DRILLING TECHNOLOGY a New Rotary Steerable System, with Through-Motor Telemetry, Delivers Superior Performance

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Plan Coordinator, FO, Plans Section (MS 5231)

UNITED STATES GOVERNMENT August 5, 2019 MEMORANDUM To: Public Information (MS 5030) From: Plan Coordinator, FO, Plans Section (MS 5231) Subj ect: Public Information copy of plan Control # S-07968 Type Supplemental Exploration Plan Lease(s) OCS-G36134 Elock - 629 Mississippi Canyon Area Operator LLOG Exploration Offshore, L.L.C. Description Subsea Well C and C-ALT Rig Type Not Found Attached is a copy of the subject plan. It has been deemed submitted as of this date and is under review for approval Leslie Wilson Plan Coordinator Site Type/Name Botm Lse/Area/Blk Surface Location Surf Lse/Area/Blk WELL/C G36134/MC/629 6100 FNL, 5062 FEL G36134/MC/629 WELL/C-ALT G36134/MC/629 6100 FNL, 5112 FEL G36134/MC/629 LLOG EXPLORATION OFFSHORE, L.L.C. 1001 Ochsner Boulevard, Suite 100 Covington, Louisiana 70433 SUPPLEMENTAL EXPLORATION PLAN OCS-G 36134 LEASE MISSISSIPPI CANYON BLOCK 629 Prepared By: Sue Sachitana Regulatory Specialist LLOG Exploration Offshore, L.L.C. 985-801-4300-Office 985-801-4716-Direct [email protected] Date: July 10, 2019 LLOG EXPLORATION OFFSHORE, L.L.C. SUPPLEMENTAL EXPLORATION PLAN OCS-G 36134 MISSISSIPPI CANYON BLOCK 629 APPENDIX A Plan Contents APPENDIX B General Information APPENDIX C Geological, Geophysical Information APPENDIX D H2S Information APPENDIX E Biological, Physical and Socioeconomic Information APPENDIX F Waste and Discharge Information APPENDIX G Air Emissions Information APPENDIX H Oil Spill Information APPENDIX I Environmental Monitoring Information APPENDIX J Lease Stipulation Information APPENDIX K Environmental Mitigation Measures Information APPENDIX L Related Facilities and Operations Information APPENDIX M Support Vessels and Aircraft Information APPENDIX N Onshore Support Facilities Information APPENDIX O Coastal Zone Management Act (CZMA) Information APPENDIX P Environmental Impact Analysis APPENDIX Q Administrative Information Mississippi Canyon Block 629, OCS-G-36134 Supplemental Exploration Plan APPENDIX A PLAN CONTENTS (30 CFR Part 550.211 and 550.241) A. -

An Overview of Vortex-Induced Vibration and Its Suppression Devices

An Overview of Vortex-Induced Vibration and Its Suppression Devices Don Allen VIV Solutions LLC Houston, Texas, USA What is VIV? • VIV is a concern for marine riser systems and offshore structures • Caused when ocean currents flow past a blunt object • Shedding vortices impart forces onto the object • “Lock in” occurs when the frequency of eddy shedding current matches the natural frequency of the tubular • Can cause accelerated fatigue damage subsea tubular Video of Riser Clashing Caused by VIV Advantages of Tail Fairings™ • Capable of reducing VIV by a full order of magnitude, even when fairings are present only near the top of a riser string • Improve riser fatigue life • Reduce risk of experiencing higher harmonics • Limit wellhead fatigue • Reduce top and bottom angles • Lower drag (Cd ~0.6) • Allow for drilling operations to continue in high currents (less rig downtime) • Most common type of suppression device in use today for drilling risers VIV Solutions can assist with analysis efforts related to fairing coverage length, CONFIDENTIAL joint layout, etc. Project Experience Vessel Client Location Atwood Advantage Atwood Oceanics Gulf of Mexico Eirik Raude Ocean Rig South Africa Stena IceMAX Shell French Guiana Deepsea Metro 1 BG Group Tanzania Deepsea Stavanger Ophir Energy Tanzania Ocean Confidence* Diamond Offshore Brazil Ocean Courage Trinidad Ocean Endeavor* Gulf of Mexico Ocean Voyager* Ocean Star* Ocean Valiant* Ocean Whittington Ocean Worker* West Sirius* Seadrill Gulf of Mexico Deepwater Discovery* Devon Energy Gulf of Mexico Discoverer Clear Leader* Transocean Gulf of Mexico Discoverer Inspiration* Chikyu* Cosmos Shoji Japan Cajun Express* Chevron Gulf of Mexico Deepwater Nautilus* Shell Gulf of Mexico CONFIDENTIAL (*) Indicates project performed through Shell Global Solutions. -

Copernic Agent Search Results

Copernic Agent Search Results Search: Oil Spill Deep Ocean Danger (All the words) Found: 1503 result(s) on _Full.Search Date: 7/17/2010 6:33:28 AM 1. Gulf Oil Spill Environmental Damage Could Get Much Worse Jul 6, 2010 ... McKinney points out that this deep underwater region is largely ... zone in the Gulf and that pose a long-term threat to ocean life. ... Studies of the 1989 Exxon Valdez oil spill in Alaska show that ... Be aware of toxic chemicals in house http://environment.about.com/b/2010/07/06/gulf-oil-spill-environmental- damage-could-get-much-worse.htm 99% 2. 6 lessons from the BP oil spill 2010/07/12 For years to come, the United States and the oil industry will be absorbing the lessons of the BP spill in the Gulf of Mexico. Regulators will toughen inspections. Oil companies will adopt ... http://www.wfmj.com/Global/story.asp?S=12792031 93% 3. 2 scientists tell presidential oil spill commission fear of dispersants is mostly unfounded 2010/07/13 An update from the second public hearing of the BP Deepwater Horizon Oil Spill and Offshore Drilling Commission. You can watch the hearing live. Eliot Kamenitz, The Times-PicayuneMathy Stanislaus of the Environmental Protection Agency, Charlie Henry of the http://www.nola.com/news/gulf-oil- spill/index.ssf/2010/07/scientists_tell_presidential_o.html 92% 4. Gulf of Mexico oil 2010/06/28 The oil spill in the Gulf of Mexico is not yet an environmental catastrophe - but could worsen as the hurricane season gets under way, scientists said today. -

The Information Redacted Contains Names F

15.d.5(CD) List of CAMS employees and 15.d.6(CD) List of CAP employees 01.24.14 (Note the list of employees required under 15.d.5 and 15.d.6 are identical and have been combined into one document) INFORMATION REDACTED IN THE FOLLOWING REPORT NON-CONFIDENTIAL SUMMARY OF INFORMATION: The information redacted contains names for each employee holding a position identified in Sections 15.d.5 (““CAMS Employees”) and 15.d.6 (““CAP Employees”) of the Consent Decree as of the date of submission, January 2014. 15.d.5(CD) List of CAMS and 15.d.6(CD) List of CAP employees 01.24.14 (redacted) 15.d.5(CD) List of CAMS employees and 15.d.6(CD) List of CAP employees 01.24.14 (Note the list of employees required under 15.d.5 and 15.d.6 are identical and have been combined into one document) Last Name First Name Current Assignment Position Discoverer Enterprise Driller Discoverer Deep Seas Driller GSF Development Driller I Driller Discoverer India Dynamic Pos Oper II Deepwater Pathfinder Subsea Spvr GSF Development Driller I Dynamic Pos Oper II Discoverer Clear Leader Dynamic Pos Oper III GSF Development Driller II Driller Discoverer Clear Leader Driller Discoverer Spirit Subsea Spvr Discoverer Spirit Driller Discoverer Deep Seas Sr Subsea Spvr (MUX) NAM Development Driller III Driller Discoverer Inspiration Driller Discoverer Inspiration Dynamic Pos Oper II Discoverer India Dynamic Pos Oper II GSF C. R. Luigs Driller Development Driller III Sr Subsea Spvr (MUX) NAM Deepwater Pathfinder Subsea Spvr INFORMATION Discoverer Clear Leader Driller Discoverer -

Marine Well Containment Company

Marine Well Containment Company Dan Smallwood, Chief Operations Officer February 2, 2012 Agenda Company Overview Interim Containment System Expanded Containment System Deployment Example 2012 Priorities 2 MWCC – Confidential Agenda Company Overview Interim Containment System Expanded Containment System Deployment Example 2012 Priorities 3 MWCC – Confidential Our Commitment Continuously ready to respond to a well control incident in the deepwater U.S. Gulf of Mexico Continuously advancing deepwater well containment in the U.S. Gulf of Mexico Recognized and respected leader in deepwater well containment in the U.S. Gulf of Mexico 4 MWCC – Confidential About Our Company Leading deepwater well containment system and technology provider for U.S. Gulf of Mexico Expertise in subsea containment and incident response training Independent, not‐for‐profit company 10 members, representing 70% of the deepwater wells drilled from 2007‐2009 Each member has an equal share and an equal vote Investment of over $1 billion in system System available to all operators in the U.S. Gulf of Mexico as a member or as a non‐member (per well basis) 5 MWCC – Confidential Agenda Company Overview Interim Containment System Expanded Containment System Deployment Example 2012 Priorities 6 MWCC – Confidential MWCC Containment System Roles MWCC Covered Entity (Responsible Party - RP) Maintain containment system in ready Direct and manage containment state response (with Unified Command) Deliver capping stack and subsea Remove debris components -

The Information Redacted Contains Names F

15.d.1(CD) List of Well Control Personnel and 15.d.3(CD) Designated Employees 01.24.14 (Note the list of employees required under 15.d.1 and 15.d.3 Are identical and have been combined into one document) INFORMATION REDACTED IN THE FOLLOWING REPORT NON-CONFIDENTIAL SUMMARY OF INFORMATION: The information redacted contains names for each employee holding a position identified in Sections 15.d.1 (“Well Control Personnel”) and 15.d.3 (“Designated Employees”) of the Consent Decree as of the date of submission, January 2014. VERSION REDACTED 15.d.1(CD) Well Control Personnel and 15.d.3(CD) Designated Employees 01.24.14 (redacted) 15.d.1(CD) List of Well Control Personnel and 15.d.3(CD) Designated Employees 01.24.14 (Note the list of employees required under 15.d.1 and 15.d.3 are identical and have been combined into one document) Last Name First Name Current Assignment Position Discoverer Deep Seas Toolpusher Discoverer Enterprise Driller Discoverer Deep Seas Driller GSF Development Driller I Driller Deepwater Champion Toolpusher Discoverer Spirit Toolpusher Development Driller III Sr Toolpusher Deepwater Pathfinder Toolpusher Deepwater Pathfinder Toolpusher GSF Development Driller II Driller Discoverer Clear Leader Driller Discoverer Spirit Driller Development Driller III Driller Discoverer Inspiration Toolpusher Discoverer Inspiration Driller Discoverer Clear Leader Sr Toolpusher GSF C. R. Luigs Driller Deepwater Nautilus Toolpusher Discoverer Enterprise OIM Offshore Inst Mgr Discoverer Clear Leader VERSIONDriller INFORMATION GSF C. R. Luigs -

Thomas Yuen , Et Al. V. Transocean Ltd., Et Al. 10-CV-01467

Case 2:10-cv-01467-JCZ-SS Document 1 Filed 05/13/10 Page 1 of 22 UNITED STATES DISTRICT COURT EASTERN DISTRICT OF LOUISIANA THOMAS YUEN and SUMNI AHN, ) Civil Action No. Individually and on Behalf of All Others ) Similarly Situated, ) COMPLAINT - CLASS ACTION ) Plaintiffs, ) ) vs. ) TRANSOCEAN LTD. and STEVEN L. ) NEWMAN, ) Defendants. ) ) )DEMAND FOR JURY TRIAL COMPLAINT FOR VIOLATION OF THE FEDERAL SECURITIES LAWS Case 2:10-cv-01467-JCZ-SS Document 1 Filed 05/13/10 Page 2 of 22 INTRODUCTION AND OVERVIEW 1. This is a securities fraud class action on behalf of all persons who purchased or otherwise acquired the common stock of Transocean Ltd. (“Transocean” or the “Company”) between August 5, 2009 and May 7, 2010, inclusive (the “Class Period”). This action is brought against Transocean and one of its senior officers and/or directors for violations of § § 10(b) and 20(a) of the Securities Exchange Act of 1934 (“1934 Act”) and Rule 10b-5 promulgated thereunder in connection with the dissemination of false and misleading statements about the Company’s deficient safety protocols, recurring blowout preventer (“BOP”) problems, and its operating and safety record. 2. Transocean is an owner and/or operator of approximately 140 mobile offshore drilling units. During the Class Period, defendants falsely represented that Transocean had remedied its past safety problems and was closely monitoring the Company’s operating and equipment, while omitting to disclose material information concerning Transocean’s repeated safety failures and recurring BOP issues. Defendants falsely represented that the Company’s BOP problems “have all been resolved,” and that BOP issues were “anomalies,” concealing that the Company had not eliminated BOP issues nor rectified the prior BOP failures. -

In the United States Court of Appeals for the Fifth Circuit

No. 10-30585 In the United States Court of Appeals for the Fifth Circuit HORNBECK OFFSHORE SERVICES, INC., Plaintiff-Appellee, v. KENNETH SALAZAR, in his official capacity as Secretary of the Interior, UNITED STATES DEPARTMENT OF THE INTERIOR, THE BUREAU OF OCEAN ENERGY MANAGEMENT, REGULATION, AND ENFORCEMENT, and MICHAEL R. BROMWICH, in his official capacity as Director of that Bureau, Defendants-Appellants. __________________________________________________________________ On Appeal from the United States District Court for the Eastern District of Louisiana, No. 10-CV-1663(F)(2) (Hon. Martin Feldman) __________________________________________________________________ AMICUS CURIAE BRIEF OF SEN. MARY LANDRIEU OF THE STATE OF LOUISIANA, CHAMBER OF COMMERCE OF THE UNITED STATES OF AMERICA, LOUISIANA OIL & GAS ASSOCIATION, GREATER HOUSTON PARTNERSHIP, IN SUPPORT OF PLAINTIFF-APPELLEE’S OPPOSITION TO DEFENDANTS-APPELLANTS’ MOTION FOR STAY R. Ted Cruz Brady Edwards Allyson N. Ho MORGAN, LEWIS & BOCKIUS LLP 1000 Louisiana Street, Suite 4000 Houston, Texas 77002 713.890.5000 Telephone 713.890.5001 Facsimile Attorneys for Amici Curiae (list of amici continues on inside cover) No. 10-30585 (list of amici, continued from front cover) Louisiana Association of Business & Industry, Mobile Area Chamber of Commerce, Greater Shreveport Chamber of Commerce, Ruston Lincoln (LA) Chamber of Commerce, Natchitoches Area (LA) Chamber of Commerce, Baton Rouge Area Chamber of Commerce, Southern Crop Production Association, New Orleans Chamber of Commerce, Mississippi -

Dsme Offshore Products &

PUBLISHED IN FEBRUARY 2015 World leader World leader in ocean Technology in ocean Technology DSME OFFSHORE PRODUCTS & PLANTS DSME OFFSHORE PRODUCTS & PLANTS www.dsme.co.kr WORLD LEADER 02_03 PROLOGUE PRODUCTS APPENDIX IN OCEAN TECHNOLOGY DSME OFFSHORE PRODUCTS & PLANTS PROLOGUE HISTORY EPCIC CONTRACTOR HSE / QUALITY MANAGEMENT PRODUCTS PORTFOLIO WORLD LEADER 04_05 PROLOGUE PRODUCTS APPENDIX IN OCEAN TECHNOLOGY HISTORY 1973 - Groundbreaking for Okpo Shipyard 2000 - DHI’s Shipbuilding Division became independent 2008 - Received Korea IT Innovation Award and acquired ISO - CLOV FPSO : Received 2013 Contractor Safety award 1978 - Established Daewoo Shipbuilding & Heavy Machinery company 27001 Certification from TOTAL / Achieved 15.6 million man-hours Co., Ltd. (DSHM) 2001 - Awarded most LNGC orders in the world and acquired - Achieved safety result of 10 million man-hours with IIF without LTIs 1981 - Held topping out ceremony for completion of Okpo OHSAS 18001 Certification for first time in Korean in Qatar LNGC project - Awarded largest number of drillship newbuilding Shipyard shipbuilding industry 2009 - Received USD 10 billion Export Tower Award and contracts (7 drillships) 1982 - Delivered first chemical carrier, ‘Bow Pioneer’ 2002 - Changed official corporate title to DSME and adopted world’s largest floating dock debuted at DSME - Awarded contract for high-spec Jack-Up Rig from 1983 - Delivered Korea’s first Drilling Rig, ‘Doo Sung’ corporate core values, ‘Trust’ and ‘Passion’ shipyard Maersk Drilling 1994 - Merged with Daewoo Heavy -

United States of America

UNITED STATES OF AMERICA DEPARTMENT OF HOMELAND SECURITY DEPARTMENT OF THE INTERIOR JOINT INVESTIGATION CONDUCTED BY UNITED STATES COAST GUARD AND BUREAU OF OCEAN ENERGY MANAGEMENT, REGULATION AND ENFORCEMENT In the Matter of the Fire & Explosion on the Deepwater Horizon RESPONSE TO COAST GUARD DRAFT REPORT BY TRANSOCEAN OFFSHORE DEEPWATER DRILLING INC. AND TRANSOCEAN HOLDINGS LLC Dated: June 8, 2011 Respectfully submitted: Sutherland Asbill & Brennan LLP /s/ Steven Roberts Steven Roberts (Texas Bar #17019300) Brad D. Brian (California Bar #79001) Rachel Clingman (Texas Bar #00784125) Munger, Tolles & Olson LLP 1001 Fannin Street, Suite 3700 355 South Grand Avenue Houston, Texas 77002-6760 Los Angeles, CA 90071 Telephone: (713) 470-6192 Telephone: (213) 683-9280 Facsimile: (713) 654-1301 Facsimile: (213) 683-5180 Edwin G. Preis, Jr. (Louisiana Bar #10703) David G. Dickman (DC Bar #465010) Richard J. Hymel (Louisiana Bar #20230) Venable LLP Preis & Roy PLC 575 7th Street, NW, 601 Poydras Street, Suite 1700 Washington, DC 20004 New Orleans, Louisiana 70130 Telephone: (202) 344-8026 Telephone: (504) 581-6062 Facsimile: (202) 344-8300 Facsimile: (504) 522-9129 John Kinchen (Texas Bar #00791027) Hughes Arrell Kinchen LLP 2211 Norfolk, Suite 1110 Houston, Texas 77098 Telephone: (713) 403-2064 Facsimile: (713) 583-8877 Counsel for Transocean Offshore Deepwater Drilling Inc. and Transocean Holdings LLC TABLE OF CONTENTS I. EXECUTIVE SUMMARY …………………………………………………… 1 A. SUMMARY OF KEY FACTUAL ERRORS IN THE DRAFT REPORT ……………………………………………………………….…… 3 1. Ignition Did Not Result From Poorly Maintained Equipment ……….… 3 2. The BOP Was Properly Maintained ………………………………….…. 3 3. The Engines On The Rig Did Not “Fail” To Shut Down Upon Detection of Gas ………………………………………………………. -

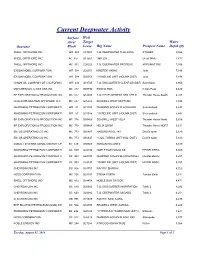

Current Deepwater Activity Surface Well Area/ Target Water Operator Block Lease Rig Name Prospect Name Depth (Ft) SHELL OFFSHORE INC

Current Deepwater Activity Surface Well Area/ Target Water Operator Block Lease Rig Name Prospect Name Depth (ft) SHELL OFFSHORE INC. WR 508 G17001 T.O. DEEPWATER THALASSA STONES 9,554 SHELL OFFSHORE INC. AC 857 G17561 H&P 205 Great White 7,819 SHELL OFFSHORE INC. MC 391 G26252 T.O. DEEPWATER PROTEUS APPOMATTOX 7,166 EXXON MOBIL CORPORATION WR 584 G20351 MAERSK VIKING Julia 7,148 EXXON MOBIL CORPORATION WR 584 G20351 * WIRELINE UNIT (HOUMA DIST) Julia 7,148 UNION OIL COMPANY OF CALIFORNIA WR 634 G18745 T.O. DISCOVERER CLEAR LEADER Saint Malo 6,800 MARUBENI OIL & GAS USA INC MC 217 G09790 ENSCO 8505 King's Peak 6,420 BP EXPLORATION & PRODUCTION INC MC 822 G14658 T.O. DEVELOPMENT DRILLER III Thunder Horse South 6,267 LLOG EXPLORATION OFFSHORE LLC MC 257 G35325 SEADRILL WEST NEPTUNE 5,848 ANADARKO PETROLEUM CORPORATI WR 51 G31938 DIAMOND OCEAN BLACKHAWK Shenandoah 5,847 ANADARKO PETROLEUM CORPORATI WR 51 G31938 * WIRELINE UNIT (HOUMA DIST) Shenandoah 5,847 BP EXPLORATION & PRODUCTION INC MC 776 G09866 SEADRILL WEST VELA Thunder Horse North 5,636 BP EXPLORATION & PRODUCTION INC MC 778 G09868 HELIX Q5000 Thunder Horse NORT 5,631 ENI US OPERATING CO INC MC 773 G16647 NABORS POOL 140 Devil's tower 5,610 ENI US OPERATING CO INC MC 773 G16647 * COIL TUBING UNIT (N.O. DIST) Devil's tower 5,610 COBALT INTERNATIONAL ENERGY LP KC 129 G30924 ROWAN RELIANCE 5,519 ANADARKO PETROLEUM CORPORATI GC 859 G24194 NOBLE BOB DOUGLAS HEIDELBERG 5,355 ANADARKO PETROLEUM CORPORATI GC 903 G24197 DIAMOND OCEAN BLACKHORNET HEIDELBERG 5,257 ANADARKO PETROLEUM CORPORATI GC 903 G24197 * WIRELINE UNIT (HOUMA DIST) HEIDELBERG 5,257 CHEVRON USA INC GC 806 G31751 PACIFIC SHARAV 4,720 HESS CORPORATION MC 726 G24101 STENA FORTH Tubular Bells 4,611 SHELL OFFSHORE INC. -

2014 Hydrocarbon Spills Rig Incident Location Product Type Volume Spilled Contained Lost to Env

2014 Hydrocarbon Spills Rig Incident Location Product Type Volume Spilled Contained Lost To Env. Root Cause Date (Barrels) (Barrels) (Barrels) GSF Development Driller II 01/01/14 United States Oil Based Mud 2.0000 1.2500 0.7500 Swaco Auger Overflows After Influx of Mud from Boost Line. Communicated incident with all crews. Held a discussion (Synthetic/Pseudo) with drill crews about completely communicating expectations and information before handling the mud system. Ensure adequate number of shakers is available for use, as per the expected amount of returns. Discoverer India 01/19/14 United States Hydraulic Oil (Mineral) 0.0012 0.0000 0.0012 At approxiamately 16:30 while adjusting the position of the forward moonpool spider beams in preparation to splash bop hydraulic fluid was seen leaking out of a hose going to the #3 spider beam in the aft moonpool and into the sea.No visible sheen witnessed. Action Items completed: 1)Change out damaged hose. 2) Inspect remaining hoses on moonpool spider beams. 3) Add moonpool spider beams to Maintenance System with regularly scheduled inspections and maintenance. 4) Post signage to close hydraulic supply valves when not in use. Development Driller III 05/02/14 United States Waste Oil 0.0019 0.0014 0.0005 Leak of waste oil at completion of transfer when the transfer the hose burped at the nozzle and sprayed oil. Personnel immediately cleaned up the waste oil. Deepwater Nautilus 05/02/14 United States Base Oil 88.0000 0.0000 88.0000 Incorrect valve was opened. Valve indentification labels have been modified as a result.