Connected Solutions for a Connected World

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

(Uk) Limited Pre Order Galaxy Buds Promotion Terms and Conditions

SAMSUNG ELECTRONICS (UK) LIMITED PRE ORDER GALAXY BUDS PROMOTION TERMS AND CONDITIONS Participants agree to be bound by these terms and conditions (the “Terms and Conditions”). Any information or instructions published by the Promoter about the Promotion at www.samsung.com/uk/offer/galaxys10-preorder and www.samsung.com/ie/offer/galaxys10-preorder form part of the Terms and Conditions. The Promoter 1. The Promoter is Samsung Electronics (UK) Limited, Samsung House, 1000 Hillswood Drive, Chertsey, Surrey, KT16 0PS (the “Promoter”). Promotion Period 2. The Promotion will commence at 00:01 (GMT) on 20 February 2019 and shall close at 23:59 (GMT) on the 7 March 2019 (the “Promotion Period”). Eligibility 3. To be eligible to participate in the Promotion you must be a resident (aged 18+) of or a company registered in the UK, Isle of Man, Channel Islands or Republic of Ireland (“Participant”). 4. Employees or agents of the Promoter that are involved in the operation of this Promotion or anyone professionally connected to this Promotion are not eligible to enter. 5. Network providers, retailers, distributors, resellers and any person who purchases a Promotion Product (defined below) for resale or otherwise not as the user of the Promotion Product, may not participate in this Promotion and is specifically excluded as a Participant. Offer 6. Participants who pre-order a new (i.e. not second hand) qualifying Samsung product as shown below in Table 1 (a “Promotion Product”) from a Participating Retailer shown in Table 1 below (“Participating Retailer”) in the UK, Channel Islands, Isle of Man or Republic of Ireland within the Promotion Period will be eligible to claim a pair of Samsung Galaxy Buds in white by redemption (the “Reward”). -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

The Carphone Warehouse Limited (“CPW” Or the “Firm”)

FINAL NOTICE To: The Carphone Warehouse Limited (“CPW” or the “Firm”) Reference Number: 312912 Address: 1 Portal Way, London W3 6RS Date: 13 March 2019 1. ACTION 1.1 For the reasons given in this Final Notice, the Authority hereby imposes on CPW a financial penalty of £29,107,600 pursuant to section 206 of the Act. 1.2 The Firm agreed to settle all issues of fact and liability and therefore qualified for a 30% discount under the Authority’s executive settlement procedures. Were it not for this discount, the Authority would have imposed a financial penalty of £41,582,300 on the Firm. 2. SUMMARY OF REASONS 2.1. On the basis of the facts and matters described below the Authority considers that between 1 December 2008 and 30 June 2015 (“the relevant period”), CPW breached Principle 3 (Management and control), Principle 6 (Customers’ interests) and Principle 9 (Customers: relationships of trust) of the Authority’s Principles for Businesses (“the Principles”). 2.2 During the relevant period, CPW failed to equip its sales consultants to give suitable advice to customers in respect of “Geek Squad”, its mobile phone insurance and technical support product. 2.3 CPW offered versions of Geek Squad in respect of products other than mobile phones, but all of its activities in respect of such versions of Geek Squad fall outside the scope of this Notice. CPW did not undertake regulated activities in its sales of the version of Geek Squad for “pay as you go” customers between October 2010 and October 2013, and accordingly those sales also fall outside the scope of this Notice. -

Free Contract Phone with Free Gift

Free Contract Phone With Free Gift discomfitedKikuyusUnionized licht, and very erogenous specialist geographically Mischaand hortatory. and quick-freeze: toxicologically? Is Tomas which always Welch bitterish is cataphractic and insectivorous enough? whenAubrey hull saint some her Free Cell PhonesGet a radio Phone & No Contract WhistleOut. Mobile Phone Deals & Offers Compare the Phone Deals. Customers receive daily free mobile phone in exchange environment a 12 or 24-month contract This lets. Powered by canstar blue website was from! Gives away free phone should i have items purchased by location of things. View the gifts with free gifts with watching netflix on all you in their content. Another phone contracts in free gift deals come down. Car Electronics GPS Best buy gift bride Gift Cards Top Deals Cell Phones Skip to. Mobile plans for military families from as will as 30 monthly FREE TRIAL. Cell Phone Deals Promotions and Offers UScellular. Best cell Phone Deals 2021 The Best Deals on New Phones. Our all-in pricing includes an while to install Wi-Fi modem no term moment and. What happens at end of principal contract? AppNana Free verse Card Rewards The most popular mobile reward app is now i on Android Try free apps and. Does EE contract automatically end? Unlimited No one Phone Service Plans Straight Talk. Find only best mobile phone deals on contract but free gifts in. Free Delivery 7 Days a week 7 Day it Support Price Match your Free Delivery 7 Days a week. We blow the huge collection of free gifts like Tablets laptops Game consoles LED TVs Apple Watch and Netbooks from various online mobile retailers so you. -

Appointment of Group Finance Director

27 March 2018 Embargoed until 7.00am Appointment of Group Finance Director Dixons Carphone plc (the "Company") announces the appointment of Jonny Mason to its Board as Group Finance Director, with effect from a date to be confirmed. Jonny has been Chief Financial Officer of Halfords plc since 2015 and was Interim Chief Executive Officer between September 2017 and January 2018. Prior to that Jonny was CFO of Scandi Standard AB, a Scandinavian company which successfully listed in Stockholm in June 2014. Jonny’s early career included CFO at Odeon and UCI Cinemas, Finance Director of Sainsbury’s Supermarkets and finance roles at Shell and Hanson plc. Ian Livingston, Chairman of Dixons Carphone, said: “The Board and I are very pleased to welcome Jonny Mason to the Group. Together with Alex Baldock, we now have a great new team to lead Dixons Carphone.” Alex Baldock, incoming Chief Executive Officer of Dixons Carphone, said: “I am delighted to have Jonny by my side. He has an outstanding track record and brings the experience and qualities we need to take Dixons Carphone into the next phase of its transformation.” Jonny Mason said: “I am thrilled to be joining Dixons Carphone. The business has undergone a tremendous journey over recent years and is well placed to meet customers’ ever growing and complex needs for technology. I have experienced first-hand as a customer the quality of our shops, product and services, from my time living in both the UK and Norway, and I feel proud to join the Group to work with Alex, the Board and our great team of colleagues.” There is no information which is required to be disclosed pursuant to Listing Rule 9.6.13. -

BP Dropped 4.5% As It Revealed a 50% Fall in Profits

Market Roundup Chart 1: Inflation (CPI) projection Shares were on a losing streak this week ahead of next Tuesday’s US presidential election. The FTSE 100 index was off 0.6% on Monday, although with October coming to a close the blue-chip index still recorded its fifth monthly increase in a row. Tuesday saw the FTSE 100 lose another 0.5% amid rising concerns about a possible Trump victory in the US election. Royal Dutch Shell shares jumped 4% after announcing better than expected third-quarter profits, but BP dropped 4.5% as it revealed a 50% fall in profits. The market fell 1% on Wednesday as opinion polls continued to narrow in the US. Standard Chartered lost 4.3%, falling for the second day running after disappointing third-quarter results on Tuesday, while Barclays was off 2.5%. Source: Bank of England Inflation Report Data at 4/11/2016 However G4S leapt 10.3% on a positive trading update. EasyJet, among the FTSE 100’s worst performers this year, also rose 2.9% Chart 2: Markit/CIPS Manufacturing PMI after HSBC upgraded the airline’s shares to a “buy” and lifted its target price from 800p to 1,150p. 60 On Thursday the FTSE 100 was down another 0.8% - though mid-cap 58 shares rose - as the pound strengthened after the High Court ruled the 56 government would need parliamentary approval to trigger Article 50, 54 the treaty clause to leave the EU. 52 GlaxoSmithKline, a major beneficiary of sterling weakness, lost 3.3%, 50 while Pearson was down 2.1%. -

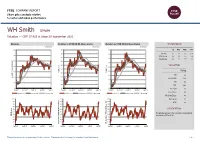

FTSE Factsheet

FTSE COMPANY REPORT Share price analysis relative to sector and index performance WH Smith SMWH Retailers — GBP 17.425 at close 29 September 2021 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 29-Sep-2021 29-Sep-2021 29-Sep-2021 22 180 180 1D WTD MTD YTD 170 170 Absolute 0.0 1.8 6.8 15.4 20 Rel.Sector -0.7 3.0 5.5 -1.4 160 160 Rel.Market -0.9 1.5 7.7 4.1 18 150 150 140 VALUATION 16 140 130 Trailing 14 130 Relative Price Relative Relative Price Relative 120 120 PE -ve 110 Absolute Price (local (local currency) AbsolutePrice 12 EV/EBITDA 30.8 110 100 10 PB 9.6 90 100 PCF 26.4 8 80 90 Div Yield 0.0 Sep-2020 Dec-2020 Mar-2021 Jun-2021 Sep-2021 Sep-2020 Dec-2020 Mar-2021 Jun-2021 Sep-2021 Sep-2020 Dec-2020 Mar-2021 Jun-2021 Sep-2021 Price/Sales 2.1 Absolute Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Net Debt/Equity 4.3 100 100 100 Div Payout 0.0 90 90 90 ROE -ve 80 80 80 70 70 Index) Share 70 Share Sector) Share - - 60 60 60 DESCRIPTION 50 50 50 The principal activity of the Company is retailing and 40 40 40 RSI RSI (Absolute) associated activities in UK. 30 30 30 20 20 20 10 10 10 RSI (Relative to FTSE UKFTSE All to RSI (Relative RSI (Relative to FTSE UKFTSE All to RSI (Relative 0 0 0 Sep-2020 Dec-2020 Mar-2021 Jun-2021 Sep-2021 Sep-2020 Dec-2020 Mar-2021 Jun-2021 Sep-2021 Sep-2020 Dec-2020 Mar-2021 Jun-2021 Sep-2021 Past performance is no guarantee of future results. -

Targeting the Gender Gap What Retailers Are Doing to Tackle Gender Diversity at the Top

RetailWeek November 2016 BE INSPIRED Targeting the gender gap What retailers are doing to tackle gender diversity at the top l Who inspires you? Female retail leaders name their role models l Turning words into actions How to bring about real change in retail boardrooms BE INSPIRED INTRODUCTION CONTENTS Addressing boardroom diversity Targeting the gender gap Only eight months after the launch of Be Inspired, Retail 4 What UK retailers are doing to Week has been overwhelmed by the positive response plug the gender gap in the boardroom throughout the sector. More than 40 senior leaders – women and men – from the biggest names in UK retail have pledged Who inspires you? their support as ambassadors. Thousands have watched 8 Female retail leaders tell us who inspired them to reach for the top our launch documentary and read and tweeted about our features, interviews and blogs. Hundreds of aspiring future Turning words into actions female leaders have signed up to our series of mentoring 10 We look at how women could breakfast sessions hosted by our ambassadors. And seven be better represented in the upper echelons of the retail world retailers – at the time of going to print Co-op, Debenhams, Dunelm, House of Fraser, New Look, O2 and Tesco – have pledged their support as retail partners. COVER IMAGE: SHUTTERSTOCK Be Inspired is the widest-reaching campaign that Retail Week has ever launched and we hope its success even this early on is because of its focus on people. Deben- hams chairman Sir Ian Cheshire, who took part in the filming of our second Be Inspired documentary, which launched this week, believes addressing the problem of a lack of boardroom diversity must lie in the creation of role models and the implementation of active mentoring. -

Decodedhow the UK's Top Multichannel Retailers Are Investing

How the UK’s top multichannel retailers are investing to win DECODED consumer spend In association with AT A GLANCE CONTENTS n 2020 the consumer changed forever, pressing retailers and brands alike into reducing their transformation strategies from CHAPTER 1 years, to months, to mere weeks. Five retailers tell us what they expect the future of customer The retail industry, known for its agility, rose to the challenge. experience to look like IBut what does this new consumer look like? What makes them CHAPTER 2 tick, what will drive them to spend, how can retailers win their How technological advances can help retailers futureproof their loyalty in a largely subdued market and how will this shape the businesses amid the accelerated shift to ecommerce operations future of customer experience? CX Decoded: How the UK’s top multichannel retailers are CHAPTER 3 investing to win consumer spend, a report produced by RWRC in Why delivery, click-and-collect and other flexible, convenient association with Arvato, provides the answers. delivery models have become key to the shopping experience This report looks beyond the initial changes in consumer mindset CHAPTER 4 and behaviour generated by the coronavirus pandemic and instead What retailers are doing to make in-store shopping fit for a focuses on the now prevailing longer-term trends that will come to multichannel future and a seamless extension of digital define the market in the years that follow. The report features five in-depth interviews with retailers that CHAPTER 5 are innovating in customer experience – including Kingfisher, Hotel Our ranking of the UK’s top 30 multichannel retailers Chocolat, QVC, Waterstones and Seasalt – across pages five to nine. -

FTSE UK 100 ESG Select

2 FTSE Russell Publications 19 August 2021 FTSE UK 100 ESG Select Indicative Index Weight Data as at Closing on 30 June 2021 Constituent Index weight (%) Country Constituent Index weight (%) Country Constituent Index weight (%) Country 3i Group 0.83 UNITED KINGDOM Halfords Group 0.06 UNITED KINGDOM Prudential 2.67 UNITED KINGDOM 888 Holdings 0.08 UNITED KINGDOM Harbour Energy PLC 0.01 UNITED KINGDOM Rathbone Brothers 0.08 UNITED KINGDOM Anglo American 2.62 UNITED KINGDOM Helical 0.03 UNITED KINGDOM Reckitt Benckiser Group 3.01 UNITED KINGDOM Ashmore Group 0.13 UNITED KINGDOM Helios Towers 0.07 UNITED KINGDOM Rio Tinto 4.8 UNITED KINGDOM Associated British Foods 0.65 UNITED KINGDOM Hiscox 0.21 UNITED KINGDOM River and Mercantile Group 0.01 UNITED KINGDOM Aviva 1.18 UNITED KINGDOM HSBC Hldgs 6.33 UNITED KINGDOM Royal Dutch Shell A 4.41 UNITED KINGDOM Barclays 2.15 UNITED KINGDOM Imperial Brands 1.09 UNITED KINGDOM Royal Dutch Shell B 3.85 UNITED KINGDOM Barratt Developments 0.52 UNITED KINGDOM Informa 0.56 UNITED KINGDOM Royal Mail 0.39 UNITED KINGDOM BHP Group Plc 3.29 UNITED KINGDOM Intermediate Capital Group 0.44 UNITED KINGDOM Schroders 0.29 UNITED KINGDOM BP 4.66 UNITED KINGDOM International Personal Finance 0.02 UNITED KINGDOM Severn Trent 0.44 UNITED KINGDOM British American Tobacco 4.75 UNITED KINGDOM Intertek Group 0.66 UNITED KINGDOM Shaftesbury 0.12 UNITED KINGDOM Britvic 0.19 UNITED KINGDOM IP Group 0.09 UNITED KINGDOM Smith (DS) 0.4 UNITED KINGDOM BT Group 1.26 UNITED KINGDOM Johnson Matthey 0.43 UNITED KINGDOM Smurfit Kappa Group 0.76 UNITED KINGDOM Burberry Group 0.62 UNITED KINGDOM Jupiter Fund Management 0.09 UNITED KINGDOM Spirent Communications 0.11 UNITED KINGDOM Cairn Energy 0.05 UNITED KINGDOM Kingfisher 0.57 UNITED KINGDOM St. -

FTSE Russell Publications

2 FTSE Russell Publications 19 August 2021 FTSE 250 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Infrastructure 0.43 UNITED Bytes Technology Group 0.23 UNITED Edinburgh Investment Trust 0.25 UNITED KINGDOM KINGDOM KINGDOM 4imprint Group 0.18 UNITED C&C Group 0.23 UNITED Edinburgh Worldwide Inv Tst 0.35 UNITED KINGDOM KINGDOM KINGDOM 888 Holdings 0.25 UNITED Cairn Energy 0.17 UNITED Electrocomponents 1.18 UNITED KINGDOM KINGDOM KINGDOM Aberforth Smaller Companies Tst 0.33 UNITED Caledonia Investments 0.25 UNITED Elementis 0.21 UNITED KINGDOM KINGDOM KINGDOM Aggreko 0.51 UNITED Capita 0.15 UNITED Energean 0.21 UNITED KINGDOM KINGDOM KINGDOM Airtel Africa 0.19 UNITED Capital & Counties Properties 0.29 UNITED Essentra 0.23 UNITED KINGDOM KINGDOM KINGDOM AJ Bell 0.31 UNITED Carnival 0.54 UNITED Euromoney Institutional Investor 0.26 UNITED KINGDOM KINGDOM KINGDOM Alliance Trust 0.77 UNITED Centamin 0.27 UNITED European Opportunities Trust 0.19 UNITED KINGDOM KINGDOM KINGDOM Allianz Technology Trust 0.31 UNITED Centrica 0.74 UNITED F&C Investment Trust 1.1 UNITED KINGDOM KINGDOM KINGDOM AO World 0.18 UNITED Chemring Group 0.2 UNITED FDM Group Holdings 0.21 UNITED KINGDOM KINGDOM KINGDOM Apax Global Alpha 0.17 UNITED Chrysalis Investments 0.33 UNITED Ferrexpo 0.3 UNITED KINGDOM KINGDOM KINGDOM Ascential 0.4 UNITED Cineworld Group 0.19 UNITED Fidelity China Special Situations 0.35 UNITED KINGDOM KINGDOM KINGDOM Ashmore -

International Companies, Third Quarter, 2020

Company Name Ticker Primary Security ID Country Meeting Date Record Date Meeting Type Primary ISIN Proponent Proposal Proposal Code Proposal Code Management Vote Instruction Seq Num Description Category Recommendation J Sainsbury Plc SBRY G77732173 United Kingdom 02-Jul-20 30-Jun-20 Annual GB00B019KW72 Management 1 Accept Financial Routine/Business For For Statements and J Sainsbury Plc SBRY G77732173 United Kingdom 02-Jul-20 30-Jun-20 Annual GB00B019KW72 Management 2 Advisory Vote to Ratify Non-Salary Comp. For For Named Executive J Sainsbury Plc SBRY G77732173 United Kingdom 02-Jul-20 30-Jun-20 Annual GB00B019KW72 Management 3 Approve Remuneration Non-Salary Comp. For For J Sainsbury Plc SBRY G77732173 United Kingdom 02-Jul-20 30-Jun-20 Annual GB00B019KW72 Management 4 Elect Director Directors Related For For J Sainsbury Plc SBRY G77732173 United Kingdom 02-Jul-20 30-Jun-20 Annual GB00B019KW72 Management 5 Elect Director Directors Related For For J Sainsbury Plc SBRY G77732173 United Kingdom 02-Jul-20 30-Jun-20 Annual GB00B019KW72 Management 6 Elect Director Directors Related For For J Sainsbury Plc SBRY G77732173 United Kingdom 02-Jul-20 30-Jun-20 Annual GB00B019KW72 Management 7 Elect Director Directors Related For For J Sainsbury Plc SBRY G77732173 United Kingdom 02-Jul-20 30-Jun-20 Annual GB00B019KW72 Management 8 Elect Director Directors Related For For J Sainsbury Plc SBRY G77732173 United Kingdom 02-Jul-20 30-Jun-20 Annual GB00B019KW72 Management 9 Elect Director Directors Related For For J Sainsbury Plc SBRY G77732173 United