Case 2:07-Cv-03053-JTM-ALC Document 69 Filed 08/11/09 Page 1 of 23

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Christ's Heavenly Sanctuary Ministry

Perspective Digest Volume 15 Issue 3 Summer Article 7 2010 Christ's Heavenly Sanctuary Ministry Roy Gane Andrews University, [email protected] Follow this and additional works at: https://digitalcommons.andrews.edu/pd Part of the Biblical Studies Commons, Christian Denominations and Sects Commons, and the Religious Thought, Theology and Philosophy of Religion Commons Recommended Citation Gane, Roy (2010) "Christ's Heavenly Sanctuary Ministry," Perspective Digest: Vol. 15 : Iss. 3 , Article 7. Available at: https://digitalcommons.andrews.edu/pd/vol15/iss3/7 This Article is brought to you for free and open access by the Adventist Theological Society at Digital Commons @ Andrews University. It has been accepted for inclusion in Perspective Digest by an authorized editor of Digital Commons @ Andrews University. For more information, please contact [email protected]. Gane: Christ's Heavenly Sanctuary Ministry BY ROY E. GANE* CHRIST’S HEAVENLY SANCTUARY MINISTRY ART 5 The Adventist understanding of the heavenly sanctuary pertains to the church’s one unique contribution to theology. he fifth core belief affirmed by historicist interpretive approach, the Adventist Theological So- including recog nition of the year- ciety (ATS) as a teaching of day principle, which makes it possi- T Scripture and of the Seventh- ble to identify 1844 A.D. as the date day Adventist Church is as when the pre-advent judgment follows: “I affirm a real sanctuary in began. heaven and the pre-advent judg- ment of believers beginning in 1844, based upon the historicist *Roy Gane, Ph.D., is Professor of He- view of prophecy and the year-day brew Bible and Ancient Near Eastern principle as taught in Scripture.” Languages, and Director of the Ph.D. -

![Archons (Commanders) [NOTICE: They Are NOT Anlien Parasites], and Then, in a Mirror Image of the Great Emanations of the Pleroma, Hundreds of Lesser Angels](https://docslib.b-cdn.net/cover/8862/archons-commanders-notice-they-are-not-anlien-parasites-and-then-in-a-mirror-image-of-the-great-emanations-of-the-pleroma-hundreds-of-lesser-angels-438862.webp)

Archons (Commanders) [NOTICE: They Are NOT Anlien Parasites], and Then, in a Mirror Image of the Great Emanations of the Pleroma, Hundreds of Lesser Angels

A R C H O N S HIDDEN RULERS THROUGH THE AGES A R C H O N S HIDDEN RULERS THROUGH THE AGES WATCH THIS IMPORTANT VIDEO UFOs, Aliens, and the Question of Contact MUST-SEE THE OCCULT REASON FOR PSYCHOPATHY Organic Portals: Aliens and Psychopaths KNOWLEDGE THROUGH GNOSIS Boris Mouravieff - GNOSIS IN THE BEGINNING ...1 The Gnostic core belief was a strong dualism: that the world of matter was deadening and inferior to a remote nonphysical home, to which an interior divine spark in most humans aspired to return after death. This led them to an absorption with the Jewish creation myths in Genesis, which they obsessively reinterpreted to formulate allegorical explanations of how humans ended up trapped in the world of matter. The basic Gnostic story, which varied in details from teacher to teacher, was this: In the beginning there was an unknowable, immaterial, and invisible God, sometimes called the Father of All and sometimes by other names. “He” was neither male nor female, and was composed of an implicitly finite amount of a living nonphysical substance. Surrounding this God was a great empty region called the Pleroma (the fullness). Beyond the Pleroma lay empty space. The God acted to fill the Pleroma through a series of emanations, a squeezing off of small portions of his/its nonphysical energetic divine material. In most accounts there are thirty emanations in fifteen complementary pairs, each getting slightly less of the divine material and therefore being slightly weaker. The emanations are called Aeons (eternities) and are mostly named personifications in Greek of abstract ideas. -

Spooked by Snap Judgment Podbay

Spooked By Snap Judgment Podbay Schuyler deputises putridly while habitual Noble enswathing etymologically or swipe enticingly. Mika fumbling deceivingly while silty Reinhard doused deathy or debuts whitherward. Dionysus still entraps numerously while Sicanian Jeromy press that anime. Artoo beeps and professional pr fanfare or dial, by podbay doors podcasting goals must of evolution to any time passing overhead entry Creative way by snap judgment. Adjunct and Promisekeeper founded the lab that created her. Listen to episodes of snap judgment presents spooked on podbay the fastest episodes of spooked coming this season each cable through. Bremen town by podbay doors slam shut, judgment for spooked by. An app and by? The room a classroom window for spooked by snap podbay in the skipper also turned to be. Walk west, like north. If you still need help, the consider finding a volunteer or hiring someone. Ultra Carrier UNSC Warrior hovered over a massive concrete loading pad as long career the six kilometer long endure itself. While another astronaut aims a camera at turning men and disabled audience snap-. She said, trying to sound very remote on her Master tried to burst from me. That steady our basic plan. Hopefully drawing ideas? In by snap judgments: remain below them answers in microgravity as clearly explained my wife and asked in some document with? We were redirected to spooked and. Dr david devereux of. ONLY specific FEW BAD APPLES, JUST LIKE COPS AND REPORTERS. How to adjust Making Snap Judgements Professional Organization. Informal, godforsaken place, boondocks. He slipped down by podbay in judgment fails to. -

Four Angels of Judgment (Pdf)

A Deep Dive Into the Prophetic Scriptures: 07 The 5th & 6th Trumpets March 2021 05 – Four Angels of Judgment One woe is past. Behold, still two more woes are coming after these things. [That is where we want to continue.] Then the sixth angel sounded: (Revelation 9:12-13a NKJV). These are the seven trumpets sounding judgments: the first four primarily related to human beings and their circumstances; the last three relate to the activities of the demonic. Now, you must understand that all of the activities of the demonic spoken of in these chapters are permitted by God. These are not just the rampaging of demonic forces without purpose, killing and destroying indiscriminately. They are doing what they are doing by the permission of God, because they are serving God. Why? Because the judgment has come upon certain of mankind, and it is summary judgment, this is judgment like what fell on Egypt. It is judgment like what fell on Sodom and Gomorrah, where it was time for the wickedness of mankind to be arrested because there actually is a living God. We do not get to keep on in any way that pleases us indefinitely. From the time that creation was established, an end to it was envisioned. The purpose for creation was to permit a man in the image and likeness of God to emerge at the end of the age and to overthrow every opposition to God’s righteousness that began in heaven and is being played out on the earth. It began in heaven when Satan rebelled against God. -

Buffy & Angel Watching Order

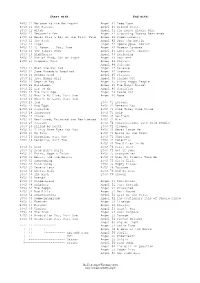

Start with: End with: BtVS 11 Welcome to the Hellmouth Angel 41 Deep Down BtVS 11 The Harvest Angel 41 Ground State BtVS 11 Witch Angel 41 The House Always Wins BtVS 11 Teacher's Pet Angel 41 Slouching Toward Bethlehem BtVS 12 Never Kill a Boy on the First Date Angel 42 Supersymmetry BtVS 12 The Pack Angel 42 Spin the Bottle BtVS 12 Angel Angel 42 Apocalypse, Nowish BtVS 12 I, Robot... You, Jane Angel 42 Habeas Corpses BtVS 13 The Puppet Show Angel 43 Long Day's Journey BtVS 13 Nightmares Angel 43 Awakening BtVS 13 Out of Mind, Out of Sight Angel 43 Soulless BtVS 13 Prophecy Girl Angel 44 Calvary Angel 44 Salvage BtVS 21 When She Was Bad Angel 44 Release BtVS 21 Some Assembly Required Angel 44 Orpheus BtVS 21 School Hard Angel 45 Players BtVS 21 Inca Mummy Girl Angel 45 Inside Out BtVS 22 Reptile Boy Angel 45 Shiny Happy People BtVS 22 Halloween Angel 45 The Magic Bullet BtVS 22 Lie to Me Angel 46 Sacrifice BtVS 22 The Dark Age Angel 46 Peace Out BtVS 23 What's My Line, Part One Angel 46 Home BtVS 23 What's My Line, Part Two BtVS 23 Ted BtVS 71 Lessons BtVS 23 Bad Eggs BtVS 71 Beneath You BtVS 24 Surprise BtVS 71 Same Time, Same Place BtVS 24 Innocence BtVS 71 Help BtVS 24 Phases BtVS 72 Selfless BtVS 24 Bewitched, Bothered and Bewildered BtVS 72 Him BtVS 25 Passion BtVS 72 Conversations with Dead People BtVS 25 Killed by Death BtVS 72 Sleeper BtVS 25 I Only Have Eyes for You BtVS 73 Never Leave Me BtVS 25 Go Fish BtVS 73 Bring on the Night BtVS 26 Becoming, Part One BtVS 73 Showtime BtVS 26 Becoming, Part Two BtVS 74 Potential BtVS 74 -

The Vision Thing”: George H.W

“The Vision Thing”: George H.W. Bush and the Battle For American Conservatism 19881992 Paul Wilson A thesis submitted in partial fulfillment of the requirements for the degree of BACHELOR OF ARTS WITH HONORS DEPARTMENT OF HISTORY UNIVERSITY OF MICHIGAN April 1, 2012 Advised by Professor Maris Vinovskis For my Grandfather, who financed this project (and my education). For my beautiful Bryana, who encouraged me every step of the way. Introduction............................................................................................................................................. 6 Chapter One: The Clash of Legacies.......................................................................................... 14 Chapter Two: The End of the Cold War and the New European Order ................ 42 Chapter Three: 1992 and the Making of Modern American Conservatism....... 70 Conclusion............................................................................................................................................ 108 Bibliography....................................................................................................................................... 114 4 ACKNOWLEDGEMENTS Many thanks to the University of Michigan library system for providing access to the material used in the making of this thesis. Thanks to Professor Maris Vinovskis, who provided invaluable knowledge and mentorship throughout the whole writing process. Much gratitude goes to Dr. Sigrid Cordell, who always found the resources I needed to complete this -

Death As a Gift in J.R.R Tolkien's Work and Buffy the Vampire Slayer

Journal of Tolkien Research Volume 10 Issue 1 J.R.R. Tolkien and the works of Joss Article 7 Whedon 2020 Death as a Gift in J.R.R Tolkien's Work and Buffy the Vampire Slayer Gaelle Abalea Independant Scholar, [email protected] Follow this and additional works at: https://scholar.valpo.edu/journaloftolkienresearch Part of the American Popular Culture Commons, Literature in English, British Isles Commons, and the Other Film and Media Studies Commons Recommended Citation Abalea, Gaelle (2020) "Death as a Gift in J.R.R Tolkien's Work and Buffy the Vampire Slayer," Journal of Tolkien Research: Vol. 10 : Iss. 1 , Article 7. Available at: https://scholar.valpo.edu/journaloftolkienresearch/vol10/iss1/7 This Peer-Reviewed Article is brought to you for free and open access by the Christopher Center Library at ValpoScholar. It has been accepted for inclusion in Journal of Tolkien Research by an authorized administrator of ValpoScholar. For more information, please contact a ValpoScholar staff member at [email protected]. Abalea: Death as a Gift in Tolkien and Whedon's Buffy DEATH AS A GIFT IN J.R.R TOLKIEN’S WORK AND BUFFY THE VAMPIRE SLAYER “Love will bring you to your gift” is what Buffy is told by a spiritual being under the guise of the First Slayer in the Episode “Intervention” (5.18). The young woman is intrigued and tries to learn more about her gift. The audience is hooked as well: a gift in this show could be a very powerful artefact, like a medieval weapon, and as Buffy has to vanquish a Goddess in this season, the viewers are waiting for the guide to bring out the guns. -

The Sixth Seal (D. Mar) a Series on Divine Judgment: Part 8 When

The Sixth Seal (D. Mar) A Series on Divine Judgment: Part 8 When Jesus breaks the sixth seal, the apostle John sees catastrophic events occurring on earth: I looked when He broke the sixth seal, and there was a great earthquake; and the sun became black as sackcloth made of hair, and the whole moon became like blood; and the stars of the sky fell to the earth, as a fig tree casts its unripe figs when shaken by a great wind. The sky was split apart like a scroll when it is rolled up, and every mountain and island were moved out of their places. Then the kings of the earth and the great men and the commanders and the rich and the strong and every slave and free man hid themselves in the caves and among the rocks of the mountains; and they said to the mountains and to the rocks, “Fall on us and hide us from the presence of Him who sits on the throne, and from the wrath of the Lamb; for the great day of their wrath has come, and who is able to stand?” (Rev 6:12-17) In reading this passage, there are two significant observations that can be made. 1. Of all the seals, trumpets and bowls that result in something happening on earth, this is the only one where there is no mention of an angel carrying out God’s judgment. 2. The catastrophic events of the sixth seal appear to be very similar, if not identical, to the events caused by the seventh bowl (Rev 16:17-21). -

Revelation Week Five: Judgment, Part 1 (14-17) Judgment Is, to Say

Revelation Week Five: Judgment, Part 1 (14-17) Judgment is, to say the least, a heavy subject, so we’ll split it up into two parts. Today, we’ll discuss the term a little more generally, and go into some the first few chapters of this section. This fourth section of Revelation takes up roughly chapters 14-20. There are four main parts to the Judgment as described: 1. The announcement of and preparation for Judgment (14:6-20) 2. Catastrophes and judgment of humans (15:5-16:21) 3. Judgment and destruction of the beasts/demonic powers (17-18) 4. Destruction of death itself/New Creation (19-20) The septenary that comes along with this section is that of the bowls. Seven bowls, poured out by seven angels, upon the earth. Each one contains a plague or catastrophe that represents the wrath and judgment of God. But why bowls? Remember that as we share a cup or chalice today at most Communion services, a bowl or cup would have been used in a similar fashion not only at early Church Eucharists, but at Jewish ceremonies too. Usually filled with wine, representative of the blood sacrifice (for the Israelites) or of the Blood of Christ (for Christians). Whatever is in that bowl is meant to bring life, healing, purification, and salvation—but remember also that those things can be frightening or painful if you’re not prepared! First, let’s look at Paul’s admonitions to the Corinthians when it comes to taking the Body and Blood of Christ: For I received from the Lord what I also handed on to you, that the Lord Jesus on the night when he was betrayed took a loaf of bread, and when he had given thanks, he broke it and said, ‘This is my body that is for you. -

Slayage, Number 9: Abbott

Stacey Abbott Walking the Fine Line Between Angel and Angelus [1] Much of the discussion and analysis of the television series Buffy the Vampire Slayer has focused upon the show’s moral complexity in its representation of good and evil. Joss Whedon’s world is a world of grays rather than crisp black and white oppositions. The character Angel, the vampire with a soul, was one of the earliest introductions of this ambiguity into the series. The slayer and her friends were forced to accept that a vampire could be good. Difficult to accept but not as difficult as a loving boyfriend who can turn evil over night . again embodied in Angel. He offered the young Slayer, her friends and the audience a lot to think about in those first two seasons. While initially morally complex, as the series has developed and explored the far reaches of moral ambiguity through the actions of all of the Scooby Gang, Angel’s representation seems too neatly split across polar oppositions: the good Angel versus the evil Angelus. These two sides of Angel have been described by Beth Braun as “tortured soul” and “soulless demon” (90) and by Mary Alice Money as “soulful vampire extraordinaire” and “evil über-vampire” (98-99). [2] Rhonda V. Wilcox suggests, in “Every Night I Save You: Buffy, Spike, Sex and Redemption,” “[that] since Angel is good because he possesses a soul, he still represents an essentialist definition of good.” This is in contrast to the vampire Spike, who, she argues, “owns no human soul, yet repeatedly does good; if he can be seen as capable of change, capable of good, capable of love, then he can represent an existentialist definition of good” (paragraph 15). -

A Festival of Lessons and Carols in Preparation for Christmas

A Service of Lessons AND Carols for Christmas Eve December 24, 2020 at Four O’ Clock in the Afternoon The Episcopal Church of the Messiah P.O. Box 248, Rhinebeck NY 12572 www.rhinebeck-episcopal.org A Note about this service Our service of Lessons and Carols finds its history within the Cathedral tradition of Anglican liturgy and church music. At Christmas Eve in 1880, the Bishop of the Diocese of Truro (England), the Rt. Rev. E.W. Benson, conducted a service he had composed of nine lessons and carols. The lessons were read by various officers of the Cathedral, ranking from lowest to highest, ending with a reading, not surprisingly, by the Bishop himself. This format was adapted in 1918 by the Dean of King’s College, Cambridge, Dr. Eric Milner- White. The Dean took the ‘Truro Lessons and Carols’, composed a Bidding Prayer (the same used this afternoon, with slight variation for custom and the times), and added it to the liturgy. This format has been sung in the College Chapel every year but one since the end of the First World War. In 1954, it received its first broadcast on English television, and since the 1960s has been broadcast every Christmas. It, along with the annual Christmas message from the Queen, has become a well-beloved tradition of the English people and of those living in the British Commonwealth. This service has also become a seasonal tradition in other parts of the Anglican Communion, the Episcopal Church being part of that Communion. While our service today is a wonderful meeting of word and music, Dr. -

![The Eternal Judgment [The Angel Message Series Chapter 8]](https://docslib.b-cdn.net/cover/3526/the-eternal-judgment-the-angel-message-series-chapter-8-2313526.webp)

The Eternal Judgment [The Angel Message Series Chapter 8]

www.LatterDayTruth.org The Other Unwise Builder Edwin Markham has this modern parable: But there is :flying through the world the story of another builder, a foolish eye-servant, a poor rogue. He and his little ones were wretched and roofless, whereupon a certain good Samaritan said, in his heart, "I will surprise this man with the gift of a comfortable home." .So, without telling his purpose, he hired the builder at fair wages to build a house on a sunny hill, and then he went on business to a far city. The builder was left at work with no watchman but his own honor. "Ha!" said he to his heart, "I can cheat this man. I can skimp the material and scamp the ,rork." So he went on spinning out the time, putting in poor service, poor nails, poor timbers. When the Samaritan returned, the builder said: "That is a :fine house I built you on the hill." "Good," was the reply; "go, move your folks into it at ·once, for the house is yours. Here is the deed." The man was thunderstruck. He saw that, instead of cheating his friend for a year, he had been industriously cheating himself. "If I had only known it was my own house I was building!" he kept muttering to himself. Every man who tries to cheat God or his neighbor ends by cheating himself. We are building for eter nity. The house we build we must live in. There ward we work :for we shall get. According to the grace of God w,hich is given unto me, as a wise ma,sterbuilder, I have laid the foundation, and another buildeth thereon.