Economic Benefit of New Capacity in the Central Grid

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Søknad Solhom

Konsesjonssøknad Solhom - Arendal Spenningsoppgradering Søknad om konsesjon for ombygging fra 300 til 420 kV 1 Desember 2012 Forord Statnett SF legger med dette frem søknad om konsesjon, ekspropriasjonstillatelse og forhånds- tiltredelse for spenningsoppgradering (ombygging) av eksisterende 300 kV-ledning fra Arendal transformatorstasjon i Froland kommune til Solhom kraftstasjon i Kvinesdal kommune. Ledningen vil etter ombyggingen kunne drives med 420 kV spenning. Spenningsoppgraderingen og tilhørende anlegg vil berøre Froland, Birkenes og Evje og Hornnes kommuner i Aust-Agder og Åseral og Kvinesdal kommuner i Vest-Agder. Oppgraderingen av 300 kV- ledningen til 420 kV på strekningen Solhom – Arendal er en del av det større prosjektet ”Spennings- oppgraderinger i Vestre korridor” og skal legge til rett for sikker drift av nettet på Sørlandet, ny fornybar kraftproduksjon, fri utnyttelse av kapasiteten på nye og eksisterende mellomlandsforbindelser og fleksibilitet for fremtidig utvikling. Konsesjonssøknaden oversendes Norges vassdrags- og energidirektorat (NVE) til behandling. Høringsuttalelser sendes til: Norges vassdrags- og energidirektorat Postboks 5091, Majorstuen 0301 OSLO e-post: [email protected] Saksbehandler: Kristian Marcussen, tlf: 22 95 91 86 Spørsmål vedrørende søknad kan rettes til: Funksjon/stilling Navn Tlf. nr. Mobil e-post Delprosjektleder Tor Morten Sneve 23903015 40065033 [email protected] Grunneierkontakt Ole Øystein Lunde 23904121 99044815 [email protected] Relevante dokumenter og informasjon om prosjektet og Statnett finnes på Internettadressen: http://www.statnett.no/no/Prosjekter/Vestre-korridor/Solhom---Arendal/ Oslo, desember 2012 Håkon Borgen Konserndirektør Divisjon Nettutbygging 2 Sammendrag Statnett er i gang med å bygge neste generasjon sentralnett. Dette vil bedre forsyningssikkerheten og øke kapasiteten i nettet, slik at det legges til rette for mer klimavennlige løsninger og økt verdiskaping for brukerne av kraftnettet. -

Helse Og Omsorg I Kvinesdal Mot 2040

Helse og omsorg i Kvinesdal mot 2040 2018 SAMMEN SKAPER VI FREMTIDEN HELSE OG OMSORG I KVINESDAL ► 2018 ► 1 Innhold 1 Bakgrunn og rammebetingelser ..............................................................................................3 1.1 Plan for helse- og omsorgstjenesten – hva er det? ..................................................................3 1.2 Utvikling i dialog med lokalsamfunnet (kommunen 3.0) ...........................................................1 2 Strategier og hovedgrep for utvikling av tjenestene .............................................................1 2.1 Økt behov på 69 prosent krever flere fagfolk og flere bygg ......................................................1 2.2 Helse- og omsorg er mer enn eldreomsorg ..............................................................................1 2.3 Styrking av tilbudet til personer med demens ...........................................................................1 2.4 Utvikling av tilbudet til mennesker med utviklingshemning .......................................................1 2.5 Psykisk helse og rusomsorg .....................................................................................................1 2.6 Rehabilitering og folkehelse ......................................................................................................3 2.7 Velferdsteknologi .......................................................................................................................4 2.8 Systematisk arbeid med forbedringer og organisatoriske -

Protokoll for Agder Og Telemark Bispedømmeråd

Møteprotokoll for Agder og Telemark bispedømmeråd Møtedato: 13.06.2016 Møtested: BUL-salen Møtetid: 09:30 - 16:00 Møtedeltakere Råd Aud Sunde Smemo AGD Bergit Haugland AGD Geir Ivar Bjerkestrand AGD Jan Olav Olsen AGD Kai Steffen Østensen AGD Kjetil Drangsholt AGD Rønnaug Torvik AGD Stein Reinertsen AGD Øivind Benestad AGD Forfall meldt fra følgende medlemmer Råd Stian Berg AGD Følgende varamedlemmer møtte Råd Thore Westermoen AGD Andre deltakere Tormod Stene Hansen, stiftsdir. alle saker Bjarne Nordhagen, sakene 40-47, 49-51 og 55 Arve Nilsen, sakene 46-51 Øyvind Berntsen, sakene 40-45 og 55 Grethe Ruud Hansen, ref alle saker Ole Jørgen Sagedal, sakene 40-45 og 55 Dag Kvarstein, sak 47 Geir Myre, sakene 48 og 49 Erland Grøtberg PF, alle saker Saksliste Saksnr Tittel Gradering 040/16 Godkjenning av innkalling og saksliste 041/16 Godkjenning av møtebok 042/16 Tilsetting sokneprest i Arendal prosti med Hisøy sokn som Unntatt offentlighet tjenestested 043/16 Tilsetting sokneprest i Lister prosti i Feda og Fjotland med Unntatt offentlighet prostiet som tjenesteområde 044/16 Tilsetting av kapellan i Skien prosti med Porsgrunn sokn Unntatt offentlighet som tjenestested 045/16 Regnskapsrapport pr 31.05.2016 046/16 Gjennomføring av bemanningsendringer Unntatt offentlighet 047/16 Bemanningsendringer i bispedømmeadministrasjonen Personalsak 048/16 Klagesak angående flytting av grav Unntatt offentlighet 049/16 Klage på avslag på anmodning om innsyn 050/16 Fordeling av ubrukte trosopplæringsmidler 2015 051/16 Samlivsform i utlysningstekst 052/16 Referatsaker 053/16 Orienteringssaker 054/16 Eventuelt 055/16 Tilsetting sokneprest/spesialprest Øvre Telemark prosti Unntatt offentlighet med sokna i Tokke og Vinje som tjenestested 040/16: Godkjenning av innkalling og saksliste Behandling: Vedtak: Følgende saker behandles for lukkede dører: 042 - 044, 046- 048 og 055. -

Menighetsblad for Feda, Kvinesdal Og Fjotland 1 Nr 2 Juni 2017 - 58

Menighetsblad for Feda, Kvinesdal og Fjotland 1 Nr 2 juni 2017 - 58. årgang Konfirmantene nå og framover fra prestens penn Nå i løpet av mai måned har totalt Mye har fungert bra, og noen ting 71 ungdommer blitt konfirmert i våre har vi lyst til å gjøre litt annerledes. Vi tre sokn, Kvinesdal, Feda og Fjotland. har stilt oss spørsmålet: Hvordan kan Det har vært en flott gjeng å være vi gjøre konfirmantopplegget enda sammen med, og vi som har hatt an- bedre, ut fra de ressursene vi har til svaret for konfirmantundervisningen rådighet? Det har vært gjort flere håper de har fått med seg både gode undersøkelser blant konfirmanter de minner og verdifull ballast til veien senere årene, og det som konfirman- videre. tene selv gjerne løfter fram som det mest positive er konfirmantleiren. I For meg som prest er dette det tråd med det har mange menigheter første konfirmantkullet i denne stil- hatt gode erfaringer med å legge om lingen. Jeg begynte i jobben i slutten konfirmantåret fra vårkonfirmasjon av august 2016, og kom dermed rett til høstkonfirmasjon (som også var inn i oppstarten av konfirmantåret. det vanlige før 1970) og bytte ut en Mye av tiden de første månedene ble kort konfirmantweekend med en litt brukt nettopp til å jobbe med ulike lengre sommerleir. deler av konfirmantopplegget: gjen- nomtenke undervisningsopplegg, Nå i høst satte vi derfor i gang en planlegge leir, organisere hjemme- prosess for å se om en tilsvarende grupper, gjennomføre ulike arrange- endring kunne være tjenlig også hos ment og aktiviteter. oss, og det har blitt vedtatt i alle Nytt fra høsten av er bl.a. -

Statnett Annual Report 2014

Annual report 2014 English Statnett Annual report 2014 Content The President and CEO comments on the 2014 annual report 4 Statnett’s strategy 6 This is Statnett 8 Statnett’s tasks 8 Organizational structure 9 Presentation of the Group management 10 Highlights 2014 12 The international interconnector between Norway and Germany is approaching realisation 12 Lofotringen sections now part of the main grid 12 Ørskog-Sogndal to be completed in steps 12 Skagerrak 4 and the Eastern Corridor strengthened transmission capacity to Denmark 12 Measures to improve information security 13 New Regulation and Market System (LARM) 13 Statnett’s former head office in Huseby has been sold 13 Ytre Oslofjord completed 13 Common price calculation in Northwest-Europe 13 Regional control centres in Sunndalsrøra and Alta merged 13 Financial framework conditions 14 Statnett’s revenues 14 Key figures 17 Corporate Social Responsibility 2014 18 Statnett’s corporate social responsibility reporting 18 Corporate social responsibility organisation 18 Statnett and society 19 Climate and the environment 24 Our employees 29 GRI 36 Corporate governance 41 Statement on corporate governance 41 Business 42 Equity and dividends 43 2 Statnett Annual report 2014 Equal treatment of owners and transactions with closely related parties 43 Freely negotiable 43 The Enterprise General Meeting 44 Election committee 44 Corporate Assembly and Board of Directors: composition and independence 44 The work of the Board of Directors 45 Risk management and internal control 46 Renumeration of the -

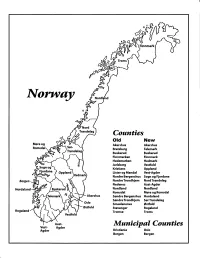

Norway Maps.Pdf

Finnmark lVorwny Trondelag Counties old New Akershus Akershus Bratsberg Telemark Buskerud Buskerud Finnmarken Finnmark Hedemarken Hedmark Jarlsberg Vestfold Kristians Oppland Oppland Lister og Mandal Vest-Agder Nordre Bergenshus Sogn og Fjordane NordreTrondhjem NordTrondelag Nedenes Aust-Agder Nordland Nordland Romsdal Mgre og Romsdal Akershus Sgndre Bergenshus Hordaland SsndreTrondhjem SorTrondelag Oslo Smaalenenes Ostfold Ostfold Stavanger Rogaland Rogaland Tromso Troms Vestfold Aust- Municipal Counties Vest- Agder Agder Kristiania Oslo Bergen Bergen A Feiring ((r Hurdal /\Langset /, \ Alc,ersltus Eidsvoll og Oslo Bjorke \ \\ r- -// Nannestad Heni ,Gi'erdrum Lilliestrom {", {udenes\ ,/\ Aurpkog )Y' ,\ I :' 'lv- '/t:ri \r*r/ t *) I ,I odfltisard l,t Enebakk Nordbv { Frog ) L-[--h il 6- As xrarctaa bak I { ':-\ I Vestby Hvitsten 'ca{a", 'l 4 ,- Holen :\saner Aust-Agder Valle 6rrl-1\ r--- Hylestad l- Austad 7/ Sandes - ,t'r ,'-' aa Gjovdal -.\. '\.-- ! Tovdal ,V-u-/ Vegarshei I *r""i'9^ _t Amli Risor -Ytre ,/ Ssndel Holt vtdestran \ -'ar^/Froland lveland ffi Bergen E- o;l'.t r 'aa*rrra- I t T ]***,,.\ I BYFJORDEN srl ffitt\ --- I 9r Mulen €'r A I t \ t Krohnengen Nordnest Fjellet \ XfC KORSKIRKEN t Nostet "r. I igvono i Leitet I Dokken DOMKIRKEN Dar;sird\ W \ - cyu8npris Lappen LAKSEVAG 'I Uran ,t' \ r-r -,4egry,*T-* \ ilJ]' *.,, Legdene ,rrf\t llruoAs \ o Kirstianborg ,'t? FYLLINGSDALEN {lil};h;h';ltft t)\l/ I t ,a o ff ui Mannasverkl , I t I t /_l-, Fjosanger I ,r-tJ 1r,7" N.fl.nd I r\a ,, , i, I, ,- Buslr,rrud I I N-(f i t\torbo \) l,/ Nes l-t' I J Viker -- l^ -- ---{a - tc')rt"- i Vtre Adal -o-r Uvdal ) Hgnefoss Y':TTS Tryistr-and Sigdal Veggli oJ Rollag ,y Lvnqdal J .--l/Tranbv *\, Frogn6r.tr Flesberg ; \. -

Tillatelse Til Å Legge Om 300 Kv Ledning Kvinesdal–Kleven

Statnett SF Postboks 4904 Nydalen 0423 OSLO Vår dato: 24.05.2018 Vår ref.: 201001760-183 Arkiv: 611 Saksbehandler: Deres dato: Anette Ødegård Deres ref.: 22959269/[email protected] Tillatelse til å legge om 300 kV ledning Kvinesdal–Kleven Norges vassdrags- og energidirektorat (NVE) har i dag gitt Statnett SF konsesjon for å bygge om 300 kV kraftledningen mellom Kvinesdal og Øye (Kleven). Omleggingen omfatter ca. 1 km av ledningen mellom mast 003 og FM 3. Vedlagt oversendes NVEs tillatelse. Dokumentene er også å finne på www.nve.no/kraftledninger. Bakgrunn Statnett søkte den 10.4.2018 om konsesjon for å legge om 300 kV-ledningen Feda–Kvinesdal og Feda– Øye på en ca. én km lang strekning. Ledningen Feda–Kvinesdal og Feda–Øye skal kobles sammen, og i stedet for å gå innom Feda stasjon, skal ledningen gå direkte fra Øye til Kvinesdal. Frem til nå har Statnett brukt navnet 'Øye' ved tilkoblingspunkt i Øye transformatorstasjon. Statnett har besluttet å endre navnet på tilkoblingspunktet til Kleven. Forbindelsen vil ha samme endepunkt i Øye som i dag, bare at det vil brukes et annet navn (se figur 2). Anlegget på Feda stasjon skal rives, og ledningsforbindelsen Kvinesdal–Feda–Øye skal legges om utenfor Feda stasjon. Statnett ønsker å legge om denne forbindelsen som en del av de pågående ledningsarbeidene, slik at dette er gjennomført før Feda stasjon rives. Ved å legge ledningen rett til Kvinesdal transformator, kan inn- og utføringen til Feda stasjon rives. Dermed vil konsesjon for ledningen mellom Feda og Øye bortfalle, og endepunktene for ledningen blir isteden Kvinesdal og Øye (Kleven). -

Administrative and Statistical Areas English Version – SOSI Standard 4.0

Administrative and statistical areas English version – SOSI standard 4.0 Administrative and statistical areas Norwegian Mapping Authority [email protected] Norwegian Mapping Authority June 2009 Page 1 of 191 Administrative and statistical areas English version – SOSI standard 4.0 1 Applications schema ......................................................................................................................7 1.1 Administrative units subclassification ....................................................................................7 1.1 Description ...................................................................................................................... 14 1.1.1 CityDistrict ................................................................................................................ 14 1.1.2 CityDistrictBoundary ................................................................................................ 14 1.1.3 SubArea ................................................................................................................... 14 1.1.4 BasicDistrictUnit ....................................................................................................... 15 1.1.5 SchoolDistrict ........................................................................................................... 16 1.1.6 <<DataType>> SchoolDistrictId ............................................................................... 17 1.1.7 SchoolDistrictBoundary ........................................................................................... -

Takk for Støtten Til Treklang

Menighetsblad for Feda, Kvinesdal og Fjotland Nr 1 mars 2019- 60. årgang Den nye utsmykningen i hovedsalen på Menighetssentet side 10-11 1 De lange linjer fra prestens penn «Hvilken religion tilhører du?» Likevel gjenspeiler deres liv at de var spørsmålet til en norsk turist på bygger på vår tusenårige kristne en flyplass i Østen. «Er du kristen?» tradisjon. Dette gir et flott grunnlag Den moderne nordmannen ristet til samarbeid om viktige etiske og energisk på hodet – forvirret over politiske spørsmål. I dag er det spørsmålet. «Er du muslim? Hindu?» et liberalistisk og nasjonalistisk Fortsatt hoderisting. «Hvilken tankegods som kan true vår kristne religion tilhører du da?» fortsatte kulturarv. Da gjelder det om å kunne lufthavn-betjenten. «Eh-eh-eh,» stå sammen med alle mennesker av stotret nordmannen. Og la til: «Jeg god vilje for å løfte fram Guds tanker er kristen.» om verden og mennesket. Landet vårt står i en kristen Nasjonalbiblioteket har kalt kulturtradisjon. Våre valg i 2019 for Bokens år. De lister opp hverdagen hviler ofte på en mange gode grunner til å styrke grunnleggende forståelse av verden fokuset på norsk litteratur. Likevel er og menneskelivet som har sin Bibelen den boka som mer enn noen opprinnelse i den jødisk-kristne har fulgt Norge gjennom hele vår tradisjon. Mange som tar avstand historie som nasjon. Skal en kunne er det de lange linjene i bygda sin fra en personlig Kristustro er forstå vår kultur og våre verdier er historie som vi vil feire. Bygda vår likevel totalt preget av den kristne det helt nødvendig å ha kunnskap er rik på tro, håp og kjærlighet. -

A Four-Phase Model for the Sveconorwegian Orogeny, SW Scandinavia 43

NORWEGIAN JOURNAL OF GEOLOGY A four-phase model for the Sveconorwegian orogeny, SW Scandinavia 43 A four-phase model for the Sveconorwegian orogeny, SW Scandinavia Bernard Bingen, Øystein Nordgulen & Giulio Viola Bingen, B., Nordgulen, Ø. & Viola, G.; A four-phase model for the Sveconorwegian orogeny, SW Scandinavia. Norwegian Journal of Geology vol. 88, pp 43-72. Trondheim 2008. ISSN 029-196X. The Sveconorwegian orogenic belt resulted from collision between Fennoscandia and another major plate, possibly Amazonia, at the end of the Mesoproterozoic. The belt divides, from east to west, into a Paleoproterozoic Eastern Segment, and four mainly Mesoproterozoic terranes trans- ported relative to Fennsocandia. These are the Idefjorden, Kongsberg, Bamble and Telemarkia Terranes. The Eastern Segment is lithologically rela- ted to the Transcandinavian Igneous Belt (TIB), in the Fennoscandian foreland of the belt. The terranes are possibly endemic to Fennoscandia, though an exotic origin for the Telemarkia Terrane is possible. A review of existing geological and geochronological data supports a four-phase Sveconorwegian assembly of these lithotectonic units. (1) At 1140-1080 Ma, the Arendal phase represents the collision between the Idefjorden and Telemarkia Terranes, which produced the Bamble and Kongsberg tectonic wedges. This phase involved closure of an oceanic basin, possibly mar- ginal to Fennoscandia, accretion of a volcanic arc, high-grade metamorphism and deformation in the Bamble and Kongsberg Terranes peaking in granulite-facies conditions at 1140-1125 Ma, and thrusting of the Bamble Terrane onto the Telemarkia Terrane probably at c. 1090-1080 Ma. (2) At 1050-980 Ma, the Agder phase corresponds to the main Sveconorwegian oblique (?) continent-continent collision. -

SOMMERFESTIVALEN Kinoforestilling Knallgod Mat! Deltakere På Mandal Skolekorpsfestival 2007

VELKOMMEN til korpsfestival i Mandal 22. – 24. juni 2007 1000 musikanter! /Premier /Defilering /konkurranser konserter aktiviteter Marsj-konkurranse Gate Oppmarsj Fritids konserter Underholdning feiring Felles St.Hans treff Dirigent SOMMERFESTIVALEN Kinoforestilling Knallgod mat! Deltakere på Mandal Skolekorpsfestival 2007 Antall Innkvartering Middag* Oppmarsj Byspilling Korps Adresse Jenter Gutter Ledere Tot. Skole Lør Søn Pulje Sted Tid 519 321 221 1061 Bekkelaget Skoles Musikkorps P.b 49, 1109 Oslo 17 20 7 44 Furulunden 1330 1530 A02 - - Blomdalen Jentekorps Aspiranter P.b 300, 4503 Mandal 35 0 0 35 - 1415 1500 A13** - - Blomdalen Jentekorps A-Korps P.b 300, 4503 Mandal 40 0 0 40 - 1415 1500 A01 - - Buøy Skoles Musikkorps Skipsbyggergt 19, 4085 Buøy 21 9 7 37 Furulunden 1330 1430 A06 Hestetroa 1200 Bygland Hornmusikk 4742 Grendi 6 7 6 19 M.Videregående 1400 1430 A07 Giert Karis plass 1230 Engelsvoll-Orstad Skulekorps P.b 13, 4353 Klepp st. 7 7 7 21 Blomdalen 1330 1430 A04 - - Evje og Hornnes Musikkorps P.b 281, 4735 Evje 13 10 3 26 M.Videregående 1430 1430 A08 Hestetroa 1330 Feda Skolekorps 4485 Feda 11 8 7 26 M.Videregående 1315 1430 A09 - - Finnøy Musikkorps Reilstad, 4160 Finnøy 18 7 12 37 Sjøsanden Camping 1315 1430 A10 Torvet 1100 Fjære Musikkorps P.b 45, 4889 Fevik 9 2 4 15 Blomdalen 1315 1430 A11 - - Gulset Skolemusikk P.b 1843, 3705 Skien 11 10 7 28 M.Videregående 1400 1430 A12 Hestetroa 1300 Helleland Skulekorps 4376 Helleland 10 12 6 28 M.Videregående 1430 1500 A14 Torvet 1200 Hobøl Skolekorps P.b 18, 1804 Spydeberg 13 6 -

Statnett Annual Report 2017

Samfunnsansvar Uavhengig attestasjonsuttalelse Annual report 2017 1 Content Financial framework conditions 4 A Word from the CEO 6 Highlights 2017 8 This is Statnett 10 Group management 12 Risk management 14 Board of Directors 16 Board of Directors’ report 18 Financial reporting 34 Statement of comprehensive income 34 Balance sheet 35 Statement of changes in equity 36 Cash flow statement 37 Notes 38 Auditor’s report 88 Corporate Social Responsibility 92 Global reporting Initiativ (GRI) 118 Independent assurance report CSR 125 2 Statnett is responsible for operating, developing and maintaining the transmission grid in Norway – including cables and power lines to other countries Statnett is responsible for the transfer of electric power to the whole of Norway and ensures that there is always a balance between consumption and power production 3 Annual Report 2017 Financial framework conditions Key Figures and Alternative Performance Measures* Key figures (MNOK) 2017 2016 2015 2014 2013 Accounting result Operating revenues 7,401 6,678 5,906 5,563 4,561 Depreciation and amortisation 1) -2,273 -2,120 -1,516 -1,150 -1,030 Driftsresultat før avskrivninger og amortisering (EBITDA) 3,585 3,272 3,230 2,528 1,376 EBIT 1,312 1,152 1,714 1,378 346 Profit before tax 976 783 1,410 1,120 89 Profit for period 2) 813 645 1,103 829 82 Adjustments Change in accumulated higher/lower revenue (+/-) before tax -646 -1,003 -444 -623 -1,042 Change in accumulated higher/lower revenue (+/-) after tax -491 -752 -324 -455 -750 Accumulated higher/lower revenue (+/-)