halifax Regional Municipality Charter, Part VIII, Planning & Development RECOMMENDATION It is recommended that the Design Review Committee: 1. Approve the qualitative elements of the substantive site plan approval application for a 3- storey addition to the Scotia Square complex on Barrington Street, Halifax, as shown on Attachment A; and 2. Approve the requested streetwall setback variance along Barrington Street as shown on Attachment A. Case 18404, Scotia Square Addition - 2 - April 11, 2013 Design Review Committee Report BACKGROUND This application for substantive site plan approval by Crombie Developments Limited is for a 3- storey addition to the Scotia Square complex at Barrington Street, Halifax (refer to Attachment A). The Scotia Square complex was constructed between the late 1960s and early 1970s on the block bound by Barrington, Duke, and Albemarle Streets and the Cogswell interchange. While renovations and some minor additions have taken place over the years, this proposal is the second major addition of floor space to the development since its initial construction behind a recently approved 3-storey addition at Duke and Albemarle Streets to be known as “Westhill on Duke”. To enable the proposal to proceed to the permit and construction phases, the Design Review Committee must consider the proposal relative to the Design Manual within the Downtown Halifax Land Use By-law. -

We Are the Partnership Celebrating 20 Years Momentum

SUMMER 2016 WE ARE THE PARTNERSHIP CELEBRATING 20 YEARS MOMENTUM A message fom A message fom the Mayor the Premier Mike Savage, Honourable Stephen McNeil, HALIFAX PARTNERSHIP TEAM (L-R) Ruth Cunningham, Vice President, Program Planning & Operations, Sasha Sears, Project Coordinator, Connector Program, Tanya Walters, Corporate Mayor of Halifax Regional Munincipality M.L.A. Premier Liaison, Ron Hanlon, President & CEO, Christine Qin Yang, Project Coordinator, Connector Program, Michelle Cant, Receptionist & Business Development Assistant, Sarah Beatty, Communications Coordinator, Denise De Long, Project Manager, Connector Program, Krista Juurlink, Manager, Communications, Jason Guidry, Director, Investment, Trade & International Partnerships, Nancy Phillips, Vice President, Investment, Trade & International Partnerships, Ian Munro, Chief Economist, Michelle Crosby, Marketing & Digital Specialist, Molly Connor, Account Executive, Business Retention & Expansion Missing from the photo: Karen Fraser, Director, Corporate Services, Paul Jacob, Economist & Policy Analyst, Kevin MacIntyre, Director, Marketing & omentum: the perfect name for a publication to ova Scotia is focused on growing our economy. Communications, Isaac Mbaziira, Project Coordinator, Connector Program, Minder Singh, Account Executive, Business Retention & Expansion, recognize 20 years of work by the Halifax Partner- Businesses are leading private-sector growth in our Amy Stewart, Director, Investor Relations & Service, Robyn Webb, Director, Labour Market Development M ship to grow and advance the economy of our city. N province. Because Nova Scotia is a small province The unique Partnership investor model marries public and pri- with a limited market, doing business means increasing our vate sector interests as we collaborate to continue Halifax’s as- exports of higher value goods and services, being open to new cension as a talent-rich, diverse, innovative and growing city. -

60 Bell Blvd

65 Cromarty Drive Business: 1-902-406-7700 Dartmouth, Nova Scotia, B3B 0G2 Facsimile: 1-902-406-7702 Reservations: 1-800-HAMPTON Welcome to the Hampton Inn & Suites by Hilton in Halifax - Dartmouth. Our Hampton Inn & Suites by Hilton Halifax - Dartmouth is situated in Dartmouth Crossing, one of the largest retail destinations in Canada east of Calgary with approximately 2.2 million square feet of retail space. Dartmouth Crossing is located north of the Highway 118 and Highway 111 interchange in Dartmouth, NS. The centre is adjacent to Burnside Park, the largest business park in Atlantic Canada. The overall decor for our new Dartmouth Hampton Inn & Suites by Hilton Halifax - Dartmouth is Modern Classic. Rich warm brown tones were combined with soft cool blues to create a harmonious balance. Espresso wood tones were used in all 163 guest rooms and suites as well as the public areas. The guest room furniture has stainless steel accents. The artwork depicts nature scenes as well as botanical organic for a calming affect. Hampton Inn & Suites by Hilton Halifax - Dartmouth amenities include: Complimentary high-speed internet access in all 162 guestrooms Complimentary wireless high-speed internet access throughout including the lobby and four meeting rooms Complimentary On the House® hot breakfast or On the Run Breakfast Bags® Our hotel is a quick 16 mile ride to and from the Halifax International Airport. Suites include wet bar, microwave, mini fridge, dining area with 2-3 chairs and a sitting area Heated over-sized indoor pool with a waterslide and separate kiddie pool Whirlpool and on-site fitness center Large work desk with ergonomic chair and portable lap desk Phones with voice mail and speakerphone Complimentary newspaper each weekday morning Complimentary local phone calls and no connection fee for calling cards Complimentary parking MEETINGS OVERVIEW Hospitality and modern day conveniences meet at Hampton Inn & Suites by Hilton. -

Introduction to Nova Scotia – Halifax Regional Municipality

Introduction to Nova Scotia Halifax Regional Municipality Resource Book Introduction This Resource Book was developed to accompany the program, Introduction to Nova Scotia. It includes information on topics divided into 10 Units: • Life in Canada • Getting Around • Social Programs and Community Services • Banking, Shopping and Finance • Housing • Health • Education • Employment • Canadian Law • Recreation It provides extensive and relevant information on living in Nova Scotia. The objective is to help newcomers make timely and well-informed decisions during their settlement process. In addition, this book contains useful information on organization/business contacts, websites and local and provincial resources. Activities are also included to promote building a base of community knowledge. We hope that you find this book valuable as you settle in Nova Scotia. This Resource Book was developed by ISANS and may not be copied, reproduced or modified. © 2015 Immigrant Services Association of Nova Scotia (ISANS) Introduction to Nova Scotia ii Unit 1- Life in Canada Facts About Canada ................................................................................................................................ 2 O Canada..................................................................................................................................................... 2 Canada’s Geography ............................................................................................................................... 3 Nova Scotia ...............................................................................................................................................