Antipodes Global Fund - UCITS

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Table 1 Comprehensive International Points List

Table 1 Comprehensive International Points List FCC ITU-T Country Region Dialing FIPS Comments, including other 1 Code Plan Code names commonly used Abu Dhabi 5 971 TC include with United Arab Emirates Aden 5 967 YE include with Yemen Admiralty Islands 7 675 PP include with Papua New Guinea (Bismarck Arch'p'go.) Afars and Assas 1 253 DJ Report as 'Djibouti' Afghanistan 2 93 AF Ajman 5 971 TC include with United Arab Emirates Akrotiri Sovereign Base Area 9 44 AX include with United Kingdom Al Fujayrah 5 971 TC include with United Arab Emirates Aland 9 358 FI Report as 'Finland' Albania 4 355 AL Alderney 9 44 GK Guernsey (Channel Islands) Algeria 1 213 AG Almahrah 5 967 YE include with Yemen Andaman Islands 2 91 IN include with India Andorra 9 376 AN Anegada Islands 3 1 VI include with Virgin Islands, British Angola 1 244 AO Anguilla 3 1 AV Dependent territory of United Kingdom Antarctica 10 672 AY Includes Scott & Casey U.S. bases Antigua 3 1 AC Report as 'Antigua and Barbuda' Antigua and Barbuda 3 1 AC Antipodes Islands 7 64 NZ include with New Zealand Argentina 8 54 AR Armenia 4 374 AM Aruba 3 297 AA Part of the Netherlands realm Ascension Island 1 247 SH Ashmore and Cartier Islands 7 61 AT include with Australia Atafu Atoll 7 690 TL include with New Zealand (Tokelau) Auckland Islands 7 64 NZ include with New Zealand Australia 7 61 AS Australian External Territories 7 672 AS include with Australia Austria 9 43 AU Azerbaijan 4 994 AJ Azores 9 351 PO include with Portugal Bahamas, The 3 1 BF Bahrain 5 973 BA Balearic Islands 9 34 SP include -

ISO Country Codes

COUNTRY SHORT NAME DESCRIPTION CODE AD Andorra Principality of Andorra AE United Arab Emirates United Arab Emirates AF Afghanistan The Transitional Islamic State of Afghanistan AG Antigua and Barbuda Antigua and Barbuda (includes Redonda Island) AI Anguilla Anguilla AL Albania Republic of Albania AM Armenia Republic of Armenia Netherlands Antilles (includes Bonaire, Curacao, AN Netherlands Antilles Saba, St. Eustatius, and Southern St. Martin) AO Angola Republic of Angola (includes Cabinda) AQ Antarctica Territory south of 60 degrees south latitude AR Argentina Argentine Republic America Samoa (principal island Tutuila and AS American Samoa includes Swain's Island) AT Austria Republic of Austria Australia (includes Lord Howe Island, Macquarie Islands, Ashmore Islands and Cartier Island, and Coral Sea Islands are Australian external AU Australia territories) AW Aruba Aruba AX Aland Islands Aland Islands AZ Azerbaijan Republic of Azerbaijan BA Bosnia and Herzegovina Bosnia and Herzegovina BB Barbados Barbados BD Bangladesh People's Republic of Bangladesh BE Belgium Kingdom of Belgium BF Burkina Faso Burkina Faso BG Bulgaria Republic of Bulgaria BH Bahrain Kingdom of Bahrain BI Burundi Republic of Burundi BJ Benin Republic of Benin BL Saint Barthelemy Saint Barthelemy BM Bermuda Bermuda BN Brunei Darussalam Brunei Darussalam BO Bolivia Republic of Bolivia Federative Republic of Brazil (includes Fernando de Noronha Island, Martim Vaz Islands, and BR Brazil Trindade Island) BS Bahamas Commonwealth of the Bahamas BT Bhutan Kingdom of Bhutan -

From Podes to Antipodes: New Dimensions in Mapping Global Time, Cost, and Distance

From Podes to Antipodes: New Dimensions in Mapping Global Time, Cost, and Distance by Matthew A. Zook* and Stanley D. Brunn** Department of Geography University of Kentucky, Lexington, KY 40506-0027 *[email protected] **[email protected] Paper prepared for Specialist Workshop on Globalization in the World-System: Mapping Change over Time University of California, Riverside February 7-8, 2004 DRAFT – DRAFT - DRAFT – DRAFT - DRAFT - DRAFT Do not distribute or reproduce DRAFT – DRAFT - DRAFT – DRAFT - DRAFT - DRAFT Table of Contents Thinking about Time, Space and Distance ................................................................................. 2 Representations of Time, Space and Distance............................................................................ 3 Thinking about and Representing Global Air Travel............................................................... 5 Description of the Data and its Generation................................................................................ 6 Data Analysis................................................................................................................................. 8 Summation of Physical, Cost and Time Distance....................................................................... 9 Explaining Cost and Time Distance ......................................................................................... 10 Representing Physical, Cost and Time Distance ...................................................................... 11 Conclusions and Future Directions .......................................................................................... -

Floating on a Malayan Breeze : Travels in Malaysia and Singapore Pdf, Epub, Ebook

FLOATING ON A MALAYAN BREEZE : TRAVELS IN MALAYSIA AND SINGAPORE PDF, EPUB, EBOOK Sudhir Thomas Vadaketh | 324 pages | 18 Dec 2012 | Hong Kong University Press | 9789888139316 | English | Hong Kong, Hong Kong Floating on a Malayan Breeze : Travels in Malaysia and Singapore PDF Book This is probably because of my race and character. A must read for anyone now working in this part of the world for a good appreciation of the peculiarities and achievements of the two countries. Bucking this economic pragmatism is ridiculously difficult. Index pp. The only North Indian group that is widely accepted and instantly recognisable—because of its critical mass and distinctive dress—is the Sikh Punjabis. Forty-five years ago Singapore separated from Malaysia. Terence Loading In Floating , there is also a chapter dedicated to discussing the effects Mainland Chinese workers are having on the Singaporean society and labour force. She is a first-generation Singaporean Marwari, people who hail from Rajasthan in North-west India, about as far as you can get geographically and culturally from Kerala. Malaysia has given preference to the majority Malay Muslims — the bumiputera , or sons of the soil. Bounced around a bit too much for me as well, but it was my first good entre into that part of the world. He writes that "since , Malaysia and Singapore have tried hard to create distinct nation states. Immigration, meanwhile, is a complex issue that deserves its own piece. Since then, a combination of forces--including policy missteps by the ruling parties, the emergence of more credible opposition candidates, and the widening of political space through the internet--has blown the lid off our hitherto politically apathetic countries" p. -

Antipodes Global Fund

Antipodes Asia Fund ARSN 096 451 393 APIR IOF0203AU MONTHLY REPORT | 30 April 2021 Commentary Global equity strength continued in April as a further supportive US fiscal Key contributors included: backdrop boosted sentiment (+2.9). Investors exhibited a preference for • Consumer Defensive cluster, notably sportswear name Li Ning amidst momentum and growth over low multiple - or value - stocks with an ongoing consumer backlash against foreign competitors boycotting Communication Services and Information Technology outperforming. Cyclical the use of cotton from the Xinjiang region, and Wuliangye which reported sectors such as Materials, Financials and Consumer Discretionary were also strong revenues amidst supply constraints from a key competitor. strong while Energy was the major laggard. • Industrials, notably LG Chem on strong results across its chemicals, electronics and batteries businesses, and POSCO resulting from US equities (+3.9%) outperformed as US technology giants resumed strength in the price of steel. leadership, helped by stabilising yields. President Biden's speech to congress • Hardware cluster, notably MediaTek which reported strong first quarter signalled further fiscal spending plans funded by new tax proposals. Europe growth in revenues, primarily in 5G handset chip sales, while also lifting (+3.1%) marginally outperformed as the trajectory for COVID-19 vaccinations near term guidance, and TSMC which also lifted 2021 revenue guidance. improved. Alchip was a notable exception following a US decision to add Chinese supercomputing entities with links to the Chinese military, which included Asia (-0.4%) underperformed as Japan (-2.9%) weighed due to rising COVID- Alchip clients, to its economic blacklist. 19 infections, a slow vaccine rollout, and a new state of emergency. -

Download Download

Number 63, Spring 2009 cartographic perspectives 69 its chapters, the text is to be highly recommended as generations, it was gradually supplemented by new encouraging further work in this realm. Because of this knowledge, which led to the need to distinguish book, and other publications by Knowles, Hillier, Bol, ancient from modern knowledge. For Hiatt, there is Gregory, and others, I look forward to future publica- a clear and consistent, if not always smooth, line of tions in the use of GIS for History. thought extending from the ancient period through the early modern. It is characterized by ancient writings being retold and supplemented, not simply to preserve the originals, but to give them prolonged credibility by Terra Incognita: Mapping the Antipodes before 1600 making them appear to foretell subsequent discover- By Alfred Hiatt ies. University of Chicago Press, 2008 The third theme explores periodization, and Hiatt’s 298 pages, 8 color plates, 47 grayscale figures conviction that conceptions of the world do not easily Hardbound (ISBN 13: 978-0-226-33303-8) fit standard period delimiters. He observes that, while change did occur, “[W]hy that change occurred will Reviewed by: Jonathan F. Lewis not be enlightening if it falls back on banalities about Benedictine University inherently “antique,” “medieval,” or “modern” ways of viewing the world” ( 9). For Hiatt, the medieval pe- Terra Incognita examines and explains the initial ap- riod witnessed not the end of a view of the world in- pearance and subsequent evolution of European per- formed by ancient writers, but rather a dialogue with spectives on remote, unvisited portions of the globe. -

Antipodes: in Search of the Southern Continent Is a New History of an Ancient Geography

ANTIPODES In Search of the Southern Continent AVAN JUDD STALLARD Antipodes: In Search of the Southern Continent is a new history of an ancient geography. It reassesses the evidence for why Europeans believed a massive southern continent existed, About the author and why they advocated for its Avan Judd Stallard is an discovery. When ships were equal historian, writer of fiction, and to ambitions, explorers set out to editor based in Wimbledon, find and claim Terra Australis— United Kingdom. As an said to be as large, rich and historian he is concerned with varied as all the northern lands both the messy detail of what combined. happened in the past and with Antipodes charts these how scholars “create” history. voyages—voyages both through Broad interests in philosophy, the imagination and across the psychology, biological sciences, high seas—in pursuit of the and philology are underpinned mythical Terra Australis. In doing by an abiding curiosity about so, the question is asked: how method and epistemology— could so many fail to see the how we get to knowledge and realities they encountered? And what we purport to do with how is it a mythical land held the it. Stallard sees great benefit gaze of an era famed for breaking in big picture history and the free the shackles of superstition? synthesis of existing corpuses of That Terra Australis did knowledge and is a proponent of not exist didn’t stop explorers greater consilience between the pursuing the continent to its sciences and humanities. Antarctic obsolescence, unwilling He lives with his wife, and to abandon the promise of such dog Javier. -

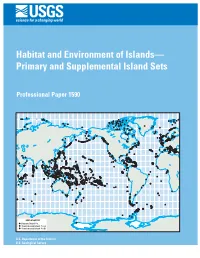

Habitat and Environment of Islands— Primary and Supplemental Island Sets

Habitat and Environment of Islands— Primary and Supplemental Island Sets Professional Paper 1590 EXPLANATION Primary Island Set Supplemental Island Set A Supplemental Island Set B U.S. Department of the Interior U.S. Geological Survey HABITAT AND ENVIRONMENT OF ISLANDS Primary and Supplemental Island Sets By N.C. Matalas and Bernardo F. Grossling U.S. GEOLOGICAL SURVEY PROFESSIONAL PAPER 1590 U.S. Department of the Interior GALE A. NORTON, Secretary U.S. GEOLOGICAL SURVEY Charles G. Groat, Director Any use of trade, product, or firm names in this report is for identification purposes only and does not constitute endorsement by the U.S. Government Reston, Virginia 2002 Library of Congress Cataloging-in-Publication Data Matalas, Nicholas C., 1930– Habitat and environment of islands : primary and supplemental island sets / by N.C. Matalas and Bernardo F. Grossling. p. cm. — (U.S. Geological Survey professional paper ; 1590) Includes bibliographical references (p. ). ISBN 0-607-99508-4 1. Island ecology. 2. Habitat (Ecology) I. Grossling, Bernardo F., 1918– II. Title. III. Series. QH541.5.I8 M27 2002 577.5’2—dc21 2002035440 For sale by the U.S. Geological Survey Information Services Box 25286, Federal Center, Denver, CO 80225 PREFACE The original intent of the study was to develop a first-order synopsis of island hydrology with an inte- grated geologic basis on a global scale. As the study progressed, the aim was broadened to provide a frame- work for subsequent assessments on large regional or global scales of island resources and impacts on -

A Century of Oz Lit in China: a Critical Overview (1906-2008)

University of Wollongong Research Online Faculty of Arts - Papers (Archive) Faculty of Arts, Social Sciences & Humanities 2011 A century of Oz lit in China: A critical overview (1906-2008) Yu Ouyang University of Wollongong Follow this and additional works at: https://ro.uow.edu.au/artspapers Part of the Arts and Humanities Commons, and the Social and Behavioral Sciences Commons Recommended Citation Ouyang, Yu, A century of Oz lit in China: A critical overview (1906-2008) 2011. https://ro.uow.edu.au/artspapers/1870 Research Online is the open access institutional repository for the University of Wollongong. For further information contact the UOW Library: [email protected] A Century of Oz Lit in China: A Critical Overview (1906–2008) OUYANG YU University of Wollongong HIS papER SEEKS TO EXAMINE THE DISSEMINATION, RECEPTION AUSTRALIAN LITERATURE: paRT OF THE LITERATURE FROM “THE and perception of Australian literature in China from WEAK AND SMALL NATIONS” (THE 1920S AND 1930S) T1906 to 2008 by providing a historical background for its first arrival in China as a literature undistinguished Apart from the three Australian poets translated into Chinese from English or American literature, then as part of a ruoxiao in 1921, whom Nicholas Jose mentioned in his paper, another minzu wenxue (weak and small nation literature) in the early poet who found his way to China was Adam Lindsay Gordon, 1930s, its rise as interest grew in Communist and proletarian as Yu Dafu noted in his diary on 18 August 1927.11 So, too, writings in the 1950s and 1960s, and its spread and growth did A. -

90-Day Finding on a Petition to List 12 Penguin Species As

Federal Register / Vol. 72, No. 132 / Wednesday, July 11, 2007 / Proposed Rules 37695 action that affects the status of a ACTION: Notice of 90-day petition SUPPLEMENTARY INFORMATION: If you geographical area and does not impose finding and initiation of status review. submit information or comments, please any new requirements on sources. Thus, include ‘‘Attn: Penguins’’ in the the requirements of section 12(d) of the SUMMARY: We, the U.S. Fish and beginning of your message. Electronic National Technology Transfer and Wildlife Service (Service), announce a attachments in standard formats (such Advancement Act of 1995 (15 U.S.C. 90-day finding on a petition to list 12 as .pdf or .doc) are acceptable, but 272 note) do not apply. As required by penguin species: emperor penguin please name the software necessary to section 3 of Executive Order 12988 (61 (Aptenodytes forsteri), southern open any attachments in formats other FR 4729, February 7, 1996), in issuing rockhopper penguin (Eudyptes than those given above. Also, please this proposed rule, EPA has taken the chrysocome), northern rockhopper include your name and return address necessary steps to eliminate drafting penguin (Eudyptes moseleyi (E. in your e-mail message. If you do not errors and ambiguity, minimize chrysocome moseleyi)), fiordland receive a confirmation from the system potential litigation, and provide a clear crested penguin (Eudyptes that we have received your e-mail legal standard for affected conduct. EPA pachyrhynchus), snares crested penguin message, please submit your comments has complied with Executive Order (Eudyptes robustus), erect-crested in writing using one of the alternate 12630 (53 FR 8859, March 15, 1988) by penguin (Eudyptes sclateri), macaroni methods described above. -

Attachment 2 International Points - Country Code Listing Alphabetic Order

Attachment 2 International Points - Country Code Listing Alphabetic Order FCC reporting Codes FCC reporting Codes Country Region Country Country Region Country Code Code Code Code Abu Dhabi 3 1 Chad 2 61 Admiralty Islands 8 2 Chagos Archipelago 7 350 Afghanistan 7 3 Chatham Island 8 62 Ajman 3 4 Chile 6 63 Alaska 5 1005 China 7 64 Albania 9 6 Choiseul Island 8 65 Alderney 1 7 Christmas Island 7 362 Algeria 2 8 Cocos (Keeling) Islands 8 67 American Samoa 8 1009 Colombia 6 68 Andaman Islands 7 355 Comoros 2 69 Andorra 1 10 Congo 2 70 Anegada Islands 4 11 Cook Islands 8 71 Angola 2 12 Coral Sea Islands 8 72 Anguilla 4 13 Corsica 1 73 Antarctica 10 14 Costa Rica 5 74 Antigua and Barbuda 4 15 Cote d'Ivoire 2 75 Antipodes Islands 8 356 Croatia 9 76 Argentina 6 16 Cuba 4 77 Armenia 9 17 Curacao 4 78 Aruba 4 18 Cyprus 1 79 Ascension Island 2 19 Czech Republic 9 384 Auckland Islands 8 357 Czechoslovakia (former) 9 80 Australia 8 20 Denmark 1 81 Austria 1 21 Diego Garcia 7 364 Azerbaijan 9 22 Djibouti 2 82 Azores 1 23 Dominica 4 83 Bahamas, The 4 24 Dominican Republic 4 84 Bahrain 3 25 Dubai 3 85 Baker Island 8 1026 Easter Island 6 86 Balearic Islands 1 27 Ecuador 6 87 Bangladesh 7 28 Egypt 2 88 Barbados 4 29 El Salvador 5 89 Barbuda 4 30 England 1 90 Bassas Da India 2 358 Equatorial Guinea 2 91 Belarus 9 50 Eritrea 2 92 Belgium 1 31 Estonia 9 93 Belize 5 32 Ethiopia 2 94 Benin 2 33 Europa Island 2 365 Bequia 4 34 Faeroe Islands 1 95 Bermuda 4 35 Falkland Islands (Islas Malvinas) 6 96 Bhutan 7 36 Fanning Atoll 8 97 Bolivia 6 37 Fernando de Noronha -

As Many Antipodes As Vertices on Convex Polyhedra J

As many antipodes as vertices on convex polyhedra J. Rouyer, Tewfik Sari To cite this version: J. Rouyer, Tewfik Sari. As many antipodes as vertices on convex polyhedra. Advances in Geometry, De Gruyter, 2012, 12 (1), pp.43 -61. 10.1515/advgeom.2011.030. hal-00777554 HAL Id: hal-00777554 https://hal.archives-ouvertes.fr/hal-00777554 Submitted on 17 Jan 2013 HAL is a multi-disciplinary open access L’archive ouverte pluridisciplinaire HAL, est archive for the deposit and dissemination of sci- destinée au dépôt et à la diffusion de documents entific research documents, whether they are pub- scientifiques de niveau recherche, publiés ou non, lished or not. The documents may come from émanant des établissements d’enseignement et de teaching and research institutions in France or recherche français ou étrangers, des laboratoires abroad, or from public or private research centers. publics ou privés. Author-produced version of the article published in Advances in Geometry, 2012, 12(1), 43–61. The original publication is available at http://www.degruyter.com doi:10.1515/advgeom.2011.030 Asmanyantipodesasverticesonconvex polyhedra Joël Rouyer Tewk Sari June 14, 2010 Abstract An earlier result states that, on the surface of a convex polyhedron with vertices endowed with its intrinsic metric, a point cannot have more than antipodes (farthest points). In this paper we produce examples of polyhedra with vertices, on which some suitable point admits exactly antipodes. We also proved that, for any positive number 1,there exist (in the closure of the set of these polyhedra) some convex surfaces on which some point have a set of antipodes of Hausdor dimension .