State-Of-The-Downtown 01696.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Iii. General Description of Environmental Setting

III. GENERAL DESCRIPTION OF ENVIRONMENTAL SETTING Section 15125 of the California Environmental Quality Act (CEQA) Guidelines requires that an EIR include a description of the existing environment. This section is intended to give a general overview of the environmental setting for this project. More detailed information on existing conditions is provided under each individual environmental topic studied in Section IV, Environmental Impact Analysis. This section also provides an overview of the related projects that are considered as part of the future conditions in evaluating cumulative impacts. A. OVERVIEW OF ENVIRONMENTAL SETTING 1. Project Site and Surrounding Area Location As stated in Section II, Project Description, the project site is located in the Wilshire Community Plan Area, approximately 2.5 miles north of the Santa Monica Freeway (I-10). In addition, the northern one-third portion of the project site is located within the Miracle Mile District, a mile-long commercial corridor fronting Wilshire Boulevard from Sycamore Avenue to Fairfax Avenue. The Wilshire and LaBrea Project consists of a residential component and a retail/restaurant component. Specifically, the proposed project is situated on a 147,057-square-foot site that is bound by Wilshire Boulevard to the north, Sycamore Avenue to the east, 8th Street on the south, and La Brea Avenue to the west. Existing Land Uses The Wilshire Community Plan Area has a pattern of low- to medium-density residential uses interspersed with areas of higher-density residential uses. Long, narrow corridors of commercial activity can be found along major boulevards, including Wilshire Boulevard. The Miracle Mile District consists of a mixture of commercial, retail, upscale restaurants, and museums that are very popular destinations for tourists. -

Final Screening

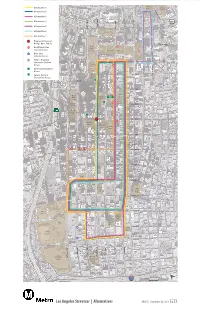

Alternative 1 Olvera Union Street Station ALAMEDA STREET Alternative 2 Alternative 3 Alternative 4 Alternative 5 HOPE STREET GRAND AVENUE HILL STREET BROADWAY SPRING STREET Alternative 6 Cathedral Alternative 7 Proposed Streetcar Bridge Over 5th St. TEMPLE STREET Music Red/Purple Line Center Station Access Civic Center Park City Hall Blue Line Station Access Future Regional Connector Station 1ST STREET Access Walt Disney Vertical Circulation Concert Access Hall MAIN STREET Broad OLIVE STREET 2ND STREET Future Vertical Museum Circulation Access Proposed ANGELES STREET LOS GTK WAY MOCA 3RD STREET Grand World Angels Flight California Central Trade Plaza Market Center 4TH STREET Westin Bonaventure Hotel 5TH STREET LA Central Millenium Library Roxie Theatre Biltmore Pershing Cameo Theatre Hotel Square Arcade Theatre 6TH STREET L.A. Theatre Palace Theatre 7TH STREET State Theatre 8TH STREET Tower Theatre Rialto Theatre Ralph’s Orpheum Theatre 9TH STREET FIDM Federal California Reserve Market Bank Center OLYMPIC BOULEVARD LA Live LA 11TH STREET Live Herald Examiner I&II Staples AT&T Center Center 12TH STREET Herald Examiner Los Angeles III Convention Center PICO BOULEVARD BROADWAY HILL STREET HOPE STREET OLIVE STREET GRAND AVENUE Los Angeles STREET FLOWER California Convention STREET FIGUEROA Hospital Center Medical Center No Scale Los Angeles Streetcar | Alternatives DRAFT | September 26, 2011 Alternative 1 Olvera Union Street Station ALAMEDA STREET Proposed Streetcar Bridge Over 5th St. Red/Purple Line Station Access Blue Line Station Access -

Multi-Family Residence 1920-1934 Montana Avenue Santa Monica, California City Landmark Assessment Report

Multi-Family Residence 1920-1934 Montana Avenue Santa Monica, California City Landmark Assessment Report Evaluation Report Building Permit History City Directory Research Photographs Tax Assessor Map Sanborn Map Prepared for: City of Santa Monica Planning Division Prepared by: PCR Services Corporation Santa Monica, California March, 2006 Multi-Family Residence 1920-1934 Montana Avenue City of Santa Monica APN: 4277-006-001 City Landmark Assessment and Evaluation BACKGROUND INFORMATION Description of site or structure, note any major alterations and dates of alterations The subject property is situated on the south side of Montana Avenue between 19th and 20th Streets on Lot 1 and the northwest 15 feet of Lot 2, Block 13 of Tract 1351 in the City of Santa Monica. The lot size of the subject property is approximately 65 feet by 160 feet. The subject property, erected in 1940, is located in a mixed single- and multi- family residential neighborhood and consists of a pair of two-story buildings: a six-unit main building (1924-34 Montana Avenue) and a combination garage and second story apartment structure (1920 Montana Avenue). The main building is situated near the southwest corner of Montana Avenue and 20th Street with its primary (north and east) elevations facing both of these streets. The garage/apartment structure occupies the west end of the parcel at Montana Avenue and an alley known as 19th Court. Its primary elevation faces Montana Avenue (north). This property has not been previously identified and assessed as part of the City’s on- going survey process. The subject property is vernacular Modern in architectural style with both buildings capped by low-pitched hipped roofs with small vent dormers and shallow boxed eaves. -

Non-Toxic Drycleaner List

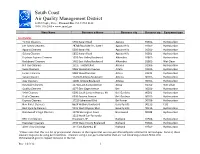

South Coast Air Quality Management District 21865 Copley Drive, Diamond Bar, CA 91765-4182 (909) 396-2000 www.aqmd.gov Store Name Business address Business city Business zip Equipment type Los Angeles Tic Toc Cleaners 5735 Kanan Road Agoura 91301- Hydrocarbon Jim Dandy Cleaners 28708 Roadside Dr., Suite I Agoura Hills 91301- Hydrocarbon Agoura Cleaners 5009 Kanan Rd. Agoura Hills 91301- Hydrocarbon Galaxy Cleaners 5855 Kanan Road Agoura Hills 91301- Hydrocarbon Dryclean Express Cleaners 1028 East Valley Boulevard Alhambra 91801- Hydrocarbon Buckboard Cleaners 1465 East Valley Boulevard Alhambra 91801- Wet Clean Hill Top Cleaners 151 E. Foothill Blvd. Arcadia 91006- Hydrocarbon Swiss Cleaners 9065 Woodman Avenue Arleta 91331- Hydrocarbon Fulton Cleaners 9081 Woodman Ave Arleta 91331- Hydrocarbon Value Cleaners 11414-B Artesia Boulevard Artesia 90701- Hydrocarbon Ajay Cleaners 11831 Artesia Boulevard Artesia 90701- Hydrocarbon Rosedale Cleaners 1173A East Alosta Avenue Azusa 91702- Wet Clean Quality Cleaners 4077 East Gage Avenue Bell 90201- Hydrocarbon V+M Cleaners 6200 South Eastern Avenue, #H Bell Gardens 90201- Hydrocarbon Dick's Cleaners 6536 Eastern Avenue Bell Gardens 90201- Hydrocarbon Express Cleaners 17210 Lakewood Blvd Bellflower 90706- Hydrocarbon Non Pareil Cleaners 8624 Wilshire Boulevard Beverly Hills 90211- CO2 Best Quality Cleaners 9115 West Olympic Blvd. Beverly Hills 90212- Hydrocarbon Brentwood Village Cleaners 11722 Barrington Court Brentwood 90049- Hydrocarbon 1212 North San Fernando REX 1 hr Cleaners Boulevard, #E Burbank 91504- Hydrocarbon Evergreen Cleaners 2436 West Victory Boulevard Burbank 91505- Hydrocarbon Allen's Dry Cleaning 321 East Alameda, #F Burbank 91502- Hydrocarbon * Please note that this is a list of professional cleaners in the region that use non-perchloroethylene alternative technologies. -

For Sale 2028-2030 Montana Avenue Santa Monica, Ca 90403

FOR SALE 2028-2030 MONTANA AVENUE SANTA MONICA, CA 90403 SANTA MONICA INVESTMENT OPPORTUNITY ALONG MONTANA AVENUE T.C. MACKER | PRESIDENT 310.966.4352 | [email protected] DRE # 01232033 www.westlacommercial.com JENNIFER MOSCOSO | ASSOCIATE 310.966.4397 | [email protected] DRE # 02044716 www.westlacommercial.com WESTMAC COMMERCIAL BROKERAGE COMPANY 1515 Sepulveda Boulevard, Los Angeles, CA 90025 310.478.7700 / www.westmac.com © 2019 WESTMAC Commercial Brokerage Company. All Rights Reserved. WESTMAC Commercial Brokerage fully supports the principles of the Equal Opportunity Act. WESTMAC Commercial Brokerage Company and the WESTMAC Commercial Brokerage Company logo are Company DRE# 01096973 registered service marks owned by WESTMAC Commercial Brokerage Company and may not be reproduced by any means or in any form whatsoever without written permission. FOR SALE 2028-2030 MONTANA AVENUE SANTA MONICA, CA 90403 © 2019 WESTMAC Commercial Brokerage Company. All Rights Reserved. WESTMAC Commercial Brokerage fully supports the principles of the Equal Opportunity Act. WESTMAC Commercial Brokerage Company and the WESTMAC Commercial Brokerage Company logo are registered service marks owned by WESTMAC Commercial Brokerage Company and may not be reproduced by any means or in any form whatsoever without written permission. EXECUTIVE SUMMARY: THE FARMS Montana Avenue Investment Opportunity WESTMAC Commercial Brokerage Company is pleased to present the opportunity to acquire 2028-2030 Montana Avenue in Santa Monica. 2028-2030 Montana Avenue is located in the upscale Montana Shopping District of Santa Monica. 2028-2030 Montana Avenue is situated on two parcels comprising of a single-tenant one-story commercial building approximately 4,000-square feet and a parking lot. The total land size is approximately 8,000-square feet. -

Shop California Insider Tips 2020

SHOP CALIFORNIA INSIDER TIPS 2020 ENJOY THE ULTIMATE SHOPPING AND DINING EXPERIENCES! Exciting Shopping and Dining Tour Packages at ShopAmericaTours.com/shop-California Purchase with code ShopCA for 10% discount. Rodeo Drive 2 THROUGHOUT CALIFORNIA From revitalizing beauty services, to wine, spirits and chocolate tastings, DFS offers unexpected, BLOOMINGDALE’S complimentary and convenient benefits to its See all the stylish sights – starting with a visit to shoppers. Join the DFS worldwide membership Bloomingdale’s. Since 1872, Bloomingdale’s has program, LOYAL T, to begin enjoying members- been at the center of style, carrying the most only benefits while you travel.DFS.com coveted designer fashions, shoes, handbags, cosmetics, fine jewelry and gifts in the world. MACERICH SHOPPING DESTINATIONS When you visit our stores, you’ll enjoy exclusive Explore the U.S.’ best shopping, dining, and personal touches – like multilingual associates entertainment experiences at Macerich’s shopping and special visitor services – that ensure you feel destinations. With centers located in the heart welcome, pampered and at home. These are just of California’s gateway destinations, immerse a few of the things that make Bloomingdale’s like yourself in the latest fashion trends, hottest no other store in the world. Tourism services cuisine, and an unrivaled, engaging environment. include unique group events and programs, Macerich locations provide a variety of benefits special visitor offers and more, available at our to visitors, including customized shopping, 11 stores in California including San Francisco experiential packages, visitor perks and more. Centre, South Coast Plaza, Century City, Beverly To learn more about Macerich and the exclusive Center, Santa Monica Place, Fashion Valley and visitor experiences, visit macerichtourism.com. -

Learn English in Beautiful Southern California Why Cel?

CEL PACIFIC BEACH CEL SAN DIEGO CEL SANTA MONICA LEARN ENGLISH IN BEAUTIFUL SOUTHERN CALIFORNIA WHY CEL? ................................................ 3 GENERAL ENGLISH .......................... 4 EXAM PROGRAMS ............................ 5 OUR LEVELS .......................................... 6 WHY CEL? 9 More than 35 years of experience in teaching English TEACHING METHODS .................... 7 9 Small class size (average of 6-7, maximum of 10 students per class) 9 Recognized and accredited by language industry associations 9 New classes start every week SAN DIEGO ............................................. 8 9 Certified and experienced teachers OUR SCHOOL ..................................................... 10 9 Friendly and comfortable English speaking homestay families ACCOMODATION ............................................... 12 9 Great locations in San Diego Downtown, San Diego Pacific Beach and Los Angeles Santa Monica ACTIVITIES ............................................................ 16 9 Students from around the world 9 A wide choice of residential accommodation options 9 Fun activity program PACIFIC BEACH ................................... 18 OUR SCHOOL ..................................................... 20 OUR MISSION ACCOMODATION ............................................... 22 The mission of CEL is to provide English Language instruction and educational programs to speakers of other languages ACTIVITIES ............................................................ 16 who want to improve their English -

5101-5121 W. Pico Boulevard S

OLYMPIC MEDICAL CENTER WEST BEVERLY GROVE HOLLYWOOD MIRACLE MILE PICO BOULEVARDMEADOWBROOK AVE 5101-5121 W. Pico Boulevard S. REDONDO BLVD Four Parcels Totaling 31,960 SF Spanning an Entire Block LOS ANGELES, CA 90019 from Meadowbrook Ave and S Redondo Blvd Over 270 Feet of Frontage on Pico Blvd; Lot Zoned C4-1-O in a Tier 2 TOC CONFIDENTIALITY AND DISCLAIMER The information contained in the following Marketing Brochure is proprietary and strictly confidential. It is intended to be reviewed only by the party receiving it from Marcus & Millichap and should not be made available to any other person or entity without the written consent of Marcus & Millichap. This Marketing Brochure has been prepared to provide summary, unverified information to prospective purchasers, and to establish only a preliminary level of interest in the subject property. The information contained herein is not a substitute for a thorough due diligence investigation. Marcus & Millichap has not made any investigation, and makes no warranty or representation, with respect to the income or expenses for the subject property, the future projected financial performance of the property, the size and square footage of the property and improvements, the presence or absence of contaminating substances, PCB’s or asbestos, the compliance with State and Federal regulations, the physical condition of the improvements thereon, or the financial condition or business prospects of any tenant, or any tenant’s plans or intentions to continue its occupancy of the subject property. The information contained in this Marketing Brochure has been obtained from sources we believe to be reliable; however, Marcus & Millichap has not verified, and will not verify, any of the information contained herein, nor has Marcus & Millichap conducted any investigation regarding these matters and makes no warranty or representation whatsoever regarding the accuracy or completeness of the information provided. -

Renovation Last Fall

Going Places Macerich Annual Report 2006 It’s more than the end result—it’s the journey. At Macerich®, what’s important isn’t just the destination. It’s the bigger picture, the before and after...the path we take to create remarkable places. For retailers, it’s about collaboration and continual reinvestment in our business and theirs. For the communities we serve, it’s about working together to create destinations that reflect their wants and needs. For investors, it’s about long-term value creation stemming from a clear vision. For consumers, it’s about the total experience our destinations deliver. 0 LETTER TO STOCKHOLDERS Letter to Our Stockholders Macerich continued to create significant value in 2006 by elevating our portfolio and building a sizeable return for our stockholders. Total stockholder return for the year was 33.9%, contributing to a three-year total return of 121.5% and a five-year total return of 326.2%. In 2006, the company increased dividends for the 13th consecutive year. As a company that considers its pipeline a tremendous source of strength BoulderTwenty Ninth is a prime Street example is a prime of howexample 2006 of was how indeed 2006 awas remarkable indeed a yearremark of - and growth, Macerich reached an important milestone in 2006 with the buildingable year netof building asset value net for asset Macerich. value for We Macerich. also completed We also the completed redevelop the- re- opening of Twenty Ninth Street in Boulder, Colorado. Not only is this a mentdevelopment of Carmel of CarmelPlaza in Plaza Northern in Northern California, California, another another excellent excellent model of model terrific new asset in an attractive, affluent community—it represents a sig- valueof value creation, creation, where where we we realized realized a significant a significant return return on onour our investment. -

Multi-Family Residence 130 San Vicente Boulevard Santa Monica, California City Landmark Assessment Report

Multi-Family Residence 130 San Vicente Boulevard Santa Monica, California City Landmark Assessment Report Evaluation Report Building Permit History Potential District Research City Directory Research Photographs Tax Assessor Map Sanborn Map Prepared for: City of Santa Monica Planning Division Prepared by: PCR Services Corporation Santa Monica, California November 2006 Multi-Family Residence 130 San Vicente Boulevard City of Santa Monica APN: 4293-003-001 City Landmark Assessment and Evaluation BACKGROUND INFORMATION Description of site or structure, note any major alterations and dates of alterations The subject property is situated on the south side of San Vicente Boulevard just east of Ocean Avenue on Lots 1 and 2 of Block K of the Palisades Tract in the City of Santa Monica. The lot size of the irregularly shaped subject parcel is approximately 206 feet by 76 feet. A narrow alley known as First Court borders the subject property on its west parcel line. Another alley (unnamed) borders the property on its south side. The subject property, originally known as the Teriton Apartments, consists of a two- and three-story apartment building arranged in a modified U-shaped configuration around landscaped courtyards with its primary elevations facing San Vicente Boulevard. Additionally, a detached utility room/parking garage and smaller detached parking garages are accessed from rear alleys. The 28-unit vernacular Modern style garden apartment complex was built in 1949 and is located in a primarily multi-family residential neighborhood. This property has been previously identified and assessed under the City’s on-going survey process on numerous occasions. It was documented as a contributor to a potential San Vicente Apartment Courts historic district comprised primarily of 1930s-1950s vernacular Modern style apartment buildings as part of the City’s 1983 historic resources survey. -

ANALYSIS of EXISTING CONDITIONS a Subregional View Of

ANALYSIS OF EXISTING CONDITIONS A subregional view of travel on the Westside has been drawn from interviews with elected officials, meetings with MTA and other agencies and analysis of existing data. The subregion considered in this analysis is shown in Figure 1. Because transportation does not respect political boundaries, the Westside Mobility Study area is roughly all of Los Angeles County west of La Brea Avenue, north of Los Angeles International Airport and south of Mulholland Drive. The Westside has many of the most important activity centers in all of Southern California; 16 of these are shown in Figure 2. The Westside Mobility Study has begun to define what might be done to meet those needs for improved linkages, specifying the most critical locations for major transit improvements and other multimodal improvements. Evaluation of Existing Transportation Conditions A goal of the Westside Mobility Study is to provide an accurate picture of the existing traffic and congestion levels on primary arterials and corridors in the Westside area. As there was a large amount of readily available, current data, no new supplementary traffic counts were conducted. Data was acquired from the following sources and ranges predominantly from 2000 to the present day: · Traffic data from the Cities of Beverly Hills, Culver City, Santa Monica and West Hollywood · Transit data from Culver City Bus, Big Blue Bus and MTA · Information from MTA’s Short Range Transportation Plan: Technical Document · Los Angeles Department of Transportation (LADOT) database of traffic counts · Previous Kaku Associates projects · Caltrans counts 10 WESTSIDE MOBILITY STUDY SSOCI TES A Corporation FIGURE 1 STUDY AREA Multi-purpose Activity Centers WESTSIDE MOBILITY STUDY SSOCI TES A Corporation FIGURE 2 MAJOR ACTIVITY CENTERS Area Characteristics - Employment, Population and Housing: The Westside area has at least 10% of the jobs in Los Angeles County and is home to over 6% of County residents. -

America Journal Ein Shopping-Guide Von New York Bis San Diego

MODE & SHOPPING Prada in Nevada Ein Shopping-Guide von New York bis San Diego „Wer glücklich reisen will, reise mit leichtem Gepäck.“ Es macht durchaus Sinn, sich an die weisen Worte von Goethe zu halten, wenn man in die USA fliegt. Dort kann man in Einkaufsparadiese eintauchen, die ihresgleichen suchen. Diana Pyter kennt die neuesten Modetrends und die besten Einkaufstipps. Fotos: Christian Heeb, Diana Pyter, New York Fashion Week Fashion York New Diana Pyter, Christian Heeb, Fotos: New York ist als hippe und einfache Shopping- Destination bekannt. Auch US-amerikanische Designer wie Zac Posen oder Michael Kors (ganz rechts) sind längst keine Geheimtipps mehr. 6/10 AMERICA | 91 MODE & SHOPPING Fotos: Diana Pyter Fotos: Gewusst wo: Rock & Republic am Robertson Boulevard in Los Angeles (oben). Alles andere als ein Geheimtipp: Der Rodeo Drive ist die Einkaufsadresse der Schönen und Reichen. Von A wie Abercrombie & Fitch bis Z wie Zales Jewelers: Es gibt nichts, was es in der Horton Plaza Mall in San Diego nicht gibt. Designermode etwa von Ralph Lauren (Bildreihe unten, ganz links) oder Tony Cohen (Bildreihe unten, 2.v.r.) kriegt deutlich billiger, wer sie in den richtigen Läden ersteht. MODE & SHOPPING Keine Frage, die namhaften US- jeweils im Februar und im September East Side – ein Magnet für Denver lockt mit dem „Cherry Creek Designer wie Marc Jacobs, Anna Sui, – im Bryant Park ihre Kreationen für alle Schuhliebhaber. Center“. Auch in Florida können Donna Karan, Vera Wang, Badgley die neue Saison und verwandeln den Wer nach jungen Trend- Modebegeisterte ihrem Hobby ausgie- Mischka, Calvin Klein, Ralph Lauren Big Apple in einen großen Laufsteg.