Seattle Office

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Rainier Square Development DRAFT

Rainier Square Development University of Washington Metropolitan Tract Addendum to Final Environmental Impact Statement Downtown Height and Density Changes January 2005 Master Use Permit Project No. 3017644 City of Seattle Department of Planning and Development February 11, 2015 DRAFT FOR CITY STAFF REVIEW 0NLY Prepared by: Parametrix Inc. Environmental Impact Statement Addendum Addendum to ENVIRONMENTAL IMPACT STATEMENT for the Downtown Height and Density Changes January 2005 Addressing Environmental Impacts of Rainier Square Development University of Washington Metropolitan Tract Rainier Square Redevelopment Master Use Permit # 3017644 City of Seattle Department of Planning and Development This Environmental Impact Statement Addendum has been prepared in compliance with the State Environmental Policy Act (SEPA) of 1971 (Chapter 43.21C, Revised Code of Washington); the SEPA Rules, effective April 4, 1984, as amended (Chapter 197-11 Washington Administrative Code); and rules adopted by the City of Seattle implementing SEPA – Seattle’s Environmental Policies and Procedures Code (Chapter 25.05, Seattle Municipal Code). The Seattle Department of Planning and Development (DPD). DPD has determined that this document has been prepared in a responsible manner using appropriate methodology and DPD has directed the areas of research and analysis that were undertaken in preparation of this DSEIS. This document is not an authorization for an action, nor does it constitute a decision or a recommendation for an action. Date of Issuance of this EIS Addendum .............................................DATE Rainier Square Development i University of Washington Metropolitan Tract Environmental Impact Statement Addendum Cite as: City of Seattle Department of Planning and Development University of Washington Metropolitan Tract Rainier Square Redevelopment February 2015 Addendum to Final Environmental Impact Statement Downtown Height and Density Proposal, January 2005 Prepared by Parametrix Inc., Seattle, WA. -

Fourth & Madison Retail

FOURTH & MADISON RETAIL 925 FOURTH AVENUE SEATTLE CBD FOURTH & MADISON RETAIL 925 FOURTH AVENUE SEATTLE CBD RETAIL OPPORTUNITY IN PROPERTY DETAILS DOWNTOWN SEATTLE Fourth & Madison is a 40-story, 845,000 SF Class LOCATION 925 4th Avenue, Seattle, WA 98101 A office tower located on the southwest corner of Fourth and Madison with a built-in customer AREA RETAIL - 2,053 sq. ft. base of over 3,000 employees officing above. RENT $35.00 per sq. ft. + NNN This retail opportunity is in the heart of the Seattle CBD with co-tenants K&L Gates, Disney, NNNS $10.95 per sq. ft. GE, Deloitte, and UBS. TENANT Negotiable • 2,053 SF currently vented for Type II hood IMPROVEMENT ALLOWANCE with potential to convert to Type I. • Superior visibility with frontage on Madison TIMING Available Now and 4th Avenue. Approximately 21,500 cars drive by this intersection daily. • Ideal tenants include coffee, specialty food use or service-oriented retail. RETAIL FLOOR PLAN MADISON STREET 4TH ANENUE OUTDOOR SEATING RETAIL 2,053 RSF N 2015 EST. DEMOGRAPHICS 1/4 Mile 1/2 Mile 1 Mile POPULATION 3,611 14,931 47,387 DAYTIME POPULATION 49,022 127,175 209,966 AVE. HH INCOME $81,871 $59,366 $57,994 2014 TRAFFIC COUNTS MADISON STREET 10,000 VPD THIRD AVENUE 10,300 VPD FOURTH & MADISON 1201 Third 857 Empl. 5,604 1200 3rd Financial Employees Center 1,810 Empl. 925 FOURTH AV Seneca St 78 Rooms Starbucks 2nd & Spring Bldg. Seattle Hotel ENUE 777 Employees 426 Rooms Employees W Hotel 1111 Third 1122 3rd 1,064 Empl. -

2016 Sustainability Report

Sustainability REPORT 2016 ANNUAL SUSTAINABILITY REPORT 2016 1 Executive Message CommonWealth Partners aims to be at the forefront of green building and efficient operations In this report, we’re proud to share the Environmental, Social, and Governance (ESG) milestones we reached in 2016. We continued to deepen and broaden our sustainability commitment through new programs and initiatives such as building resiliency against natural disasters, demand response programs, and tenant engagement in sustainability. Additionally, we are proud of our performance in GRESB's annual Real Estate Assessment Survey — ranking 2nd out of 35 in the Office category, up from 3rd place last year. As the reporting competition gets steeper each year, the improvement in our ranking is a testament to the resilience of our ESG program Some highlights of our progress last year include: • Becoming a leader in GRESB’s annual survey for the office category • Benchmarking 96% of our portfolio in ENERGY STAR Portfolio Manager • Obtaining ENERGY STAR Labels with a weighted average score of 89.93 • Participating in ENERGY STAR’s annual Battle of the Buildings Bootcamp, achieving the highest estimated energy cost savings and reduction in total Greenhouse Gas emissions • A property award at Urban Green's 2016 EBIE Awards Ceremony These accomplishments are just a sampling of our overall advancement in becoming a more sustainable company. CommonWealth Partners will continue to integrate our sustainability policies and measures throughout our business in order to mitigate climate change risk, maximize competitiveness, and stay ahead of social, economic, and environmental impacts. And we can only do this in close cooperation with all of our stakeholders – investors, tenants, suppliers, and employees. -

Safeco Insurance Company of Indiana Ending

ANNUAL STATEMENT OF THE SAFECO INSURANCE COMPANY OF INDIANA of INDIANAPOLIS in the state of INDIANA TO THE Insurance Department OF THE FOR THE YEAR ENDED December 31, 2009 PROPERTY AND CASUALTY 2009 ANNUAL STATEMENT 11215200920100100 For the Year Ended December 31, 2009 OF THE CONDITION AND AFFAIRS OF THE Safeco Insurance Company of Indiana NAIC Group Code 0111 0111 NAIC Company Code 11215 Employer's ID Number 23-2640501 (Current Period) (Prior Period) Organized under the Laws of Indiana , State of Domicile or Port of Entry Indiana Country of Domicile United States of America Incorporated/Organized: March 25, 1971 Commenced Business: March 3, 1972 Statutory Home Office: 500 North Meridian Street , Indianapolis, IN 46204 (Street and Number) (City or Town, State and Zip Code) Main Administrative Office: 1001 Fourth Avenue, Safeco Plaza (Street and Number) Seattle, WA 98154 206-545-5000 (City or Town, State and Zip Code) (Area Code) (Telephone Number) Mail Address: 175 Berkeley Street , Boston, MA 02116 (Street and Number or P.O. Box) (City or Town, State and Zip Code) Primary Location of Books and Records: 175 Berkeley Street Boston, MA 02116 617-357-9500 (Street and Number) (City or Town, State and Zip Code) (Area Code) (Telephone Number) Internet Web Site Address: WWW.SAFECO.COM Statutory Statement Contact: Joanne Connolly 617-357-9500 x44393 (Name) (Area Code) (Telephone Number) (Extension) [email protected] 617-574-5955 (E-Mail Address) (Fax Number) OFFICERS Chairman of the Board Gary Richard Gregg Name Title 1. Gary Richard Gregg # President and Chief Executive Officer 2. Dexter Robert Legg Secretary 3. -

AMAZON 601 Pine Project Package 6-25-20

PINE FLAGSHIP RETAIL IN THE HEART OF DOWNTOWN SEATTLE Convention Center Expansion (opening 2022) Hyatt Regency 1,260 rooms 105,000 sf Exhibition 7TH AVENUE ART ST ART ART ST ART W W 6TH AVENUE Y Y A A STE STE W W 383,000 SF OLIVE OLIVE City Flagship Store PIKE STREET PIKE STREET PINE STREETPINE STREET Center 5TH AVENUE STREETCAR 4TH AVENUE 3RD AVENUE 340 units Condo Planned Chromer 500 units 2ND AVENUE fice f VIRGINIA ST VIRGINIA woPine T The Emerald 125,000 SF o 38 stories of condos 1ST AVENUE Seattle Art Museum are all a short walk from 601 Pine. all a short walk from Seattle Art Museum are world-renowned Pike Place Market, The Paramount Theater, the Washington State Convention & Trade Center and the Trade Convention & State the Washington The Paramount Theater, Place Market, Pike world-renowned crossroads of the urban core, Seattle’s shopping, cultural, financial and entertainment districts and Capitol Hill. The entertainment districts cultural, financial and shopping, Seattle’s core, of the urban crossroads of workers and visitors from around the globe to experience this one-of-a-kind urban setting. 601 Pine is situated at the around of workers and visitors from sports, art and cultural events and a variety of retail and dining options, Downtown Seattle draws a diverse cross section cross a diverse Seattle draws Downtown dining options, and retail of cultural events and a variety and art sports, community, 29 parks, a focus on environmental sustainability, state-of-the-art venues for conventions, professional conventions, professional state-of-the-art venues for sustainability, focus on environmental a 29 parks, community, centers for commerce, development and culture. -

Safeco Insurance Company of Illinois Ending

ANNUAL STATEMENT OF THE SAFECO INSURANCE COMPANY OF ILLINOIS of HOFFMAN ESTATES in the state of ILLINOIS TO THE Insurance Department OF THE FOR THE YEAR ENDED December 31, 2009 PROPERTY AND CASUALTY 2009 ANNUAL STATEMENT 39012200920100100 For the Year Ended December 31, 2009 OF THE CONDITION AND AFFAIRS OF THE Safeco Insurance Company of Illinois NAIC Group Code 0111 0111 NAIC Company Code 39012 Employer's ID Number 91-1115311 (Current Period) (Prior Period) Organized under the Laws of Illinois , State of Domicile or Port of Entry Illinois Country of Domicile United States of America Incorporated/Organized: August 29, 1980 Commenced Business: January 1, 1981 Statutory Home Office: 2800 West Higgins Road, Suite 1000 , Hoffman Estates, IL 60169 (Street and Number) (City or Town, State and Zip Code) Main Administrative Office: 1001 Fourth Avenue, Safeco Plaza (Street and Number) Seattle, WA 98154 206-545-5000 (City or Town, State and Zip Code) (Area Code) (Telephone Number) Mail Address: 175 Berkeley Street , Boston, MA 02116 (Street and Number or P.O. Box) (City or Town, State and Zip Code) Primary Location of Books and Records: 175 Berkeley Street Boston, MA 02116 617-357-9500 (Street and Number) (City or Town, State and Zip Code) (Area Code) (Telephone Number) Internet Web Site Address: WWW.SAFECO.COM Statutory Statement Contact: Joanne Connolly 617-357-9500 x44393 (Name) (Area Code) (Telephone Number) (Extension) [email protected] 617-574-5955 (E-Mail Address) (Fax Number) OFFICERS Chairman of the Board Gary Richard Gregg Name Title 1. Gary Richard Gregg President and Chief Executive Officer 2. -

View Projects

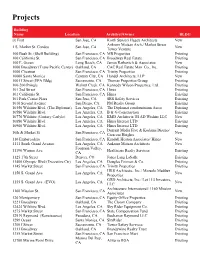

Projects Building Name Location Architect/Owner BLDG @ First San Jose, CA Korth Sunseri Hagey Architects New Ankrom Moisan Arch./ Market Street 1 S. Market St. Condos San Jose, CA New Tower Venture 100 Bush St. (Shell Building) San Francisco, CA MB Properties Existing 100 California St. San Francisco, CA Broadway Real Estate Existing 100 E. Ocean Long Beach, CA James Ratkovich & Associates New 1000 Broadway (Trans Pacific Center) Oakland, CA CAC Real Estate Man. Co., Inc. Existing 1000 Chestnut San Francisco, CA Trinity Properties Existing 10000 Santa Monica Century City, CA Handel Architects, LLP New 1001 I Street (EPA Bldg) Sacramento, CA Thomas Properties Group Existing 100-200 Pringle Walnut Creek, CA Kennedy Wilson Properties, Ltd. Existing 101 2nd Street San Francisco, CA Hines Existing 101 California St. San Francisco, CA Hines Existing 101 Park Center Plaza San Jose, CA SRS Safety Services Existing 1010 Second Avenue San Diego, CA PM Realty Group Existing 10350 Wilshire Blvd. (The Diplomat) Los Angeles, CA The Diplomat condominium Assoc Existing 10580 Wilshire Blvd. Los Angeles, CA B & G Construction Existing 10776 Wilshire (Century Carlyle) Los Angeles, CA KMD Architects/ El AD Wishire LLC New 10880 Wilshire Blvd. Los Angeles, CA Hines Interest LTD Existing 10960 Wilshire Blvd. Los Angeles, CA Hines Interest LTD Existing Durrant Media Five & Kodama Diseno/ 10th & Market St. San Francisco, CA New Crescent Heights 110 Embarcadero San Francisco, CA Kendall Heaton Associates/ Hines New 1111 South Grand Avenue Los Angeles, CA Ankrom Moisan Architects New Fountain Valley, 11190 Warner Ave. Healthcare Realty Services Existing CA 1125 17th Street Denver, CO Jones Lang LaSalle Existing 11400 Olympic Blvd (Executive Ctr) Los Angeles, CA Douglas Emmett & Co. -

Francis Celentano

FRANCIS CELENTANO BORN 1928, New York, NY EDUCATION Academy of Fine Arts, Rome 1958 New York University, Institute of Fine Arts, M.A. (Graduate School, Tuition Scholarship) 1954-1957 New York University, Washington Square College, B.A. 1949-1951 AWARDS National Endowment for the Arts, Western States Arts Federation, Regional Fellowship in Painting 1990 Invitation to the International Seminar of Artists, Fairleigh Dickinson Univ., Madison, NJ 1965 Fulbright Scholarship in Painting, Rome 1958 ONE-PERSON EXHIBITIONS The Laura Russo Gallery, Portland, OR 1990, 2004, 2007, 2010, 2012, 2015 “Francis Celentano: Form and Color,” Hallie Ford Museum of Art, Willamette University, Salem, OR 2010-2011 “Optical Paintings from the 1960s,” Jacobson Howard Gallery, NY, NY 2008 Bryan Ohno Gallery, Seattle, WA 2005 Gallery of Art, Eastern Washington University, Cheney, WA 2003 Gordon Woodside/John Braseth Gallery, Seattle, WA 1993, 1997 "Francis Celentano: Selected paintings 1954-1995," Gordon Woodside/John Braseth Gallery, Seattle, WA and Safeco Mezzanine Gallery, Seattle, WA (40 year retrospective) 1995-1996 Whatcom Museum of History and Art (10 year retrospective), Bellingham, WA 1992 Greg Kucera Gallery, Seattle, WA 1986, 1989, 1991 "Celentano at Safeco: Paintings by Francis Celentano 1975-1990," Safeco Plaza, Seattle, WA 1990 Portland Center for the Visual Arts, Retrospective Exhibition, Portland, OR 1986 "Paintings by Francis Celentano," The Faculty Club, University of Washington, Seattle, WA 1983 Fountain Gallery, Portland, OR 1983 Diane Gilson -

Seattle Office Market Data for the First Quarter of 2016

Seattle Office 600 University Street, Suite 2220 Seattle, Washington 98101 Commercial Real Estate Services broderickgroup.com SEATTLE OFFICE MARKET OVERVIEW First Quarter 2016 DOWNTOWN SEATTLE OFFICE MARKET STATISTICS Entire Seattle Market # of buildings w/ 50,000 SF or more of contiguous Total SF: 53,760,829 Qtr Change YTD Change available space within Vacant SF: 3,545,443 each category Vacant %: 6.59% ( -0.52%) ( -0.52%) Asking Rates: $35.36/SF, G ( +$0.00) ( +$0.00) Entire Seattle Market Absorption Qtr: 533,619 SF Absorption YTD: 533,619 SF Class A Buildings 15 Total SF: 34,876,090 Vacant SF: 2,299,700 Qtr Change YTD Change Class A Buildings Vacant %: 6.59% ( -1.03%) ( -1.03%) Asking Rates: $40.28/SF, G ( +$0.41) ( +$0.41) Absorption Qtr: 509,901 SF 10/ Absorption YTD: 509,901 SF 15 Class A CBD Class A CBD Total SF: 18,844,936 Vacant SF: 1,211,539 Qtr Change YTD Change Vacant %: 6.43% ( -1.90%) ( -1.90%) 5/ Asking Rates: $40.66/SF, G ( +$0.59) ( +$0.59) 15 Absorption Qtr: 354,152 SF Absorption YTD: 354,152 SF Class A+* Class A+ * Total SF: 6,102,368 Vacant SF: 408,583 Qtr Change YTD Change 1 / Vacant %: 6.70% ( -1.14%) ( -1.14%) 15 Asking Rates: $44.00/SF, G ( -$0.29) ( -$0.29) Absorption Qtr: 94,307 SF Absorption YTD: 94,307 SF Two Union Square, US Bank Centre, Fourth & Madison, 1201 Third Avenue, * broderickgroup.com | pg. 2 Russell Investments Center, 1918 Eighth, West 8th SEATTLE OFFICE MARKET OVERVIEW First Quarter 2016 SIGNIFICANT LEASES Significant Leases LEASING ACTIVITY Quarter Tenant Building Submarket Size (SF) Significant leases in the Seattle area for the First Quarter were Q1 2016 Google 625 Boren Lake Union 607,000 dominated by technology market movers leasing space in both existing and future space. -

Certificate of Liability Insurance 05/28/2019 This Certificate Is Issued As a Matter of Information Only and Confers No Rights Upon the Certificate Holder

DATE (MM/DD/YYYY) CERTIFICATE OF LIABILITY INSURANCE 05/28/2019 THIS CERTIFICATE IS ISSUED AS A MATTER OF INFORMATION ONLY AND CONFERS NO RIGHTS UPON THE CERTIFICATE HOLDER. THIS CERTIFICATE DOES NOT AFFIRMATIVELY OR NEGATIVELY AMEND, EXTEND OR ALTER THE COVERAGE AFFORDED BY THE POLICIES BELOW. THIS CERTIFICATE OF INSURANCE DOES NOT CONSTITUTE A CONTRACT BETWEEN THE ISSUING INSURER(S), AUTHORIZED REPRESENTATIVE OR PRODUCER, AND THE CERTIFICATE HOLDER. IMPORTANT: If the certificate holder is an ADDITIONAL INSURED, the policy(ies) must have ADDITIONAL INSURED provisions or be endorsed. If SUBROGATION IS WAIVED, subject to the terms and conditions of the policy, certain policies may require an endorsement. A statement on this certificate does not confer rights to the certificate holder in lieu of such endorsement(s). PRODUCER CONTACT NAME: DML Insurance Services PHONE FAX (A/C, No, Ext): (206)838-9077 (A/C, No):(206)838-9076 4005 20th Ave W Ste 132 E-MAIL Seattle WA 98199- ADDRESS: INSURER(S) AFFORDING COVERAGE NAIC # INSURER A :Ohio Casualty Ins Co 24074 INSURED INSURER B :Ohio Security Ins Co 24082 3R Technology, LLC INSURER C : 5511 1st Ave S INSURER D : Seattle WA 98108- INSURER E : INSURER F : COVERAGES CERTIFICATE NUMBER: REVISION NUMBER: THIS IS TO CERTIFY THAT THE POLICIES OF INSURANCE LISTED BELOW HAVE BEEN ISSUED TO THE INSURED NAMED ABOVE FOR THE POLICY PERIOD INDICATED. NOTWITHSTANDING ANY REQUIREMENT, TERM OR CONDITION OF ANY CONTRACT OR OTHER DOCUMENT WITH RESPECT TO WHICH THIS CERTIFICATE MAY BE ISSUED OR MAY PERTAIN, THE INSURANCE AFFORDED BY THE POLICIES DESCRIBED HEREIN IS SUBJECT TO ALL THE TERMS, EXCLUSIONS AND CONDITIONS OF SUCH POLICIES. -

Safeco Insurance Company of America Ending December 31, 2010

ANNUAL STATEMENT OF THE SAFECO INSURANCE COMPANY OF AMERICA of SEATTLE in the state of WASHINGTON TO THE Insurance Department OF THE FOR THE YEAR ENDED December 31, 2010 PROPERTY AND CASUALTY 2010 PROPERTY AND CASUALTY COMPANIES - ASSOCIATION EDITION ANNUAL STATEMENT 24740201020100100 For the Year Ended December 31, 2010 OF THE CONDITION AND AFFAIRS OF THE Safeco Insurance Company of America NAIC Group Code 0111 0111 NAIC Company Code 24740 Employer's ID Number 91-0742148 (Current Period) (Prior Period) Organized under the Laws of Washington , State of Domicile or Port of Entry Washington Country of Domicile United States of America Incorporated/Organized: September 2, 1953 Commenced Business October 1, 1953 Statutory Home Office 1001 Fourth Avenue, Safeco Plaza , Seattle, WA 98154 (Street and Number) (City or Town, State and Zip Code) Main Administrative Office: 1001 Fourth Avenue, Safeco Plaza (Street and Number) Seattle, WA 98154 206-545-5000 (City or Town, State and Zip Code) (Area Code) (Telephone Number) Mail Address: 175 Berkeley Street , Boston, MA 02116 (Street and Number or P.O. Box) (City or Town, State and Zip Code) Primary Location of Books and Records: 175 Berkeley Street Boston, MA 02116 617-357-9500 (Street and Number) (City or Town, State and Zip Code) (Area Code) (Telephone Number) Internet Web Site Address WWW.SAFECO.COM Statutory Statement Contact: Pamela Heenan 617-357-9500 x44689 (Name) (Area Code) (Telephone Number) (Extension) [email protected] 617-574-5955 (E-Mail Address) (Fax Number) OFFICERS Chairman of the Board Gary Richard Gregg Name Title 1. Gary Richard Gregg President and Chief Executive Officer 2. -

Seattle Office Market Overview Year End 2015

Seattle Office Market Overview Year End 2015 Commercial Real Estate Services 600 University Street, Suite 2220 | Seattle broderickgroup.com Seattle Office Market Overview Year End 2015 DOWNTOWN SEATTLE OFFICE MARKET STATISTICS Entire Seattle Market # of buildings w/ 50,000 SF or more of contiguous Total SF: 53,760,829 Qtr Change YTD Change available space within Vacant SF: 3,825,847 each category Vacant %: 7.12% ( -1.09%) ( -2.52%) Asking Rates: $35.36/SF, G ( +$0.59) ( +$0.89) Entire Seattle Market Absorption Qtr: 315,494 SF Absorption YTD: 1,471,361 SF Class A Buildings 12 Total SF: 34,707,290 Vacant SF: 2,646,575 Qtr Change YTD Change Class A Buildings Vacant %: 7.63% ( -0.14%) ( -1.62%) Asking Rates: $39.87/SF, G ( +$2.85) ( +$4.92) Absorption Qtr: 234,361 SF 11/ Absorption YTD: 941,617 SF 12 Class A CBD Class A CBD Total SF: 18,844,936 Vacant SF: 1,569,588 Qtr Change YTD Change Vacant %: 8.33% ( -1.51%) ( -3.92%) 6/ Asking Rates: $40.07/SF, G ( +$0.21) ( +$3.06) 12 Absorption Qtr: 32,509 SF Absorption YTD: 522,017 SF Class A+* Class A+ * Total SF: 6,102,368 Vacant SF: 478,085 Qtr Change YTD Change 1 / Vacant %: 7.83% ( +0.91%) ( -0.25%) 12 Asking Rates: $44.29/SF, G ( +$0.37) ( +$2.89) Absorption Qtr: -21,163 SF Absorption YTD: 17,007 SF Two Union Square, US Bank Centre, Fourth & Madison, 1201 Third Avenue, * broderickgroup.com | pg. 2 Russell Investments Center, 1918 Eighth, West 8th Seattle Office Market Overview Year End 2015 SIGNIFICANTSignificant LeasesLEASES LEASING ACTIVITY Quarter Tenant Building Submarket Size (SF) Significant leases in the Seattle area for the Fourth Quarter included Q4 2015 Safeco Insurance (Expansion + Renewal) Safeco Plaza CBD 504,000 market movers leasing space in both existing and future space.