Jose Cuervo Family (34%)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Becle, S.A.B. De C.V

[Translation for informational purposes only] ANNUAL REPORT FILED IN ACCORDANCE WITH THE GENERAL PROVISIONS APPLICABLE TO ISSUERS OF SECURITIES AND TO OTHER PARTICIPANTS IN THE SECURITIES MARKET, FOR THE YEAR ENDED DECEMBER 31, 2018. BECLE, S.A.B. DE C.V. Guillermo González Camarena No.800-4, Col. Zedec Santa Fe, C.P. 01210, Mexico City, Mexico “CUERVO” Securities Representing the Capital Stock of the Issuer Characteristics Market in which they are registered Single Series Shares of Common Stock Bolsa Mexicana de Valores, S.A.B. de C.V. The securities of the issuer referred to above are registered in the National Securities Registry (Registro Nacional de Valores). Registration in the National Securities Registry (Registro Nacional de Valores) does not certify the soundness of the securities or the solvency of the issuer, or the accuracy or veracity of the information contained in the prospectus, and it does not validate the actions that, as applicable, have been performed in contravention of applicable law. [Translation for informational purposes only] TABLE OF CONTENTS 1) Overview 4 A) GLOSSARY OF TERMS AND DEFINITIONS 4 B) EXECUTIVE SUMMARY 7 C) RISK FACTORS 22 D) OTHER SECURITIES 42 E) MATERIAL CHANGES TO THE RIGHTS OF SECURITIES REGISTERED IN THE NATIONAL SECURITIES REGISTRY 43 F) PUBLIC DOCUMENTS 44 2) THE COMPANY 45 A) HISTORY AND DEVELOPMENT OF THE COMPANY 45 B) BUSINESS DESCRIPTION 49 i) Main Activity 49 ii) Distribution Channels 61 iii) Patents, licenses, brands and other agreements 63 iv) Main customers 64 v) Applicable law -

The Beverage Company Liquor List

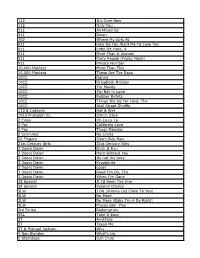

The Beverage Company Liquor List Arrow Kirsch 750 Presidente Brandy 750 Stirrings Mojito Rimmer Raynal Vsop 750 Glenlivet French Oak 15 Yr Canadian Ltd 750 Everclear Grain Alcohol Crown Royal Special Reserve 75 Amaretto Di Amore Classico 750 Crown Royal Cask #16 750 Amarito Amaretto 750 Canadian Ltd 1.75 Fleishmanns Perferred 750 Canadian Club 750 G & W Five Star 750 Canadian Club 1.75 Guckenheimer 1.75 Seagrams Vo 1.75 G & W Five Star 1.75 Black Velvet Reserve 750 Imperial 750 Canadian Club 10 Yr Corbys Reserve 1.75 Crown Royal 1.75 Kessler 750 Crown Royal W/Glasses Seagrams 7 Crown 1.75 Canadian Club Pet 750 Corbys Reserve 750 Wisers Canadian Whisky 750 Fleishmanns Perferred 1.75 Black Velvet Reserve Pet 1.75 Kessler 1.75 Newport Canadian Xl Pet Kessler Pet 750 Crown Royal 1.75 W/Flask Kessler 375 Seagrams Vo 375 Seagrams 7 Crown 375 Seagrams 7 Crown 750 Imperial 1.75 Black Velvet 375 Arrow Apricot Brandy 750 Canadian Mist 1.75 Leroux Blackberry Brandy 1ltr Mcmasters Canadian Bols Blackberry Brandy 750 Canada House Pet 750 Arrow Blackberry Brandy 750 Windsor Canadian 1.75 Hartley Brandy 1.75 Crown Royal Special Res W/Glas Christian Brothers Frost White Crown Royal 50ml Christian Broyhers 375 Seagrams Vo 750 Silver Hawk Vsop Brandy Crown Royal 375 Christian Brothers 750 Canada House 750 E & J Vsop Brandy Canada House 375 Arrow Ginger Brandy 750 Canadian Hunter Pet Arrow Coffee Brandy 1.75 Crown Royal 750 Korbel Brandy 750 Pet Canadian Rich & Rare 1.75 E&J Brandy V S 750 Canadian Ric & Rare 750 E&J Brandy V S 1.75 Seagrams Vo Pet 750 -

Songs by Title

Karaoke Song Book Songs by Title Title Artist Title Artist #1 Nelly 18 And Life Skid Row #1 Crush Garbage 18 'til I Die Adams, Bryan #Dream Lennon, John 18 Yellow Roses Darin, Bobby (doo Wop) That Thing Parody 19 2000 Gorillaz (I Hate) Everything About You Three Days Grace 19 2000 Gorrilaz (I Would Do) Anything For Love Meatloaf 19 Somethin' Mark Wills (If You're Not In It For Love) I'm Outta Here Twain, Shania 19 Somethin' Wills, Mark (I'm Not Your) Steppin' Stone Monkees, The 19 SOMETHING WILLS,MARK (Now & Then) There's A Fool Such As I Presley, Elvis 192000 Gorillaz (Our Love) Don't Throw It All Away Andy Gibb 1969 Stegall, Keith (Sitting On The) Dock Of The Bay Redding, Otis 1979 Smashing Pumpkins (Theme From) The Monkees Monkees, The 1982 Randy Travis (you Drive Me) Crazy Britney Spears 1982 Travis, Randy (Your Love Has Lifted Me) Higher And Higher Coolidge, Rita 1985 BOWLING FOR SOUP 03 Bonnie & Clyde Jay Z & Beyonce 1985 Bowling For Soup 03 Bonnie & Clyde Jay Z & Beyonce Knowles 1985 BOWLING FOR SOUP '03 Bonnie & Clyde Jay Z & Beyonce Knowles 1985 Bowling For Soup 03 Bonnie And Clyde Jay Z & Beyonce 1999 Prince 1 2 3 Estefan, Gloria 1999 Prince & Revolution 1 Thing Amerie 1999 Wilkinsons, The 1, 2, 3, 4, Sumpin' New Coolio 19Th Nervous Breakdown Rolling Stones, The 1,2 STEP CIARA & M. ELLIOTT 2 Become 1 Jewel 10 Days Late Third Eye Blind 2 Become 1 Spice Girls 10 Min Sorry We've Stopped Taking Requests 2 Become 1 Spice Girls, The 10 Min The Karaoke Show Is Over 2 Become One SPICE GIRLS 10 Min Welcome To Karaoke Show 2 Faced Louise 10 Out Of 10 Louchie Lou 2 Find U Jewel 10 Rounds With Jose Cuervo Byrd, Tracy 2 For The Show Trooper 10 Seconds Down Sugar Ray 2 Legit 2 Quit Hammer, M.C. -

Zephyr Spirits Menu – Hyatt Regency Sydney

SPIRITS MENU VODKA Ketel One, Holland $13 Belvedere, Poland $16 Stoli Elit $16 Chase Vodka, UK $16 U’luvka, Poland $16 Grey Goose, France $17 Beluga Translantic, Russia $18 LONDON GIN Bombay Dry Gin, UK $13 Tanqueray, UK $13 Whitley Neill Raspberry, UK $13 Bombay Sapphire, UK $14 Sipsmith, UK $16 Burleighs, UK $18 Boodles, UK $18 Tanqueray No. 10, UK $18 Beefeater 24, UK $20 NEW AGE GIN The West Winds, The Sabre, WA AUS $13 Bloom, UK $15 Nosferatu Blood Orange Gin, Victoria AUS $15 The Botanist, SCT $16 78 Degree Pink Gin, SA AUS $16 The London No., UK $16 The Splendid, Tasmania $16 Roku, JPN $17 Four Pillars, VIC AUS $18 The West Winds, Cutless, WA AUS $18 Gin Mare, ES $18 Hendrick’s, SCT $18 Monkey 47 Sloe Gin, GER $18 Monkey 47, GER $18 Archie Rose - Zephyr Tailored Gin, NSW AUS $18 Ki No Bi, Japan $18 Estu Gin, Japan $18 Uncle Val’s Botanical Gin, USA $20 Aviation, USA $20 Hendrick’s Orbium, SCT $21 The West Winds Broadside, WA AUS $22 Green Ant, SA AUS $22 JENEVER & OLD TOM Bokma Jenever, Holland $16 Hayman’s Old Tom, UK $20 PLYMOUTH Plymouth, Sloe, UK $15 Plymouth, UK $18 TEQUILA Don Julio Blanco $12 1800 Anejo $14 Patrón XO $16 ArteNOM Seleccíon de 1549 Blanco $19 ArteNOM Seleccíon de 1146 Reposado $20 Patrón Silver $22 Don Julio Anejo $24 Clase Azul Reposado $25 Fortaleza Anejo $32 Jose Cuervo Reserve De Familia $40 Don Julio 1942, extra anejo $42 Don Fulano Imperial, Extra Anejo $42 BLENDED WHISKY Johnnie Walker Black $12 Chivas Regal 12 Year Old $14 Johnnie Walker Double Black $15 Monkey Shoulder $16 Johnnie Walker Gold $19 Johnnie -

Strengths of a Great Mix

Annual Report 2009 A great mix Strengths of a great mix Diageo has built a great mix of strengths and resources which it No1 manages to target In-depth customer growth in both good and consumer times and more understanding challenging times. No6 No2 Developing Highly leaders today, eff ective routes Cover picture: for tomorrow to market 2009 is the year in which Diageo celebrates 250 years of Guinness. www.diageoreports.com A great mix No5 No3 Focused World class execution marketing No4 capability Outstanding collection of brands Go online and visit all our 2009 reports and our annual review at www.diageoreports.com This is the Annual Report of Diageo plc and its consolidated subsidiaries, except as for the year ended 30 June 2009 and it the context otherwise requires. A glossary is dated 26 August 2009. It includes of terms used in this report is included at information that is required by the US the end of the document. Securities and Exchange Commission Diageo’s consolidated fi nancial (SEC) for Diageo’s US fi ling of its Annual statements have been prepared in Report on Form 20-F. This information accordance with International Financial GO may be updated or supplemented at the Reporting Standards (IFRS) as endorsed time of the fi ling of that document with and adopted for use in the European Union ONLINE! the SEC or later amended if necessary, (EU) and IFRS as issued by the International although Diageo does not undertake to Accounting Standards Board (IASB). update any such information. The Annual References to IFRS hereafter should be Report is made available to all shareholders construed as references to both IFRS as on its website (www.diageo.com). -

112 It's Over Now 112 Only You 311 All Mixed up 311 Down

112 It's Over Now 112 Only You 311 All Mixed Up 311 Down 702 Where My Girls At 911 How Do You Want Me To Love You 911 Little Bit More, A 911 More Than A Woman 911 Party People (Friday Night) 911 Private Number 10,000 Maniacs More Than This 10,000 Maniacs These Are The Days 10CC Donna 10CC Dreadlock Holiday 10CC I'm Mandy 10CC I'm Not In Love 10CC Rubber Bullets 10CC Things We Do For Love, The 10CC Wall Street Shuffle 112 & Ludacris Hot & Wet 1910 Fruitgum Co. Simon Says 2 Evisa Oh La La La 2 Pac California Love 2 Pac Thugz Mansion 2 Unlimited No Limits 20 Fingers Short Dick Man 21st Century Girls 21st Century Girls 3 Doors Down Duck & Run 3 Doors Down Here Without You 3 Doors Down Its not my time 3 Doors Down Kryptonite 3 Doors Down Loser 3 Doors Down Road I'm On, The 3 Doors Down When I'm Gone 38 Special If I'd Been The One 38 Special Second Chance 3LW I Do (Wanna Get Close To You) 3LW No More 3LW No More (Baby I'm A Do Right) 3LW Playas Gon' Play 3rd Strike Redemption 3SL Take It Easy 3T Anything 3T Tease Me 3T & Michael Jackson Why 4 Non Blondes What's Up 5 Stairsteps Ooh Child 50 Cent Disco Inferno 50 Cent If I Can't 50 Cent In Da Club 50 Cent In Da Club 50 Cent P.I.M.P. (Radio Version) 50 Cent Wanksta 50 Cent & Eminem Patiently Waiting 50 Cent & Nate Dogg 21 Questions 5th Dimension Aquarius_Let the sunshine inB 5th Dimension One less Bell to answer 5th Dimension Stoned Soul Picnic 5th Dimension Up Up & Away 5th Dimension Wedding Blue Bells 5th Dimension, The Last Night I Didn't Get To Sleep At All 69 Boys Tootsie Roll 8 Stops 7 Question -

Tequila Margaritas

TEQUILA Tequila is made by distilling the fermented juice of agave plants. It is descended from pulque, a favorite alcoholic drink of Aztecs and other Indian tribes. Agave (taken from the Greek, meaning magnificent), a pre-historic plant, is a spicy leafed member of the LILY family. It is not a cactus. By Mexican law, tequila is produced from blue agave only, one of Mexico’s hundreds of varieties of agave. Mezcal, on the other hand, can be made from other species of agave. Tequila is a specific type of mezcal. All tequila is mezcal, but not all mezcal is tequila. Tequila is produced in specifically designated regions of Mexico, most notably Jalisco. The more elaborate bottled tequila sometime contains a “worm”, a caterpillar like bug that bores into the plant. The survival of its body, intact, is said to be a sign of the spirit’s high alcohol content and the consumption of the worm and enhancement of manliness. Mixto - Colorless tequilas that are matured for only a few weeks. Others may be colored and softened on the palate, with a caramel or almond essence. Silver or Blanco - Colorless tequilas that are matured for only a few weeks. Reposado - Matured in oak casks, often from Kentucky bourbon distillers, up to 6 months. Añejo - Matured in oak casks, often from Kentucky bourbon distillers, for at least a year. Extra Añejo - Matured in oak casks, often from Kentucky bourbon distillers, for at least 3 years and occasionally 8-10 years. MARGARITAS All Flavors Available Strawberry, Peach, Raspberry, Pina Colada, Mango 16oz $8.75 For $1.50 ea. -

Jose Cuervo Family (34%)

Becle, S.A.B. de C.V. Corporate Presentation Nov, 20 2018 Disclaimer This presentation has been prepared by Becle, S.A.B. de C.V. (“Becle”, “Cuervo” or the “Company”) for informational purposes. Nothing in this presentation is intended to be taken by, or should be taken by, any individual recipient as investment advice, a recommendation to buy, hold or sell any security, or an offer to sell or a solicitation of offers to purchase any security. Although the information presented in this presentation has been obtained from sources that Becle believes to be reliable, Becle does not make any representation as to its accuracy, validity, timeliness or completeness for any purpose. No representation or warranty express or implied is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of the information or opinions contained herein. Certain of the information contained in this presentation represents or is based upon forward looking statements or information. These forward-looking statements may relate to Becle’s financial condition, results of operations, plans, objectives, future performance and business, including, but not limited to, statements with respect to general macroeconomic conditions, consumer preferences, competition and availability of raw materials. All statements contained in this presentation that are not clearly historical in nature are forward-looking, and the words “anticipate,” “believe,” “continues,” “expect,” “estimate,” “intend,” “project” and similar expressions and future or conditional verbs such as “will,” “would,” “should,” “could,” “might,” “can,” “may” or similar expressions are generally intended to identify forward-looking statements. The information in this presentation, including but not limited to forward-looking statements, applies only as of the date of this presentation and is not intended to give any assurance as to future results. -

Jose Cuervo®

Historia de Jose Cuervo® José Antonio de Cuervo y sus hijos José María Guadalupe y José Prudencio, jamás imaginaron que los centenares de agaves que cultivaron en el siglo XVIII iban a multiplicarse por millones con el paso del tiempo. Tampoco vislumbraron que ellos serían los fundadores de una dinastía tequilera que iba a convertirse en una de las empresas más fuertes, hoy la más antigua del ramo. Es posible que Casa Cuervo® haya nacido antes de 1795 y sea, tal vez, una de las empresas más antiguas del país. No sabemos con certeza si José Antonio de Cuervo que en 1758 había obtenido algunas tierras en lo que hoy es Tequila, Jalisco para sembrar diferentes cultivos formó parte de aquellos contribuyentes que cosechaban agaves desde principios del siglo XVIII. José Prudencio de Cuervo, hijo de José Antonio, afianzó su relación con Tequila al colaborar entre 1771 y 1775 en la construcción de la parroquia del pueblo. Hacia 1781 en plena prohibición de Carlos III para la producción y comercio de más de 75 bebidas, por considerar que embrutecían el alma y la conducta de los indios, adquirió los potreros de la Hacienda de Abajo, donde más tarde se instalaría la Taberna de Cuervo. En 1795, su hermano José María Guadalupe Cuervo recibió de Carlos IV, cuando ya había sido anulada la prohibición, la primera licencia para producir vino mezcal, antecedente de nuestro actual Tequila. Con esto, comenzó de manera formal la historia de la más antigua compañía tequilera. Más tarde, al morir José Guadalupe, dejó todas sus propiedades a sus hijos Don José Ignacio Faustino y Doña María Magdalena de Cuervo. -

Jose Cuervo Family (34%)

BECLE, S.A.B. de C.V. Board Meeting Bank of America, Investor Lunch Apr 25 2018 October 1st, 2019 Disclaimer This presentation has been prepared by Becle, S.A.B. de C.V. (“Becle”, “Cuervo” or the “Company”) for informational purposes. Nothing in this presentation is intended to be taken by, or should be taken by, any individual recipient as investment advice, a recommendation to buy, hold or sell any security, or an offer to sell or a solicitation of offers to purchase any security. Although the information presented in this presentation has been obtained from sources that Becle believes to be reliable, Becle does not make any representation as to its accuracy, validity, timeliness or completeness for any purpose. No representation or warranty express or implied is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of the information or opinions contained herein. Certain of the information contained in this presentation represents or is based upon forward looking statements or information. These forward-looking statements may relate to Becle’s financial condition, results of operations, plans, objectives, future performance and business, including, but not limited to, statements with respect to general macroeconomic conditions, consumer preferences, competition and availability of raw materials. All statements contained in this presentation that are not clearly historical in nature are forward-looking, and the words “anticipate,” “believe,” “continues,” “expect,” “estimate,” “intend,” “project” and similar expressions and future or conditional verbs such as “will,” “would,” “should,” “could,” “might,” “can,” “may” or similar expressions are generally intended to identify forward-looking statements. -

Casa Cuervo Beyond Tequila

CASA CUERVO BEYOND TEQUILA 2016 ANNUAL REPORT INTERNATIONAL COMPANY OF DISTILLED BEVERAGES CASA CUERVO –WITH OVER 250 YEARS OF FAMILY TRADITION– WAS BORN FROM THE VISION OF DON JOSÉ MARÍA GUADALUPE DE CUERVO Y MONTAÑO, WHO RECEIVED A DECREE FROM KING CHARLES IV TO PRODUCE AND SELL VINO DE MEZCAL, CURRENTLY KNOWN AS TEQUILA. THIS TRADITION LIVES ON THROUGH THE DIRECTION OF ITS MAJOR SHAREHOLDER –JUAN FRANCISCO BECKMANN VIDAL– AND ITS CEO –JUAN DOMINGO BECKMANN LEGORRETA–. CASA CUERVO OWNS THE OLDEST DISTILLERY OF TEQUILA IN MEXICO, “LA ROJEÑA”, WHICH IS A FAMILY INSIGNIA AND CONTINUES OPERATING AND PRODUCING THIS SPIRIT. Casa Cuervo is the largest producer of tequila and the third largest of Irish whiskey worldwide, due to its sales volumes. With a family tradition of 11 generations, the Company produces, markets and distributes in over 85 countries a portfolio of more than 30 brands of alcoholic beverages, Ready to Drink cocktails, as well as non-alcoholic beverages. Among the most important are: 1800®, Maestro Tequilero®, Maestro Tequilero® Dobel®, Centenario®, Kraken®, Bushmills®, Jose Cuervo® Margaritas and B:oost®. Since February 2017, the shares of Casa Cuervo (Becle, S.A.B. de C.V.), are traded on the Mexican Stock Exchange (BMV) under the ticker symbol CUERVO. CONTENT A LEGACY OF SUCCESS 5 2016 RELEVANT EVENTS 12 2016 FINANCIAL HIGHLIGHTS 14 MESSAGE FROM THE CEO 16 BEYOND TEQUILA 19 STRONG FOOTPRINT 36 PRODUCTION AND BOTTLING FACILITIES 40 COMPETITIVE ADVANTAGES 42 OPERATING AND FINANCIAL PERFORMANCE 44 CORPORATE GOVERNANCE 46 MANAGEMENT DISCUSSION AND ANALYSIS 50 FINANCIAL STATEMENTS 53 INVESTOR INFORMATION 62 A LEGACY OF SUCCESS 1758 1795 1873 1880 1900 1940 Casa Cuervo is born King Charles IV issues The first three tequila First Company to bottle Jose Cuervo brand Leader in the a royal decree in Spain barrels are exported tequila in glass bottles is established tequila industry granting Mr. -

Participants of Margarita Fest Spiral Dance

a newspaper for the rest of us www.lansingcitypulse.com May 30 - June 5, 2018 See page 9 2 www.lansingcitypulse.com City Pulse • May 30, 2018 THIRD ANNUAL CITY PULSE LGBQT+ INCLUSION AWARDS Thursday, June 14 • 7 p.m. to 9 p.m. Spiral Dance Bar • 1247 Center St., Lansing Come fete the honorees on Thursday, June 14. Doors open at 7 for the Inclusion Awards Cocktail Party. Awards Ceremony at 8 p.m. Purchase in advance by credit card at www.lansingcitypulse.com or call Ella at (517) 999-6704 with credit card information. Mail checks to City Pulse/Inclusion Awards, 1905 E. Michigan Ave., Lansing 48912 by June 13. Pay in person with cash or credit weekdays 9 a.m. to 5 p.m. at the mailing address. HONOREES Emcee Kaston Anderson-Carpenter Nick Page Lansing City Nicole Ellefeson (aka Lauren Ordair) Councilwoman Erica Fitzbaden Maxine Thome Williamston Community Schools Evan Lewis Kathie Dunbar Theresa Rosado City Pulse • May 30, 2018 www.lansingcitypulse.com 3 grand lansing city concert market • Birthday Parties • Bachelorette Parties series • Team Building Events • Family Get Together • Girls’ Night Out • Private Party PUBLIC CLASSES 7 DAYS A WEEK! june 14th: yancyy july 12th: tell yo mama 26th: rodney page august 9th: kathleen murray band 16th: 89th key september 6th: msu professors of jazz Welcome Another Gardening Season!! Please visit our selection of garden art to enhance your plantings. free admission | 6:30pm Included are: Sculpture for the wall and 325 city market drive free-standing, ceramic chimes, downtown lansing Hummingbird feeders, hand-turned wooden bird houses, lansingcitymarket.com Mobiles, bird feeders sponsored by: 4 www.lansingcitypulse.com City Pulse • May 30, 2018 Budget Hearing Notice VOL.