LNG Purchases by Soes and Foreign Country Utilities Threaten Electric Grid Reliability and More

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Climate and Energy Benchmark in Oil and Gas

Climate and Energy Benchmark in Oil and Gas Total score ACT rating Ranking out of 100 performance, narrative and trend 1 Neste 57.4 / 100 8.1 / 20 B 2 Engie 56.9 / 100 7.9 / 20 B 3 Naturgy Energy 44.8 / 100 6.8 / 20 C 4 Eni 43.6 / 100 7.3 / 20 C 5 bp 42.9 / 100 6.0 / 20 C 6 Total 40.7 / 100 6.1 / 20 C 7 Repsol 38.1 / 100 5.0 / 20 C 8 Equinor 37.9 / 100 4.9 / 20 C 9 Galp Energia 36.4 / 100 4.3 / 20 C 10 Royal Dutch Shell 34.3 / 100 3.4 / 20 C 11 ENEOS Holdings 32.4 / 100 2.6 / 20 C 12 Origin Energy 29.3 / 100 7.3 / 20 D 13 Marathon Petroleum Corporation 24.8 / 100 4.4 / 20 D 14 BHP Group 22.1 / 100 4.3 / 20 D 15 Hellenic Petroleum 20.7 / 100 3.7 / 20 D 15 OMV 20.7 / 100 3.7 / 20 D Total score ACT rating Ranking out of 100 performance, narrative and trend 17 MOL Magyar Olajes Gazipari Nyrt 20.2 / 100 2.5 / 20 D 18 Ampol Limited 18.8 / 100 0.9 / 20 D 19 SK Innovation 18.6 / 100 2.8 / 20 D 19 YPF 18.6 / 100 2.8 / 20 D 21 Compania Espanola de Petroleos SAU (CEPSA) 17.9 / 100 2.5 / 20 D 22 CPC Corporation, Taiwan 17.6 / 100 2.4 / 20 D 23 Ecopetrol 17.4 / 100 2.3 / 20 D 24 Formosa Petrochemical Corp 17.1 / 100 2.2 / 20 D 24 Cosmo Energy Holdings 17.1 / 100 2.2 / 20 D 26 California Resources Corporation 16.9 / 100 2.1 / 20 D 26 Polski Koncern Naftowy Orlen (PKN Orlen) 16.9 / 100 2.1 / 20 D 28 Reliance Industries 16.7 / 100 1.0 / 20 D 29 Bharat Petroleum Corporation 16.0 / 100 1.7 / 20 D 30 Santos 15.7 / 100 1.6 / 20 D 30 Inpex 15.7 / 100 1.6 / 20 D 32 Saras 15.2 / 100 1.4 / 20 D 33 Qatar Petroleum 14.5 / 100 1.1 / 20 D 34 Varo Energy 12.4 / 100 -

GIIGNL Annual Report Profile

The LNG industry GIIGNL Annual Report Profile Acknowledgements Profile We wish to thank all member companies for their contribution to the report and the GIIGNL is a non-profit organisation whose objective following international experts for their is to promote the development of activities related to comments and suggestions: LNG: purchasing, importing, processing, transportation, • Cybele Henriquez – Cheniere Energy handling, regasification and its various uses. • Najla Jamoussi – Cheniere Energy • Callum Bennett – Clarksons The Group constitutes a forum for exchange of • Laurent Hamou – Elengy information and experience among its 88 members in • Jacques Rottenberg – Elengy order to enhance the safety, reliability, efficiency and • María Ángeles de Vicente – Enagás sustainability of LNG import activities and in particular • Paul-Emmanuel Decroës – Engie the operation of LNG import terminals. • Oliver Simpson – Excelerate Energy • Andy Flower – Flower LNG • Magnus Koren – Höegh LNG • Mariana Ortiz – Naturgy Energy Group • Birthe van Vliet – Shell • Mika Iseki – Tokyo Gas • Yohei Hukins – Tokyo Gas • Donna DeWick – Total • Emmanuelle Viton – Total • Xinyi Zhang – Total © GIIGNL - International Group of Liquefied Natural Gas Importers All data and maps provided in this publication are for information purposes and shall be treated as indicative only. Under no circumstances shall they be regarded as data or maps intended for commercial use. Reproduction of the contents of this publication in any manner whatsoever is prohibited without prior -

Derek Chen Chairman of CPC Corporation, Taiwan Tokyo, Japan 24Th November 2016 5Th LNG Producer

5th LNG Producer- Consumer Conference Derek Chen Chairman of CPC Corporation, Taiwan Tokyo, Japan 24th November 2016 CPC CORPORATION, TAIWAN Taiwan’s primary energy mix KLOE 160,000,000 In 2015: u 98% of total energy needs 1.9 % Renewable 140,000,000 7.3 % Nuclear was imported. 1.5 % u Fossil fuels’ share was 8.7 % 120,000,000 13.3 %, Gas 90.8%: coal (29.3%), oil 7.4 % (48.2%) and gas (13.3%). 100,000,000 u Renewable energy accounted for 1.9%. 80,000,000 52.7 % 48.2 % Oil Compared with the last 60,000,000 decade: u Primary energy supply: 40,000,000 increased by 8.5% 29.7 % 29.3 %,,Coal u Natural gas supply: 20,000,000 increased by 96% - Source: Bureau of Energy, Ministry of 2005 2015 Economic Affairs, ROC. CPC CORPORATION, TAIWAN 2 Taiwan’s energy consumption mix Electricity made up 49% of total energy consumption in 2015. Principal fuels for power generation : coal (34%), natural gas (28%) and nuclear (16%). Energy consumption structure in 2015 Electricity Mix Natural Gas 0.8% Renewable Energy 0.9% 3% 2014 2.5% Oil 4.5% 2015 Hydro Power 2.9% Oil 2.9% 39% Electricity Cogeneration 16.1% 49% 15.2% Nuclear 16.3% Coal 14.1% 8% 27.9% Natureal Gas 30.4% Renewable Coal 33.6% energy 31.9% 1% 0.0% 10.0% 20.0% 30.0% Source: Bureau of Energy, Ministry of Economic Affairs, ROC. CPC CORPORATION, TAIWAN 3 Demand for LNG is growing The gradual year-on-year increase in Taiwan’s LNG imports is a result of increasing demand for its use in power generation. -

Financial Analysis with Liquidity and Profitability

FINANCIAL ANALYSIS WITH LIQUIDITY AND PROFITABILITY RATIOS OF PERTAMINA AND CHINA PETROLEUM CORPORATION FROM 2013 TO 2018 MERLINA 40800042 CHENG SHIU UNIVERSITY ABSTRACK The purpose of this study is to measure, find out, and compare the financial performance of Pertamina and China Petroleum Corporation (CPC) companies in Taiwan, as measured by liquidity ratios (Current ratios, quick ratios, and cah ratios) and profitability ratios (Net profit margin, return on assets, return on equity, and gross profit margin ratio) using financial statement data from the two companies starting in 2013 to 2018. With the financial statement data analyzed using descriptive methods and trend analysis, the results of the analysis of the two companies show that Pertamina is more superior to Taiwan's CPC. Suggestions for further research are, it is hoped that researchers can increase the scope of company research with other countries, as well as increase financial ratio research to measure and assess the company's financial performance so that it is more detailed to obtain information. Keywords: Liquidity ratios, profitability ratios, company comparisons. 1 ACKNOWLEDGEMENT First I thank "Allah Allah Subhanahu Wa Ta'ala" because of him I was able to complete this research smoothly, and I say many thanks to my supervisor lecturer "Paul" who helped a lot, and guided me to complete this research. , thank you also to the IBI Darmajaya campus for giving me the opportunity to take part in a joint research program and for the Cheng Shiu University campus for accepting me to complete my research. Thank you also to my beloved lecturer, Ms. Krystl, and all my beloved friends who are always there (Cindy, Anas, Amin, Kholik, David, and others) while in Kaohsiung, Taiwan, I offer these to my parents, family, and beloved friends (Lingling) who have supported I. -

The Carbon Neutral LNG Market: Creating a Framework for Real

THE CARBON-NEUTRAL LNG MARKET: CREATING A FRAMEWORK FOR REAL EMISSIONS REDUCTIONS BY ERIN BLANTON AND SAMER MOSIS JULY 2021 As governments and companies consider options to decarbonize their energy systems, addressing greenhouse gas emissions from natural gas and liquified natural gas (LNG) will inevitably become a greater concern. Natural gas is viewed by some as potentially providing a bridge in a broad energy transition from dependence on fossil fuels to lower-emission sources. Even with advancements in renewable energy, many forecasts show natural gas will remain core to meeting global energy demand for some time, including as a backup fuel source for renewables.1 But as the emissions profile of the natural gas value chain has become clearer, estimates of its footprint have increased, raising questions about natural gas’s transitory function. While gas will continue to have a prominent role in the energy mix,2 without action to better account for, reduce, and offset natural gas and LNG emissions, the breadth and length of its use will increasingly come into question—including by countries with growing energy demand who see diminishing incentive to favor natural gas over high-emitting but fiscally cheap fuel sources, such as coal. Amid these considerations, discussions of value chain carbon intensity and greenhouse gas (GHG) accounting are becoming an important component of LNG trade, giving rise to the concept of “carbon-neutral LNG.” In the trade of carbon-neutral LNG, GHG emissions from supply and/or consumption are accounted for -

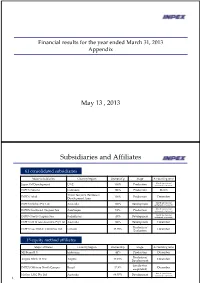

Subsidiaries and Affiliates

Financial results for the year ended March 31, 2013 Appendix May 13 , 2013 Subsidiaries and Affiliates 61 consolidated subsidiaries Major subsidiaries Country/region Ownership Stage Accounting term March (provisional Japan Oil Development UAE 100% Production settlement of account) INPEX Natuna Indonesia 100% Production March Timor Sea Joint Petroleum INPEX Sahul 100% Production December Development Area March (provisional INPEX Ichthys Pty Ltd Australia 100% Development settlement of account) March (provisional INPEX Southwest Caspian Sea Azerbaijan 51% Production settlement of account) March (provisional INPEX North Caspian Sea Kazakhstan 45% Development settlement of account) INPEX Oil & Gas Australia Pty Ltd Australia 100% Development December Production/ INPEX Gas British Columbia Ltd. Canada 45.09% December Evaluation 15 equity method affiliates Major affiliates Country/region Ownership Stage Accounting term MI Berau B.V. Indonesia 44% Production December Production/ Angola Block 14 B.V. Angola 49.99% December Development (production INPEX Offshore North Campos Brazil 37.5% December suspended) March (provisional Ichthys LNG Pty Ltd Australia 66.07% Development settlement of account) 1 Segment information For the year ended March 31, 2013 (April 1, 2012 through March 31, 2013) (Millions of yen) Eurasia Asia/ Middle Japan (Europe/ Americas Total Adjustments *1 Consolidated *2 Oceania East/Africa NIS) Sales to third 118,936 485,275 85,540 520,835 5,944 1,216,533 ― 1,216,533 parties Segment income 28,568 281,622 41,751 357,343 (6,089) 703,196 (9,748) 693,447 (loss) Segment assets 265,467 690,763 526,519 266,649 188,208 1,937,607 1,678,551 3,616,158 Note: 1. -

2018 78 Member Companies in 26 Countries

The LNG industry GIIGNL ANNUAL REPORT 2018 78 MEMBER COMPANIES IN 26 COUNTRIES GIIGNL (International Group of LNG Importers) is the worldwide association of LNG importers. EUROPE 30 Founded in 1971, at the outset of the LNG industry, AMERICAS members ASIA its membership has grown to 78 companies worldwide, 11 37 members members comprising nearly all companies active in LNG imports or in the operation of LNG terminals. It is a non-profit organization and its resources only come from the membership fees. The association constitutes a forum for exchange of experience among its members, with a view to enhance safety, reliability and efficiency of LNG imports. GIIGNL members are coming from 26 countries headquartered in the main three regions: Americas, 11 members, Asia, 37, Europe, 30. Full Members Elengy S.A. Guangdong Dapeng LNG Company, Ltd. National Grid Grain LNG, Ltd. Southern LNG Company, L.L.C. Associate Members BOTAŞ Enagas Hazira LNG Private Ltd. Nippon Gas Co., Ltd. South Hook LNG Terminal Company, Ltd. EDF Trading Limited BP Global LNG Enel Trade SpA Hiroshima Gas Co., Ltd. N.V. Nederlandse Gasunie Sumitomo Corporation ENN LNG Trading Company Limited Centrica LNG Company ENGIE Höegh LNG Osaka Gas Co., Ltd. TEPCO Fuel & Power, Inc. Gazprom Marketing & Trading Limited Cheniere Energy, Inc. ENGIE Gas and LNG, LLC Hokkaido Gas Co., Ltd. Pakistan LNG Limited (PLL) The Chugoku Electric Power Co., Inc. GSPC LNG Limited Chubu Electric Power Co., Inc. Eni S.p.A. Iberdrola Generación España, S.A.U. Petronet LNG Limited The Kansai Electric Power Co., Inc. INPEX Corporation CNOOC Gas & Power Trading & Excelerate Energy L.P. -

GIIGNL Annual Report

The LNG industry GIIGNL Annual Report 2021 Profile Acknowledgements Profile We wish to thank all member companies for their contribution to the report and the GIIGNL is a non-profit organisation whose objective following international experts for their is to promote the development of activities related to comments and suggestions: LNG: purchasing, importing, processing, transportation, handling, re-gasification and its various uses. • Cybele Henriquez – Cheniere Energy • Najla Jamoussi – Cheniere Energy The Group constitutes a forum for exchange of • Callum Bennett – Clarksons information and experience among its 86 members in • Oliver Stavrinidis – Clarksons order to enhance the safety, reliability, efficiency and • Laurent Hamou – Elengy sustainability of LNG import activities and in particular, • Jacques Rottenberg – Elengy the operation of LNG import terminals. • María Ángeles de Vicente – Enagás • Paul-Emmanuel Decroës – Engie • Oliver Simpson – Excelerate Energy • Andy Flower – Flower LNG • Magnus Koren – Höegh LNG • Gavin Stevens – MOL • Mariana Ortiz – Naturgy Energy Group • Birthe van Vliet – Shell • Mayumi Ikeda – Tokyo Gas • Donna DeWick – Total © GIIGNL - International Group of Liquefied Natural Gas Importers • Xinyi Zhang – Total All data and maps provided in this publication are for information purposes and shall be treated as indicative only. Under no circumstances shall they be regarded as data or maps intended for commercial use. Reproduction of the contents of this publication in any manner whatsoever is prohibited without prior consent of the copyright owners. Editorial The LNG industry in 2020 Jean Abiteboul President Dear Colleagues, 2020 can be characterized as a year of market Towards the end of the year, the market recorded price investment in infrastructure and access to low-cost volatility. -

The 1St APEC Oil and Gas Security Network Forum Participants List Appendix II

The 1st APEC Oil and Gas Security Network Forum Participants List APEC Economy/ No. Name Position Contact Info Organization Delegates 2-1-14 Mita, Minato-ku, Tokyo 108-8361, Japan Counsellor, Australian Embassy, TEL: +81-3-5232-4020 1 Australia Ms. Carolyn Barton Tokyo FAX: +81-3-5232-4039 Email: [email protected] 580 Booth, Ottawa, Ontario, K1A0E9, Canada Director, Oil Sands and Energy TEL: +1-613-995-1525 2 Canada Mr. Douglas Heath Security Division, Ministry of FAX: +1-613-992-0614 Natural Resources Canada Email: [email protected] 38, Yuetan Nanjin Xicheng District, Beijing, 100824, China Program Officer, National Energy 3 Mr. Yanzhong Li TEL: +86-159-1082-6127 Administration FAX: +86-10-6850-5673 Email: [email protected] China 38, Yuetan Nanjin Xicheng District, Beijing, 100824, China Program Officer, National Energy 4 Mr. Feng Zhu TEL: +86-135-8191-7696 Administration FAX: +86-10-6850-5673 Email: [email protected] Plaza Centris Building 8th floor, Jl. H.R. Rasuna Said Kav. Policy Analyst, Directorate General B-5 Jakarta 12910 Indonesia 5 Ms. Dian Apriyani of Oil and Gas, Ministry of Energy TEL: +62-21-526-8910 and Mineral Resources FAX: +62-21-526-8981 Email: [email protected] Indonesia Plaza Centris Building 6th floor, Jl. H.R. Rasuna Said Kav. Policy Analyst, Directorate General B-5 Jakarta 12910 Indonesia 6 Ms. Wahyu Yudhiastuti of Oil and Gas, Ministry of Energy TEL: +62-21-526-8910 ext.130 and Mineral Resources FAX: +62-21-5296-1461 Email: [email protected] Director for Natural Resources and Ministry of Economy, Trade and Industry (METI), 1-3-1 Energy Research, International Kasumigaseki, Chiyoda-ku, Tokyo 100-8901, Japan Affairs Division, Agency for 7 Mr. -

Associação Brasileira De Relações Internacionais Foz Do Iguaçu – PR, 27 E 28 De Setembro De 2018 Área Temática: Análise De Política Externa

4º Seminário de Relações Internacionais – Associação Brasileira de Relações Internacionais Foz do Iguaçu – PR, 27 e 28 de setembro de 2018 Área Temática: Análise de Política Externa Neither Independence nor Unification: Taiwan’s Mainland China Policy during the Ma Ying-jeou Era (2008-2016) Ben Lian Deng Mestrando do Programa de Pós-graduação em Economia Política Internacional da Universidade Federal do Rio de Janeiro (UFRJ) Setembro de 2018 不獨立不統一:馬英九時代臺灣對中國大陸政策(2008-2016) 鄧本良 巴西里約熱內盧聯邦大學國際政治經濟係 摘要 本文的目的是分析馬英九政府(2008-2016)期間臺灣對中國大陸政策的合理性及其對 臺灣經濟,外交和海峽兩岸政策的影響。中國國民黨候選人馬英九贏得了臺灣 2008 總統大選 以後,結束了陳水扁 8 年的臺獨政權及完全改變臺灣與中國大陸的關係。馬英九,自己認為是 華人和反對臺獨,上台後採取一些政策,例如中斷所有臺獨活動,與北京建立直接聯繫以及簽 署許多經濟協議。雖然在此期間兩岸關係有急劇改善,但馬政府拒絕與北京進行任何政治對話。 本文的結論是,馬英九促進維護臺灣的主權,以拒絕與中國大陸統一。馬政府戰略採取中國友 好政策立場,以便從北京獲得政治和經濟讓步。 關鍵詞:馬英九,國民黨,中國大陸,臺灣,海峽兩岸關係 Neither Independence nor Unification: Taiwan’s Mainland China Policy during the Ma Ying-jeou Era (2008-2016) Ben Lian Deng International Political Economy Program of the Federal University of Rio de Janeiro Abstract The purpose of this article is to analyze the rationality of Taiwan`s mainland China policy during the Ma Ying-jeou administration (2008-2016) and how it influenced the Taiwanese economic, foreign and cross-strait policies during this period. In 2008, Ma, from the Kuomintang (Chinese Nationalist Party), won the Taiwanese presidential elections, ending 8 years of Chen Shui-bian’s pro-independence administration and completely altering relations between Taiwan and China. Ma, who identified himself as ethnic Chinese and against Taiwanese independence, adopted several policies, such as the interruption of all pro-independence activities, the establishment of direct contact with Peking, and the signing of several economic agreements. Although cross-strait relations improved drastically during this period, Ma refused to conduct any political dialogue with Peking. -

Project Records

delivery record year client project destination DESTINATION MITSUBISHI HEAVY INDUSTRIES LTD. Sep.1996 CHINA STEEL CORPORATION POL TAIWAN HIROSHIMA MACHINERY WORKS MITSUBISHI HEAVY INDUSTRIES Feb.1999 GHAZLAN POWER PLANT 600MW x 4 TURBINE & GENERATOR SAUDI ARABIA LTD.NAGASAKI SHIPYARD MITSUBISHI HEAVY INDUSTRIES Jul.2000 KBR-T/Q-CHEN P/R COMPRESSOR QATAR LTD.HIROSHIMA MACHINERY WORKS MITSUBISHI HEAVY INDUSTRIES Jul.2000 ARABAMA TURBINE & GENERATOR USA LTD.NAGASAKI SHIPYARD MITSUBISHI HEAVY INDUSTRIES LTD. Sep.2000 KDHC/ANSAN 62.6MW TURBINE HIROSHIMA MACHINERY WORKS MITSUBISHI HEAVY INDUSTRIES LTD. Dec.2000 CSN HOT MILL AWC BRAZIL HIROSHIMA MACHINERY WORKS MITSUBISHI HEAVY INDUSTRIES,LTD Feb.2001 CHANG CHUN PLASTICS TURBINE & GENERATOR TAIWAN YOKOHAMA MACHINERY WORKS MITSUBISHI HEAVY INDUSTRIES Jun.2001 HONGKONG RAMA GT57 TURBINE & GENERATOR HONGKONG LTD.NAGASAKI SHIPYARD Jun.2001 CHORYO HIGH TECH.CO., LTD NIPPON OIL CORPORATION HELANG MITSUBISHI HEAVY INDUSTRIES LTD. Aug.2001 MCEC KALTIM-4 PROJECT INDONESIA HIROSHIMA MACHINERY WORKS MITSUBISHI HEAVY INDUSTRIES LTD. Oct.2001 M-LNG SOUR GAS BOILER MALAYSIA HIROSHIMA MACHINERY WORKS MITSUBISHI HEAVY INDUSTRIES LTD. Oct.2001 CUC CURACAO IPP 22.5MWx4 210T/Hx3 BOILER NETHERLANDS HIROSHIMA MACHINERY WORKS MITSUBISHI HEAVY INDUSTRIES LTD. Nov.2001 SAMSUNG ENGINNERING NIC.TURBIN KOREA HIROSHIMA MACHINERY WORKS MITSUBISHI HEAVY INDUSTRIES LTD. Dec.2001 GASBOL-3 COMPRESSOR & TURBIN BRAZIL HIROSHIMA MACHINERY WORKS 1/4 delivery record year client project destination DESTINATION MITSUBISHI HEAVY INDUSTRIES LTD. Dec.2002 WOODSIDE COMPRESSOR & TURBIN AUSTRAILA HIROSHIMA MACHINERY WORKS MITSUBISHI HEAVY INDUSTRIES LTD. Jan.2002 FLUOR DANIEL F-D JUPC POWER PLANT SAUDI ARABIA YOKOHAMA MACHINERY WORKS MITSUBISHI HEAVY INDUSTRIES LTD. Jul.2002 CHIYODA CORP.RAS LAFFAN COMPRESSOR & TURBIN QATAR HIROSHIMA MACHINERY WORKS MITSUBISHI HEAVY INDUSTRIES LTD. -

(Appendix) [PDF:2.0MB

Financial results for the six months ended September 30, 2014 Appendix November 10, 2014 Subsidiaries and Affiliates 66 consolidated subsidiaries Major subsidiaries Country/region Ownership Stage Accounting term March (provisional Japan Oil Development UAE 100% Production settlement of account) INPEX Natuna Indonesia 100% Production March Timor Sea Joint Petroleum INPEX Sahul 100% Production December Development Area March (provisional INPEX Ichthys Pty Ltd Australia 100% Development settlement of account) March (provisional INPEX Southwest Caspian Sea Azerbaijan 51% Production settlement of account) (Production March (provisional INPEX North Caspian Sea Kazakhstan 45% suspended) settlement of account) INPEX Oil & Gas Australia Pty Ltd Australia 100% Development December Production/ INPEX Gas British Columbia Ltd. Canada 45.09% December Evaluation 19 equity method affiliates Major affiliates Country/region Ownership Stage Accounting term MI Berau B.V. Indonesia 44% Production December Production/ Angola Block 14 B.V. Angola 49.99% December Development INPEX Offshore North Campos Brazil 37.5% Production December March (provisional Ichthys LNG Pty Ltd Australia 66.07% Development settlement of account) 1 Segment Information For the six months ended September 30, 2014 (April 1, 2014 through September 30, 2014) (Millions of yen) Reportable segments Eurasia Middle Adjustments Consolidated Asia & Japan (Europe & East & Americas Total *1 *2 Oceania NIS) Africa Sales to third parties 58,754 228,806 61,466 307,829 6,282 663,140 ‐ 663,140 Segment income (loss) 7,700 120,353 26,107 205,266 (7,591) 351,836 (5,104) 346,731 Note: 1. Adjustments of segment income of ¥(5,104) million include elimination of inter‐segment transactions of ¥105million and corporate expenses of ¥(5,210) million.